Nowadays, almost no company can do without business trips - either it is necessary to conclude an agreement with suppliers, or to resolve issues with customers (for example, to set up the supplied equipment), etc. Today, we will step by step consider the procedure for sending an employee on a business trip and point out the typical mistakes of employers in this case .

According to Art. 166 of the Labor Code of the Russian Federation, a business trip is recognized as a trip by an employee by order of the employer for a certain period of time to carry out an official assignment outside the place of permanent work. Business trips of persons whose permanent work is carried out on the road or has a traveling nature are not recognized as business trips.

The specifics of sending employees on business trips are established by the Regulations approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749 .

1. Choosing who to refer. The first step is to remember the restrictions that are established by labor laws. Thus, some employees are completely prohibited from being sent on business trips, while others can be sent, but only with their written consent.

By virtue of Art. 259 of the Labor Code of the Russian Federation prohibits sending pregnant women on business trips. It is prohibited to send minors on official trips (with the exception of creative workers of the media, cinematography organizations, television and video crews, theaters, theatrical and concert organizations, circuses and other persons involved in the creation and (or) performance (exhibition) of works, in accordance with the lists of jobs, professions, positions of these workers, approved by Decree of the Government of the Russian Federation of April 28, 2007 No. 252 ).

Note!

During the period of validity of the apprenticeship contract, employees cannot be sent on business trips not related to the apprenticeship ( Article 203 of the Labor Code of the Russian Federation ).

In addition, pay attention to the rehabilitation program for a disabled person if you plan to send him on a business trip. If this document contains a ban on business trips, sending a disabled person on a business trip will be unlawful and may entail administrative liability for the employer. This follows from Art. 23 of the Federal Law of November 24, 1995 No. 181-FZ “On the social protection of disabled people in the Russian Federation” : disabled people employed in organizations, regardless of organizational and legal forms and forms of ownership, are provided with the necessary working conditions in accordance with the individual rehabilitation program for the disabled person.

Sending women with children under three years of age on business trips is permitted only with their written consent and provided that this is not prohibited for them in accordance with a medical certificate. Let us remind you that the procedure for issuing such conclusions by medical organizations is approved by Order of the Ministry of Health and Social Development of the Russian Federation dated May 2, 2012 No. 441n .

Here it is important to understand that it is the medical report that matters to the employer - a certificate will not do. Conclusions are issued to citizens based on the results of medical examinations, medical examinations, clinical examinations, decisions made by a medical commission, as well as in other cases. But certificates are issued by doctors (in some cases, paramedics and obstetricians) based on entries in the citizen’s medical records or based on the results of a medical examination.

Please note that it is necessary to obtain written consent for a business trip and check for medical contraindications if you plan to go on a business trip ( Articles 259 , 264 of the Labor Code of the Russian Federation ):

- a father raising children without a mother;

- guardian (trustee) of minors;

- mother (father) raising children under the age of five without a spouse;

- an employee with a disabled child;

- an employee caring for a sick family member in accordance with a medical report.

2. We obtain consent and notify about the possibility of refusal. In addition to the fact that it is necessary to obtain written consent for a business trip from employees of these categories, they must be informed in writing of the right to refuse the trip. This is usually formatted as follows. The employer prepares a notice in which the employee is invited to go on a business trip and informed that he has the right to refuse it. The notice is drawn up in two copies and may look like this.

| Limited Liability Company "April" (April LLC) Ref. No. 12/4 To the Public Relations Manager from 04/15/2015 A. I. Ponomareva Dear Anna Ivanovna! We ask you to agree to be sent on a business trip from 04/20/2015 to 04/25/2015 to the All-Russian Joint Stock Company "Nizhny Novgorod Fair", located in Nizhny Novgorod, to participate in the exhibition "GardenExpo 2015". Additionally, we notify you that, on the basis of Art. 259 of the Labor Code of the Russian Federation, you have the right to refuse to be sent on a business trip because you have a child under the age of three. Director Ivanov V.P. Ivanov I agree to the business trip. I am familiar with the right to refuse a business trip. Public Relations Manager, Ponomareva, 04/15/2015 |

Of course, an employee can express his consent or disagreement to a business trip in the form of a separate document, for example, an application that he submits to the personnel department.

