Organizations can revaluate fixed assets (clause 15 of PBU 6/01 “Accounting for fixed assets”, approved by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n; hereinafter referred to as PBU 6/01). The main goal of this event is to determine the real value of fixed assets in accordance with their market prices and reproduction conditions on the date of revaluation.

It is up to the company to decide whether to revalue the property or not.

However, it is worth remembering: if a company has revalued its assets once, then in the future it should be carried out regularly, but not more than once a year. This condition is necessary to ensure that the cost of these fixed assets, at which they are reflected in accounting and reporting, does not differ significantly from the current (replacement) cost. The concept of materiality is given in paragraph 44 of the “Methodological instructions on accounting for fixed assets” (approved by order of the Ministry of Finance of Russia dated October 13, 2010 No. 91n, hereinafter referred to as Instructions No. 91n) and discussed with an example. Let's bring him. Example 1 Albatross LLC decided to revaluate fixed assets.

The cost of fixed assets at the end of the previous reporting year amounted to 1,000,000 rubles. The current (replacement) cost of objects of this homogeneous group at the end of the reporting year is 1,100,000 rubles. The resulting difference is considered significant: (1,100,000 - 1,000,000) / 1,000,000 = 0.1. Let's consider the same example, provided that the current (replacement) cost is 1,030,000 rubles. In this case, the decision on revaluation is not made, since the difference that arises is not significant: (1,030,000 - 1,000,000) : 1,000,000 = 0.03. However, from these calculations it is not entirely clear why a deviation of 10 percent is considered significant, but a deviation of 3 percent is not. Probably, the legislator implies a 5 percent materiality barrier, mentioned in the Instructions on the procedure for drawing up and presenting financial statements (approved by order of the Ministry of Finance of Russia dated July 22, 2003 No. 67n, as amended by orders of the Ministry of Finance of Russia dated December 31, 2004 No. 135n, dated September 18, 2006 No. 115n).

Accounting: additional valuation

In accounting, the amount of revaluation for each fixed asset item is reflected by the following entries:

Debit 01 (03) Credit 83 subaccount “Revaluation of fixed assets” - the initial (replacement) cost of the fixed asset has been increased;

Debit 83 subaccount “Revaluation of fixed assets” Credit 02 – accrued depreciation on fixed assets has been increased.

For a fixed asset that was previously discounted, make these entries only for the amount of the revaluation, which exceeds the amount of loss resulting from previous markdowns. Determine the amount of the loss using analytical accounting data (for example, using a statement of the results of revaluation of fixed assets). Reflect the amount of additional valuation of the fixed asset within the amount of loss from previous markdowns (reflected on account 91) with the following entries:

Debit 01 (03) Credit 91-1 – the initial (replacement) cost of the fixed asset was increased within the limits of the loss generated during previous markdowns of this object;

Debit 91-2 Credit 02 – accrued depreciation on a fixed asset has been increased within the limits of the loss generated during previous markdowns of this object

An example of reflecting the primary revaluation of a fixed asset in accounting

As of December 31, Alpha LLC conducted an initial revaluation of the computer. The organization has no other office equipment.

Based on the results of the revaluation, the initial cost of the computer should be increased by 2000 rubles, and the amount of accrued depreciation - by 200 rubles.

Alpha's accountant made the following entries in the accounting records:

Debit 01 Credit 83 subaccount “Revaluation of fixed assets” – 2000 rubles. – the initial cost of the computer was increased based on the results of revaluation;

Debit 83 subaccount “Revaluation of fixed assets” Credit 02 – 200 rub. – based on the results of revaluation, the accrued amount of depreciation on the computer was increased.

An example of how subsequent revaluation of a fixed asset is reflected in accounting. Based on the results of the previous revaluation, the fixed asset was discounted

As of December 31, Alpha LLC carried out a subsequent revaluation of the computer. The organization has no other office equipment.

Based on the results of the revaluation, the replacement cost of the computer should be increased by 2000 rubles, and the amount of accrued depreciation - by 200 rubles. The total amount of the revaluation was 1800 rubles. (2000 rub. – 200 rub.).

