It is important to find out in advance the deadline for filing a tax return for individual entrepreneurs in 2018, so as not to anger your tax inspector. Every year, entrepreneurs are required to submit reports on their activities to the Federal Tax Service and make payments regulated by law.

Individual entrepreneurs have a choice in what scheme they will do this. Most often they choose a simplified taxation system.

However, there are also those who do not fit the parameters for the simplified tax system and are forced to choose, for example, OSNO (general system).

Who must file returns

The obligation to regularly disclose financial results was assigned to certain categories of individual entrepreneurs. Payers of the following regimes must provide the tax office with information about income received:

- OSNO;

- simplified tax system;

- UTII;

- Unified Agricultural Sciences.

Answering the question of who should submit data to the inspectorate, it is worth highlighting businessmen with a patent and self-employed citizens. There is no reporting for them.

Tax legislation contains general rules. Forms and instructions are approved by separate orders of the Federal Tax Service of Russia.

- USN. The report form for single tax payers was introduced by Order No. ММВ-7-3/ [email protected] dated 02/26/2016.

- UTII. The form and instructions were approved by order No. ММВ-7-3/ [email protected] dated 06/26/2018.

- Unified Agricultural Sciences. Agricultural producers are required to submit a report, guided by the instructions of service No. ММВ-7-3 / [email protected] dated 07/28/2014.

- BASIC. Entrepreneurs must fill out several forms at once. The forms were introduced by orders No. ММВ-7-11/ [email protected] and No. ММВ-7-3/ [email protected]

In addition, Article 80 of the Tax Code of the Russian Federation provides for the possibility of submitting a single report. An individual entrepreneur’s declaration is submitted in the absence of turnover and objects of taxation for several taxes. The form was approved by order of the Ministry of Finance of Russia No. 62n dated July 10, 2007. The condition for submitting the form is a complete stop in the movement of funds in the cash register and in the current account.

Reporting of individual entrepreneurs with employees on the simplified tax system

In order to understand what taxes and mandatory payments for individual entrepreneurs on a simplified basis with employees should be made in 2021, a number of features should be identified.

Individual entrepreneurs who have employees on staff additionally submit reports to the Federal Tax Service with information on the amounts paid, withheld and transferred to income tax for each employee:

- Report 2-NDFL;

- Report 6-NDFL.

In addition to strict reporting to the Federal Tax Service, individual entrepreneurs are required to submit quarterly information to the Pension Fund of the Russian Federation and the Social Insurance Fund. The report to the FSS is submitted in the prescribed form - 4-FSS. With regards to submitting a report to the Pension Fund, this operation has been abolished since the beginning of 2021. To replace it, a new scheme for submitting a single calculation for insurance premiums has been developed, on the basis of which the individual entrepreneur submits this data to the Federal Tax Service . The system for submitting reports to the Pension Fund of Russia has undergone changes, but has retained the need to submit monthly reports - information about insured persons in the SZV-M form and personalized accounting information for the year.

Table of deadlines for submitting individual entrepreneurs’ reports to the simplified tax system in 2021 with employees:

| Reporting according to the simplified tax system | Periodicity | Deadlines for submitting individual entrepreneurs’ reports to the simplified tax system with employees |

| tax return | once a year | until April 30 |

| 2-NDFL | once a year | until April 1 |

| 6-NDFL | quarter half year nine months | until April 25 until July 25 until October 25 |

| information about the number (Federal Tax Service) | once a year | until January 20 |

| unified calculation of insurance premiums (FTS) | quarter half year nine months | until April 30 until July 30 until October 30 |

| SZV-M | every month | until the 15th |

| 4-FSS | quarter half year nine months | until April 20 until July 20 until October 20 |

| certificate confirming the type of activity (FTS) | once a year | until April 15 |

Strict compliance with this list is mandatory, including under the condition that only one employee will work. It is necessary to pay fees before the established time limit in order to avoid accrual of late fees, which are automatically summed up for each day of delay.

Having considered what kind of reporting an individual entrepreneur submits to the simplified tax system with employees in 2021, it remains to add that maintaining accounting records for an individual entrepreneur under a simplified form of taxation is excluded .

Data on what reports an individual entrepreneur submits to the simplified tax system with employees remains valid until the end of 2021. All changes regarding tax legislation can be tracked on the Federal Tax Service website in a specialized section. To display the correct data of the current tax legislation in the region, if it is not automatically determined by the system, you should select the appropriate location. If the business activity is registered in Moscow, and the working region is different from it, then you must indicate the location, as the region - Moscow. Individual entrepreneurs are required to report to supervisory government authorities and pay taxes with advance payments at their place of registration .