In this case, it is advisable to indicate in the notification the time frame within which the employee must make a decision, for example: “You can inform about the decision made in a separate statement, which must be submitted to the HR department by ... (such and such a date).” 3. We issue an order. Before talking about the order, let us recall that previously, in order to be sent on a business trip, the employee had to issue a work assignment and a travel certificate. However, due to changes made by Decree of the Government of the Russian Federation of December 29, 2014 No. 1595 to the Regulations , the registration of these documents has been cancelled. They were used to confirm the presence of an employee at a specific time in a specific location for reimbursement of expenses in connection with a business trip. But various departments have written that in some cases, marks on a travel certificate cannot be placed physically (for example, during negotiations with individuals), so the fact of being at the place of business at the appointed time can be confirmed by other documents - an order (instruction) on sending the employee on a business trip, travel documents, hotel bill ( letters from the Ministry of Finance of the Russian Federation dated August 16, 2011 No. 03-03-06/3/7, Ministry of Labor of the Russian Federation dated February 14, 2013 No. 14-2-291 ).

For your information

Since the need to prepare a work assignment and a travel certificate has disappeared, it is in the order to send on a business trip that the official assignment must be spelled out in as much detail as possible, that is, the purpose of the trip, as well as the deadlines for completing this assignment.

Before 01/08/2015, a service assignment was usually indicated as the basis for issuing an order, since according to the previous version of the Regulations , the purpose of an employee’s business trip was determined by the head of the sending organization and was indicated in the service assignment, which was approved by the employer.

After the named date, as the basis for issuing an order, you can indicate the details of the documents (if any), in accordance with which the employee was required to be sent on a business trip (agreement with a counterparty, an order to conduct an inspection, an invitation to an exhibition, etc.).

Since the organization has the right to continue to issue official assignments for business trips and require employees to report on their implementation (if this is provided for by local regulations), an official assignment can also be indicated as the basis for the order.

For your information

To send an employee on a business trip, you can issue an order using the unified T-9 form (T-9a for sending a group of employees) or using a form developed and approved by the organization itself.

The order is signed by the head of the organization (or another authorized person) and the employee is introduced to this document against signature.

Let's talk separately about the shelf life. According to the List of standard management archival documents generated in the course of the activities of state bodies, local governments and organizations, indicating storage periods , approved by Order of the Ministry of Culture of the Russian Federation dated August 25, 2010 No. 558 , orders for sending on business trips must be stored ( clause 19 ):

- for 75 years - if orders are issued on long-term domestic or foreign business trips, as well as on business trips of workers with difficult, harmful and dangerous working conditions;

- within five years - if orders are for short-term domestic and foreign business trips.

Of course, difficulties may arise with storage periods, since neither the Labor Code nor the above-mentioned list of standard management archival documents provide criteria for classifying business trips as short-term or long-term. Therefore, we recommend keeping orders for business trips longer than three days for 75 years.

| Limited Liability Company "Vesna" (Vesna LLC) Order No. 31 about sending an employee on a business trip April 14, 2015 Samara Send Ivan Ivanovich Ivanov, leading specialist of the information technology department, on a business trip to Leto LLC, located in Arzamas, Nizhny Novgorod region, for a period of 3 (three) days from April 21 to April 23, 2015 in order to provide software installation services , designed to control the movements of the moving parts of the supplied machines. Reasons: supply contract No. 24 dated January 13, 2015, concluded between Vesna LLC and Leto LLC, memo from the head of the information technology department P. P. Petrov on the need to install software dated April 13, 2015. Director Sidorov S.S. Sidorov I have read the order. Ivanov, 04/14/2015 |

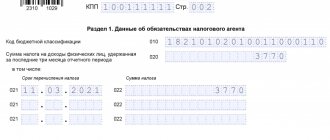

4. We issue an advance. According to clause 10 of the Regulations, when an employee is sent on a business trip, he is given a cash advance to pay for travel expenses and rental accommodation and additional expenses associated with living outside his place of permanent residence (daily allowance).

