The trade margin indicator is used when setting prices for goods sold by retail enterprises. To record the amounts of trade margins, account 42 is used. In the article, we will talk about the procedure for forming the realized margin on goods and, using an example, we will consider the main accounting entries for account 42.

Features of using the $42$ “Trade Margin” account

Definition 1

Trade margin is part of the price of a product, applied in wholesale and retail trade. It is the added value to the purchase price of a product. Its purpose is to reimburse the costs of selling, receiving premiums, and paying part of the indirect taxes.

Trade discount is part of the retail price.

Using a $42$ account becomes advisable in automated retail trading. The introduction of such an accounting system makes it possible to simplify and make transparent the balance of goods, their sale and determine profit. This system also helps prevent abuse. Automation will also make it possible to introduce targeted storage, which will simplify the process of accepting goods, their display, tracking the expiration dates of goods, and keeping records of certificates of conformity. Until the implementation of the automated system, accounting is carried out in retail prices.

Finished works on a similar topic

- Course work Features of using account 42 “Trade margin” 440 rub.

- Abstract Features of using account 42 “Trade margin” 220 rub.

- Test work Features of using account 42 “Trade margin” 230 rub.

Receive completed work or specialist advice on your educational project Find out the cost

The main advantage of using the $42$ account is the storage and assignment of goods to the financially responsible person. With such accounting, you can daily remove intermediate balances of goods, which is convenient if a trading enterprise has many departments and a wide range of goods.

With all the positive aspects, there are also disadvantages. Namely, with such a system the accounting process becomes more complicated. Accounting entries become more complicated. It is also important to note that in retail trade prices may change frequently. Automation of the accounting process allows you to quickly change the price of a product; all that remains is the human factor - changing the price tags on the product in a timely manner in order to avoid conflict situations with customers.

Note 1

Any business transaction is reflected in the primary document; the trade margin will be reflected in the register of retail prices. This document determines the selling price. The price register must be approved by the head of the enterprise; such a register does not have a uniform form. It must be compiled for each invoice, daily.

Are you an expert in this subject area? We invite you to become the author of the Directory Working Conditions

Accounting entries used involving account 42

In the PBU you can familiarize yourself with typical transactions involving account 42. Let us present the main transactions on this account in the table:

| Debit accounts | Credit accounts | the name of the operation |

| 41 | 42 | Markup on inventory items received by the enterprise. |

| 44 | 42 | The amount of markup on goods for own consumption. Definitely written off. |

| 90.02 | 42 | A reversal of the amount of the trade margin or markup on goods sold. |

| 94 | 42 | Write-off of the markup amount on retired TMF. The reason is damage or shortage. Performed on the basis of a bookkeeping certificate or an inventory report. |

Do not forget that suppliers' prices for purchased goods may vary from invoice to invoice, but the sales price can be set for a long time.

Seller control scheme

- receipt of goods by quantity, acceptance of goods is noted in the invoice, certified by the signature of the materially responsible person.

- when prices change, the seller is given a register of retail prices and price tags for the goods;

- invoices are filed with the goods report and checked;

- The correctness of sales reflection is carried out by reconciling the amounts of the $Z$-report and the amount of the loaded $Z$-report into the automated system. Such an operation can be carried out automatically (a sales receipt is issued in an automated system and when the document is posted, a cash receipt is automatically printed);

- inventory is carried out.

Another advantage of keeping records using the $42$ account is tax accounting, which is carried out in purchase prices.

To switch to this system you must:

- change the accounting policy - perhaps once a year, accounting begins in the new year.

- if an enterprise operates with several stores, the accounting policy must reflect which divisions will use such a system.

Practical case

A certain enterprise purchased a batch of irons in the amount of 150 units. At the same time, the total purchase price was 329,300 rubles, the amount of VAT was 49,395 rubles. The commercial premium was determined to be 30%. When determining the size of the trade margin and the selling price of the goods, the company’s accountant made the following calculations:

- The size of the markup for the entire batch of products = ((329,300-49,395))*30%) = 83,972 rubles.

- Sales price of the entire lot = 329,300 – 49,395 + 83,972 = 363,877 rubles.

- Retail cost per unit of product = 363,877 / 150 = 2,426 rubles.

The following entries were made:

1) Dt 41

Kt 60 – RUB 279,905, accounting for the received consignment of goods;

2) Dt 19

Kt 60 – 49,395 rubles, accounting for the amount of VAT;

3) Dt 60

Kt 51 – RUB 329,300, transfer of funds for purchased goods;

4) Dt 68

Kt 19 – RUB 49,395, VAT deductible;

5) Dt 41

Kt 42 – 83,972 rubles, accounting for trade margins.

