Is it necessary to indicate in the SZV-M an employee who is on maternity leave?

Yes need.

Despite the fact that while the specified employee is on maternity leave, the employer will not make any payments in her favor, the employment contract with her is not terminated, and the period of time she is on maternity leave will be counted towards the employee’s insurance period ( Subclause 2, Clause 1, Article 11 of the Federal Law of December 17, 2001 N 173-FZ “On Labor Pensions in the Russian Federation”). The absence of the fact of accrual of payments and other remuneration for the reporting period is not a basis for failure to submit reports in the SZV-M form (PFR Letter No. 08-22/6356 dated 05/06/2016 “On Submission of Reports”).

Discussed here.

Are lawyers required to submit a report to the Pension Fund of Russia in the SZV-M form?

Lawyers are classified as payers of insurance premiums who do not make payments and other remuneration to individuals (Article 419 of the Tax Code of the Russian Federation).

Lawyers are not required to submit a report on themselves to the territorial body of the Pension Fund of the Russian Federation in the SZV-M form.

If lawyers have employees with whom employment contracts and civil contracts have been concluded, they are required to submit a monthly report to the territorial body of the Pension Fund of the Russian Federation in the SZV-M form for their employees.

Discussed here.

Are public associations required to submit a report to the Pension Fund of Russia in the SZV-M form?

This depends on the fact of the presence or absence of labor or civil law relations between public associations and their participants, based on labor or civil law contracts, for payments under which insurance contributions for compulsory pension insurance are accrued and paid to the Pension Fund.

In the absence of such formalization of relations, public associations do not submit reports in the SZV-M form for such persons (Letter of the Pension Fund of the Russian Federation dated July 13, 2021 No. LCH-08-26/9856).

Discussed here.

Is it applied to the head of the organization?

Often, the owners of small companies take on management responsibilities. In other words, the founder of an enterprise or firm becomes its director. But they forget about proper documentation of the relationships that have arisen. As a result, there is neither an employment nor a civil law contract with the director, therefore no earnings are accrued.

The latest clarifications from the Ministry of Labor (letter No. 17-4/10/B-1846 dated March 16, 2018) have adjusted the requirements for reporting to the Pension Fund. Now SZV-M for founders who are not employees will be filed in 2021 in any case. The presence of a contract and earnings do not play any role.

The position of officials is quite simple: if the founding citizen performs the functions of the head of the company, then in fact he has an employment or civil relationship with the policyholder. Therefore, information about it is included in the pension report.

IMPORTANT!

Be sure to include in your pension reporting information about the person performing the functions and having the authority of a director. Even if the manager is not paid a salary and is not officially registered with the company.

Is an organization obliged to indicate its founder in the report using the SZV-M form?

In accordance with clause 2.2 of Art.

11 of the Federal Law of 01.04.1996 N 27-FZ “On individual (personalized) accounting in the compulsory pension insurance system”, the policyholder submits information about each insured person working for him on a monthly basis no later than the 15th day of the month following the reporting period (month). including persons who have entered into civil contracts, for which insurance premiums are charged in accordance with the legislation of the Russian Federation on insurance premiums). But because There is no employment contract (or GPC agreement) concluded with the founder of the organization, then it does not need to be included in the SZV-M form. Discussed here.

Example

An accountant or director went on long unpaid leave. Should information about them be included in the report?

Yes, turn it on. Leave without pay does not interrupt or terminate the employment relationship. Therefore, submit SZV-M if the director is not paid a salary.

Submit reports even if the company’s activities have been suspended and there is only one manager on staff - the only founder who has been sent on long-term unpaid leave. And if, for example, a manager resigns, then a zero form is submitted to the Pension Fund.

The difference between the zero form and the regular form is that it does not indicate information about the insured persons. All other information about the organization must be entered.

In what cases is SZV-M canceled?

The cancellation form SZV-M must be submitted to the Pension Fund of the Russian Federation if the initially submitted form indicated an employee who was dismissed before the reporting month or if in the reporting month the organization (IP) made payments in favor of this dismissed person.

If in the initial SZV-M you indicated the contractor under the GPC agreement, with whom the GPC agreement was concluded in the reporting month, but he must begin performing work in accordance with the agreement only in the month following the reporting month, then a canceling SZV must also be submitted to him -M.

