Current as of January 30, 2021

To offset insurance premiums, penalties and fines, a written application is submitted to the Pension Fund and the Social Insurance Fund. In what form depends on which fund the overpayment occurred in.

To overpay to the Pension Fund use:

- application for offset of amounts of overpaid insurance premiums, penalties and fines (Form 22-PFR, Appendix 3 to Order of the Ministry of Labor of Russia dated December 4, 2013 No. 712n).

To overpay to the FSS use:

- application for offset of amounts of overpaid insurance premiums, penalties and fines (Form 22-FSS, Appendix 2 to FSS Order No. 49 dated 02/17/2015).

Applications must include information about the fund and the company, including its registration number in the fund.

Then you need to check the checkbox to select the type of test - regular or interregional. With a regular offset, it is enough to write in the table the amount of the overpayment, as well as against which payments it should be offset (contributions, penalties, fines). For interregional offsets, the amount of erroneously transferred contributions (penalties, fines) is written in the table and where it should be sent.

If an employee falls ill within 30 days after dismissal, he has the right to present the slip to the employer to receive payment for it.

The procedure for applying for sick leave after dismissal is no different from that provided if the employment contract remains in force. The certificate of incapacity for work should be handed over to the employer and accompanied by a statement.

The application is written to the head of the company and registered in the human resources department. It is possible to submit documents by registered mail.

To avoid troubles, it is better to personally bring the completed form in 2 copies and register it at the reception.

Keep one after indicating the incoming number and date of acceptance. Sometimes you have to defend your rights through court.

In this case, a second copy must be attached to the statement of claim.

Approximate structure of an application for sick leave payment:

- In the upper right corner the details of the organization to which the appeal is addressed are indicated: name, position and full name. responsible official. Next, it is written from whom the application for payment of benefits was received.

- In the central part, the main requirement is drawn up: “I ask you to assign and pay temporary disability benefits according to sheet No..... dated…..in accordance with paragraph 2 of Article 7 of Law No. 255 - Federal Law of December 29, 2006.” Here you should indicate the current account for transferring the cash payment and make an inventory of the documents provided.

- The application is endorsed with the signature of the employee and the date of application.

According to the standards, two copies are drawn up, one with the incoming number remains with the addressee.

Submit documents in electronic or paper form. If the average headcount of your company is 26 or more people, use the electronic method. Submit documents in the form of an electronic register. If the average number of employees is less than 25 people, then you can use the paper method.

If there was an accident at work or an employee received an occupational disease, documents for the Fund are drawn up and transferred in the same order. But in expanded quantities. You must also submit a report on an industrial accident or a report on an occupational disease with copies of the investigation materials.

If the employee was employed at another company for the previous two years, the sick leave certificate must be submitted there. If there are 2 or more such enterprises, then sick leave is submitted to one of them, whichever the employee prefers, since the benefit must be paid by one employer.

Every employee working under the terms of an employment contract has the right to receive benefits for temporary disability. If the employer is unable to pay the costs, then the employee has every right to draw up an application sent directly to the Social Insurance Fund.

Appealing to the fund to pay for sick leave in the absence of funds in the employer’s account is allowed if a bank card file is created. The FSS issues a refusal to pay when a legal entity has no encumbrances, even if there are insufficient funds to pay off the debt on the certificate of incapacity.

- Correctors (liquids, tapes, putties) must not be used under any circumstances!

- Cross out the error with one thin line. Carefully.

- Fill in the correct information on the back of the form.

- Certify the corrections with your full name, position and signature of the head of the organization.

- Place a round seal of the organization (if available) next to it.

In the provided cells, enter the abbreviated name of the organization in capital letters. If the abbreviated name is not provided in the constituent documentation, enter the full name.

Consider the sample and example of filling out sick leave in 2021 by the employer, stop when the field cells run out. There is no need to put quotation marks.

The space between words is one empty cell.

Let us repeat that you can fill out the certificate of incapacity for work only with black paste, gel, fountain or capillary pen. But if you fill out a document with a simple ballpoint pen, then problems with controllers are likely.

In order for the Social Insurance Fund to accept an application for sick leave and make a payment, you need to fill out the documents correctly and justify the costs. There are no special deadlines for submitting an application; the law sets the time at which the fund pays out funds, if there are no inaccuracies in the documents.

The primary authority that deals with the payment of sick leave benefits is the legal entities themselves. To receive benefits from your employer, you do not need to write official statements and/or contact any third authorities: usually everything is resolved verbally to the accounting department.

