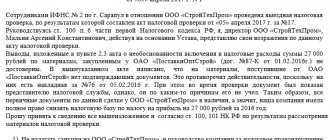

Tax reporting must be submitted on time and compiled without errors: this axiom is firmly known to both novice entrepreneurs and experienced “bisons”.

To ensure that tax laws are strictly observed, every document submitted to the tax office is automatically checked. This mandatory verification of submitted reports is called desk verification .

All firms, organizations and private entrepreneurs are constantly subject to this type of tax control: it is not surprising that a large number of questions arise about this process and its consequences. This article will try to answer many of them.

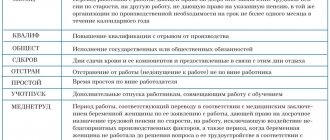

Classification of desk checks:

How is the check carried out?

A desk tax audit is a check of compliance with the legislation on taxes and fees on the basis of a tax return and documents that the taxpayer independently submitted to the tax office, as well as documents that the tax authority has. This check is regulated by Art. 88 Tax Code of the Russian Federation. The start date of the audit is the date the taxpayer submits a declaration, calculation or information to the tax office.

Without exception, all declarations and calculations received from taxpayers are checked. Taxpayers are not notified of the start of a desk audit, and no decision is made on its appointment.

Concept and types of tax audits

Federal Tax Service inspections are activities carried out by this government body aimed at monitoring compliance by organizations, individual entrepreneurs, and individuals with the procedure for calculating and paying taxes.

In Art. 87 of the Tax Code of the Russian Federation provides for two types of inspections: office and on-site. In practice, there are many more types of checks. In particular, they can be planned and unplanned, comprehensive and selective, thematic and general, control and counter.

An on-site inspection is carried out with officials visiting the territory of the subject being inspected, while a desk inspection is carried out without it. The subject of inspection activities, regardless of the type of inspection, does not change - this is supervision of compliance with the law in the field of tax payment.

A desk audit is also called a documentary audit. This is due to the fact that Federal Tax Service employees study the correctness and timeliness of calculation and payment of tax payments based on the declarations submitted by the organization. The subject of the audit is exclusively the reporting submitted by the company, and the Federal Tax Service can go beyond this subject only when it is necessary to study other documents for the purpose of data reconciliation.

A situation is possible when a company does not submit the required declaration on time, and a desk audit is carried out on the basis of information available to the Federal Tax Service, without a declaration.

Check period

The period for conducting a desk audit is 3 months. If during the audit, errors or inconsistencies in information are revealed, the taxpayer is sent a request asking for documents, explanations of the facts of violations identified and an updated declaration or calculation.

The taxpayer is given 5 days to provide explanations and clarifications. If during this period the taxpayer does not independently correct errors or does not provide the required explanations, he will be fined.

From January 1, 2021, the fine for this violation is 5 thousand rubles; if a similar violation is repeated within a calendar year, the fine will be 20 thousand rubles.

Explanations related to VAT returns are provided only in electronic form, through an electronic document management operator, in the format approved by Order of the Federal Tax Service of the Russian Federation dated December 16, 2016 No. ММВ-7-15/ [email protected] Explanations provided on paper are considered not provided .

The legislative framework

In the process of work, employees of the desk inspection department are guided by acts and decrees strictly prescribed by law. At the moment, the camera room is obliged to use in its work the rules of law prescribed in articles , , , of the Tax Code of the Russian Federation.

Orders of the Federal Tax Service (FAS) also have supreme force for department employees. All main issues related to the desk department are clearly stated in Article 88 of the Tax Code of the Russian Federation.

In addition to the fact that tax officials rely on already published legislative acts, the office department carefully monitors all changes in legislation . Such monitoring of the legislative framework allows inspectors to carry out their activities with maximum efficiency.

Registration of inspection results

After the end of the desk audit, a report is drawn up indicating the violations found and the amounts of additional taxes assessed. Within 5 working days, the inspection report is handed over to the taxpayer.

Within a month, the taxpayer has the right to submit disagreements to the desk audit report.

Within 10 working days after the expiration of the period for submitting disagreements, the head of the inspectorate makes a decision to hold the taxpayer accountable for committing a tax offense.

If the taxpayer does not agree with this decision, he has the right to send an appeal to a higher tax authority. This complaint is considered within a month from the date of filing. The consideration period may be extended, of which a notification is sent to the taxpayer.

If the taxpayer does not agree with the decision of a higher tax authority, he has the right to go to court.

If no violations are identified during a desk audit, it is automatically closed, the taxpayer is not notified about this, and documents for the audit are not handed over to him.

What it is

Before considering the main tasks and structure, it is necessary to give a clear definition that will reflect the essence of the work of the desk audit department .

