Source: Magazine “Food Industry: Accounting and Taxation”

Many agricultural producers and organizations of the agro-industrial complex receive subsidies from the budget to support the production of milk and meat, crop production, beekeeping, for the purchase of production equipment, the construction of production complexes, etc. Are subsidies included in the VAT tax base? Does a taxpayer have the right to receive a deduction for goods (work, services) paid for with subsidies? In what situation will it be necessary to restore the deductible VAT on goods (works, services)?

According to clauses 1 , 2 of Art. 78 of the Budget Code of the Russian Federation, subsidies to legal entities and individual entrepreneurs are provided on a free and irrevocable basis in order to compensate for lost income and (or) financial support (reimbursement) of costs in connection with the production (sale) of goods (exception - excisable goods, except for wine products made from grapes grown on the territory of the Russian Federation), performance of work, provision of services. Subsidies can be provided from the federal budget and the budgets of state extra-budgetary funds, from the budget of a constituent entity of the Russian Federation and the budgets of territorial state extra-budgetary funds, as well as from the local budget.

To deduct and restore VAT, it is important from which budget of the budget system of the Russian Federation the organization (entrepreneur) receives the subsidy: from the federal or from the regional (local). In this regard, you need to keep in mind: subsidies from the federal budget are transferred to the budgets of the constituent entities of the Russian Federation, and the subsidy funds are sent to the final recipients through the Ministry of Agriculture of the region, but the subsidies received are precisely federal subsidies.

In what case should VAT be charged when receiving a subsidy?

According to paragraph 1 of Art. 146 of the Tax Code of the Russian Federation, transactions for the sale of goods (work, services) on the territory of the Russian Federation are recognized as subject to VAT, regardless of the source of financing. In accordance with paragraphs. 2 p. 1 art. 162 of the Tax Code of the Russian Federation, the VAT tax base is increased by the amount of money received for goods (work, services) sold in the form of financial assistance, to replenish special-purpose funds, to increase income or otherwise related to payment for goods (work, services) sold.

Thus, if subsidies provided by the budget are essentially a payment for goods (work, services) sold by the organization that are subject to taxation, then VAT in relation to these subsidies is calculated in the generally established manner. In this case, VAT amounts presented by suppliers of goods (works, services) are accepted for deduction in the generally established manner.

If subsidies were received by an organization from the budget to reimburse costs associated with payment for purchased goods (works, services), including VAT, then these subsidy amounts are not included in the tax base.

The explanations given concern subsidies provided by both regional (local) and federal budgets ( letters of the Federal Tax Service of the Russian Federation dated February 28, 2013 No. ED -19-3/26 ( clause 1 ), the Ministry of Finance of the Russian Federation dated April 18, 2013 No. 03‑07‑11 /13330 , dated 04/18/2013 No. 03‑07‑11/13370 , dated 06/09/2011 No. 03‑03‑06/1/337 , dated 02/08/2013 No. 03‑07‑11/3144 , dated 02/01/2013 No. 0 3 ‑07‑11/2142 , dated 05/27/2011 No. 03‑03‑06/1/313 (relates to the situation with the provision of subsidies from the federal budget for the purchase of chemical agents, diesel fuel, and for reimbursement of part of the cost of paying interest on loans)).

Features of accounting

State aid as a subsidy, subvention and government loans, as well as a non-financial resource, is regulated by the accounting provisions for accounting for state aid. All types of loans I have listed fall under targeted financing. Budget money is recognized using one of the following options:

- When targeted financing occurs, debts for such money are displayed.

- Upon their actual receipt, when such financing increases in the accounting accounts of the placement of such money.

The regulation states that budget money can be written off from the account for targeted financing to improve the company’s financial results.

