An individual entrepreneur chooses the taxation system when registering his activities and registering with the tax authorities. True, you can switch to a different system later, subject to a number of conditions. Initially, everyone is invited to work under the general taxation system, but based on the low tax rates in other systems, entrepreneurs give preference to one of them.

This article is intended to answer questions on the taxation of individual entrepreneurs using a simplified system or reporting on imputed income. Specialized taxation for agricultural activities of entrepreneurs deserves some mention.

Who can switch to “simplified”?

In general terms, an individual entrepreneur cannot switch to “simplified” if he works in the areas of large or partially medium-sized businesses. The transition to the simplified tax system of 6 or 15% is not available to organizations, the list of which is provided in paragraph 3 of Art. 346.12 of the Tax Code of the Russian Federation:

- companies and individual entrepreneurs paying the unified agricultural tax (UST);

- businessmen who mine or sell minerals and sell excisable products;

- companies in the structure of which there are branch organizations;

- enterprises where the share of other participating companies is 25% or more;

- organizations with specific types of activities - banks, participants in the financial securities market, insurance companies, pawnshops, investment funds and pension funds, gambling companies, law firms, microfinance organizations;

- companies with different status: foreign, budget or government institution;

- all companies with more than 100 employees;

- organizations with a fixed asset value of 100 million rubles or more.

In all other circumstances, “simplified” is available to most entrepreneurs and other participants in small and partially medium-sized businesses. With the exception of representatives of the financial sector, this taxation system can be chosen by individual entrepreneurs representing any other types of activities.

Taxation with imputed income for individual entrepreneurs

This type of relationship with tax authorities implies compliance with a number of mandatory conditions:

- The type of activity of an individual entrepreneur must be specific (provision of services, retail trade).

- The number of employees has limits.

- There are restrictions on the area that will be used for direct activities.

The conditions are quite mild. This tax system implies the absence of mandatory use of cash register equipment and simple reporting and bookkeeping. An undoubted advantage is the low tax rates when choosing this method.

It is worth remembering that a single tax on imputed income is required to be paid even if an individual entrepreneur has temporarily suspended activities. Again, the lack of value added tax may become an obstacle to transactions with large clients using the general tax system.

Features of “simplified”

An individual entrepreneur using the simplified tax system requires payment of a single fee and exemption from a large number of other taxes. Under this tax regime, an entrepreneur has the right not to pay:

- personal income tax, or personal income tax, if the taxpayer is an individual entrepreneur who has income from the activities of a businessman, except when the individual entrepreneur is obliged to pay personal income tax at rates of 9, 13 or 35%;

- income tax if the taxpayer is an organization, except in cases where the company is required to pay tax at rates of 0, 9, 13, 15 or 20% (in case of joint business with foreign companies);

- property tax for individuals, if the taxpayer is an individual entrepreneur using real estate to conduct commercial activities, except in cases where the tax base is based on the cadastral value of real estate;

- corporate property tax, if the taxpayer is an organization in which real estate is used for commercial activities, except in cases where individual entrepreneur taxes are based on the cadastral value of real estate;

- value added tax, or VAT, in all cases, except when: the entrepreneur imports and sells goods under the jurisdiction of the Russian state; the counterparty is issued an invoice with the allocated amount of VAT; commercial activity is carried out on the basis of agreements on joint activities (simple partnership), trust management of property, investment partnership or concession agreement on the territory of the Russian Federation.

Instead of paying the above payments, individual entrepreneurs using the simplified tax system are required to pay an annual single tax, which is also determined by different rates: 6 or 15%.

What other taxes does the simplifier pay?

The simplified tax system replaces a number of taxes, but not all.

