How to calculate average earnings for piecework wages

hello, I work in a mail processing shop as a sorter, we have introduced piecework payment, the price is a penny, we do not produce anything, we just process mail and send it, how will the payment be calculated from scratch or from the minimum wage, we calculated that the salary will be about 1500, is this correct

Hello!

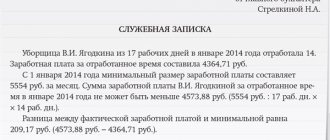

Even in the case of piecework wages, it is necessary to standardize the working day. If an employee has fully worked his monthly quota (at least 40 hours a week), but taking into account all additional payments, allowances, incentives and compensation payments, his salary does not even reach the level of the minimum wage, then he must be paid exactly the minimum wage. If the number of working hours per week is below the norm (for example, you work only 15 hours a week), then wages may be lower than the current minimum wage level in the region.

How to calculate average earnings for piecework wages

The piece rate is calculated as the quotient of dividing the daily (hourly) tariff rate of the i-th category by the daily (hourly) production rate, expressed in certain units of measurement. Рсд=Тсi/Нвр. (18.5) where Nvyr is the production rate per day, (hour).

With time-based wages, wages are paid depending on the time worked and the qualifications of the employee. With piecework wages, wages depend on the quantity of products produced. Remuneration does not depend on the type of enterprise and is made in accordance with the Labor Code of the Russian Federation. In state-owned enterprises, the remuneration system is established by the state. How to calculate wages for piecework wages - the calculation is made based on the piecework rates established for the product and the number of processed products.

Directory of types of work

Let's calculate the amount of piecework payment, taking into account the cost of the work performed, in “Settings - Types of work”.

Fig. 10 Directory of types of work performed

Here you can combine views into groups - arrange them into folders, for which you click the corresponding button and indicate the name of our group. For example, let’s create groups for work performed by a car service center – “Repair (domestic cars)” and “Repair (foreign cars)”.

Fig. 11 Creating groups by type of work

Fill out the directory with types of work via “Create”. For each element, indicate the name, price, and from what date it is entered. Set accounting settings if different from the preset settings.

Fig. 12 Element card

We are grouping.

Fig. 13 Completed reference book

On our website you can also find information about hourly wages in 1C 8.3 ZUP.

Algorithm for calculating piecework wages with formulas and examples

The piecework form of wage calculation is used where the specifics of economic activity make it possible to determine the relationship between an employee’s salary and the volume of work performed (services provided) or the volume of products produced by him.

- piecework pricing carried out for a specific type of work based on a price rate corresponding to the category of work (not to be confused with the category of the employee);

- the norm of produced products, which is an indicator of the fulfillment of approved norms for a specific unit of time.

- time standard indicating the established time period during which a unit of product is manufactured (work, services). To accurately determine time parameters, the timing method is used. Using this method, the time spent on movements and actions during production operations is determined.

Setting up piecework documentation

In the “Settings” directory we will find a template for entering parameters for displaying piecework payments.

Fig. 14 Working according to the template

Finding “Piecework”

Fig.15 Changing the template

The work types tab has the following settings:

- fill out types of work in advance/in the document;

- summarized or broken down by day;

- separately by employee or use distribution according to the list (KTU).

Fig.16 Setting up a data entry template

Let's set up 1C:ZUP for the correct calculation of piecework payments

It is better to configure the settings before entering documents. If there are entered documents where the work is already reflected separately for each employee, when you try to save the “Distributed according to the list of employees” setting, when using KTU, 1C:ZUP will not allow you to close the setting and will report that there are already entered documents.

How to calculate piecework wages: formula, examples

The incentive system must be comprehensive. It is built in accordance with employee motivation factors, their needs and expectations. The use of motivation tools allows the company to reduce staff turnover and increase labor productivity.

