Home / Tax Law / Is furniture considered a fixed asset?

To determine the amount of monthly depreciation charges, it is necessary to establish the appropriate depreciation group according to the All-Russian Classification of Fixed Assets (OKOF) or according to technical data from the office furniture manufacturer. The search for the required codes is carried out by the name or purpose of the asset.

How to register office furniture

Nuances in calculating depreciation arise when, for example, a set of furniture for a manager’s office or workstations for staff is accounted for not as a set, but as separate modules. Despite the fact that this option is quite acceptable in cases where the constituent elements of the set can be used separately, there are often cases of disputes with regulatory tax authorities regarding incorrect recording of depreciation deductions in accounting. Judicial practice in this matter is very contradictory.

Features of depreciation calculation

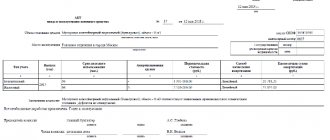

Office furniture as a fixed asset is accounted for by the following entries: Dt08 Kt60 for the amount of the cost of furniture, Dt19 Kt60 for the amount of VAT and Dt01 Kt08 for the amount of the full cost of acquisition - from the moment of commissioning.

- D10 – K60 – when reflecting the fact of receiving inexpensive furniture;

- D19 – K60 – correspondence used to record the amount of VAT;

- D20 – K10 – write-off of the value of acquired assets after they are put into operation;

- D004 - to record the fact of receipt of inexpensive furniture.

Registration of furniture movement in accounting transactions is regulated by the standards of PBU 6/01 and the Tax Code of the Russian Federation. Furniture sets should be classified as fixed assets, and cheaper elements of the interior furnishings of premises are allowed to be reflected as part of the inventory. The distribution of furniture among different types of assets is complicated by the discrepancy between approaches to assessing objects in tax and accounting.

Rules for organizing furniture accounting

FOR REFERENCE! If the expected life of an asset is unclear, it should be taken from the technical documentation. If the accompanying forms do not contain the necessary information, you can check the data with the manufacturer.

That is, at first glance, the rules for forming the initial cost of fixed assets in accounting and tax accounting are the same. However, for a number of points, Chapter 25 of the Tax Code of the Russian Federation contains slightly different rules regarding OS, leading to the emergence of irremovable differences between accounting and tax accounting data. For example, these are the rules for accounting for interest on borrowed funds raised for the purchase of fixed assets.

Note that in tax accounting, fixed assets are recognized as assets with a value of over 10,000 rubles (Article 256 of the Tax Code of the Russian Federation). If you set another limit in accounting that exceeds 10,000 rubles, this will lead to temporary differences.

Let us recall that in accounting, interest on borrowed funds raised for the acquisition of fixed assets, accrued before the object was accepted for accounting, must be attributed to its original cost (clause 8 of PBU 6/01).

The resulting monthly amount will be the amount of depreciation that will be written off as expenses each month. For this amount, the accountant will reflect the entry Dt 20 (23, 25, 26, 44) Kt 02 every month. Read about what entries are made to account for depreciation in this article.

In 2021, such a concept as office furniture, chair, table, etc. is not directly contained in the Classification, that is, a depreciation group is currently not defined for this type of property. What to do in this case?

How is SPI determined?

- up to 40,000 rub. – for accounting (set by the enterprise independently within the specified amount, fixed in the accounting policy);

- 100,000 rub. – for tax accounting, all objects cheaper than the specified amount are not considered fixed assets, are not depreciated and are immediately written off.

- Debit 10 Credit 60 – purchase of office furniture according to UPD or delivery note;

- Debit 19 Credit 60 – VAT reflected;

- Debit 68 Credit 19 – VAT presented by the supplier is accepted for deduction on the invoice or UPD;

- Debit 60 Credit 51 – payment was made for office furniture;

- Debit 20 (25, 26, 44...) Credit 10 – furniture has been put into operation.

