Which regulations regulate payment for work on days off?

Issues of remuneration, both on weekdays and on weekends, are regulated by the employment contract, as well as internal documents of the company, such as regulations on remuneration and collective agreement.

At the same time, the norms contained in local acts of an enterprise or organization should not contradict the norms of the Labor Code of the Russian Federation. Art. 153 of the Labor Code of the Russian Federation determines that the employer is obliged to pay double the amount (no less) for work on a day off or a non-working holiday.

Postponement of holidays in 2021

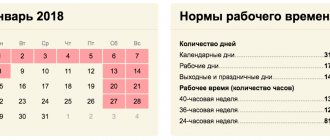

The production calendar approved by the Ministry of Labor and Social Policy will help employers and employees of organizations competently plan the production process, as well as determine the days allocated for rest. According to this document, in 2021 the following transfers will be made:

01/06/2018, which falls on a Saturday, will be moved to 03/9/2018 (Friday), that is, Russians will have the opportunity to rest for four whole days - from 03/9/2018 to 03/11/2018;

non-working days will be 04/30/2018 (falls on Monday) and 05/2/2018 (falls on Wednesday). This will be done on Saturday 04/28/2018 and 01/7/2018 (Sunday). Moreover, 05/01/2018 is already an official holiday, and 04/29/2018 falls on a Sunday, so Russians will have the opportunity to have additional rest;

in February, the weekend falls from 02/23/2018 to 02/25/2018;

The traditional day of the state holiday remains 05/09/2018 - this year it falls on Wednesday;

Saturday 06/09/2018 will be a working day, but this will be followed by a rest period from 06/10/2018 to 06/12/2018;

in November, weekends associated with holidays will make the period from November 3, 2018 to November 5, 2018 non-working.

On what days will you be paid double for work?

Work on weekends and non-working holidays is paid twice (Article 153 of the Labor Code of the Russian Federation). At the same time, which days are considered weekends depends on the work and rest schedule established in the company. They are enshrined in the PVTR.

Each organization or enterprise has its own work and rest schedule:

- five or six day work week;

- schedule with fixed days off;

- schedule with floating days off;

- daily or semi-daily work shifts;

- watch.

Each of the possible work modes has its own days off.

Their duration cannot be less than 42 hours weekly (Article 111 of the Labor Code of the Russian Federation). Shift schedules, as well as schedules with floating days off, are drawn up and communicated to employees in advance. The list of state holidays (which are also paid at double rate) is contained in Art. 112 Labor Code of the Russian Federation:

- New Year holidays - January 1-6 and 8;

- Christmas - January 7;

- Defender of the Fatherland Day - February 23;

- International Women's Day - March 8;

- Spring and Labor Day - May 1;

- Victory Day - May 9;

- Russia Day - June 12;

- National Unity Day - November 4.

Non-working days from May 1 to May 10, 2021

In 2021, Russia was scheduled for a standard three-day holiday: from May 1 to May 3 and from May 8 to 10. Days from May 4 to May 7 are working days. However, for some organizations, May 4, 5, 6 and 7 have become non-working days.

On Friday, April 23, 2021, the President signed a decree that made May 4, 5, 6 and 7 non-working days and allowed people to rest continuously from May 1 to May 10. The need for this measure was stated by the head of Rospotrebnadzor.

Presidential Decree No. 242 dated April 23, 2021 “On the establishment of non-working days on the territory of the Russian Federation in May 2021” was published on the Kremlin website.

Decree No. 242 established non-working days with employees maintaining their wages from May 4 to May 7. The decree consists of only three paragraphs, without specifying who is subject to this decree.

How to pay for work on a day off with a time-based wage system

The name “time-based wage system” indicates that staff earnings depend on the time they work. Pay an employee who comes to work on a day off or a holiday on a temporary basis in the amount of at least two hourly or daily tariff rates.

To calculate the hourly tariff rate, use the formula:

Work on weekends and non-working holidays is paid in double (or more) amounts only when the employee exceeds the standard working hours for the month. If in total there was no excess in the month, then you need to pay for work on a holiday or weekend without taking into account the double increase, that is, in the amount of a single rate (daily or hourly).

Payment for time off taken by an employee is calculated in the same way.

Instead of receiving monetary compensation for working on a holiday, the employee has the right to take time off. In this case, the holiday is paid as usual, the doubling of payment is canceled, and the selected day is not paid.

The legislator has not regulated the procedure for choosing a day of rest instead of a worked holiday, but do not forget that the employee must notify the manager or accounting department about his choice before the end of the month (after all, by default he will simply be charged double pay). In addition, the rest day itself must be agreed upon with management.

How to apply for work on a day off

Working on a weekend is only possible if there is a justification. Going to work on a day off or NAP is formalized by order or directive, subject to the employee’s written consent to work on a legal day off.

If you have any unresolved questions, you can find answers to them in ConsultantPlus.

Full and free access to the system for 2 days.

How to pay on December 31, 2020

New Year holidays, as is customary, begin even before January 1st. Although few people are inclined to work on December 31st, there are many different concerns that require urgent solutions before the onset of the new year. In 2020, this day falls on a working Thursday and must be worked as usual.

The only relaxation is a pre-holiday reduction in working hours by one hour (Part 1 of Article 95 of the Labor Code of the Russian Federation). The exception is continuously operating companies and types of work where a reduction in working hours is not possible. In these cases, it is not reduced and is subject to compensation either by additional rest time, or by payment of at least one and a half times the amount with the consent of the employee (Part 2 of Article 95 of the Labor Code of the Russian Federation).

