Who takes SZV-M and when?

All organizations and entrepreneurs are required to submit information about insured persons to the Pension Fund every month in the SZV-M form.

The deadline for submitting such reports is no later than the 15th day of the month following the reporting month (Clause 2.2 of Article of the Federal Law of 01.04.96 No. 27-FZ). For violation of this deadline, a fine of 500 rubles is established. in relation to each insured person (Article Law No. 27-FZ). Let's consider situations in which fee payers manage to challenge the fine through the court or reduce its amount.

Is it possible to reduce the sanctions?

Unfortunately, the legislation does not provide for mitigating circumstances for violators to reduce the amount of the fine or its maximum limit. Therefore, failure to submit reports on insured persons inevitably leads to additional costs for companies. But in practice things are different.

Organizations and individual entrepreneurs have the right to apply to the court:

- Recognize the Pension Fund's decision on the fine as partially invalid.

- Ask to reduce the amount of the sanction.

Reason – the violation occurred for the first time or the duration of the delay was insignificant. The document should indicate a link to paragraph 5 of the motivational part of the resolution of the Constitutional Court of the Russian Federation No. 2-P dated January 19, 2021. There are cases when the claim is satisfied and the costs are reduced by half.

For large organizations with a large number of employees, the fine from the Pension Fund of the Russian Federation can cost a decent amount. Responsible persons can use an electronic diary, a reminder program, or make a note in the accountant’s calendar. All this will help you avoid violations and pass the SZV-M. Including on time.

Also see “SZV-M for June 2021: due date and sample filling.”

Late submission of SZV-M due to error correction

We are talking about a situation where the policyholder submitted the SZV-M form on time, but then an error was discovered in the submitted report (for example, the reporting period was incorrectly specified). To correct the situation, the policyholder submitted clarifications, but they were received by the fund after the end of the period allotted for submitting reports.

Companies and entrepreneurs who independently identify and correct their mistakes will not face a fine. This is directly stated in paragraph 39 of the Instruction, approved by order of the Ministry of Labor of Russia dated December 21, 2016 No. 766n.

In practice, punishment can be avoided even by those who made corrections after the Pension Fund pointed out the error. Thus, the fine was challenged by an entrepreneur who mixed up the columns in the report reserved for first and patronymic names. The judges supported him due to the insignificant nature of the mistake (resolution of the Court of Justice of the West Siberian District in the resolution dated December 14, 2018 No. A27-6320/2018; see “SZV-M: is a fine for erroneously posting the employee’s full name in the form columns legal?”) . In a similar way, the case was resolved against a company that made an error in an employee’s report (ruling of the Supreme Court of the Russian Federation dated September 28, 2018 No. 309-KG18-14482; see “The Supreme Court clarified whether the insurer can be fined for a typo in SZV-M”).

Please note: when submitting SZV-M and other reports, those policyholders who use web services to prepare and check reports (for example, the Kontur.Extern reporting system) will feel most comfortable. All current updates and test programs are installed in web services without user intervention. If the data entered by the policyholder does not meet the requirements for filling out the form and control ratios, the system will certainly warn him about this and tell him how to correct the errors. And timely correction of errors will save the accountant from the need to submit “clarifications,” go to court or pay fines.

Submit SZV-M for free through Kontur.Extern

Fine for incomplete or unreliable information in SZV-M

If the policyholder submitted the SZV-M with errors or did not indicate any important information in the form (for example, the employee’s SNILS), or perhaps one of the insured persons simply forgot to include in the report, then he will also be punished for this under Article 17 of the Law No. 27-FZ.

According to this norm, the violator faces a fine of 500 rubles. for each “physicist” for whom incomplete or unreliable information is provided in SZV-M.

