To reduce the tax burden, small businesses are allowed to switch from the general regime to the simplified regime (STS). To do this, the enterprise should not be subject to restrictions prescribed by law. To switch to the simplified tax system, you must submit an application to the tax authority before the end of the year.

Let us recall the restrictions for application and the order of transition. Everything written below is also relevant for individual entrepreneurs, with the exception of certain points that we will explain throughout the article.

Basics of the simplified tax system

The use of the simplified tax system makes it possible to facilitate the preparation of reporting, and also reduces the number and amount of taxes paid. The transition to a simplified system exempts an enterprise from paying taxes such as VAT on profits and property, although there are a number of exceptions. Regional authorities have the right to independently reduce tax rates on the simplified tax system.

When submitting an application, an enterprise can choose an object of taxation

- "Income". Taxes are paid on all proceeds. The standard rate is 6% (at the regional level it can be reduced to 1%).

- "Income minus expenses." The tax rate is set at 15% , but regional authorities can set it at a rate from 5 to 15%. The difference between revenue and expenses is taken into account as the tax base. This means that the more expenses a company has, the less tax it will have to pay. The base is reduced only by the amount of expenses that are prescribed in Article 346.16 of the Tax Code of the Russian Federation. At the end of the year, it may turn out that the tax amount is less than 1% of the amount of income. In this case, you must pay the difference.

You can change the object of taxation starting next year.

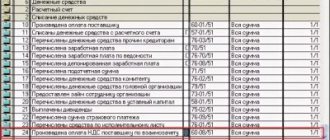

In a simplified system, tax accounting must be kept in a ledger for accounting expenses and income , the form of which is approved by Order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n. The book does not need to be certified by the Federal Tax Service.

At the end of the reporting year, you must submit a tax return according to the simplified tax system : organizations - before March 31, individual entrepreneurs - until April 30 inclusive.

Advantages of the simplified tax system

Switching to a simplified system can be a good solution for young businesses or those suffering from a lack of money. This tax system has a bunch of benefits that will allow you to save a good amount on taxes.

- The enterprise is not obliged to remit VAT, income tax or property tax (with rare exceptions under paragraph 2 of Article 346.11 of the Tax Code of the Russian Federation).

- The taxpayer is free to choose an object (“Income 6%” or “Income minus expenses 15%”), due to which he can choose a more convenient option for himself.

- In some regions, tax rates for both objects have been lowered by regional authorities, which makes the simplified tax system even more profitable.

- Intangible assets and fixed assets are included in expenses if they were purchased within the period of application of the simplified tax system.

- Accounting becomes noticeably simpler: there is no need to certify the book of income and expenses with the tax office, and it is enough to submit reports once a year.

In addition, a conditional 6 or even 15% simplified tax system will significantly reduce the company’s tax expenses. Especially when you compare them with the 20% rate for an LLC on the general system. However, for individual entrepreneurs, the simplified tax system is also more profitable - you don’t have to deal with VAT and other unpleasant concepts.

Who is allowed to switch to the simplified tax system?

The Tax Code specifies restrictions for the use of the simplified tax system , namely:

- number of employees - no more than 100 people ;

- You cannot switch to a simplified system if over the previous 9 months your income exceeded 112.5 million rubles . The amount of income is determined on the basis of documents - primary tax records. Sales revenue and non-operating income are taken into account. The amounts of taxes presented to the buyer are deducted from the income;

- the residual value of fixed assets, which are recognized by law as depreciable property, at the beginning of 2020 should not exceed 150 million rubles . This is considered property whose useful life is more than 1 year, and its original price was more than 100 thousand rubles . Article 256 of the Tax Code of the Russian Federation states that it does not include land, securities, natural resources, unfinished construction projects, etc.;

- the enterprise must not have branches;

- the share of other organizations in the authorized capital does not exceed 25%.

The last two points do not apply to individual entrepreneurs, since they do not have founders or branches.

