What happens to employees

1. Severance pay in the amount of one average monthly salary in production.

2. Receiving an average monthly salary for two months (for the period of employment). This amount will include severance pay. If an employee registers with the employment center, the number of salaries may increase to three

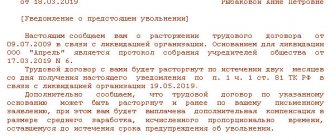

3. To be sent notice of his upcoming dismissal. This is necessary so that the employee has time to prepare for upcoming financial losses. Typically, notices are required to be given at least two months prior to termination.

But compensation is not everything, because employees worked and have the right to receive wages in the event of bankruptcy of the enterprise. It doesn’t matter when exactly they quit – before or after the start of the procedure, or they didn’t quit at all. True, there is a sequence that, according to the law, must be observed.

Employees have the right to demand wage arrears, defending their interests. To do this, citizens can apply not only to the labor inspectorate, but also to the prosecutor’s office or court.

How money is distributed among employees

The queue has its own rules for repaying debt.

And the further the queue, the less likely it is that all claims will be paid. That is why the legislator pushes wages forward. But even between creditors who are in the same queue, there are their own rules for repaying debt. For employees, when paying off current debts, calendar priority plays a role. The earlier in date the debt was formed, the sooner it is repaid. At the same time, demands for remuneration of executives are partially moved beyond the second priority when repaying current debts. All amounts that exceed the minimum amount of the corresponding payments are paid only after the claims under the third priority have been settled.

Next, the bankruptcy trustee proceeds to satisfy the registered debt generated as of the date of filing the bankruptcy petition. The amount of debt owed to each employee is formed from the debt, taking into account interest for late payment of wages, vacation pay, dismissal payments and other payments.

There is also a sequence here:

- Initially, severance pay and arrears of wages are paid, but not more than 30,000 rubles each. for each employee.

- Then the balance of the salary debt is paid to each employee.

- And last but not least, the requirements of the authors of intellectual property results are satisfied.

This is also important to know:

What are the stages of bankruptcy of an individual?

Within each sub-line, the money is divided proportionally among all employees.

Consequences of bankruptcy

A bankrupt enterprise, by a court decision, is transferred under the management of an external consultant; in this case, the employer himself no longer controls the situation, so employees should clarify all issues with the new responsible person. The task of the external manager is to liquidate the organization and pay debts to creditors.

When liquidating a legal entity, the manager must dismiss employees in accordance with Article 81 of the Labor Code of the Russian Federation. Contractual relations with personnel must be terminated gradually. Lastly, relations with exceptional categories of employees are subject to termination:

- Pregnant women, as well as those caring for children on required leave.

- Minor employees.

- Mothers and fathers raising children without a second parent.

- Disabled people.

General dismissal process

An enterprise that is declared bankrupt by court is entrusted with the management of an external manager, and he resolves all issues.

The former employer cannot control the situation, so it makes no sense to contact him for all questions. The new director must liquidate the organization in the correct order, pay off all debts and dismiss workers, according to the order, in stages: first on general terms, then maternity leavers and minors, and lastly single parents and disabled people.

The manager approves and signs orders on dismissal dates in this order, then pays mandatory bankruptcy compensation.

This is also important to know:

How to independently file an application for bankruptcy of an individual

Any person currently employed may leave the organization before the planned date of dismissal. The manager must be notified of early departure. But at the same time, the level of payments changes - only the average salary and vacation compensation are provided.

The general characteristics and procedure for dismissal depend on the initiator: the person himself wrote an application or in the process of liquidation of the company.

Step-by-step process of self-care:

Free legal consultation We will answer your question in 5 minutes!

Ask a Question

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

- Writing an application.

- Registration of the document.

- Signing the dismissal order.

- Registration of an order.

- Familiarization of the employee with the order.

- Drawing up settlement documents.

- Performing the calculation.

- Registration of a work book.

- Issuance and confirmation of receipt of documents.

Step-by-step process for dismissal due to liquidation:

- Signing the dismissal order.

- Registration of an order.

- Familiarization of the employee with the order.

- Drawing up settlement documents.

- Performing the calculation.

- Registration of a work book.

- Issuance and confirmation of receipt of documents.

Types of debt

The payment procedure can be divided into several stages, depending on at what stage the bankruptcy procedure occurs.

