Deadlines for payment of insurance premiums for individual entrepreneurs

The employer must transfer insurance premiums accrued from salaries/other payments to employees to the budget no later than the 15th day of the month following the month of accrual of contributions (clause 3 of Article 431 of the Tax Code of the Russian Federation).

During this period, both regular insurance premiums and additional ones (from payments to “pests”) are transferred.

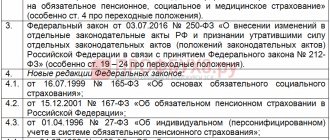

If an entrepreneur makes payments to employees/other persons, he must pay employer insurance contributions and contributions for himself.

If an entrepreneur works without employees, then he pays contributions only for himself.

The entrepreneur makes payment of contributions from payments to employees/other persons within the same time frame as the organization. That is, no later than the 15th day of the month following the month in which insurance premiums were calculated.

| Period for which contributions are paid | Payment deadline |

| December 2018 | 15.01.2019 |

| January 2019 | 15.02.2019 |

| February 2019 | 15.03.2019 |

| March 2019 | 15.04.2019 |

| April 2019 | 15.05.2019 |

| May 2019 | 17.06.2019 |

| June 2019 | 15.07.2019 |

| July 2019 | 15.08.2019 |

| August 2019 | 16.09.2019 |

| September 2019 | 15.10.2019 |

| October 2019 | 15.11.2019 |

| November 2019 | 16.12.2019 |

As a general rule, an entrepreneur must pay the annual amount of contributions for himself no later than December 31 of this year (clause 2 of Article 432 of the Tax Code of the Russian Federation). Moreover, the individual entrepreneur himself determines the frequency of transferring contributions for himself (for example, monthly, quarterly, once a year), the main thing is that by the last day of payment the entire amount goes to the budget. For 2021, contributions must be paid no later than 01/09/2019.

But if you have a large amount of income, you will also have to pay additional fees.

Since last year, the administrator of payments for contributions has changed. Now, instead of the Pension Fund, Social Insurance Fund and Compulsory Medical Insurance Fund, payments are accepted by the Federal Tax Service. The Social Insurance Fund still only pays contributions for injuries.

Organizations and individual entrepreneurs still, as a general rule, transfer contributions no later than the 15th day of the month following the month of their accrual from salaries and other payments to employees (clause 3 of Article 431 of the Tax Code of the Russian Federation). If the 15th falls on a weekend or holiday, the deadline for payment is the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

You must pay and report on compulsory insurance against industrial accidents and occupational diseases to the Social Insurance Fund. The payment deadlines are the same as for other types of social insurance - no later than the 15th (clause 4 of Article 22 of Law 125-FZ). See the table with deadlines below.

Deadlines for payment of insurance premiums in 2021 for employees

Individual entrepreneurs who do not have employees calculate contributions in 2021 in a new way, and pay contributions to the Federal Tax Service in the same manner.

As a general rule, an entrepreneur must make an annual payment for himself no later than December 31. In this case, the individual entrepreneur independently determines the frequency of payments (monthly, quarterly, once a year). If income for 2021:

- does not exceed 300 thousand rubles, the entrepreneur will have to pay a fixed payment no later than December 31, 2018 (paragraph 2, paragraph 2, article 432 of the Tax Code of the Russian Federation). The entrepreneur determines the specific amounts and terms of payment of the fixed payment during 2021 for himself. It can be paid either at the end of the year in full, or divided into several periodic payments. The main thing is to make the entire fixed payment amount by the end of 2021.

- exceeds 300 thousand rubles, you must pay additional contributions for compulsory pension insurance in the amount of 1% of the excess amount. The payment deadline is no later than April 1 of the year following the reporting year. For 2021 - no later than April 1, 2021.

The procedure for filling out payment slips depends on what fees the company pays.

Contributions to the Social Insurance Fund. The company transfers payments for injuries to the Social Insurance Fund. Therefore, you need to fill out payment slips according to the rules from Appendix 4 to Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n.

