Shock absorption group: passenger car

The main depreciation group for a passenger car is the third group with a useful life of more than 3 but less than 5 years, that is, from 37 months. 60 months inclusive. To determine the exact group, it is necessary to refer to the standards of the Classification of Fixed Assets, approved. By the Government of the Russian Federation in Resolution No. 1 of 01/01/02.

Important! Since 2021, an edited version of the Classification with amendments has been in force in accordance with Government Decree No. 640 of 07/07/16. The updated standards should be followed when commissioning facilities in 2021. For facilities that the enterprise began to use before the specified date, the old rules for determining depreciation groups and useful lives (SPI).

What licenses are needed for a Gazelle with a cargo trailer?

To drive a Gazelle cargo truck with a trailer, you will need to obtain a license with a whole list of categories: “C”, “CE”, “B”, “BE” and “D”.

If the loaded maximum weight of the Gazelle is up to 3.5 tons:

- for a light (up to 750 kg) trailer, category “B” is enough;

- for a heavier (more than 750 kg) trailer, you will need (if the total weight of the vehicle exceeds 3.5 tons) the “BE” category.

Naturally, there may be situations where category “B” may not be enough to drive this car and category “C” will be needed to drive a truck.

In what situations does a Gazelle need category “C”?

If the loaded maximum weight of the Gazelle is more than 3.5 tons:

- together with a light (up to 750 kg) trailer, the car requires driver category “C”;

- in cases where the weight of a car with a heavy trailer is more than 3.5 tons, you will need a “CE” license category.

This is explained by the fact that there are various modifications of the model, for example, an extended version of the Gazelle - GAZ-33022 has a maximum permitted weight of 3.6 tons. Even though you may not plan to use this full potential, the law still requires you to have a “C” driving category.

Which depreciation group does a passenger car belong to?

The distribution of passenger vehicles into appropriate groups depends on the class of the car, engine size, and purpose. Correctly determining which depreciation group a passenger car belongs to will allow the accountant to accurately calculate the amount of depreciation, and therefore accrue tax payments to the budget in accordance with the requirements of the tax legislation of the Russian Federation.

The table in the next section will help you determine which depreciation group a passenger car belongs to based on its main characteristics. The necessary information can be taken from the transport documentation - PTS (vehicle passport). If there are disagreements and ambiguities regarding the type of vehicle, you can make an official request to the manufacturer or to the territorial division of the traffic police.

The procedure for applying the new edition of the OS Classifier

Updated groups for establishing SPI came into force in connection with the adoption of new OKOFs. The specified standards must be applied to vehicles that began operation on January 1, 2021. It is not necessary to change the group and SPI for vehicles put into operation before 2021.

For example, in June 2021, the organization purchased a Kamaz-5320 flatbed truck, and the vehicle was put into operation in July. The accountant established the Kamaz depreciation group as the fourth (5-7 years), intended for general purpose on-board transport.

As can be seen from the table for the new Classification, the group has not changed for this type of freight transport.

Important! To facilitate the transition to new OKOF codes, Rosstandart created a comparative recommendation table - departmental order No. 458 dated April 24, 2016.

Depreciation groups for passenger vehicles. Table

In the process of assigning a specific car model to a depreciation group, you need to focus on the engine size of the vehicle, the type and category of the vehicle. Additionally, you should take into account the total cost of the car, since it is unlikely that it will be possible to classify the Lada Largus and, for example, a luxury Lexus into the same depreciation group.

Table of depreciation groups for passenger vehicles - according to 2021 data.

| Group | SPI (years) | Current OKOF | Car class |

| Passenger vehicles, engine capacity is not specified according to the new Classifier. | |||

| Fourth | Passenger vehicles intended for transporting disabled people (small class), engine size not specified. | ||

| Passenger vehicles of large and higher classes, with an engine capacity of more than 3.5 liters. |

Until 01/01/17, most passenger vehicles also belonged to group 3, so there were no special changes in this regard for accountants. When establishing a car class, it is recommended to be guided by the international gradation (6 classes - mini A, small B, lower middle C, middle D, upper middle E, highest F).