- After introducing the observation stage, at the initial stage of bankruptcy, the employer must calculate wages and all due payments.

- Then the manager must pay all current payments, out of sequence, but after paying the legal costs of the bankruptcy procedure and the agreed remuneration to the insolvency administrator.

Note that if financial management lies with the manager, then he distributes wages and pays them to employees.

As a rule, a salary arrears repayment schedule is drawn up.

- At the stage of liquidation of the organization, and this is 2 months before the final closure, the manager must inform all employees in writing about the upcoming dismissal.

- If an employee quits at this stage, his salary and compensation must be immediately calculated and paid 2 months in advance. This is stated in Article 178 of the Labor Code of the Russian Federation.

- The manager must also inform employees about their salary payments. The information must be entered into the register of creditors.

- Next, the registered debt is paid in the second order. If there are not enough funds to settle payments with second-priority creditors, then the available amount will be distributed among them in proportion to the size of the debt.

This is the procedure for paying off the debt of a bankrupt enterprise.

Please note that claims for ongoing debt payments will not be entered into the register.

There are two main types of debts of a bankrupt company:

- Current. This is the name given to the amount of money that bankrupt companies must pay after bankruptcy is declared. However, the money in question was not paid to the employees. These amounts are not included in the register of claims, but they are in first place in terms of speed of compensation.

- Registry. This category includes debts on wages, benefits, vacation pay, workers' compensation before the company was declared bankrupt. Such debts are included in the register and are listed among the second-priority debts.

First of all, the debtor must pay legal costs, which cannot be avoided if you go through all the circles of hell of the bureaucratic bankruptcy procedure. Only after this will debts be paid to employees, many of whom may have worked for the company for years and built a career in it. You will also have to compensate for damage to health and morale, but only if the company has such obligations to its employees.

Companies are not always interested in transferring debts to employees; therefore, in order to protect their interests, employees can choose a representative who protects their interests. It is best for this to be a professional who has positive experience in such matters.

According to the law, debts of a current nature are initially paid, and only after that the payment of registered debts begins.

Since current debts are paid first in the bankruptcy process, let us consider the features of this procedure in more detail. It should be taken into account that the current debt on wages is taken into account separately and is not included in a special register, which includes all claims of creditors. This is a huge advantage for employees whose salary arrears are included in this list.

- legal costs that arose during the consideration of bankruptcy cases;

- payment for work arb. manager;

- payment for the services of those persons who were attracted by the AU to assist in the bankruptcy procedure (notaries, appraisers, etc.).

As a result, the costs turn out to be more than large, because even if employees stand outside the register queue, this does not guarantee that they will get at least something. This happens because debts are covered by income from the sale of the debtor’s property, which is not always enough.

Wage arrears in this situation cannot be returned through the court. The workers' demands have already been accepted, but the problem is the financial well-being of the debtor, which turned out to be so bad that it is impossible to compensate for the debts. But there is also good news. According to statistics, if wage debts are included in the current debt, most likely they will be returned to the person.

But if an employee’s rights are violated, a complaint to an arbitration court is the most objective measure. If the fact is confirmed, then the court will determine the amount of payment.

If wage debts accumulated before the bankruptcy case began, they will be included in the register. It includes all debts, perhaps excluding current ones, which have their own category, which we discussed above. The register contains not only salary debts before bankruptcy, but also the company’s debts to creditors and third parties.

The register is compiled and maintained by a manager appointed by the arbitration court, but there may be cases when this process is handled by a special registrar organization. It is in order to get into this register that you need to contact the manager in time, otherwise you may not be included in the queue or moved too far in the queue. This is fraught with the fact that there will be no money left to compensate the debt.

In order to ensure that the requirement has been included in the register, you can contact the AU. He can issue an extract from the register, and then there will be no unpleasant surprises. But there are several conditions for how you need to send a document:

- the letter must be registered with a list of attachments;

- sent to the address indicated on the FRSB website.

In addition, in addition to information about whether the employee is included in the register, it will be interesting to evaluate other advantages of the document. It contains all the relevant information on the case, so the workers' representative can view the AC reports to stay informed about what is happening and instruct clients.

By the way, if the registry indicates the wrong amount of debt (for example, less than required), this can be challenged. However, in this case you need to seek help from the district court. His decision serves as sufficient evidence and basis for inclusion of changes in the register.