So many workers never face the need to apply to the Social Security Fund at all.

- The form must be filled out in block letters only;

- the document can be filled out either manually or using machine typing;

- all entries must be black and not go beyond the corresponding columns;

- the text must be written neatly , without blots, corrections, overwriting or etching;

- The document has two sections that relate to the payment of funds . They correspond to two methods of transferring money within the framework of temporary disability benefits: to the specified address via Russian post or by transfer to a bank account. Accordingly, the citizen must complete only one of the above sections;

- a citizen must fill out only those sections for which he has information . All other columns must remain empty.

Offset of overpayment to the Social Insurance Fund: fill out an application

In the application on Form 22-FSS, select the desired type of offset by checking the appropriate box:

- “offset of overpaid insurance premiums”, when offset occurs between types of payments, and first, the debt on penalties and fines will be offset against the overpayment, and the remaining amount will be offset against future payments,

- “Interregional offset of insurance contributions” is carried out between regional branches of the Social Insurance Fund, if the contributions were transferred using other details, and now they need to be taken into account in your branch of the fund (for example, if the payer was deregistered in one branch of the Social Insurance Fund and registered in another, and mistakenly continued to pay at the old place of registration).

Next, we fill out two tables of form 22-FSS of the Russian Federation (see below for a sample of filling): in one, indicate for which contributions, penalties, and fines the excess amounts were paid, in the other - against which payments you want to offset them.

Important: if the overpayment of contributions for disability and maternity occurred after January 1, 2015, then it can be offset not only against the same contributions, but also against contributions for “injuries.” And vice versa - “injuries” can be counted towards contributions for “disability and maternity”. For earlier overpayments, offset is possible only within one type of contribution (letter of the Ministry of Labor of the Russian Federation dated September 24, 2014 No. 17-3/B-451).

With the completed application, contact your FSS branch where you are registered. This can be done by sending an application by mail, handing it over to the fund branch in person, or sending it electronically. After receiving your application, the fund may:

- propose to carry out mutual reconciliation of settlements with the signing of the act in order to identify the exact amount of overpayments and debts,

- make a decision on offset without reconciliation.

In the first case, the decision on offset will be made by the social insurance fund within 10 days from the date of signing the reconciliation act, and in the second - within 10 days from the date the fund receives your application for offset.

An application for offset of insurance premiums can be submitted to the Social Insurance Fund within three years from the date the overpayment was made.

Application form 23-fss – Your lawyer

By Order of the FSS of the Russian Federation dated July 20, 2015 N 305, changes were made to the application

See this form in the MS-Excel editor and a sample of how to fill it out

Appendix No. 3 to the order of the Social Insurance Fund of the Russian Federation of February 17, 2015 No. 49

(as amended July 20, 2015)

Form 23 - FSS of the Russian Federation

Application for the return of overpaid insurance contributions, penalties and fines to the Social Insurance Fund of the Russian Federation

in accordance with Article 26 of the Federal Law of July 24, 2009 N 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund” and Article 22.

1 of the Federal Law of July 24, 1998

N 125-FZ “On compulsory social insurance against accidents at work and occupational diseases” requests a refund of overpaid insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity, penalties and fines, insurance contributions for compulsory social insurance from industrial accidents and occupational diseases, penalties and fines (underline as appropriate) to the Social Insurance Fund of the Russian Federation in the following amounts:

(in rubles and kopecks)

For compulsory social insurance in case of temporary disability and in connection with maternity

For compulsory social insurance against industrial accidents and occupational diseases

base.garant.ru

Form (download) and sample of filling out form 23-FSS of the Russian Federation in 2021

It happens that companies and individual entrepreneurs with staff allow, for one reason or another, to overpay insurance premiums for injuries, which go to the Social Insurance Fund.

This means that they can be counted against future deductions for industrial accidents and occupational diseases, or simply returned to the organization. In the second case, a special form is filled out (can be downloaded from the article).

We are talking about Form 23-FSS in 2021.

Which form to use

Since 2021, the order of the Social Insurance Fund dated November 17, 2021 No. 457 has been in force, which approved several forms of documents necessary for offset or return of overpaid (excessively collected) insurance premiums for injuries.

The Form 23-FSS form of interest to us for the return of these contributions is given in Appendix No. 3. It takes only 2 sheets and looks like this:

Please note that it is better to download form 23-FSS, since this application form does not have an official electronic format. Although the law provides for the possibility of submitting it in the form of an electronic document.