State finances covering the company’s expenses of the previous reporting period are reflected as part of the debt for them and increase the financial results of the company’s activities through other income. For this purpose, accounting records are carried out:

Debit 76 Credit 91-1

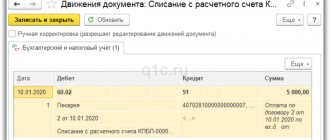

I can provide you with an example of indicative accounting entries:

- Display of public finance debt: Debit 76 Credit 86.

- Increase in other income of the company when management makes an order to allocate compensation: Debit 86 Credit 91-1.

- According to the leasing agreement, money came to the account as payment reimbursement: Debit 51 Credit 76.

Is it possible to get a deduction of “input” VAT on goods (works, services) paid for with a subsidy?

Based on paragraphs 1 , 2 of Art. 171 , paragraph 1, art. 172 of the Tax Code of the Russian Federation, tax deductions for VAT are made on the basis of invoices issued by sellers when the taxpayer purchases goods (work, services), property rights, documents confirming the actual payment of tax amounts when importing goods into the territory of the Russian Federation, after the registration of these goods ( works, services), property rights and in the presence of relevant primary documents.

Thus, deductions of VAT amounts are applied if the taxpayer fulfills the following conditions: the presence of an invoice for purchased goods (works, services), property rights, their acceptance for accounting, the availability of relevant primary documents, settlement documents confirming the actual payment by the taxpayer of the tax amounts paid them when importing goods into the territory of the Russian Federation, use in transactions recognized as an object of taxation. The Tax Code does not establish restrictions on the use of VAT deductions in the case of payment for goods (work, services) using budget subsidies. Meanwhile, from the explanations of the Ministry of Finance it follows that the right to deduct VAT depends on which budget of the budgetary system of the Russian Federation the subsidies are allocated from.

Purchasing waste paper

Before the introduction of changes, all companies and individual entrepreneurs purchasing scrap metal and raw animal skins. Counterparties issue invoices to their clients with the note “VAT is calculated by the tax agent” and, accordingly, do not pay it to the treasury. Clients of such companies, except those who are not registered as individual entrepreneurs, issue invoices with allocated VAT and withhold such tax accordingly. They are obliged to pay it to the treasury and are entitled to a tax deduction.

With the introduced amendments, waste paper is added to the product group.

The Tax Code contains a definition of what is included in it. This is all paper and cardboard considered as waste, their defects, other papers and printing products whose archival shelf life has expired. The advantage will apply to those companies that purchased waste paper starting this year and they will be tax agents for VAT.

Subsidies from regional and local budgets

If funds are allocated from the budget of a constituent entity of the Russian Federation or from a local budget, VAT can be deducted in the general manner ( letter of the Ministry of Finance of the Russian Federation dated September 19, 2013 No. 03-07-11/38849 (applies to deductions for the purchase of fixed assets, materials and animals), from 04/18/2013 No. 03-07-11/13370 , dated 02/09/2012 No. 03-07-11/32 , dated 12/10/2010 No. 03-07-11/486 , dated 03/09/2010 No. 03-07-11/5 2 ). The legality of deducting “input” VAT on goods purchased using regional subsidies is also confirmed by the Federal Tax Service ( ED -19-3/26 dated February 28, 2013 ). Moreover, the tax authority refers in its explanations to arbitration practice ( resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 13, 2007 No. 9591/06 , dated April 1, 2008 No. 13419/07 , dated April 1, 2008 No. 12611/07 ).

Position of the Ministry of Finance

In turn, the Ministry claims that state loans allocated to self-supporting firms are not considered targeted revenues in their economic essence. As a result, they are not taken into account when calculating the tax base for the income tax base as expenses; there is no need to additionally charge tax on the subsidy. I have already mentioned, but I will still repeat, that state subsidies to cover expenses for the manufacture and production of products are not subject to separate accounting and this is stated in a number of letters from regulators.

As a taxable object, we can consider the following options:

- Import of products to the country's customs;

- Carrying out construction work for the purpose of one’s own consumption and use;

- Sale of products and transfer of property rights. This includes their free transfer;

- Transfer of products and services for your own measures, expenses for which are not applied to the deduction and accrued depreciation is added to this when calculating the company’s income tax.