The rules haven't changed. The company fills out status 08 in the payment slip. It now has a different name. It is said that this status should be used for payments to the budget system with the exception of taxes and contributions. But this status is still eligible for personal injury contributions. Status 01 for quot; unhappyquot; don't make any contributions.

In 2021, the BCC for injury contributions paid by employers is the same as it was before - 393 1 0200 160. If you pay penalties, in categories 14-17 of the BCC you must enter 2100.

In field 105 the company enters OKTMO. This prop is also often mistaken. For municipalities, OKTMO codes consist of 8 characters, and for populated areas - of 11. You can find out the code you need at your FSS branch.

Contributions to the inspection. The company fills out instructions for pension, medical and social contributions according to the rules for tax payments. They are enshrined in Appendix 2 to Order No. 107n.

In field 101 of the payment invoice, enter status 01. At the beginning of the year there was confusion with the status in the invoice. The tax authorities asked to set the status either as 14 or 02. But the bank did not allow such payments.

As a result, the tax office and the funds agreed on status 01 (letter of the Federal Tax Service of Russia dated 02/03/17 No. ZN-4-1/). Now it is enshrined in the order of the Ministry of Finance.

Status 01 is now called quot;Taxpayer (payer of fees, insurance premiums lt;hellip;gt;)quot;. Officials ruled out code 14 completely.

In field 16 quot; Recipientquot; indicate the name of the inspectorate to which you pay taxes. For example, for Federal Tax Service No. 15 in Moscow. Local experts claim that they still encounter 16 errors in the field. Some companies list funds as the recipient, but this is incorrect.

Pay your contributions using the new KBK, they start at 182. But here, too, there are errors. For example, they enter a non-existent KBK, instead of the last three digits 160 they fill in 260. If you make such an inaccuracy, the payment can be clarified. To do this, submit an application in free form.

Write down the basis of payment (field 106) with a two-digit code. For current payments - TP. Then reflect the tax period for which you pay contributions. This is a month. For example, for January - MS.01.2018.

Previously, a separate division paid contributions on its own if it met three conditions (Part 11, Article 15 of Federal Law No. 212 of July 24, 2009): having a bank account, a separate balance sheet, and accrual of payments to employees.

Divisions must pay contributions and submit calculations if they accrue payments in favor of employees (clause 13 of Article 431 of the Tax Code of the Russian Federation). The Ministry of Labor believes that nothing will change for companies. The first two signs were superfluous, so they are not in the Tax Code of the Russian Federation. If the division pays employees itself, it is assumed that it has a separate balance sheet and account.

The inspectorate at the place of registration will need to be informed that the department itself calculates payments to employees. The Pension Fund itself will transmit information on old divisions that pay contributions to the tax authorities (Clause 1, Article 4 of the Federal Law of July 3, 2016 No. 243-FZ).

The company can pay insurance premiums in advance until the end of the month or a quarter in advance. But inspectors have questions about the overpayment. quot;UNPquot; I asked the tax authorities what would happen if the organization transferred contributions for May in May. We also asked if it was possible to pay several months in advance.

mdash; You can pay your dues earlier. Fill out the payments as usual. This will simply work out as an advance payment. If the details are correct, then you won’t have to clarify anything, don’t worry. It is better to make a separate payment invoice for each month so that there are no questions later. If you pay like this, then call us just in case, we will check it in the database.

mdash; It is recommended to pay your dues next month before the 15th, but you can do it in advance. There is no violation. In the payment slip, indicate the month for which you are paying. You can pay for several months, but one payment is not worth mdash; we just won't understand.

mdash; So far we have not had any restrictions. On the payment slip, the main thing is to write what month it is for. There is no need to pay for several months in advance.

mdash; You can pay safely, don't worry about anything. The law states that until the 15th, but not later. There is no need to warn us about anything. The main thing is to write in field 107 and in the purpose of payment that these are contributions for May. We ask for clarification when paying personal income tax, not contributions.

mdash; I think nothing bad will happen. Although this is not clearly stated. Don’t warn us in advance - everything will go on your personal account card and everything will be fine. What's the point of warning us? Fill out everything correctly, and the payment will not be delayed.

mdash; The main thing is to pay for May no later than June 15th. You can do it in advance, that's okay. You can read Chapter 34 of the Tax Code of the Russian Federation. Everything is written there in detail. You can pay in advance for the entire quarter - everything will be counted. But ideally, it is better to pay after the fact - it will be easier and calmer. You see, we are just starting to work with this, and some difficulties may arise.

mdash; The main thing is that you do not violate the deadline, otherwise you will incur penalties. Payments will come to us and go into your card. There is no need to put anything additional on the payment slip. Many people pay in advance, don't worry. It is better to send in two payments two months in advance to avoid confusion.

