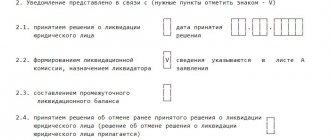

Decision-making

The decision on liquidation is made by the owners - founders, shareholders of the company. If there are several of them, a general meeting . If we are talking about an LLC, then all owners must vote to close the business, which should be reflected in the minutes. If there is only one founder, he makes the sole decision and draws it up in paper form.

A liquidation commission is also being formed , which will deal with closure issues, including dismissal. Its work will last until the termination of the company’s existence is recorded in the Unified State Register of Legal Entities.

Notice of liquidation

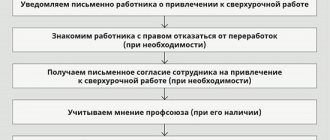

First of all, you should notify the trade union , if one has been created in the organization. This must be done at least 3 months before the company is liquidated. For this purpose, a notification is sent to the representative body.

Next, you need to warn employees that the company is facing liquidation. This must be done in advance, but no later than 2 months before dismissal . This requirement is contained in Article 180 of the Labor Code of the Russian Federation. That is, the employer gave the employee a notice, say, on July 15, which means that he can be fired no earlier than September 15. This rule applies if a standard employment contract is concluded with the employee. But there are situations when the notice period may be different :

- if a fixed-term contract is concluded, notice of dismissal must be given 3 days in advance ;

- if a contract has been concluded for seasonal work - 7 days in advance .

Notice of dismissal must be given in writing . To do this, you can draw up a notice in free form, in which you indicate:

- that by decision of the owners the organization is being liquidated, therefore the contract with the employee is subject to termination on the basis of clause 1 of part 1 of Article 81 of the Labor Code of the Russian Federation;

- that the contract will be terminated after 2 months from the date of notification, and also indicate the date of termination;

- that the employee will receive all payments due to him upon dismissal ;

- that if an employee resigns of his own free will earlier, he will be paid compensation in the amount of average earnings .

The notice is signed by the manager. The employee must also sign and date it.

Situation: the employee does not want to sign anything. In this case, the employer draws up an act of refusal to sign the notice. Instead of the refusenik, any other employee must sign it. From the next day after the date of drawing up the act, the expiration of the two-month period before dismissal will begin.

Liability for violations during dismissal upon liquidation

If the dismissal procedure during the liquidation of a business is carried out in violation of labor laws, it can be challenged in court. Violations may include:

- Failure to comply with the statutory deadlines for notifying an employee or accruing payments to him.

- Violation of any of the points of a procedural nature - failure to draw up internal acts or orders.

- Late issuance of a work book or errors in the entries made in it.

This is also important to know:

Article 77 of the Labor Code upon dismissal: grounds for terminating an employment contract

Important! When the liquidation of a business entity is carried out due to the death of the employer, this procedure is not considered dismissal by liquidation, but is carried out in a completely different format - due to circumstances that do not depend on the will of the parties.

To challenge the legality of dismissal, the employee must, no later than within one month from the date of dismissal, file a claim with the district court against the employer. Geographically, it is possible to appeal to both the court at the place of residence and the court at the location of the employer. Moreover, if the specified period was missed for valid reasons, if such reasons are confirmed, the court may restore it.

Dismissal may also be considered illegal if there was a fictitious liquidation procedure of the enterprise, or if there was a termination of the activities of one of the branches while the business entity continued to exist. In this case, the employee may demand compensation. Possible compensation that an employee illegally dismissed following liquidation can count on includes, first of all, reinstatement at work with compensation for all days of forced absence from the moment of dismissal until the court decision. In addition, the legislation directly provides for the right to claim moral damages from the employer, but judicial practice in most cases only satisfies direct material claims against the employer. Responsibility for paying wages if the employer was an individual entrepreneur rests with him even after cessation of activity as an individual. If the employer was a legal entity, compensation may be paid from its financial or material assets. In addition, they can be recovered from the responsible persons of the said enterprise - according to the legislation on subsidiary liability, it can be borne by the director of the enterprise, his deputy and the chief accountant even after the liquidation of the business.

Employment service notification

At least 2 months before dismissal, the employer is obliged to notify the Employment Service . To do this, a notification is submitted to the territorial authority using the form from Government Resolution No. 99, which is called “Information on laid-off employees.” Although it is not at all necessary to use this particular form - you can write a notification in free form. You must indicate the name of the company, its address and telephone number, as well as a list of employees. For each of them, you should indicate your last name, first name and patronymic, education, profession or specialty, qualifications and average salary.