Useful life of office furniture in 2021

Depreciation groups and useful lives. Search for groups by OKOF code online. The fixed assets classifier serves to assign a depreciation period for material assets and uses codes from the All-Russian Classifier of Fixed Assets.

And if it also exceeds the cost limit established by the organization in its Accounting Policy for accounting purposes (no more than 40,000 rubles per unit), then it is subject to accounting as part of fixed assets in account 01 “Fixed Assets” (clause 5 of PBU 6 /01, Order of the Ministry of Finance dated October 31, 2021 No. 94n). In tax accounting, furniture is recognized as an object of fixed assets if its initial cost exceeds 100,000 rubles per unit. Recognizing furniture as an object of fixed assets, it must be depreciated (clause 17 of PBU 6/01, clause 1 of Article 256 of the Tax Code of the Russian Federation). What is the depreciation group for office furniture? And what is the useful life of furniture to set in accounting? We'll talk about this in our consultation.

We recommend reading: Can bailiffs confiscate property without registration and without marriage if he lives with a woman

Disposal of furniture: OS

- Debit 08 Credit 60 – purchase of office furniture using a bill of lading or a transfer and acceptance certificate;

- Debit 19 Credit 60 – VAT allocated (if furniture is purchased from a VAT payer);

- Debit 68 Credit 19 – VAT is accepted for deduction (if there is a correctly executed invoice);

- Debit 60 Credit 51 – payment was made to the OS supplier;

- Debit 01 Credit 08 – furniture was put into operation on the basis of the OS-1 act;

- Debit 20 (25, 26, 44 ...) Credit 02 – monthly depreciation.

You might be interested ==> List of free medications for group 3 disabled people

Purchasing furniture: accounting as OS

As a result of furniture write-off, the company may incur additional costs. expenses or additional income. For example, broken furniture should be sent for recycling. Or “crosspieces” from discarded office chairs can be used for repairs. Such expenses and income are charged to account 91 “Other income and expenses”.

In order to write off the value of the property specified in paragraphs. 3 p. 1 art. 254 of the Tax Code of the Russian Federation, during more than one reporting period, the taxpayer has the right to independently determine the procedure for recognizing material expenses in the form of the cost of such property, taking into account the period of its use or other economically justified indicators.

The courts, as a rule, take the side of organizations in such cases. For example, the Federal Antimonopoly Service of the Moscow District, in its Resolution dated June 28, 2012 in case No. A40-50869/10-129-277, recognized the legal attribution of accrued depreciation on such fixed assets as chairs for visitors to expenses that reduce the taxable base for income tax , sofas, wardrobe, office kitchen, refrigerators, TV, etc. Recognizing the decision of the tax authority in this part as invalid, the courts reasonably proceeded from the fact that the use of these facilities is aimed at ensuring normal working conditions and is the responsibility of the employer, and therefore the incurrence of expenses associated with the fulfillment of this obligation is directly related to the participation of employees in production process.

The table is the main tool or materials

In addition to SPI, it is also necessary to evaluate the cost criterion for classifying it as fixed assets or low value. The limit is set by the company's accounting policy, but the legislator also controls this parameter. For tax authorities, it is important what you immediately include in the costs of the period, and what stretches out for a period of more than 1 year.

