Firms and individual entrepreneurs that employ hired workers or pay monetary remuneration under civil contracts (performance of work, provision of services) transfer insurance contributions to the Federal Tax Service every month. Limits are established for taxable income, above which insurance contributions to the budget are not paid or a reduced rate is applied. The maximum base for calculating insurance premiums for 2019 has already been announced; in the article we will present its established amounts and tell you how to apply them.

Control over insurance premiums since 2017

From January 1, 2021, the Tax Code of the Russian Federation has been supplemented with a new chapter 34 “Insurance premiums”.

This chapter includes articles 419-432, regulating the rules for calculating and paying insurance premiums. At the same time, the basic principles regarding taxes, starting from 2021, also apply to insurance premiums. This is provided for by Federal Law No. 243-FZ dated 07/03/16. Thus, from 2021, pension, medical and contributions in case of disability and in connection with maternity (except for contributions for injuries) are part of the tax legislation, which will guide tax authorities. It is the Federal Tax Service that, starting from 2021, will administer these types of insurance premiums (in particular, accept the appropriate reporting on them).

Insurance premiums for injuries in 2021 will continue to remain under the control of the Social Insurance Fund. This fund will also accept reporting on this type of insurance premiums.

The Pension Fund, in turn, will continue to control personalized reporting. In 2021, you will still need to submit the SZV-M form to the Pension Fund on a monthly basis. Additionally, an annual report will appear in the Pension Fund of the Russian Federation with summarized data on the length of service of employees. Also see “Control bodies over the payment of insurance premiums from 2021“.

How the new limits were calculated

The maximum value of the base for calculating insurance premiums for 2018 was approved in accordance with paragraphs 3 and 6 of Article 421 of the Tax Code of the Russian Federation. The new values were approved by Decree of the Government of the Russian Federation dated November 15, 2017 No. 1378).

This Resolution was published on the official legal information portal on November 17, 2021. From January 1, 2021, the size of the maximum base values for calculating insurance premiums is as follows:

- 815,000 rubles is the maximum base for calculating insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity;

- 1,021,000 rubles is the maximum value of the base for calculating insurance contributions for compulsory pension insurance.

Please note: the maximum amount of the base for calculating “medical” contributions is not approved. These contributions, regardless of the amount of income of an individual in 2021, must be paid at a rate of 5.1%. There is also no maximum base for contributions “for injuries”. Therefore, their size for 2021 is not given in the table.

In 2021, the maximum values of the base for insurance premiums increased compared to 2021. Let's compare the values in the table.

| Year | Maximum base for pension contributions | Maximum base for social contributions |

| 2017 | 876,000 rub. | RUB 755,000 |

| 2018 | RUR 1,021,000 | RUB 815,000 |

Let's give an example and calculations.

Petrov A.S. works in the organization under an employment contract. He receives a monthly salary of 94,000 rubles. In 2021, the Cosmos organization applies general insurance premium rates:

- pension contributions (PFR) – 22% and 10% (above the taxable base);

- contributions for temporary disability and maternity (FSS) – 2.9%;

- medical contributions (FFOMS) – 5.1%;

In the FSS of the Russian Federation, in case of injury, the organization pays insurance premiums at a rate of 0.2%.

In accordance with Decree of the Government of the Russian Federation dated November 15, 2017 No. 1378, the maximum values of the taxable base for insurance premiums are fixed. In 2021, compared to previous similar periods, these limits have been increased again and currently amount to:

- for OPS - RUB 1,021,000. Above this amount, contributions will be calculated at a reduced rate;

- for OSS (without “injuries”) - 815,000 rubles. Contributions will not be accrued above this amount;

- for compulsory medical insurance - no limit is set.

| Contributions/Base Limit in 2021 and 2021 | Base limit in 2021 | Base limit in 2021 |

| Pension | Over 876,000 rub. income was taxed at 10% | Over 1,021,000 rub. income is taxed at 10% |

| For temporary disability | Over 755,000 rub. income was not taxed | Over 815,000 rub. income is not taxed |

| Medical | The entire amount of income was taxed | The entire amount of income is taxed |

| For injuries | The entire amount of income was taxed | The entire amount of income is taxed |

Note that the Government of the Russian Federation sets the maximum base for calculating insurance premiums, focusing on 12 times the average salary and an increasing coefficient.

For complete information on insurance premiums, read the article: “Insurance premiums in 2021.”

