Doing business in Russia involves high risks. Including tax. It is noteworthy that even without using any optimization tools and paying all the required taxes, you cannot say with metal in your voice: “there will definitely be no problems.” Conscientious suppliers and real transactions also come under close tax attention.

It's fair to ask: why? On the one hand, there is a history of the widespread use of ephemeral accounts by taxpayers, which is why the latter, in the eyes of the tax authorities, look nothing less than swindlers. On the other hand, we have completely obvious problems in the economy, which, apparently, will be solved through “additional” tax revenues to the budget.

Unfortunately, taxpayers cannot change this situation. High tax risks must be accepted and taken into account in your activities. TaxCoach experts tell you how.

Trends and brands

Tax risk is the risk of the tax inspectorate overestimating the tax consequences of certain business transactions.

The Federal Tax Service responsibly reports on its victory over “fly-by-night companies.” The main merit goes to a robot named “ASK VAT-2”, which compares the data from the taxpayer’s declaration with the data from the declarations of his counterparties and, if “gaps” are detected, the taxpayer receives a request to provide explanations.

Therefore, the absence of “problem” counterparties in a particular business has ceased to be a kind of protection against tax risks.

After 10 years, the attention of inspectors is again drawn to suppressing cases of unjustified application of special tax regimes, which also provide the opportunity to reduce VAT payments. This is the same “artificial fragmentation of a business”, which can include absolutely everything - from franchising to the creation of several similar companies by one founder. The devil, as always, is in the details.

Criteria for inclusion in the Risks database

What criteria do tax authorities use to include companies in the database? This is classified information. Some reasons can be found out as a result of the trial:

— failure to submit reports; — registration at a mass address; — mass director or founder (in more than 10 companies); — number of company (less than 3 people); — lack of fixed assets and other assets; — non-payment or payment of minimum taxes at high turnover; — inconsistency of data in reporting and declarations for profit and VAT; — failure to submit documents for the request; - failure of the manager to appear on the agenda.

Attention! Even an existing organization that conducts business and pays taxes is at risk of being included in the database. Moreover, companies are added to the list automatically, but the system is not debugged.

Taxpayer Analysis

The likelihood of tax risks materializing in a particular business depends on compliance with the criteria enshrined in the 2007 Concept for the Planning System for On-site Tax Audits.

And the year should not stop, since all the criteria are relevant. There are 12 named in total, but we consider it possible to group them.

Tax burden, profitability, share of VAT deductions (criterion 1, 3 and 11)

Key criteria. As a rule, taxpayers who lag behind in these indicators are the first among potential candidates for GNP. Generalized indicators for the entire country are contained in the appendix to the concept. This application is updated annually. Accordingly, by calculating the tax burden and profitability for the previous year, and then comparing them with industry averages, the taxpayer can assess his chances of being included in the audit plan.

In terms of value added tax, attention is paid to the share of declared VAT deductions. The overall recommended value is 0.89.

At the same time, it is important to understand that the indicators in the appendix to the Concept are averaged, which means they can and will change depending on the industry and region.

As an additional tool for assessing tax risks, you should use the tax calculator of the Transparent Business service. With its help, you will receive data on industry average indicators for the tax burden and profitability for a specific type of activity, taking into account the characteristics of the corresponding region and the “scale” of the business.

Losses, level and growth of expenses (criterion 2, 4, 7)

Two criteria that show that the taxpayer is “cheating” with the cost. Reflecting losses is a sure way to receive a request from the Federal Tax Service to provide explanations. And if the situation repeats two or more times in a row, the chances of being included in the inspection plan increase.

Of course, losses do not always mean that the company is optimizing taxes. The reasons may be different: investing in new projects, claims from counterparties, financial crisis. However, these reasons need to be clearly understood and communicated in responses to requirements.

In addition, the tax office will definitely request information on how the taxpayer is going to correct the situation, a kind of anti-crisis plan.

The situation is similar with the growth rate of expenses. In an ideal world, an enterprise should annually maintain the same ratio of income and expenses, or better yet, reduce the share of expenses through automation, improvement of technological processes, and other things. However, situations are different. Accordingly, if the taxpayer’s expenses have increased for some reason, these reasons must be identified and, at the request of the inspectorate, voiced.