For which mistakes the policyholder will be fined and for which ones not, find out from a separate consultation. Some of them are presented in the table below.

| Acceptable errors in SZV-M | Unacceptable errors in SZV-M |

| The surname of the insured person is indicated by a dot or two hyphens | The registration number of the policyholder is incorrect |

| There is a hyphen at the end of the last name, first name or patronymic of the insured person | The policyholder's TIN is incorrectly indicated. |

| There are spaces around the hyphen in the double surname of the insured person | Full name of the insured person is not filled in |

| The name of the insured person is written in Latin letters | Only the middle name of the insured person is indicated without first and last name |

| In SNILS there is a hyphen instead of a space | The SNILS number of the insured person is not indicated or it is indicated incorrectly |

| There are spaces before the TIN | An “X” is indicated in the “supplementary” field if the original SZV-M form has not yet been submitted |

| The “TIN” column contains only zeros. | The “original” SZV-M form is resubmitted for the same reporting period |

| Invalid reporting period code specified | |

| The report is signed with someone else’s electronic signature (for example, a representative without a power of attorney) |

But if the policyholder discovers errors or inaccuracies in the already submitted SZV-M before the Fund discovers them, and sends a corrected version (“supplementing” or “cancelling” form, depending on the situation), then there should be no fine. This conclusion follows from paragraph 3 of clause 39 of the Instructions on the procedure for maintaining individual (personalized) records of information about insured persons, approved. Order of the Ministry of Labor of Russia dated December 21, 2016 No. 766n (hereinafter referred to as Instruction No. 766n)). It does not matter when the policyholder updates the information, during the reporting period (i.e. before the 15th) or outside of it.

Example 2. An accountant at Topol LLC passed the SZV-M for March 2021 on April 10. But later, on April 12, I discovered that I had made a mistake in the employee’s full name. On the same day, the accountant submitted to the Pension Fund a “supplementary” report form (with the “additional” type), in which he indicated the correct information about the person. The pensioners did not impose a fine.

There will be no fine if the Pension Fund discovers shortcomings, but the policyholder corrects them within 5 working days from the date of receipt of the notification that the errors have been corrected (paragraph 2, paragraph 39 of Instruction No. 766n, part 5 of Article 17 of Law No. 27- Federal Law):

- from the date of receipt - upon delivery of the notice in person;

- from the 6th day from departure - when sending a notification by registered mail;

- from the date of confirmation of receipt - when sending a notification electronically via TKS.

Example 3. On April 10, 2021, Peresvet JSC reported in the SZV-M form for March 2021. On the same day, the Company received an electronic notification from the Pension Fund of Russia that the errors had been corrected. It turned out that when filling out the report, the accountant incorrectly indicated the SNILS for two employees.

a) On April 11, form SZV-M (with the “additional” type) with correct data on employees for which the Fund found errors. There was no fine from the Pension Fund;

b) On April 20, form SZV-M (with the “additional” type) with correct data on employees for which the Foundation discovered errors. The Pension Fund of Russia imposed a fine on the Company in the amount of 1,000 rubles. (= 2 people x 500 rub.).

Pension Fund specialists did not comment on whether the provisions of paragraph 39 of Instruction No. 766n are applicable to a situation where the policyholder did not include any of the insured persons in the SZV-M, or, on the contrary, indicated unnecessary ones.

In the original report SZV-M forgot an employee

It happens that a company or individual entrepreneur provides the original SZV-M form, which does not contain information about some employees. Then, upon discovering a lack of data, the employer submits an additional form for previously excluded insured persons.

If the additions are received by the Pension Fund outside the established period, inspectors impose a fine of 500 rubles. for every forgotten employee. Such actions correspond to the position set out in the letter of the Pension Fund dated March 28, 2018 No. 19-19/5602 (see “SZV-M for “forgotten” employees submitted outside the reporting period: the Pension Fund insists on fines”). Insurers, in turn, consider such punishment unfair. They claim that since the original report was submitted on time, the sanction is not justified, despite the violation of the deadline for submitting amendments.

Judicial practice on such disputes is contradictory. There are decisions made in favor of the fund. Thus, the AS of the North-Western District came to the conclusion that the fine for the supplementary SZV-M form was legal, since “forgotten” employees were mentioned for the first time in the additional report. This means that it cannot be said that the information on them was submitted on time along with the original SZV-M form (resolution dated 03/01/18 No. A44-4882/2017). A similar conclusion was made in the resolution of the Far Eastern District AS of 02.19.18 No. F03-253/2018.