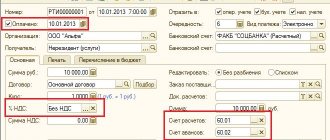

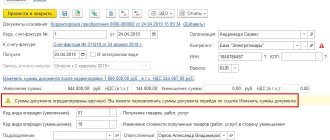

Organization of work with a $42$ account in the $1$С program

“Retail Sales Report” is intended to reflect sales transactions . By default, the program offers the cash register transaction type; you also need to specify the warehouse and cash flow item. The name of the product and its quantity must be indicated. The document automatically generates transactions:

- Dr $90.02.1$ – Cr $41.02$

- Dr $50.01$ – Cr $90.01.1$

- Dr $90.03$ – Kt $68.02$

Note 3

Although a document is used to generate a transaction for the receipt of funds at the cash desk, an entry in the cash book is not made, since it should be formed on the basis of “Cash receipt orders.” We have already completed course work

Expense cash order in more detail. To create the necessary entry, you need to create a document; it will no longer generate a posting, but the funds will go into the cash book.

Also, to organize accounting using this system, the program must reflect the necessary changes in the accounting policies and in the working chart of accounts.

Need help creating a study plan? Specify a topic and receive a response in 15 minutes get help

The meaning of the designated position in the Chart of Accounts

Position 42 of the Chart of Accounts is intended to summarize information about markups on the purchase price of products sold at retail enterprises that record them at their selling price.

For this item, records are also kept of those discounts that were provided by sellers to organizations engaged in retail commercial activities in case of possible product losses or reimbursement of additional transportation costs.

The credit part of the account reflects the amount of added value of goods accepted for accounting.

The amount of markdown or markup for those products that are sold, released or written off as a result of defective goods, their damage, insufficiency in the delivered volume, etc., is reversed, which is recorded in an accounting entry such as:

1) Dt 42

Kt 90.

Analytics for this position should allow for separate accounting of the size of discounts and mark-ups, and the difference in cost related to goods in retail commercial organizations, as well as to shipped goods.

What is the meaning of margin

When we think about the nature, about the economic content of the margin, we are surprised to recognize its paradoxical nature. If we proceed from the idea of a dynamic balance, then in margin accounting there is no account 42 “Trade margin” and there should not be.

This is due to the fact that the “Goods” account in both accounting options, as Χ and as Χ + Δ, demonstrates the asset as actually invested capital. These are, in essence, deferred expenses, because money and/or obligations to pay them are invested in values, expenses are capitalized, and there is no place in this concept for future income. However, if account 42 “Trade margin” is introduced into the chart of accounts, then it does not create a source of own funds, but can, as was customary in Soviet accounting, perform the function of a counter-active account. He only refines the valuation of goods, bringing it to the selling price.

Static balance is another matter. Products in it are initially shown at sales prices of the current reporting day.

And the balance sheet asset, as required by aifharez*, is treated not as deferred expenses, but as deferred income. And indeed, it is obvious that the assets, one way or another, will either be sold or will contribute to this sale, therefore, the entire asset will turn into money and will bring either profit or loss. Hence, account 42 “Trade margin” is a source of own funds, these are potential future profits, and not at all some kind of regulation.

In Soviet accounting, and many even now, understanding the balance in the light of a static concept, they use account 42 “Trade margin” as a regulator, and this in practice leads to big financial errors. The fact is that almost all accountants, financiers and administrators confuse the static balance sheet with the dynamic one, and when determining solvency, they use data on inventory without trade margins.

Note:

* Ifharez should be defined as the process of transferring the national accounting system to international standards. Read more about ifarez on the website /document.jsp?ID=1427.

If we are talking about a dynamic balance sheet, then there are reasons for this, but in terms of a static balance sheet this is incorrect and seriously worsens the financial performance of the company. There are cases where banks have refused a loan to good applicants on this basis. The former lost money and profits, the latter lost good clients.

At the same time, there is a huge danger here. To obtain a loan, it is very easy to carry out a fictitious revaluation of goods, artificially increase the credit turnover of account 42 “Trade margin” and ensure for yourself the required level of solvency. Some people, convinced that the bank’s people will not get into the general ledger, will perform this operation directly on the balance sheet.

But that’s why there are analysts in the bank, these “pike in the river so that the crucian carp don’t sleep.”

State regulation of pricing

Prices for certain products are controlled by the state. The government determines the acceptable price for certain goods that have special social significance. If a product is on the List of Price-Controlled Products, then their final cost, including markup, must be formed in accordance with current laws and regulations at the federal and local levels.

If there is a steady increase in prices for goods of social importance, the Government has the right to temporarily limit their maximum limit. But this can be done if the price increase level exceeds 30% over a 30-day period. The maximum permissible value of the cost of such goods, established by the Government, can be maintained for up to 90 days.

Socially significant goods include the following: meat, milk, sunflower oil and butter, flour, eggs, sugar, salt, bread, cereals, potatoes, some types of fruits and vegetables. In addition to food products, the list of goods for which control over selling prices can be established includes children's products, medicines, medical products, goods intended for sale in the Far North and regions equivalent to it.