From our website, via a direct link, download form 23-FSS of the Russian Federation for free.

Return mechanism

You can submit a completed form 23-FSS of the Russian Federation to the fund for a refund of overpayment of insurance premiums for injuries only within 3 years from the date of excessive transfer of the corresponding amounts. This is stated in paragraph 13 of Art. 26.12 of the Law of July 24, 1998 No. 125-FZ EXAMPLE

From the date of receipt of a refund application from the policyholder, the law gives FSS specialists 10 days to respond.

By law, the territorial office of the Social Insurance Fund must inform the policyholder in writing or electronically within 10 days:

- about each identified fact of overpayment (clause 3 of article 26.12 of Law No. 125-FZ);

- amount of overpayment.

By the way, the territorial branch of the fund may offer the policyholder to make a mutual reconciliation of calculations (clause 4 of article 26.12 of Law No. 125-FZ). We strongly advise you to agree to it. In addition, nothing prevents the enterprise from taking the initiative to conduct a reconciliation regarding overpayment of contributions for injuries.

The results of the reconciliation are documented in the act. It will show whether there has been an overpayment, as well as the amount that can be refunded.

Filling example

Filling out form 23-FSS of the Russian Federation does not cause any particular difficulties. Moreover, the FSS has not approved a separate procedure for completing this return application form.

Please note that at the very beginning of the application form you must correctly indicate the registration number in the Social Insurance Fund and the code of subordination. They are assigned to each policyholder when registering for injury.

If the overpayment was only for contributions, put dashes in the lines “Penalties” and “Fines”.

//www.youtube.com/watch?v=_C-DNuEgekY

The following link shows a sample of filling out Form 23-FSS in 2021.

buhguru.com

Order No. 49 was registered by the Ministry of Justice of Russia on March 20, 2015

By departmental order, the FSS established the forms of documents used when adjusting settlements with policyholders for insurance premiums and penalties.

See also Form 4-FSS (2015) and the procedure for filling it out (Order of the FSS of Russia dated February 26, 2015 N 59).

Social Insurance Fund of the Russian Federation

dated February 17, 2015 N 49

“On approval of document forms used when offsetting or returning amounts of overpaid (collected) insurance contributions, penalties and fines to the Social Insurance Fund of the Russian Federation”

registered by the Ministry of Justice of Russia on March 20, 2015.

In accordance with Articles 26, 27 and 29 of the Federal Law of July 24, 2009 N 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund” (Collection of Legislation of the Russian Federation, 2009 , N 30, Art. 3738; 2010, N 31, Art. 4196; N 50, Art.

6597; 2011, N 27, art. 3880; 2012, N 50, art. 6966; 2014, N 26, art. 3394), Article 22.1 of the Federal Law of July 24, 1998

N 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases” (Collected Legislation of the Russian Federation, 1998, N 31, Art. 3803; 2003, N 17, Art. 1554; 2013, N 51, Art. 6678 ), I order:

the form of the act of joint reconciliation of calculations for insurance premiums, penalties and fines to the Social Insurance Fund of the Russian Federation (Form 21 - FSS of the Russian Federation) in accordance with Appendix No. 1;

an application form for crediting the amounts of overpaid insurance contributions, penalties and fines to the Social Insurance Fund of the Russian Federation (Form 22 - FSS of the Russian Federation) in accordance with Appendix No. 2;

an application form for the return of overpaid insurance contributions, penalties and fines to the Social Insurance Fund of the Russian Federation (form 23 - FSS of the Russian Federation) in accordance with Appendix No. 3;

an application form for the return of amounts of excessively collected insurance contributions, penalties and fines to the Social Insurance Fund of the Russian Federation (Form 24 - FSS of the Russian Federation) in accordance with Appendix No. 4;

the form of the decision to offset the amounts of overpaid insurance contributions, penalties and fines to the Social Insurance Fund of the Russian Federation (Form 25 - FSS of the Russian Federation) in accordance with Appendix No. 5;

form of the decision on the return of amounts of overpaid (collected) insurance premiums, penalties and fines to the Social Insurance Fund of the Russian Federation (Form 26 - FSS of the Russian Federation) in accordance with Appendix No. 6;

form of the decision to offset the amounts of excessively collected insurance contributions, penalties and fines to the Social Insurance Fund of the Russian Federation (Form 27 - FSS of the Russian Federation) in accordance with Appendix No. 7.

