Many enterprises in which labor results are assessed based on product output use a piece-rate wage system. At the same time, workers have an incentive to be more productive, since their earnings directly depend on meeting and exceeding production standards. Recording time worked in this case is the same mandatory procedure as with the time-based system. It allows you to comply with labor laws and adjust prices.

Is it necessary to issue an order?

The need to fulfill or exceed the production plan does not always fit into the framework of working hours. In this case, there is a need to organize work beyond the normal duration of the shift, but overtime work according to the Labor Code of the Russian Federation has restrictions on attracting personnel to work outside the limits of the normal working day. In addition to its own restrictions established by Article 99 of the Labor Code of the Russian Federation, involvement in such work requires additional payment for overtime hours, which is established by Article 152 of the Labor Code of the Russian Federation.

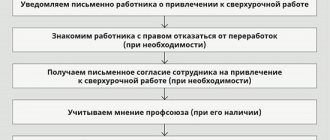

The Labor Code of the Russian Federation does not indicate that registration of overtime work requires the issuance of a separate order from the manager. The main requirement is the employee’s written consent to work beyond the norm.

An exception is the cases listed in Part 3 of Art. 99 Labor Code of the Russian Federation. The employee’s consent may not be asked if:

- there is a need to prevent an accident or natural disaster;

- engage an employee to eliminate a breakdown that interferes with the enterprise’s water supply, lighting, communications, transport and other communications;

- An emergency arose, martial law was introduced, etc.

Despite the fact that in the above cases the employee’s written consent to overtime work is not necessary, overtime must be formalized and paid for.

For payment, overtime time in the time sheet is indicated by the code “C” or “04”. The basis for paying overtime hours is the timesheet.

The following categories of employees have the right to refuse overtime work:

- disabled people;

- women raising children under three years of age;

- a parent raising a child under five years of age alone;

- citizens raising disabled children;

- employees caring for a sick relative.

Such employees must be informed in writing of the possibility of refusing overtime work. This information can be indicated in the order. Managers of organizations should be aware that it is prohibited to involve pregnant employees and minors in extracurricular work.

How much and how are overtime hours paid?

Organizational managers are often interested in how much to pay for overtime worked by an employee? For greater clarity, we have placed a table:

| Period of extracurricular work | Overtime pay |

| First 2 hours | Must be paid at least one and a half times the amount |

| Subsequent hours | At least double the size |

The amount of payment for overtime work indicated in the table is considered minimal, that is, the employer does not have the right to pay less. But the amount of payment for work above the norm can be increased by the head of the enterprise. Information about this should be indicated in the company’s local act or employment contract with the employee.

If the employee does not mind, the organization can compensate him for the time worked above the norm, not in cash, but with additional days off. The duration of the non-working period cannot be less than the time spent on work. But such overtime work is paid at a single rate.

If processing is the employee’s own initiative, then such work is not extracurricular and is not paid.

Legal restrictions

Information about overtime work should not be indicated in the employment contract concluded with the employee. HR employees, in turn, must keep records of their overtime hours. Usually they add up the number of hours at the end of the accounting period and subtract the time provided for by the work schedule from the resulting number. The difference in amounts is the calculation of overtime work.

The duration of overtime work is limited by law. For exceeding established legal norms, not only the organization, but also its leaders can be punished. Thus, the Labor Code establishes the total duration of the working regime - no more than 40 hours per week, that is, 8 hours per day. And the duration of processing should not exceed 4 hours for two days in a row. If we consider the period of possible processing per year - no more than 120 hours. In addition, pregnant women, employees with small children, minor workers, disabled people, and workers on the basis of an apprenticeship contract will not be able to work overtime.

Moreover, with a shift schedule, working two shifts in a row is prohibited. Employees who work irregular hours will not be able to claim overtime pay at all. But they have the opportunity to claim a bonus for working hours.

What methods of recording working hours exist?

Choosing a method for recording working time is a concern for managers. Much in this matter depends on the scope of the organization. The chosen type of accounting must be specified by the director of the company in the internal regulations. The following types of accounting are distinguished:

- daily;

- Monday;

- summarized.

With summarized accounting, there may be a deviation in the duration of working hours during the day, week or month. The main requirement: at the end of the accounting period, the employee must have worked a number of hours in accordance with the approved norm.

