Trade

Retail

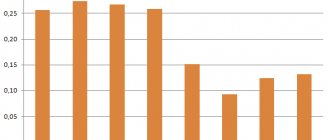

* The calculations use average data for Russia

Once upon a time in ancient times there were such people in Rus'. They wandered through cities and villages, carrying a special box on their shoulders. This is a mobile warehouse.

And in that box there were all sorts of goods, and such that the people really needed. And almost everyone could pick up something useful from the peddler. The peddlers knew how to put together an assortment in such a way that none of the “clients” were offended. Alas, they disappeared a long time ago, they no longer exist, and they are not needed now. It's a pity. The ability of peddlers to select the composition of the goods, the principles, so to speak, of forming the contents of the box could be quite useful to a modern car service in filling the warehouse of spare parts.

Let’s make a reservation right away: our little study does not pretend to be universal. We will not consider a situation where the issue of providing spare parts is akin to rescuing drowning people - “the business of the drowning people themselves.” This, as you know, is very common among small auto repair shops, especially those that specialize in repairing domestic cars. Indeed, why fool yourself, hire a specially trained person, spend money on equipment for a special room, freeze certain funds, and even get a headache with a guarantee for the quality of these same spare parts. The client arrived, the master told him exactly what pieces of hardware he would need, the client went to the nearest auto parts store, bought the part - and everyone was fine.

A simple and effective method, but, alas, extremely uncivilized. The client mutates, develops and changes, and places ever higher demands on the service. Well, he, the client, doesn’t want to go somewhere and look for something. And he will simply turn around and go to another place, where he will not be burdened with the task of independently searching for parts.

The correct procedure for writing off fixed assets - postings, example and documentation

The property of an enterprise, in particular fixed assets (hereinafter referred to as fixed assets), can be written off from the company's records for various reasons.

It happens that they simply become unusable, or the manager decides to sell them or donate them.

In this article, we will look in detail at how the procedure for writing off fixed assets occurs, what documents are needed for this, and what entries the accounting employee will make to write off the residual value of the fixed asset.

[upto]

How to correctly write off an operating system from the balance sheet of an enterprise - rules

The procedure for decommissioning an OS contains many nuances. They need to be studied in advance, before the process starts.

Knowing the correct procedure and what entries need to be made by the accounting department, the company will be able to carry out the procedure correctly, which will help avoid problems with regulatory authorities (in particular with the tax office).

Write-offs are carried out by the company only in certain situations.

The main reasons for deregistration of fixed assets:

Deterioration of an object can be physical or moral. The first implies breakdowns or failure, in the second case they talk about the obsolescence of the model.

In both situations, further use of the fixed asset for its intended purpose is considered inappropriate.

Here a simple invoice for internal movement is issued. The company's fixed assets still remain on the balance sheet.

Regardless of the reasons, the procedure for writing off an asset from the balance sheet of an enterprise will be identical in all cases.

itself begins with the approval of the special commission by the head . For this purpose, a corresponding order is issued for the enterprise. The commission consists of at least three people.

The members of the commission are middle managers: Ch. engineer, gl. mechanic, gl. accountant, etc. Specialists should be from different fields, this will help to consider the impossibility of further using the OS from different points of view.

The Commission carries out a number of actions:

- assessment of the possibility of restoring the previous parameters of the object;

- thorough inspection of the OS;

- determination of the reason for liquidation;

- identification of those responsible (in case of theft or breakdown);

- drawing up an inspection report;

- drawing up a conclusion;

- drawing up a defective statement;

- formation of an act on decommissioning of the operating system and protocol.

If the decision is positive, a special order is issued . It must be signed by all members of the commission, the head of the company and other interested parties.

After issuing the order, the accountant makes the necessary entries and the property is written off. If the OS contains parts that can be used in the future in other property, it is necessary to disassemble and post the parts.

To write off fixed assets, an additional subaccount is opened to account 01 .

The initial cost of the object is transferred to it.

The next step is to write off depreciation for the entire period of use of the property from account 02 to an open subaccount to account 01.

After making this posting, a residual value is formed, which also needs to be written off.

The amount of income tax depends on the correct display of entries in accounting.

Accountant mistakes can lead to disastrous consequences.

Let's look at what kind of postings an accountant will make in more detail below.

Causes

The write-off procedure occurs for the following reasons:

- sale of an object to an individual or legal entity;

- transfer of property as the authorized capital of another company;

- transfer of an object by exchange or gift;

- when identifying a shortage of an object;

- upon partial liquidation of the facility.

In most cases, deregistration occurs after the item ceases to provide economic benefit to the company.

