Acting Governor of the Khabarovsk Territory Mikhail Degtyarev, leader of the Union of Employers of the region Sergei Smolentsev and Chairman of the Khabarovsk Regional Trade Union Council Galina Kononenko signed a tripartite agreement providing for new minimum wage rates.

The last time tariffs were updated in the Khabarovsk Territory was in 2021, officials stated.

Mikhail Degtyarev focused on the fact that prices are rising today both in the consumer market and in the housing and communal services sector, however, the mandatory minimum for citizens remains at its previous level. The main goal of the concluded agreement is to improve the standard of living of people living in the Khabarovsk Territory.

What is the minimum wage established in the Khabarovsk Territory from March 1, 2021

With the maximum increase for length of service in special climatic conditions, the guaranteed amount of the minimum wage was increased as follows:

- Ayano-Maisky district - from 28,142 to 29,421 rubles. (+4.5 percent);

- Okhotsk region - from 30,700 to 31,980 rubles. (+4.1 percent);

- southern regions of the Khabarovsk Territory - from 19,188 to 20,467 rubles. (+6.6 percent);

- areas equated to the regions of the Far North - from 21,746 to 25,584 rubles. (+17.6 percent).

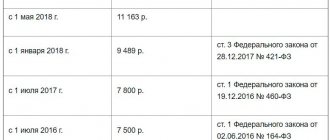

Table of changes in the minimum wage value in the region

Note to the table: updated minimum wage values for a specific date are highlighted in bold. The values in the Khanty-Mansiysk Autonomous Okrug - Ugra for 2014, 2021, 2021, 2021, 2021, 2021 are given. These minimum wage values are applied in the cities of: Khanty-Mansiysk, Surgut, Nizhnevartovsk, Nefteyugansk, Kogalym, Nyagan, Megion, Langepas, Raduzhny, Pyt-Yakh, Urai, Lyantor, Yugorsk, Sovetsky, Beloyarsky and other settlements of the Khanty-Mansiysk Autonomous Okrug - Yugra.

About the minimum wage in the region

The minimum salary that a Russian citizen receives is called the minimum wage. The indicator is set at least once a year by Decree of the Government of the Russian Federation. According to Art. 133 of the Labor Code, the minimum wage must correspond to the subsistence level, because you cannot earn less than you need to spend. Minimums vary by region, and therefore it is quite logical that in Art. 133.1 of the Labor Code of the Russian Federation provides for the right for a region to independently set the minimum wage for its residents.

Be careful:

the minimum wage must be compared with the salary without taking into account the regional coefficient. And the regional coefficient and percentage bonus should be paid above the minimum wage. That is, the salary without the regional coefficient and the “northern bonus” should be no less than the regional or sectoral minimum wage. This procedure is relevant for employees who work in the Far North and equivalent areas, and for those who work in special “non-northern” climatic conditions. These conclusions are contained in the decision of the Constitutional Court dated December 7, 2021 No. 38-P.

You may like => Schroeder In Which Group By Depreciation Group 2021

1. In the Khanty-Mansiysk Autonomous Okrug - Ugra, establish a minimum wage in an amount equal to the minimum wage established by federal law, applying to it the regional coefficient and a percentage increase in wages for work experience in the regions of the Far North and equivalent to them localities, but not below the subsistence level of the working population in the Khanty-Mansiysk Autonomous Okrug - Ugra.

Answer

Guided by Articles 48, 133.1 of the Labor Code of the Russian Federation, Law of the Khanty-Mansiysk Autonomous Okrug - Ugra dated October 10, 2003 N 53-oz “On tripartite commissions for regulating social and labor relations in the Khanty-Mansiysk Autonomous Okrug - Ugra”, Duma of Khanty-Mansiysk Mansi Autonomous Okrug - Ugra and the Government of the Khanty-Mansi Autonomous Okrug - Ugra on behalf of the government authorities of the Khanty-Mansi Autonomous Okrug - Ugra, the Association of Employers of the Khanty-Mansi Autonomous Okrug - Ugra, the Association of Trade Union Organizations of the Khanty-Mansi Autonomous Okrug - Ugra have concluded this Agreement about the following.

There are often situations when an LLC is registered in one subject of the Russian Federation, and its employees work in a branch of the LLC in another subject. In this case, what minimum wage should we be guided by when setting salaries for branch employees?

It follows from this that the monthly salary of a person working in the Leningrad region and in an employment relationship with an employer subject to a regional agreement cannot be lower than the minimum wage in the Leningrad region if this person has fully worked the standard working hours during this period and fulfilled labor standards.

Minimum wage when setting wages for LLC branch employees

Employers have a period of 30 days during which they can send to the labor body a written refusal to join the regional agreement on the minimum minimum wage in a specific subject. Silence automatically means consent, that is, if they do not refuse, they join the agreement.

You may like => Finding the Republic of Armenia on the Territory of the Russian Federation Law

At the end of last year, on December 29, amendments were adopted to Article 1 of the Federal Law of June 19, 2000 No. 82-FZ on the minimum wage and the Federal Law of October 24, 1997 No. 134-FZ on the subsistence level in Russia. The minimum wage in Khanty-Mansi Autonomous Okrug increased to 9,489 rubles from January 1, 2021 and amounted to 85% of the subsistence minimum established at the federal level.

A systematic approach to remuneration in the public and commercial sectors of the economy

Official representatives of the Committee on Labor and Employment emphasized that the agreement provides for the introduction of a unified systematic approach to the remuneration of citizens employed in the public and commercial sectors of the economy. The document should be understood as an additional social guarantee and the elimination of discrimination in the world of work, the department stated.