This department represents a team of tax employees whose main task and function is to monitor compliance with the tax obligations of enterprises based on the reporting they provide. In general, the main function of the department can be described as the verification of tax reports and documentation. The peculiarity of the employees of this department is that all the work on analyzing and studying documents takes place in the department of the tax service itself, without visiting taxpayers.

Errors when submitting reports

Disagreements between the tax inspectorate and taxpayers often arise during the reporting process. If declarations and calculations are filled out incorrectly, the reporting verification program automatically refuses to accept them, indicating errors.

What are these errors:

1. The reporting is signed by a representative with a power of attorney, but the tax inspectorate’s database does not contain either the power of attorney itself or data on the representative.

2. The reporting is signed by a representative under a power of attorney, but the information message about the power of attorney indicates a power of attorney without the right to sign.

3. The declaration is signed by the head of the organization. But his data in the declaration does not coincide with the information in the Unified State Register of Legal Entities.

4. The primary declaration is submitted with the attribute “corrective” or vice versa.

5. Reporting is submitted using outdated and ineffective forms.

Definition of the concept

There is no tax office that does not have a desk audit department; what it does can be understood from the name. Enterprises, individual entrepreneurs and legal entities regularly become the object of his close attention. persons who are engaged in commercial activities and are required to pay taxes on time. In rare cases, inspectors may check charities and some other organizations that are not engaged in business activities. Particular attention is paid to those enterprises that are characterized by the following features:

- their tax base is lower than that of similar organizations;

- their statements contain more expenses (deductions) than income;

- They have only losses over several tax periods.

Violations due to desk audits

When conducting a desk audit of specific declarations and/or calculations, the entire taxpayer’s reporting for that period is analyzed. The data specified in the general reporting is compared with the audited one. It is during this analysis that most violations are revealed. Data from external sources, information received from taxpayers' counterparties, and previous desk audits are analyzed.

Various violations are established:

1) simple arithmetic errors;

2) discrepancy between the tax base of VAT and income tax;

3) discrepancies between 6-NDFL and RSV data;

4) violation of the procedure for recovering VAT on advance payments paid;

5) provision of an incomplete set of documents when refunding VAT from the budget or for losses;

6) understatement of revenue;

7) overestimation of expenses;

for UTII and PSN, there is a discrepancy between the physical indicator of the number of employees and the data of 6-NDFL and DAM;

for UTII and PSN, there is a discrepancy between the physical indicator of the number of employees and the data of 6-NDFL and DAM;

9) lack of documents confirming tax benefits;

10) calculations of property tax without taking into account the cadastral value of the property.

These are the most common violations that are detected during desk tax audits. It is impossible to describe them all. But, as statistics show, 90 percent of violations and errors are made by taxpayers due to their carelessness. This is explained by both the heavy workload of accountants and the lack of experience. But we must also understand that this inattention can be costly for the organization. Therefore, very carefully check that all reporting forms are filled out correctly, do not delay submission until the last day, compare report data, and prepare packages of documents on losses and VAT refunds in advance.

From the third quarter of 2021, desk tax audits of your reporting will use another source of information about income - information from online cash registers. Do not forget to reflect this information in full and without errors in the reporting, so that you do not have to provide explanations and documents for inspections and pay penalties.

Department functions

In general, the desk tax service carries out a huge amount of work, which can be divided into several main functions :

- Analysis and verification of documentation.

- Identification of violations.

- Preparation of the legislative framework for initiating an on-site inspection.

- Creation and updating of a single database with additional data.

- Personnel retraining.

In most cases, inspectors have to carry out the entire scope of work on a continuous basis, because... document flow increases every year.

Current structure

At the moment, the structure of the department includes employees of the following positions :

- head of a department with a wide range of responsibilities;

- specialists in the field of high technology;

- accountants;

- lawyers;

- economists.

Depending on the specific tax authority, the composition and structure may be reduced, which leads to the fact that one employee performs responsibilities in several areas at once.

Job of a state tax inspector

In the process of retraining and additional training, tax inspectors gain access to more responsible and difficult tasks, so his work can be characterized as a constant process of identifying legal and tax violations by commercial and non-commercial enterprises.

The employee’s responsibilities also include collecting information and statistics on taxation for the region as a whole.

The requirement to provide explanations for reporting is not a reason for a fine

If tax authorities discover errors, inaccuracies, or contradictions in the submitted reports, they have the right to demand that the taxpayer provide explanations. The latter has 5 days to do this or submit an adjusted report to the inspectorate.

If an error in reporting led to an underpayment of tax to the budget, the tax authorities will impose a fine. However, the violation is confirmed only by a tax audit report.