To calculate the growth rate of income and expenses, you can use balance sheet data (financial results report) and income tax return. Income indicators (revenue) of the previous period (for example, 2021) are divided by the indicators of the year before (2018) and multiplied by 100. The same with expenses (cost). If the result of the first calculation is lower than the second, questions from the Federal Tax Service are likely.

Separately, the Concept notes a criterion for individual entrepreneurs paying personal income tax (applying SST). Thus, the share of expenses declared by them should not exceed 83% of income.

Salary level (criterion 5)

This criterion is close to the first group. Deviations from the industry average may indicate that the taxpayer: firstly, is optimizing personal income tax and insurance premiums, and secondly, is taking cash somewhere to pay unofficial salaries.

The tax calculator of the Transparent Business service will still help you verify data on the average payroll in your industry.

The taxpayer’s indicators are close to the maximum values for the application of special regimes (criterion 6)

It is noteworthy that the Concept for planning GNP refers to the maximum indicators not only the amount of revenue of the entity and the number of its personnel, but also the share of participation of another legal entity in the authorized capital by 25%. That is, such a composition of participants is also an irritating factor.

Now this feature is actively used to identify artificial crushing schemes.

Chains of intermediaries and dubious transactions (criterion 8 and 12)

We believe that the phrases “unjustified tax benefit”, “business purpose” and “due diligence” are familiar to all or almost all entrepreneurs. Criteria 8 and 12 are just about this.

Ignoring requirements (criterion 9)

Under no circumstances should you remain silent regarding the requirements of the Federal Tax Service. This will only make the taxpayer’s situation worse.

Migration (criterion 10)

Previously, the migration of companies from one inspectorate to another (including to another region) was an effective tactic to complicate tax control. However, at the moment, the legislative framework and the inspectorate’s approach to changing the address have seriously changed.

- Firstly, moving from region to region is significantly longer. The Federal Tax Service has enough time to decide on the advisability of a tax audit.

- Secondly, during any migration of an enterprise, the relevant Federal Tax Service carries out a thorough check to confirm the real location of the company.

Business fragmentation: tax risks and tax opportunities

Elmira Bagautdinova

independent expert, tax consultant, full member of the Chamber of Tax Consultants of Russia, certified teacher of IPB and PNK of Russia, MBA programs at UlSTU

2019 has been declared the year of “wrong fragmentation”

Companies have not learned or do not want to split their business correctly. Fictitious splitting attracts the attention of the tax inspectorate. Inspections begin that lead to significant additional charges and fines. These checks came out on top in 2021. If you have one, and the rest are in special modes, the tax authorities will have a lot of questions:

– why is the activity not carried out within one organization? – why do your companies have the same addresses, telephone numbers, IP addresses, common departments, websites, cash registers, signs, banners, a single advertising concept or discount program, accounts in the same bank, etc.? – why don’t your employees even know where they are employed?

And there are many more questions, but the conclusion will be the same: artificial fragmentation - to save taxes.

REMINDER: Artificial fragmentation is the creation of a situation in which the appearance of the actions of several persons covers up the actual activities of one taxpayer.

“The most problematic point now is crushing.” Daniil Egorov, deputy head of the Federal Tax Service

Legal basis for “fragmentation”

Business fragmentation is a business process as a result of which, instead of one company, a number of new independent structures appear. The terms “scheme” and “business splitting” are not disclosed in any tax regulations. The Civil Code of the Russian Federation does not prohibit legal entities from carrying out reorganization in the form of division or separation (Article 57 of the Civil Code of the Russian Federation), as well as registering new organizations with the transfer of assets and property to them (Article 51 of the Civil Code of the Russian Federation). It turns out that from the point of view of the Civil Code of the Russian Federation, the fragmentation of a business does not contradict the rules of law.

Tax legislation also does not prohibit legal entities from choosing the most beneficial tax system for them . The courts have also noted this right.

Please note! The need for reorganization will have to be proven if, thanks to its implementation, it was possible to save on taxes.

It is not prohibited to be the founder of several companies. However, the tax authority is trying to qualify the splitting of a business as the absence of a business purpose (intention) and the receipt by the taxpayer of an unjustified tax benefit (ITB).

REMINDER: The criteria for INV are set out in Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated October 12, 2006 No. 53.

In court, taxpayers will have to justify the business purpose and answer the main question: “Why were the new organizations created?”

The main advantages of splitting a business

- Reducing the tax burden.