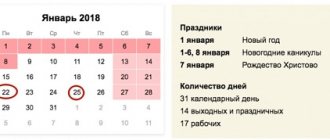

The standard working day is 8 hours. With a five-day working week, the working time limit reaches 40 hours. But there are exceptions. If a person works a shift, his working day can last 12 hours. For some categories of employees, a shortened working day may be established. In this case, their working week is 24-36 hours. You can find out how much time a worker with a normal or reduced working day must work per month, quarter and year using the production calendar. Using a regular calculator, it will not be difficult to calculate recycling.

In the case of daily accounting, overtime or shortfalls are recorded within one day. Labor payment is calculated for each day of processing separately. And overtime (payment) is given at the end of the month.

Overtime pay: example

Let's look at a specific example of how to calculate overtime (2019). Manager Barulin V.M. worked 3 hours after hours on 03/03/2019 and 4 hours on 03/10/2019. His hourly earnings are 140 rubles. The first two hours of each overtime must be paid at one and a half times the rate. The rest of the time is double time. The amount will be:

March 3 = (140 rub. × 1.5 × 2 hours) (140 rub. × 2 × 1 hour) = 700 rub.

March 10 = (140 rubles × 1.5 × 2 hours) (140 rubles × 2 × 2 hours) = 980 rubles.

Barulin V.M. 1680 rubles will be credited. for extra work.

When recording working hours in aggregate, overtime work (payment) should be assessed as follows: time worked outside of normal hours is calculated based on the results of the accounting period. The first two hours of work are paid at least time and a half. The rest of the time is double time.

Calculation of overtime when working in shifts

In order to calculate the amount of additional payment for overtime during a shift change, it is first necessary to determine the number of hours worked in excess of the norm.

With the weekly accounting method, identifying hours worked in excess of the norm is quite simple. You just need to know the maximum standard for the duration of a working week for a specific employee, established by law. All hours worked above this limit will be overtime.

If the company uses cumulative accounting of work time, then in order to determine the duration of overtime it will be necessary to calculate the time worked cumulatively for the entire accounting period. This point is fundamentally important, since excessively worked hours that go beyond the norm established by law are considered overtime only at the end of the reporting period.

Free legal consultation We will answer your question in 5 minutes!

Ask a Question

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

For example, if in a company, for employees working in shifts, time worked is calculated using the cumulative accounting method using a quarterly reporting period, with a standard 40-hour work week, the normal length of work time in the 3rd quarter of 2021 will be as follows:

- July - 168 hours;

- August - 184 hours;

- September - 176 hours;

- total - 528 hours.

This is also important to know:

What is unemployment benefit and how to get it

Let's say an employee worked:

- in July - 160 hours;

- in August - 186 hours;

- in September - 186 hours;

- in total for the 3rd quarter - 532 hours.

Thus, the overtime duration for the 3rd quarter of 2021 for this employee is 532 − 528 = 4 hours. It is these 4 hours that should be compensated to the employee as overtime worked.

How is overtime paid on a salary basis?

In Art. 152 of the Labor Code of the Russian Federation there is no information about what amount should be taken into account. Therefore, many employers are wondering whether to take into account only salary or average income along with bonuses and allowances. When calculating overtime, managers often take double the tariff as a minimum. Incentive and compensation payments are not taken into account. Overtime work is paid inclusive of bonus payments only if the employer has established such a procedure.

If such a procedure is not established, then the cost of an hour is equal to the salary divided by the number of standard hours in the accounting month according to the production calendar. If the period of summarized accounting is more than one month, it is necessary to determine the average cost of an hour for the entire period (for example, salary income for a quarter divided by the standard time for the specified quarter). Overtime calculations must be made from the resulting cost per hour.

Judges' opinion

However, the official position of the ministry on the issue of payment for overtime hours during a shift work schedule did not receive support from judges. On the contrary, judges of the Supreme Court of the Russian Federation characterized the algorithm proposed by officials as discriminatory in relation to “day laborers”.

According to the arbitrators, the additional payment for overtime must be calculated at one and a half times the first two hours, falling on average for each working day of the accounting period, and the remaining hours of “overtime” must be paid at double.

However, at present it is not safe to be guided by the position of the Supreme Court, although it is more beneficial for the employer. The fact is that the judges’ conclusions are based on the calculation procedure approved in clause 5.5 of the resolution of the USSR State Committee for Labor No. 162, All-Union Central Council of Trade Unions No. 12-55 dated 05.30.1985, and it became invalid in 2021 (order of the Russian Ministry of Labor dated 05.10.2017 No. 415 ). This means that links to this document have lost their relevance.