When submitting an SZV-M with the code “cancel”, it is necessary to note in it only those persons for whom it is necessary to delete the information presented in the original SZV-M, and employees for whom the correct data were submitted do not need to be indicated in the cancellation form, otherwise the Pension Fund of the Russian Federation will delete information in the database and on it.

Discussed here.

Deadlines for founding directors

There are no special deadlines for submitting personalized reports for directors who are the sole founders of the company. They must submit reports, like all others, within the following deadlines:

- SZV-M is always due by the fifteenth day of the next month;

- The SZV-experience is always submitted before March 1 of the following reporting year.

There are exceptions to this rule when the deadline falls on a weekend. In such a situation, the deadline is postponed to the next working day after the weekend.

Is it necessary to provide SZV-M to the liquidator?

If the founders / participants of the organization have decided to liquidate it, then one of their next actions should be the appointment of a liquidation commission or liquidator (clause 2 of article 61, clause 3 of article 62 of the Civil Code of the Russian Federation, clause 1 of article 57 of the Law of 08.02 .1998 No. 14-FZ).

It is to the liquidation commission or the sole liquidator that the powers to manage the affairs of the company are transferred (Clause 4, Article 62 of the Civil Code of the Russian Federation). All employees were dismissed after advance notice of dismissal (clause 1 of article 81, article 84.1 of the Labor Code of the Russian Federation), the contract with the general director was terminated, and the liquidator is in charge of all the affairs of the company. The liquidated organization should enter into a GPC agreement (or a service agreement) with each member of the liquidation commission or with the liquidator. On the part of the organization, one of the company’s participants can sign the GPA with a power of attorney provided by the other participants. In this situation, it is better to pay the members of the liquidation commission or the liquidator in advance so that debts in the amount of their remuneration are not reflected in the liquidation balance sheet.

The SZV-M form reflects individual information not only about the organization’s employees, but also about those with whom the company has entered into GPA for the provision of services (clause 2.2 of Article 11 of Law No. 27-FZ dated April 1, 1996). After all, insurance premiums must be calculated from remunerations (Article 420 of the Tax Code of the Russian Federation). Thus, in the SZV-M form it is necessary to indicate the full name, SNILS and TIN of the sole liquidator or all members of the liquidation commission. And you will need to submit the SZV-M form with this information every month until the month inclusive until the registration entry on the liquidation of the company is compiled.

Sometimes the CEO (who is also the sole founder) decides to liquidate his company on his own. At the same time, he does not enter into an agreement with himself, and does not pay remuneration. In such a situation, during the period when the organization is in the process of liquidation, zero reports in the SZV-M form do not need to be submitted (Letter of the Pension Fund of the Russian Federation dated July 27, 2016 No. LCH-08-19/10581).

Discussed here.

What happens if you don't give in?

If reports are not submitted for such directors, then the fund’s specialists will charge a fine of 500 rubles. The fine is calculated for each month and for each employee. There is information about all companies in the fund, so if the inspector discovers that the director of the company does not include himself in the personal accounting information, then a fine will inevitably be assessed.

Example.

In LLC Peonies, apart from the director, who is the founder in the singular, there are no more employees. The director did not enter into an employment contract with himself, but he is active. He does not submit personal accounting information to the fund. We will calculate the amount of the fine if he does not submit a single SZV-M report in 2021.

| Month | Amount of fine, rub. |

| March | 500 |

| April | 500 |

| May | 500 |

| June | 500 |

| July | 500 |

| August | 500 |

| September | 500 |

| October | 500 |

| November | 500 |

| December | 500 |

| Total | 5000 |

The table shows that the amount of the fine for the year will be impressive, so it is necessary to submit a report.

Is it necessary to provide SZV-M to the bankruptcy (arbitration) manager?

No no need.

According to Art. 2 of the Bankruptcy Law, an arbitration manager is a citizen of the Russian Federation who is a member of a self-regulatory organization of arbitration managers, a bankruptcy trustee is an arbitration manager approved by an arbitration court to conduct bankruptcy proceedings and carry out other procedures established by Federal Law N127-FZ of October 26, 2002 “On Insolvency (Bankruptcy) » powers. The rights and obligations of the arbitration manager in a bankruptcy case are determined by Art. 20.2 of the Bankruptcy Law. When making a decision to declare a debtor bankrupt and to open bankruptcy proceedings, the arbitration court approves the bankruptcy trustee in the manner prescribed by Article 45 of Federal Law No. 127-FZ, about which it issues a ruling (Article 127 of the Bankruptcy Law). The powers of the bankruptcy trustee are determined by Art. 129 of the Bankruptcy Law.