Thus, if, before making a decision on the “camera chamber”, the company manages to submit corrected reports to the Federal Tax Service, and also transfers the underpaid amount of tax and penalties to the budget, then a fine can be avoided.

Letter of the Federal Tax Service of the Russian Federation dated February 21, 2018 No. SA-4-9/ [email protected]

Editor's note: it is worth adding that senior judges consider the fine in this case to be lawful. According to the Supreme Court of the Russian Federation, if the taxpayer eliminates the violations after the tax authorities send him a request to provide explanations for the reporting, then he cannot avoid liability for underpayment of tax (definitions dated March 27, 2017 No. 305-KG17-1782, dated October 10, 2016 No. 305- KG16-12560).

In what form should explanations for declarations and calculations be provided?

If, during a desk audit, tax officials find errors or inconsistencies in the submitted reports, they have the right to request clarification from the taxpayer. The person being inspected has 5 days to provide explanations or correct previously submitted forms.

If inaccuracies are found by inspectors in the declaration of profit, property or transport, as well as personal income tax reporting, then explanations can be submitted in any form (on paper or according to the TKS). But if the tax office is dissatisfied with the VAT return, then you need to communicate with the Federal Tax Service exclusively in virtual form according to the format established by the Federal Tax Service of the Russian Federation. Otherwise, explanations will be considered not provided and a fine will follow.

Let us recall that the central office of the Federal Tax Service of the Russian Federation, in its decision on a taxpayer’s complaint, argued that the local Federal Tax Service Inspectorate must accept VAT explanations in any electronic form, but they do not necessarily have to comply with the format.

Objects of inspections

Enterprises of various forms of ownership, individual entrepreneurs, as well as legal entities may be subject to desk inspection.

With rare exceptions, only those enterprises that make a profit from their activities are subject to inspection. However, if there are compelling reasons, the desk audit department of the Tax Service can also inspect charities and other organizations that are not engaged in commercial activities.

In accordance with the current regulatory documents, first of all, those enterprises whose taxes collected are below the average level compared to similar enterprises, whose reporting contains a significant number of deductions, and where a loss has been identified over a certain number of adjacent tax periods may be subject to inspection.

How to send VAT explanations if you have multiple addresses

Companies (IPs) submitting electronic VAT returns submit to the Federal Tax Service, upon its request, explanations in the same form and format determined by the Federal Tax Service of the Russian Federation (Order No. ММВ-7-15 dated December 16, 2016 / [email protected] ).

This obligation has appeared since the beginning of 2021.

Submitting paper explanations is the same as not submitting them at all.

At the same time, the law allows companies to use the services of several EDF operators, so a company may have more than one email address.

In such a situation, tax officials recommend sending letters to the last address that was used to exchange information with inspectors.

When generating a response with explanations, the company itself can indicate the declaration identifier displayed in the acceptance receipt (notification of entering the VAT report).

It is also not forbidden to inform the tax authorities about the address to which correspondence via TKS should be sent.

How to provide explanations to the declaration: the Federal Tax Service answers

| Question | Answer |

| If, upon receipt of a request for clarification, the taxpayer has reconciled invoices with the counterparty and no violations have been established, is it necessary to respond to the request? | It is necessary to provide explanations to the tax authority confirming that the invoice is reflected in the tax return section |

| If a taxpayer receives a request to provide explanations indicating invoices, which, in his opinion, are reflected correctly in the declaration, what should he do in this case? | If possible, carry out a reconciliation with the counterparty to ensure that the identification indicators of invoices are correctly reflected in the declaration of the buyer and seller and inform the Federal Tax Service that there is no error |

| If the taxpayer sends clarifications on the TKS in response to a request, will the taxpayer be notified that the tax authority has received these clarifications? | Explanations are considered accepted by the tax authority if the taxpayer has received a notification of acceptance signed with the electronic signature of the inspectorate. Otherwise, the taxpayer will receive a notice of refusal to accept |

| If the explanations provided do not eliminate the identified discrepancies, will the inspectorate inform taxpayers about this, or will a new request for explanations be issued again? | If, after the taxpayer provides explanations, the discrepancies are not eliminated, the Federal Tax Service has the right to send a request for the presentation of documents or carry out other tax control measures |

| Will the tax authority inform the taxpayer if the explanations provided eliminate the identified discrepancies? | No, the Tax Code of the Russian Federation does not provide for the obligation of tax authorities to inform the taxpayer about the elimination of discrepancies |

| Is it necessary to attach documents to a response to a request for clarification? | The taxpayer has the right to additionally submit to the inspection copies of documents confirming the accuracy of the data included in the tax return |

| Can the deadline for providing explanations be extended? | The Tax Code does not provide for an extension of the deadline for submitting explanations |