Note! The depreciation group of a truck crane is determined depending on the type of equipment specified. Thus, lifting boom cranes belong to group 2; stacker cranes for group 5; lifting - to group 7. Since the depreciation group is not approved specifically for automobile cranes, it is necessary to establish the useful life in accordance with the technical purpose of such vehicles.

A government agency acquired a fixed asset item (a passenger car) that had previously been in use. How to determine its useful life in order to accept it for budget accounting and calculate depreciation?

In accordance with paragraph 44 of Instruction No. 157n, the useful life of a fixed asset is the period during which it is intended to be used in the course of the institution’s activities for the planned purposes.

As a general rule, determining the useful life of fixed assets (including objects that were previously in operation) for the purpose of accepting them for accounting and calculating depreciation is based on:

- information contained in the legislation of the Russian Federation establishing the useful life of property for the purpose of calculating depreciation;

- recommendations contained in the manufacturer's documents included in the package of the property (in the absence of norms in the legislation of the Russian Federation providing for the useful life of the property for the purpose of calculating depreciation);

- the decision taken by the institution’s commission on the receipt and disposal of assets (in cases of lack of information in the legislation of the Russian Federation and the manufacturer’s documents).

In accordance with the Classification of fixed assets included in depreciation groups, approved by Decree of the Government of the Russian Federation dated January 1, 2002 No. 1 (hereinafter referred to as the OS Classification), passenger cars belong to the third depreciation group (property with a useful life of more than three years to five years inclusive ( code OKOF 15 3410010)).

According to para. 3 clause 44 of Instruction No. 157n for fixed assets included in depreciation groups from the first to the ninth, the useful life is determined by the longest period. Therefore, the useful life of the car will be five years (60 months). You should know that for fixed assets that were previously in operation, the end date of their useful life is determined taking into account the period of their actual operation (paragraph 12, clause 44 of Instruction No. 157n). That is, institutions, for the purpose of calculating depreciation for these objects, have the right to provide for a depreciation rate taking into account the useful life, reduced by the number of years (months) of operation of this property by the previous owners.

If the period of actual use of the object by the previous owners turns out to be equal to its useful life, determined by the OS Classification, or exceeds this period, the institution has the right to independently determine the useful life of the car, taking into account safety requirements and other factors. This conclusion is based on the provisions of tax legislation (paragraph 2, paragraph 7, article 258 of the Tax Code of the Russian Federation). We believe that the useful life of fixed assets that were previously in use should be determined in a similar way in order to accept them for budget accounting.

The actual service life of a used fixed asset must be documented. If there are no documents, then the useful life is established in accordance with the Classification of fixed assets, as for a new fixed asset item (letter of the Ministry of Finance of the Russian Federation dated June 16, 2010 No. 03-03-06/1/414,).

Please note that depreciation on fixed assets that were previously in use is calculated in accordance with the generally established procedure provided for in clauses 85, 86 of Instruction No. 157n (in a straight-line manner starting from the 1st day of the month following the month the object was accepted for accounting), and is carried out until the cost of this object is fully repaid or it is written off from the register. The annual depreciation amount is calculated based on the book value of the property and the depreciation rate calculated taking into account its useful life. During the financial year, depreciation is calculated monthly at 1/12 of the annual amount.

For clarity, let's give an example.

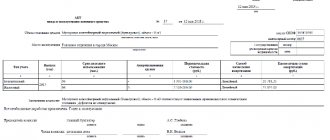

A government agency purchased a previously used passenger car worth RUB 420,000. The period of its actual operation by the previous owner is documented and is 2 years 8 months. (32 months). It is necessary to determine the useful life of the car and the amount of monthly depreciation charges.

According to the OS Classification, the total useful life of a passenger car is five years (60 months).

At the time the car was accepted for registration, it had already been in use for 2 years and 8 months. (32 months), so its remaining useful life will be 2 years 4 months. (28 months) (5 years (60 months) - 2 years 8 months (32 months)).

Every month during the specified period, depreciation will be charged in the amount of 15,000 rubles. (RUB 420,000 / 28 months).