Dismissal

If one of the employees has expressed a desire to resign earlier than two months, he only needs to submit an application. Upon dismissal, such an employee must be paid compensation for the period not worked before liquidation. It is calculated based on average earnings.

As for the dismissal of all others who did not want to terminate the employment contract earlier, the procedure is as follows :

- After two months from the date of notification, a dismissal order . There are two options: draw up one order for everyone or for each employee separately. From a legal point of view, there is no difference. But it is important that each employee is familiar with the order , and this is confirmed by his signature.

- An entry about the termination of the employment relationship is made in the employee’s personal card and work book . Here is an example: “Dismissed due to the liquidation of the organization, paragraph 1 of part 1 of Article 81 of the Labor Code of the Russian Federation.”

- On the last working day, issue the funds due to the employee , work book and other documents, as for a regular dismissal, including a certificate of earnings for 2 years.

As for finances, upon liquidation the dismissed person must receive :

- the salary that is due to him for the period worked;

- if he did not use vacation - compensation;

- severance pay in accordance with Article 178 of the Labor Code of the Russian Federation, equal to the amount of average earnings.

This is a general case, but an employment or collective agreement may provide for increased benefits.

Situation: in a company that is subject to liquidation, an employee is expecting a child. Is she entitled to any special preferences, benefits, payments? No, in this case the general rules apply, that is, a pregnant woman is dismissed in the same way as all other employees. A similar procedure applies to women who are on maternity leave, single parents and other preferential categories.

Rules for notifying the employment center about mass layoffs

Notification of impending layoffs to the employment service. According to Art. 25 of Law No. 1032-1, organizations must notify the labor exchange no later than 2 months before the start of the event, and individual entrepreneurs must do this no later than 2 weeks before the start of layoffs.

This is also important to know:

Order of dismissal for absenteeism: sample and form

Mass liquidation is the liquidation of an enterprise of any organizational and legal form with 15 or more employees, or the dismissal of workers in the amount of 1 percent of the total number of employees in connection with the liquidation of enterprises within 30 calendar days in regions with a total number of employees of less than 5 thousand people.

Notification must be made in writing by registered mail or courier. In this case, a copy of the notification with a mark from the employment service or with a postal receipt must be kept as evidence of the notification.

The Central Employment Center notification form can be viewed at the employment center notification link.

Payment of benefits after dismissal

The former employee is entitled to average monthly earnings for a period of employment not exceeding two months , including severance pay. If he can find a new job earlier, the payment will stop.

The employment service may decide that benefits should be paid for the third month of job search . This happens in exceptional cases if the former employee registered with the Employment Center within two weeks after dismissal, but was not employed.

Payments upon liquidation of an enterprise to women on maternity leave and on sick leave

After a company ceases operations, the most questions arise from those who are preparing to go on maternity leave, are on maternity leave, or fall ill after dismissal. Meanwhile, the state provides certain security for these most vulnerable categories of citizens.

This is also important to know:

How to formalize dismissal for absenteeism

In paragraphs 3 and 4 tbsp. 13 Federal Law “On Compulsory Social Insurance...” dated December 29, 2006 No. 255-FZ states that if a former employee of a liquidated enterprise falls ill within a month after dismissal, payment for sick leave is made by the Social Insurance Fund, where you must apply with documents within 6 months (but it’s better not to delay!). The same standards apply to expectant mothers who go on sick leave for pregnancy and childbirth.

As for workers dismissed during maternity leave or parental leave, after dismissal they need to contact the social security authority at their place of residence. You must submit a certificate of salary for the past 12 months to social security. Based on these documents, a monthly allowance will be calculated and paid in the amount of 40% of average earnings, and not the minimum as for the unemployed.

Free legal consultation

We will answer your question in 5 minutes!

Free legal consultation We will answer your question in 5 minutes!

Call: 8 800 511-39-66

Ask a Question

Important! Child care benefits will be paid only to those who have not registered with the employment service and, accordingly, do not receive unemployment benefits.

It is worth keeping in mind that receiving benefits for disability, maternity and child care through government organizations does not exclude or affect the receipt by employees of dismissal payments in connection with the liquidation of the enterprise.

Notification of the military registration and enlistment office

No later than two weeks from the date of dismissal of employees subject to military registration, it is necessary to notify the military registration and enlistment office about this. To do this, you need to use the form from Appendix No. 9 to the Methodological Recommendations of the General Staff of the RF Armed Forces on maintaining military records in organizations. The form can be obtained directly from the military registration and enlistment office.

Another point worth considering is that the organization may have employees who are subject to executive documents. For example, for the payment of alimony. After the dismissal of such an employee, you must immediately notify the unit of the Bailiff Service and return the writ of execution to them. If the employer fails to do this, he may be fined.