Due to the revaluation for the previous year, a loss in the amount of 800 rubles is recorded on computer account 91.

Alpha's accountant made the following entries in the accounting records:

Debit 01 Credit 91-1 – 889 rub. (2000 rubles × 800 rubles: 1800 rubles) – the replacement cost of the computer was increased based on the results of the revaluation within the limits of the loss generated during previous markdowns;

Debit 01 Credit 83 subaccount “Revaluation of fixed assets” – 1111 rubles. (2000 rubles – 889 rubles) – based on the results of the revaluation, the replacement cost of the computer was increased in excess of the loss generated during previous markdowns;

Debit 91-2 Credit 02 – 89 rub. (200 rubles × 800 rubles: 1800 rubles) – based on the results of the revaluation, the accrued amount of depreciation on the computer was increased within the limits of the loss generated during previous markdowns;

Debit 83 subaccount “Revaluation of fixed assets” Credit 02 – 111 rub. (200 rubles – 89 rubles) – based on the results of the revaluation, the accrued amount of depreciation on the computer was increased in excess of the loss generated during previous markdowns.

How is the revaluation of fixed assets for production purposes reflected: accounts used for revaluation

Let's move on to accounting entries for additional valuation of fixed assets. To revaluate fixed assets, account 83 “Additional capital” is used if this procedure is carried out for the first time.

| Dt | CT | Description |

| 01 | 83 | An entry was made for the amount of increase in the value of fixed assets: an additional valuation of fixed assets was carried out |

| 83 | 02 | A posting has been made for the amount of change in depreciation |

If there is a subsequent revaluation, then it is necessary to look at whether there was an additional or devaluation in previous periods. If the first option, then the entries are similar; if a markdown occurred, then the amount of the revaluation should adjust it, reflecting it as other income.

| Dt | CT | Description |

| 91.2 | 01 | The amount of markdown in previous periods was recorded |

| 02 | 91.1 | A change in depreciation in previous periods was recorded during the writedown of fixed assets |

| 01 | 91.1 | An increase in the cost of fixed assets was recorded due to the amount of markdown of the previous year |

| 91.2 | 02 | An increase in depreciation was recorded due to the amount of its adjustment during markdown last year |

| 01 | 83 | If the amount of the revaluation exceeds the amount of last year’s depreciation, then the remainder is charged to additional capital |

| 83 | 02 | If the amount of the revaluation exceeds the amount of last year’s depreciation, then the depreciation adjustment also occurs in correspondence with the additional capital account |

We examined how the revaluation of fixed assets for production purposes is reflected. For other fixed assets, you can open a separate sub-account for account 83 (for example, if the organization owns a significant number of fixed assets of social significance).

Postings for markdowns occurring after revaluation in previous periods will look like this:

| Dt | CT | Description |

| 83 | 01 | A decrease in the cost of fixed assets was recorded due to the value of last year’s revaluation |

| 02 | 83 | A decrease in depreciation was recorded due to the amount of its adjustment during last year’s revaluation |

| 91.2 | 01 | If the amount of the markdown exceeds the amount of last year’s revaluation, then the balance goes to the account of other income and expenses |

| 02 | 91.1 | If the amount of the depreciation exceeds the amount of last year's revaluation, then the depreciation adjustment also takes place in the account of other income and expenses |

Accounting: markdown

In accounting, the amount of depreciation for each fixed asset item is reflected in the following entries:

Debit 91-2 Credit 01 – the initial (replacement) cost of the fixed asset has been reduced;

Debit 02 Credit 91-1 – accrued depreciation on fixed assets has been reduced.

At the same time, for a fixed asset that was previously revalued, make these entries only for the amount of the depreciation, which exceeds the amount of additional capital formed during previous revaluations. Determine the amount of additional capital using analytical accounting data (for example, using a statement of the results of revaluation of fixed assets). Reflect the amount of depreciation of fixed assets within the amount of additional capital from previous additional valuations with the following entries:

Debit 83 subaccount “Revaluation of fixed assets” Credit 01 – the initial (replacement) cost of a fixed asset is reduced within the limits of additional capital formed during previous revaluations of this object;

Debit 02 Credit 83 subaccount “Revaluation of fixed assets” - the accrued depreciation on a fixed asset is reduced within the limits of additional capital formed during previous revaluations of this object.