Types of tax returns

Reports are classified according to different criteria. The legislation distinguishes the following types.

| Types of declaration | a brief description of | Link to regulations |

| Full | The report is submitted at the frequency prescribed by the tax regime. This is the main document of a merchant, reflecting the amount of income. On its basis, contributions to the budget are calculated. | Articles 346.23, 229,346.10, 346.32 of the Tax Code of the Russian Federation |

| Refined | If an entrepreneur discovers errors that lead to an underestimation or overestimation of obligations to the treasury, he must make corrections. The adjustment must be filed on the same form as the original report. The deadline for sending data will not be considered missed. There will be no penalties. | Article of the Tax Code of the Russian Federation |

| Zero | The report is submitted if there is no turnover for the period. Zero forms allow you to maintain your status during downtime, reduce taxes to a minimum and avoid fines. | The legislator does not distinguish “nulls” as a separate type. They are handed over according to the rules of full declarations. |

Professional accountants classify reports by frequency. Thus, there are monthly, quarterly and annual forms.

Reporting of individual entrepreneurs without employees on the simplified tax system

The Book of Accounting for Income and Expenses (KUDiR) is the main tool for an entrepreneur for keeping records of tax expenses.

It is acceptable to keep a book in an electronic version, but at the end of the year it is necessary to prepare and bind its printed version. Certification of the accounting book by the Federal Tax Service from January 1, 2021 is not required.

Having considered what payments and reports an individual entrepreneur submits to the simplified tax system of 6% without employees in 2021, strictly following the guidelines, it is possible to avoid additional payment of penalties in the form of penalties for untimely contributions. The amount of accrued penalties is equal to 1/300 of the refinancing rate in effect during the period of non-payment for each day of delay according to the Tax Code of the Russian Federation. Payment on time guarantees the absence of monetary penalties in the amount of 20% to 40% of the amount of the unpaid debt. Due to the daily growing debt, payment must be made strictly within the specified time frame .

When to submit data

The deadline for providing information to the tax authority depends on the regime applied. Violation of the rules will result in fines.

- USN. Entrepreneurs are required to submit only an annual declaration. The document must be received by the inspectorate no later than April 30. The report is sent at the end of the year, that is, merchants have at least 4 months to fill out the form.

- Unified Agricultural Sciences. Agricultural producers submit declarations annually by March 31.

- UTII. Payers are required to submit data to the inspection quarterly. Entrepreneurs have 20 days to draw up a declaration. The countdown begins from the end of the quarter.

- BASIC. Entrepreneurs report on personal income tax no later than April 30 of the following year. The value added tax return must be submitted within 25 days after the end of the quarter. The report is accepted only in electronic form (clause 5 of Article 174 of the Tax Code of the Russian Federation).

If the deadline falls on a holiday or weekend, the next working day is considered final.

Important! Businesses should know when to provide information when ceasing operations. “Simplers” and agricultural producers are given 25 days to compile a final report. The period begins to run from the end of the month in which the entry was made in the Unified State Register of Individual Entrepreneurs. Personal income tax payers must submit the form no later than 5 days.

Payers are required to send a single simplified declaration to the inspectorate before the expiration of 20 days from the end of the quarter, half-year, 9 months or year. It is important for entrepreneurs on OSN to remember the need to submit Form 3-NDFL. The single report does not relieve you from the obligation to disclose personal income tax information.

Procedure and formal rules for filling out

To ensure that the declaration does not return for revision and is not returned with a statement, you must comply with all formalities when filling it out. This is especially true for calculations that are submitted in printed form. Electronic forms that are completed on a computer are a little easier to fill out, but you still need to know the details. The tax framework guidelines look like this:

- All declarations (except for VAT calculations) can be completed both on paper and electronically. When the declaration is filled out by hand, blue or black ink may be used. When this is done using a PC, you need to leave the font installed in the template - Courier New 16-18.

- Do not print pages using duplex printing. Each page is printed on a separate sheet.

- It is recommended to number pages after completing the entire declaration. The numbering should be continuous and take into account only completed sheets. Pages without information do not need to be counted or printed.

- Any corrections to the document are prohibited.

- Considering that in the upper left part of the title page of all declarations there is a barcoding of the calculation, you cannot fasten the pages using a stapler or paper clips so as not to damage the code.

- It is prohibited to stitch pages in any place. All sheets must be easily disassembled. This is necessary for scanning and saving scanned copies in electronic format in the internal system of the Federal Tax Service of the Russian Federation.

- All declaration forms are prepared for machine reading, so each indicator in the calculation has a specific location (line, column, block). Rules for filling them out:

- When filling out by hand, you must write in capital block letters;

- the text is written from left to right, beginning from the leftmost cell;

- cost indicators, on the contrary, are equal to the right edge;

- when there is no data in the block, a dash is placed in each familiar place (relevant only for handwritten forms; when filling out on a PC, you can ignore this point);

- The date is entered in the format “DD.MM.YYYY”.