From Sergei Smolentsev’s comments it follows that honest and conscientious entrepreneurs most likely will not face a large increase in burden. The leader of the Union of Employers called the bar included in the new agreement “whitens the labor market” and reduces the area in which “grey” wages are potentially possible.

What to do if you don't have enough money

This is not the first time that heads of large companies operating in Russia have addressed officials with this question. Associations of employers and the union of industrialists express dissatisfaction with how to increase the wage fund and not break the law if the most unfavorable developments in business activities have been created:

- inflation is rising;

- the ruble exchange rate is steadily falling;

- European sanctions reduce to zero any cooperation with foreign partners.

Analysts advise reconsidering your attitude towards employees and the salaries of your superiors. In general, deputies are also on the side of the government. An increase in the minimum wage in Belgorod and other regions of the country automatically increases the amount of tax deductions for employees. The employer acts as a tax agent and policyholder.

To this, the directors respond: at this rate, many regions in Russia will soon become subsidized. Moreover, it is not only commercial organizations that suffer. There is nothing to pay state employees either. Local workers employed in the public sector financed from the budget of the Trans-Baikal Territory are becoming fewer and fewer every year.

A huge burden is placed on the regional treasury, while the federal treasury remains on the sidelines and strenuously supplies the residents of the center with a decent minimum wage.

The new minimum wage is aimed at increasing the level of protection of hired employees

According to Galina Kononenko, for citizens employed in the public sector of the economy, “Law 222 establishes regional coefficients,” while for employees of the non-budgetary sector these figures were “floating.”

The signed agreement is aimed, first of all, at increasing the level of protection of hired employees from all sectors of the economy, Kononenko concluded.

The new minimum wage will be applied in all calculations starting from March 1. The execution of the document will be monitored by the State Labor Inspectorate of the Khabarovsk Territory.

How can an employer avoid paying the new minimum wage?

Managers of enterprises operating in Belgorod and the region can express their disagreement with the new minimum wage. The minimum wage is set based on the subsistence level. For extra-budgetary organizations it is higher than for budgetary ones.

Not wanting to comply with the wage agreement, the employer has the right to write a written refusal to comply with it, indicating specific reasons. Refusal will help delay changes in the minimum wage. The director is given 30 days to do this after the publication of the contract for the region. The director cannot challenge the federal minimum wage.

The following documents must be attached to the refusal:

- a protocol recording consultations between the head of the organization and representatives of the trade union;

- proposals that he makes according to the frequency of increasing the minimum wage for hired employees to the amount determined by the agreement. Within these deadlines, the manager undertakes to meet the minimum wage increase.

In the future, the director will need to be prepared to actively participate in the next minimum wage increase meeting. He will be involved in discussions and consultations. Refusal to participate is not possible.

If the head of the company has not published a written refusal, it means that he agrees with the terms of the contract.

Minimum wage in the Belgorod region

Decree of the Government of the Belgorod Region dated December 9, 2021 No. 499-pp on a tripartite agreement between the regional association of trade union organizations, associations of employers and the Government of the Belgorod Region for 2021 - 2021

- the amount of wages did not exceed the federal minimum wage in force in the billing period;

- the length of the insurance period did not exceed six months;

- the sick leave certificate contained a note from the medical organization about the employee’s violation of the established regime during the period of illness.

Minimum wage in the Belgorod region

The regional association of trade union organizations includes in the collective agreements of organizations of production types of economic activity obligations to provide material support to women on maternity leave for up to three years, in families with an average per capita income, the size of which does not exceed the subsistence level of the working population in the Belgorod region, in an amount not lower than the minimum wage (minimum wage).

The following categories of minor citizens have a preferential right to employment against the established quota:

- orphans

- released from educational colonies or graduated from special closed educational institutions

- registered with internal affairs bodies, commissions on juvenile affairs and protection of their rights

- children from families in which both parents (or the only one) are recognized as unemployed

- children from low-income or large families

- children from single-parent families

- children from families that have lost their breadwinners;

- children from refugee and internally displaced families

- minors who have undergone treatment and rehabilitation for drug addiction and alcoholism.

We recommend reading: How to find out Okud?

Living wage and minimum wage from January 1, 2021 in the Belgorod region

A special cost of living has been established for pensioners in the Belgorod region for 2021: the latest news indicates the adoption of local law No. 310 dated November 27, 2021. Its name is “On establishing the cost of living for a pensioner in the Belgorod region in order to determine the social supplement to pensions for 2021 " If we compare the amount that was indicated in the law of similar content for 2021 (No. 186 of October 31, 2021), we will see that it has remained the same - 8,016 rubles. The pension PM has not changed in the Belgorod region since 2021. Pensioners receive not a regional, but a federal supplement from the federal budget. In this case, the all-Russian pension PM is taken into account.

- No. 134-FZ “On the subsistence level in the Russian Federation” dated October 24, 1997;

- Law No. 154 “On the living wage in the Belgorod region” dated July 23, 2021;

- Resolutions of the regional government establishing the cost of living on a quarterly basis.

We recommend reading: Payments to grandchildren of Chernobyl victims in 2021

What is the minimum wage in force in the Belgorod region in 2021

1. Transfers of cash benefits to citizens who are considered temporarily disabled. 2. Women who are expecting a child when going on legal maternity leave. 3. To deduct penalties and transfer mandatory state taxes.

Many factors depend on the size of the minimum wage, the minimum wage of able-bodied citizens of the Russian Federation, by which both the economic situation of the entire country and a separate region are assessed. Relatively recently, such a concept was considered only as a federal one. Today, most of the regions of our country have the right to determine the minimum wage at the regional level, taking into account the most significant nuances both for the region and for local residents.

We recommend reading: Documents for age pension 2021 for PFR women