This procedure for reflecting in accounting the results of the revaluation of fixed assets is established in paragraph 48 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

An example of how a primary depreciation of a fixed asset is reflected in accounting

As of December 31, Alpha LLC conducted an initial revaluation of the computer. The organization has no other office equipment.

Based on the results of the revaluation, the original cost of the computer should be reduced by 2000 rubles, and the amount of accrued depreciation – by 200 rubles.

Alpha's accountant made the following entries in the accounting records:

Debit 91-2 Credit 01 – 2000 rub. – the initial cost of the computer was reduced based on the results of revaluation;

Debit 02 Credit 91-1 – 200 rub. – the accrued amount of depreciation on the computer was reduced based on the results of the revaluation.

An example of how a subsequent depreciation of a fixed asset is reflected in accounting. Based on the results of the previous revaluation, the fixed asset was overvalued

As of December 31, Alpha LLC carried out a subsequent revaluation of the computer. The organization has no other office equipment.

Based on the results of the revaluation, the replacement cost of the computer should be reduced by 2000 rubles, and the amount of accrued depreciation – by 200 rubles. The total amount of the markdown was 1800 rubles. (2000 rub. – 200 rub.).

In connection with previous revaluations, additional capital in the amount of 800 rubles is listed on computer account 83.

Alpha's accountant made the following entries in the accounting records:

Debit 83 subaccount “Revaluation of fixed assets” Credit 01 – 889 rub. (2000 rubles × 800 rubles: 1800 rubles) – based on the results of the revaluation, the replacement cost of the computer was reduced within the limits of the additional capital formed during previous revaluations;

Debit 91-2 Credit 01 – 1111 rub. (2000 rubles – 889 rubles) – the replacement cost of the computer was reduced based on the results of the revaluation in excess of the additional capital formed during previous revaluations;

Debit 02 Credit 83 subaccount “Revaluation of fixed assets” – 89 rubles. (200 rubles × 800 rubles: 1800 rubles) – based on the results of the revaluation, the accrued amount of depreciation on the computer was reduced within the limits of the additional capital formed during previous revaluations;

Debit 02 Credit 91-1 – 111 rub. (200 rubles – 89 rubles) – based on the results of revaluation, the accrued amount of depreciation on the computer was reduced in excess of the additional capital formed during previous revaluations.

The purpose of revaluation of fixed assets

Revaluation of fixed assets is relevant for organizations whose fixed assets make up a significant part of their assets.

Fixed assets are revalued to display them on the balance sheet at their fair market value, which may be necessary:

- to increase the authorized capital;

- when registering fixed assets as collateral for loan obligations;

- to take into account the real amount of accrued depreciation when forming the cost of finished products;

- to attract investment;

- when restructuring an organization;

- when selling certain assets.

Useful life

After revaluation, the useful life of a fixed asset is not revised (clause 20 of PBU 6/01). If before the revaluation the fixed asset was not fully depreciated, determine the monthly amount of depreciation charges based on the replacement (residual taking into account revaluations) cost of the fixed asset determined based on the results of the revaluation (clause 19 of PBU 6/01). For example, if an organization uses the straight-line method, calculate the monthly amount of depreciation charges using the formula:

| Monthly amount of depreciation after revaluation of fixed assets using the straight-line method | = | Replacement cost of a fixed asset after revaluation | : | Remaining useful life of the fixed asset (month) |

If before the revaluation the fixed asset was fully depreciated, then after the revaluation there is no need to resume depreciation. This is explained by the fact that the amount by which the initial (replacement) cost of a fully depreciated fixed asset changes is equal to the amount by which accrued depreciation changes. That is, both before and after revaluation, the residual value of the fixed asset will be zero. This follows from paragraph 48 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

An example of reflecting in accounting the primary revaluation of a fixed asset and subsequent depreciation

As of December 31, Alpha LLC conducted an initial revaluation of the computer. The organization has no other office equipment.