What documents are needed - documentation

The law does not contain a specific obligation to fill out certain forms of documents when writing off property from the balance sheet of an enterprise. Companies have the right to develop them independently, subject to prior approval by order.

In this case, it is necessary to ensure that such documentation contains the required details.

It is allowed to use unified forms of primary documents , as well as modified or independently developed forms.

The main thing is that the forms used are stipulated by the accounting policy.

The list of required documents directly depends on the reason for the write-off.

When selling, fill out the following forms:

- act of write-off of form OS-1 (OS-1a or OS-1b);

- Act of Handover;

- contract of sale

If the main asset has become unusable, use:

Defective statements and acts are filled out by the commission for writing off fixed assets. Errors and clerical errors should not be allowed in such documentation. Otherwise, this may lead to problems with inspection authorities.

Postings in accounting

To remove an asset from the balance sheet of an enterprise, you need to write off depreciation from account 02 and the original cost from account 01.1 to subaccount 01.2 using entries Dt 01.2 Kt 02 and Dt 01.1 Kt 01.2 .

After which, a residual value is formed in subaccount 01.2, which must be written off as a debit to account 91 by posting Dt 91.2 Kt 01.2.

When writing off a fixed asset, accounting makes several important entries:

| Postings | Description | |

| Dt | CT | |

| 01.1 | 01.2 | Posting for writing off the initial cost of an object |

| 02 | 01.2 | Write-off of depreciation |

| 91.2 | 01.2 | Posting for writing off the residual value of an object |

| 91.2 | 70, 76, 69 | Costs associated with deregistration are taken into account |

| When worn | ||

| 10 | 91.1 | The capital assets remaining from the write-off of the fixed asset (parts, assemblies) were capitalized |

| When selling | ||

| 62 | 91.1 | The sales price of the fixed asset is reflected |

| 91.3 | 68 | VAT charged on the sold item |

| 91.2 | 10 (20,23,26 …), 60 | Sales expenses are reflected |

| For free transfer | ||

| 91.3 | 68 | VAT is reflected on the market value of the donated OS |

| When contributing fixed assets to the authorized capital of another organization | ||

| 76 | 01.2 | Transfer of fixed assets to the management company of another company |

| 58 | 76 | The debt on the contribution to the capital of another company is reflected |

| In case of shortage | ||

| 94 | 01.2 | Write-off of residual value |

As can be seen from the table, the entries made by the accountant are directly related to the reasons for the write-off: sale, transfer, shortage or wear and tear.

Also, the accountant will additionally make entries for the receipt of parts if the property is being dismantled for spare parts.

This is done after the main object is written off.

conclusions

Several main conclusions can be drawn on this topic:

- When selling, depreciation (impossibility of further use of the object) or loss of fixed assets, the organization must write them off from the balance sheet.

- The procedure is accompanied by documentation. The main ones are the write-off act, the defective statement (if worn out), the purchase and sale agreement (if sold), etc.

- To carry out the procedure, the company creates a special commission consisting of at least three people. It consists of middle managers and accounting staff. The composition of the commission is approved by order of the head.

- After the commission has inspected the property and issued a conclusion about the impossibility of further use of the OS in the company, an order is issued regarding the fact of write-off.

- It is allowed to write off a fixed asset and capitalize its individual parts for further use.

- All orders will not be considered valid without the manager's visa. Also, all accompanying documentation is signed by members of the commission.

[upto]

Source: https://praktibuh.ru/buhuchet/vneoborotnye/os/vybytie/spisanie-osnovnyh-sredstv.html

Capitalization of materials after dismantling fixed assets - posting

Capitalization of materials after dismantling fixed assets - postings in this case are recorded in accordance with general accounting procedures. How to reflect capitalization in accounting and what to pay special attention to, we will talk in our article.

General procedure for liquidation of fixed assets

Capitalization of spare parts as a result of liquidation of fixed assets

Materials from the liquidation of fixed assets were capitalized: taxes

Results

General procedure for liquidation of fixed assets

Loss or deterioration of the original technical characteristics of the OS during its operation is a normal operating situation. Any working property wears out naturally, and over time its further use becomes impractical. This means that the time has come to make a decision on liquidation.

The procedure for liquidating fixed assets is prescribed in the guidelines for accounting for fixed assets (approved by order of the Ministry of Finance dated October 13, 2003 No. 91). In general it is as follows.

Based on the decision of the manager, a liquidation commission is created, whose specialists will decide the fate of the outdated OS.

It is tasked with assessing the technical condition of the facility and making an appropriate decision.

If a decision is made to liquidate, then the conclusions made by the commission group are formalized in a conclusion, which indicates the reasons why the further use of the object is considered inappropriate.