Please note that when traveling on business to an area from where the employee, based on transport conditions and the nature of the work performed on the business trip, has the opportunity to return daily to his place of permanent residence, daily allowances are not paid. To issue cash to an employee on account of expenses associated with the activities of a legal entity or individual entrepreneur, an expense cash order form 0310002[1] is drawn up in accordance with a written application of the accountable person, drawn up in any form and containing a record of the amount of cash and the deadline, on which they are issued, the manager’s signature and date ( clause 6.3 of Bank of Russia Directive No. 3210-U dated March 11, 2014 “On the procedure for conducting cash transactions by legal entities and the simplified procedure for conducting cash transactions by individual entrepreneurs and small businesses” ).

Based on the order for sending on a business trip, the accountant calculates the preliminary amount of expenses associated with the trip and coordinates it with the head of the business trip unit and the chief accountant.

The amount that needs to be paid to the employee is determined based on the duration of the business trip specified in the order for assignment, the cost of travel, the approximate cost of housing, the amount of daily allowance established by the organization for business trips in Russia and abroad. If an employee is sent on a business trip outside the Russian Federation, payment and reimbursement of expenses in foreign currency (including payment of an advance or repayment of an unspent advance in foreign currency) are carried out taking into account the Federal Law of December 10, 2003 No. 173-FZ “On Currency Regulation and Currency Control” ( clause 16 of the Regulations ).

5. We record the departure of an employee. Based on clause 8 of the Regulations, the employer is obliged to keep records of employees leaving on business trips from the sending organization and arriving at the organization to which they are sent. This is done in the appropriate journals. According to Order of the Ministry of Health and Social Development of the Russian Federation dated September 11, 2009 No. 739n , the employer or a person authorized by him by order (instruction) must appoint an employee of the organization responsible for maintaining the departure log and the arrival log.

The form of the logbook for employees leaving on business trips from the sending organization is given in Appendix 2 to this order. Information about the last name, first name and patronymic of the posted worker, the name of the organization to which he is sent, and destination are reflected.

Please note that the form contains the column “Date and number of travel certificate.” So: from the moment of amendments to the Regulations , that is, from 01/08/2015, this column will remain blank.

Note!

The employer (or a person authorized by him) is obliged to ensure the storage of the departure log and the arrival log for five years from the date of their registration.

6. We put marks on the working time sheet. Since, by virtue of Art. 91 of the Labor Code of the Russian Federation, the employer is obliged to keep records of the time actually worked by each employee; the time spent on a business trip must be recorded in the working time sheet. Let us remind you that working time is recorded in a timesheet and the employer has the right to use both the unified form T-13 from the Resolution of the State Statistics Committee of the Russian Federation dated January 05, 2014 No. 1 “On approval of unified forms of primary accounting documentation for recording labor and its payment” , and the timesheet form, developed independently.

Based on clause 8 of the Regulations, the actual period of stay at the place of business trip is determined by travel documents presented by the employee upon return from a business trip. If he travels to the place of business trip and (or) back to the place of work on personal transport (car, motorcycle), the actual period of stay at the place of business trip is indicated in a memo, which is submitted by the employee upon returning from a business trip to the employer along with supporting documents confirming use of the specified transport for travel to the place of business trip and back (waybills, invoices, receipts, cash receipts, etc.).

Days of absence of an employee from the workplace due to a business trip are indicated by code “K” (or “06” - “business trip”), while the number of hours worked is not entered.

7. We accept the report. Upon returning from a business trip, the employee is obliged to submit to the employer, within three working days, an advance report on the amounts spent in connection with the business trip and make a final payment on the cash advance issued to him before departure for travel expenses.

The employee must report on expenses for travel, housing and other expenses made with the knowledge of the employer. But he does not need to report for daily allowances - the basis for their payment will be the number of days of business trip recorded in the order for sending on a business trip.

Attached to the advance report are documents on the rental of accommodation, actual travel expenses (including payment for services for issuing travel documents and providing bedding on trains) and other expenses associated with the business trip.

Let us recall that organizations use the advance report form AO-1, approved by Resolution of the State Statistics Committee of the Russian Federation dated August 1, 2001 No. 55 .

