Author of the article: Sudakov A.P.

A checkbook is a booklet consisting of 25 or 50 check forms. It is received by the owner of an organization or individual entrepreneur after signing an agreement with the bank for cash settlement services. Based on the issued check, the counterparty has the opportunity to receive money in cash from the organization’s account, and this can be either the owner or a third party. In this article, we will look at how to fill out a checkbook correctly so that the bank does not have any claims and money is issued without delay.

Introduction

First, let's look at the meaning of the terms. A checkbook is a document of strict accountability that is linked to the bank account of an organization. With its help, you can make settlements with counterparties who will be able to cash checks at a bank or other financial institution. The book, which is valid in Russia, looks like a long notepad. A classic check is a rectangular sheet consisting of two parts: the main one (remains in the book) and a tear-off one. The detachable part is transferred to the counterparty and is used to provide it to the bank. The main part remains in the book and is confirmation that the operation was actually carried out. The owner of the book fills out two parts of the check, indicating the amount of the amount to be received. To get it, you need to contact the financial institution where you have a current account .

Standard view of a checkbook

Filling out a checkbook sample 2021

To write cash checks, you must obtain a book from the bank.

To do this, you will need to apply for a checkbook at the bank where you have an open current account.

After this, for a certain amount of money, the applicant will be given a checkbook, which will contain a certain number of checks, for example 60. From this moment, you can write cash checks and receive cash from them at the bank.

It is necessary to fill out a cash check very carefully and carefully, since this is a strict reporting form; corrections and errors cannot be made in it.

If an error was made during the execution of the check, it is considered invalid, and the form itself is crossed out and “cancelled” is written on it.

The book itself visually resembles a small oblong notebook. Each page is divided into two parts. These are checks, one of which is signed and handed over to the bank for subsequent issuance of the specified amount, and the second is a copy.

It is he who remains in the book and serves as a kind of document for reporting when funds are written off from the account. You can get a book by writing a corresponding application to the bank. How to fill out a checkbook? If there is no information about the seal, then the inscription “b/p” is recorded on the card.

Finance in cash arrives at the company's cash desk, as a result of which an order (KO-1) is issued for the amount of money, information about the PKO is recorded on the back of the spine.

Info Sample of filling out a cash check Filling out the front side of the form On the first page of the check, you should first fill out the counterfoil (on the left), which, as mentioned above, remains in the hands of the current account holder (in the checkbook).

Many banks, keeping up with the times, offer their clients to open a corporate card. This can be a personalized or impersonal plastic card equipped with a PIN code.

Quite often, enterprises using a corporate card make it available to the financially responsible person to pay for current purchases.

An employee making a payment using a corporate card must report to his company for each amount spent. Supporting documents in this case are strict reporting forms, cash receipts and sales receipts.

It is issued to a specific legal entity or individual entrepreneur; its use by third-party organizations or individuals without a notarized power of attorney from its holder is strictly prohibited.

The receipt is provided to the bank, and the counterfoil remains with the enterprise. In an organization, this type of security must be kept by the chief accountant and accounted for as an off-balance sheet account.

In Russia, unlike the United States, for example, checkbooks are used by organizations, not individual citizens. So, all checks of an organization or individual are stored in a checkbook.

To obtain such a book, you need to submit an application to the bank.

At the Sberbank office, with an application in hand, you pay for this service - either in cash at the cash desk or with a bank card at an ATM.

In this case, the servicing bank, as a rule, offers the individual entrepreneur to open a corporate card (such as is opened by organizations).

To obtain a book, the client contacts his bank with a corresponding application. It usually consists of 25 or 50 pages. Each page has a spine, which remains with the client, and the check itself, which is handed over to the bank.

Typically, a checkbook contains 25 or 50 pages, each of which consists of two parts: the check itself, which must be submitted to the bank, and the counterfoil, which remains with the organization. The cash checkbook is kept under lock and key by the chief accountant, and the counterfoils of paid and damaged checks (as well as the damaged checks themselves) must be kept by the drawer for at least three years.

How to make an application

To receive a book, you must come to the bank where you are served and write a standardized application. It contains the following data:

- Detailed information about the company you represent.

- The date on which the application for extradition is made.

- Your current account number to which it will be linked.

- An application for the issuance of a book, as well as an indication of the number of sheets in it (25 or 50).

- Full name of the person who issues the book.

- Signature of the head of the company or chief accountant.

What is a checkbook

A checkbook is a payment document that provides the right to have a certain amount of funds in a personal bank account and with their help to pay for any transactions using a check.

This payment document is issued on the basis of an application submitted to the bank branch by the account owner or his authorized representative. The cost of a checkbook is calculated depending on the number of checks in it. Each sheet is a check, which is an integral part of the book. A check is a security that has the right of the book holder to pay to third parties the required amount of money, entered in the designated column in the check.

Literally, the book looks like a small notebook with stapled forms. The number of checks in it is usually either 20 or 50.

An application for receiving a book is submitted based on form No. 896. Next, it is transferred to the bank branch in which the future owner of the book has already opened an account. Within ten banking days from the date of the application, it is signed by the director of the bank and its chief accountant.

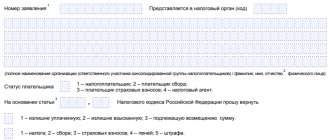

Basic nuances of filling

Let's look at the key rules for filling out a checkbook. Usually it is kept by the head of the organization or another responsible person. The book is filled out in the same handwriting, preferably in block letters. The form must be filled out completely, that is, both in the spine and in the tear-off part. Accordingly, both parts must be completely identical and filled with the same pen.

Attention:

Corrections to the document are not allowed. Information is indicated in the appropriate columns; their position cannot be changed.