After this, the manager signs an order to cease operation and liquidate the OS. This document is the basis for writing off the initial cost of fixed assets and accumulated depreciation.

Based on the order, the chief accountant of the company draws up an act for writing off the object, which is approved by the manager. The act must record the following information:

- on the acceptance of the object on the balance sheet of the enterprise;

- date of production or construction of the facility;

- initial commissioning of the OS facility;

- useful life of the object;

- purchase price of the fixed asset;

- accrued depreciation, revaluations and repairs of buildings, structures, other objects, reasons for disposal, technical condition of main parts and components.

The act can be drawn up not only according to forms OS-4, OS-4a, OS-4b, but also in any form. The legislator allows you to make a choice, determining the most acceptable option. After which the accountant should make a note about the disposal of the fixed asset item by making entries in the inventory cards according to forms OS-6, OS-6a, OS-6b.

Find out how to competently and correctly draw up an act from the article “Act for write-off of fixed assets - sample filling” .

Capitalization of spare parts as a result of liquidation of fixed assets

One of the ways to liquidate an OS is to dismantle the object. It can be carried out both by the organization’s own resources and with the involvement of third parties.

After dismantling, it is necessary to correctly reflect both income and expenses incurred in accounting.

Let's consider various options for liquidating an object by dismantling and the corresponding wiring.

Option 1: liquidation by the organization itself (economic method)

If the liquidation of an OS is carried out by the organization itself, the costs of liquidation are reflected by the posting: Dt 91-2 Kt 70 (68, 69, 10).

If the company structure has a special division and the facility is dismantled by it, costs from accounts 10, 70, 69, etc. are first accumulated in account 23 and only then written off to account 91-2.

Option 2: contract method

If dismantling/liquidation is entrusted to a contractor, the postings will be as follows:

- Dt 91-2 Kt 60 - for the amount of costs;

- Dt 19 Kt 60 - for the amount of VAT claimed by the contractor (unless, of course, he is a special regime agent).

When dismantling the operating system, the company, as a rule, remains at its disposal material - spare parts in various technical conditions, which can be used in further activities or have worn out and are unsuitable for use.

Organizations need to independently assess the suitability of the material and determine the cost of spare parts. Material is accepted for accounting at market price.

IMPORTANT! The market price must be supported by a documented certificate of the average market cost of materials. The certificate can be obtained from an expert organization or it can be drawn up by a company’s specialized specialist who will monitor the cost of similar materials and make an informed conclusion.

Capitalized materials remaining from a liquidated facility can be used in production activities or sold.

The receipt of materials from dismantling is reflected by the entry: Dt 10 Kt 91-1.

Further use in production will be reflected by wiring: Dt 20, 25, 26, etc. Kt 10.

Upon sale, other income will arise in the amount of revenue and other expenses in the amount for which the materials were taken to the warehouse:

- Dt 62 Kt 91-1;

- Dt 91-2 Kt 10.

Find all the nuances of writing off materials in our article “The procedure for writing off materials in accounting (nuances).”

Materials from the liquidation of fixed assets were capitalized: taxes

Income and expenses when dismantling the operating system will not only be in accounting. They will also have to be recognized for income tax purposes.

Thus, expenses for the liquidation of an operating system are included in non-operating expenses (subclause 8, clause 1, article 265 of the Tax Code of the Russian Federation). Note that on the same basis the residual value of the object being decommissioned is also written off.

https://www.youtube.com/watch?v=H0dBYJtP91A

The income will be the market value of the materials remaining after dismantling.

The further fate of the inventories obtained in this way will also affect the profit tax. So, when the materials obtained as a result of the liquidation of the operating system are released into production or sold, their cost will go to material costs or sales costs, respectively.

Find out about changes in tax accounting of fixed assets in 2018 from the material “The procedure for tax accounting of fixed assets in 2017-2018.”

Results

When registering materials remaining from a dismantled OS, it is necessary to act in strict accordance with the law. Namely: create a commission to liquidate an asset, capitalize the material received from liquidation and include it in income, and then take it into account depending on the end use.

We also recommend our article “How to capitalize scrap metal from write-off of fixed assets?”

Subscribe to our accounting channel Yandex.Zen

Subscribe

Source: https://nalog-nalog.ru/buhgalterskij_uchet/vedenie_buhgalterskogo_ucheta/oprihodovanie_materialov_posle_demontazha_osnovnyh_sredstv_provodki/

WE EQUIP THE BOX

So, we decided that there should be a warehouse and a spare parts department. And the need for these units is not discussed. Looking ahead a little, let's assume that the appropriate areas are prepared and there is staff. Where to begin?

