published: 06/10/2016

For a legal entity, the right to computer programs (hereinafter referred to as “PC”), as a rule, arises as a result of its creation by a specific individual, or as a result of acquisition from another person (individual or legal).

If we are talking about the creation of a personal computer by an employee, then such legal relations arise on the basis of an employment contract. By virtue of Art. 1295 of the Civil Code of the Russian Federation, the exclusive rights of works created by employees within the scope of their official duties belong to the employer. At the same time, if the employer, within three years from the day on which the official work was placed at his disposal, does not begin to use this work, does not transfer the exclusive right to it to another person, or does not inform the author about keeping the work secret, the exclusive right to the official work returned to the author.

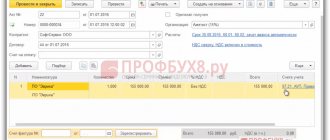

The following accounting entries are made in the organization's accounting.

| Contents of operations | Debit | Credit | Amount, rub. | Primary document |

| In February 2015 | ||||

| The exclusive right to a computer program has been acquired | 08-5 | 76 | 3 000 000 | Agreement on alienation of exclusive rights |

| Remuneration paid to the copyright holder | 76 | 51 | 3 000 000 | Bank account statement |

| The exclusive right to a computer program is accepted for accounting as part of the intangible assets | 04 | 08-5 | 3 000 000 | Intangible assets accounting card |

| For the period from March to December (term of use of intangible assets in 2015) | ||||

| Accrued depreciation on intangible assets (50,000 × 10) | 20 (23, etc.) | 05 | 500 000 | Accounting certificate-calculation |

| Manufactured products accepted for accounting | 43 | 20 (23, etc.) | 500 000 | Invoice for transfer of finished products to storage locations |

| Cost of goods sold written off | 90-2 | 43 | 500 000 | Accounting information |

How to take into account computer programs, antiviruses and help systems

It is perhaps difficult to find an organization that does not use software in its work. To automate accounting and personnel records, companies purchase special licensed programs: services for submitting electronic reporting, reference and legal systems, accounting programs, etc. For the safe operation of users, anti-virus protection tools are installed on computers and laptops. In this article we will consider which accounting accounts computer programs should be accounted for, how to determine the period of their use and how to write them off as expenses.

Any computer program is the result of intellectual work (Article 1225 of the Civil Code of the Russian Federation). The software product can be created in-house, or it can be purchased from a third party.

When purchasing a computer program, an organization can acquire exclusive or non-exclusive rights to use it. This point determines further accounting of software products.

To include the program in expenses, the following documents are required:

- a license (sublicense) agreement or alienation agreement that confirms the buyer’s right to use the program;

- deed of transfer of rights.

The license agreement is concluded between the user and the copyright holder of the software product. Also, his authorized representative (for example, an agent) can act on behalf of the copyright holder.

Most often, popular software products are sold by dealers and franchisees. In such cases, the software is sold on the basis of a sublicense agreement.

Let's consider the features of accounting for exclusive and non-exclusive rights to use programs.

Useful life of a perpetual licenseBranches and ATMs of JSC Rosselkhozbank

Monday, December 14, 2009 13:03 + to quote book

Software lifespan and Microsoft license expiration dates

Not long ago, a council of experts discussed the issue of software service life. The discussion was very heated and long, so here are only the main conclusions. It is also useful to read Tatyana Ilchenko’s post on her blog.

License validity period

The license term is the period during which the end user has the right to use the software. This period is determined by the license agreement between the copyright holder and the end user. If the license agreement does not specify a period, then it is equal to 5 years in accordance with Art. 1235 of the Civil Code of the Russian Federation.

In addition, the validity period of licenses cannot be longer than the validity period of exclusive rights, which for software under Russian law is a maximum of 70 years after the death of the author in accordance with Art. 1281 Civil Code of the Russian Federation.

In practice, rights to software are transferred along the chain: copyright holder, distributor, reseller, end user. Sublicense agreements are concluded between them. In this case, the validity period of the licenses cannot exceed the period for which the rights were transferred under the sublicense agreement.

Here the question often arises: “Agreements between distributors and resellers are concluded for 1 year - does this mean that the validity period of all licenses is also no more than 1 year?” Of course not! The fact is that 1 year is just the period during which business relations between the distributor and the reseller are possible. Simply put, this is the period during which a reseller can purchase rights for resale. And this agreement does not limit the validity of rights, referring to the period defined in the license agreement.

Another point is important for foreign manufacturers. In accordance with Art. 7 of the Civil Code of the Russian Federation in Russia establishes the superiority of international law over national law. Therefore, the validity period of licenses may be determined by the legislation of another country if there is a direct reference to it in the text of the license agreement.

What is the validity period of Microsoft licenses?

For boxed and OEM versions of products, the license agreements included in the package apply. It was not possible to find any direct indication of the validity period of the licenses. This means that, in accordance with the Civil Code of the Russian Federation, this period is 5 years.

Open Licenses, like other corporate licenses, are subject to the appropriate agreement, Product Use Rights and Product List. In accordance with the text of the Open License agreement, the validity of licenses is governed by Irish law. In accordance with it, the validity period of licenses is unlimited, i.e. equal to the duration of the exclusive rights (the same 70 years after the death of the author or 70 years from the date of publication if the author is unknown).

For Open Value and Enterprise Agreement licenses, the validity period is defined in the text of the corresponding agreement and is unlimited, i.e. equal to the period of validity of the exclusive rights after payment of the 3rd annual license fee. Until this point, the validity period of licenses is 1 year.