Insurance companies, banks, microfinance organizations and some other companies whose activities are related to finance cannot switch to the simplified system. The simplified tax system is not available to those individual entrepreneurs and organizations that produce excisable goods, extract and sell minerals. The full list of restrictions is given in paragraph 3 of Art. 346.12 Tax Code of the Russian Federation.

Who can use simplified work?

The simplified taxation system is more profitable compared to others. But not all entrepreneurs can work on it. Certain criteria must be met. They relate to economic situation, business size and scope of activity.

Criteria for a company that is going to switch to the simplified tax system:

- There should not be more than 100 employees

- The payer is not engaged in certain types of activities (banking, insurance, mining of non-common minerals, pawnshops, and so on).

- Annual income does not cross the threshold of 150 million rubles.

- The company has no branches.

- Income for 9 months of the current year does not exceed 112.5 million rubles if the transition is carried out with OSNO.

- The residual value of the enterprise's fixed assets is less than 150 million rubles.

If a company violates at least one criterion or is engaged in one of the activities “prohibited” for the simplified tax system, then it cannot count on the use of this system.

Before submitting the notification, recalculate your indicators again. And if you are just registering a company, then think about it - will you be able to fit into the established limits?

Transition deadlines

To switch to the simplified system in 2021, you must submit a notification to the Federal Tax Service by the end of this year. The form was approved by Order of the Federal Tax Service of the Russian Federation dated November 2, 2012 No. MMB-7-3/ [email protected] , and the electronic format was approved by Order of the Federal Tax Service of the Russian Federation dated November 16, 2012 No. MMB-7-6/ [email protected]

to submit a notification about a change in tax regime :

- personally;

- through an authorized representative;

- by registered mail.

When submitting a notification personally or through a representative, the filing date will be considered the day the form is received by the Federal Tax Service. If the document is sent by mail, the date indicated on the postal stamp.

The regulations for the transition to the simplified tax system are enshrined in Art. 346.13 of the Tax Code of the Russian Federation. Deadlines for submitting notifications for switching to the simplified tax system:

| New LLC or individual entrepreneur | Operating organizations and individual entrepreneurs | Payers of the single tax on imputed income |

| Simultaneously with the submission of documents for state registration or no later than 30 calendar days from the date of registration with the tax authority | No later than December 31 of the current year | Within 30 calendar days from the date of termination of the obligation to pay UTII |

| clause 2 art. 346.13 Tax Code of the Russian Federation | clause 1 art. 346.13 Tax Code of the Russian Federation | clause 2 art. 346.13 Tax Code of the Russian Federation |

Companies that are ready to switch to the simplified tax system next year will be able to use their right to switch only until the end of 2019 , otherwise the opportunity to switch will only appear from January 1, 2021.

Organizations that already use the simplified tax system can continue to work under it next year without additional notification to the tax office.

Until what time do you need to apply for transfer?

The transition to a simplified taxation system is a serious matter. Each individual situation of entrepreneurs and companies has its own deadlines and features. Remember that you can only change the tax system once a year, so approach the decision wisely. When submitting an application, take into account weekends and shortened working days of the Federal Tax Service. Don’t wait until the last minute: if you’re even a day late, you’ll have to work for another year using OSNO.

An important nuance: legally you can submit an application until December 31, 2021, which is a holiday. Consequently, the deadlines are postponed to the first working day after the holidays. That is, you can submit all applications until January 9, 2021.

By the way, if you worked under the simplified tax system in 2021, then you do not need to notify the tax authorities about this again. No one will change the tax system for you if you meet all the criteria for applying the simplified tax system.

For new entrepreneurs

If you have just decided to register a business and decided that you want to pay taxes according to the simplified tax system, then you don’t have to bother and submit an application on the same day on which you came to register an individual entrepreneur or LLC.

You can also switch to the simplified tax system without unnecessary problems, if 30 days have not yet passed since the registration of the business. You just need to bring an application and submit it to the Federal Tax Service, and then you will pay taxes according to the simplified system, and not according to the originally chosen system.

For those switching from OSNO

If you are switching to the simplified tax system from the general taxation system, you must submit a corresponding notification before December 31, 2021. In this case, the new scheme will apply from January 1, 2019.