We invite you to familiarize yourself with: Salary by hour, sick leave calculation

Customer Reviews

Gratitude from Kikkas V.P. Kikkas V.P. I am grateful to the Legal Agency of St. Petersburg for understanding the situation and timely assistance in my seemingly hopeless situation, personally to Denis Yuryevich Stepanov, I hope to continue to cooperate.

Kikkas V.P. 08.11.2018

Gratitude from N.A. Tomashpolskaya I would like to express my deep gratitude to Alexander Viktorovich Pavlyuchenko for his competent legal advice and sensitive, attentive attitude towards me, who found myself in a difficult situation.

Sincerely, Tomashpolskaya N.A. 07/01/18

Gratitude I express my deep gratitude to lawyer Konstantin Vasilyevich for his attentive, kind, and, most importantly, very clear and competent explanation of my situation. It's nice to know that the world is not without good people. I wish Konstantin Vasilyevich good health, success in everything, prosperity, good, grateful clients and all the best. Sincerely.

Thanks to Stepanov D.Yu. I express my deep gratitude to lawyer Denis Yuryevich Stepanov for his high professionalism and attentiveness to his case when considering the issue in word with a contractor who improperly completed the work of erecting a screw foundation. The cost of the work amounted to 178,300 rubles. And the court of the Vyborg district (Case No. 2-1432/2018) dated March 12, 2018) to collect, taking into account all fines, 504,800 rubles. Once again, I thank you and wish you success in your future work and only successful business conduct.

Grateful to you, your client. 05/18/18

Gratitude from Ustinova T.M. I would like to express my deep gratitude to Sergei Vyacheslavovich for the legal services provided when I had a difficult relationship with Beauty Salon LLC and Alfa-Bank.

Ustinova T.M. November 10, 2018

Feedback from Gizatullina Dear leader!

I would like to express my deep gratitude to lawyer Lidiya Aleksandrovna Kuznetsova for her professional advice in solving my problem, for her sensitive, attentive attitude towards me as a client, for her competent approach to the matter. I also want to express my sincere gratitude to the team for their friendliness and professionalism. I wish you continued success in your legal career.

Gratitude from Plisetsky V.V. I would like to express my gratitude to Sergei Vyacheslavovich Mavrichev for his sensitive attitude and understanding towards clients. The issue was resolved within one day. I am very grateful to Sergei Vyacheslavovich.

Plisetsky V.V. October 19, 2018

Gratitude from Marina Kuleshova I express my deep gratitude to Alexander Viktorovich Pavlyuchenko for his competent legal work and professionalism, as well as to his assistant Elena Vladimirovna for the qualified assistance provided. I wish you prosperity and achievement of professional heights.

Sincerely, Marina Kuleshova. 08/15/2018

Gratitude from Alexey Shubakov Many thanks to Sergei Vyacheslavovich for the complete and detailed consultation. I have not encountered legal assistance before, but now, with a very favorable impression, I will definitely apply again in the future.

Shubakov Alexey 10/17/2018

Review by Gavrichkova A.N. I would like to express my deepest gratitude to Yuri Vladimirovich Sukhovarov for his humane attitude towards my problem and detailed professional advice on solving it. I wish I could meet such people in my life more often.

Sincerely, Gavrichkov Alexander Nikolaevich.

Required Notices

All employees must be notified of the planned dismissal at least 2 months before the date of termination of employment.

The following groups are exceptions:

- Seasonal employees - are notified no later than 1 week before the date of termination.

- Employees with short-term labor contracts are given three days' notice.

The manager issues an order to reduce staff in connection with the liquidation of the enterprise, copies of the document are issued to all personnel. All personnel of the organization sign for a copy of the order. If the employee refuses to sign, then the manager must draw up a statement of refusal.

Dismissal in the event of bankruptcy of an enterprise also requires notification of the local employment center. The notice period depends on the number of people to be fired:

- If the number of employees is more than 15 people, then notification is sent 90 days in advance.

- If the staff number is less than 15 employees, notice must be given 60 days in advance.

On the last working day, a full settlement is made with all employees, they are given all the necessary documents confirming their work activity (work books, certificates, etc.).