- When it is necessary to take into account currency transactions in the declaration, all figures must be converted into rubles at the rate that was established by the Central Bank of the Russian Federation on the day of their receipt or payment.

- Pay attention to the indicators, after filling which empty cells remain, for example, the code according to OKTMO (the municipality where the individual entrepreneur is registered or reports, you can check it using the hyperlink). The code has only 8 characters, and the familiarity is 11; when filling out, you need to enter the code from left to right, and then put 3 dashes, for example, “12121212—”.

- The declarant's TIN is indicated on all pages of the report.

- When the form is submitted to the Federal Tax Service by the authorized representative of the individual entrepreneur, a photocopy of the power of attorney certified by a notary office must be attached to the declaration.

- And most importantly, all data must “fight” with the tax accounting of the entrepreneur. That is, all the numbers in the Individual Entrepreneur Accounting Book must match the physical indicators in the declaration. It is worth knowing that the tax inspector conducting a desk audit has the right to request KUDiR, as well as all the fiscal documents that are reflected in it.

Video lesson: to help individual entrepreneurs using the simplified tax system 6% - how to prepare and submit a declaration

Methods for submitting documents

Entrepreneurs have the right to send reports in paper and electronic form.

The exception is VAT returns. They are accepted only in digital format. Other reports are allowed to be sent:

- personally;

- by registered mail with a list of attachments;

- via telecommunication channels.

The entrepreneur himself decides how to submit information. To organize electronic document management with the tax authority, you will need a qualified digital signature.

How often to submit reports

The reporting period for the simplified tax system is a calendar year, so the report for this tax is submitted immediately for the year.

Individual entrepreneurs without employees submit statistical reports only at the request of Rosstat. Monthly, quarterly or annual reporting is provided.

We recommend reading: Individual entrepreneurs’ reporting on the simplified tax system with employees: what needs to be submitted to the Pension Fund, Tax Service and Social Insurance Fund.

Responsibility for violations

Sanctions for late submission of reports are provided for in Article 119 of the Tax Code of the Russian Federation. The norm also applies to cases of entrepreneurs evading filing declarations. Misdemeanors are punishable by fines of at least 1 thousand rubles. The amount of the penalty is calculated based on the amount of tax payable. For each month of delay, 5% is charged. The total penalty must not exceed 30% of the assessed tax. If a zero declaration is not submitted to the regulatory authority, the sanction is limited to 1 thousand rubles. Failure to pay taxes on time is also subject to penalties. Penalties are charged on the entire amount of arrears. Form 3-NDFL can be submitted through the state service portal or multifunctional center.

Who is obliged to take

The deadlines for filing the 3-NDFL declaration for 2021 are set for citizens for whom the preparation of the report is recognized as a legal obligation. This category of persons includes:

- individual entrepreneurs who have chosen the general tax regime;

- self-employed citizens (notaries, lawyers);

- heads of farms.

Additionally, the obligation to prepare an income statement is assigned to citizens who have made transactions of a certain type over the past 12 months. Thus, the deadline for filing 3-NDFL for 2021 is set for persons who:

- rented out housing under long-term contracts;

- received income from persons who did not perform the functions of tax agents;

- won prizes;

- made transactions of purchase and sale of real estate or cars;

- received income from sources located outside the country;

- turned out to be legal successors of intellectual property, etc.

Also, the deadline for submitting the 3-NDFL declaration for 2021 is relevant for foreigners if the amount of tax on labor income received in the Russian Federation was greater than what was previously paid for the purchase of a patent.

Persons for whom the preparation of a declaration is not recognized as mandatory have the right to fill out a report and submit it to the fiscal authorities on a voluntary basis. This is necessary to obtain the right to tax deductions related to the purchase of housing, payment for educational or medical services.

When documents may be refused acceptance

The inspectorate has the right to reject a report if there are compelling reasons. Employees of the Federal Tax Service rely on the administrative regulations approved by Order of the Ministry of Finance of Russia No. 99n dated 07/02/12. The grounds for refusal to accept are given in paragraph 28. The report may be returned if:

- identification documents from the declarant;

- powers of attorney from the representative;

- signatures, other mandatory details;

- qualified digital signature when submitting a declaration via TKS.

The reason for the rejection is an application to the inspectorate with a violation of jurisdiction. The control service has the right to return documents even if the established form is not followed.