| Is it possible to refuse to accept clarifications in response to a request for clarification? | Only in case of violation of the electronic format of the response to the request for clarification |

| Is it possible to provide explanations along with filing an updated VAT return? | The Tax Code does not prohibit the submission of explanations along with the submission of an updated tax return |

| In what cases is only an explanation submitted in response to a request for explanations, and in what cases is an amended tax return submitted? | If an error is identified in the submitted VAT return that leads to an underestimation of the amount of tax payable, the organization is obliged to submit an updated return. If an error in the declaration led to an overpayment or did not affect the amount of tax payable, then it is not necessary to submit an “adjustment”. In such cases, an explanation may be provided |

| What is the deadline for providing explanations in response to a request? | Explanations must be submitted within 5 days from the date of transmission of the acceptance receipt via TKS to the tax authority |

| Is it necessary to send a receipt for the request for clarification? What is the deadline for sending a receipt for acceptance of this request? | Yes. Upon receipt of a request for clarification, the taxpayer is obliged to submit to the Federal Tax Service a receipt for acceptance of such a document in electronic form via TKS within 6 days from the date the tax authority sent the request |

Article 88 of the Tax Code of the Russian Federation. Desk tax audit (current version)

1. A desk tax audit is carried out at the location of the tax authority on the basis of tax returns (calculations) and documents submitted by the taxpayer, as well as other documents on the activities of the taxpayer available to the tax authority, unless otherwise provided by this chapter. A special declaration submitted in accordance with the Federal Law “On the voluntary declaration by individuals of assets and accounts (deposits) in banks and on amendments to certain legislative acts of the Russian Federation”, and (or) documents and (or) information attached to it, and also, the information contained in the specified special declaration and (or) documents cannot form the basis for conducting a desk tax audit.

A desk tax audit of the calculation of the financial result of an investment partnership is carried out by the tax authority at the place of registration of the participant in the investment partnership agreement - the managing partner responsible for maintaining tax records (hereinafter in this article - the managing partner responsible for maintaining tax records).

1.1. When submitting a tax return (calculation) for a tax (reporting) period for which tax monitoring is carried out, a desk tax audit is not carried out, except for the following cases:

1) submission of a tax return (calculation) later than July 1 of the year following the period for which tax monitoring is carried out;

2) submission of a tax return for value added tax, which states the right to a tax refund, or a tax return for excise taxes, which states the amount of excise duty to be reimbursed;

3) submission of an updated tax return (calculation), in which the amount of tax payable to the budget system of the Russian Federation is reduced, or the amount of the resulting loss is increased compared to the previously submitted tax return (calculation);

4) early termination of tax monitoring.

1.2. If the tax return for personal income tax in relation to income received by the taxpayer from the sale or as a result of a gift of real estate is not submitted to the tax authority within the prescribed period in accordance with subparagraph 2 of paragraph 1 and paragraph 3 of Article 228, paragraph 1 Article 229 of this Code, a desk tax audit is carried out in accordance with this article on the basis of documents (information) available to the tax authorities about such a taxpayer and about the specified income.

If there are circumstances specified in paragraph one of this paragraph, a desk tax audit is carried out within three months from the day following the expiration date for payment of tax on the relevant income.

When conducting a desk tax audit in accordance with paragraph one of this clause, the tax authority has the right to require the taxpayer to provide the necessary explanations within five days.

If, before the completion of a desk tax audit in accordance with paragraph one of this clause, the taxpayer (his representative) submits the tax return specified in paragraph one of this clause, the desk tax audit is terminated and a new desk tax audit begins based on the submitted tax return. In this case, documents (information) received by the tax authority as part of a terminated desk tax audit and other tax control measures in relation to such a taxpayer may be used when conducting a desk tax audit based on the submitted tax return.

2. A desk tax audit is carried out by authorized officials of the tax authority in accordance with their official duties without any special decision of the head of the tax authority within three months from the date of submission by the taxpayer of the tax return (calculation) (within six months from the date of submission by the foreign organization, registered with the tax authority in accordance with paragraph 4.6 of Article 83 of this Code, a tax return for value added tax), unless otherwise provided by this paragraph.

If the tax return (calculation) is not submitted by the taxpayer - the controlling person of the organization, recognized as such in accordance with Chapter 3.4 of this Code, or by a foreign organization subject to registration with the tax authority in accordance with paragraph 4.6 of Article 83 of this Code, the tax authority within the prescribed period, authorized officials of the tax authority have the right to conduct a desk tax audit on the basis of the documents (information) they have about the taxpayer, as well as data about other similar taxpayers within three months (within six months for a foreign organization subject to registration registration with the tax authority in accordance with paragraph 4.6 of Article 83 of this Code) from the date of expiration of the deadline for submitting such a tax return (calculation), established by the legislation on taxes and fees.