If an employer, on his own initiative, decides to make December 31 a non-working day for his company’s employees, he must issue an order and pay for such an additional day off. Officials emphasize that the employer can reduce the standard working hours, but this should not affect the salaries of employees (Rostrud Information).

If the employee himself asks for an unscheduled day of rest on December 31, the employer may offer him to take a vacation at his own expense.

The authorities of a number of constituent entities of the Russian Federation announced the postponement of the working day from December 31 to Saturday December 26 (Order of the Government of the Belgorod Region dated November 30, 2020 No. 462-rp, Decree of the Government of the Murmansk Region dated December 4, 2020 No. 849-PP). However, the Ministry of Labor spoke out about the inadmissibility of such a transfer, since every week an employee must rest for at least 42 hours in a row and such a transfer deprives him of legal rest (Letter of the Ministry of Labor dated August 12, 2020 No. 14-2/10/P-7979).

Are holidays grounds for reducing wages?

Article 112 of the Labor Code of the Russian Federation enshrines guarantees that do not allow employers to reduce wages to employees due to vacations. In addition, the employer is obliged to pay the full amount due to employees within the time limits established in accordance with the Labor Code of the Russian Federation, the collective agreement, internal labor regulations, and the employment contract. If the management of an organization refuses to pay wages on the New Year holidays, in accordance with the law, employees can file a complaint with the State Labor Inspectorate or the court.

Is it necessary to index salaries?

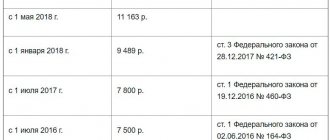

If the company has low-paid full-time employees (not part-time), you need to check whether their salary is lower than the minimum wage, which from January 1, 2021 is equal to 9,489 rubles per month. If it is lower, it will be increased, otherwise you will face a serious fine (from 30,000 to 50,000 for each violation, that is, for each “deprived” employee). It is important to take into account the regional minimum wage indicator - it can significantly exceed that determined by the federal government.

Source: https://ppt.ru

No ConsultantPlus?

Select a kit yourself , taking into account the specific features of your organization

Concept

Shift work refers to a work schedule in which people work on different days of the week. Some workers are replaced by others to perform the same activities.

Suppose, with a two-by-two schedule, an employee can work:

- in one week: Monday, Tuesday, Friday, Saturday;

- on the 2nd: Tuesday, Wednesday, Saturday, Sunday.

It is advisable to introduce such schedules if the production process requires constant operation of the enterprise. Shift work is provided for in Art. 103 Labor Code of the Russian Federation.

People can work two, three or four shifts. Such a schedule helps to divide workers into certain groups, each of which performs work on certain days and times.

It is important that a person does not work two shifts in a row; this is prohibited by Part 5 of Article 103 of the Labor Code of the Russian Federation.

How are shifts that fall on a holiday paid?

According to Art. 153 of the Labor Code of the Russian Federation, remuneration on holidays is made no less than double the amount. This way, not the entire shift is paid, but specifically the hours that fall on a holiday. Sometimes, the shift may change from one day to another. Procedure for calculating payment for work on a day off.

When a person's salary is calculated based on salary, the cost of labor per day is first calculated, then it is multiplied by two.

For hourly wages, the number of hours worked on a holiday is calculated, multiplied by the hourly rate and additionally multiplied by two.

Internal regulations for the enterprise can establish other calculation rules. The main thing is that wage conditions are not lower than those established by law.

Workers who work according to a schedule go to work automatically; the basis for their involvement in work on days off is the work schedule itself.

For double payment, no additional documents are drawn up; the accountant makes calculations based on the labor code.

We recommend reading: the procedure for paying for work on a holiday with a salary.

Example of calculation 2 through 2

Let's look at a specific example of how to calculate wages for work according to a shift work schedule, if it partially coincides with holidays.

Initial data:

Let’s assume that in May 2021, Konstantin Petrovich Kozlov works according to an approved shift schedule from eight in the morning to eight in the evening:

According to the schedule, the employee works 16 days, 12 hours. Two of these days fall on holidays: the first and second of May. The rate per hour of work is 150 rubles.

Calculation:

- Two days of 12 hours must be paid at double rate:

150 * 24 * 2 = 7200.

- The remaining 14 days of 12 hours are paid at a single rate:

14 * 12 * 150 = 25200.

- In total for May the employee's salary was accrued:

25200 + 7200 = 32400.

- He will receive in his hands: 32400 – 32400 * 13% = 28188.

When working at night

If the shift involves night work, then double payment will be made until twelve o'clock on a holiday, and single payment after a non-working day.

For example, a person works 12 hours, but not during the day, but at night from eight in the evening until eight in the morning.

He started work on the evening of May 8 and left work on the morning of May 9.

Then from 20 -00 to 00 -00 payment is made in a single amount (not yet a holiday), and from 00 - 00 to 8 - 00 in a double amount, since these hours already fall on a holiday.

We will calculate the salary according to the above presented schedule.

Initial data:

Suppose an employee worked in 12-hour shifts from eight in the evening until eight in the morning.

Calculation:

- First, let's calculate the payment for holiday hours:

From eight in the evening to twelve (4 hours each) on May 1 and 9:

(4 * 150 * 2) *2 = 2400 rub.

- The remaining hours (16 * 12 – 8 = 184 hours) are paid in a single amount:

184 * 150 = 27600 rub.

- An additional payment for night hours (16 * 8 = 128 hours) is calculated in the amount of 20%:

128 * 150 * 20% = 256 rub.

- Total monthly salary accrued:

256 + 27600 + 2400 = 30256 rub.

The person will receive the specified salary amount minus thirteen percent income tax.