For those transferring from UTII

At the businessman’s own request, you can change the taxation system in the same way as in the case of OSNO - once a year, and the changes will only take effect from January 1 of the next year. But if the enterprise’s imputation activities are closed, then the business owner can switch to the simplified tax system at any time of the year, and not just from January 1, 2021. You must submit an application within 30 days from the date of deregistration as a UTII payer.

It is interesting that this relaxation applies only to companies on UTII that have been deregistered due to imputation. And if something has changed for companies using other systems, they do not have the right to change them to the simplified tax system according to this principle.

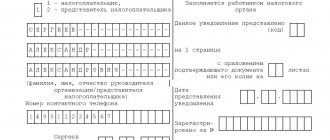

Rules for filling out the notification

The form is easy to fill out, it only fits on one page, but you need to know the mandatory requirements:

- Choose object of taxation. In business it is believed that if the company's expenses are more than 60% of her income, it is more profitable to choose “income minus expenses”, if less than 60% is “income”.

The taxpayer has the right to change the object of taxation every year. The tax authority must also be notified of this before December 31 of the previous year. If an organization uses an object that is not specified in the notification, officials may make additional tax assessments.

- Indicate the residual value of fixed assets and the amount of income as of October 1 of the current year.

- If a notification is submitted through a proxy, the application form must indicate a document confirming his authority and attach a copy of it.

- The notification form should be filled out in 2 copies. One is kept by the tax office, the second by the applicant (with a mark of acceptance). Tax inspectors often ask to provide them with both copies; in this case, you can make another copy.

Why choose simplified tax system?

The simplified tax system is a preferential tax system. And benefits imply economic benefits, which exists here too.

Firstly, the simplified tax system has a low tax rate. You can pay 6% of total income or 15% of income minus business expenses.

Secondly, an individual entrepreneur using the simplified tax system under the “Income” system can reduce the tax base by the amount of insurance premiums paid. If you pay insurance premiums only for yourself, then the tax base can be reduced by the entire amount of contributions. If an individual entrepreneur pays both for himself and for his employees, then the base can be reduced by 50% of the contributions paid.

Thirdly, the simplified tax system is a system with simple reporting, which many individual entrepreneurs cope with on their own. This means savings on accounting services.

Confirmation of transition to simplified tax system

According to the requirements of the Tax Code of the Russian Federation, an organization should not wait for confirmation from the Federal Tax Service about the transition to another tax regime. After providing notification, you can begin working on the new system. But it is better to make sure that the actions are legal. You can go to the official website of the Federal Tax Service and see information about the transition to the special regime in your personal account.

If you still need a supporting document from the Federal Tax Service to conduct business activities, you must send a request. Within 30 calendar days, the tax office is required to provide a response letter indicating that the organization submitted a notification and has the right to apply the “simplified tax treatment.”

How to switch to the simplified tax system for newly created companies or newly registered individual entrepreneurs

Newly created companies (registered entrepreneurs) can submit a notification of transition to the simplified tax system no later than 30 calendar days from the date of registration with the tax office. In this case, you can apply the simplified system from the moment of registration. In order not to miss the thirty-day period, you can notify about the transition to the simplified tax system immediately when submitting documents for company registration. This procedure for switching to the “simplified” system has been applied since January 1, 2013 by newly created organizations (registered entrepreneurs).

Please note: since 2013, all companies and entrepreneurs who have not notified in a timely manner about the transition to the simplified tax system are deprived of the right to apply this special regime (subclause 19, clause 3, article 346.12 of the Tax Code of the Russian Federation). In this case, the inspection will send a message to the violators about the violation of the deadlines for notification of the transition to the simplified tax system (form 26.2-5, approved by order of the Federal Tax Service of the Russian Federation dated November 2, 2012 No. ММВ-7-3 / [email protected] ).

A newly registered entrepreneur who switched to the simplified tax system from the date of registration has the right to change the object of taxation only from the next year. Such clarifications were given by the Federal Tax Service of Russia in letter No. SD-3-3/2511 dated 06/02/2016. The tax authorities have the following reasoning.