If, before the end of the desk tax audit of the documents (information) available to the tax authority, the taxpayer submits a tax return, the desk tax audit is terminated and a new desk tax audit begins based on the submitted tax return. Termination of a desk tax audit means termination of all actions of the tax authority in relation to the documents (information) available to the tax authority. In this case, the documents (information) received by the tax authority as part of a terminated desk tax audit may be used when carrying out tax control measures in relation to the taxpayer.

A desk tax audit based on a tax return for value added tax, documents submitted to the tax authority, as well as other documents on the activities of the taxpayer available to the tax authority is carried out within two months from the date of submission of such a tax return (within six months from the day of submission by a foreign organization registered with the tax authority in accordance with paragraph 4.6 of Article 83 of this Code, a tax return for value added tax).

If, before the end of the desk tax audit of the value added tax tax return, the tax authority has identified signs indicating a possible violation of the legislation on taxes and fees, the head (deputy head) of the tax authority has the right to decide to extend the period for conducting the desk tax audit. The period for a desk tax audit may be extended to three months from the date of submission of the tax return for value added tax (with the exception of a desk tax audit of a tax return for value added tax submitted by a foreign organization registered with the tax authority in accordance with paragraph 4.6 of Article 83 of this Code).

3. If a desk tax audit reveals errors in the tax return (calculation) and (or) contradictions between the information contained in the submitted documents, or reveals inconsistencies between the information provided by the taxpayer and the information contained in the documents available to the tax authority and received by it in during tax control, the taxpayer is informed about this with the requirement to provide the necessary explanations within five days or make appropriate corrections within the prescribed period.

When conducting a desk tax audit on the basis of an updated tax return (calculation), in which the amount of tax payable to the budget system of the Russian Federation is reduced in comparison with a previously submitted tax return (calculation), the tax authority has the right to require the taxpayer to submit within five days necessary explanations justifying changes in the relevant indicators of the tax return (calculation).

When conducting a desk tax audit of a tax return (calculation) in which the amount of loss received in the corresponding reporting (tax) period is stated, the tax authority has the right to require the taxpayer to provide, within five days, the necessary explanations justifying the amount of the loss received.

Taxpayers who are obligated by this Code to submit a tax return for value added tax in electronic form, when conducting a desk tax audit of such a tax return, provide the explanations provided for by this paragraph in electronic form via telecommunication channels through an electronic document management operator in the format established federal executive body authorized for control and supervision in the field of taxes and fees. If the specified explanations are submitted on paper, such explanations are not considered submitted.

3.1. If a foreign organization subject to registration with the tax authority in accordance with paragraph 4.6 of Article 83 of this Code fails to submit a tax return for value added tax within the established period, the tax authority within 30 calendar days from the date of expiration of the established period for its submission sends a notification to such organization the need to submit such a tax return. The form and format of this notification are approved by the federal executive body authorized for control and supervision in the field of taxes and fees.

4. The taxpayer submits to the tax authority explanations regarding identified errors in the tax return (calculation), contradictions between the information contained in the submitted documents, changes in the relevant indicators in the submitted updated tax return (calculation), in which the amount of tax payable to the budget is reduced system of the Russian Federation, as well as the amount of the resulting loss, has the right to additionally submit to the tax authority extracts from tax and (or) accounting registers and (or) other documents confirming the accuracy of the data entered in the tax return (calculation).

5. The person conducting a desk tax audit is obliged to consider the explanations and documents submitted by the taxpayer. If, after considering the submitted explanations and documents, or in the absence of explanations from the taxpayer, the tax authority establishes the fact of committing a tax offense or other violation of the legislation on taxes and fees, officials of the tax authority are obliged to draw up an inspection report in the manner prescribed by Article 100 of this Code.

6. When conducting a desk tax audit, the tax authority has the right to demand that a taxpayer-organization or a taxpayer-individual entrepreneur provide, within five days, the necessary explanations about the transactions (property) for which tax benefits are applied, and (or) request, in the prescribed manner, from these taxpayers documents confirming their right to such tax benefits.

7. When conducting a desk tax audit, the tax authority does not have the right to request additional information and documents from the taxpayer, unless otherwise provided by this article or if the submission of such documents along with the tax return (calculation) is not provided for by this Code.

8. When submitting a tax return for value added tax, in which the right to a tax refund is declared, a desk tax audit is carried out taking into account the specifics provided for in this paragraph, on the basis of tax returns and documents submitted by the taxpayer in accordance with this Code.

The tax authority has the right to request from the taxpayer documents confirming, in accordance with Article 172 of this Code, the legality of applying tax deductions.