If the payer is late with payment, tax authorities will charge penalties. The general procedure for calculating penalties is as follows. From the 31st day of delay, the interest rate for calculating penalties is 1/150 of the Central Bank rate, up to 30 days - 1/300 of the Central Bank rate. The new procedure applies to arrears arising from October 1, 2021.

How to pay insurance premiums to a budget organization

Insurance premiums for compulsory medical insurance are paid (clause 1, clause 1, article 419, clause 1, article 420, clause 11, article 431 of the Tax Code of the Russian Federation, clause 1, article 10 of the Federal Law of November 29, 2010 N 326-FZ):

- organizations that make payments to individuals under employment contracts and civil agreements for the performance of work (provision of services);

- OPs vested with the authority to pay benefits to employees and other individuals according to the above-mentioned GPA. Please note that the vesting of a separate division with such powers must be reported to the Federal Tax Service at the location of the parent organization (clause 7, clause 3.4, article 23 of the Tax Code of the Russian Federation, Appendix No. 1 to the Order of the Federal Tax Service dated January 10, 2017 No. MMV-7-14/);

- Individual entrepreneurs making payments to individuals under employment contracts, GPA for the performance of work (rendering services).

In 2021, legislators have again prepared innovations regarding the payment of insurance payments by employers. New deadlines for payment of insurance premiums will not be established, however, innovations will be introduced regarding several categories of taxpayers.

Main changes in the procedure for calculating and paying contributions in 2018:

- new rules for calculating and transferring payments by individual entrepreneurs were approved;

- the maximum tax base for insurance premiums has increased;

- The list of types of activities of organizations using the simplified tax system for which a preferential rate is possible has changed.

In 2021, the maximum base limit for calculating payments to the funds is:

- Pension fund - 1,021,000 rubles. Upon reaching this amount, the rate is reduced from 22 to 10%.

- Social Insurance Fund - 815,000 rubles. Once the specified limit is reached, the accrual of contributions stops.

In connection with the work carried out by the state to improve OKVED-2, the list of activities for simplified organizations that have the right to transfer insurance premiums at a preferential rate has been changed. A complete list of types of activities for which preferential payment is possible is indicated in Art. 427 Tax Code of the Russian Federation. Check your type of activity and use the benefit if the state provides such an opportunity.

IMPORTANT! If you are entitled to a benefit, but have not used it before, then you must submit an updated calculation of insurance premiums and recalculate the amounts transferred for previous periods.

Insurance contributions for pension, social and medical insurance, as well as “injury” contributions for December 2021 must be paid no later than January 15, 2021 (clause 3 of article 431 of the Tax Code of the Russian Federation, clause 4 of article 22 of Law No. 125 -FZ).

Since 2021, insurance premiums have come under the control of the Federal Tax Service and new payment deadlines are established by Article 431 of the Tax Code of the Russian Federation. This article will also provide that the amount of insurance premiums calculated for payment for a calendar month must be paid no later than the 15th day of the next calendar month.

The wording of paragraph 4 of Article 22 of the Federal Law of July 24, 1998 No. 125-FZ in 2021 also provides that insurance premiums “for injuries” must be transferred no later than the 15th day of the calendar month following the calendar month for which insurance premiums are calculated contributions. Thus, the deadline for paying insurance premiums in 2021 has not changed.

In addition, we note that in 2021, the rule continues to apply that if the payment deadline falls on a weekend or non-working day, then insurance premiums must be transferred no later than the next working day (Clause 6, Article 6.1 of the Tax Code of the Russian Federation).