You should also remember that it is unacceptable to extend beyond the graph fields, so be sure to calculate the length of the lines. The books have a special place for the signature of the issuing and receiving person, as well as a seal. If the organization does not have a seal, then it is necessary to indicate the full name of the organization (as it is indicated in the documents), as well as the full last name, first name and patronymic of the person who wrote the check. In general, there is nothing difficult to fill out. Just be careful, don't make mistakes and don't go beyond the edges of the frames.

The fields must be filled out strictly according to the rules. For example, after the phrase “Cash check issued to,” you need to indicate the amount of payment in numbers and words. Also be sure to indicate the date of signing the document (it is also written in words). All numbers are indicated with spaces double underlined. In the “issue” paragraph, you need to write the recipient’s initials in full, without abbreviations.

Nuances of filling

Since you already know what a checkbook is, we will consider a sample of filling out this document further for clarity. It is noteworthy that different banks may issue forms of different designs, but in general they are 80–90% the same. The only thing is that they may have slightly different markings or the phrases are constructed a little differently, but in general all checks look the same. Therefore, the principle of filling them is identical. We will look at a traditional design example that is most common.

Standard check type

A traditional form has a front and back side, a main part and a tear-off part, as well as a line along which the cut is made. The first step is to fill out the part that is transferred to the counterparty. In it you need to indicate the “to” section (the amount is entered in it in numbers). For example, for 50,000 rubles 50 kopecks. After 50,000, you need to put a double dash to the end of the section so that extra numbers cannot be entered into it. Next, enter the name of the counterparty to whom the check is issued, and the full amount in words in the appropriate section. Then the signature of the person who issues the document, the date of issuance of the check and the signature of the person who receives the amount are placed.

After filling out the tear-off coupon, you need to enter the relevant data into the main part of the document. It includes:

- The name of the company that writes the check.

- Current account number at a bank or other financial institution.

- The amount transferred to the counterparty (in numbers).

- The place where the check is issued (name of the locality).

- The date on which the document is completed.

- The name of the bank that should cash the check, as well as the corporate account number.

- Last name, first name and patronymic (without abbreviations) of the person who should receive the funds.

- Payment amount (in words).

- Signature of the person filling out the document.

Filling out a checkbook

Info

Sample of filling out a cash check Filling out the front side of the form On the first page of the check, you should first fill out the counterfoil (on the left), which, as mentioned above, remains in the hands of the current account holder (in the checkbook). This includes:

- amount (in numbers and up to kopecks),

- date of receipt (day, month (in words), year),

- surname and initials of the person who receives the money.

Employees of the banking institution sign in the lines under the word “Signatures”.

Below is the date of receipt of the check and the signature of the recipient. The left side of the form, after filling out, is sent to the bank.

Rules for filling out the reverse part

We have already explained what a checkbook is and how the front side of the document is filled out. But it also has a downside. It presents a table into which certain data is also entered. It must indicate for what purposes the funds are allocated (for example, payment of wages for 2021 or the purchase of equipment under a contract) and the amount of the allocated amount.

Separately on the plate you need to put the signature of the issuing and receiving person, as well as the name of the document that is provided for issuing funds. In this title you need to indicate the check number, its series, the date of issue and the place where the money was received. After this, the controller, accountant and cashier sign the paper. On the tear-off coupon you should indicate the number of the order that will be posted, as well as the date on which the payment operation is carried out.

Attention:

Checkbooks from different financial institutions may vary slightly. But, having mastered the filling rules using our examples, you will be able to fill out other documents.

The location of the points usually changes. For example, the amount in words may appear first, and then the name of the counterparty to whom the loan is issued, or perhaps it’s the other way around. Accordingly, the location of the tear-off coupon may also change, as well as the information on the back of the document.

Standard check type

Sample of filling out the spine

Design options

Finally, let's look at an example of filling out a checkbook, which is produced by the largest bank in Russia - Sberbank. It serves almost 85% of LLCs and individual entrepreneurs in the country that have current accounts for working with clients. Sberbank's checkbook is considered a model for other companies. It also consists of 25 or 50 sheets, it has two sides (back and front) and a tear-off slip. In order for the document to be valid and accepted without problems at the financial institution, you must complete all sections.

First, the name of the company (IE or LLC) is entered on the check, then the company's current account is entered. Next, enter the check number (in order) and the amount of payment in numerical form. The last to be filled in is the date of signing the document and the territorial location (name of the locality). After the basic data, you need to write down the name of the financial organization (in our case, Sberbank), and then the last name, first name and patronymic of the person to whom the loan will be issued. Then you need to put a signature and seal, provided that the organization has one.

Attention:

Officially, the check does not have an “expiration date,” but in most cases it is recommended to cash it no later than 10 calendar days after issue. If you delay, the financial institution may refuse payments or request confirmation.

As you can see, there is nothing complicated in the rules. You just need to carefully enter the information and make sure there are no errors. You can fill in the basic details regarding your company, check number and financial institution in advance to avoid wasting time in the future. Then you just need to enter the amount in numbers and words, as well as the recipient’s full name.

How to fill out a checkbook

How to use the book correctly The checkbook contains several dozen absolutely identical cash receipts. If it is necessary to withdraw cash, an employee of the organization must fill out a check. At the same time, you cannot leave the forms blank - they should be filled out strictly in the order located in the book.

Basic information can be entered into the check both at the company’s office and at the bank itself. The check must be signed and stamped only in the presence of a bank specialist, who will check them with samples of the signature and seal of the company representative at his disposal (the use of facsimile signatures is prohibited). If the autograph does not match one to one or the seal imprint is not very clear, you will have to fill out a new check and sign and stamp again.