Procedure for notifying social protection authorities

When dismissing employees of an enterprise, it is imperative to notify government institutions providing social support to the population in the appropriate manner:

- The first step is to send written notice to the trade union organization. Its notification must take place at least three months before liquidation. You can find a ready-made notification form on the Internet, add the details of your company and send it. The notification must contain information: the name of the trade union, information about the entrepreneur and employees, place of preparation, date, order to terminate the existence of the enterprise, signature of management. The employer needs to keep the second copy with a stamp as confirmation.

- The Employment Center must be notified of the upcoming liquidation and bankruptcy of the company 2 months before the dismissal of employees. The written notification must contain information about the enterprise, the date and reason for dissolution, a table of employees indicating the position, qualifications, quantity and wages. In the same way, the second copy of the signed notice remains with the manager.

- The pension fund is informed by the tax authority in accordance with Federal Law No. 210.

- Notification of the military registration and enlistment office must take place one week before complete liquidation.

- The Social Security Fund, like the pension fund, does not need to be notified separately - since 2015, this has been handled by the tax service. But employees can apply there themselves for social support and benefit payments.

This is also important to know:

What is enforcement proceedings in bankruptcy: revocation of the writ of execution

Late notification or lack of notification is subject to fines.

Sequence of salary payment, indexation of payments

Since one point in the queue has its own internal order, sometimes receiving a salary during bankruptcy is a rather complicated process with many misunderstandings. Everyone wants to get paid, but the further people stand in line, the less likely they are to receive compensation. And because employees put in the time and effort, they expect fair compensation rather than the possibility of it.

Even creditors who are in the same queue may not receive money at the same time. To avoid confusion, a special calendar is used. The rules here are simple: the sooner the debt appears, the sooner it will be repaid. But management is paid last. This is due to the size of their salary. If the amounts are greater than the stated limits, they go to the end of the queue (executed in the third queue). That is, they may not be compensated at all.

The amount of debt is formed taking into account:

- interest on arrears;

- vacation pay;

- compensation upon dismissal, etc.

The order of payments is as follows:

- First of all, severance pay and salary debts are returned (if the amount does not exceed 30 thousand rubles per employee).

- Next, the remaining debts to employees are compensated.

- Payment for the work of intellectual property owners.

Within queue groups, amounts are divided in equal shares.

When an employee is dismissed due to liquidation, he is entitled to pay:

- payment for the time period actually worked in the last month before dismissal (or average earnings, in case of early dismissal);

- compensation for vacation days that the employee did not have time to use;

- severance pay in the form of average earnings for 1 month after termination of the contract (Article 178 of the Labor Code of the Russian Federation);

- if he fails to get a job and registers with the employment center, the average earnings for the second and in exceptional cases for 3 months after dismissal (Article 178 of the Labor Code of the Russian Federation).

In addition, it should be pointed out that if the place of work of those dismissed was the Far North, then on the basis of Art. 318 of the Labor Code of the Russian Federation, they are paid an average salary (severance pay) for 3 months after termination of the contract, and by decision of the employment center, it can be maintained for the 4th and 5th month. Each type of these payments has its own calculation features that must be taken into account when providing them.

In the event of bankruptcy of an organization, employees must receive a salary, which is accrued to them regardless of the functioning of the company and the establishment of its insolvency (Article 130 of the Labor Code of the Russian Federation). The obligations of a legal entity to the workforce that arose during the period of bankruptcy proceedings are considered current debts.

Such debts to creditors are considered priority. However, payments to employees for wages and benefits as part of current debts are made in the second place. If wage debts arose before the initiation of bankruptcy proceedings, then they can be classified as current payments and included in the register of claims.

In case of bankruptcy of a legal entity, the staff has the right to receive wages, vacation pay and benefits. The benefit is calculated depending on the average daily earnings multiplied by the required number of days. If a dismissed person has not found a new job within 14 days, he has the right to an additional amount of average monthly income.

Table. Bankruptcy of an enterprise, due payments to dismissed employees

| Grounds for dismissal | ||

| By agreement of the parties (clause 1, article 77 of the Labor Code of the Russian Federation) | At the initiative of the employer (Article 81 of the Labor Code of the Russian Federation) | At your own request (clause 3 of article 77 of the Labor Code of the Russian Federation) |

| Salary | ||

| Vacation compensation | ||

| Compensation | Benefit in the amount of average monthly earnings (Article 178 of the Labor Code of the Russian Federation) | Average salary for the period of forced absence (Articles 234, 394 of the Labor Code of the Russian Federation) |

| Average monthly salary for the second and third months after dismissal (Article 178 of the Labor Code of the Russian Federation) | Compensation for moral damage (Article 394 of the Labor Code of the Russian Federation) | |

| Legal costs (Article 94 of the Code of Civil Procedure of the Russian Federation) |

- Wages for the period worked, taking into account indexation.