The maximum value of the base for calculating insurance premiums is the limit of the calculated contributions for the employee, starting from which either a zero or a reduced rate for insurance contributions is used. The maximum value applies to payments to each employee.

The Tax Code establishes that income accrued to an employee in the form of wages and other amounts, payments of which the employer makes in favor of employees, are subject to inclusion in the base for insurance contributions. Calculation is the obligation of the enterprise established by regulations and is carried out at the expense of its expenses.

Up to a certain point, the rule applies: the higher the salary, the more the employer must send to the Pension Fund and other funds. If the salary amount crosses the base limit, then there is a reduction in the costs of business entities for compulsory insurance. That is, insurance premium rates in this case are regressive.

The use of a marginal base encourages employers not to hide the increased salaries of people working at the enterprise. Under such conditions, they comply with current legislation and save their money.

The use of the maximum base for insurance premiums is enshrined in the Tax Code of the Russian Federation. Currently, the insurance rates in the Pension Fund are 22%, in the Social Insurance Fund - 2.9%.

When an employee’s salary cumulatively, starting from the first days of the year, exceeds the limit established for the current year, then the rates take values of 10% and 0%, respectively, in relation to amounts above these limits.

For preferential tariffs, both rates are equal to 0%. Such benefits are listed in the Tax Code of the Russian Federation. These include, for example, the use of the simplified tax system for the type of activity specified in the code, the income from which has a share of more than 70%.

Attention! Maximum limits are not determined for contributions to health insurance, as well as for contributions determined according to additional tariffs. Also, these limits are not determined for injury contributions.

When filling out the calculation of insurance premiums, it is necessary to separately highlight the amounts of transfers within the maximum values of the base, and their values above it. In this case, the reflection in the report occurs twice - in total amounts in the calculation itself, indicating the summed excess values for all employees, as well as in the information for each such employee.

It must be remembered that for pension insurance, maximum amounts also apply when paying wages under work contracts. For insurance against situations of disability and maternity, the amounts received by the employee under contract agreements are not included in the base limits.

The maximum amount for insurance amounts is approved for each year.

By Government Decree No. 1426 of November 28, 2018, its indicator for 2021 was approved in the following amount:

- for pension amounts in the amount of 1,150,000 rubles;

- for social – 865,000 rubles.

In the previous year 2021, the corresponding maximum amounts were in force for the Pension Fund of the Russian Federation - 1,021,000 rubles, for the Social Insurance Fund in relation to disability and maternity insurance - 815,000 rubles.

Attention! Interest rates will not increase in 2021; they remain the same. Thus, we will transfer 22% to the Pension Fund before the established limit, after 10%; in medical insurance – 5.1% and in social insurance – 2.9%.

| Recipients of insurance premiums | Provided maximum amount for insurance premiums, rub. | Current insurance premium rate |

| Pension Fund | 1,150,000 inclusive | 22% |

| Pension Fund | More than 1,150,000 | 10% |

| Medical insurance | No maximum size | 5,1% |

| Social insurance | 865,000 inclusive | 2,9% |

| Social insurance | More than 865,000 | 0% |

| Recipients of insurance premiums | Provided maximum amount for insurance premiums, rub. | Current insurance premium rate |

| Pension Fund | 1,021,000 inclusive | 22% |

| Pension Fund | More than 1,021,000 | 10% |

| Medical insurance | No maximum size | 5,1% |

| Social insurance | 815,000 inclusive | 2,9% |

| Social insurance | More than 815,000 | 0% |

Let's look at an example of how the maximum base for insurance premiums is used. Let us assume that the employee has a salary of 112,000 rubles. They worked all the months according to the report card in full.

The company makes calculations based on general tariffs for insurance premiums - for pension insurance 22% (10% for amounts greater than the base), social insurance - 2.9%, medical insurance 5.1%. The injury contribution is set at 0.2%.

| Month | The amount of salary subject to contributions, cumulatively up to the limit | The amount of the salary subject to contributions on an accrual basis in excess of the limit | Insurance deductions at a rate of 22% | Insurance deductions at a rate of 10% |

| 01.2019 | 112 000 | 24 640 | ||

| 02.2018 | 224 000 | 24 640 | ||

| 03.2018 | 336 000 | 24 640 | ||

| 04.2018 | 448 000 | 24 640 | ||

| 05.2018 | 560 000 | 24 640 | ||

| 06.2018 | 672 000 | 24 640 | ||

| 07.2018 | 784 000 | 24 640 | ||

| 08.2018 | 896 000 | 24 640 | ||

| 09.2018 | 1 008 000 | 24 640 | ||

| 10.2018 | 1 021 000 | 99 000 | 2 860 | 9 900 |

| 11.2018 | 1 021 000 | 211 000 | 11 200 | |

| 12.2018 | 1 021 000 | 323 000 | 11 200 |

| Month | Cumulative amount of salary subject to contributions | Insurance deductions 2.9% |