- Security of assets and top officials of the company.

- Transparent structure / ease of management.

- Business development by areas.

- Protection from raiding.

What documents to follow

– Methodological recommendations of the Federal Tax Service and the Investigative Committee (IC) (letter of the Federal Tax Service dated July 13, 2017 No. ED -4-2/ [email protected] ) on establishing, during tax and procedural audits, circumstances indicating intent in the actions of taxpayer officials aimed at non-payment of taxes. This document lists among the tax evasion schemes the artificial fragmentation of a business in order to maintain or obtain the status of a single tax payer under the simplified tax system.

– New Article 54.1 of the Tax Code of the Russian Federation. She supplemented the tax legislation with provisions on the inadmissibility of taxpayers reducing the tax base or the amount of tax as a result of artificially produced distortions. The main purpose of transactions, as before, should not be non-payment of taxes (a criterion for the business purpose of transactions). The Federal Tax Service of Russia notes that a typical example of such a distortion is the creation of a business fragmentation scheme.

– Review of court cases related to the application of Chapters 26.2 and 26.5 of the Tax Code of the Russian Federation, approved. Plenum of the RF Armed Forces dated 07/04/2018, Determination of the RF Armed Forces dated 11/21/2017 No. 304-KG17-16800, 08/27/2018 No. 304KG18-12160 and others. As well as arbitration practice in various districts.

– Letters from the Federal Tax Service on splitting issues: dated December 29, 2018 No. ED -4-2/25984, dated August 11, 2018 No. SA -4-7/ [email protected] , dated October 11, 2017 No. SA -4-7/ [email protected ] , dated October 31, 2017 No. ED -4-9/ [email protected] and others. In them, the tax service explains how to identify illegal splitting, what evidence to look for, and what specifically confirms abuse and unjustified tax benefits.

The Federal Tax Service is tightening control and intensifying the fight against fictitious fragmentation

In February 2021, a letter from the Federal Tax Service dated December 29, 2018 No. ED - 4-2/25984 appeared in the databases, which instructed territorial tax authorities to strengthen control and analytical work in this direction. The Tax Service has instructed territorial inspectorates to strengthen control and more actively find companies that create the appearance of the activities of several independent companies. We are talking about illegal division of business.

Note! If a large company deliberately splits into several small firms in order to apply the simplified tax system or UTII, inspectors may charge additional VAT and income tax, as well as penalties and fines, on revenue. The Federal Tax Service warns that in addition to additional charges and tax sanctions, more serious consequences are possible for participants in the scheme. Up to the initiation of criminal cases against business owners.

At the end of the letter it is stated that “it is necessary to exclude the presentation of unfounded claims to the division of a business that is not aimed at abuse, since the choice and change of the business structure is the exclusive right of the business entity.”

Example. The entrepreneur divides the business in order to be able to apply preferential tax regimes. Together with a group of controlled persons, which included his relatives and acquaintances, he operated in a shopping and entertainment center. I leased retail space to several individual entrepreneurs. Moreover, the area was divided so as not to exceed the restrictions established for UTII - the area of the trading floor can be no more than 150 square meters. m.

Tax officials found out that all controlled persons participated in the activity formally. As a result, officials proved that the beneficiary was the entrepreneur, and he received tax savings. The amount of taxes that he managed to save through illegal crushing amounted to more than 80 million rubles. The money was collected, the entrepreneur paid it to the budget.

When is crushing safe?

- Legal work.

- Use of independent bona fide persons.

- Having business goals.

- Correct document flow.

- Reasonable pricing policy.

It is important to know! The use of artificial legal structures for business operations that do not contain signs of illegality, but are meaningless and do not have non-tax reasons, is equated to abuse of law in the field of tax legal relations.

Recommendations:

— Do not unnecessarily abuse special regimes in a group of companies. — Justify cooperation with controlled individual entrepreneurs and organizations. — Have reasonable objections to the tax authorities’ claims. — Remember that officials do not have the right to tell a business how to conduct its activities and choose for it the method of its implementation.

What schemes are used to divide a business?

There are two main schemes by which companies illegally split up their businesses.