January 15, 2021 is Monday. Therefore, insurance premiums for December 2021 must be paid no later than this date. The payment deadline will not be postponed.

Now the procedure for calculation, payment, terms and rates is regulated by the new 34th chapter of the Tax Code.

The changes affected compulsory pension and medical coverage (CPS, compulsory medical insurance), as well as contributions in case of temporary disability and in connection with maternity (VNiM).

Insurance against accidents and occupational diseases should be paid according to the old rules (Law No. 125-FZ of July 24, 1998), that is, funds should be transferred to the Social Insurance Fund. Moreover, payments must be transferred to the Social Insurance Fund in pennies. Rounding to whole numbers is not required.

What changed

In 2017, the administration of insurance premiums from wages was transferred to the Federal Tax Service. This means that tax authorities:

- control the timeliness and completeness of insurance transfers;

- accept and verify reports on insurance premiums for employees in 2021;

- collect arrears and penalties, issue fines.

Payment of contributions in 2021 goes to the territorial offices of the Federal Tax Service. Read more in the article about who should now pay insurance premiums.

The Pension Fund and the Social Insurance Fund have the right to check past periods (until December 31, 2016), but last year’s debt on insurance contributions to the Pension Fund in 2021 does not need to be transferred. We pay debts using the new KBK.

The calculation procedure has not been changed (Article 52 of the Tax Code of the Russian Federation): as in the previous calendar period, the tax base is multiplied by the established tariff. The procedure for determining the taxable base is now established by Art. 420-421 Tax Code of the Russian Federation.

Insurance payments, which should not be included in the base for calculating SV, are enshrined in Art. 422 of the Tax Code of the Russian Federation.

In comparison with the norms of Law No. 212-FZ, the list of insurance payments has been modified in terms of daily allowances, payments to guardians and employer payments for voluntary social security.

The procedure for paying insurance premiums in 2021 is enshrined in Article 431 of the Tax Code of the Russian Federation. Key points:

- The policyholder is obliged to settle payments by the 15th day of the month following the reporting month. That is, for August the SV should be transferred by September 15th.

- Transfers are made by type of insurance coverage (compulsory insurance, compulsory medical insurance, VNIM).

- When paying VNIM, a new procedure for offsetting employer expenses applies (Part 2 of Letter of the Federal Tax Service of Russia dated 02/01/2017 No. BS-4-11/2748). Participants in the pilot project do not offset expenses when paying for VNIM.

Any innovations provoke a large number of questions from accounting workers. Thus, the debate over how to round up insurance premiums in 2021 continues to this day.

To eliminate errors in calculations and prevent penalties from regulatory authorities, we will determine the answer to the pressing question: how to pay insurance premiums: with or without pennies in 2021.

So, based on Art. 431 of the Tax Code of the Russian Federation, we can affirmatively state that disputes about how insurance premiums are paid (with or without kopecks in 2021) are absolutely groundless. Paragraph 5 of this article gives a comprehensive answer: we pay in rubles if the amount is “round”, and in rubles and kopecks if the amount is a fraction.

Consequently, the payment of insurance premiums (with or without kopecks in 2018) depends on the specific value of the payment. To make it clearer, let's look at a specific example.

Example No. 1.

For the month of July, employees of the State Budgetary Educational Institution DoD SDYUSSHOR "ALLUR" were accrued wages and vacation pay in the amount of 1,500,000 rubles. There are no non-taxable income in the accrued amount. Electricity taxation is carried out according to generally established tariffs. Let's calculate the amount of payments to the budget:

- OPS: 1,500,000 × 22% = 330,000.00 rubles;

- Compulsory medical insurance: 1,500,000 × 5.1% = 76,500.00 rubles;

- VNiM: 1,500,000 × 2.9% = 43,500.00 rubles;

- FSS NS and PZ = 1,500,000 × 0.2% = 3,000.00 rubles.

Consequently, in July, GBOU DOD SDUSSHOR ALLYUR makes payments without kopecks. But this payment format is not associated with rounding!

