After working for 6 months at his current place of work, the employee has the right to take another paid vacation (possibly earlier, by agreement with the employer). In the event of a leave of absence and termination of the employment contract before the end of the accounting year, a debt arises for vacation pay paid in advance.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

This happens when the employee has already taken his vacation in advance and has not worked enough time to repay the pay for these days. The employer has the right to withhold overpaid vacation pay upon final settlement with the employee.

At the same time, the employer reserves the right to withhold vacation pay or not.

Upon dismissal, there are two possible scenarios:

- vacation days remain unfilled;

- a debt is formed by the employee to the employer.

Unused vacation days are subject to monetary compensation upon final payments. Vacation pay is calculated according to the standard scheme, based on the employee’s average daily earnings.

In case of debt, the organization has the right to withhold payment for the vacation used.

Let's consider in which case it is necessary to withhold overpaid vacation.

Under what conditions may unworked vacation days appear?

The Labor Code determines that each employee has the opportunity to receive annual paid leave only after he has worked for the company for at least 6 months. Moreover, he can take the full period at once. However, if in the future he has a desire to resign, he will be required to return the funds that were issued for unworked rest days.

The law obliges every employer, before the start of the new year, to draw up and implement a vacation schedule for the future period. If an employee goes on vacation immediately at the beginning of the year, a precedent may be created that the vacation will actually be accrued in advance for the entire next year.

After all, before letting an employee go on vacation, the personnel officer calculates the date for which vacation time is granted. In this case, the rule applies that every full month gives the right to 2.33 days of paid rest.

In addition to the main period, additional leave may also be provided by law or internal regulations.

Attention! Since he has already been granted vacation, but in fact these days have not yet been worked, upon dismissal the accountant will have to make a deduction for unworked vacation upon dismissal.

Registration of return

To register a deduction for vacation taken in advance, you must first draw up an order. It is issued on the day the employee is dismissed.

The order contains the following information:

1. Name of the organization, as well as the date of compilation.

2. Title of the document.

3. Full name of the dismissed employee and his position.

4. Grounds for retention (indication of the employee who is resigning and has already used vacation).

5. Number of days in debt.

6. Grounds for retention (Articles 137 and 138 of the Labor Code of the Russian Federation) .

7. The administrative part, which is addressed to the accountant.

8. Amount of retention.

9. Responsible person for monitoring the execution of the order.

10. Signature of persons familiar with the order - the chief accountant, the person being dismissed and the signature of the director.

Based on such an order, the accounting department calculates and withholds funds.

To withhold for unworked days or not

Deducting previously issued vacation pay from your salary is a right, not a mandatory action for the employer. When dismissing an employee of this type, the administration has the right to decide not to withhold excess amounts from him.

However, the format of this decision is not regulated. You can simply tell the employee that there is no need to return excess vacation pay. But since in the event of disagreement, a verbal agreement cannot be confirmed in any way, it is better to document such a decision. For example, you can sign a bilateral agreement that the company forgives the employee’s debt to him for paid vacation pay.

In addition, in such a document it is also advisable to show the amount that is “forgiven” to the employee, as well as the number of vacation days for which it was accrued. At the end of the agreement, the details of each party, signatures and seals (if any) must be affixed.

The employee may decide, at his own discretion, to return the amount in excess of what he received. In this situation, the accountant will not have to make deductions for unworked vacation days upon dismissal.

You might be interested in:

Complaint to the prosecutor's office against an employer: in what case is it filed, how to write, terms of consideration

Another vacation. What the law says

Every employee has the right to receive paid leave, also called annual leave. The Labor Code explains which categories of workers can count on vacation leave. These include:

- Employees for whom this place of work is considered their main place of work.

- Part-timers.

- Working from home or remotely.

- Employees performing part-time duties.

This list includes almost everyone who takes part in labor activities at the enterprise. Thus, every employee has the right to leave within a specified period and for a certain number of days.

What is the duration of the annual basic paid leave at the enterprise? The standard vacation for most organizations is twenty-eight calendar days. More specifically, Article 115 of the Labor Code emphasizes that an employee cannot receive less than twenty-eight calendar days of annual leave per year. However, there are other categories of persons who have the right to a longer period of rest, due to the complexity of the work, as well as workers who receive additional leave, for example, due to harmfulness, or disabled people of the second group.

In what situations can you perform a deduction for these days, and when not?

The Labor Code enshrines the right of the company administration to carry out deductions if the employee received leave in advance and then decided to resign. However, there are situations in which it is prohibited to withhold such amounts from an employee.