8.1. If inconsistencies are identified between information about transactions contained in the tax return for value added tax, or when information about transactions contained in the tax return for value added tax submitted by the taxpayer is identified, information about these transactions contained in the tax return for tax value added submitted to the tax authority by another taxpayer (another person who, in accordance with Chapter 21 of this Code, is charged with the obligation to submit a tax return for value added tax), or in the journal of received and issued invoices submitted to the tax body by a person who, in accordance with Chapter 21 of this Code, is entrusted with the corresponding responsibility, if such contradictions and inconsistencies indicate an underestimation of the amount of value added tax payable to the budget system of the Russian Federation, or an overestimation of the amount of value added tax, declared for reimbursement, the tax authority also has the right to request from the taxpayer invoices, primary and other documents related to these transactions.

8.2. When conducting a desk tax audit of a tax return (calculation) for corporate income tax, personal income tax of a participant in an investment partnership agreement, the tax authority has the right to request from him information about the period of his participation in such an agreement, about his share of profits (expenses, losses) ) investment partnership, as well as use any information about the activities of the investment partnership available to the tax authority.

8.3. When conducting a desk tax audit on the basis of an updated tax return (calculation) submitted after two years from the date established for filing a tax return (calculation) for the relevant tax for the corresponding reporting (tax) period, in which the amount of tax payable in budget system of the Russian Federation, or the amount of the received loss has been increased compared to the previously submitted tax return (calculation), the tax authority has the right to request from the taxpayer primary and other documents confirming changes in information in the relevant indicators of the tax return (calculation), and analytical tax accounting registers, on the basis of which the indicated indicators were formed before and after their changes.

8.4. When conducting a desk tax audit of an excise tax return in which the tax deductions provided for in Article 200 of this Code are claimed in connection with the return by the buyer to the taxpayer of previously sold excisable goods (except for alcohol and (or) excisable alcohol-containing products), the excise tax return submitted in connection with the return by the taxpayer - manufacturer of alcohol and (or) excisable alcohol-containing products of ethyl alcohol to the supplier - manufacturer of ethyl alcohol, an excise tax return reflecting tax deductions of excise tax amounts paid by the taxpayer when importing excisable goods into the territory of the Russian Federation, subsequently used as raw materials for the production of excisable goods, the tax authority has the right to request from the taxpayer primary and other documents confirming the return of excisable goods and the legality of applying the specified tax deductions, with the exception of documents previously submitted to the tax authorities on other grounds.

8.5. When conducting a desk tax audit of a tax return for value added tax, the tax authority has the right to request from a foreign organization registered in accordance with paragraph 4.6 of Article 83 of this Code documents (information) confirming that the place of provision of services specified in paragraph 1 of the article 174.2 of this Code, the territory of the Russian Federation is recognized, as well as other information (information) regarding such services.

8.6. When conducting a desk tax audit of the calculation of insurance premiums, the tax authority has the right to request, in the prescribed manner, from the payer of insurance premiums information and documents confirming the validity of reflecting amounts not subject to insurance premiums and the application of reduced insurance premium rates.

8.7. When conducting a desk tax audit of a tax return for value added tax, in which the tax deductions provided for in paragraph 4.1 of Article 171 of this Code are claimed, the tax authority has the right to request from the taxpayer documents confirming the legality of the application of the specified tax deductions, if inconsistencies are identified in those reflected in the tax return information about such tax deductions to information available to the tax authority.

8.8. When conducting a desk tax audit of a tax return for corporate income tax, in which an investment tax deduction is claimed, provided for in Article 286.1 of this Code, the tax authority has the right to require the taxpayer to provide, within five days, the necessary explanations regarding the application of the investment tax deduction, and (or) to request, in the prescribed manner, from the taxpayer primary and other documents confirming the legality of applying such a tax deduction.

9. When conducting a desk tax audit on taxes related to the use of natural resources, tax authorities have the right, in addition to the documents specified in paragraph 1 of this article, to request from the taxpayer other documents that are the basis for the calculation and payment of such taxes.

9.1. If, before the end of the desk tax audit, the taxpayer has submitted an updated tax return (calculation) in the manner prescribed by Article 81 of this Code, the desk tax audit of the previously submitted declaration (calculation) is terminated and a new desk tax audit begins on the basis of the updated tax return (calculation). . Termination of a desk tax audit means the termination of all actions of the tax authority in relation to a previously submitted tax return (calculation). In this case, the documents (information) received by the tax authority as part of a terminated desk tax audit may be used when carrying out tax control measures in relation to the taxpayer.

10. The rules provided for by this article also apply to payers of fees, payers of insurance premiums, tax agents, and other persons who are responsible for submitting a tax return (calculation), unless otherwise provided by this Code.