| 01.2018 | 112 000 | 3 248 |

| 02.2018 | 224 000 | 3 248 |

| 03.2018 | 336 000 | 3 248 |

| 04.2018 | 448 000 | 3 248 |

| 05.2018 | 560 000 | 3 248 |

| 06.2018 | 672 000 | 3 248 |

| 07.2018 | 784 000 | 3 248 |

| 08.2018 | 896,000 (only 815,000 is taxable) | 899 |

| 09.2018 | 1 008 000 | |

| 10.2018 | 1 120 000 | |

| 11.2018 | 1 232 000 | |

| 12.2018 | 1 344 000 |

Since the maximum amount is not established for the amount in medical insurance, it is necessary to make monthly deductions to the fund in the amount of: 112,000 x 5.1% = 5,712 rubles.

The contribution rate for injury deduction is set based on the risk of the main type of activity. There is also no maximum amount for this type of deduction. Therefore, the organization will have to make a payment every month in the amount of 112,000 x 0.2% = 224 rubles.

A citizen can be hired by a company or entrepreneur (clause 1 of Article 420 of the Tax Code of the Russian Federation):

- under an employment contract;

- under a civil law agreement (GPC) for the performance of work, provision of services;

- under the author's order agreement, etc.

Payments and rewards made in favor of individuals within the framework of these agreements form an object of taxation with insurance premiums (paragraph 1, paragraph 1, article 420 of the Tax Code of the Russian Federation) Not everything is of course! There is no need to pay insurance premiums for some types of payments (they are listed in Article 422 of the Tax Code of the Russian Federation).

Thus, in order to determine the basis for calculating insurance premiums, you need to add up all taxable payments. It is important to remember that it is considered (clause 1 of Article 421 of the Tax Code of the Russian Federation):

- each company (IP) independently, without taking into account payments for other places of work (if any);

- for each individual separately;

- monthly on an accrual basis from the beginning of the calendar year.

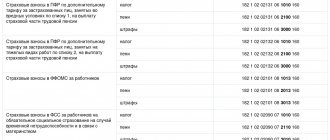

| Type of contributions | New KBK |

| Pension contributions | 182 1 0210 160 |

| Contributions to the FFOMS (medical) | 182 1 0213 160 |

| Contributions to the Social Insurance Fund of the Russian Federation (for disability and maternity) | 182 1 0210 160 |

| Contributions for injuries | 393 1 0200 160 |

| Additional pension contributions at tariff 1 | 182 1 0210 160, if the tariff does not depend on the special assessment; 182 1 0220 160, if the tariff depends on the special estimate |

| Additional pension contributions at tariff 2 | 182 1 0210 160, if the tariff does not depend on the special assessment; 182 1 0220 160, if the tariff depends on the special estimate |

The concept of a limit on insurance premiums

The premium limit, also known as the accrual basis limit, is the limit on the calculated contributions for an employee. In other words, this is the amount of payments made by the employee to insurance funds . The size of the maximum payments is established by the state in accordance with Article 421 of the Tax Code of the Russian Federation.

Starting from this amount, either a zero or a reduced rate of insurance deductions is applied. The higher the employee’s salary, the greater the amount the employer must pay to insurance funds. However, if the amount reaches a certain limit, the costs of compulsory insurance for business entities are reduced. In other words, insurance premium rates are then regressive.

According to tax legislation, such limits are established in order to reduce the tax burden on employers. The larger the wage fund, the less taxes will need to be paid to the Pension Fund and the Social Insurance Fund.

This accrual scheme encourages employers not to hide the wages of persons working at the enterprise. Thus, the employer can save money without breaking the law.

There are no maximum limits for health insurance premiums. This also applies to contributions for additional tariffs and contributions for injuries.

Reduced contribution rates for employees in 2018

In 2021, insurance premium rates will not change. All tariffs have been kept at the 2021 level. Here are tables with tariff rates for 2021.

If the employer is not entitled to reduced insurance premium rates, the following rates will apply until the above limits are reached:

- for pension insurance – 22%;

- for health insurance – 5.1%;

- for social insurance for disability and maternity – 2.9%;

- for insurance for injuries and occupational diseases - from 0.2% to 8.5% depending on the risk class.