The all-Russian classifier OK 013-2014 (SNS 2008) (hereinafter referred to as the new OKOF) was adopted and put into effect by order of Rosstandart dated December 12, 2014 N 2018-st. The objects of classification in OKOF are fixed assets. The classifier was developed on the basis of harmonization with the System of National Accounts (SNA 2008) of the United Nations, the European Commission, the Organization for Economic Cooperation and Development, the International Monetary Fund and the World Bank Group, as well as with the All-Russian Classification of Products by Type of Economic Activity (OKPD2) OK 034- 2014 (CPA 2008) and is intended, among other things, for the transition to the classification of fixed assets accepted in international practice. Until January 1, 2017, the All-Russian Classifier of Fixed Assets OK 013-94 (OKOF), approved by Decree of the State Standard of Russia dated December 26, 1994 N 359 (hereinafter referred to as the old OKOF), was used. In order to simplify the use of the new OKOF, by order of Rosstandart dated April 21, 2016 N 458, direct and reverse transitional keys between editions of classifiers (hereinafter referred to as the Transitional Key) were approved. The search for the code of a new OKOF can be carried out by the name of the OS or by its purpose. If searching for the code of a new OKOF does not lead to the desired result, then you can use the old OKOF and search for it. Next, find the code from the new OKOF using the Transitional key. At the same time, financial department specialists note that in the description of the new OKOF there is no procedure for assigning classification objects to a specific code. Therefore, the determination of the OKOF code is in any case based on subjective judgment. In addition, when choosing an OKOF code, it is advisable to proceed from the principle of prudence. The main thing is to prevent overestimation of depreciation charges and, as a result, underestimation of the taxable base for property tax (see letter of the Ministry of Finance of Russia dated September 21, 2017 N 02-06-10/61195). Regarding the telecommunications cabinet, we note the following. In our opinion, a telecommunications cabinet according to the new OKOF belongs to communication equipment with code 320.26.30. According to the Classification, a telecommunications cabinet with the new OKOF code 320.26.30 assigned to it can be classified as the fourth depreciation group for industrial and household equipment with a useful life of over 5 years up to 7 years inclusive. We draw your attention to the “Note” column, which contains an indication of “furniture for cable and wire communications enterprises”. We also believe that it is possible to establish a useful life based on information from the manufacturer or (for accounting purposes) the expected useful life. Regarding office furniture, we note the following. According to the old OKOF, furniture for offices (code 163612450 “Furniture sets for administrative premises”) is classified in the subsection “Industrial and household equipment” (code 160000000), in the class “Special furniture” (code 163612000). According to the Classification, as amended, in force until January 1, 2017, “Special furniture” (code 163612000) belonged to the 4th depreciation group (property with a useful life of more than 5 years up to 7 years inclusive). At the same time, according to the new OKOF (as amended from 01/01/2017 to 07/31/2017), “Furniture sets for administrative premises” are classified under code 330.31.01.1 “Furniture for offices and trade enterprises.” This conclusion also follows from the direct transition key. However, in the current edition of the Classification “Furniture for offices and retail establishments” (code 330.31.01.1) is not named. At the same time, we draw your attention to the explanations of representatives of the financial department, which were given in relation to the budgetary organization in the letter dated December 27, 2016 N 02-07-08/78243: “In case of any contradictions in the use of direct (reverse) transition keys approved by the Order N 458, and OKOF OK 013-2014, as well as the absence of positions in the new OKOF OK 013-2014 codes for accounting objects previously included in the groups of material assets, which, according to their criteria, are fixed assets, the commission for the receipt and disposal of assets of the accounting subject can accept an independent decision to classify these objects into the appropriate group of OKOF OK 013-2014 codes and determine their useful life. In relation to material assets that, in accordance with Instruction 157n, relate to fixed assets, but these assets are not included in OKOF OK 013-2014 (SNA 2008), in this case such objects are taken into account as grouped according to the All-Russian Classifier of Fixed Assets OK 013-94″. See also letter of the Ministry of Finance of Russia dated December 30, 2016 N 02-08-07/79584. In our opinion, it would be more correct to classify office furniture as belonging to the group of the new OKOF 330 “Other machinery and equipment, including household equipment, and other objects.” The most suitable code in this grouping would be OKOF code 330.28.99.39.190 “Other special-purpose equipment, not included in other groups” or 330.28.29 “Other general-purpose machines and equipment, not included in other groups.” In relation to the situation under consideration, in the absence of a direct indication of the corresponding grouping in the Classification for office furniture for tax accounting purposes, it is possible to establish a useful life based on the manufacturer’s information. If you follow the above explanations, since before the introduction of the new OKOF, office furniture belonged to the 4th depreciation group, for which the useful life ranged from 5 years to 7 years inclusive, then the organization has the right to office furniture purchased after January 1, 2021, also classified as 4th depreciation group.