We recommend you study! Follow the link:

What types of taxes exist for individual entrepreneurs and how to find out what taxation system the entrepreneur is on

So, what other payments are due to the simplifier:

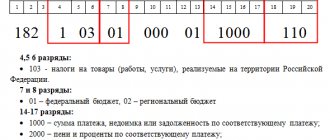

- fixed payment (insurance premiums) for yourself. Previously, this payment was calculated on the basis of the minimum wage, but starting this year, the government will set a specific amount of the annual payment. In 2021, this is 26,545 rubles for compulsory pension insurance (KBK 18210202140061110160) and 5,840 rubles for compulsory medical insurance (KBK 18210202103081013160). Payment must be made before the end of the reporting year and regardless of whether the individual entrepreneur carried out activities and whether there was a profit. The only exception is the year of registration; if the business was registered in the second quarter, third or fourth quarter, then there is no need to pay for the period preceding registration;

- an additional one percent contribution for pension insurance (KBK 18210202140061110160), if the amount of revenue for the year exceeded 300,000 rubles, from the excess amount. Payments for 2021 must be transferred no later than July 1, 2021. At the same time, the total payment “for yourself” has a limit of 212,360 rubles;

- Personal income tax for employees (if any) is withheld from the employees’ salaries, but is transferred by the entrepreneur;

- Insurance premiums for employees must be paid by the 15th of each month following the month of payroll. If the 15th falls on a weekend or holiday, the last day of payment is considered to be the next working day.

The entrepreneur pays contributions from his own funds in the amount of:

- in the Pension Fund of the Russian Federation 22%, if the limit of 1,021,000 rubles is exceeded, the rate is reduced to 10%;

- in the Social Insurance Fund 2.9% (excluding contributions for injuries), if the limit of 815,000 rubles is exceeded, contributions stop being paid;

- in the Federal Compulsory Medical Insurance Fund 5.1%;

- from 0.2 to 8.5% for compulsory social insurance against accidents at work. The rate is determined according to professional risk classes, based on the type of activity the individual entrepreneur conducts.

Some individual entrepreneurs (NGOs working in the field of sports, healthcare, culture; participants of the FEZ in Crimea and a number of others) have the right to pay contributions at preferential rates;

- if an individual entrepreneur has transport or a plot of land used for business activities, then transport and land taxes are paid;

- if you own premises that are taxed at cadastral value (area in retail and office centers), property tax will also be added;

- if an individual entrepreneur is engaged in trade in Moscow, then it is also necessary to pay a trading fee.

And even with all these nuances, “simplified” remains the most optimal tax regime for most individual entrepreneurs in 2021.

Types of single tax under the simplified tax system

An individual entrepreneur under the simplified tax system in 2021 and further reporting periods until the introduction of a new Federal Law on amendments to the Tax Code of the Russian Federation is required to select an object of taxation when registering an activity or switching to a “simplified system”:

- simplified tax system for income, or simplified tax system 6, - in general cases, an individual entrepreneur pays tax at the rate of 6% of total income;

- The simplified tax system is income minus expenses, or the simplified tax system is 15% - in general cases, an individual entrepreneur pays an amount based on 15% of the difference obtained from total income minus the amount of expenses.

Despite the simplified tax regime for both beginners and continuing entrepreneurs, there are regulations on the duties of a tax agent: VAT, personal income tax, etc., which does not completely exempt individual entrepreneurs from paying general fees. In any case, the entrepreneur is obliged to pay insurance premiums.

The choice of a particular rate depends on what features are present in the entrepreneur’s business area, what possible amounts of income and expenses may be and what is the procedure for their accounting.

It should be noted that the choice of IP 6 or 15% can reasonably be changed to another rate.

On various grounds, with the consent of the tax authorities, the single tax rate can be reduced or increased.

For example, when registering new individual entrepreneurs in 2021 and subsequent years, the rate for a certain period may be 0%. Special conditions for the simplified system apply to the constituent entities of the Crimean Republic and the city of Sevastopol, as well as some other regions of the Russian Federation.

Starting from December 6, 2011, after the adoption of Federal Law of the Russian Federation No. 402-FZ, all individual entrepreneurs under the simplified tax system or under other tax regimes are required to keep accounting records, except for processes when an entrepreneur keeps records of income and expenses for tax purposes in the manner established by the law of the Russian Federation.