These include:

- If the company is undergoing a reduction procedure;

- If an employee resigns due to the liquidation of the organization;

- If the conclusion of a medical examination requires the employee to be transferred to a place with easier work, and dismissal is made due to the lack of necessary vacancies or the employee’s refusal to transfer.

- The director or chief accountant is dismissed due to a change of ownership of the company;

- The employee has to resign due to conscription into the army;

- The contract is terminated due to the death of the employee;

- The employee was issued a medical certificate confirming the impossibility of further performance of work duties;

- The employment agreement is terminated due to force majeure (catastrophes, natural disasters, epidemics, accidents, etc.)

Is the employer required to withhold funds?

The law does not indicate that the employer is obliged to withhold all funds for the vacation used. This is just the right of the employer, and not his obligation.

But if the employer decides not to withhold funds, it is better not to limit yourself to an oral agreement, but to sign a full-fledged document. It will allow you to avoid disagreements between the former employer and employee in the future.

Optimally, the signed document should indicate the amount and number of days that are “forgiven” to the former employee. This can also be done if the settlement amount is insufficient to repay the debt to the employer for unworked vacation days.

But there are situations when the employer, by law, does not have the right to withhold:

1. If the dismissal occurs due to staff reduction and the employee falls into this reduction.

2. Upon complete liquidation of the company.

3. In the case when dismissal occurs due to medical reasons. If doctors recommended that an employee switch to an easier level of work, but he refused or the company is not able to offer him suitable conditions, the employee quits, and the employer is obliged to pay the full payment without any deductions.

4. If the dismissed employee is a director or chief accountant, and the dismissal occurs due to a change in the owner of the organization.

5. Dismissal upon conscription for military service.

6. The employee died, and the settlement is made with his relatives.

7. The employment contract was terminated due to a catastrophe, natural disaster and other force majeure circumstances.

These are situations that are prescribed by the Labor Code, and the employer does not have the right to withhold funds in this case for vacation taken in advance.

Otherwise, the worker may apply to the labor inspectorate or court to protect his rights.

Deduction amount

According to the Labor Code, the administration has the right to withhold from the employee’s earnings amounts in excess of the vacation pay issued to him. The entire debt can be retained in full, but no more than 20% of it can be withdrawn from any payment.

Most often, a situation arises that an employee is entitled to only one payment - and this is the payment upon dismissal. At the same time, 20% of it is not enough to fully repay the entire resulting debt. Then the employee can express a voluntary decision and transfer the remaining portion on his own initiative to the cash desk or credit it to his current account.

Attention! If he does not want to voluntarily pay the remaining amount, then it can only be obtained by transferring the case to court. However, court decisions in these types of proceedings are extremely contradictory - in two similar cases, the judge can take either side of the case or the other.

How to withhold vacation pay for days not worked

Step 1. Calculation of the amount to be withheld from the employee

When the accountant calculated vacation pay for issuance, he used information about the average earnings of this employee. This is exactly what you need to do when you need to determine the amount of vacation pay to be returned.

In this case, there is no need to make the calculation again on the day of dismissal - you need to find in the archive a form for calculating the vacation pay itself, and take this indicator from there. For these purposes, enterprises usually use a calculation note in the T-60 form.

It is also necessary to accurately determine the number of days for which excess vacation pay was received. To do this, you can use the vacation pay calculator.

After this, you can begin to calculate the amount to be refunded. To do this, you need to multiply the average daily earnings by the number of days overpaid.

Attention! In a situation where the duration of the last rest period is less than the number of overpaid days, then first the debt is calculated using the average earnings of the last period, then - what was used in the previous one, etc.

Step 2. Documentation and deduction of debt from the employee’s earnings

The law establishes that the amount of debt can be withheld only after all taxes and fees prescribed by law have been removed from the salary.

You might be interested in:

Is it possible to have two work books at the same time, what could be the consequences?

Before withholding the amount of the debt, it is necessary to issue an appropriate order. There is no strictly approved form for it, and usually such a document is drawn up using company letterhead. You must indicate your full name. the employee, how many days of vacation were provided to him in excess, from what funds will be withheld, the exact amount.

The completed form must be presented to the employee against signature. It is also recommended to make a column in which the employee will not only sign, but also express in writing his consent to the withholding.

Principles for calculating vacation pay

Types of vacations:

- regular paid;

- additional (paid);

- study leave;

- for pregnancy and childbirth, etc.

In our case, only one type of vacation is considered - regular.

The amount of paid vacation pay can be represented by the formula:

Average daily earnings (SDZ) * Number of vacation days (KolD).