You might be interested ==> Omskoblgaz official website schedule for checking gas equipment among the population for 2021

According to paragraph 1 of Art. 256 of the Tax Code of the Russian Federation, depreciable property for the purposes of Chapter 25 of the Tax Code of the Russian Federation includes property with a useful life of more than 12 months and an initial cost of more than 100,000 rubles. In accordance with paragraph 1 of Art. 258 of the Tax Code of the Russian Federation, depreciable property is distributed among depreciation groups in accordance with its useful life. The useful life is the period during which the asset serves to fulfill the goals of the taxpayer's activities. The useful life is determined by the taxpayer independently on the date of commissioning of this depreciable property in accordance with the provisions of Art. 258 of the Tax Code of the Russian Federation and taking into account the Classification. The norm of paragraph 6 of Art. 258 of the Tax Code of the Russian Federation establishes that if any types of fixed assets are not indicated in depreciation groups, their useful life is established by the organization taking into account the technical conditions or recommendations of manufacturers. Thus, if, based on the documents available to the organization, it is impossible to determine the useful life of the OS, then you can contact the manufacturer (seller) with a corresponding request. Next, based on the established useful life, you can determine the depreciation group in accordance with clause 3 of Art. 258 Tax Code of the Russian Federation. Let us note that specialists of the Ministry of Finance of Russia, when considering taxpayers’ questions regarding the determination of depreciation groups, also often refer to the norm of paragraph 6 of Art. 258 of the Tax Code of the Russian Federation (see, for example, letters of the Ministry of Finance of Russia dated 03/06/2017 N 03-03-06/1/12629, dated 12/30/2016 N 03-03-06/1/79707, dated 11/03/2016 N 03-03- 06/1/64814, dated 04/03/2015 N 03-03-06/4/18874). At the same time, on the issue of classification of fixed assets included in depreciation groups, the Russian Ministry of Finance refers taxpayers to the Russian Ministry of Economic Development (see letters of the Russian Ministry of Finance dated April 25, 2016 N 03-03-06/1/23916, dated November 3, 2015 N 03-03-06 /1/63570, dated 04/03/2015 N 03-03-06/4/18874, dated 08/25/2014 N 03-03-06/1/42310).

On this issue, we adhere to the following position: For office furniture, the most suitable code would be OKOF code 330.28.99.39.190 “Other special-purpose equipment, not included in other groups” or 330.28.29 “Other general-purpose machines and equipment, not included in other groups” groups." The telecommunications cabinet belongs to communication equipment with code 320.26.30. For accounting purposes, the useful life for fixed assets is established by the organization in accordance with the accounting policies of the organization. Based on the Classification, both the telecommunications cabinet and office furniture can be classified in the fourth depreciation group for industrial and household equipment with a useful life of over 5 years up to 7 years inclusive. We also believe that it is possible to establish a useful life for accounting purposes based on information from the manufacturer or the expected useful life, unless otherwise specified in the accounting policy. For tax accounting purposes for office furniture, due to the lack of a direct indication of the grouping in accordance with the Classification, it is possible to establish a useful life based on the manufacturer’s information.

You may be interested ==> Help for families and children is given 100,000 rubles

Inventory is classified as fixed assets if its useful life is more than 12 months and its cost is more than 40,000 rubles. (Clause 4 PBU 6/01). At a lower cost, it is allowed to take it into account as part of the inventory (clause 5 of PBU 6/01). At the same time, the organization can set its own cost limit between fixed assets and inventories at the above limit. For example, how to take into account objects costing over 20,000 rubles as fixed assets, and cheaper ones as inventories. The cost threshold must be fixed in the accounting policy.