The residual value of the computer as of December 31 is 50,000 rubles. The remaining useful life is 20 months.

Based on the results of the revaluation, the initial cost of the computer should be increased by 2000 rubles, and the amount of accrued depreciation - by 200 rubles.

Alpha's accountant made the following entries in the accounting records:

Debit 01 Credit 83 subaccount “Revaluation of fixed assets” – 2000 rubles. – the initial cost of the computer was increased based on the results of revaluation;

Debit 83 subaccount “Revaluation of fixed assets” Credit 02 – 200 rub. – based on the results of revaluation, the accrued amount of depreciation on the computer was increased.

The replacement cost of the fixed asset after revaluation was:

52,000 rub. (50,000 rub. + 2,000 rub.).

Monthly amount of depreciation after revaluation of fixed assets using the straight-line method:

2600 rub. (RUB 52,000: 20 months).

From January of the year following the revaluation, the accountant calculated monthly depreciation in the amount of 2,600 rubles. and reflected in accounting by posting:

Debit 26 Credit 02 – 2600 rub. – depreciation has been accrued on the revalued computer.

OS re-evaluated: main points

The possibility of additional valuation of fixed assets, as well as their markdown, is given in clauses 14–15 of PBU 6/01 “Accounting for fixed assets”, approved by order of the Ministry of Finance of the Russian Federation dated March 30, 2001 No. 26n. The procedure for revaluing the cost of accepting fixed assets for accounting is carried out so that fixed assets are reflected at a more current current (replacement) cost. The current value is equivalent to a certain amount of money that would have to be paid if a particular item needed to be replaced at the revaluation date.

We list the main rules for revaluation (devaluation or revaluation of fixed assets):

- Such a procedure is allowed only once a year, no more;

- the procedure is done for a group of similar objects;

- if the procedure is performed once, it should be done every year thereafter;

- At the same time, the cost of fixed assets (initial or current) and depreciation are revalued.

Reflection in financial statements

When forming the Balance Sheet indicators for the reporting year, reflect fixed assets taking into account the results of the revaluation of fixed assets on line 1130 “Fixed Assets”. In addition, the results of the revaluation are reflected in the balance sheet on line 1340 “Revaluation of non-current assets”. In this case, the amount of additional capital is reflected in the balance sheet without taking into account revaluation on line 1350 “Additional capital (without revaluation)”.

The results of the revaluation must also be reflected in the following forms of financial statements:

- according to the lines “Increase in capital” and “Decrease in capital” (columns 4 and 6) of the Statement of Changes in Capital;

- in the Notes to the Balance Sheet and the Statement of Financial Results.

Situation: is it possible to write off losses from previous years using additional capital formed as a result of the revaluation of fixed assets?

No you can not.

This is due to the fact that due to the additional capital formed during the revaluation of a fixed asset, the amounts of its subsequent markdowns are written off (paragraph 6 of clause 15 of PBU 6/01, Instructions for the chart of accounts (account 83)). If the additional capital is written off to pay off losses from previous years, then the methodology for reflecting the results of revaluation of fixed assets in accounting will be violated. A similar point of view is reflected in the letter of the Ministry of Finance of Russia dated July 21, 2000 No. 04-02-05/2.

Attention: writing off losses from previous years using additional capital formed as a result of the revaluation of fixed assets may entail administrative liability.

In practice, in order to make the Balance Sheet more attractive, the founders of the organization decide to allocate additional capital generated through revaluations of fixed assets to pay off losses of previous years. However, this may lead to a gross violation of the rules for presenting financial statements. A gross violation of the rules for presenting financial statements is a distortion of any line of the financial statements by at least 10 percent. Therefore, if the value of additional capital in the financial statements is distorted by at least 10 percent, the court may fine the head of the organization or the chief accountant in the amount of 2,000 to 3,000 rubles. (Article 15.11, Part 1 of Article 23.1 of the Code of Administrative Offenses of the Russian Federation).