For your information

For public sector organizations, a different form of advance report has been established, as well as a time sheet. Currently, the Order of the Ministry of Finance of the Russian Federation dated March 30, 2015 No. 52n “On approval of forms of primary accounting documents and accounting registers used by public authorities (state bodies), local government bodies, management bodies of state extra-budgetary funds, state ( municipal) institutions, and guidelines for their use." From the moment this order comes into force, these institutions will be required to use the forms approved by it.

Who to send on business trips

Only a person who has signed an agreement with the company and has labor obligations with them can be sent on a work trip. This is due to the fact that a person, even on a business trip, must receive his salary; this is the responsibility of the company. That is, any employee who is on the company’s staff can be sent on a business trip if necessary.

Travel of production workers

Installation and assembly engineers, builders, and workers often have to “travel.” For these specialists, any example of a business trip task from the following is relevant:

- installation and initial testing of production equipment "Line-1" in workshops,

- installation, adjustment and commissioning of “Conveyor-100” equipment,

- warranty service of the machine “A-2”,

- routine maintenance on the production line of JSC “Customer”,

- unscheduled repairs, correction of machine breakdowns,

- equipment prevention.

Supervisor

It is the director who is most interested in the development of the enterprise so that it brings maximum profit. The goals for a director’s business trip may be the following:

- For meetings with business partners with whom you can conduct joint business in the future;

- To open a new branch in another city or country;

- The trip is aimed at resolving controversial issues that arose at another enterprise.

Business trips to purchase materials

Directors of enterprises, as well as employees of purchasing departments, often go on business trips to purchase goods for the needs of the enterprise.

In this case, the order can indicate any example of the purpose of business trips from the following:

- conducting negotiations with Possible Supplier 1 LLC and Possible Supplier 2 LLC, discussing the terms of cooperation;

- establishing business contacts with Zavod LLC, studying the production process and product samples;

- concluding contracts for the purchase of raw materials and components with LLC “Material” and JSC “Details”;

- agreeing on the terms of the contract with the supplier Manufacturer LLC.

Chief Accountant

Sometimes the chief accountant is sent on trips.

It is worth noting that an accountant in any enterprise is a financially responsible person. After all, it is this person who keeps records of finances, money and property matters. Therefore, we can say that the employee is simply attached to his place of work. If he is sent on a business trip, then a part-time employment contract is drawn up. This is especially important to do if the employee leaves for more than one month. The goals for such a working trip of the chief accountant of an enterprise may be the following:

- Checking reporting and accounting in a branch of the enterprise;

- Creation of a new database at an enterprise that opened recently;

- Acceptance of cases. This happens if an accountant is transferred to a new position in another city. At first, he will need to travel to the enterprise to take over all the documents and get to grips with the business;

- Training. Training or a trip to a conference can significantly improve the professionalism of an accountant, which in the future will help him keep records correctly.

Reimbursement

Article 167 of the Labor Code of the Russian Federation specifies exactly what expenses the employer is obliged to reimburse:

- On the way.

- For rental housing.

- Daily allowance.

- Other costs provided for by internal regulations.

The daily allowance is up to 700 rubles per day. This is the amount whose spending does not require confirmation. If this is a trip to another country, then you also need to compensate for visa and consular fees, expenses for obtaining a foreign passport.

FOR YOUR INFORMATION! The head of the company can increase the amount of daily allowance. To do this, you need to add the appropriate clause to local acts. Money paid in excess of 700 rubles is subject to personal income tax.

Travel allowances are issued based on the employee’s application. The corresponding provision is contained in the letter of the Ministry of Finance No. 03-11-11/42288. The purpose of the payment is money on account.

Let's consider additional features of issuing money:

- If a remote worker returns daily to the city in which he usually works, travel allowances will not be accrued. However, he can receive compensation for his expenses. For this purpose, documentary evidence of expenses for transport and so on is collected. Expenses are reimbursed at the end of the trip.

- An advance is issued before the trip. It is usually transferred to a salary card.

- All documents confirming the employee’s expenses are provided no later than 15 days after the trip.