Classification of fixed assets included in depreciation groups

The fixed assets classifier serves to assign a depreciation period for material assets and uses codes from the All-Russian Classifier of Fixed Assets. For fixed assets put into operation from 2021, the useful life is determined by the codes of the new OKOF OK 013-2021. For fixed assets introduced before 2021, the deadlines are determined by the codes of the old OKOF OK 013-94. If, according to the new classifier, the fixed asset belongs to another group of the organization, then the terms do not change. For tax accounting, refer to clause 8, clause 4, article 374 of the Tax Code of the Russian Federation and clause 58, article 2 of the Law of November 30, 2021 No. 401-FZ.

- The first group is all short-lived property with a useful life from 1 year to 2 years inclusive

- cars and equipment

- The second group is property with a useful life of more than 2 years up to 3 years inclusive

- cars and equipment

- Means of transport

- Industrial and household equipment

- Perennial plantings

- Third group - property with a useful life of more than 3 years up to 5 years inclusive

- Facilities and transmission devices

- cars and equipment

- Means of transport

- Industrial and household equipment

- The fourth group is property with a useful life of over 5 years up to 7 years inclusive

- Building

- Facilities and transmission devices

- cars and equipment

- Means of transport

- Industrial and household equipment

- Cattle working

- Perennial plantings

- Fifth group - property with a useful life of over 7 years up to 10 years inclusive

- Building

- Facilities and transmission devices

- cars and equipment

- Means of transport

- Industrial and household equipment

- Fixed assets not included in other groups

- Sixth group - property with a useful life of over 10 years up to 15 years inclusive

- Facilities and transmission devices

- Dwellings

- cars and equipment

- Means of transport

- Industrial and household equipment

- Perennial plantings

- Seventh group - property with a useful life of over 15 years up to 20 years inclusive

- Building

- Facilities and transmission devices

- cars and equipment

- Means of transport

- Perennial plantings

- Fixed assets not included in other groups

- Eighth group - property with a useful life of over 20 years up to 25 years inclusive

- Building

- Facilities and transmission devices

- cars and equipment

- Vehicles

- Industrial and household equipment

- Ninth group - property with a useful life of over 25 years up to 30 years inclusive

- Building

- Facilities and transmission devices

- cars and equipment

- Vehicles

- Group ten - property with a useful life of over 30 years inclusive

- Building

- Facilities and transmission devices

- Dwellings

- cars and equipment

- Vehicles

- Perennial plantings

We recommend reading: Department for Issuing Cars for Large Children in Rostov

What applies to household equipment and accessories?

Important! The article discusses the accounting procedure provided for by PBU 5/01. From 01/01/2021 it will no longer be in force, and the accounting rules are regulated by the new FSBU 5/2019 “Inventories”. Some accounting rules have been changed significantly. An analytical review from ConsultantPlus will help you rebuild your inventory accounting. Get trial access to K+ for free and proceed to the material.

Accounting for inventory and household supplies as part of OS

In any option, objects are taken into account at their acquisition cost, which is the sum of all costs associated with the purchase. In general, VAT is not included in this amount. It is included in the price only if MCs are used for non-taxable activities (clauses 2, 5, 6 PBU 5/01 “Accounting for inventories”, approved by order of the Ministry of Finance of Russia dated 06/09/2001 No. 44n, clause 8 PBU 6 /01 “Accounting for fixed assets”, approved by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n).

Not all office equipment and inventory can be taken into account when writing off expenses. So, if there are no complaints about the purchased furniture, then the inclusion of some equipment in the documentation may raise questions among tax inspectors.

There is another way to keep records. It can be carried out within a separate off-balance sheet account. If the company goes this route, it will need to create accounting cards for all furniture items. For such purposes, unified or independently developed forms can be used.