Once the employee benefit limits have been reached, the insurance premium rates will be:

- for pension insurance – 10%;

- for social insurance for disability and maternity – 0%;

Insurance premiums for compulsory health insurance and contributions for injuries continue to be charged at the same rates, because no limits have been established for these types of payments.

Rates (table) of insurance premiums in 2021 for employees for transfer to the Federal Tax Service

Federal Law No. 361-FZ dated November 27, 2017 maintained insurance premium rates at this level for the period 2021–2021 (previously the period was 2021–2021).

These types of payments are not transferred to the funds in 2021, because control over their calculation and payment has been transferred to the Federal Tax Service. And only contributions for injuries at a rate of 0.2% to 8.5% are still paid to the Social Insurance Fund.

Let us show with an example how the amount of payments per employee is calculated if reduced insurance premium rates do not apply. The basis for calculation is determined for each employee separately, on a cumulative basis from the beginning of the year.

The sales manager at Vityaz LLC was paid 1,274,730 rubles for 2018. The organization does not have the right to reduced insurance premium rates. Let's calculate what amounts the employer must transfer to insure this employee.

- Payments for pension insurance consist of two parts: (1,021,000 * 22%) plus (1,274,730 - 1,021,000) * 10%), a total of 249,993 rubles.

- Social insurance contributions are calculated only up to the limit, i.e. (815,000 * 2.9%) 23,635 rubles.

- Insurance premiums for compulsory health insurance are charged at a flat rate (5.1%), regardless of the amount of payments to the employee. In our example, this is (1,274,730 * 5.1%) 65,011 rubles.

- Contributions for injuries and occupational diseases are charged on the entire amount at the minimum rate, because the type of activity belongs to the first risk class (1,274,730 * 0.2%) 2,549 rubles.

The total amount of insurance payments for this employee will be 341,188 rubles.

As can be seen, insurance payments for employees generally exceed 30% of the amounts paid to them. To reduce the financial burden of employers, the state has established reduced insurance premium rates, but not for all businessmen.

There are several categories of such beneficiaries, and reduced rates of insurance premiums for them are provided for in Article 427 of the Tax Code of the Russian Federation. Among them are participants in free economic zones and the Skolkovo project, IT organizations, ship crews, etc.

Additional requirements are established for entrepreneurs and organizations working on the simplified tax system. The income of simplifiers should not exceed 79 million rubles per year (while in general this limit is 150 million rubles), and the share of revenue from the preferential type of activity should be at least 70%.

Reduced insurance premium rates for certain categories of employers

After reaching the maximum payment base, the employer applying reduced tariffs does not pay pension and social insurance contributions.

Limit base for calculating insurance premiums in 2021

Please note! For payments to foreigners and stateless persons temporarily staying in Russia (with the exception of highly qualified specialists), VNIM contributions are calculated at the rate of 1.8%.

Additionally, policyholders pay contributions to the Social Insurance Fund “for injuries” at a rate of 0.2% to 8.5%, depending on the main type of economic activity (Article 21, paragraph 1 and 3 of Article 22 of the Federal Law of July 24, 1998 No. 125-FZ (hereinafter referred to as Law No. 125-FZ), Federal Law dated December 19, 2016 No. 419-FZ, Federal Law dated December 22, 2005 No. 179-FZ).

Please note! For some categories of employers, the Tax Code provides for reduced (or zero) insurance premium rates. For example, IT companies pay contributions for compulsory health insurance in the amount of 8%, for compulsory medical insurance - 4%, for VNIM - 2% (clause 3, clause 1, clause 1.1, clause 2, clause 5 of Article 427 of the Tax Code RF). And “simplers” who carry out preferential activities listed in clause 5, clause 1, Article 427 of the Tax Code of the Russian Federation, pay only one pension contribution at a rate of 20% (clause 3, clause 2, Article 427 of the Tax Code of the Russian Federation).

In this case, the payer calculates contributions for compulsory health insurance and the case of personal and personal care based on the tariffs indicated in the table until the taxable base of an individual person reaches the so-called maximum value.

The maximum value of the base for calculating insurance contributions for compulsory pension and social insurance is established by the Government of the Russian Federation at the end of each year for the next calendar year, taking into account the growth of average wages in the country (clauses 4-6 of Article 421 of the Tax Code of the Russian Federation). Thus, in 2021 the following values apply (clause 1 of the Decree of the Government of the Russian Federation of November 29, 2016 No. 1255):

- for contributions to compulsory health insurance – 876,000 rubles;

- for contributions to the case of VniM - 755,000 rubles.