2. The order comes into force from the day paragraphs 3, 5, 7, 9, 11, 13 and 15 of paragraph 1 of the order of the Ministry of Labor and Social Protection of the Russian Federation dated December 4, 2013 are declared invalid.

N 712n “On approval of document forms used when offsetting or returning amounts of overpaid (collected) insurance premiums” (registered by the Ministry of Justice of the Russian Federation on February 12, 2014

N 31292) and appendices N 2, N 4, N 6, N 8, N 10, N 12, N 14 thereto.

Chairman of the Foundation A.S. Kigim

Appendix 1 to the order of the Social Insurance Fund of the Russian Federation

dated February 17, 2015 N 49

Appendix 2 to the order of the Social Insurance Fund of the Russian Federation

dated February 17, 2015 N 49

Appendix 3 to the order of the Social Insurance Fund of the Russian Federation

dated February 17, 2015 N 49

Appendix 4 to the order of the Social Insurance Fund of the Russian Federation

dated February 17, 2015 N 49

Appendix 5 to the order of the Social Insurance Fund of the Russian Federation

dated February 17, 2015 N 49

Appendix 6 to the order of the Social Insurance Fund of the Russian Federation

dated February 17, 2015 N 49

Appendix 7 to the order of the Social Insurance Fund of the Russian Federation

dated February 17, 2015 N 49

www.ib.ru

Updated forms of documents for insurance contributions to the Federal Social Insurance Fund of Russia

Up-to-date forms of documents have been accepted for applying for a credit or refund of overpayments on contributions. The new forms will apply from April 4 this year.

Order of the FSS of Russia dated February 17, 2015 No. 49 approved updated forms of documents related to the relationship between the payer of insurance premiums in the FSS of Russia (the policyholder) and the body monitoring insurance premiums in the FSS of Russia (the insurer).

The new forms begin to apply on April 4 of this year.

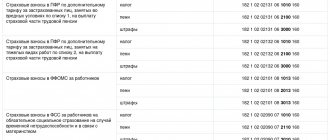

The table provides a list of document forms approved by the published Order, and also indicates which party fills out which form.

For an accountant, forms from 21 - FSS to 24 - FSS are interesting.

List of document forms regulated by the published Order

:

How to give consent to issue an electronic sick leave

If the organization does not have separate divisions, then the calculation of 4-FSS for the 3rd quarter. 2021, submit it to the territorial office of the FSS at its location (clause 1 of article 24 of the Law of July 24, 1998 No. 125-FZ). This is the place of registration of the organization.

If there are separate units, then Form 4-FSS must be submitted in the following order. Submit the calculation to the territorial office of the Social Insurance Fund at the location of the separate unit, if such a unit has a current (personal) account and independently pays salaries to employees.

According to the law, the possibility of returning money paid in excess is strictly limited to a period of three years. Applications received after this will not be accepted.

If the application arrived in a timely manner and the facts indicated in it are true, then the return of funds must occur within a month after its receipt by the employees of the extra-budgetary fund with which the incident happened. At the same time, if the fund violates its obligations and is overdue for the return of funds, then by writing a corresponding statement, for each day of delay, you can demand interest in the amount of 1/300 of the refinancing rate (if representatives of the organization refuse to pay voluntarily, you can safely go to court ).

The form consists of a title page and several tables, each of which contains a separate block of information.

As part of the 4-FSS report for the 3rd quarter of 2021, only the main sheets containing general information about the payer, insurance premiums and labor protection measures are required to be completed:

- Title page.

- Table 1 containing the calculation of the base for calculating contributions.

- Table 2, which reflects the status of settlements with the Social Insurance Fund division.

- Table 5, including information on the special assessment of working conditions and medical examinations.

The remaining tables apply only if the policyholder has the data to fill them out:

- Table 1.1 is used if the policyholder temporarily sends its employees to work for another legal entity or individual entrepreneur.

- Table 3 contains information on compulsory insurance costs (for example, sick pay for industrial accidents).

- Table 4 reflects information on the number of accidents and occupational diseases.

Using the same principle, we will consider the order of filling out the report - first all the “mandatory” sheets, and then the “additional” sheets.

The following information is indicated at the top of the title page:

- Policyholder registration number . This is the number that the company (IP) received when registering with the Social Insurance Fund.

- Subordination code . Code of the fund branch to which the policyholder is attached.

- Correction number . The original form states "000". If a clarifying calculation is submitted, “001”, “002” and so on are indicated.