Carrying out accounting of office equipment

Based on the statement, it turns out that office furniture is part of the inventory. If a company purchases inexpensive items, they are all reported as inventory. In addition, the company maintains control over the movement and safety of purchased property. The receipt of furniture can be reflected using the following postings:

When the cost threshold for fixed assets changes at the state level, the company applies the previous standards for previously commissioned elements, and the updated indicators are used for current and future acquisitions.

Furniture depreciation in 2021

If you cannot find a solution this way, you can also use the previous OKOF OK 013-94 and search on it. Then find the code from the new OKOF OK 013-2021 (SNS 2021), using the Transitional key, approved. by order of Rosstandart dated April 21, 2021 No. 458 (hereinafter referred to as the Transitional Key). If it is not possible to determine the OKOF code in the new classifier, the institution should assign a conditional code to the fixed asset object that is remotely suitable in meaning for this fixed asset. In the case under consideration, a contextual search by name, purpose and other characteristics of the specified fixed assets does not produce results. If you use the Transitional Key, for fixed assets such as furniture, you are asked to select a code from group 330.31.01.1 “Furniture for offices and trade enterprises.” However, according to Amendment No. 3/2021 OKOF, approved.

We recommend reading: Major renovation of apartment buildings 2021 in Belgorod, benefits for pensioners

After this, you can write it off through depreciation. At the next stage, a depreciation group is selected. It starts with classification. If the type of property is not found in it, you should contact OKOF. According to clause 39 of the federal standard “Fixed Assets,” the rules for calculating depreciation are changing from January 1, 2021: The new rules apply only to those objects that will be accepted for accounting as part of fixed assets from January 1, 2021. For objects reflected on account 101 00 before January 1, 2021, there is no need to recalculate depreciation (letter of the Ministry of Finance of Russia dated December 15, 2021 No. 02-07-07/84237). In particular, there is no need to charge depreciation up to 100% for fixed assets worth from 40 thousand to 100 thousand rubles registered before January 1, 2021.

How to properly record furniture in accounting

Law of December 6, 2021 No. 402-FZ). Therefore, when reflecting fixed assets built on an economic basis in accounting, apply the same rules as under the general taxation system. Operations related to the receipt, movement and disposal of fixed assets do not affect the calculation of UTII (clause.

Depreciation Group of Fixed Assets 2021 Furniture

Typically, the cost of office furniture is low and amounts to less than 40,000 rubles per unit. Such furniture can be taken into account as goods and materials. If the useful life of such furniture is more than 12 months , it is necessary to ensure separate accounting of inventory items for the safety of the furniture.

If, according to all standards, a furniture set should be taken into account as part of fixed assets, then its amount after installation and start of operation will be reflected in account 01. Depreciation will have to be charged on such objects every month. The arrival of new furniture is shown in the accounting records with the following entries:

Furniture kitchen shock-absorbing group 2021

I have a password. Password has been sent to your email Enter. Enter email Wrong login or password. Incorrect password. Enter password. This is my first time here. They allow you to get to know you and receive information about your user experience.

The current version of your browser is not supported. Encyclopedia of disputable situations on income tax The court made the following conclusion: since a coffee machine, coffee maker, microwave ovens and kitchen furniture are necessary for employees to eat, and vacuum cleaners are necessary to maintain cleanliness and order in the office, the court considered that the organization rightfully included depreciation charges in expenses for this property. Expert consultation, Fixed asset items, the cost of which is not significant, with the same useful life, for example, furniture used during the same period to furnish one room, are combined into one inventory item as an asset accounting unit. Legal resources “Hot” documents Codes and the most popular laws Reviews of legislation Federal legislation Regional legislation Draft legal acts and legislative activities Other reviews Reference information, calendars, forms Calendars Forms of documents Useful tips Financial consultations Magazines of the publishing house "Glavnaya Kniga" Internet interviews Forums Classics of Russian law Useful links and online -services Subscribe to newsletters News informer ConsultantPlus News RSS feeds and Twitter Export of materials Documents Collections of materials.