Example No. 2. Accrued wages for August at the State Budgetary Educational Institution of Children's and Youth Sports School "ALLUR" amounted to 102,653 rubles due to the majority of employees being on vacation. CA calculations for August will be as follows:

- OPS: 102,653 × 22% = 22,583.66 rubles;

- Compulsory medical insurance: 102,653 × 5.1% = 5235.30 rubles;

- VNiM: 102,653 × 2.9% = 2976.94 rubles;

- NS and PZ: 102,653 × 0.2% = 205.31 rubles.

As a result, for August, a budgetary institution is obliged to pay the budget in rubles and kopecks. There are no exceptions in this case.

Can payments to the Pension Fund of Russia be rounded in 2021? It is possible, but only in a big way. For example, when calculating for August, a budgetary institution will transfer not 22,583 rubles and 66 kopecks, but exactly 22,584 rubles. The result is an overpayment of 34 kopecks. This method of payment is not prohibited, but it is not necessary to round payments up.

Summarize. The company, deciding how to pay insurance premiums to the Pension Fund of Russia - with or without kopecks in 2021, or in favor of other types of insurance coverage, can make calculations without kopecks, rounding up payments. However, representatives of the Federal Tax Service do not encourage this method of payment.

Specific rates of insurance premiums in 2021 are established for the entire calendar period. Changes occur when the limit established by law is exceeded (GD of the Russian Federation dated November 29, 2016 No. 1255):

- for compulsory health insurance, a limit of 755,000 rubles per insured person is set;

- for VNiM - 876,000 rubles;

- not established for compulsory medical insurance.

The size of the limit is set in full thousands. For example, in August 754,400 rubles were accrued, round up to exactly 754,000. If the amount is 875,550 rubles, then 876,000.

Let's look at a specific example.

MonthAmount of accruals (rubles)

| January | 100 000,00 |

| February | 100 000,00 |

| March | 100 000,00 |

| April | 100 000,00 |

| May | 200 000,00 |

| June | 10 000,00 |

| July | 150 000,00 |

| August | 150 000,00 |

| TOTAL | 910 000,00 |

Exceeding the limit for OPS occurs in July (760,000.00 rubles), and for VNiM - in August (910,000.00 rubles). From this moment, reduced tariffs for insurance premiums for compulsory health insurance are established in 2018. The rate is reduced from 22% to 10%, and for VNiM - from 2.9% to 0%.

We will fill out the payment order according to the new rules. First of all, we establish the number and date of the payment. We fill out the fields in chronological order, otherwise the Treasury or the bank will cancel the operation.

Go to field 101. For transfers of insurance coverage to the Federal Tax Service, set the value to “01”, since the legal entity pays.

We fill in information about the payer (name, tax identification number, checkpoint, bank, settlement and correspondent accounts of a budget organization).

What changed

In 2017, the administration of insurance premiums from wages was transferred to the Federal Tax Service. This means that tax authorities:

- control the timeliness and completeness of insurance transfers;

- accept and verify reports on insurance premiums for employees in 2021;

- collect arrears and penalties, issue fines.

Payment of contributions in 2021 goes to the territorial offices of the Federal Tax Service. Read more in the article about who should now pay insurance premiums.

The Pension Fund and the Social Insurance Fund have the right to check past periods (until December 31, 2016), but last year’s debt on insurance contributions to the Pension Fund in 2021 does not need to be transferred. We pay debts using the new KBK.

What payments are subject to compulsory medical insurance contributions?

Insurance premiums for compulsory medical insurance are subject to almost all payments made in favor of employees and individuals with whom GPD agreements have been concluded for the performance of work/provision of services (clause 1 of Article 420 of the Tax Code of the Russian Federation). True, some payments are still not subject to compulsory medical insurance contributions. You will find their complete list in Art. 422 of the Tax Code of the Russian Federation. Non-taxable payments, for example, include:

- benefits paid in accordance with the law (for example, temporary disability benefits);

- daily allowance within the established limit (700 rubles for each day of a business trip in Russia, 2500 rubles for each day of a business trip abroad);

- the amount of financial assistance that the employer provides to its employees is within 4,000 rubles. per employee per year.