But there are also decisions that confirm the policyholders are right. The Supreme Court ruling dated 09/05/18 No. 303-KG18-5702 states that if the premium payer himself discovered a lack of data in the SZV-M report, then additional information is, in fact, the policyholder correcting his own mistakes. But it should not be punishable by a fine (see “The Supreme Court explained when the provision of a supplementary SZV-M form for “forgotten” employees does not entail a fine”). There are also cases where the sanction was declared unlawful even though the lack of data was discovered not by the policyholder, but by the Fund. The decisive role was played by the fact that the organization submitted additional information before the expiration of the period specified in the notice of discrepancies (decision of the Supreme Court of the Russian Federation dated 07/05/19 No. 308-ES19-975; see “The Supreme Court canceled the fine for SZV-M for “forgotten” employees handed over after the Pension Fund discovered an error").

Considering the existence of positive judicial practice, employers who find themselves in a similar situation, in our opinion, have a chance to challenge the sanction.

Results

Employers submit the SZV-M report to the Pension Fund of the Russian Federation on a monthly basis for all employees. It indicates SNILS, full name, INN. If errors are identified in the information already submitted, corrections should be made to the original data using the SZV-M supplementary and canceling forms. Using the first, the submitted reports can be supplemented with information that is not included in it. The second cancels information submitted erroneously. If erroneous information needs to be replaced with correct information, then in addition to the cancellation form, a supplementary form must be submitted. They fill out the cancellation form according to the same rules as the original one, but indicate the type “Canceling” in it and enter data into the main table only for those employees whose information needs to be canceled or replaced.

Sources:

- Law “On individual (personalized) accounting...” dated 01.04.1996 No. 27-FZ

- Law “On Insurance Pensions” dated December 28, 2013 No. 400-FZ

- letter of the Pension Fund of 04/07/2016 No. 09-19/4844

- Resolution of the Pension Fund Board of April 15, 2021 No. 103p

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

The delay of SZV-M arose due to errors regarding several employees

Form SZV-M is a table that lists information about all insured persons: full name, SNILS number and TIN number. For successful completion, it is necessary that the information for all employees be entered correctly. If an error is made regarding at least one employee (for example, an incorrect TIN or SNILS is indicated), the fund refuses to accept the report.

The employer is forced to correct the errors in the SZV-M and make another attempt. Often the second attempt does not meet the deadline, and then inspectors impose a fine. In this case, the amount of the sanction is calculated based on the number of all employees, and not just those whose information was corrected. Insurers do not agree with this, because, from their point of view, only employees with corrected data should be taken into account when calculating the fine.

When considering such disputes, judges cannot reach a consensus. Sometimes they support inspectors (Resolution of the Far Eastern District AS dated November 21, 2017 No. F03-4421/2017; see “Fine for late submission of SZV-M: how much you will have to pay if the original electronic calculation was not accepted due to a gross error”).

However, there are also positive solutions for policyholders. One of them is the resolution of the AS of the West Siberian District dated 08.23.17 No. A27-22235/2016. The judges concluded that a report containing erroneous information on individual insured persons is not considered not to be submitted in full. Therefore, the fine cannot be calculated based on the number of all employees. It is possible that in other cases the victory will remain with the payers. For this reason, we think employers should try to prove their case in court.

Cancellation form SZV-M - how to fill out

Filling out the SZV-M cancellation form has two features compared to the original one:

- in paragraph 3, instead of the “Original” code, “Cancelling” is indicated;

- the main table of the report (clause 4) contains information only on those persons whose data is removed from the original form; if this data is shown with an error in the original report, then it should be entered with the same error in the canceling form.

For other report parameters, the same filling procedure applies as for the original form:

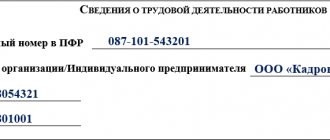

- clause 1 reflects the data of the reporting entity (PFR registration number, name, INN, KPP);

- clause 2 contains the month and year corresponding to the reporting period to which the corrections relate;

- for clause 3, the requirement to enter the form type code remains mandatory;

- in clause 4 all data related to the employee, information about whom is to be deleted from the original report, is entered;

- the report is signed by an authorized person, indicating the date of completion and, if available and necessary, a seal.

Example of filling out a canceling SZV-M