Of course, from system support. Because without it it is impossible to take almost a single step. To create and maintain a database - and without it today normal work with a large range of spare parts is completely unthinkable - it is necessary to equip the warehouse and the corresponding department with computer equipment. You won’t keep records using the old-fashioned method - through a paper file cabinet?

General databases are quite large, and in order to competently, clearly and quickly process all kinds of queries on this database, both computer hardware and software for it must meet the modern level. Moreover, simply purchasing it is not enough; a local network is a necessary component of the system. As for software, today the most common product suitable for our purposes is 1C or 1C Rarus software. Recently, new developments from other companies have appeared, but they have not yet been tested in practice, so we believe that it is premature to talk about them in more or less detail.

The main disadvantage of this software product is its own high cost and the cost of technical support. If the technical center does not have its own system administrator who can correct and debug the program in a timely manner, then due to each failure you will have to contact the developer company. And this is wasted time and, accordingly, money.

Some companies are developing their own products. This seems to be convenient, as it provides a certain independence from “outsiders.” However, the flip side of this coin is the need to maintain your own staff of programmers, which means additional costs. It is very important that the selected software product has the ability to be upgraded, otherwise in a couple of years it will simply become outdated, and off to new expenses.

In addition to the above, the spare parts department must be provided with the necessary documentation and spare parts catalogs. This is one of the main problems, but if the company is an official dealer of a car plant, then the plant is obliged to provide documentation either under the contract or for money, it all depends on how the contract is drawn up. But small companies have it worse - they themselves have to search, purchase, and obtain documentation by any means. However, the money spent on this will subsequently bring only profit.

Modern non-traditional technologies - the Internet, for example, can be a good addition to internal system support. One of the options for expanding the scope of services for clients is to provide them with the necessary information through the World Wide Web. Many people are now trying not to sit on the phone, calling companies to see if they have the parts they are interested in and the services they provide, but are trying to get as much information about the company as possible from its website. A company’s website is its business card on the Internet, and the more solid and rich it is, the more likely it is that the client will definitely contact this company.

The main thing in this matter is technical support and constant updating of the site. Because outdated and inaccurate information can play the opposite role - the role of anti-advertising.

And finally, the last thing in terms of system support. Both in the process of initial filling and in the course of further work to maintain the necessary stock of the warehouse, everyone, as a rule, is faced with another problem, which can be called fundamental. This is the determination of the exact part identification number for the order. Without accurate information about the part, an order is impossible, delivery of the required part to the technical center, as well as retail sales is impossible. Why does a customer need a part that doesn’t fit his car?

This situation can be resolved. It is enough to stock up on modern catalogs of spare parts, which need to be periodically updated as new models are released by a particular manufacturer. Typically, updates occur at least once every six months, and maybe once a quarter, it depends on the volume of car production by the manufacturer and the speed of updating the model range.

Catalogs are located on different media. These are electronic EPC catalogs on CDs, microfiche - a more outdated version, and, of course, good old, time-tested printed catalogs. Having more detailed information on all the machines of the manufacturer that a particular dealer works with will allow him to avoid mistakes when ordering parts, and, accordingly, financial losses, because often an incorrectly ordered part costs much more than all the catalogs combined. For example, an air conditioning compressor for a new Japanese car can cost from 800 to 1500 dollars, and the cost of an updated catalog may not exceed 30-100 USD. Think for yourself, decide for yourself whether to have it or not.

Accounting for the disposal of fixed assets from the enterprise

June 16, 2014 Accounting for fixed assets

A fixed asset can leave an enterprise in several ways and for various reasons.

An object can be sold, donated, contributed to the authorized capital of another organization, or written off due to moral or physical wear and tear.

We will analyze each method of disposal of a fixed asset, how an object is deregistered, and what entries for writing off a fixed asset should be made by an accountant in each case.

An OS object can leave an enterprise in several ways:

- write-off due to physical wear and tear or breakdown;

- write-off due to obsolescence;

- disposal upon sale;

- disposal upon transfer free of charge to another person;

- inclusion in the charter capital of another enterprise;

- exchange.

We will consider accounting for each of these procedures for the disposal of fixed assets below; accounting entries are given for each case.

Write-off as a result of physical or moral wear and tear

If a fixed asset is physically worn out, its useful life has expired, it is obsolete or damaged so much that it cannot be used for further use, then it must be written off, that is, deregistered.

Before writing off an OS, it is necessary to assess its condition, the possibility or impossibility of its further operation. This assessment is carried out by a special commission.

If the commission decides to write off an object, then the manager issues an order on the need to write off the fixed asset.

In this case, a write-off act is drawn up in the form OS-4, OS-4a or OS-4b, on the basis of which the accountant makes entries to deregister the fixed asset and makes a note about the write-off in the inventory card OS-6, OS-6a or OS- 6b.