Tax base

Employers must determine the accrual base for each employee on a monthly accrual basis from the beginning of the pay period.

The maximum value of the insurance premium base is determined by Decree of the Government of the Russian Federation dated November 29, 2016 No. 1255:

- compulsory pension insurance - 1,021,000 rubles;

- social insurance in case of temporary disability and in connection with maternity - 815,000 rubles;

- for other types of compulsory insurance, the maximum values have not been determined.

The database should include remuneration for full-time employees, as well as other remuneration in favor of individuals subject to compulsory social insurance in accordance with federal laws on specific types of compulsory social insurance, determined by the norms of Article 420 of the Tax Code of the Russian Federation and Article 421 of the Tax Code of the Russian Federation, as well as Law No. 125-FZ. Thus, other remunerations in favor of individuals include:

- payment under civil contracts, the subject of which is the performance of work or the provision of services;

- payment under copyright contracts in favor of the authors of the works themselves;

- payments under agreements on the alienation of the exclusive right to works of science, literature, art, publishing license agreements, licensing agreements.

Employers calculate the amounts due for payment during the calendar year (settlement period) based on the results of each calendar month in the manner specified in Article 431 of the Tax Code of the Russian Federation. Consequently, the deadline for paying insurance premiums in 2021 comes monthly for employers.

The legislation does not establish a limit on the base for calculating contributions to compulsory medical insurance. Accordingly, contributions are paid from the entire amount of taxable payments.

Liability and fines

The deadlines must be strictly observed, otherwise the policyholders will be subject to penalties and administrative liability.

The employer is always responsible for the violation. Article 119 of the Tax Code specifies a penalty of 5% (of the contribution amount) accrued for each overdue month. The limit on this amount is at least 1000 rubles, but not more than 30% of the amount of payments.

If a budget organization deliberately underestimated the tax base (Article 120 of the Tax Code of the Russian Federation), then liability is assumed in the form of a fine of 20% of the unpaid amount of deductions (but not more than 40,000 rubles).

In Art. 121 of the Tax Code of the Russian Federation states that if the tax base is understated and, accordingly, the subsequent reduction in the amount of the contribution tax or if the amounts required for payment are erroneously calculated, the tax authorities impose a fine of 20% of the amount of unpaid contributions.

In case of partial payment or complete refusal to pay the insurance policy, the policyholder, in accordance with Article 122 of the Tax Code of the Russian Federation, is subject to penalties in the amount of 40% of the unpaid amount.

When insurance premiums are considered paid

Insurance premiums must be paid for all individuals who receive any payment for their work, regardless of whether they work for themselves or for any third parties.

It is worth noting that the transfer of insurance premiums is subject to a fairly large number of rules that may change depending on various circumstances, and in particular, the timing often changes depending on the month in which the payment is transferred.

In this regard, many are asking questions about what law sets the deadline for paying insurance premiums for December 2018 and how to pay them correctly.

Destination

The transfer of insurance premiums for December 2021 is carried out in January 2021, and therefore employers will have to indicate new codes in payment documents.

Due to the fact that, in accordance with Federal Law No. 243-FZ, adopted on July 3, 2021, the function of administering insurance premiums is transferred to the Federal Tax Service, they will need to be transferred to the Tax Service.

This was indicated by the head of the Tax Service, Mikhail Sergeev, and in his address he paid special attention to the fact that the key change for payers is the need to indicate new budget classification codes.

Transfers of insurance contributions to the Pension Fund, as well as health and social insurance funds, must be made before 01/16/17. Such deadlines are established in accordance with Part 5 of Article 15 of Law No. 212-FZ, which was adopted on July 24, 2009, as well as paragraph 4 of Article 22 of Law No. 125-FZ, adopted on July 24, 1998.

Many accountants say that in 2021, Law No. 212-FZ completely loses legal force, as a result of which the regulation of insurance premiums is already carried out in accordance with the main 34 of the Tax Code, but this chapter also provides that the total amount of contributions should be calculated up to 15 the th day of the calendar month that follows the billing month.