The main task here is to calculate SDZ. To calculate it, take the accrued salary for 12 months before the vacation, divided by the number of days worked.

If the employee’s length of service in the organization is less than a year, the ratio of the number of months from the date of hire to the actual time worked (number of days) is taken.

The amount of accrued wages includes all payments included in the wage system. That is, all social payments, travel or food compensation are not included in the calculation of average earnings for the period.

In general, the formula for calculating vacation pay looks like this:

In the case when an employee has worked all of his days for a period in full, the formula for calculating the number of working days looks much simpler: the average number of calendar days is .3, multiplied by 12 months.

Tax features

The need to recalculate accrued taxes and contributions depends on what the administration decided to do with excessively issued vacation pay. If these amounts are “forgiven” to the employee, then there is no need to recalculate personal income tax and insurance contributions. They are, first of all, payments to the employee, and therefore are subject to both personal income tax and insurance payments.

On the other hand, if you refuse to withhold the amount, it is necessary to adjust the base for calculating income tax - they must be excluded from expenses that reduce income.

When withholding, it is necessary to adjust the amounts of contributions and withheld personal income tax only at the time of dismissal. There is no need to make corrections on the day the payments themselves were made.

The amount of vacation pay that was issued in excess reduces the base for contributions to social funds in the month of their return by the employee. In this regard, the calculation of deductions will need to be made on a reduced base.

When a 2-NDFL form is drawn up, it is necessary to reduce the amount of earnings received for this month by the amount of withheld vacation pay, and the amount of accrued personal income tax by the amount of tax received during the recalculation.

Attention! The administration is obligated to inform the employee about this within 10 days when excessively withheld personal income tax amounts arise. The latter must apply for the return of these amounts.

The administration, after receiving this application, can reduce the amount of tax that needs to be transferred to the budget by the amount of tax submitted by the employee for refund.

How to withhold overpaid vacation pay upon dismissal (example)

The employee was registered on the staff on 02/04/2014. In November I took 28 days off. I submitted my resignation on September 30, 2014. The average daily earnings when calculating vacation pay is 1,750 rubles. The working year corresponds to the period from 02/04/2014 to 02/04/2015; the period from 10/01/2014 to 02/04/2015 remained unworked, which is a full 4 months (4 days of February are not taken into account, since they do not reach half a month). The experience is 8 months. Following the formula, we calculate the vacation days not worked: 28 – (28/12*8) = 9.33 days Next, we calculate the vacation pay paid in advance, subject to withholding: 9.33 * 1750 = 16327.5 rubles.

We recommend reading: Judicial practice of appealing a will

In this case, it is assumed that after the end of the vacation the employee will return to the workplace and work the allotted time. However, this does not always happen in practice. Sometimes an employee, having rested in advance, soon quits without working the required period for the granted leave. In this case, the employer has the right to withhold the amount of vacation pay overpaid to the employee. However, there are certain restrictions that employers need to be aware of.

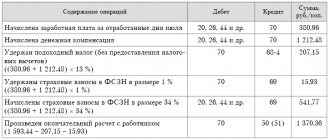

Accounting entries

The procedure for showing deductions for unworked vacation days upon dismissal in accounting was disclosed by the Ministry of Finance in its letter published in 2003. At the same time, it showed a case in which an employee voluntarily repays the amount of debt in cash. In the document, the Ministry of Finance advises using the reversal method to make all adjustments.

| By Debit | By Credit | Operation description |

| 20,23,25,26,44 | 70 | Reversal of the amount of overpaid vacation pay during the vacation period. In this case, the one that records vacation payments for this category of employees is selected as a cost account. |

| 96 | 70 | Reversal of vacation pay amounts that were accrued from the reserve. This entry must be made if vacation pay amounts are paid from the reserve and not immediately written off to expense accounts. |

| 50 | 70 | The amount of overpaid vacation pay was transferred to the cash desk |

| 70 | 68 | Accrued taxes and contributions are reversed. |

| 20,23,25,26,44 | 69 |

How many days can I take a vacation?

As for the rights of the employee, it is worth recalling Article 122 of the Labor Code. It says here that a citizen has the right to take his leave for any time by notifying the employer two weeks in advance. This is also prescribed in advance in the vacation schedule for the next year. So the employee has the right to receive full leave at any convenient time.

As for dividing the allotted days, the Labor Code gives a hint here too. It says that you can take vacation in parts. However, it is worth noting that one part must be at least 14 calendar days. But the size of subsequent ones is not regulated. However, not every employer is ready to issue vacations of two or three days. Therefore, the employee should negotiate with the employer or personnel department employees.