Tax calculation and payment

In order to correctly calculate the payment under the simplified tax system, you must remember that the tax period for this tax regime is a calendar year. The reporting periods at the end of which advance payments must be made are: first quarter, six months, and nine months. The calculation is carried out on an accrual basis, that is, for nine months it is necessary to take into account all income/expenses for these nine months, including the first quarter and half of the year. On the Internet you can find many online calculators that will save individual entrepreneurs from independently calculating the amount, but it is better to at least once understand what is coming from and where.

STS "Income"

To find out the tax payable on the “income” object, you need to multiply all revenue for the reporting period by the tax rate (we rely on the standard 6%, but remember that regions can set their own preferential rates).

If an individual entrepreneur has no staff, the resulting tax amount can be reduced by paying a fixed payment “for yourself” up to 100%, but only if it is paid in the quarter for which the advance payment was accrued under the simplified tax system.

That is, in order to reduce the advance payment for the first quarter, you must pay part of the fixed contribution before March 31. To reduce for half a year - until June 30. 9 months – until September 30. Accordingly, if an individual entrepreneur’s work is seasonal, then it is better to transfer the majority of the fixed payment in the quarter in which the largest revenue falls.

Example:

- In the first quarter, the individual entrepreneur received 300,000 rubles from clients.

- He also paid 1/4 of the fixed payment “for himself” until March 31 (26545 + 5840): 4 = 8096.25 rubles.

- 300,000 x 6% = 18,000 – 8096.25 = 9903.75 – the amount of the advance payment under the simplified tax system in this case. If the figure, after the tax reduction, turned out to be 0 or less, there would be no need to pay an advance payment.

- Now let’s say that last year the individual entrepreneur’s cash receipts amounted to 350,000 rubles. And in the first quarter, one percent was also paid on income exceeding 300,000 rubles ((350,000 - 300,000) x 1% = 500 rubles).

- The advance payment we calculated can be reduced by the one percent contribution paid in the first quarter for the previous year: 9903.75 – 500 = 9403.75 final payment amount under the simplified tax system for the 1st quarter.

- During the second quarter, the individual entrepreneur earned another 300,000 rubles. When calculating the payment for the half-year, we take the tax base for both quarters - that is, (300,000 + 300,000) x 6% = 36,000 rubles.

- We reduce the resulting payment by the amount of the fixed contribution paid for these two quarters and the one percent contribution paid in the first quarter: 36000 - 8096.25 x 2 - 500 = 19307.5

- And we reduce it by the amount of the advance for the first quarter: 19307.5 - 9403.75 = 9903.75 - this is the amount payable for the six months.

Using the same scheme, the advance payment is calculated for nine months and for a year.

If an individual entrepreneur hires staff, then the tax can be reduced not only by the amount of a fixed payment “for oneself”, but also by the amount of insurance premiums for employees, but not more than 50% of the tax amount.

Let's break it down for clarity:

- In the first quarter, the individual entrepreneur received 300,000 rubles from clients.

- He also prudently paid a quarter of the fixed payment “for himself” until March 31 (26545 + 5840): 4 = 8096.25 rubles and insurance premiums for an employee in the amount of 3000 rubles, the total deduction amount is 11096.25 rubles.

- 300,000 x 6% = 18,000 – 11,096.24 = 6903.75, but the deduction was more than 50% (18,000: 2 = 9,000), which means the amount of the advance payment will be 9,000 rubles.

It is important to note that if an entrepreneur initially worked without an employee, and then hired a person, then from the moment of hiring until the end of the year (even if the employee works for only a month and leaves), he will have the right to a tax reduction of only 50%.

USN “Income minus expenses”

In order to get ahead of the tax payable under the “income minus expenses” object, it is required from all revenue for the reporting period, to subtract all documented expenses that are included in the list in Article 346.16 of the Tax Code of the Russian Federation, and multiply the resulting difference by the tax rate (take the base - 15 %, but remember that regions can set their own benefits).

We recommend you study! Follow the link:

IP income minus expenses simplified

Example:

- During the first quarter, the individual entrepreneur earned 300,000 rubles.

- At the same time, his expenses (fixed payment for himself, insurance premiums for employees, employee salaries, rent, cost of goods, their transportation, etc.) amounted to 240,000 rubles.