Thus, for example, January 15, 2021 falls on a Sunday, and therefore the deadline for payment of insurance premiums for the last month of 2021 is legally postponed to January 16, and this applies to any types of insurance premiums.

Registration procedure

If the salary for December is paid during this month, then in this case the transfer of the amount of insurance contributions can also be carried out in December, and this can be done using the old budget classification codes to the accounts of the Social Insurance Fund or the Pension Fund. If the final payment is made during January 2021, when the new rules come into force, then in this case they should already be transferred to the Tax Service using the new codes.

Do not forget that an incorrect indication of the KBK leads to the fact that ultimately the payment turns out to be uncertain and does not go to a specific budget account, as a result of which the payer becomes overdue and has to conduct a dialogue with tax officials in order to take this into account fee amount.

At the same time, most experts recommend not transferring funds before new budget classification codes are approved, since according to the new rules, all overpayments will remain within the competence of the Social Insurance Fund and the Pension Fund, while the arrears will be collected by the Tax Service.

| Pension insurance | 18210202010061010160 |

| Health insurance | 18210202101081013160 |

| Social insurance | 18210202090071010160 |

| For injuries | 39310202050071000160 |

| Additional pension insurance at tariff 1 | 18210202131061010160 or 18210202131061020160 depending on whether the special assessment affects the tariff used |

| Additional pension insurance at tariff 2 | 18210202132061010160 or 18210202132061020160 depending on whether the special assessment affects the tariff used. |

Money orders

Payment orders along with payments must be issued before January 16, 2021, and they must indicate those intermediate BCCs that are provided for the corresponding transfer to the Tax Service.

It is worth noting the fact that today there is some uncertainty as to what exactly the payer’s status should be indicated in the process of drawing up a payment order transferred to the Tax Service.

The reason is that previously it was customary to indicate code “08” when issuing payment orders, while officials recommended writing code “14”.

In many samples, the taxpayer status is indicated by code “14”, since they are filled out in accordance with the joint explanations given by the tax authorities and various funds. But there is an opinion that the use of this code is actually incorrect, since it is intended for taxpayers, and payers of taxes and contributions are different persons.

In addition, as mentioned above, the use of this code leads to all sorts of difficulties with the bank, and therefore, in order to finally clarify the situation and eliminate the possibility of late payments, it is best to act in accordance with the capabilities of the banking software used .

In any case, incorrect indication of the payer’s status is not a reason for the money not to go to the budget, and therefore even a penalty cannot be imposed on the entrepreneur.

In addition, given such confusion, many control authorities will most likely independently regulate such payments, defining them according to their intended purpose.

Submitting reports

Registration of reporting on insurance premiums is carried out in accordance with the same rules with which insurance premiums are calculated, that is, when paying premiums in 2021, you need to draw up documentation in accordance with the rules that were in force then, while in the first quarter of 2021 already you will need to submit documents in accordance with the rules prescribed in Chapter 34 of the Tax Code. A similar rule applies to updated calculations.

Special attention should be paid to reporting from PZ and NS, since they continue to be supervised by the Social Insurance Fund, which has approved a new form 4-FSS, according to which information is now indicated only on the total amount of insurance premiums that are paid for insurance against occupational diseases or any accidents.

Among other things, in 2021, reports will have to be submitted every month in the SZV-M form, and reports will need to be submitted to the Pension Fund once a year, indicating information about the insurance experience of individuals. To date, this form has not yet been approved, but it is already known that the deadline for submitting this document is March 1, 2021.

At the same time, experts recommend adhering to the established deadlines so as not to encounter various problems from control authorities.

Individual entrepreneurs with employees make mandatory payments in the same way as employer organizations; no changes have occurred here. Innovations affected the method of determining the amount of insurance for the entrepreneur himself and the timing of payment of pension contributions.

From 2021, the fixed payment is no longer tied to the minimum wage. It is legally established as a fixed amount for the purposes of paying contributions for both pension and health insurance. Transferring contributions to the social insurance fund is a right, not an obligation, of an individual entrepreneur and is carried out on a voluntary basis.