And if the amount of taxable payments accrued in favor of an individual on an accrual basis from the beginning of the year (base) exceeds the established limits, then the rate of contributions for compulsory pension insurance is reduced from 22% to 10%, and contributions for the case of VNIM cease to be accrued altogether (paragraph 3 p. 1 Article 426 of the Tax Code of the Russian Federation, clause 3 of Article 421 of the Tax Code of the Russian Federation).

Keep in mind! For the purposes of calculating medical and pension contributions paid at an additional tariff, as well as contributions for “injuries,” maximum bases are not approved. In other words, these types of contributions are paid at the rates provided by the Law, regardless of the total income of the individual.

Let's see how the contribution limits will change in 2018.

- for contributions to compulsory pension insurance – 1,021,000 rubles. (from an individual’s income within the limit, contributions are paid at a rate of 22%, above the limit - at a rate of 10%);

- for contributions to the case of VniM - 815,000 rubles. (from an individual’s income within the limit, contributions are paid at a rate of 2.9%; above the limit, they are not paid at all).

Let's reflect all of the above in the table.

The base for contributions “for injuries”, as well as for compulsory medical insurance, is not limited, therefore contributions are calculated from all taxable payments and remunerations in favor of individuals at the rate established by the Social Insurance Fund (clause 1 of Article 22 of Law No. 125-FZ).

Please note! Payers of insurance premiums who apply reduced tariffs do not pay contributions from above-limit incomes of individuals for either pension insurance or insurance in case of temporary disability and in connection with maternity.

Let us remind you that monthly payments for insurance premiums for compulsory medical insurance, compulsory medical insurance and the case of VNIM from the income of individuals are transferred until the 15th day of the month following the settlement month, taking into account the transfer rules established by clause 7 of article 6.1 of the Tax Code of the Russian Federation, according to the details of the Federal Tax Service (clause p. 3, 7 and 11 of Article 431 of the Tax Code of the Russian Federation):

- at the location of the organization (or its separate division);

- at the place of registration (i.e. place of residence) of the individual entrepreneur.

In this case, for each type of insurance, a separate payment slip is issued, in which the amount of the contribution is indicated in rubles and kopecks (clauses 5 and 6 of Article 431 of the Tax Code of the Russian Federation).

The procedure for paying contributions “for injuries” is regulated by clause 4 of article 22 of Law No. 125-FZ. In accordance with this norm, the monthly obligatory payment must be sent to the account of the territorial branch of the Social Insurance Fund before the 15th day of the month following the month for which contributions were calculated.

Note. Let us assume that the Company pays contributions to the Social Insurance Fund “for injuries” at a rate of 0.2%.

Questions about establishing the base for insurance premiums from 2021 will be regulated by Article 421 of the Tax Code of the Russian Federation. The taxable base, as before, will be determined separately for each individual on an accrual basis from the beginning of the year. The base will need to include taxable payments that you accrued in favor of the employee from the beginning of the year until the last day of the past month.

In 2021, the limit on pension contributions at the general tariff was 796,000 rubles, on social contributions - 718,000 rubles. For pension contributions, payments over the limit were taxed at a rate of 10 percent, and for social contributions, there was no need to charge contributions on amounts above the limit. For “medical” contributions, no maximum base was established in 2021. See “Limit value of the base for calculating insurance premiums for 2021: table“.

Limits are expected to increase for 2021. The Government of the Russian Federation established a new limit by its Resolution No. 1255 dated November 29, 2016. The maximum values of the base for insurance premiums for 2021 are as follows:

- 876,000 rub. – for compulsory pension insurance. Payments that exceed this amount are subject to pension contributions at a rate of 10 percent;

- 755,000 rub. – for compulsory social insurance in case of temporary disability and in connection with maternity. Payments exceeding this amount are no longer subject to insurance premiums.

The rate of contributions for compulsory health insurance does not depend on the amount of payments in 2021. Therefore, all payments without restrictions are subject to “medical” contributions at a rate of 5.1 percent.

Thus, the base limits for calculating insurance premiums in 2021 have increased. However, the procedure for calculating contributions within the base and above the limit remains the same.