Thus, in order to avoid labor disputes with employees, it is better to pay for overtime hours during a shift work schedule, guided by the explanations of officials of the regulatory agency.

What are the rules for paying overtime on a shift schedule?

Let's look at how overtime is paid during a shift work schedule. If a worker works in shifts, his salary can be calculated using both hourly tariff rates and on a salary basis.

In the first case, overtime is calculated as follows: the number of hours worked during a certain period is multiplied by the established rate.

If the organization uses a salary system, then every month the employee is transferred the same amount of remuneration.

Accounting documents for payment of piecework work

When using a piecework payment system, accounting is carried out using documents that reflect not the hours worked, but the results of the task.

Documents for calculating the basic salary

These include:

- Report on production and acceptance of work. It is compiled in production facilities with conveyor lines. Workers either perform different operations, sequentially assembling the finished product, or perform the same work to produce identical products. To pay for labor, personal or team production of products or technological operations performed is registered;

- Route map (sheet). The document is created in serial production, in which the creation of a finished product from a set of parts requires a series of operations in a strictly defined sequence. A technological route (map, schedule) for the assembly is drawn up. It provides the possibility of additional processing of individual parts (route branching and creation of auxiliary routes). The results of the work are judged by the features of such sheets, since they reflect information about the reception of work at each stage.

- The route sheet and acceptance report are used at the end of the reporting period to pay for labor based on the results of individual operations and receipt of target products;

- Work orders for piecework work. They are used to pay workers who carry out individual orders and provide repair services. Such documents help pay workers in small-scale production.

When issuing a task, the standard time for its completion and the total amount of work are specified. The work order is issued before technological operations are carried out. It is drawn up in accordance with the work plan, route map and technical documentation.

Such documents are issued for the performance of individual tasks or work that requires a certain amount of time.

Both individual and collective work orders for piece work are drawn up.

During the execution of a task, it may be necessary to draw up intermediate work orders for specific technological operations (welding, testing, manufacturing of auxiliary parts). Payment for labor is carried out according to the final result using appropriate rates.

How is overtime pay for piece workers calculated?

Citizens who work piecework are paid for each part produced. Overtime pay for piece workers depends on how many parts they produce outside of normal working hours, as well as on the length of overtime work. Cash is paid without taking into account one and a half or double premium.

Example: Kurochkina A.N. works at the factory. She works piecework. For each part made, she is paid 400 rubles. On 03/09/2019 she worked 4 hours outside of school hours, producing 5 parts during this time: 2 pcs. - for the first 2 hours and 3 pcs. — for the remaining 2 hours. Payment depends on the number of parts produced and on the time worked above the norm. Therefore the calculation is:

(400 rub. × 1.5 × 2 pcs.) (400 rub. × 2 × 3 pcs.) = 1200 rub. 2400 rub. = 3600 rub.

Sources:

- https://znaybiz.ru/kadry/rezhim/rabochee-vremya/sverxurochnye-chasy.html

- https://zakonguru.com/trudovoe/oplata/zarplata/pri-smennom-grafike-raboty.html

- https://glavkniga.ru/situations/k502311

- https://spmag.ru/articles/pererabotka-pri-smennom-grafike-raboty

- https://azbukaprav.com/trudovoe-pravo/zarplata/sverhurochnaya/oplata-pri-smennom-grafike.html

- https://trudinsp.ru/oplata-sverhurochnyh-pri-smennom-grafike.html

- https://bukvaprava.ru/2018/05/23/kak-proizvoditsya-oplata-sverhurochnyh-chasov-pri-smennom-grafike-raboty/

- https://nsovetnik.ru/grafik_i_uchet_rabochego_vremeni/oplata_pererabotki_pri_smennom_grafike_raboty/

- https://clubtk.ru/vse-pro-oplatu-sverkhurochnykh-v-2017-godu

- https://blogkadrovika.ru/oplata-sverh-raboty-pri-smen-graf/

- https://spmag.ru/articles/oplata-sverhurochnoy-raboty-po-tk-rf-2018

- https://classomsk.com/zashhita-prav-rabotnika-i-rabotodatelya/kak-proizvoditsya-oplata-pererabotki-po-trudovomu-kodeksu.html

Subscribe to the latest news