Another innovation for 2021 is that pension insurance contributions for 2021 (and all subsequent years) from revenues exceeding RUB 300,000 must be paid by 07/01/2018 (previously the payment deadline was 04/01/2017).

| Payment type | Sum | Terms of payment |

| For pension insurance (if the individual entrepreneur’s income is less than 300,000 rubles per year) | RUB 26,545 | No later than December 31, 2018 At one time or in parts in any proportion |

| For pension insurance (if the individual entrepreneur’s income is more than 300,000 rubles per year) | RUB 26,545 1% of the amount exceeding RUB 300,000. | RUB 26,545 — until December 31, 2018 (at a time or in parts) 1% - no later than 07/01/2019 |

| For health insurance | 5840 rub. | No later than December 31, 2018 |

ATTENTION! Transferring fixed contributions to the budget for oneself is the responsibility of an individual entrepreneur and is carried out even in the absence of activity and income. If a person does not conduct business, it is necessary to deregister from tax registration in order to avoid accrual of arrears on insurance premiums if they are not paid.

Payment of compulsory medical insurance contributions is made to the Federal Tax Service (clause 11 of Article 431 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service dated March 1, 2017 No. BS-4-11/):

- at the location of the organization;

- at the location of the OP empowered to pay remuneration to individuals, in terms of contributions attributable to this separate division (clause 12 of Article 431 of the Tax Code of the Russian Federation);

- at the place of residence of the individual entrepreneur.

Who is obliged to pay

The legislator includes the following as payers:

- enterprises;

- individual entrepreneurs;

- individuals who are not individual entrepreneurs;

- individuals engaged in independent private practice and providing legal, medical, consulting services, and others.

All categories of payers, except the last, pay contributions on the income of employees. The last category of individuals calculates contributions on their income. If a subject belongs to several categories of payers at the same time, then he pays the SV separately for all reasons.

Individual entrepreneurs pay SV for themselves and their employees, but only for pension and medical benefits. Contributions to the Social Insurance Fund are paid by entrepreneurs on a voluntary basis. If an entrepreneur does not have employees, then he pays contributions only for himself.

Entrepreneurs pay contributions regardless of whether they conduct business and receive income or not. The obligation to pay SV arises for individual entrepreneurs as soon as they acquire this status.

For individual entrepreneurs, the legislator provided in Art. 430 of the Tax Code a list of situations when they may not be accrued with SV because the activity is not being carried out, for example:

- completion of military service;

- child care after birth until 3–4.5 years;

- looking after an elderly close relative;

- living abroad with a spouse who is engaged in diplomatic work (maximum 5 years);

- living with a spouse liable for military service at the place of his service (also for a maximum of 5 years).

Article 430. Amount of insurance premiums paid by payers who do not make payments and other remuneration to individuals

If an individual entrepreneur conducts business and receives income from it, but at the same time he has the right not to pay SV, he is obliged to pay them.

Refund and offset of overpayment of compulsory medical insurance contributions

The procedure for returning/crediting an overpayment depends on the period of its occurrence.

Situation 1. The overpayment occurred for periods that expired before 01/01/2017.

You must apply for a refund of the overpayment to your Pension Fund branch (Article 20, Part 1, Article 21 of the Federal Law of July 3, 2016 No. 250-FZ). You will find the recommended return application form on the Pension Fund website.

Offsetting the “old” overpayment against the payment of insurance premiums for periods starting from 01/01/2017 is impossible (Letter of the Ministry of Finance dated 03/01/2017 No. 03-02-07/2/11564).

Situation 2. The overpayment occurred for periods after 01/01/2017.

An application for a refund (Appendix No. 8 to the Order of the Federal Tax Service dated 02.14.2017 No. ММВ-7-8/) or an application for offset (Appendix No. 9 to the Order of the Federal Tax Service dated 02/14/2017 No. ММВ-7-8/) must be submitted to your Federal Tax Service Inspectorate within three years from the date of payment of the excess amount (clause 7 of article 78 of the Tax Code of the Russian Federation).