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

| 463 000 | 512 000 | 568 000 | 624 000 | 711 000 | 796 000 | 876 000 | 1 021 000 | 1 150 000 |

Note: There is currently no legal limit for health insurance contributions.

Taxable amounts (salary, vacation pay, etc.) form the basis for calculating insurance premiums.

Every year, legislation changes the maximum base of insurance premiums. This means that there is no need to tax in excess of the approved limit or the rate will decrease. A regressive scale is used when calculating contributions to compulsory pension insurance.

The list of codes is given in the order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/

In connection with the indexation, the maximum bases for calculating insurance premiums in 2021 have changed:

- To the Pension Fund of Russia - 1,150,000 rubles

- In the Social Insurance Fund - 865,000 rubles

The size of the limit for calculating contributions for compulsory health insurance (in the Federal Compulsory Medical Insurance Fund) in 2021 has not been established.

We present data for 2021, 2021 and 2021. for comparison.

- for pension insurance;

- for social insurance in case of temporary disability and in connection with maternity;

- for health insurance;

- for insurance for injuries and occupational diseases.

In this case, the limit on the calculation of contributions is established only for the first two types of insurance.

Average salary in the Russian Federation * 12 months * 2

Considering that the projected average salary in 2018 will be 42,522 rubles, the limit on calculating contributions to compulsory pension insurance is equal to (42,522 * 12 * 2) 1,021,000 rubles, taking into account rounding.

Limit for calculating insurance premiums for 2021 * 1.08

We calculate: (755,000 * 1.080) = 815,000 rubles, taking into account rounding.

We will indicate the maximum value for calculating different types of insurance premiums for employees in 2021 in the table.

We remind you: insurance premiums in 2021 for individual entrepreneurs for themselves do not have a maximum base for calculation and are calculated according to different rules.

Rates

If companies or individual entrepreneurs in 2021 do not use the reduced tariffs established for certain categories, then the following rates should be applied (Article 426 of the Tax Code of the Russian Federation):

- 22% – “pension” contributions (PFR); if the maximum base is exceeded, contributions are calculated at a rate of 10%;

- 2.9% – the amount of social insurance contributions (in case of illness and maternity); if the maximum base is exceeded, contributions are not accrued;

- 5.1% - for health insurance (MHIF).

First, the value of the base for calculating insurance premiums is calculated, then it is compared with the current limit, and only then the premiums themselves are calculated according to the tariff.

Let's give an example

Employee Belyaev’s official salary is 100,000 rubles. Let’s say that Belyaev worked completely for the whole of 2021. We will take into account income on an accrual basis. Let's calculate insurance premiums for 2019:

- The largest part of the accrued fees are pension insurance contributions ; the accrual base for 2021 at a rate of 22% is limited to 1,150,000 rubles, then accrual is made at a rate of 10%.

Until the base is exceeded, Belyaev’s income is fully taxed (22% every month); the size of the base for calculating insurance premiums was below the established limit until November (inclusive):

100,000 x 11 months. = 1,100,000 – salary for January – November.

1,100,000 x 22% = 242,000 – contributions accrued up to November 2021 inclusive.

In December the base was exceeded:

100,000 x 12 months. = 1,200,000

The accounting department will do the calculation like this:

1,150,000 x 22% = 253,000 – accrued to the Pension Fund for 2021 at a rate of 22%.

The remaining amount (1,200,000 – 1,150,000 = 50,000) is subject to mandatory pension contributions at a rate of 10%:

50,000 x 10% = 5,000

The accounting department accrued total Pension Fund contributions for employee Belyaev for 2019 - 258,000 rubles (253,000 + 5,000), of which contributions for December - 16,000 rubles. (258000 – 242000).

- For the Social Insurance Fund, the maximum base for calculating insurance premiums is 865,000 rubles in 2021.

Until reaching 865 thousand rubles. Belyaev’s salary is fully taxed:

100,000 x 8 months = 800,000 – salary January-August,

800,000 x 2.9% = 23,200 – accrued contributions to the Social Insurance Fund from January to August.

In September (the month of excess), the accountant will calculate social insurance contributions as follows:

865,000 x 2.9% = 25,085 – the maximum amount accrued to the Social Insurance Fund for 2019, of which RUB 1,885 for August. (25,085 – 23,200).

For the rest of the salary exceeding the limit (1,200,000 – 865,000 = 335,000), contributions are not charged.

The total accrued contributions to the Social Insurance Fund for employee Belyaev for 2021 are 25,085 rubles.