We recommend reading: Who are low-income families in Yekaterinburg

Accounting for office furniture in accounting

Accounting for furniture in accounting must be organized in accordance with the norms of tax legislation (Article 257 of the Tax Code of the Russian Federation) and accounting provisions (clause 4 of PBU 6/01). Furniture items can be accounted for as inventories or fixed assets. The criteria for identifying ownership are the cost of the object, its service life and purpose.

Related publications

- D91 - K01 posting is formed in the amount of the residual value of the object that was decided to be decommissioned;

- D02 – K01 – accrued depreciation amounts are written off;

- D10 - K99 - correspondence will be relevant in situations where furniture is liquidated by disassembly, and the remaining individual materials are registered and used in the activities of the enterprise;

- D91 - K99 - indicates the amount received by the organization as a result of the disposal of furniture;

- D99 - K91 - posting reflects the loss that was caused by the disposal of furniture.

May 20, 2021 semeiadvo 557

Share this post

- Related Posts

- List of Free Medicines for Diabetics 1 for 2021

- At what age do they sell strong alcoholic drinks in Mordovia?

- Pensioners 2021 for products in the Rostov region 2021

- St. Petersburg train benefits 2021

Kitchen shock absorbing group

It is on the basis of this document that fixed assets are distributed into depreciation groups. Tax legislation regulates the procedure for action in such situations. Clause 6 of Art. Consequently, enterprises have the right to determine the SPI of furniture based on its specific qualities.

Also, based on approximate guidelines in the Classification and taking into account the reliability of a particular asset, codes are assigned and the 4th depreciation group is established for the desk and sofa. These positions can, with a stretch, be attributed to the OKOF code. Unfortunately, the legislator left out an impressive block of enterprise property, without indicating in the Classification which depreciation group the furniture belongs to.

We recommend reading: Benefits for minor children of Chernobyl liquidators

Disposal of furniture when writing off fixed assets

Write-off of federal real estate (including objects of unfinished construction) and especially valuable movable property assigned to federal autonomous institutions by the founder or acquired using funds allocated by the founder for the acquisition of this property is carried out in agreement with the federal government bodies that are the founders of autonomous institutions (paragraph "and" clause 4 of Resolution No. 834). As for the write-off of federal property of autonomous institutions acquired with funds received from income-generating activities, such a decision is made by the institutions independently (clause “k”, paragraph 4 of Resolution No. 834).

We recommend reading: LPH Is It Possible to Build a House for Living in 2021

The actual cost of material inventories remaining with the institution as a result of disassembly, disposal (liquidation) of fixed assets is determined based on their current estimated value as of the date of acceptance for accounting, as well as the amounts paid by the institution for the delivery of material inventories and bringing them into a suitable condition. for use (clause 106 of Instruction No. 157n). When determining the actual cost of the waste received, it is necessary to take into account the costs of delivery and bringing it into a usable state. Write-off of fixed assets in the accounting records of an autonomous institution is reflected in accordance with the requirements of Instruction No. 183n

Accounting system

In the accounting policy of Master Furniture LLC, the fixed asset is recognized as property that is used and generates income for more than 12 months and has a tangible form. Accounting is carried out on the basis of PBU “Accounting for fixed assets” and guidelines for accounting of fixed assets. Classification of fixed assets is carried out in accordance with the all-Russian classifier of fixed assets OK 013-94, the accounting unit is an inventory object. Analytical accounting is maintained for each inventory item.

We recommend reading: Tax Benefits for Car Payments for Group 3 Disabled Persons in 2021 in Kazakhstan

The amounts of actual costs are collected on account 08. Balance Dt 08 reflects the amount of actual costs for unfinished construction and acquisition. Turnover Dt 08 - the amount of actual costs for the acquisition of fixed assets for the reporting month. Turnovers according to Kt08 are actual costs that make up the initial cost of commissioned objects.