The organization does not have the obligation to submit information in the SZV-M form to the bankruptcy trustee, since the bankruptcy trustee is not an employee of the organization (Resolution of the Seventeenth Arbitration Court of Appeal dated February 28, 2021 No. 17AP-259/2017-Aku).

Discussed here.

Is it necessary to provide SZV-M for a foreign worker?

The SZV-M indicates only those foreigners with whom labor and civil contracts have been concluded to perform work in the Russian Federation and who have the status of permanent residents of the Russian Federation, temporary residents of the Russian Federation, temporarily staying in the Russian Federation (Clause 1 of Article 7 of the Federal Law dated December 15, 2001 N 167-FZ).

For a highly qualified foreign specialist temporarily staying in Russia (including from EAEU member countries), the SZV-M form does not need to be submitted, because the organization does not accrue pension contributions to him.

And for a highly qualified foreign specialist who has a residence permit (receipt of this document leads to the employee acquiring the status of a permanent resident in the territory of the Russian Federation, accordingly, from this moment payments to him are subject to insurance contributions to the Pension Fund of the Russian Federation) it is necessary to submit an SZV-M.

The status of a foreign citizen for the purpose of classifying him as an insured person is determined on the basis of Law No. 115-FZ of July 25, 2002.

Discussed here.

Does the Pension Fund have the right to collect a fine for failure to submit SZV-M from the company’s current account in a pre-trial manner?

The procedure for collecting fines is established by Art.

17 Federal Law dated April 1, 1996 No. 27-FZ. The procedure includes several stages: drawing up an act, which must be delivered to the person who committed the offense within five days from the date of its signing; issuing a requirement to pay a fine for failure to submit a report in the SZV-M form to the Pension Fund of the Russian Federation. Payment of the fine is made within 10 calendar days from the date of receipt.

In case of non-payment or incomplete payment by the policyholder of financial sanctions upon request, the collection of the amounts of financial sanctions is carried out by the Pension Fund of the Russian Federation in court. Direct debiting of fines for SZV-M from the bank accounts of organizations and individual entrepreneurs is prohibited.

Discussed here.

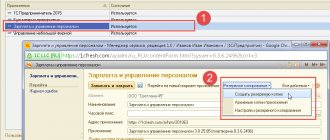

How to submit reports to the fund

There are three ways to pass SZV-M and SZV-STAZH:

- During a personal visit to the Pension Fund of Russia, this can be done by the director or a representative of the company using a power of attorney, which is signed by the director and certified by the seal of the organization;

- By mail - by registered mail with an inventory of the attachment - an inventory of the attachment is needed so that the director has confirmation that the report was sent;

- Electronically - for this you need to conclude an agreement on electronic document management with the fund.

Important! The deadline for submitting reports to the fund does not depend on the method of submission; for all methods it is the same deadline.

What to do if an employee does not have SNILS?

A person who is hired for the first time under an employment contract or who has entered into a GPC agreement, for which insurance premiums are calculated for remuneration in accordance with the legislation of the Russian Federation, receives an insurance certificate of compulsory pension insurance containing the insurance number of an individual personal account, through the policyholder, unless otherwise provided by federal law. dated 04/01/1996 N 27-FZ.

In case of loss of SNILS, the insured person is obliged to contact the policyholder within a month from the date of loss with an application for its restoration. The policyholder must submit this application to the relevant body of the Pension Fund of the Russian Federation along with a document confirming the insurance number of the individual personal account of the insured person.

The Pension Fund of the Russian Federation, upon application of the insured person for the loss of SNILS, within a month from the date of application, on the basis of an individual personal account opened for him, issues him a duplicate of the specified insurance certificate through the policyholder or in person. The Fund may require additional information from the insured person confirming his identity and information contained in his individual personal account (Article 7 of Federal Law No. 27-FZ of April 1, 1996).

Discussed here.