Registration form P14001 is intended for reporting changed information about the organization, which is published in the Unified State Register of Legal Entities, but does not require changes to the LLC Charter. If new information for the Unified State Register of Legal Entities changes the Charter, then this is reported using form P13001. The forms were approved by Order of the Federal Tax Service dated January 25, 2012 No. ММВ-7-6/ [email protected] and are not used .

Attention! From November 25, 2021, an application for amendments to an LLC must be submitted using the new unified form P13014.

Form P14001 is used not only to make changes to the Unified State Register of Legal Entities, but also to correct detected errors in the state register in order to bring this information into compliance with the Charter.

In what cases is form P14001 filled out?

- Everything related to a share in an LLC: sales, donations, inheritance, withdrawal of a participant and distribution of his share.

- Change of director.

- Change of legal address, if it does not change in the Charter (the Charter indicates only the locality, without a detailed address, and the new address will be in the same locality).

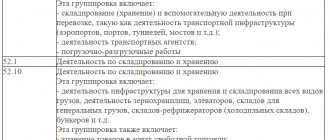

- Changing OKVED codes, if this does not contradict information about the types of activities of the company specified in the Charter.

- Correcting errors in the Unified State Register of Legal Entities.

When making various changes (for example, a change of director and addition of OKVED codes), you can submit one application on form P14001, but you cannot indicate in one application a change in registration information and correction of errors in the Unified State Register of Legal Entities.

How to fill out form P14001?

Form P14001 is even more voluminous than form P13001, it has 51 pages: the title page and application sheets from “A” to “P”. All pages of form P14001 do not need to be filled out, but only those that indicate the changed information. Continuous numbering is included in the form, i.e. The first page will be the title page, and then only completed pages will be numbered. There is no need to turn in blank pages.

When changing information in the Unified State Register of Legal Entities, on the title page of form P14001, in paragraph 2, put the number “1” - “due to a change in information about the legal entity.” When correcting errors on the title page of form P14001, in paragraph 2, enter the number “2” - “in connection with the correction of errors made in a previously submitted application.”

The applicant for form P14001, in contrast to form P13001, can be a much wider range of persons (manager, founder or participant of an LLC, notary, executor of a will, etc.), a total of 16 categories indicated on page 1 of sheet “P”.

Below we provide the current form of form P14001 and examples of how to fill it out in different situations. Since all registration forms are approved by one document, the requirements for filling out form P14001 are the same as for form P11001.

Form P14001 fillable

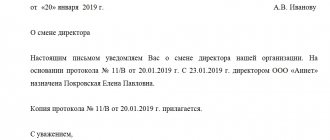

Change of LLC director. In form P14001, fill out the title page, sheets “K” and sheets “P”. We fill out sheets “K” for both directors – old and new.

On page 1 of sheet “K” for the former director in the section “Reason for entering information” we indicate the number “2”, i.e. "Termination of powers." Next, we enter the data of the former director in section 2 “Information contained in the Unified State Register of Legal Entities.” Section 3 in this case is not completed.

On page 1 of sheet “K” for the new director in the section “Reason for entering information” we indicate the number “1”, i.e. "The assignment of powers." Next, we enter the data of the new director in section 3 “Information to be entered into the Unified State Register of Legal Entities.” Section 2 in this case is not completed. The data of the new director is entered on sheets “R”, because he is the applicant in this case.

Adding OKVED codes. Please note: Form P14001 is submitted if the addition of OKVED codes for the LLC does not make changes to the Charter. If these changes are needed, then you need to fill out form P13001.

On the title page of form P14001 in paragraph 2 we put the number “1” - “due to a change in information about the legal entity.” Next you need to fill out sheets “N”. On page 1 of sheet “N” we enter the codes that need to be entered into the Unified State Register of Legal Entities, and on page 2 of sheet “N” - the codes that will be excluded from the register.

When changing the main type of activity, enter the new OKVED code on sheet “N” page 1, and the old code on sheet “N” page 2. If we only enter additional codes, then we fill out sheet “N” page 1, and if we only exclude the previous codes, then, accordingly, sheet “N” page 2.

If one sheet “H” was not enough to indicate all the added (or excluded) codes, then you can fill out additional sheets. We remind you that we indicate OKVED codes of at least four digits. They should be entered not in a column, but line by line - from left to right

All that remains is to fill out all the pages of sheet “P”. The applicant in this case is the head of the organization, and his details are indicated in the form.