- If a business traveler uses a company vehicle, he is also paid compensation for gasoline. In this case, you must comply with the established limits: 1,200 rubles per month, if the engine volume does not exceed 2,000 cubic meters. meters. If it exceeds this mark, the limit increases to 1,500 rubles.

- If this is a short business trip, then the amount of compensation is determined in proportion to the days.

- If an employee uses a company car, gas station receipts must be attached to the report.

What to do if the employee has not fully spent the advance? Unspent money is returned to the company's cash desk.

Driver

This point is somewhat more complicated than the others, because the position of a driver often involves traveling work, which means that such trips cannot be called business trips. However, this only works in certain areas. If the driver needs to take his immediate superior to another region, then this is already considered a business trip.

In the event that the driver needs to go to another city for more than one day to check his vehicle, this is also registered as a business trip. After all, maintaining the car in proper quality is his direct responsibility under the employment contract.

Important! It is worth noting that the rules for registering a business trip for truck drivers will not be different. The only thing is that the goal will be the transportation and delivery of various goods.

Requirements for registration of business trip purposes

There are no clear regulatory requirements for documenting the purposes of a business trip. However, sometimes inspection authorities have questions about the document. This happens in several cases:

- the purposes of the business trip do not correspond to the type of activity of the company or are not in its interests;

- the formulation does not imply the possibility of completing the task (not clear enough or too global);

- the task is beyond the employee’s competence (you cannot send a cleaner to establish business connections);

- the duration of the business trip exceeds the time within which the goal can actually be accomplished.

All this may raise suspicions that the entrepreneur wants to hide net profit by “drawing” expenses that did not exist.

Sales Manager

Various companies very often send their sales managers on work trips. Firms in such cases are usually engaged in the sale or manufacture of various products, items or equipment. Sending a manager to another city is always a good idea, because this will help increase sales and demand significantly. The purpose of the manager's trip may be the following:

- The manager will study the needs of the enterprises in order to convey information to the firm. In the future, the company can expand its product range based on this analysis and increase its profits;

- Conducting negotiations with potential buyers. The usual personal presence of a manager is required when large purchases are involved;

- Sometimes managers visit their competitors' outlets to analyze and improve the performance of their enterprise.

What if the stated purpose of the trip is not achieved?

In this case, can business trip expenses be taken into account to reduce the tax base? This issue still causes controversy between accountants and representatives of the Federal Tax Service. The latter claim that expenses for an unsuccessful trip are not taken into account for tax purposes.

Accountants and company owners, in turn, bring claims to recognize that an employee’s business trip is of a production nature, regardless of its result. They often manage to defend their point of view in court.

In particular, a very common example of the purpose of business trips is “Sign a contract with the customer.” There is a possibility that the deal will not go through. In this case, tax officials consider it unreasonable to classify business trip expenses as expenses to reduce profits. However, company managers have repeatedly been able to prove that during the negotiations strong business ties were established with potential customers, which could lead to the conclusion of a contract in the future. The court recognized the right of the taxpayer to accept travel expenses for tax accounting.

Company lawyer

Very large enterprises always have their own lawyer, who, by the way, can also be sent on a business trip. The only reason for this is to resolve disputes that have arisen in other branches. Sometimes conflicts occur over land plots on which the construction of a branch is planned in the future. It is the head office lawyer who solves such problems.

Examples of the purpose of a business trip for a director, driver, accountant and other employees

To better understand how to correctly draw up the purpose of a business trip, it is easiest to consider examples of drawing up goals for different categories of workers. They may look like this:

An example of setting the purpose of a director’s business trip: to take part in negotiations on concluding a contract for the supply of products with a representative in Moscow on 10/01/2018.

The wrong goal setting is to conclude an agreement with a representative of the partners. In this case, the goal does not have specific indications of the date and place of negotiations. In addition, it presupposes the mandatory conclusion of an agreement, when in practice negotiations may end with a refusal to sign it.

An example of the purpose of a driver’s business trip: from 10.00 to 20.00, to ensure the movement of citizen Ivanov within the city of St. Petersburg during the period from 01/11/19 to 01/25/19 in a VAZ-2114 company car, number E1913SN.