You are probably aware that the base is increased by funds received from the sale of goods as financial assistance when crediting finances.

Depending on the type of government subsidy received for accounting operations for the sale of products or transfer of rights, the company makes a conclusion about whether it should include such money in the VAT tax base or not.

Likewise, the opinions of the regulators themselves contradict each other, and it is still unclear what the owners of companies and other market participants should do. I strongly recommend that you still rely on the list in the code describing specific tax recovery situations, and also study intra-industry documents based on your type of activity. This paper is the basis of any business, and if you are fined, it will be for violating its clauses and provisions.

Subsidies from the federal budget

As you know, VAT refers to federal taxes and is credited to the federal budget at the rate of 100% ( Article 13 of the Tax Code of the Russian Federation , Article 50 of the Budget Code of the Russian Federation ). Financiers point out that VAT is not deductible if goods (work, services) are paid for from the federal budget (subsidy), since this leads to a repeated refund of the tax from the budget ( letters dated 02/08/2013 No. 03‑07‑11/3144 , dated 02/01/2013 No. 03‑07‑11/2142 , dated 08/08/2011 No. 03‑03‑06/4/92 , dated 06/09/2011 No. 03‑03‑06/1/337 , dated 05/31/2011 No. 03 ‑07‑15/55 , dated 05/27/2011 No. 03‑03‑06/1/313 ( clause 2 ), dated 03/18/2011 No. 03‑07‑11/61 , dated 12/10/2010 No. 03‑07‑11 /486 , dated 08/31/2009 No. 03‑07‑14/91 ). In addition, in the Letter of the Ministry of Finance of the Russian Federation dated December 23, 2013 No. 03‑03‑06/4/56546 with reference to paragraphs. 6 clause 3 art. 170 of the Tax Code of the Russian Federation clarifies that VAT amounts presented to the taxpayer by contractors for work performed to modernize depreciable property, paid for from the federal budget, are not accepted for deduction.

It should be said that the Federal Tax Service, giving explanations regarding the possibility of applying VAT deductions on goods (works, services) paid for with subsidies from the federal budget, although it quotes the position of the Ministry of Finance verbatim, at the same time notes that in the current judicial practice ( resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 01.04.2008 No. 13419/07 , dated 01.04.2008 No. 12611/07 ) expresses the position that the Tax Code does not provide for restrictions on the right to tax deductions for organizations selling goods (work, services) at regulated prices and receiving in connection with these are subsidies in case of purchasing goods from budget funds. Therefore, the Federal Tax Service instructs the tax authorities, in order to reduce the number of court disputes lost to taxpayers and to exclude court decisions not in favor of the tax authorities, when making decisions based on the results of tax audits and participating in legal proceedings with taxpayers, to be guided by established judicial practice ( letters of the Federal Tax Service of the Russian Federation dated March 30 .2011 No. KE -4-3/5012 , dated July 28, 2009 No. 3‑1‑11/ [email protected] ). That is, in essence, the Federal Tax Service agreed with the Ministry of Finance, but suggested that local tax authorities act with an eye on arbitration practice in order to exclude decisions not being made in favor of the tax inspectorates.

If a deduction in the indicated case cannot be applied, then does the taxpayer have the right to attribute the amount of “input” VAT on goods (work, services) paid for with a subsidy to expenses for profit tax purposes? In Letter dated March 19, 2012 No. 03‑03‑06/4/20, the Ministry of Finance indicates that this cannot be done. Here's the thing. Clause 1 of Art. 170 of the Tax Code of the Russian Federation establishes that VAT amounts presented to the taxpayer when purchasing goods (work, services, property rights) are not included in expenses when calculating corporate income tax, except for the cases provided for in paragraph 2 of Art. 170 Tax Code of the Russian Federation . In turn, in paragraph 2 of Art. 170 of the Tax Code of the Russian Federation contains an exhaustive list of transactions in which the amounts of VAT presented to the buyer when purchasing goods (work, services) are taken into account in the cost of these goods (work, services). Operations related to payment for goods (works, services) from the federal budget are not mentioned in the specified list. Thus, when paying for goods (work, services) at the expense of the federal budget, the VAT amounts charged to the buyer when purchasing goods (work, services) cannot be taken into account by the buyer as expenses for profit tax purposes.