Notarized purchase and sale of shares . If the sale of a share does not occur within the framework of the preemptive right, then it must be formalized by a notary. In case of a notarized purchase and sale of a share, the contract is drawn up by a notary and he himself submits form P14001 to the tax authority.

In this case, fill in:

- title page;

- sheets for participants “B”, “G”, “D”, “E”, according to their category (Russian organization; foreign organization; individual; subject of the Russian Federation);

- sheets “P” for the applicant, i.e. share seller.

Change of legal address of LLC . When changing the address of an organization, which entails a change in the Charter, this must be reported using form P13001. If the Charter specifies only a locality, and you change the address within this locality, then fill out form P14001.

In the application for a change of address, fill out the title page, sheet “B” indicating the new address and sheets “P”. The applicant is the current head of the LLC.

Withdrawal of a participant from the LLC. When a participant leaves an LLC, there is no purchase or sale of a share, but a payment of compensation equal to its value. The share itself passes to the company, which must distribute it among the participants, sell it or redeem it within a year. The Federal Tax Service must be notified of the participant’s withdrawal within a month after such a decision is made.

As usual, fill out the title page and sheets “P” for the applicant, who in this case will be the head of the LLC. As for other sheets, there are two options:

- If within a month after the decision was made, the share of the withdrawing participant was distributed, then fill out sheets for participants “B”, “D”, “D”, “E”, respectively, according to their category (Russian organization; foreign organization; individual; subject of the Russian Federation) . In this case, only the first page of the corresponding sheet is filled out for the former participant, and for the participants among whom his share was distributed, new information about the share in the authorized capital is also indicated, i.e. nominal value and size. In sheet “Z” I reflect information about the transfer of the share to the company and its distribution among the participants.

- If within a month the fate of the share has not been decided, then you will have to report changes in registration information on form P14001 twice. First, this will be a message about the withdrawal of a participant from the LLC, for which they fill out a sheet corresponding to the former participant and sheet “Z” about the transfer of the share to the company. Then, when the share is distributed, sheets are submitted for the participants who are co-owners of this share and sheet “Z”, which will indicate the new sizes of the participants’ shares.

New forms of documents used for state registration

Currently, these requirements and forms of relevant documents are approved by the Decree of the Government of the Russian Federation dated June 19, 2002. No. 439 “On approval of forms and requirements for the execution of documents used for state registration of legal entities, as well as individuals as individual entrepreneurs.”

Interesting: Personal income tax certificate 2 new form 2019

The first field indicates the value of the indicator, consisting of whole monetary units (for example, rubles), in the second - from a part of a monetary unit (kopecks). In this case, the first field is aligned to the right, the second - to the left. If the indicator consists of whole monetary units, the second field (after the dot) is not filled in.

Correction of erroneous information about the organization in the Unified State Register of Legal Entities

Errors in the Unified State Register of Legal Entities, despite the fact that the information in the Charter is correct, can arise both through the fault of the tax authorities and through the fault of the legal entity. A discrepancy between the information from the Charter and that contained in the extract from the Unified State Register of Legal Entities may cause refusal of notary services, opening a bank account, obtaining a license, concluding transactions with counterparties, etc.

When receiving registration documents from tax authorities, you must carefully check the information entered in the Unified State Register of Legal Entities. If an error is detected at the stage of issuing documents, the tax inspector draws up a comment card. Well, if errors surfaced after they were entered into the state register, then form P14001 is filled out.

We remind you that if there are errors not only in the information in the Unified State Register of Legal Entities, but also in the Charter, this must be reported using form P13001.

When correcting errors in the register, submit the cover page of form p14001; “P” sheets for the applicant and sheets containing correct information:

- sheet “A” if there is an error in the name of the legal entity;

- sheet “B” if there is an error in the organization’s address;

- sheets for participants “B”, “D”, “D”, “E”, according to their category, in case of an error in the data about the participants;

- sheet “K” if there is an error in the information about the director;

- sheet “P” if there is an error in the amount of the authorized capital

On the title page, be sure to indicate the state registration number of the entry in the Unified State Register of Legal Entities that needs to be corrected.