Smartsourcing.ru

I would like to include in separate publications several of Timur Sabaev’s answers at the webinar on liability for the use of counterfeit software in enterprises. When listing open source software, companies often have difficulty determining the cost of the software. It would be good if the company bought the box and thus got the opportunity to estimate the cost of the software. What to do if the software was downloaded from the network?

Timur offers the following methodology for determining the book value of software:

1. The open source software distribution kit is downloaded and recorded onto a disc.

2. The cost of the blank is estimated, as well as the cost of the administrator’s working time

3. An act is drawn up

4. The software is placed on the balance sheet in accordance with the amount received.

5. Then it is depreciated.

And one more material proposed by Timur Sabaev - the article “Tax and accounting of software for end users”, prepared by Ernst & Young at the request of NP PPP.

In order not to return twice to balance sheet accounting software, here is another useful link. Recently, the Ministry of Finance issued a letter in which it clarified the rules for accounting for software.

Software is an intangible asset of an organization and thus software costs must be amortized if its useful life is more than a year. At the same time, you cannot write off the software - using the decommissioned software in the company will be a violation of the license agreement. Thus, the Ministry of Finance clarified that if the license agreement does not limit the validity period of the software, the company needs to install it independently by order of the general director.

However, regional inspection organizations may have their own opinion on this matter.

According to subparagraph 26 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), other expenses associated with production and sales include expenses associated with the acquisition of the right to use computer programs and databases under agreements with the copyright holder (licensing agreements) . These expenses also include expenses for the acquisition of exclusive rights to computer programs worth less than 20,000 rubles. and updating computer programs and databases. Expenses for the implementation and modification of a computer software product are also taken into account as part of other expenses in accordance with subparagraph 26 of paragraph 1 of Article 264 of the Code. Paragraph 1 of Article 272 of the Code provides that expenses are recognized in the reporting (tax) period in which these expenses arise based on the terms of the transactions. If the transaction does not contain such conditions and the connection between income and expenses cannot be clearly defined or is determined indirectly, the expenses are distributed by the taxpayer independently. Organizations using the accrual method, expenses for the acquisition of a computer program are taken into account as part of other expenses associated with production and (or) sales, in the following order: - if, under the terms of the agreement for the acquisition of non-exclusive rights, a period for using computer programs is established, then the expenses, relating to several reporting periods are taken into account when calculating the tax base evenly throughout these periods; — if the terms of the agreement for the acquisition of non-exclusive rights cannot determine the period of use of computer programs, then, in our opinion, the expenses incurred are distributed taking into account the principle of even recognition of income and expenses; In this case, the taxpayer has the right to independently determine the period during which these expenses are subject to accounting for profit tax purposes. At the same time, we inform you that in accordance with paragraph 4 of Article 1235 of the Civil Code of the Russian Federation, the period for which a license agreement is concluded cannot exceed the period of validity of the exclusive right to the result of intellectual activity or to a means of individualization. If the license agreement does not specify its validity period, the agreement is considered to be concluded for five years, unless otherwise provided by the Civil Code of the Russian Federation. Thus, if the contract (agreement) does not specify the period for using the acquired software product, the taxpayer independently determines the period for using the acquired non-exclusive right, taking into account the requirements for determining the specified period established by the Civil Code of the Russian Federation. At the same time, we inform you that this letter from the Department does not contain legal norms or general rules specifying regulatory requirements, and is not a regulatory legal act. In accordance with Letter of the Ministry of Finance of Russia dated 08/07/2007 N 03-02-07/2-138, the opinion of the Department is of an informational and explanatory nature on the application of the legislation of the Russian Federation on taxes and fees and does not interfere with following the norms of the legislation on taxes and fees in the understanding , different from the interpretation set out in this letter.

Deputy Director of the Department S.V. Razgulin

Based on materials

By the way, from the same letter it is clear that if the contract does not explicitly provide for the validity period of the license agreement, then according to the Civil Code the contract is valid for no more than 5 years. Those. After five years, commercial licenses expire and such systems may be recognized as unlicensed by inspection authorities. What about the terms, for example, of the Microsoft Open License? Check to see if you have any solutions left for Windows 2000 Server or for NT, and even for Windows Server 2003, five years could well have passed?

Additional materials

- Software license management. Results and recording of the webinar

- “Chaos in software and licenses? What to do?" Results of the round table on license management

- License management and IT asset management

Exclusive rights

Exclusive rights usually arise when a program is created at the request of an organization and adapted to its requirements. If an organization acquires the exclusive right to use a computer program, it becomes its sole owner. The author (developer) of the product does not have the right to sell or provide it to others.

The exclusive right passes to the buyer on the basis of an alienation agreement (Article 1234 of the Civil Code of the Russian Federation).

Most often, exclusive rights for accounting purposes are taken into account as part of intangible assets (IMA). To do this, the following conditions must be simultaneously met (clause 3 of PBU 14/2007):

- the organization has documents that confirm its rights to use the intangible asset;

- an intangible asset can be separated from other objects;

- the object of intangible material does not have a material form;

- the organization does not plan to sell the rights to the computer program for at least a year;

- a computer program is used in the production of products (works, services) or for management needs;

- the object can bring economic benefits (income);

- the period of use of the computer program exceeds 12 months;

- the initial cost of intangible assets can be reliably determined.