When an asset is disposed of in this way, its residual value is written off from the 01 account on which the object is listed. The residual value is calculated by subtracting the amount of accrued depreciation from the original (replacement) cost.

- Initial – this is the cost at which the fixed asset was accepted for accounting on account 01 upon receipt (read more about the receipt of fixed assets here).

- Replacement value is the value obtained as a result of revaluation.

- Accrued depreciation – all accumulated depreciation charges as of the write-off date, recorded on the loan account 02, are taken.

The step-by-step procedure for writing off fixed assets is as follows:

- On account 01, an additional subaccount 2 “Disposal of fixed assets” is opened. In this case, subaccount 1 will include operating systems.

- A posting is made to write off the original (replacement) cost: D01/2 K01/1.

- A posting is made to write off accrued depreciation: D02 K01/2.

- In subaccount 2, the residual value of the fixed assets has formed (the difference between debit and credit), which is written off as other expenses by posting D91/2 K01/2.

If the object is fully depreciated, its useful life has ended, then the residual value will be equal to 0 (the debit of subaccount 2 account 01 is equal to its credit).

Expenses for writing off fixed assets, for example, for dismantling, are also written off as other expenses (D91/2 K70, 69, 76).

Parts, spare parts, materials remaining after dismantling the OS facility and subject to further use are accounted for at the average market value as material assets (D10 K91/1).

Based on the results of the write-off, a financial result is formed on account 91; in the event of a profit, posting D91/9 K99 is made; in the event of a loss, posting D99 K91/9 is reflected.

Postings when writing off a fixed asset:

Sale of fixed assets

If disposal as a result of write-off is formalized by a write-off act, then disposal of a fixed asset through sale is formalized by an acceptance and transfer certificate, form OS-1, OS-1a, OS-1b.

If for an enterprise the sale of fixed assets is an isolated case and is not a regular type of activity, then the income and expenses associated with the sale are reflected in account 91 (in contrast to the sale of goods, which are reflected in account 90 “Sales”).

When selling a fixed asset to a third party, the residual value of the object is written off in the same way, posting:

- D01/2 K01/1 – the initial cost of the fixed assets has been written off,

- D02 K01/2 – depreciation on this fixed asset is written off.

- D91/2 K01/2 – the residual value of fixed assets intended for sale has been written off.

- D91/2 K70 (69, 76) – related expenses are reflected.

Revenue received from the sale of fixed assets is reflected in the credit of account 91 in the first subaccount, the posting looks like:

- D62 (76) K91/1 – revenue from the sale of fixed assets is reflected.

The sale of a fixed asset is an operation subject to VAT. The price at which the property is sold to the buyer must include value added tax. The VAT amount is reflected by posting D91/3 K68.nds.

Based on the results of the sale, a financial result is formed on account 91, which is reflected in one of the postings:

- D99 K91/9 – loss from the sale of fixed assets is reflected (if expenses exceeded revenue).

- D91/9 K99 – profit from the sale of fixed assets is reflected (if the proceeds from the sale exceeded expenses).

Postings when selling a fixed asset:

Free transfer (donation)

The donation of a fixed asset is equivalent to the sale, therefore the mechanism for disposal of fixed assets is similar to the sale.

In the same way, the residual value is written off to the debit of account 91/2. This includes all associated costs.

Since the object is being transferred free of charge, there will be no revenue in this case. However, VAT must be charged. VAT is calculated based on the average market value of the fixed asset on the date of transfer.

The loss received from the gift is reflected by posting D99 K91/9.

Postings for the gratuitous transfer of fixed assets:

Contribution of fixed assets to the authorized capital of another enterprise

Let's consider another way to dispose of fixed assets - adding it to the authorized capital of another organization. The transfer is similarly formalized by an act of acceptance and transfer.

Contribution of fixed assets to the authorized capital is considered a financial investment of the enterprise in order to receive income in the form of dividends, therefore account 58 “Financial investments” is used to reflect this operation.

Initially, postings are made to write off the original cost and depreciation: D01/2 K01/1 and D02 K01/2.

The posting for the transfer of fixed assets to another enterprise has the form: D76 K01/2, which is carried out for the amount of the residual value of the fixed assets.

In this case, a debt is formed for the contribution to the authorized capital, which is reflected by posting D58 K76.

There is no need to charge VAT on the cost of fixed assets, since this operation is not equated to a sale, but is considered an investment of the enterprise.