- Compensation payment for vacation. Or the employee may be asked to take a vacation and then resign. Compensation is calculated taking into account the days that the employee did not use during the entire period of work in the organization. Vacations are usually counted for 2 years.

- Severance pay in the amount of the average monthly salary for 1 month.

- During the period of employment, the average monthly salary is maintained, but payments will be made for no more than 2 months. This is stated in Article 178 of the Labor Code of the Russian Federation.

- There may also be arrears of wages that the employer did not pay to the employee previously. It can be paid according to a statement or cash order. The employee must sign each document.

Calculation of vacation pay in a new way - how to calculate vacation pay upon dismissal, next vacation, going on maternity leave, etc.?

Funds are distributed among employees in turn, equally among everyone on the list of this queue.

The law establishes the procedure for making payments. As we wrote above, a queue will be approved, according to which the employees will be paid the money they are entitled to.

- First of all, arrears of wages and the amount for severance pay are subject to payment. The total amount cannot exceed RUB 30,000.

- Then the remaining salary is distributed among employees, which exceeds RUB 30,000.

- Next, other employee payments are paid.

Please note that employees holding management positions at the enterprise will be partially assigned to the third stage of paying off current debt.

Payments will be made only after the remaining employees have been paid the minimum wage and other compensation.

There are payments that the company is obliged to pay out of turn - that is, before all payments to employees.

These include:

- Legal costs.

- Payment to the arbitration manager.

Also, priority is given to workers who have been harmed by the enterprise to their health or life. Payments will be made only on the basis of court decisions.

After them, the employer must pay back wages and other amounts to his subordinates.

In accordance with Article 134 of the Labor Code of the Russian Federation, the employer is obliged to increase wages in real terms, that is, index them, taking into account the consumer price growth index. As a rule, indexation should be specified in the collective agreement.

If there is no collective agreement, then indexation is unlikely to occur.

Indexation can be done annually, quarterly or monthly.

Salaries must be calculated with indexation indicators, which are published monthly by the FSSS bodies.

Mandatory payments to employees

When a company is liquidated, mass layoffs occur when the enterprise goes bankrupt. Payments to employees are provided for by law. In case of bankruptcy of legal entities, compensation and mandatory payments are provided for personnel:

- Salary for time actually worked.

- Compensation if the vacation was not used in full or was partially provided.

- Benefits (day off and while looking for a new job).

Benefits are calculated based on the employee's average monthly earnings. In total, employees who are downsized are paid an average monthly income for 2 months. If the bankrupt enterprise is located in the Far North or in an area equivalent to it, the volume of benefit payments will be income for 3 months.

If an employee registers with the employment center within 2 weeks after leaving the organization, but is unable to find a new job within 2 months, then he receives the right to another payment of the previous average monthly income.

For northern residents, the period required to register at the labor exchange is extended to 1 month, and the paid search for work is extended to six months. This measure is due to the fact that although northerners are socially protected, mobility in their areas of residence is limited by climatic conditions.

Dismissal: what payments are due to employees

- Salary for actual work time, which is calculated by the HR employee according to the schedule (usually bankrupt companies have debts to employees).

- Vacation pay for unused rest days.

- Severance pay. It is calculated by multiplying the average salary with all benefits and bonuses by the number of working days for a two-week period from the date of dismissal by order. For northern peoples, the calculation is made in a slightly different way due to the specific terrain and low temperatures. Employees are paid three times their salary, which is calculated by multiplying the average daily wage by the number of working days within 90 days from the date of dismissal by order.

- Allowance for the period of job search (usually 3-4 months).

Pensioners who work in the company, regardless of the date of departure, must be paid all benefits and compensation. That is, even if they decide to leave earlier than the planned date of their own free will.

For employees who are on maternity leave for pregnancy or child care, payments are supplemented by special social benefits. If an enterprise cannot pay social obligations, then a woman has every right to apply to the social insurance fund. This organization will transfer funds within ten calendar days.