11. A desk tax audit of a consolidated group of taxpayers is carried out in the manner established by this article, on the basis of tax returns (calculations) and documents submitted by the responsible participant of this group, as well as other documents on the activities of this group available to the tax authority.

When conducting a desk tax audit for a consolidated group of taxpayers, the tax authority has the right to request from the responsible participant in this group copies of documents that must be submitted with the tax return for corporate income tax for the consolidated group of taxpayers in accordance with Chapter 25 of this Code, including those related to activities other members of the audited group.

The necessary explanations and documents for the consolidated group of taxpayers are submitted to the tax authority by the responsible participant in this group.

12. When conducting a desk tax audit of a tax return (calculation) submitted by a taxpayer - a participant in a regional investment project, for taxes in the calculation of which tax benefits provided for participants in regional investment projects by this Code and (or) the laws of the constituent entities of the Russian Federation were used, the tax the body has the right to request from such a taxpayer information and documents confirming the compliance of the indicators for the implementation of a regional investment project with the requirements for regional investment projects and (or) their participants established by this Code and (or) the laws of the relevant constituent entities of the Russian Federation.

13. A desk tax audit of the calculation of insurance premiums, which declares the costs of paying insurance coverage for compulsory social insurance in case of temporary disability and in connection with maternity, is carried out taking into account the provisions established by Chapter 34 of this Code.

The “clarification” submitted on the day of the inspection does not affect its results

On the last day of the audit, the organization filed an adjusted VAT return for the controlled period.

The inspectors did not reflect the fact that the “clarification” had been submitted in their decision.

The Federal Tax Service of the Russian Federation, having considered the taxpayer’s complaint, indicated the following: the “clarification” was sent at the time between drawing up the inspection report and issuing a decision on it.

The Tax Code of the Russian Federation does not provide for the development of such events.

Therefore, tax authorities independently determine the rules for considering the updated declaration:

- carrying out additional verification;

- "camera room";

- return visit to the organization.

Considering that the “clarification” reflected the amount accrued based on the results of the control, and the fact that it was not paid to the budget, the Federal Tax Service of the Russian Federation recognized the inspectors’ decision as fair.

What does the desk audit department do in the tax service?

As already noted, the main function of tax inspectors from the audit department is to analyze and study the financial reports of taxpayers. In addition, the list of responsibilities of department employees includes the following tasks:

- Reception and processing of documentation related to tax calculations and payments.

- Consideration of controversial issues arising in the process of calculating contributions and other payments.

- Initiating audits and sending requests to other tax authorities in order to obtain information about the taxpayer.

- Preparation of the legislative framework for competent registration of violations against unscrupulous citizens.

You can submit a “clarification” of profit even if the transaction is declared invalid

In 2015, the bank made a real estate sale transaction, which the court later declared invalid. In this regard, the credit institution filed an updated profit declaration for this period.

The Federal Tax Service expressed disagreement with the submitted declaration. However, due to the recognition of the transaction as invalid in accordance with clause 2 of Art. 167 of the Civil Code of the Russian Federation, the bank was obliged to reimburse the buyer for everything he paid. Consequently, the bank lost profit from the transaction.

The bank submitted a “clarification” on profits, since in accordance with Art. 81 of the Tax Code, a taxpayer has the right to submit corrected reporting if he made mistakes in the declaration that led to an overpayment of tax to the budget.

According to the Federal Tax Service of the Russian Federation, in this case the bank acted lawfully.

Letter of the Federal Tax Service of the Russian Federation dated November 28, 2017 No. SD-4-3/ [email protected]

Objects of inspections

Any commercial enterprises and legal entities that receive profit as a result of their activities may be subject to inspections by the office department. It is now quite common practice for only those organizations that are engaged in commercial activities to be inspected.

If necessary, tax inspectors from the office department can begin checking various religious and charitable organizations that do not make a profit.

As a rule, in most cases, only those enterprises and organizations that, in the course of their activities, have already had shortcomings in the matter of taxation are subject to inspection. Also often subject to inspections are those commercial organizations whose tax payments are much lower than payments made by enterprises of the same income level.

There should not be a fine for unformalized explanations of VAT returns

Desk audit of VAT payment has its own characteristics. Most companies submit electronic reporting for this tax.

As stated in paragraph 3 of Art. 33 of the Tax Code of the Russian Federation, explanations to the virtual declaration requested by the inspection must be sent only in electronic form via TKS in the approved format. Explanations on paper are not considered provided.

If the explanations or an updated declaration requested during the camera meeting are not submitted within 5 days, then a fine will follow under Art. 129.1 of the Tax Code of the Russian Federation in the amount of 5 thousand rubles, for a repeated offense in the same calendar year it will increase to 20 thousand rubles.