- (300,000 – 240,000) x 15% = 9,000 rubles advance payment under the simplified tax system for the first quarter.

However, it may happen that the amount of expenses at the end of the year is approximately equal to or even higher than the income portion. In this case, the Tax Code provides for the payment of a minimum tax equal to 1% of the total revenue.

Example:

- The individual entrepreneur received 300,000 rubles for the year.

- And his expenses amounted to 290,000 rubles.

- (300,000 – 290,000) x 15% = 1,500 rubles would be payable under standard tax calculation.

- However, the minimum tax based on a taxable base of 300,000 rubles is equal to 300,000 x 1% = 3,000 rubles.

- Accordingly, 3,000 rubles will have to be paid to the budget at the end of the year, minus previously paid quarterly advance payments.

- The difference between the actual tax and the minimum 3000 - 1500 = 1500 can be taken into account in the expenses of the next tax periods, but not later than 10 years later.

It is required to transfer advance payments to the budget no later than the 25th day of the month following the reporting period (Article 346.19 and paragraph 7 of Article 346.21 of the Tax Code of the Russian Federation), that is, April 25, July 25, October 25, and payment for the year - until April 30 of the following year inclusive. For 2021 – until May 3, 2021. In this case, the payment deadline is considered to be the day when the individual entrepreneur submitted a payment order to the bank, provided that the required amount is available in the account.

There are two situations in which the tax according to the simplified tax system must be paid within other terms:

- an activity falling under the simplified tax system has been terminated - then the taxpayer must make settlements with the budget no later than the 25th day of the month following the month of termination of the activity specified in the notification provided by the Federal Tax Service in accordance with clause 8 of Art. 346.13 Tax Code of the Russian Federation;

- The individual entrepreneur has lost the right to be on the simplified tax system, which must be reported to the tax authority no later than 15 days after the end of the quarter in which this right was lost (recommended form No. 26.2-2). And payments are made no later than the 25th day of the month following the quarter.

For some entrepreneurs who registered for the first time, and no more than two years have passed since the start of their work, there are tax holidays:

- if a law on tax holidays was adopted in the region before the opening of this individual entrepreneur;

- if the entrepreneur’s activities relate to the production, scientific, social sphere, as well as the sphere of consumer services;

- the share of the above types of work should not be less than 70% of the businessman’s total income.

Unfortunately, a more complete list of requirements can only be found at the local Federal Tax Service, since regional laws may stipulate other nuances, for example, specific OKVED, restrictions on the number of employees and/or maximum cash flow per year.

The tax holiday will be valid until December 31, 2021, but not more than two years for a specific individual entrepreneur.

Calculation of single tax at a rate of 6%

The object of taxation for IP 6 is income. That is, a single collection is made on the basis of calculations of the total income that was received from the commercial activities of the entrepreneur during the reporting period. In general cases, the simplified taxation system rate is 6 percent, but for the reasons stated earlier, the rate can be changed with the consent of the Federal Tax Service.

The calculation of IP 6 percent occurs according to the following principle:

- Incomes other than non-taxable ones are summed up.

- From the amount of income received, 6 percent is calculated, which is a single tax or advance payment.

- In accordance with the Tax Code of the Russian Federation, the amount received can be reduced by a number of deductions.

In this circumstance, the object of the simplified tax system of 6 percent is income and nothing more. Business expenses are not taken into account in any way when calculating the single fee. Individual entrepreneur 6 percent has the right to calculate the rate depending on the characteristics of the type of activity and the economy of the region of the Russian Federation in which the entrepreneur conducts business.

As for the date when a businessman calculates tax under the simplified tax system, income must be received exclusively during the reporting period. For example, if an individual entrepreneur receives payment in 2021 for goods or services provided, the contract for which was signed at the end of the previous year, then based on the income received, the individual entrepreneur is accounted for under the simplified tax system in 2021, and the tax payment is paid for the same period.

General taxation system for individual entrepreneurs

To move directly to specific cases of application of various taxation systems, it is necessary to clarify the issues of application of the general system. For individual entrepreneurs, the use of a general taxation system is quite rare, but sometimes occurs.