Sample of filling out the new form P13001

After you have filled out the form, you need to number the pages at the top of each sheet, the numbering is continuous. Three cells with the page number must be filled in, that is, the first page is 001, the second is 002, and so on. Under no circumstances should anything be corrected or added to . Double-sided printing is also prohibited.

- Sheet A contains information about the name of the enterprise or organization. This includes the new name of the company: full and abbreviated, in Russian. Please note that the application indicates the previous name.

- Sheet B must be completed when changing the legal address. It is necessary to carefully enter the detailed address of the executive body of the legal entity, including the index and digital code of the subject of the federation. Two columns of the sheet provide space to fill in the object type and specific name. The order also contains a list of abbreviations. For example, highway - sh, prospect - pr-kt, lane - lane, etc. As for the words “office”, “apartment”, “house”, their abbreviation is not provided.

- Sheet B assumes changes in the authorized capital: an increase or decrease. The new capital amount is indicated. Particular attention is paid to the reduction of the authorized capital - not only the date of the reduction itself is entered, but also the date of two publications about it.

- Sheets G-Z are filled out simultaneously with the previous sheet and have similar items. The exception is joint stock companies. Which of these sheets to make changes to is determined depending on the subject - participant of the legal entity: G - Russian legal entity. face;

- D – foreign legal entity. face;

- E – individual;

- F – Russian Federation, subject of the Russian Federation, municipal entity;

- Z – a mutual investment fund that owns a share in the authorized capital of a legal entity. faces.

Interesting: Ministry of Internal Affairs order on wearing uniforms

Change of passport data of the leader and participants

The Federal Tax Service itself makes changes to the passport data of the director and participants of the LLC in the state register automatically, within five working days after receiving such information from the Federal Migration Service. In this case, you do not need to submit Form P14001. To make sure that the Unified State Register of Legal Entities contains current passport information of the manager and participants, you can request an extended extract through the tax office.

If it turns out that there are no new passport data in the statement (which may lead to problems with banks, counterparties, or government agencies), then you must submit a free-form application to the registration authority about unreliable registration information. The application will need to be accompanied by a copy of the new passport and copies of the decision/minutes of the meeting on changing the passport data.

Rules and sample for filling out form P13001

The appendices consist of sheets marked with the letters of the Russian alphabet from A to M, some sheets may contain several pages. Each sheet of the application is intended for a specific type of change, except for sheet M. Sheet M must contain information about the applicant.

To fill out the fields of the application, the Courier new font, size 18, must be used, all letters in capitals only. Filling out by hand is also allowed, but only in black ink and block letters. When moving part of a word to a new line, there is no hyphen; you just need to continue the word you started on a new line. If a line ends in such a way that there is not enough space for a space after the finished word, then the new line begins with a space. Separate cells must be allocated for brackets and quotation marks.

Interesting: Available Places in Sanatoriums of the Russian Federation for 2021

Procedure for submitting an application in form P14001

Depending on the situation, the package of documents for reporting new registration information also includes:

- minutes of the general meeting of participants or the decision of the sole participant to change registration information;

- agreement on the sale of the share and a document confirming its payment;

- certificate of right to inherit a share;

- participant’s statement about leaving the LLC;

- documents confirming the right to use the premises at the new address (lease agreement, letter of guarantee from the owner or a copy of the certificate of ownership);

There is no state fee when submitting an application in form P14001.

The authenticity of the applicant's signature on form P14001 must be notarized. The notary mark is affixed on page 4 of sheet “P”. You must report changes in registration information using form P14001 to the registering tax office within three working days (Article 5 of the Law “On State Registration”).

Form P13001 - form and instructions for filling out

Almost every organization is developing and rationalizing production, and it is impossible to do without making appropriate changes to the documentation. To officially enter into force the changes made to the charter documents of the LLC, it is necessary to register them or notify the state registration authority by filling out form P13001.

Sheet I contains information about reducing the authorized capital of the LLC (due to the redemption of the share that belongs to the company). You must first determine full or partial repayment. If the share repayment is complete, then the remaining items on this sheet should not be filled out.

18 Jul 2021 glavurist 4150

Share this post

- Related Posts

- When Can You Get a Tax Deduction on Mortgage Interest?

- How to turn off the antenna in an apartment in Moscow via MFC

- Supplement to Pension for Labor Veterans in the Stavropol Territory in 2020

- Rules for Registration and Check-Out into an Apartment