- the minimum guarantees that an employer is obliged to provide to an employee;

- tariff agreements of trade unions (or other workers' organizations) representing the interests of workers with employers' unions (at the level of guarantees secured by work results);

- collective agreements between employers and trade unions (at the level of guarantees that a particular employer can afford);

- according to tax laws.

How to calculate average earnings for piecework wages

Guarantees for employees (payment of annual leave; for the period of performance of public duties; those sent for advanced training, for examination at a medical institution; for those transferred for health reasons to an easier, lower-paid job; for those temporarily transferred to another job due to production needs; for pregnant women and women with children under three years of age transferred to easier work; in various forms of industrial training, retraining or training in other specialties; for donors, etc.), as well as guarantees and compensation for employees in case of moving to work in other locality, business trips, work in the field, etc. are established by the Labor Code of Ukraine and other acts of Ukrainian legislation. Chapter VIII of the Labor Code provides the following guarantees to employees released from work as a result of their election to elective positions in government bodies, party, trade union and other public organizations: after the end of their powers in an elective position, they are provided with their previous work, and in its absence - other equivalent work at the same or, with the consent of the employee, at another enterprise, institution, organization (Art.

We recommend reading: Where to register a child

Partial defects due to the fault of the employee are paid depending on the degree of suitability of the product at reduced rates. 5. An employee’s work is paid according to its quantity and quality. However, in practice, cases arise when an employee is distracted from performing his job duties and then a reduction in his pay is possible.

Topic: Calculation of vacation pay for piecework wages

Good night! Please tell me how vacation pay is paid for piecework? those. There is an installer who is paid, for example, 1000 rubles for each visit. in a month he made 15 trips and earned 15,000 rubles. but at the same time he was on vacation this month and was paid vacation pay in the amount of 3,000 rubles. and so I think, because... he is on a deal (i.e. he received exactly as much as he earned), then at the end of the month he gets 12,000 in salary? (15000-3000). or are vacation pay paid in the same way as to salaried employees?

The average daily earnings for payment of vacations granted in working days, in cases provided for by this Code, as well as for payment of compensation for unused vacations, are determined by dividing the amount of accrued wages by the number of working days according to the calendar of a six-day working week.

What is said about employee salaries in the labor legislation of the Russian Federation?

So, according to the Labor Code of the Russian Federation, wages (wages) are the employee’s remuneration for his work, in other words, this is the cost of the enterprise’s labor resources. Article 129 of the Labor Code of the Russian Federation states that the totality of components - the qualifications of an organization's employee, the complexity and volume of his work, the quality and working conditions - determine the level of remuneration of the employee. Labor legislation includes incentive and compensation payments as components of wages, as well as payment of wages for time not worked.

What applies to compensation payments? The following types of compensation exist:

- for unused vacation upon dismissal;

- for main, additional and study leave;

- for severance pay upon dismissal.

Payroll calculation under the piecework wage system

A simple piece-rate system involves payment for the quantity of products produced (the volume of work or services performed) based on the piece-rate rates accepted by the company. Such prices are determined per unit of product of one type or another.

According to paragraphs 1 and 4 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated October 12, 2006 No. 53 “On the assessment by arbitration courts of the validity of the taxpayer’s receipt of a tax benefit,” the taxpayer’s submission to the tax authority of all properly executed documents provided for by the legislation on taxes and fees in order to obtain tax benefit is the basis for receiving it, unless the tax authority proves that the information, from September 11, 2013

Reflection of piecework earnings in regulated accounting

A piece work order, unlike all other primary documents of the system, does not require auxiliary operations to generate entries for accounting and tax accounting (to reflect other accruals in accounting, it is necessary to generate the document “Reflection of wages in regulated accounting” at the end of the month). The amount of earnings of each employee will be distributed among the cost accounts indicated on the “Completed Work” tab in proportion to the amount for each technological operation.