If cases of overpricing are detected for goods regulated by states, the responsible persons and organizations will face fines. For management, fines of up to 50,000 rubles are provided, for legal entities - in the amount of twice the amount of revenue exceeded as a result of overstatement for the entire period of overstatement, but for a total duration of no more than a year.

What is this?

When we talk about markups, a lot becomes clear to us.

We bought goods and want to sell them. As a rule, if we are not thinking about a charity event, we want to sell it for more than we bought it for. And this is where accountants immediately encounter a problem: the employer bought valuables for Χ rubles. per unit, but wants to sell for Υ rub. At the same time, an accountant, what is Χ rub. knows, but about Υ rub. may not even guess. However, once the goods have been purchased and brought to the store, it means that they must arrive, but, one wonders, at a price of Χ rubles. or Υ rub. If the accountant is talking about Υ rub. doesn't know, then there is no problem. But this is only how it seems, because a new problem immediately arises: is it necessary to receive goods at a price of Χ rub. or should it be according to their entire cost, i.e. should we add, say, delivery costs (costs), i.e. according to the value Χ + Δ?

If at the purchase price, i.e. at Χ rub., then it is very easy, simple and understandable. Transport costs, or more correctly, distribution costs for the balance of goods (theoretically, they can include not only the costs of importing goods), should in this case be taken into account separately, not by the registration method, but by calculating the average percentage once per reporting period.

However, those who do not agree to take Δ into account separately usually, in justification, talk about great science: inventories (and incoming goods increase their value) must reflect the amount of capital invested by the owner, and he invests not only in the purchase price, but also in the entire their delivery, i.e., both to Χ and to Δ.

And in fact, it happens in life when Δ > Χ.

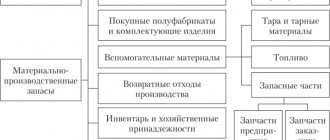

Typical transactions for account 41

In accordance with PBU, account 41 is an active accounting account, therefore, receipts of commodity assets will be reflected as a debit, and disposals as a credit. The movement of goods is reflected in correspondence with the accounting account of the company’s working plan of accounts, approved in the accounting policy. Let's look at typical postings for goods accounting:

- Debit 41 - Credit 60 - reflects the receipt of goods from the supplier. If an organization maintains separate accounting for a warehouse, then detailed account 41-01 will be used in the accounting records.

In addition to the purchase price of goods, an organization may also include in the accounting value of products purchased for sale some expenses associated with the acquisition of goods.

For example, the services of a third-party company for the delivery and unloading of goods to a warehouse. In this case, the wiring

- Debit 41 - Credit 15 - the cost of goods is formed through accounting account 15 “Procurement and acquisition of inventory items”.

In retail trade, the unit price of a product includes a trade margin. To form it, use the following entry:

- Debit 41 - Credit 42 “Trade margin”.

After the sale of goods, the trade margin is subject to write-off to account 90 “Sales” using the reversal method. Read more about this in the article “Revenue from the sale of goods is reflected: posting.”

Upon the sale of goods, a record is made of the write-off of the cost (accounting price) of material assets. Wiring:

- Debit 90 - Credit 41.

The write-off of shortages or damage to goods based on the results of an inventory carried out by the company must be reflected in the following entry:

- Debit 94 - Credit 41.

If errors are detected in accounting, special account 41-k “Adjustment of goods of the previous period” is used to correct them. This accounting account is used to make corrective entries after the closing of the reporting period.

Life

But in life there is not a single virtue without a flaw. This was once called dialectics (the struggle of opposites). If goods are taken into account at purchase prices, other important points disappear: 1) it is impossible to carry out automatic collation, i.e., reconciliation of written-off goods (merchandise report) with capitalized revenue (cash report). The presence of a single commodity and cash report deprives accounting of an important control point; 2) when using a computer, the cashier automatically records the fact that goods are written off exactly at sales prices. But, on the other hand, introducing a margin, a trading margin, into accounting allows you to reveal the potential expected profit.

The above points are of great importance and force accountants to think about what option for accounting for goods should be included in the order on accounting policies.

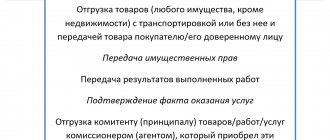

Commission sales of goods: postings, characteristics

The main feature of the sale of non-food products accepted for commission is that with the transfer of property, the rights to its ownership are retained by the principal. Relations between the parties are regulated by agreement.

For accounting purposes of products accepted for commission, account 004 is used. When goods are accepted for commission, the amount is reflected as a debit, and when written off, as a credit. The commission agent's remuneration is reflected by posting Dt 76 Kt 90.1.

Implementation and its recording in documents is an important component of accounting. Distortion of data will entail incorrect calculation of the tax base and incorrect assessment of financial results.