For such a tax return, the following fees are payable:

- value added tax at rates from zero to eighteen percent;

- tax calculated on income received at a rate of thirteen percent;

- real estate tax, which is directly applied in the activities of an individual entrepreneur.

Under the general taxation system, there are no restrictions on the number of employees.

If real estate tax is paid regardless of the results of activities - annually, then the other two fees are paid only if the entrepreneur’s activities generated income.

The use of this technique implies a rather complex relationship with the tax authorities, consisting of constant reporting. The rates for the general system relative to other systems are also quite high. Therefore, few individual entrepreneurs initially choose this direction in their activities.

It is much easier to use other taxation systems when carrying out activities. One of them is called simplified - because its differences from the general system are immediately visible.

Calculation at a rate of 15%

In contrast to the simplified tax system of 6%, the calculation of a single tax at a rate of 15% is based on another object of taxation - the difference in income and expenses received during the reporting period.

The 15% IP is calculated according to the following principle:

- All income in the tax period, with the exception of non-taxable income, is summed up.

- All expenses established by a specific list for individual entrepreneurs on the simplified taxation system in the Tax Code of the Russian Federation are summed up.

- The previously received amount of income is reduced by the amount of expenses for the reporting period.

- From the difference between income and expenses, the entrepreneur receives a single tax of 15% at a general rate.

- If the amount of tax received is less than the established amount of the minimum tax - 1% of total income for the reporting period - then the minimum tax is paid.

When drawing up estimates of expenses and income, the entrepreneur is obliged to take into account all the features, lists, lists that the simplified taxation system provides. To do this, you should monitor daily the smallest changes in local, regional and federal legislation, which may include changes in calculations, in the list of expenses and income, as well as in document forms.

Insurance premiums

Payments for medical and pension insurance are mandatory for an individual entrepreneur as long as he is registered in the Unified State Register of Individual Entrepreneurs. Their number depends on the number of employees the individual entrepreneur has. This also affects the deduction procedure, which can significantly reduce individual entrepreneurs’ taxes on the simplified tax system.

From 2021, insurance premiums are no longer tied to the minimum wage. Their size is established by law and is gradually increasing.

How much can insurance payments affect taxes? Individual entrepreneurs (USN 6%) without employees transfer insurance premiums exclusively “for themselves.” This year their amount is 32,385 rubles, of which 26,545 rubles go to the Pension Fund and 5,840 rubles to the Compulsory Medical Insurance Fund.

With an annual income of over 300 thousand, contributions to the Pension Fund increase by 1% of the excess income. The amount can grow up to a maximum of 212,360 rubles, after which the pension payment will no longer change.

Tax deductions can be made for the full amount of insurance premiums “for oneself”, which implies the possibility of zeroing out taxes for individual entrepreneurs (USN 6%) in 2021.

If there are employees, individual entrepreneur taxes (USN 6%) cannot be reduced to zero. The “simplified” tax can be reduced by no more than half due to the individual entrepreneur’s own fixed contributions, as well as due to contributions for employees.

In the case when the object of taxation “income minus expenses” is selected, the taxes of individual entrepreneurs on the simplified tax system with and without an employee are calculated in the same way. Insurance premiums in full (both for yourself and for employees) are included in expenses, reducing the tax base.

Let us remind you that the simplified tax system does not relieve an individual entrepreneur of the obligation to calculate and transfer NLFL from employees’ wages. But in this case, this is not a tax on the individual entrepreneur himself. This is a tax on the income of individuals - its employees. In this case, the employer only plays the role of a tax agent: withholds tax from income and transfers it to the budget.

Individual entrepreneur reporting under the simplified tax system

IP on the simplified tax system, as with any other tax payment regime, operates under certain reporting deadlines. The following terms are accepted for the reporting period: one quarter - 3 months, half a year - 6 months, 9 months. The tax period is a calendar year.

In the first 3 quarters, LLCs and individual entrepreneurs using the simplified tax system have the prerogative to calculate a single fee at the simplified tax rate of 6 or 15% as an advance payment. An entrepreneur can pay tax for 9 months, but is not required to submit tax reports to the Federal Tax Service - this is done exclusively after 12 months.