Piecework wages when calculating average earnings

Specialists from the Perm regional branch of the FSS of Russia reminded that when calculating average earnings, on the basis of which benefits for temporary disability are calculated, all types of payments and other remunerations in favor of the employee are taken into account, which are included in the base for calculating insurance contributions to the FSS of Russia (Part 2 of Art. 14 Federal Law of December 29, 2006 No. 255-FZ).

In accordance with Part 1 of Article 7 of the Federal Law of July 24, 2009 No. 212-FZ, the object of taxation of insurance premiums for organizations are payments and other remunerations accrued by them in favor of individuals within the framework of labor relations. Thus, these payments should be included in the calculation of average earnings when calculating temporary disability benefits, since they are accrued in favor of the employee within the framework of the employment relationship.

How to maintain and store

From 01/01/2013 it is permissible to use a free form of work order for piece work. But it’s better to focus on 414-APK. It provides the most comprehensive information to facilitate salary calculations.

Your own form will have to be approved separately and fixed in the accounting policies of the organization. If necessary, you can create forms for individual tasks, not just group ones.

When the work order is completely completed, it is transferred to the accounting department. Based on this document, salaries of team members are calculated. Amounts are transferred to pay slips.

Since the work order is a primary salary document, its storage period is appropriate. According to Article 29 of Federal Law No. 402-FZ of December 6, 2011, it cannot be less than five years, starting from the year following the reporting year.

A) Examples of calculating wages for workers using time-based and piece-rate wage systems

A time worker of the 6th category worked 168 hours in a month and produced 20% more products than normal. The hourly wage rate for this worker is set at 54.5 rubles. The organization has a Regulation on Bonuses, according to which for exceeding the norm, a monthly bonus is paid in proportion to exceeding the norm. Determine the worker's monthly earnings.

A piecework worker of the 6th category fulfilled production standards - he processed 300 products. At the same time, he saved 20,000 rubles in materials. The piece rate is set at 27.5 rubles. The regulations on wages establish that a bonus of 20% of the amount saved is paid for saving materials. Calculate the worker's wages.

We recommend reading: Housing Privatization Agency

How to calculate wages using a piece-rate wage system in 2021

Example 3. A piece-rate progressive wage system has been established. For the production of one part, an employee earns 2 rubles/piece. The production rate has been set at 10 thousand parts per month. Each part that is manufactured in excess of the specified norm costs 3 rubles/piece.

To calculate wages under a piece-rate wage system, in addition to the salary, the employee receives a bonus, and the procedure for calculating wages under a piece-rate wage system is similar to the procedure for calculating wages under a direct piece-rate wage system; a distinctive feature is the presence of a bonus as part of the employee’s salary. This remuneration system motivates employees to create quality products.

Average earnings for business trips with piecework wages ->

First of all, it should be noted that the procedure for calculating average earnings for paying for business trip time differs from calculating vacation pay. To do this, use the following formula: SZ = ZP: OD × RD,

where SZ is the average salary saved for the duration of the business trip; Salary – the amount of accruals to the employee for the billing period, taken into account in the calculation (the billing period is considered to be the period of 12 calendar months preceding the start date of the business trip); OD – the number of days actually worked in the billing period; RD – number of working days to be paid. As you can see, it is the working days that fall during the business trip that are paid, and not the calendar days, as when calculating vacation pay. Accordingly, there is no need to recalculate calendar days for those months that have not been fully worked out. Otherwise, the calculation rules are identical to those used when calculating vacation pay. That is, in the same way, periods when the employee did not actually work, but retained his place of work, are excluded from the calculation period (clause 5 of Regulation No. 922). This is, for example, vacations of all kinds, as well as sick time. And besides, among other things, the time of past business trips is excluded from the billing period. Of course, paragraph 9 of the Regulations states that in order to calculate the average daily earnings, the amount of wages actually accrued for the billing period must be divided by the number of days actually worked during this period. But during a business trip, unlike vacation or sick time, the employee still performs his job duties. At first glance, a contradiction arises. But only at first glance. The fact is that when calculating average earnings, the amount of average earnings that was previously retained by the employee and fell into the billing period should not be taken into account. And this is a general rule, enshrined in paragraph 5 of the Regulations. At the same time, paragraph 9 of the Regulations does not establish any special rules. It refers to days worked as those days that were paid to the employee in the usual manner, that is, based on salary. At the same time, the business trip period is paid based on average earnings. But there are no differences in the calculation of earnings included in the calculation. This also applies to indexation rules (if wages increased in the billing period) and accounting for bonuses.