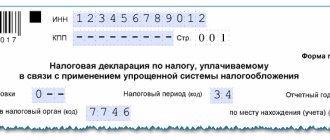

Sample of filling out an individual entrepreneur's declaration under the simplified tax system for 2018

Income of individual entrepreneurs in 2021 – 120,000 rubles. for every quarter. In March 2018, he paid an additional contribution to compulsory pension insurance for 2021 - 1,800 rubles, in December 2021 - a fixed payment - 32,385 rubles.

1st quarter

The calculated advance payment is RUB 7,200. (RUB 120,000 x 6%) is reduced by an additional contribution to compulsory pension insurance. Advance payment due – RUB 5,400. (RUB 7,200 – RUB 1,800).

Half year

Calculated advance payment – 14,400 rubles. ((RUB 120,000 + RUB 120,000) x 6%) is reduced by the additional contribution to compulsory pension insurance and the advance payment for the previous period. Advance payment due – RUB 7,200. (RUB 14,400 – RUB 1,800 – RUB 5,400).

9 months

The calculated advance payment is RUB 21,600. ((RUB 120,000 + RUB 120,000 + RUB 120,000) x 6%) is reduced by an additional contribution to compulsory pension insurance and advance payments for previous periods. Advance payment due – RUB 7,200. (RUB 21,600 – RUB 1,800 – RUB 5,400 – RUB 7,200).

Year

The amount of tax calculated at the end of the year is 28,800 rubles. ((RUB 120,000 + RUB 120,000 + RUB 120,000 + RUB 120,000) x 6%) reduced by an additional contribution to compulsory pension insurance – RUB 1,800, fixed payment – RUB 32,385. and advance payments for previous periods - 19,800 rubles. (5,400 rub. + 7,200 rub. + 7,200 rub.). The calculated tax amount for the year is less than the amount to be reduced, so there is no need to pay tax.

Source: General Ledger

Requirements for introducing simplification

The right to introduce a simplified taxation system is granted to individual entrepreneurs if 3 mandatory conditions are met:

- the number of full-time personnel does not exceed 100 people;

- annual income is less than 150 million rubles;

- the residual value of assets at the disposal of the individual entrepreneur is within 150 million rubles.

An important innovation for 2021 will be the introduction of the so-called transition period, when exceeding the above restrictions does not lead to an immediate transition to the general tax regime. In this case, the taxpayer will have to pay higher rates. The transition period is considered to be the period when the individual entrepreneur receives income in the amount of 150-200 million rubles. and has a staff size of 100-130 people.

The legislation allows both the choice of the simplified tax system when registering the legal status of an individual entrepreneur, and the transition to a simplified system in the process of conducting business activities. In the second case, you must notify the Federal Tax Service in advance of your desire to use the simplified tax regime.

IMPORTANT. Starting in 2021, major changes will be introduced to the simplified taxation system. The main one is the introduction of a second level of requirements for the application of the simplified tax system.

An additional level of restrictions on the use of simplified language includes two main parameters:

- the amount of annual income is between 150 and 200 million rubles;

- the number of employees is from 100 to 130 people.

In a situation where the indicators of the financial and economic activities of an individual entrepreneur are within the specified framework, he does not lose the opportunity to use the simplified taxation regime. But in this case, the interest rate when calculating tax increases:

- from 6% to 8% when choosing income received as a result of the activities of an individual entrepreneur as an object of taxation;

- from 15% to 20%, if the object of taxation is the difference between the income received by the individual entrepreneur and the expenses incurred.

Which authority should I submit to?

Entrepreneurs submit tax reports to their “native” tax office. That is, the one in which registration took place. Its location always coincides with the place of residence of the individual entrepreneur.

Reporting is submitted in 2 copies. The first service employee must pick it up, and the second must provide it with a special mark and give it to the individual entrepreneur. The returned copy should be tucked away in your reports folder.

And a few more nuances:

- When sending a declaration by mail, one copy of the report is included in a registered letter. And as confirmation of acceptance of the declaration by the regulatory authority, you can use a shipping receipt, a notification with the seal of the Federal Tax Service and the signature of its employee.

- If a businessman combines several modes, the declaration must be submitted for each.

Summary

Analysis of the data indicated in the table clearly demonstrates the importance of competent and timely execution of mandatory reporting. There are two fairly simple ways to avoid problems with regulatory authorities.

The first involves independently studying the list and deadlines for submitting mandatory reports, for example, on the official website of the Federal Tax Service. This approach requires certain knowledge and a lot of time, but allows you to save money on inviting specialists.

The second option involves contacting a specialized consulting company that provides legal and accounting services on an outsourcing basis. In this case, the entrepreneur receives many advantages, the main one of which is the guarantee of correct accounting, timely execution and submission of mandatory reporting. It is important to note that the money spent on professionals is more than compensated by the lack of expenses for creating your own accounting and legal department, as well as by minimizing possible problems with the fiscal authorities.