Postings when adding a fixed asset to the capital of another enterprise:

Source: https://buhs0.ru/vybytie-osnovnyx-sredstv-s-predpriyatiya/

ACCOUNTING AND CONTROL

So, you and I have built a “box”, equipped it and filled it with the necessary goods. And we set off. Now the most difficult part begins - the goods come and go, and in different ways: to a technical center for repairs, to retail sales (if such a practice exists), to close warranty claims if you also have a car dealership. Everything flows, everything changes, and, therefore, there is a need for constant replenishment of the nomenclature, accounting, as the classic of one unforgettable teaching said, and control.

In large car dealerships, the movement of spare parts and components can be divided into four main directions. The most optimal scheme of work is something like this.

Parts are issued from the warehouse using invoices to the retail and wholesale sales departments, as well as against previously placed orders in these departments.

The issuance of spare parts to the technical center is carried out on the basis of an order for each specific vehicle currently being repaired. For a car dealership, parts are supplied on the basis of a completion card or other documents developed directly by a specific company, because there is no uniform form of document flow.

It is necessary to provide for the possibility of the customer returning the part. In this case, the part must be returned according to the invoice based on the consumption document. This is done so that the number of parts in the warehouse listed in the database corresponds to the actual one. The situation with warranty parts is a little more complicated; their implementation is carried out not only on the basis of an order, but also on the basis of a warranty application. All these documents must be monitored by the relevant services and displayed in a database to maintain statistics of failures and demand for specific types of parts.

One of the major problems in the life of a warehouse is the task of selecting items and the speed of warehouse turnover.

To operate successfully and profitably, tech centers need to strive to accelerate inventory turnover. This can be done on the basis of analytical work for a year, month, week. That is, you need to constantly check how many and what items were sold during the current period.

The so-called “lost sales statistics” plays a huge role in this matter. For example, a customer wants to purchase a part from a retail department. The manager, after checking the database, finds out that it is not in stock. The client leaves, and a week later the situation repeats itself. If this information is not recorded anywhere except in the manager’s head, then we can safely say that it is lost. To correctly maintain these statistics, the entire range of parts produced by a specific manufacturer must be entered into the database; sometimes these databases reach 300-500 thousand catalog numbers.

If done this way, the picture will look like this. The manager, having determined the exact catalog number of the requested item, checks availability in the database. If a part is missing, it is automatically entered into the table of lost sales. After a certain period (week, month, quarter), a selection is made from this table under the condition that the warehouse must have a part with a number of requests of at least 3 per week and at least 10 per month.

In turn, managers and warehouse supervisors must understand perfectly well that the warehouse of an auto repair center, especially one working on foreign cars, should mainly contain parts for cars no older than 3-5 years from the start of production. As practice shows, the main demand for parts for these cars is, in particular, for original parts. It makes up about 85% of total sales, since for owners of foreign cars whose cars are more than 6 years old, the “original” is very expensive, and they are forced to look for a cheap “non-original” or go to used car dismantling sites.

Postings for write-off of fixed assets

The write-off of an asset from the company's balance sheet can occur for various reasons: upon sale, transfer, termination of operation due to physical or moral wear and tear, as well as irreparable breakdown, etc. How to write off a fixed asset in the company's accounting will be discussed in the article.

Write-off of fixed assets: accounting rules

In generally accepted practice, to account for the disposal of fixed assets, it is necessary to open a separate subaccount to the account. 01 (for example, “01/select”), to which the initial/replacement cost of the object is transferred at the time of registration of disposal of the asset from account 01 by posting D/t 01/select K/t 01.

Then the accumulated depreciation on the retiring asset is written off - D/t 02 K/t 01/select. At the same time, on the account. 01/vyb, the residual value of the object is formed, subject to write-off as other costs, which is necessarily reflected in the orders of the manager. If an object with fully accrued depreciation is written off, then the balance on account 01/select. will be zero.

Example:

The company decided to write off an inactive obsolete machine with an original cost of 360 thousand rubles. with accumulated depreciation in the amount of 300 thousand rubles.

The accountant prepared the following transactions for write-off:

D/t 01/select. K/t 01 – 360 tr.

D/t 02 K/t 01/select – 300 tr.

Debit 01/select records the residual value of the object as 60 tr. which should be attributed to other costs of the company - D/t 91 K/t 01/select. The company's losses incurred from writing off fixed assets with residual value can be reduced by capitalizing the useful remains of the object, for example, scrap ferrous and non-ferrous metals or other fragments.