An incorrect example of setting the purpose of a business trip: to ensure the movement of the client. As in the previous situation, there is no specificity here either about the client’s identity, or about the employee’s terms of work and the specific car.

An example of the purpose of an accountant’s business trip: to ensure a financial audit of branch No. 4 in the city of Saratov with the preparation of organization forms in form No. 14-85.

Wrong example: conduct a financial audit in the Saratov branch.

An example of the purpose of a lawyer’s business trip: to take part as a representative of the Vector organization in a court hearing in case No. 88-12-23 on 05/01/2019 in the Saratov Arbitration Court.

Wrong example: obtain a positive court decision in favor of the company at a court hearing in Saratov.

Nuances

In order for a person to be sent on a business trip, it is necessary to take into account some nuances:

- The reason for the trip must be clearly stated in the order and then written down on the travel certificate. You can view a sample form on the Internet;

- The company must remember that the trip cannot last more than 40 days. Deadlines are set in advance. A person cannot go on a business trip for an indefinite period of time;

- If the business trip lasts more than one month, then, at the employee’s request, his salary is redirected to him. This is done at the expense of the organization;

- The company reimburses its employee for all expenses related to travel and rental housing. In some cases, expenses related to the fact that the employee is not at his place of residence are paid;

- A business trip is considered to be a trip where an employee leaves for another region relative to his permanent job, and not his place of residence. That is, if you live in St. Petersburg, but work in Moscow, a trip to St. Petersburg will be considered a business trip, despite the fact that in fact you are going home.

Business trip of management personnel

Chief executives of companies and their deputies travel to other cities and countries, as a rule, for:

- conducting key negotiations with partners,

- participation in official events,

- establishing contacts with potential customers.

A business trip of a manager is most often formalized not by an order in the T9 form, but by an order containing the phrase: “I am leaving for the city of ______________ for the purpose of...”. In the order, as in the order, it is necessary to indicate the full name. and the employee’s position, destination, purpose and objectives of the trip.

Here are examples of job assignments that the company's chief executive can assign to himself or his deputies:

- conducting negotiations with Komplekt LLC;

- demonstration of samples of Standard LLC products;

- participation in the exhibition “Electrical Materials of Russia”, Moscow September 27, 2021;

- holding a presentation for participants of the Cosmotechnics meeting on July 20, 2021;

- participation in the seminar “How to survive the financial crisis” on August 21, 2016, conducted by Uchebny LLC in Moscow;

- giving a lecture to undergraduate and graduate students of Moscow State University on the topic “State support for domestic producers”;

- exchange of experience with participants of the conference “Business is easy and with pleasure”, held from October 10 to 15, 2021;

- professional development;

- familiarization with new technologies.

The business trip of the director and his deputies may also be associated with checking the quality of work of the company's branches. Here are some examples:

- summing up the financial and economic activities of the subsidiary Our Firm LLC for the 1st half of 2016;

- participation in the audit of financial and trading operations of the branch of Enterprise LLC in Nsk;

- carrying out an analysis of the quality of work and certification of personnel in additional office No. 0233 in A-sk from September 2 to September 10, 2016.

If necessary, the purpose of a business trip can be divided into several narrower tasks. They are usually not indicated in the order, but are reflected in the company’s internal documents.

So, for example, the following tasks can be set for the goal “conducting negotiations with Perspektiva LLC on possible cooperation”:

- Acquaintance and personal meeting with the general director of Perspektiva LLC: demonstration of advertising materials, product samples, discussion of delivery conditions.

Planned result:

- establish contact with the head of Perspektiva LLC,

- provide him with information about the competitive advantages of Our Company LLC products and the benefits of cooperation,

- negotiate a contract for the supply of the first batch of goods.

2. Participation in a meeting with the purchasing department of Enterprise LLC, discussion of the terms of the contract.

Planned result:

- Achieve the right to supply goods on the terms of 100% prepayment, subject to the provision of Perspektiva LLC with a wholesale discount of no more than 20% of the price indicated in the price list (1 option);

- Agree on the supply of goods in the amount of one ton of raw materials per month, without a discount, with payment in installments for a period of no more than 3 weeks (option 2).

Upon returning from the trip, the director sums up whether the purpose of the trip was achieved.