The simplified tax system for income or income and expenses for reporting will require:

- Declaration under the simplified tax system is a document that is submitted once a calendar reporting year. The deadline for individual entrepreneurs is until April 30, for LLCs – until March 31 of the following year for the reporting period. If no commercial activity was carried out over the past year, at the same time and at any rates of 6 or 15%, the individual entrepreneur is required to submit a zero declaration with zeros entered in all columns;

- book of accounting of income and expenses, abbreviated as KUDIR, is a document that should be filled out at the end of each financial transaction during the entire reporting period. Any income and expenses of an individual entrepreneur for each calendar year are entered into a separate book. KUDIR can be in paper or electronic form. The entrepreneur is obliged to correctly fill out the book, but must not approve or send it to the tax authorities, except in cases where this is required by the Federal Tax Service;

- reporting to the Social Insurance Fund and the Pension Fund of Russia, payment of insurance premiums. Here you need to know that the reporting of funds includes the submission of reporting documents and certain payments. An individual entrepreneur is required to pay pension and insurance taxes if he has a staff and is registered as an employer. In addition, the entrepreneur is required to submit reports to the Pension Fund and the Social Insurance Fund. If an individual entrepreneur is registered with the Pension Fund of the Russian Federation and the Social Insurance Fund as an employer, but does not have a staff of employees, he submits zero reports to the same government agencies.

The main principles in the commercial activities of an entrepreneur under the simplified tax payment system are the timely submission of the declaration and the transparency of data in the book of income and expenses.

The procedure for switching to the simplified tax system

The law specifies several ways to begin using the simplified tax regime.

When registering an LLC or individual entrepreneur

If a future business entity is only collecting all the necessary documents for registering an individual entrepreneur or opening an LLC, then he can submit an application to start using the simplified regime in a general package.

In this situation, along with forms confirming completion of the registration procedure, he will also be given a notice of application of the simplified tax system.

Attention: if at the time of opening a business there are still doubts about choosing a system, then this can be done within 30 days from the moment you receive the forms for registering an LLC or individual entrepreneur.

Transition from other modes

The Tax Code allows existing business entities to change the current tax regime to a simplified system.

But such a step is allowed only from January 1 of the calendar year. Therefore, in order to make the transition, you must complete and submit an application to the tax authority before December 31 of the current year. In it, the business entity indicates that it meets the criteria defined in the Tax Code for the application of the simplified tax system. The latter are calculated based on October 1 of the current year.

So, in order to start applying the simplified regime from January 1, 2019, it is necessary that as of October 1, 2021, the income received does not exceed 112.5 million rubles.

Another opportunity to start using a simplified version is not provided for by law.

USN income minus expenses: what is included in expenses

To understand what is included in the concept of “expenses”, it is necessary to carefully study the list established by law. For an individual businessman, the following options (finances spent) are relevant:

- purchase of funds necessary for the operation of the company;

- purchase of exclusive rights;

- production process costs.

The concept of expenses also includes the acquisition of intangible assets or know-how (in the field of electronics). Financial costs that can be written off in the new tax period:

- to obtain patents for the activities of an individual or company;

- carrying out repair work;

- necessary and force majeure financial costs;

- payment of wages;

- rental of premises or purchase;

- business or premises insurance.

In order not to miss the opportunity to reduce the financial burden, you need to carefully study the tax code, namely Article 346.

Additional taxes for individual entrepreneurs

The simplified tax system does not exempt entrepreneurs from additional taxes. We are talking about those that are tied to the specifics of the business that an individual entrepreneur runs on the simplified tax system. What taxes might these be?

For example, transport tax, property tax, excise taxes, water or land tax, mineral extraction tax, etc. In Moscow, individual entrepreneurs on the simplified tax system conducting trading activities may also be payers of the trade tax. Certain types of activities of an individual entrepreneur on the simplified tax system can be transferred to a patent or to UTII - in this case, he becomes the payer of these additional taxes.