Scheme 1 - the organization transfers part of the proceeds, property and personnel to another company or individual entrepreneur under a special regime. That is, the founder creates several companies or a company and individual entrepreneurs, but in fact they work as a single whole and actually disguise one business, the same buyers. Firms can work in parallel, or new participants are registered when the indicators of one company approach the maximum limits under the simplified tax system (clauses 15,16, clause 3, article 346.12 of the Tax Code, clause 4, article 346.13 of the Tax Code).

Keep in mind! If the revenue of each company is within the limit on the simplified tax system, but in total exceeds 150 million rubles, then inspectors believe that in this case the simplified companies are illegally splitting up the business and must pay taxes according to the general system.

Scheme 2 is the creation of a group of companies in which there are organizations or individual entrepreneurs both on the general system and on special regimes - simplified tax system and UTII. That is, counterparties are divided, with and without VAT. This scheme of work is also combined with cashing. Friendly firms and individual entrepreneurs are used to increase the firm's expenses on the common system. Entrepreneurs do not actually conduct activities, but only imitate them.

Signs of illegal business fragmentation

What exactly will inspectors pay attention to during the inspection, what circumstances will cause them suspicion? The letter of the Federal Tax Service dated August 11, 2017 No. SA -4-7/ [email protected] lists general signs that indicate the coordination of actions of participants in business fragmentation schemes, and reveals the main signs that indicate fragmentation. Each feature is illustrated with examples from court decisions made both in favor of the inspectorate and in favor of payers. A total of 17 signs of fictitious fragmentation have been formulated. But in judicial practice there are more such signs.

Important! If a company has one or two characteristics, this does not prove the illegality of the division. But the combination of such criteria will definitely entail verification and subsequent additional charges. Moreover, taxes will be assessed based on all the profits received by the participants in the scheme.

Business goals of the company

- Removal of non-core activities from the parent company.

- Business distribution by type of activity.

- Distribution of business on a regional basis.

- Increased staff motivation.

- Increasing the responsibility of top managers for the results of their work, etc.

Recommendations: Read in detail the letter of the Federal Tax Service dated August 11, 2018, analyze all the signs set out in it by which inspectors determine illegal fragmentation and the explanations of the tax authorities.

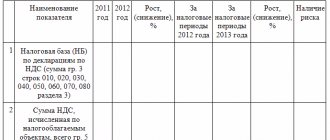

To prove illegal division, inspectors need to correctly calculate the taxes and obligations of the beneficiary. To do this, they are required not only to add up all the income received by the participants, but also to determine the expenses incurred by them. Only the resulting difference will become the tax base. The courts carefully check the methodology used by tax authorities. Therefore, the Federal Tax Service of Russia recommends that lower inspections must:

– take into account not only the income, but also the expenses of the participants in the scheme, justify the tax rates, provide detailed calculations in the act and decision on the audit, explaining the methodology used, prove the specific amounts involved in the calculation. To do this, you need to request documents from counterparties, bank statements, study data on similar taxpayers, and take into account the taxpayer’s objections.

For your information: Over the past 4 years, arbitration courts have considered more than 400 cases worth 12.5 billion rubles, that is, on average more than 30 million rubles per case.

The Federal Tax Service and some regional departments (UFTS) have developed internal check tables indicating signs of fictitious fragmentation. For example, tables, separately, when a business is divided:

– companies on OSNO that distribute income between the simplified tax system and UTII, firms that work on the simplified tax system and distribute activities among themselves, organizations on UTII that distribute premises among themselves.

For what purposes are they using these analytics? Inspectors can use the list of indicators from the tables to collect evidence of illegal crushing during inspection. Moreover, this list is not exhaustive.

The table is also necessary for companies to assess their risks. An organization can fill in the data and understand whether it is at risk. The more indicators a company has, the more likely inspectors are to suspect illegal crushing. In order not to attract attention to the company, you need to avoid signs of fragmentation.

To be continued in the July issue of Business Review.

Business fragmentation: what to pay attention to

Due to the use of business splitting schemes by companies during tax audits, organizations are charged additional income tax, VAT, fines, and penalties. They are also accused of illegal use of special regimes. The number of tax disputes and courts is growing every year. Is business “disengagement” a necessity or an illegal scheme?

Entrepreneurs in tax schemes: dangerous optimization

Basically, businessmen want to live honestly and at the same time pay less taxes. Having learned about a new method of tax optimization and decided that it is suitable for their business or individual economic operations, entrepreneurs begin to work in a “new way”: they do not assess tax risks and consequences, forgetting that the close attention of tax authorities is constant.