Postulates of the code

Please note that the object of taxation is income from the sale of a product, other property and rights thereto, as well as all non-operating income. Separately, you should not keep accounting for the subvention allocated to your business. How you spend such finances You are not required to report. A complete list of income that is not applicable to taxable profit is indicated in the code and it fully satisfies the requests of users. At the same time, free products and rights received are included in non-operating income, with the exception of certain exceptions.

There is a wording that all subsidies are provided to legal entities, individual entrepreneurs and individuals who produce goods irrevocably and free of charge in order to compensate for expenses and lost income due to the production of such a product. The norm does not apply to government agencies of various budgets. Consequently, all budget funding issued to the company is applicable to be added to the income tax base as non-operating income at the time the funds are credited to the company's current account.

In what case will VAT have to be restored?

According to paragraphs. 6 clause 3 art. 170 of the Tax Code of the Russian Federation , the amounts of VAT accepted for deduction by the taxpayer on goods (work, services), including fixed assets and intangible assets, property rights in the manner prescribed by Chapter. 21 of the Tax Code of the Russian Federation , are subject to restoration if the taxpayer, in accordance with the legislation of the Russian Federation, receives subsidies from the federal budget for reimbursement of costs associated with payment for purchased goods (works, services), taking into account tax, as well as for reimbursement of costs for paying tax when importing goods into territory of the Russian Federation and other territories under its jurisdiction . Tax amounts are subject to restoration in the amount previously accepted for deduction. Tax amounts subject to restoration in accordance with this subclause are not included in the cost of the specified goods (works, services), but are taken into account as part of other expenses by virtue of Art. 264 Tax Code of the Russian Federation . Reinstatement of tax amounts is carried out in the tax period in which the amounts of the provided subsidies were received. When restoring the tax in the sales book, it is necessary to register the invoice on the basis of which the “input” VAT was accepted for deduction for the amount of tax to be restored ( clause 14 of the Rules for maintaining the sales book ).

According to the Federal Law of July 19, 2011 No. 245-FZ, 01.10.2011 came into force . 6 clause 3 art. 170 Tax Code of the Russian Federation . Until the indicated moment in the previously valid version of Ch. 21 of the Tax Code of the Russian Federation did not provide for the restoration of VAT amounts in the above case. Nevertheless, even before this this approach was practiced by tax authorities. The Ministry of Finance also explained that it is necessary to restore the VAT previously accepted for deduction on goods (works, services), in case of payment of the tax from the federal budget ( letters of the Ministry of Finance of the Russian Federation dated December 6, 2011 No. 03‑07‑11/337 , dated May 27. 2011 No. 03‑03‑06/1/313 , dated 05/31/2011 No. 03‑07‑15/55 ).

When paying VAT on purchased goods (works, services) at the expense of subsidies allocated from regional or local budgets, the grounds for restoring the tax accepted for deduction on these goods (works, services), based on paragraphs. 6 clause 3 art. 170 of the Tax Code of the Russian Federation is not available ( letters of the Ministry of Finance of the Russian Federation dated April 18, 2013 No. 03-07-11/13330 , dated October 30, 2012 No. 03-07-11/462 ). Similarly, the Letter of the Ministry of Finance of the Russian Federation dated March 23, 2012 No. 03-07-11/78 states that the amounts of VAT accepted for deduction on purchased technological equipment when receiving subsidies from the budget of a constituent entity of the Russian Federation to compensate for part of the cost of this equipment cannot be restored.