- K period . Select a code from the options presented below the cell. For example, the first quarter corresponds to the code “03”. The number of requests to the fund for compensation payments is indicated through a fraction.

- Calendar year . The year to which the reporting period relates is indicated.

- Termination of activities. If the entity ceased to operate during the reporting period, “L” is indicated.

- Name. You must indicate the full name of the legal entity along with the legal form or the last name, first name and patronymic of the entrepreneur.

- Basic codes:

- TIN - 10 lines for an organization, 12 for an entrepreneur;

Checkpoint - entrepreneurs do not indicate;

- OGRN (OGRNIP) - registration number of the company or individual entrepreneur from the Certificate of Registration;

- OKVED code is a code for the type of activity in accordance with the All-Russian Classifier.

Table 1 consists of 9 rows. Lines 1-4 are filled in for each of the last three months of the reporting period. In columns 4 and 5 and 6, the indicator from column 1 is indicated monthly , and in column 3 - for the entire reporting period . These lines reflect the following data;

- line 1 - amounts of accrued payments to individuals;

- line 2 - amounts not subject to contributions;

- line 3 - taxable base - the difference between lines 1 and 2 for each column;

- line 4 - amounts of payments to disabled people included in the indicators of line 3.

The remaining lines reflect the following data:

- line 5 - insurance rate;

- line 6 - percentage of discount on the tariff, if it is established by the FSS department;

- line 7 - percentage of surcharge on the tariff, if it is established by the FSS department;

- line 8 - date of establishment of the premium from line 7;

- line 9 - final tariff amount taking into account lines 6 and 7.

This table is filled out if the policyholder has sent its employees temporarily to other companies . The lines are filled in for each organization or entrepreneur to which employees are sent. Accordingly, the data of the receiving party is reflected in the columns of the table. The following table shows how to fill out the fields.

| Column number | What to contribute |

| 2 | Registration number in the FSS |

| 3 | TIN |

| 4 | OKVED |

| 5 | Number of workers sent |

| 6 | Contributory payments to these employees for the reporting period |

| 7 | Contributory payments to disabled employees from those assigned |

| 8, 10, 12 | Payments to assigned employees for each of the last 3 months of the reporting period |

| 9, 11, 13 | Payments to disabled persons from those referred for each of the last 3 months of the reporting period |

| 14 | Tariff size* |

| 15 | Tariff amount up to hundredths of a percent, taking into account discounts/surcharges* |

*Note . For employees sent for temporary work in other companies, contributions are calculated at the rate of the receiving party.

The table contains calculations for contributions for injuries. The source of data for filling it out are accounting registers.

The table is visually divided into 2 parts. The left side is filled in as follows:

- Line 1 - the amount of the policyholder's debt to the Social Insurance Fund at the beginning of the period.

- Line 1.1 - the amount of debt of the legal successor transferred from the reorganized entity or the amount of debt of the insured remaining after the closure of a separate division.

- Line 2 - the amount of contributions accrued for the period. In addition to the total amount, it is indicated (in column 1): the amount at the beginning of the period;

- amounts for each of the last three months.

- Line 10 - due to excess costs;

The rows on the right side of the table are filled in like this:

- line 13 - due to excess costs;

- at the beginning of the period;

This table shows the costs of injury contributions . On lines 1-8, fill in columns 3 (number of days) and 4 (amount). Payment information must be provided:

- on line 1 - in connection with accidents;

- on line 4 - in connection with occupational diseases;

- on line 7 - for vacation for sanatorium treatment.

Data on these payments is detailed. The number of days and amount are indicated in relation to persons who:

- suffered while working outside (lines 2 and 5);

- suffered while working for another organization (lines 3, 6 and 8).

For the rest of the line, the following information is indicated:

- line 9 - amount spent on measures to prevent injuries and occupational diseases;

- line 10 - total cost (sum of lines 1, 4, 7 and 9);

- line 11 - the amount of benefits that were accrued but not paid.

Information about the number of affected persons is reflected here . There are only 5 lines in the table, which indicates:

- in line 1 - the number of persons injured due to accidents, based on reports of industrial accidents in form N-1;

- in line 2 - the number of people injured in fatal accidents (included in the indicator from line 1);

- in line 3 - the number of persons affected by occupational diseases, based on acts on cases of occupational diseases;

- in line 4 - the total number of victims (line 1 + line 3);

- in line 5 - the number of persons who lost their ability to work only temporarily, based on data from sick leave.

Lines 1-3 indicate insured events for the reporting period according to the date of the examination .