From January 1, 2021, the tax amnesty came into force!

This means that starting January 1, 2021, debts deemed uncollectible will be written off from individual entrepreneurs and individuals. Individual entrepreneurs will be exempt from tax debts that arose before January 1, 2015, and insurance premiums accrued before January 1, 2021, and debts on property taxes will be written off from ordinary citizens: transport, land, property taxes.

For what taxes will debts be written off?

Let's consider the list of main taxes for which arrears are expected to be written off in 2021.

Ordinary citizen (individual)

- Transport tax All debt that arose before January 1, 2015, as well as penalties accrued on it before the day the decision was made to write off the debt, is subject to write-off

- Land tax

- Property tax

Individual entrepreneur (IP)

- Tax under the simplified tax system, UTII, PSN, personal income tax. The debt for all taxes paid in connection with the application of tax regimes (single tax under the simplified tax system, UTII, PSN, as well as personal income tax) that arose before January 1, 2015, as well as penalties and fines with from the moment of occurrence until the day the decision to write off is made

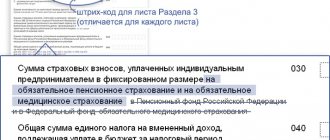

- Insurance premiums

Contributions for compulsory insurance payable to the Pension Fund, FFOMS, Social Insurance Fund, arising for the period before January 1, 2021

Important: Land tax benefits have been introduced for pensioners at the federal level in the amount of 600 sq.m. This means that the tax will not be collected from the pensioner’s 6 acres of land, which will significantly ease the tax burden on this category of persons.

Let us consider in more detail the procedure and features of debt write-off for each of the above categories of persons.

The meaning of the events

In order to understand the essence of the tax amnesty announced for 2021, it is necessary to clarify who pays what taxes in Russia.

- Personal income tax (NDFL) – 13%. This type of fee applies to all Russians, regardless of position, age, and is deducted from their salary. Personal income tax is also collected from civil contracts.

- Medical and social insurance (insurance contributions) – 30%. This type of fee is paid by the employer, however, the contribution is essentially deducted from the employee's salary.

- VAT at 18%. Tax is included in the price of goods and services.

You should also add mandatory fees for:

- Vehicle.

- Real estate.

- Earth.

- Overhaul.

In addition, there are also excise taxes, import duties, trade taxes, etc.

Everything that citizens pay in the form of direct or indirect taxes forms the state budget and is then spent on budgetary needs. Everything seems to be correct, but having paid state-approved deductions from your income, you have very little money left for living. Despite the fact that interest rates on basic taxes are not increasing, the annual appearance of new fees increases the fiscal burden for all Russians. Therefore, the president of the country proposed a tax amnesty. Who will be affected by the writing off of tax debts in 2021?

The category of citizens eligible for amnesty includes:

- Individual.

- Individual entrepreneurs (IP).

- Persons engaged in private practice (lawyers, notaries).

This list is regulated by Law No. 436, signed by the head of state on December 28, 2017. Throughout 2021, a certain type of debt should have been automatically written off. That is, citizens did not have to appear and write a statement to the Federal Tax Service. However, over the past year, although the work was carried out by tax inspectors, it was not completely completed.

The point of debt write-off measures is to strengthen the financial situation of citizens. Forgiveness of existing debts will allow citizens who have accumulated debts during the crisis to re-engage in business activities.

It should be taken into account that the terms of the extended tax amnesty for 2021 are a one-time event. This means that you should not hope for annual systematic debt write-off.

Conditions for writing off debts for individuals

The tax amnesty for individuals in 2021 will affect debts for:

In this case, debts accumulated up to a certain time will be written off, as well as fines accrued for it. The size of the debt will not matter, nor will the reasons why it arose. Thus, the transport tax under the tax amnesty in 2021 for individuals and individual entrepreneurs will be written off if it arose before 1.01.15. All penalties accrued to the debtor under this item until 2021 are also cancelled.

Conditional income received from January 1, 2015 to January 1, 2017 by individuals can also be forgiven. This refers to “non-existent” income generated from writing off bank debts or penalties for housing and communal services. Forgiven amounts are conditional income from which personal income tax must be collected. According to the innovation, there will be no need to submit a report to the fiscal services and pay this fee.

Pensioners receiving benefits are a separate category among individuals. Fiscal preferences are provided for them, allowing them to completely eliminate fees to the Federal Tax Service for property. Deductions will not be charged only for one object in use (house, apartment, low-power car). The legislation also provides for forgiveness of payments for land if its size is no more than 6 acres (for everything that you have to pay more).

What to expect as an individual entrepreneur

For individual entrepreneurs (IP), the tax amnesty in 2021 applies to amounts of debt arising as a result of activities before January 1, 2015. This means VAT, personal income tax, as well as special regimes - everything that is collected from the income of entrepreneurs. In addition, taxes that are not directly related to activities will be withdrawn from individual entrepreneurs - everything that can be written off for individuals. Penalties accrued for non-payment of taxes will also be written off. The following are not subject to amnesty:

- MET. Type of taxes provided by the state for the extraction of natural resources.

- Excise duty.

- Customs duties.

This is interesting: Is it possible to put a dacha in SNT

Debt forgiveness will take place without an application, including for those who have closed their individual entrepreneurs, but have debts on the points listed above. The personal presence of the businessman is not necessary. You can check whether the debt has been written off remotely. It is enough to go to your personal account, if the person is authorized on the website of the fiscal service, and check the corresponding section. Those who do not have a personal account in the Federal Tax Service system, but want to know the status of the debt amount, should visit the fiscal department and ask the inspector about the state of affairs.