Instructions for the application of the Unified Chart of Accounts for public authorities (state bodies), local governments, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal) institutions, approved. By Order of the Ministry of Finance of the Russian Federation dated December 1, 2010 No. 157n.

Look at the finished table to find out which depreciation group the passenger car belongs to. In 2021, to determine the group by car, use the updated OKOF code book.

Accountants use the Classification of fixed assets included in depreciation groups, approved. Decree of the Government of the Russian Federation dated 01.01.02 No. 1 (hereinafter referred to as Classification) to determine which depreciation group a passenger car belongs to. In 2021, a new edition of this document is in effect, taking into account the changes made by Decree of the Government of the Russian Federation dated 07.07.16 No. 640. The new edition indicates new OKOF codes, which have been used since 2021 and continue to be valid in 2021. (All-Russian Classifier of Fixed Assets (OKOF) OK 013-2014 (SNA 2008).)

An error when choosing a depreciation group for a fixed asset can lead to the additional charge of two taxes at once - on profit and on property. Inspectors very often find such errors: this was recently confirmed by the Federal Tax Service in a review of typical violations. Download a cheat sheet that will help you always accurately determine the depreciation group.

What rights are needed for a passenger Gazelle?

The passenger version of the Gazelle is designed to transport up to 15 people. As a rule, such minibuses are used for transportation within the city or for intercity flights. The legislation of Russia and the current traffic rules in particular provide for:

- Drivers of buses with more than 8 passengers must have a category “D” driving license. That is why, before starting to drive minibuses, absolutely all drivers are required to obtain this category;

- Drivers of minibuses with more than 9 but less than 16 passenger seats will need a subcategory of rights “D1”;

- The presence of a combination from category “D” and subcategory “D1” automatically allows you to use a light (not heavier than 750 kg) trailer;

- Users of heavier trailers, in a situation where its weight together with the vehicle exceeds 3.5 tons, will have to acquire either a “DE” or “D1E” license.

The model range of the GAZ brand is distinguished by pleasant diversity, because users have access to options for transporting goods and cargo, tourist models and models intended only for transporting people.

Be careful! To avoid the possibility of administrative punishment, you should know that to drive a Gazelle, the driver is required to have a license with categories from “B” to “E”. Of course, the choice of the right categories depends solely on the model of the machine you are using.

Depreciation period of a passenger car

To find out which depreciation group a passenger car belongs to, let’s look at the Classification. Passenger cars belong to three depreciation groups. Which group a car belongs to depends on its type. For convenience, we have compiled a table - select the type of car and immediately determine which group the car belongs to. And then look at how to set the useful life.

Most passenger cars belong to the third group. Consequently, their useful life is over three years to five years inclusive, that is, from 37 to 60 months inclusive.

Shock absorption group of a truck

We found,

What depreciation group do passenger cars belong to? Let's move on to cargo vans. Trucks are classified in the Classification into the following depreciation groups.

| Car type | OKOF OK 013-2014 | Depreciation group | Useful life |

| Cargo with a maximum weight of not more than 3.5 tons | 310.29.10.41.111 310.29.10.42.111 | Over 3 years up to 5 years inclusive | |

| Truck with a maximum weight of over 3.5 tons | 310.29.10.41.112 310.29.10.41.113 310.29.10.42.112 310.29.10.42.113 | Over 7 years up to 10 years inclusive | |

| Dump trucks and some other trucks, regardless of maximum weight | 310.29.10.41.120 310.29.10.42.120 | Fourth | Over 5 years up to 7 years inclusive |

OKOF: code 310.29.10.5

310.29.20.23 - Other trailers and semi-trailers

Classifier: OKOF OK 013-2014 Code: 310.29.20.23 Name: Other trailers and semi-trailers Subsidiary elements: 4 Depreciation groups: 1 Direct adapter keys: 31

310.29.10.5 — Special purpose motor vehicles

Classifier: OKOF OK 013-2014 Code: 310.29.10.5 Name: Special-purpose motor vehicles Subsidiary elements: 4 Depreciation groups: 2 Direct transition keys: 27