The procedure for reflecting the results of revaluation of a fixed asset in tax accounting depends on the taxation system that the organization applies.

Procedure for revaluation of fixed assets

Immediately before the revaluation, the organization must draw up an administrative document. Such a document may be an order or instruction, which is mandatory for all services of the organization that will be involved in the revaluation of fixed assets.

In addition, you should check the presence of fixed assets subject to revaluation and prepare a list of fixed assets subject to revaluation.

In this list it is recommended to indicate the following data about the fixed asset:

- accurate name;

- date of acquisition, construction, manufacture;

- date of acceptance of the object for accounting.

The results of the revaluation are formalized in the form of an act by a special commission with the attachment of all documents on the basis of which the value of the revalued fixed assets was established.

Data on revaluations are reflected in the Inventory card for recording fixed assets OS-6.

BASIC: income tax

In tax accounting, the results from the revaluation of fixed assets are not taken into account (paragraph 6, paragraph 1, article 257 of the Tax Code of the Russian Federation). In this regard, if before the revaluation the monthly amounts of depreciation deductions in accounting and tax accounting were the same, then after the revaluation they will differ.

If the fixed asset has been overvalued, then in accounting the monthly amount of depreciation deductions will be greater than in tax accounting. In this case, reflect the permanent tax liability in your accounting:

Debit 99 subaccount “Fixed tax liabilities (assets)” Credit 68 subaccount “Calculations for income tax” - the permanent tax liability from the difference between monthly depreciation deductions for accounting and tax accounting purposes is taken into account.

If the fixed asset has been discounted, then in accounting the monthly amount of depreciation deductions will be less than in tax accounting. In this case, reflect the permanent tax asset in accounting:

Debit 68 subaccount “Calculations for income tax” Credit 99 subaccount “Fixed tax liabilities (assets)” - a permanent tax asset is taken into account from the difference between monthly depreciation deductions for accounting and tax accounting purposes.

This procedure follows from paragraph 7 of PBU 18/02.

Basic rules for revaluation of fixed assets

Revaluation of fixed assets is carried out at current (replacement) cost by indexation or direct recalculation at confirmed market prices.

If an enterprise decides one day to revaluate fixed assets, then subsequently it will be necessary to revaluate fixed assets on a regular basis so that the cost at which fixed assets are reflected in accounting and financial statements does not differ significantly from the current (replacement) cost of the objects fixed assets.

Revaluation of fixed assets can be carried out no more than once a year at the end of the reporting year.

All fixed assets that are included in a group of similar fixed assets must be revalued.

A homogeneous group of fixed assets can be computer technology, buildings and structures, equipment, vehicles, etc.

BASIC: property tax

Take into account the results of the revaluation of fixed assets when calculating property taxes. This is due to the fact that the tax base for property tax is defined as the residual value of a fixed asset, formed according to accounting data (clause 1 of Article 375 of the Tax Code of the Russian Federation). That is, taking into account his revaluations.

Situation: from what point do you need to increase (decrease) the residual value of a fixed asset after its revaluation in order to calculate property tax?

Take the results of the revaluation into account when calculating the tax (average annual value of property) of the reporting year in which it was carried out (clause 4 of Article 376 of the Tax Code of the Russian Federation).

This is due to the fact that the residual value of a fixed asset for calculating property tax must be determined according to the accounting rules (clause 1 of Article 375 of the Tax Code of the Russian Federation). In accounting, the value of fixed assets is revalued as of December 31 of the reporting year (clause 15 of PBU 6/01, clause 43 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n).

Before January 1, 2011, revaluation was carried out at the beginning of the reporting year. The new procedure was published on March 28, 2011 and applies from January 1, 2011 (letter of the Ministry of Finance of Russia dated June 14, 2011 No. 07-02-06/106). The legislation did not provide for any transitional provisions in connection with changes to the procedure for revaluation of fixed assets. Therefore, when calculating property tax for 2011, it is necessary to take into account the results of the revaluation of fixed assets carried out as of January 1 and December 31, 2011. At the same time, the tax base for property tax for previous years does not need to be recalculated.