Recently, a higher tax authority considered a dispute regarding the payment of a 5,000 fine in favor of the company.

In March, she received a request to provide explanations for the VAT return for the third quarter of last year. The explanations were sent to the inspection on time according to the TKS, but in a regular letter, to which the primary documents were attached.

Tax officials considered the explanations not provided, since the company did not comply with the letter format approved by Order of the Federal Tax Service of the Russian Federation dated December 16, 2016 No. ММВ-7-15/ [email protected] For this, she was fined 5 thousand rubles.

A higher tax authority overturned the inspector's decision. Since Article 88 of the Tax Code of the Russian Federation does not provide any indication that non-formalized electronic explanations are not considered submitted.

And the article. 129.1 of the Code punishes only for their failure to submit, and not for violation of the electronic format.

Therefore, a company that sent explanations to the Federal Tax Service by a simple letter under the TKS cannot be held liable under Art. 129.1 Tax Code of the Russian Federation.

Decision of the Central Office of the Federal Tax Service of the Russian Federation dated September 13, 2017 No. SA-4-9/ [email protected]

Editor's note:

This decision will help organizations that find themselves in similar situations to avoid fines without going to court. It is enough to refer to it when the need arises.

Let us remind you that the requirement to provide explanations for the VAT return will be sent if tax authorities identify contradictions or inconsistencies between the information contained in the declaration of the taxpayer and his counterparty or in the journal of received and issued invoices. The request is accompanied by a list of transactions for which discrepancies have been identified.

The algorithm for filling out the explanations depends on the fact that there are errors in the declaration that led to an understatement of tax.

If such an error has crept in, you must submit a “clarification” (clause 1 of Article 81 of the Tax Code of the Russian Federation). Whether or not to attach explanations revealing the reason for the inaccuracies is up to the organization itself, since the Tax Code of the Russian Federation does not prohibit this option for presenting documents.

If the company is confident that the reporting is completed correctly, then this must be conveyed to the controllers in the explanations. For example, reveal the reason for the discrepancies between the “profitable” base and the VAT base (there could be transactions exempt from VAT) or the reason for the discrepancy between the purchase book data and the sales book of the counterparty (after reconciliation with it). If necessary, copies of primary documents can be attached to the explanations.

Inaccuracies found in the report that did not affect the calculation of tax or did not underestimate its payment do not lead to the need to submit an “adjustment”. This should be reflected in the explanations.

However, the last rule does not always work. A different procedure for clarifying calculations has been established for tax agents; details are in the next review.

The procedure for submitting “clarifications” is different if the tax is paid by a tax agent

Financiers recalled the special provision of paragraph 6 of Art. 81 of the Tax Code of the Russian Federation, which obliges tax agents, including VAT, to submit updated calculations in the following cases:

- the submitted reports do not reflect (incompletely reflect) any data;

- in case of overstatement or understatement of tax liabilities.

The Ministry of Finance of the Russian Federation clarified that the updated declaration must contain all those sections that were filled out in the primary reporting, even if there are no errors in them.

When compiling a “clarification”, corrections are made to previously completed sections. In this case, new sections are filled in, for example, section 2 “Amount of tax to be paid to the budget, according to the tax agent,” if it was not filled out by mistake in the initial declaration.

Sections that do not require corrections remain unchanged.

Letter of the Federal Tax Service of the Russian Federation dated January 11, 2017 No. AS-4-15/200.

Editor's note:

Thus, for tax agents it does not matter whether the payment is overestimated or underestimated; someone else’s tax must be recalculated in any case.

If the tax agent company detects distortions specified in the letter, the declaration must be clarified.

This also applies to calculations using Form 6-NDFL.

For example, if a March error was noticed at the end of the year after the calculations were submitted based on the results of 9 months, then three “clarifications” will have to be submitted: for the first quarter, half a year and 9 months. After all, section 1 of the form is filled out with a cumulative total, and such an error appears in all calculations submitted for the reporting periods (letter of the Federal Tax Service of the Russian Federation dated July 21, 2017 No. BS-4-11 / [email protected] ).

Distortions in calculations result in a fine of 500 rubles.

A five-day period for filing an updated declaration is established by the Tax Code of the Russian Federation only when issuing a tax demand (to clarify or clarify inconsistencies). In other cases, no deadline is specified. But it is better to submit it early, so that a mistake in underestimating the amount to be paid does not lead to a fine of 20 percent of the arrears (Article 122 of the Tax Code of the Russian Federation). After all, tax officials can be the first to find it, then punishment cannot be avoided.

Before submitting the “clarification”, you must pay the arrears and penalties (clause 4 of Article 81 of the Tax Code of the Russian Federation).