- Since the base for calculating insurance premiums for compulsory medical insurance is not limited, Belyaev’s income is fully taxed:

100,000 x 12 months = 1,200,000 – salary for the entire 2021.

1,200,000 x 5.1% = 61,200 – annual amount of compulsory medical insurance contributions for 2019.

In total, Belyaev’s medical insurance premiums amounted to 61,200 rubles.

The amount of payments due for each employee is calculated in a similar way on a monthly basis.

Object of taxation of insurance premiums

A taxable object in 2021, as before, will be considered payments and other remuneration in favor of individuals accrued under employment and civil law contracts (Article 420 of the Tax Code of the Russian Federation). The list of payments that may not be subject to contributions will also be preserved. This list is given in Article 422 of the Tax Code of the Russian Federation. It, as before, indicates, for example, benefits, financial assistance, payment of food costs, etc.

The only change concerns the daily allowance. In 2021, the entire amount of daily allowance specified in the collective agreement or in a local regulation was exempt from contributions. From January 2021 the situation will change. It will be possible not to pay contributions only for amounts not exceeding 700 rubles for domestic business trips, and for amounts not exceeding 2,500 rubles for foreign trips. This is enshrined in paragraph 2 of Article 422 of the Tax Code of the Russian Federation. That is, in fact, from 2021, the same limits apply to daily allowances as for personal income tax (clause 3 of Article 217 of the Tax Code of the Russian Federation).

With regard to contributions “for injuries” everything will remain the same. In 2017, daily allowances will be exempt from these contributions in full.

How are insurance premiums calculated?

Federal Law No. 303-FZ made certain amendments to the Tax Code of the Russian Federation. These amendments concern the procedure for calculating insurance premiums. Legislators decided to leave the current rates as the base ones and abandoned plans to gradually increase tariffs to the level fixed in Art. 425 Tax Code of the Russian Federation.

In 2021, the maximum taxable base for pension contributions will be 1,129,000 rubles. In addition, the amount of deductions at the basic contribution rates will also increase. Let us recall that in 2021, the maximum base for calculating Pension Fund contributions was 1,021,000 rubles, for Social Insurance Fund contributions – 815 thousand rubles.

In other words, this year the base for the Pension Fund will increase by more than 100 thousand rubles, and the reduced rate will no longer be achievable for the majority. To apply the reduced rate for at least a month, the salary must be more than 95 thousand rubles per month.

In 2021, the structure of the tax base for contributions will not change. To calculate this base, it is necessary to add up all contribution payments related to the taxable object. A detailed list of such payments is listed in paragraph 1 of Article 420 of the Tax Code of the Russian Federation. In particular, these include wages and vacation pay. Next, non-taxable payments are subtracted from the result. The list of such payments is contained in Article 422 of the Tax Code of the Russian Federation. These payments include state benefits or financial assistance in the amount of up to 4,000 rubles per year.

Table of contribution limits

1 file(s) 14.92 KB

Download

The procedure for calculating penalties for late payment of insurance premiums has changed

For “injury” contributions, the payment deadline will also remain the same. They must be transferred to the budget no later than the 15th day of the month following the month for which these contributions were accrued.

Thus, for example, all types of insurance premiums for January 2017 will need to be paid on time, no later than February 15. See “Deadline for Payment of Insurance Premiums: 2021.”

- for delay in payment of insurance premiums by more than 30 calendar days, the interest rate of the penalty is taken equal to 1/300 of the refinancing rate of the Central Bank of the Russian Federation, valid for a period of up to 30 calendar days (inclusive) of such delay;

- for late payments from the 31st day, 1/150 of the refinancing interest rate will be applied.

For more information, see “Calculation of penalties for taxes and insurance premiums in 2021: what has changed.”

Insurance premiums paid by individual entrepreneurs “for themselves” in 2021 - 2021

The maximum bases that we described above are used by organizations and entrepreneurs exclusively when calculating insurance premiums from payments and rewards to individuals - ordinary citizens.

Annual contribution = minimum wage x 12 x interest rate

The rates of insurance premiums paid by individual entrepreneurs “for themselves” are established by clause 2 of Article 425 of the Tax Code of the Russian Federation: for compulsory health insurance in the amount of 26% and for compulsory medical insurance in the amount of 2.9%. Thus, for 2021 the entrepreneur needs to pay:

- pension contributions - in the amount of 23,400 rubles. (= RUB 7,500 x 12 x 26%);

- medical contributions - in the amount of 4,590 rubles. (= RUB 7,500 x 12 x 2.9%).