As mentioned above, a newly registered entrepreneur notifies the tax inspectorate about the transition to the simplified tax system no later than 30 calendar days from the date of registration indicated in the certificate of registration with the Federal Tax Service (clause 2 of article 346.3 of the Tax Code of the Russian Federation). From this date indicated in the certificate, the individual entrepreneur is recognized as a payer of the “simplified” tax.

As already mentioned, the Tax Code of the Russian Federation allows a “simplified” person to change the object of taxation only from the beginning of each calendar year (clause 2 of Article 346.14 of the Tax Code of the Russian Federation). And provided that he notifies the tax office about this before December 31 of the year preceding the year in which he wants to apply a different tax regime. But during the tax period, changing the object of taxation is not allowed. The ability to correct errors in the notification of transition to the simplified tax system relating to the object of taxation is also not provided for by law.

note

The tax inspectorate does not have the right to refer to the untimely notification by a newly created entity of the application of the simplified tax system if the validity of its application has already been actually recognized. As such recognition, it was taken into account that the tax authorities did not object to the company making advance payments under the simplified tax system.

For entrepreneurs registered for the first time and wishing to immediately apply the simplified tax system, the tax period will be considered the period of time from the moment of registration with the Federal Tax Service until the end of the current year (clause 2 of article 346.13 of the Tax Code of the Russian Federation). Accordingly, if a notice of transition to the simplified tax system is submitted in the middle of the year, then the taxable object specified in it cannot be changed until the end of the year, the Federal Tax Service explained. The same rule applies to organizations.

The situation is different if the taxpayer, before switching to the simplified tax system, applied a different taxation regime (clause 1 of Article 346.13 of the Tax Code of the Russian Federation). In this case, he must notify the tax office about the transition to the “simplified tax” no later than December 31 of the year preceding the year in which he wants to apply the special regime. Of course, indicating the selected object of taxation. The tax period for such “simplifiers” begins on January 1 of the year following the year in which the notification was submitted to the Federal Tax Service.

In letters dated October 14, 2015 No. 03-11-11/58878 and dated January 16, 2015 No. 03-11-06/2/813, the Russian Ministry of Finance gave the following recommendations to taxpayers. If an individual entrepreneur submits a notice of transition to the simplified tax system from the beginning of the next calendar year, but then decides to change the initially selected object of taxation, he can clarify the previously submitted notice. But no later than December 31 of the year in which it was filed, that is, before the application of the simplified tax system begins. The new notification must indicate a different object of taxation. The Federal Tax Service of Russia indicated that these clarifications of the Ministry of Finance of Russia cannot be applied in this case. Since the entrepreneur sent a letter to the Federal Tax Service to clarify the notification of the transition to the simplified tax system after the date of registration as a payer of a “simplified” tax with the selected object of taxation.

Thus, a newly registered entrepreneur can change the object of taxation according to the simplified tax system only from the beginning of the new calendar year.

Limits for the transition of an LLC to the simplified tax system from 2021

From 2021, even more organizations will be able to voluntarily join the “simplified” special regime. This is due to the increase in “transitional” limits, which companies that decide to use the simplified tax system should be guided by.

The “income” limit for switching to the simplified tax system in 2021 is 112.5 million rubles, which, unlike previous years, is now not indexed to the deflator coefficient. If for the period January - September 2021 the company’s revenue (excluding VAT) is higher than this amount, it will not be able to switch to the “simplified” system (Clause 2 of Article 346.12 of the Tax Code of the Russian Federation).

Another restriction that applies only to legal entities is the residual value of depreciable fixed assets, not exceeding 150 million rubles. as of October 1, 2017 (clause 16, clause 3, article 346.12 of the Tax Code of the Russian Federation).

In addition, the criteria for the transition to the simplified tax system for authorized capital continue to apply - it can consist of contributions from other legal entities of a maximum of 25%. Also, participants in production sharing agreements and organizations with branches cannot switch to the simplified system.