Good afternoon, dear forum users! The company sends workers on business trips to work on site. The workers are given an hourly wage rate and a piecework wage system is also used, i.e. on the volume of work performed. Work on a business trip is paid according to average earnings. Question: is it correct to calculate average earnings based on payment for actual time worked (minus business travel days) and the share of piecework wages attributable to time worked, i.e. Is the part of the piecework payment attributable to business trip days included in the time excluded from the calculation of average earnings? Thanks in advance.

Making a piecework outfit

A piece work order is a system document that allows you to reflect a list of works and performers of these works, as well as distribute the amount for the work among the performers. A piecework order can be issued either once - based on the results of the billing period, or according to primary documents issued at production.

For example, if an employee has been making identical parts all month, you can issue one work order, where you indicate one technological operation “Production of parts”, and as the quantity - the number of parts made per month.

The “Performed Work” tab of the document contains a list of operations performed by an employee or team. If, when creating the “Technological Operations” directory, the price and information for accounting and tax accounting were indicated for each operation in the list, they will automatically fill in the corresponding columns of the document.

With the lump sum form of remuneration, you can specify one technological operation, a quantity equal to one, and manually enter the required amount for payment.

If the work was carried out at prices different from those accepted by the basic ones, they can be adjusted manually. In particular, with piecework-progressive wages, it is possible to indicate the same technological operation twice in a piecework order, but with different prices: for work within the limits of the production norm (basic price) and for work above the norm (adjusted).

The “Performers” tab indicates the employee or list of employees who performed the stated technological operations. In the “Start Date” column you need to indicate the date the work was completed. If the execution of work on a work order lasted more than one day, you can set the “Period is entered in two dates” flag and in the “Complete date” column that appears, indicate the completion date of the work.

If an employee was fired before work on a long-term (for example, ten-day) assignment was completed, then for this employee it is necessary to set the end date of the assignment equal to the date of dismissal, otherwise the system will not take the piecework assignment into account in the final earnings. To correctly distribute earnings within the team (since the quit employee worked less time than the entire team), the labor participation rate (LFC) can be used, namely, indicating the actual time worked as the LFC. If such a document does not indicate the KTU, earnings, as usual, will be distributed equally among employees, regardless of the specified periods of work.

If an employee was hired and joined a team that had already been performing a long work order for some time, it would not be a mistake if, when filling out the work order, the start date of his work coincides with the start date of the work order, and is not equal to the date of the actual start of work. His earnings will also be regulated with the help of the KTU.

To distribute the amount earned among team members, the labor participation coefficient is used. Time worked, the ratio of workers’ qualifications in numerical terms, or any other coefficient can be used as KTU.

For example, the work of loading a car was performed by two loaders. One worked for 2 hours, the other for 4 hours. In this case, the KTU for them can be specified as 2 and 4, respectively. It should be emphasized that the sum of the labor participation coefficients along the line may not be equal to one.

To calculate the amount of earnings of each employee of the team, use the “Calculate” button on the toolbar of the “Performers” tab. When calculating, the total amount for technological operations is divided by the number of team members, taking into account the technical specifications. Thus, the amount of 600 rubles earned by the loaders (see the previous example) will be divided into 6 parts, 2 of which 200 rubles each will be received by the first loader, and 4 parts of 400 rubles each will be received by the second loader.

Amounts can be adjusted manually. When carrying out a work order, the system controls that the amount of earnings of the entire team coincides with the amount for technological operations.