It would seem that there are no special difficulties in the interpretation of paragraphs. 6 clause 3 art. 170 of the Tax Code of the Russian Federation should not be invoked. VAT should be restored on the basis of this norm if VAT was paid on them as part of the price of goods (work, services), for reimbursement of costs for which a subsidy was received from the federal budget, that is, if VAT was paid from federal budget funds. However, in practice, some experts and courts believe that in the phrase “subsidies from the federal budget for reimbursement of costs associated with payment for purchased goods (works, services), including tax,” the words “including tax” refer to the word “subsidies,” and not to the words “payment for purchased goods (work, services), taking into account tax,” based on which they believe that it is necessary to restore VAT accepted for deduction only if:

- funds were received from the federal budget;

- Budget funds are allocated including VAT.

A similar position is taken by the Volga Region Autonomous Okrug. The arbitrators examine the payment orders with which the subsidies are transferred, and, not finding in them information that the subsidies are transferred including VAT, they conclude that there are grounds for applying paragraphs. 6 clause 3 art. 170 of the Tax Code of the Russian Federation and there is no VAT restoration. This position is presented in the decisions of the Federal Antimonopoly Service dated July 10, 2014 in case No. A 65-28197/2013 , dated November 28, 2013 in case No. A 65-6789/2013 (subsidies from the federal budget to compensate for part of the costs of purchasing chemical agents and for compensation part of the costs for the purchase of chemical plant protection products), dated 07/01/2014 in case No. A 65-22566/2013 (subsidy for compensation of 40% of the costs of building an enterprise for slaughtering and meat processing and the purchase of technological equipment), dated 06/10/2014 to case No. A 65-22400/2013 , dated November 26, 2013, case No. A 65-7113/2013 , dated November 26, 2013, case No. A 65-7110/2013 , dated November 21, 2013, case No. A 65-6832/2013 , dated November 19, 2013 in case No. A 65-6806/2013 , dated November 18, 2013 in case No. A 65-7114/2013 (in all cases we are talking about subsidies from the federal budget allocated on the basis of the Decree of the Government of the Russian Federation dated March 17, 2011 No. 178 on the federal target program for the conservation and restoration of soil fertility in agricultural lands and agricultural landscapes). In the listed judicial acts, the arbitrators indicated that, based on the literal meaning of paragraphs. 6 clause 3 art. 170 of the Tax Code of the Russian Federation, the taxpayer does not have the obligation to restore VAT to the budget when receiving subsidies from the federal budget to reimburse costs associated with payment for purchased goods (work, services), with the wording “excluding VAT”. The tax inspectorate’s arguments that the payment order does not necessarily have to contain information about the amount of VAT, and that when allocating a subsidy, the budget reimburses all costs, including taxes, the courts rejected with reference to the Regulations on the rules for transferring funds , approved by the Central Bank RF 19.06.2012 No. 383-P , according to which the payment order specifies the purpose of payment, the name of goods, works, services, numbers and dates of contracts, commodity documents, and may also indicate other necessary information, including in accordance with the law, including VAT. The arbitrators also relied on the fact that the requirement to indicate in payment documents information about payment or non-payment of VAT is established by Part 4 of Art. 168 of the Tax Code of the Russian Federation , based on which in settlement documents (including in registers of checks and registers for receiving funds from a letter of credit, primary accounting documents and invoices) the corresponding amount of tax is highlighted as a separate line.

The position “if the payment order does not contain information about the receipt of subsidies from the federal budget for reimbursement of costs, taking into account VAT amounts, then there is no need to restore the VAT accepted for deduction on goods (works, services)” is taken by the AS ZSO in its decisions dated December 2, 2014 in case No. A 67-6916/2013 (subsidies for the purchase of chemical plant protection products, mineral fertilizers and to support an economically significant regional program for the development of beef cattle breeding), dated 04/25/2014 in case No. A 03-11367/2013 (subsidies for the purchase of elite wheat seeds, peas, barley).