Informal selection criteria

VAT refund

Of course, VAT refund is not a criterion for assigning an on-site inspection and this is an absolutely legal operation. However, the amount of tax recovered is a separate performance indicator for each inspection. The result is thorough checks of companies applying to receive taxes from the budget with the aim of refusing them.

Accordingly, this operation indirectly increases tax risks, since it causes biased attitudes of tax inspectors towards taxpayers.

Company property

Another unofficial criterion that attracts the attention of the tax authority is the welfare of the taxpayer. The Federal Tax Service needs to not only make additional assessments, but also collect them, that is, get real money. In this regard, when choosing between two companies with /- the same “failures”, the inspectorate will choose the one from which the additional accrual can be recovered.

IR "Risks"

The information resource “Risks” is an internal information resource of the Federal Tax Service of Russia. This is non-public information.

The resource was created to automate and systematize the processes of collecting, accumulating, storing and processing certain information about organizations received by tax authorities legally in the course of performing their functions.

This service lists organizations that have a potential risk of tax evasion.

The resource is maintained on the basis of the Order of the Federal Tax Service dated June 24, 2011 No. MMV-8-2/42dsp@ “On approval of the Methodological Recommendations for maintaining the information resource “Risks”, which has the postscript “dsp”, that is, for official use.

How to handle official information is described in the Regulations approved by Order of the Federal Tax Service of December 31, 2009 N MM-7-6 / [email protected] It states that tax officials are allowed to work with documents containing official information of limited distribution in accordance with the List of Federal Tax Service officials who have the right of access to official secrets, and the powers defined by their official regulations.

An ordinary taxpayer cannot obtain information from the Risks IR.

However, in some cases, the secret becomes clear.

Decrease in the amount of GNP

Let's turn to statistics.

For example, in 2021, the tax office conducted 22,602 audits of organizations. 99% of them ended with additional accruals. The total amount of additional charges, taking into account penalties and fines, amounted to 340 billion rubles, that is, an average of 15.2 million per “successful” inspection.

In 2021 the picture has changed. GNP affected 12,549 organizations, that is, a decrease of almost 2 times over 3 years. The average amount of additional charges for an inspection is 25 million.

The difference is colossal: minus 10 thousand checks, plus 10 million additional charges. All this indicates an increase in the efficiency of tax control. However, in addition to an on-site tax audit, the tax office has another tool that allows you to replenish the budget.

The legalization commission acts as a kind of warning shot that precedes the inspection. The event is a negotiation process between the taxpayer and the inspectorate on the topic of clarifying tax obligations. In general, the call to the commission is based on the criteria for including the taxpayer in the audit plan.

However, verification is a long process; it is possible to agree on conditions acceptable to both parties much faster.

At the same time, there is no need to perceive the legalization commission as some kind of intimidating mechanism. On the contrary, this is an opportunity to defend your position and think through strategies for future defense.

The creditor is the “omnipotent”

Identifying the violator and assessing additional taxes is only half the battle. The budget still needs to receive real money. In this part, progress also does not stand still; at the moment, the tax authority is vested with super-powers to collect taxes.

Firstly, inspectors have a special right to “shake” clone companies, that is, organizations to which activities are transferred, if the taxpayer has problems. Article 45 of the Tax Code allows for the recovery of tax arrears from a dependent person in court.

Please note, no bankruptcy or subsidiary liability. To satisfy the requirement, the inspectorate must prove to the court that the actions of the taxpayer and the persons to whom the activity is transferred (revenue and property are transferred) are of a coordinated (depending on each other) nature and lead to the impossibility of fulfilling the obligation to pay additional taxes.

Information is accepted as evidence that:

- the company’s assets are rapidly decreasing since the beginning of the audit;

- a new company is created during the verification period, and the list of counterparties surprisingly coincides;

- the debtor's employees are transferred to work in a new company, etc.

Secondly, a simplified procedure for bringing the debtor's beneficiaries to subsidiary liability in a bankruptcy case. Thus, if more than 50% of creditors' claims arise from tax debts, the guilt of the controlling persons (directors, participants) is presumed.

Obviously, this provision was introduced into the bankruptcy law in order to facilitate the work of the tax inspectorate and simplify the procedure for collecting from controlling persons the debts of their companies to the budget.