Postings when writing off sold fixed assets

When selling fixed assets, like any other property, it is assumed not only to receive income from the sale, but also to form a block of costs consisting of the residual value of the disposed object and expenses associated with its sale. Typical entries for write-off of fixed assets will be as follows:

| Operations | D/t | K/t |

| Income from the sale of fixed assets is taken into account | 62 | 91 |

| VAT charged | 91 | 68 |

| Write-off of the residual value of the sold object | 91 | 01/select |

| Costs associated with sales are written off | 91 | 10,60,76 |

Postings for write-off of fixed assets upon gratuitous transfer

A special feature of this operation is the lack of income received from the transfer of an object, although it is interpreted in the Tax Code of the Russian Federation as a sale. Therefore, payment of VAT on the market value of the transferred object also becomes a prerequisite. Otherwise, the accounting entries are identical to the entries made when selling the operating system.

Postings for write-off of fixed assets as a result of damage or shortage

As in the situation when, due to moral or physical wear and tear, an asset cannot be used, assets damaged as a result of an accident, emergency circumstances, or recorded shortages based on the results of the regular inventory are reflected as part of other costs. However, first it is advisable to take them into account in the account of losses and shortages 94 by posting D/t 94 K/t 01/select.

Subsequently, the manager, by his order, approves either the attribution of the cost of the fixed assets to the account. 91 (D/t 91 K/t 94), or recovery of the amount of losses from the guilty person upon identification (D/t 73 K/t 94).

Liquidation of fixed assets

The certificate can be obtained from an expert organization or it can be drawn up by a company’s specialized specialist who will monitor the cost of similar materials and make an informed conclusion.

Capitalized materials remaining from a liquidated facility can be used in production activities or sold. The receipt of materials from dismantling is reflected by the entry: Dt 10 Kt 91-1. Further use in production will be reflected by wiring: Dt 20, 25, 26, etc. Kt 10.

Upon sale, other income will arise in the amount of revenue and other expenses in the amount for which the materials were taken to the warehouse:

- Dt 62 Kt 91-1;

- Dt 91-2 Kt 10.

Find all the nuances of writing off materials in our article “The procedure for writing off materials in accounting (nuances).”

Dismantling and write-off of fixed assets

AttentionResults When registering materials remaining from a dismantled OS, you must act in strict accordance with the law. Namely: create a commission to liquidate an asset, capitalize the material received from liquidation and include it in income, and then take it into account depending on the end use.

Registration

Important: Ministry of Finance dated October 13, 2003 No. 91). In general it is as follows. Based on the decision of the manager, a liquidation commission is created, whose specialists will decide the fate of the outdated OS. It is tasked with assessing the technical condition of the facility and making an appropriate decision.

If a decision is made to liquidate, then the conclusions made by the commission group are formalized in a conclusion, which indicates the reasons why the further use of the object is considered inappropriate.

InfoAfter this, the manager signs an order to cease operation and liquidate the OS.

This document is the basis for writing off the initial cost of fixed assets and accumulated depreciation.

Based on the order, the chief accountant of the company draws up an act for writing off the object, which is approved by the manager.

We dismantle fixed assets

In others, they agree with the tax authorities that expenses arising during the liquidation period cannot be taken into account for tax purposes before the liquidation procedure is fully completed (resolution of the Federal Antimonopoly Service of the West Siberian District dated February 26, 2010 in case No. A27-6662/2009) .

Thus, in order to avoid tax risks, it is more advisable for an organization to decide to write off the costs of dismantling fixed assets only after completion of the liquidation process.

Can VAT be deducted? When liquidating fixed assets, it is necessary to pay attention to some important points related to the deduction of VAT on dismantling work.

Capitalization of materials after dismantling fixed assets - postings

Option 2: contract method If dismantling/liquidation is entrusted to a contractor, the postings will be as follows:

- Dt 91-2 Kt 60 - for the amount of costs;

- Dt 19 Kt 60 - for the amount of VAT claimed by the contractor (unless, of course, he is a special regime agent).

When dismantling the operating system, the company, as a rule, remains at its disposal material - spare parts in various technical conditions, which can be used in further activities or have worn out and are unsuitable for use.

Organizations need to independently assess the suitability of the material and determine the cost of spare parts.

We liquidate a fixed asset: costs of dismantling and accounting for remaining parts

N 91н, provides for the attribution of costs associated with the movement of fixed assets within an organization to production costs.

Dismantling (disassembly) of fixed assets when they are written off: registration and accounting (Sizonova O.)

Consequently, the organization’s expenses for dismantling a fixed asset should be recognized as expenses for the organization’s ordinary activities on the basis of clause 7 of PBU 10/99.