If during liquidation the employee is on sick leave or on vacation, then he must additionally be paid for the days of delay in notification, as for normal working days. Because everyone should have the same position and equality in their job search time.

This is also important to know:

Legal support of bankruptcy procedures: description, stages, procedure

When filling out an order for payments, you can rely on the following example:

He will help you quickly and competently draw up the necessary documentation to reduce problems and avoid liability that a manager may incur when organizing the destruction of a company with violations.

If the manager has found a new job for you and refuses to pay benefits and compensation, then you can safely go to court. Since this is a violation of obligations to you. Regardless of the time and method of finding a new job, mandatory cash payments must be provided.

All employees in the event of bankruptcy of an enterprise must be provided with all payments and social guarantees from the manager of the destruction of the enterprise. In situations where rights are not respected, there are visible violations, you should contact the judicial authorities.

The manager and founders may be subject to criminal, subsidiary, and administrative liability if there is a statement and evidence of a violation of the rights of the dismissed or dismissed persons.

Always be attentive and responsible about the processes of laying off employees during bankruptcy and calculating payments at the same time.

Special situations

Any employee of a company being liquidated may leave it before the date specified in the notice of dismissal. Early departure is agreed upon with the manager. Such employees, instead of benefits, receive compensation, which is calculated as the average income for the period between the dates of actual and planned termination of the employment contract.

We suggest you read: Loan agreement fraud

Payments to employees of retirement age must be issued in full, including both benefits.

For employees on maternity or child care leave, general payments must be supplemented by appropriate social benefits (for maternity or child care). If the company’s budget does not have enough funds to issue social supplements, then the employee has the right to apply directly to the Social Insurance Fund. Based on the woman’s application, the FSS will transfer the money within 10 days.

Temporarily disabled employees can also contact the Social Insurance Fund. In case of significant delays in payments, this measure is especially justified, since the internal problems of the organization should not affect the level of mandatory financial wealth of employees during whose working life social payments to the fund were made on time.

Can the bankruptcy trustee influence the amount of payments?

Let's talk further about how to receive a salary in a bankrupt enterprise, if during bankruptcy the company changed the salary several times. This fact significantly affects the total amount of the salary paid, and employees may not agree with the presented calculations. However, companies, or rather management and judicial authorities that are involved in the bankruptcy process, act using legal methods.

For example, the court may reduce the amount of the required debt, no matter what kind of debt we are talking about - registered or current. The reason for this change is the fact that the salary increased over the last six months before bankruptcy began. Moreover, this step on the part of the company may be considered an attempt to bring it to a crisis, and then the proceedings will drag on even longer. This does not mean that the money will not be returned at all, it’s just that the difference will be paid only in the third phase, if there is enough money for it.

Let's take a closer look at how debts entered into the register are paid to employees, because there is a certain priority in it. But the unfortunate thing is that there is often not enough money to pay for the remaining debt. At best, only a few injured workers will be refunded; at worst, no one will be compensated.

Yes maybe. We mentioned this right of the bankruptcy trustee when we wrote about the amount of payments. But this procedure is not the decision of the manager alone. This specialist evaluates the company’s total assets, and if he sees that they are not large enough, he submits a special petition to the court under his control.

This court grants or denies pending petitions after examining the company's case. In addition, the manager can review the payment of salary in the case of a specific employee. But he cannot satisfy the demands of persons out of turn. This is illegal and is punishable by fines, removal of the manager and other sanctions.

Dear readers!

Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please contact the online consultant form.

It's fast and free! Or call us by phone (24/7):

If you want to find out how to solve your particular problem, call us by phone. It's fast and free!

In accordance with Article 139 of the Labor Code of the Russian Federation, payments that exceed the average monthly salary will not be included in the register of claims of employees of the second and subsequent stages - and this, as a rule, is the management team of the enterprise: manager, deputies, chief accountant, heads of branches and representative offices.

Payments concern wages, severance pay, and other compensation. They may be limited by a lack of funds in the enterprise’s account, formed after the sale of property or the distribution of other assets of the enterprise.

A cap will be placed on all employee benefits based on the size of the bankruptcy estate—that is, the total amount of funds distributed.

As for the wage moratorium, it does not apply to payments - it does not matter whether they relate to registered or current debt.