Similar conclusions are contained in the letter of the Ministry of Finance of Russia dated October 25, 2011 No. 03-05-05-01/84.

Is it possible to re-evaluate a newly purchased OS?

Revaluation of groups of similar fixed assets is possible only once a year or may not be carried out at all. At the same time, clause 15 of PBU 6/01 specifically indicates that this procedure is organized only at the end of the reporting year. Therefore, if a company bought a new fixed asset this year, it belongs to the group of revalued ones, according to internal documentation, and the economic situation is such that the cost of the fixed asset has changed significantly, then at the end of the reporting year an additional valuation (discount) of the newly purchased fixed asset is possible.

Accounting for revaluation of goods

Based on the specific economic situation and the conditions of interaction with other market participants, retail trade organizations can revaluate (change prices) goods in the following cases:

- changes in market conditions;

- changes in demand for goods;

- deterioration in the quality characteristics of goods (obsolescence of models and styles, deterioration of presentation, partial loss of properties, etc.);

- moral obsolescence of these values.

Revaluation of goods can occur in the direction of lower prices (markdown) and in the direction of increase (revaluation). The selling price of goods changes based on the order of the head of the organization. In accordance with the Law of the Russian Federation of June 18, 1993 N 5215-1 “On the use of cash registers when making cash settlements with the population,” changing the price of goods by crossing out and correcting the price tags is not allowed. Therefore, if a product is sold at new prices, price tags for it are issued anew.

Goods in retail trade are accounted for at purchase prices (acquisition cost minus VAT) or sales prices, including trade margins, VAT and sales tax amounts.

Initial database setup

On the “Administration” tab:

- in the “Item Settings” section, set the “Product Quality” flag

Entering master data

Let’s enter the organization: “Techno”, for it we set the cost estimation method, taxation system, bank account, cash register cash register (with the type autonomous cash register register) and the organization’s cash register.

Let's create an Item that will be stored in the warehouse, let's call it “TV”.

Let's create a Line of Business (Finance tab) - "Wholesale Sales" and set up the distribution of sales by line of business:

Let's add a new Expense Item - “Markdown of equipment”, distribution - to the area of activity:

Let's introduce a new warehouse into the system - “Wholesale”:

For the supplier, create a new agreement, where you must specify “Register supplier prices automatically”:

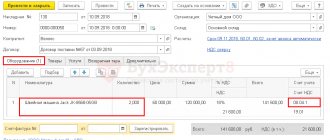

Registration of goods receipt

To receive goods, enter the receipt document:

And, as usual, don’t forget to enter Pricing based on receipt:

Reflection of markdowns in the warehouse

After some time, it turned out that two TVs had scratches on the body. Let's reflect this in the program.

Let's create an Inventory Order (Warehouse tab):

Let's enter the Recalculation of goods (Warehouse tab, item Recalculation of goods), where we indicate that there are 8 units of the proper product in the warehouse, and 2 of the discounted product:

Registration of sale of non-discounted goods

We will formalize the sale of non-discounted goods using a sales document.

Generation of financial results

To obtain financial results, you must enter the document Calculation of the cost of goods (Finance tab, Regulatory documents item):

Revaluation of goods can affect both a decrease and an increase in value. Each situation has its own accounting procedure. Revaluation is especially affected by the prices in which goods are recorded: sales or acquisitions.

Order of conduct

Revaluation of OS is carried out at the enterprise in the following order:

- An audit of non-current assets in need of revaluation is carried out. It is necessary to check their actual availability.

- An appropriate administrative act of the organization's management is drawn up, ordering the revaluation of existing fixed assets.

- Certain assets are revalued by the relevant specialists of the enterprise at the current (replacement) cost through direct recalculation, carried out according to actual market prices, or indexation.

- The results of the revaluation of fixed assets (revaluation, depreciation) are adequately reflected in the relevant accounting registers.