In accounting, these expenses (excluding VAT) are reflected on the date of signing the acceptance certificates for completed work (if they are performed by a contractor) by debiting cost accounting accounts, for example, account 25 “General production expenses”, in correspondence with account 60 “Settlements with suppliers and contractors." The amount of VAT presented by the contractors is reflected in the debit of account 19 “Value added tax on acquired assets” in correspondence with the credit of account 60 “Settlements with suppliers and contractors”. I. Lozhnikov, auditor's office December 1, 2004

Write-off of fixed assets upon liquidation

The Ministry of Finance of Russia, by Order No. 147n dated December 12, 2005, introduced significant changes to the procedure for accounting for fixed assets.

This document changed almost all the norms of PBU 6/01 “ Accounting for fixed assets ,” approved by Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n.

This includes the condition for recognizing objects as fixed assets, the procedure for determining the initial cost, the disposal of fixed assets, and much more. In this article we will talk in more detail about writing off fixed assets .

In accordance with the new edition of clause 29 of PBU 6/01, not only fixed assets that are physically leaving the organization, but also those that are not capable of bringing economic benefits in the future should be written off from accounting. The list of cases of disposal of fixed assets is given in paragraph. 2 paragraph 29:

“Disposal of an item of fixed assets occurs in the event of: sale, cessation of use due to moral or physical wear and tear, liquidation in the event of an accident, natural disaster or other emergency situation; transfers in the form of a contribution to the authorized (share) capital of another organization, a mutual fund; transfers under an agreement of exchange, gift; making contributions under a joint venture agreement; identifying shortages and damage to assets during their inventory; partial liquidation when carrying out reconstruction work and in other cases.”

Other cases include the disposal of fixed assets in accounting, which are not physically removed from the organization, but are not capable of bringing economic benefits (income) to the organization in the future.

The write-off of fixed assets must be formalized by order of the manager and the Act on the write-off of a fixed asset object in Form N OS-4, approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 N 7.

Source: https://iiotconf.ru/likvidacija-osnovnyh-sredstv-provodki/

The main nuances of writing off a fixed asset

In addition to depreciation of a fixed asset, other cases of its write-off can be distinguished:

- Sales to other organizations;

- Donation, exchange;

- Theft or embezzlement;

- Contribution to the authorized capital;

- Liquidation due to emergency situations:

Important! Any operation to write off a fixed asset must have a documentary justification:

- Management order, which establishes the composition of the inventory commission.

- The act of writing off the operating system, which indicates the reasons for this action.

It is not a write-off of a fixed asset when it is moved within one enterprise (between structural divisions). If a fixed asset is temporarily not in use due to reconstruction work or additional installation, then it is also not subject to write-off.

WE FILL WITH GOODS

The first problem that you will have to face when filling a warehouse is the arrival of incoming parts and spare parts. Received parts must be properly recorded. That is, they are immediately entered into the database with a note on the purchase and retail value, in Russian, if we are talking about imported parts, by name and in accordance with catalog numbers. If you have to work with so-called “original” and “non-original” parts, then it is necessary to keep separate records of non-original parts, since it is clear that their specification differs from that indicated in the “branded” catalogs of manufacturers. In this case, you will most likely need to worry about creating a “matching table” if one does not exist. Some parts manufacturers, such as Bosch, have catalogs where their own part numbers are aligned with the numbers assigned to the same parts by the automaker itself.

The stage of arrival of spare parts is extremely important, because all further work with the product depends on how correctly this operation is carried out.

Basic truths, you say? Maybe, but many years of experience of the author of these lines in the spare parts department of one of the dealer technical centers shows that many simply do not know them, they go by feel, by trial and error. Meanwhile, a mess reigns in the warehouse, which, of course, does not at all contribute to the success of the technical center.

So, continuing the conversation about “elemental truths”, let us pay attention to the stage immediately following the arrival of the “goods”.

The parts simply need to be laid out on shelves and racks. I don’t know how they usually store diapers there, but when it comes to auto parts, you should definitely adhere to a number of unshakable principles. Firstly, the goods must be placed in the warehouse according to the address storage, which greatly simplifies the search.

Secondly, all hardware should be divided into groups that are located separately, for example:

- front suspension parts - rack No. 1, shelf No. 1;

- brake system parts - rack No. 1, shelf No. 2, etc.;

- consumables - rack No. 2, shelf No. 1-3, etc.;

- body parts - rack No. 3;

- non-original parts should be stored in a separate place, in the same way as they were received, this should eliminate confusion in the warehouse;

- It is better to place parts that are in high demand - such as filters, spark plugs, brake pads, drive belts - as close as possible to the area where they are issued, this will significantly save both the time of the technical center and warehouse employee, and the time of the client.

Heavier units and transmission parts should be located on lower racks, but again closer to their delivery area due to their considerable weight. Optical parts and radiators can be placed on higher tiers, since their weight is insignificant and demand is low. In this situation, the saying “put it further away, take it closer” does not work.