We are convinced that the words “including tax” in paragraphs. 6 clause 3 art. 170 of the Tax Code of the Russian Federation relate to payment for goods (works, services), and not to subsidies. After all, the procedure for VAT recovery provided for in paragraphs. 6 clause 3 art. 170 of the Tax Code of the Russian Federation , does not apply when the taxpayer receives subsidies from the federal budget to reimburse costs associated with the payment of purchased goods (work, services) not subject to VAT ( Letter of the Ministry of Finance of the Russian Federation dated October 16, 2012 No. 03-07-11/430 ). Indication in the “Purpose of payment” field of payment orders the words “Without VAT” and “Not subject to VAT” means that the operation to provide a subsidy is not subject to VAT and that this tax is not included in the amount of the provided subsidy ( clause 5 of Article 168 of the Tax Code of the Russian Federation ) . The presence of such a record does not in any way affect the obligation to restore VAT enshrined in paragraphs. 6 clause 3 art. 170 Tax Code of the Russian Federation .

This position is adhered to by the AS of the Central District. In the Resolution dated December 3, 2014 in case No. A 35-2212/2014 (subsidies for the provision of unrelated support to agricultural producers in the field of crop production), the AC CO explained: if the taxpayer incurred costs associated with payment for purchased goods (work, services), including tax , and the amount of subsidies from the federal budget corresponds to these costs, then VAT is subject to restoration. Moreover, if the right to a tax deduction and the obligation to restore VAT under paragraphs. 6 clause 3 art. 170 of the Tax Code of the Russian Federation arose in the same tax period, the tax deduction is not subject to application. In the Resolution of the AS CO dated September 26, 2014 in case No. A 09-9194/2013 (subsidies for reimbursement of costs for the purchase of specialized agricultural equipment for cultivating and harvesting potatoes), the arbitrators proceeded from the fact that the amount of subsidies was calculated from the actual costs of equipment, including VAT . The court did not accept the argument that the payment orders by which the subsidies were transferred to the company did not include VAT, since the provisions of Chapter. 21 of the Tax Code of the Russian Federation provide for the mandatory allocation of the amount of VAT in invoices issued by the seller and in the buyer’s payment documents only when selling goods (work, services) or transferring property rights. The transfer of subsidies from funds from a specific budget to the recipient does not constitute the sale of goods (works, services) or the transfer of property rights. The disputed amount of money is precisely a subsidy from the federal budget received by the company to reimburse costs associated with payment for purchased goods (work, services), including VAT. Having received this subsidy in the tax period following the period in which a VAT deduction was claimed for goods (works, services), the cost of which was compensated by the subsidy, the taxpayer is obliged to restore the amount of VAT on them. Similar explanations are given in the Resolution of the AS CO dated August 28, 2014 in case No. A 48-3219/2013 (subsidies for compensation of part of the costs of purchasing mineral fertilizers). In the Resolution of the Federal Antimonopoly Service dated May 30, 2014 in case No. A 64-5896/2013 (subsidies for reimbursement of part of the costs for the construction of complexes for the slaughter of pigs and the production of by-products, storage of meat and by-products, including the purchase of equipment) it was also established that the amount of subsidies was calculated from the actual costs of the company, including VAT. The calculation certificates submitted by the company to the regional department of agriculture also contained a calculation of the requested amounts of subsidies, taking into account the VAT paid by the company to the supplier. Under these circumstances, the court came to the conclusion that the subsidy received by the company is precisely a subsidy from the federal budget to reimburse costs associated with payment for purchased goods (work, services), including VAT. When receiving this subsidy in a different tax period, the company, due to the requirements of paragraphs. 6 clause 3 art. 170 of the Tax Code of the Russian Federation would be required to restore the amount of VAT previously claimed for deduction. But since in the case under consideration the company’s right to a tax deduction and the right to restore the amount of VAT in connection with receiving a subsidy from the federal budget arose in the same tax period, the tax deduction is not subject to application.