Revaluation of existing fixed assets implies updating their original (primary) value.

However, if these assets have already been revalued before, their current (replacement) value is subject to recalculation.

In addition, it is necessary to recalculate the amount of depreciation accrued (accumulated) during the operation of the corresponding object.

It is important to note! that the primary value of a property (asset) can be revalued both in the direction of its increase (this is the so-called revaluation) and in the direction of its decrease (we are talking about markdown).

The specifics of accounting for the results of such updating will be determined by whether a revaluation of a specific fixed asset has previously been carried out.

What is OS revaluation?

If a revaluation has not previously been made for specific fixed assets, accounting actions are carried out according to the following rule: the amount of revaluation of the asset is recorded as part of the so-called additional capital of the enterprise and, accordingly, is displayed on the credit of accounting account 83, known as “Additional capital”.

If an estimated revaluation of fixed assets has already been made, revaluation operations for similar objects are recorded in accounting somewhat differently.

Thus, the next revaluation of previously revalued fixed assets will be taken into account in the accounting registers as follows:

- If an asset has already been revalued earlier at this enterprise, the value of its next revaluation is taken into account in accounting account 83.

- If an asset has already been discounted before at a given enterprise, the amount of its revaluation, corresponding to the size of the discount made for previous reporting periods, is subject to credit to account 91, which, as is known, is used to account for other income and expenses. If the amount of the additional valuation of a fixed asset turns out to be greater than the amount of its depreciation recorded in accounting account 91, the amount of this excess must be attributed to accounting account 83 (the dynamics of additional capital are taken into account).

Reflection of revaluation in accounting

If a markdown has not previously been made for a specific asset, its revaluation is recorded as follows:

| Operation | Debit | Credit |

| Increase in primary value | 01-account | 83-score |

| Increasing the amount of depreciation | 83-score | 02-account |

If a depreciation was previously performed for a specific fixed asset object, its revaluation is taken into account as follows:

| Operation | Debit | Credit |

| Revaluation by an amount corresponding to the depreciation performed previously | 01-account | 91.1-account |

| Depreciation is overestimated (as part of the markdown performed previously) | 91.2-account | 02-account |

| Replacement cost is overestimated (more than the value of the previous markdown) | 01-account | 83-score |

| Depreciation is overestimated (more than the previous depreciation value) | 83-score | 02-account |

Markdown concept

If any revaluation has not previously been carried out for specific fixed assets, the corresponding accounting operations are performed according to the following rule: the amount of the depreciation of the asset is taken into account in the accounting account of other income and expenses of the enterprise and, accordingly, is reflected in the debit of accounting account 91, known as “ Other income and expenses."

Rule! The depreciation is taken into account as part of other expenses on account 91.

If a recalculation of the cost of fixed assets has already been made before, revaluation transactions are reflected in accounting in a different way:

- If an asset belonging to a given company has already been subject to revaluation before, the amount of its depreciation is taken into account in accounting account 83 by reducing the amount of additional capital formed by accumulating the amounts of revaluation of the asset for previous reporting periods. If the amount of the markdown turns out to be greater than the amount of its revaluation, then the amount of this excess must be included in the financial result as an element of other costs (account 91).

- If an asset belonging to this organization has already been discounted previously, the amount of its next markdown is taken into account in accounting account 91.

Accounting and postings

If a markdown has not previously been made for a specific asset, its revaluation is recorded as follows:

| Operation | Debit | Credit |

| Additional assessment of primary cost | 01-account | 83-score |

| Increasing the amount of depreciation | 83-score | 02-account |

If a depreciation was previously performed for a specific fixed asset object, its revaluation is taken into account as follows:

| Operation | Debit | Credit |

| Revaluation by an amount corresponding to the depreciation performed previously | 01-account | 91.1-account |

| Depreciation is overestimated (as part of the markdown performed previously) | 91.2-account | 02-account |

| Replacement cost is overestimated (more than the value of the previous markdown) | 01-account | 83-score |

| Depreciation is overestimated (more than the previous depreciation value) | 83-score | 02-account |