For private practice entrepreneurs, the tax amnesty for 2021 will apply to insurance premiums. Debts incurred before January 1, 2017 will be written off.

Tax amnesty for individual entrepreneurs

For individual entrepreneurs with tax arrears that arose before January 1, 2015, the entire amount of unpaid mandatory payments will be subject to write-off, regardless of its size. However, the legislator limited the list of taxes for which debt “forgiveness” is possible.

So, not included in this list:

- Mineral extraction tax.

- Excise taxes.

VAT paid in connection with the movement of goods across the border of the Russian Federation.

Also, along with the tax, the entire amount of penalties and interest accrued in connection with its non-payment, starting from the period of formation until the tax inspectorate makes a decision to write off the debt, will be written off.

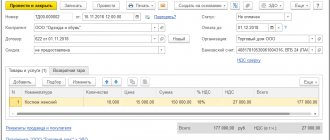

In addition to taxes, it is planned to forgive individual entrepreneurs in terms of unpaid insurance premiums accrued for the period until January 2021, provided that the individual entrepreneur did not conduct any activity during this time and did not submit reports, and therefore insurance premiums were accrued to him in the maximum amount, according to Part 11 Art. 14 of the law of July 24, 2009 No. 212-FZ.

Important: write-off of contributions is possible only if the individual entrepreneur did not conduct business, and therefore the debt on fixed payments, for example for the 4th quarter of 2021, will not be written off to the entrepreneur.

Tax amnesty for ordinary citizens

According to the changes made to the Tax Code of the Russian Federation in 2021, bad debts will be written off from individuals for:

- Transport, land and property taxes incurred for periods up to January 1, 2015 inclusive, as well as penalties accrued on the specified arrears from the period of formation of the debt until the tax authority makes a decision. In this case, the size of the arrears, the reason for its occurrence, and also the financial situation of the debtor. According to the law, the entire amount of this debt will be considered uncollectible and subject to unilateral write-off by the tax authority.

- Personal income tax, subject to payment in connection with the receipt by a citizen of income on which the employer has not calculated and paid tax to the budget.

This situation affects cases where a citizen received income from an employer, from which personal income tax was not calculated and paid to the budget.

Let us recall that the employer is a tax agent in relation to his employee, and therefore he is obliged to independently calculate and transfer to the budget the amount of personal income tax, which, in turn, is obliged to report on the certificate in Form 2-NDFL.

If for some reason the employer cannot transfer personal income tax to the budget, he must notify the employee and the tax authority about this. In this case, the responsibility to pay tax falls on the shoulders of the employee.

According to the tax amnesty law, amounts of personal income tax debt resulting from the situation described above are subject to write-off for the period from January 2015 to January 2021.

Also, as in the case of individual entrepreneurs, the legislator limited the list of income subject to write-off.

Features of the tax amnesty

All individuals can count on having their tax debts written off in 2021. It doesn’t matter how much debt they have. The financial situation of the debtor will not be taken into account.

Payers of the following taxes are eligible for the tax amnesty:

The write-off will be carried out for the period before January 1, 2015. Penalties and fines will be written off from the moment they arise until a decision is made to write off the arrears on taxes of an individual.

Debts for other types of contributions to the state are not covered by the tax amnesty. Thus, debts on alimony, state duty, non-payment of personal income tax from the sale of property or debts on other fees will not be written off.

The financial status of the debtor and the amount of debt do not affect the right to participate in the tax amnesty. Representatives of the tax service will not clarify the reason for the late deposit of funds.

| Who can count on participating in the tax amnesty | What taxes will be written off? | For what period will taxes be written off? |

| Individuals | Transport | Debts before January 1, 2015, penalties and fines from the moment they arise until the decision to write them off is made |

| Land | ||

| For property |

You can also be exempt from paying personal income tax, but only if the debt arose through the fault of the employer. The need to contribute funds for the organization will be assigned to the citizen in the event that the employer, for some reason, cannot independently determine the amount of tax and contribute the required amount to the budget. Federal Law No. 436 specifies a list of income for which debt write-off is not covered by the tax amnesty.

This is interesting: Where you can pay with bonuses Thank you from Sberbank: shops and cafes

So, this list included:

- wages;

- prizes received in competitions and games;

- dividends and other material benefits.

You can familiarize yourself with the full list by studying paragraph 72 of Article 217 of the Tax Code of the Russian Federation.

Debts for which income cannot be written off?

The list of income not subject to write-off will be listed in paragraph 72 of Art. 217 Tax Code of the Russian Federation. The specified income will include the citizen’s profit received:

- in the form of remuneration for the performance of labor or other duties, performance of work, provision of services;

- in the form of dividends and interest;

- in the form of material benefit, determined in accordance with Art. 212 Tax Code of the Russian Federation;

- in kind, determined in accordance with Art. 211 of the Tax Code of the Russian Federation, including gifts received by taxpayers from organizations or individual entrepreneurs;

- in the form of winnings and prizes received in competitions, games and other events.

In this case, we are talking about debt resulting from the write-off of citizens' debts by organizations - for example, telecom operators and banks, clarifies the head of the legal department of HEADSConsulting Diana Maklozyan. According to experts, this amount is about 22 billion rubles.

How and when will debts be written off?

Debt write-offs from citizens and individual entrepreneurs will be carried out unilaterally, that is, these persons will not submit any documents or statements to the tax authorities!

The law does not establish the obligation to notify individual entrepreneurs and citizens about the written off debt and its amount. It is assumed that the interested person will have to independently contact the tax authorities to clarify the amount of arrears and the amount of debt written off.