(Since 01/01/2017, the minimum wage has been in force, approved by Article 1 of Federal Law No. 82-FZ dated 06/19/2000 (as amended on 06/02/2016).)

At the same time, if an individual entrepreneur earns more than 300 thousand rubles in a year, then he will have to pay additional contributions to compulsory pension insurance in the amount of 1% on income in excess of the specified amount. At the same time, maximum contributions to pension insurance in 2021 should not exceed 8 times the annual fixed contribution, i.e. 187,200 rubles. (= 8 x 7,500 rub. x 12 x 26%).

for compulsory pension insurance (OPI):

- for 2021 – 26,545 rubles;

- for 2021 – 29,354 rubles;

- for 2021 – 32,448 rubles;

for compulsory health insurance (CHI):

- for 2021 – 5,840 rubles;

- for 2021 – 6,884 rubles;

- for 2021 – 8,426 rubles.

At the same time, individual entrepreneurs whose annual income exceeds 300 thousand rubles still have the obligation to pay an additional “pension” contribution (1%).

Read more about this in the article “Fixed insurance premiums for individual entrepreneurs in 2021.”

Changes from 2021

The maximum values of the bases are approved by the Government for each year. In November 2021, their sizes for 2019 were adopted:

- In the Pension Fund of Russia, the maximum accrual base next year will be 1,150,000 rubles;

- In the Social Insurance Fund - 865,000 rubles.

- For additional contributions from the Pension Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund, and for injuries, the maximum bases have not been approved next year, so contributions will be calculated according to the same rules as in previous periods.

These increases were made taking into account the indexation of the average salary and its growth compared to the previous year. The new base limits apply from the beginning of 2021 until December 31.

From 2021, reduced tariffs for most business entities on preferential tax systems will be cancelled.

Attention: only charitable, non-profit, sports and other similar organizations using the simplified tax system can now transfer a smaller amount of contributions. Moreover, this right is reserved to them until 2024 inclusive.

In 2021, a bill was proposed that would abolish the existence of a maximum base for contributions to the Pension Fund. It was assumed that this step would be able to cover the shortage of funds in the Pension Fund in just one year.

However, the project was rejected and contributions must continue to be counted next year, taking into account the accepted maximum base.

KBC for transferring contributions in 2017

Until 2021, insurance premiums had to be transferred in separate payment orders to each extra-budgetary fund: Pension Fund, Federal Compulsory Medical Insurance Fund and Social Insurance Fund (Part 4 of Article 16 of Federal Law No. 212-FZ of July 24, 2009). From 2021, the Federal Tax Service will become the administrator of pension, medical and contributions in case of disability and in connection with maternity (except for contributions for injuries).

Therefore, starting with payments for January 2021, payment orders for the transfer of these contributions must indicate the Federal Tax Service as the recipient. In this regard, new budget classification codes (BCC) for payment of contributions should be approved (Article 6 of the Budget Code of the Russian Federation, paragraph 1 of Article 30 of the Tax Code of the Russian Federation).

Offsetting different types of insurance premiums has become impossible

From 2021, different types of insurance premiums cannot be offset against each other. Offset is allowed only within contributions of the same type (clause 1.1 of Article 78 of the Tax Code of the Russian Federation). So, for example, an overpayment of pension contributions from 2017 can only be offset against future payments for the same. Starting from 2021, the company has no right to offset this overpayment against arrears on medical or social contributions.

Let us recall that until 2021 it was possible to offset any insurance premiums administered by the same fund. For example, overpayments of insurance premiums for compulsory pension insurance could be offset against medical contributions.

Special insurance cases

In addition to the main types of insurance, there are also special cases. In particular, for 2021 preferential rates for non-profit organizations and charitable organizations will remain. They must pay contributions to pension insurance at a rate of 20%; for the Social Insurance Fund and the Federal Compulsory Medical Insurance Fund the rate is 0%.

For business entities using the simplified tax system, UTII or PSN, the period of application of reduced insurance rates ends in 2019 (the availability of benefits when calculating insurance premiums depended on the type of activity of the enterprise or individual entrepreneur). Starting from 2021, this category of companies and entrepreneurs will have to pay the following insurance premiums:

- Pension insurance contributions will be made at the usual rates of 22% and 10% (instead of 20%);

- Within the framework of social insurance, the rate will be 2.9%, instead of the zero rate;

- On the Compulsory Medical Insurance Fund - 5.1% instead of a zero tariff.