What is the coefficient K1 2021 for UTII?

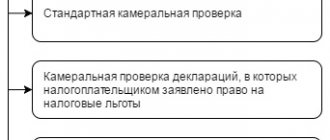

The use of a special imputed regime is provided for both legal entities and individual entrepreneurs and is carried out in accordance with the norms of the chapters. 26. 3 NK. When doing business on UTII K1 for individual entrepreneurs in 2021, as well as for organizations, it is approved only by federal authorities. The control body is the Ministry of Economic Development of the Russian Federation. At the same time, the K2 coefficient is regulated by the authorities of districts, districts, and individual cities of federal significance (clause 3 of Article 346.26 of the Tax Code).

The concept of the deflator coefficient K1 for UTII 2021 is clarified in the stat. 346.27, which says that this indicator is approved for a year (calendar). Unlike K1, the adjusting indicator K2 clarifies the DB (basic profitability) and takes into account various features of the business in the imputation. First of all, such factors as the type of product, mode and location of work, seasonality of activity, field area and number of vehicles for advertising, etc. are implied.

Why is the K1 adjustment factor so important for UTII taxpayers? Since this indicator is directly involved in calculating the amount of imputation tax, it is impossible to determine the tax base (taxable base) without the deflator value. In accordance with paragraph 2 of Art. 346.29 NB is calculated by multiplying the BD value and the physical indicator for a specific type of commercial activity. And according to clause 4 of stat. 346.29, the amount of basic profitability should be adjusted by two coefficients - K1 for UTII in 2021. and K2. Next, let’s see what the accepted value of K1 is for UTII from 2018.

Coefficients K1 and K2 for UTII for 2021

Calculation of K2 UTII in 2021

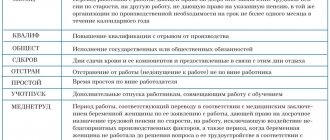

As can be seen from the text of the table above, it reflects only one component of K2 - this is Kvd. What does this coefficient mean? If you study the norms of Decision No. 37, paragraph 2 states that the adjustment indicator K2 is calculated using the formula:

K2 = Kvd x Kmd, where:

- Kvd is the first calculated coefficient (of conducting activities) for calculating K2, approved by regional authorities depending on the type of industry activity.

- Kmd is the second calculation coefficient (place of activity) for calculating K2, approved by regional authorities depending on the place of actual business activity.

Accordingly, the calculation of the K2 coefficient for UTII is carried out in accordance with Appendices 1, 2 of Decision No. 37 in the current edition. And the more profitable the business, the higher the value of the components of the formula. The level of profitability is influenced by both the type of activity and the address where it is carried out. To make it clear, let’s continue the example of considering Rostov legislation and give several values of Kmd values for the city:

| Territorial indicator of the place of doing business in Rostov-on-Don | Standard value K2 – indicator Kmd |

| The whole street Lenin, including the territory from the beginning of the square. Militia all the way to the end of the street | 1,0 |

| The entire Semashko Avenue, including areas from Turgenevskaya Street to Sadovaya Street | 1,0 |

| The whole street Moskovskaya, including the territories from Ostrovsky Lane to Voroshilovsky Avenue | 1,0 |

| The whole street Nansen | 0,8 |

| Microdistrict SZhM, including all lengths of Dobrovolsky and Volkova streets, as well as Korolev Avenue | 0,8 |

| The entire Sivers Avenue - from Krasnoarmeyskaya Street to Sadovaya | 0,8 |

| Those areas of the city that are not named in clauses 1, 2 of Appendix 2 of Decision No. 37 | 0,6 |

Size K1 for UTII for 2021

So what is K1 for UTII 2021? Suppose there are three entrepreneurs who provide transport services. Their type of activity is the same, but citizens live in different areas geographically. For example, one individual entrepreneur is registered at the individual’s place of registration in the Stavropol Territory, the second in Murmansk, and the third in St. Petersburg? What will be K1 according to UTII for the 1st quarter? 2018?

It should immediately be noted that the value of the deflator is approved immediately for a year (calendar). Therefore, the indicator per 1 sq. equal to the figure for 2 square meters. etc. As for the territorial side of issues, K1 is approved by federal legislation. This means that it doesn’t matter whether we are talking about K1 for UTII in 2018 in the Stavropol Territory or K1 for 2021 for UTII in Murmansk. In both cases, the same coefficient value is used in the calculations.

Note! The same rule applies to federal cities. Accordingly, the size of K1 for UTII in 2018 in St. Petersburg is taken according to the general indicator.

To find out the new K1 for UTII in 2021, you need to study the norms of Order No. 579 of October 30, 2017, adopted by the Ministry of Economic Development of the Russian Federation. This document was officially registered with the Ministry of Justice on November 13, 2017 under No. 48845. Here, the updated K1 value for the year 2021 was approved in the amount of 1.868. Regardless of the territory of Russia in which imputed entrepreneurial activity is carried out, as well as what type of OKVED the individual entrepreneur is engaged in, the value of K1 remains unchanged.

Note! If a taxpayer applies a special regime other than an imputed one, deflator coefficients are also approved for it. But the meaning of such indicators will be different. To find out which one, you should be guided by the same Order No. 579. K1 for personal income tax, simplified tax system, trade tax, patent, property tax for individuals are established here.

UTII K2 for individual entrepreneurs in 2021

Like a legal entity, entrepreneurs have the right to conduct business under the imputed special regime. This taxation system is beneficial because it reduces the fiscal burden on business. In addition, tax calculation is not complicated and is accessible to persons without relevant accounting education. How to calculate the K2 coefficient for individual entrepreneurs when calculating UTII tax in 2021?

The algorithm of actions is the same for organizations and entrepreneurs. K2 can be determined by knowing the type of work activity and the exact address of its implementation. The data is taken from the legislative documents of the entrepreneur’s region. Moreover, the approval of coefficients is carried out at the level of local authorities. That is, for example, if an individual entrepreneur has a business in Aksai, there is no need to rely on Decision No. 37, because it is valid specifically for the city of Rostov-on-Don. And Aksai will have his own document.

How to calculate K2 for UTII for 2021 - example

Let's look at specific numbers and figure out how to calculate the K2 coefficient. Let's assume that entrepreneur Ivanov N. O. is engaged in retail trade in products. His store is located on the street. Volkova in the Northern region of Rostov-on-Don. What K2 indicator will be valid for this entrepreneur? Calculations are made as follows:

- Kvd - according to Appendix 1 to Decision No. 37 is equal to 0.85 (increased as amended on August 29, 2014).

- Kmd – according to Appendix 2 to Decision No. 37 is equal to 0.8.

- K2 = 0.85 x 0.8 = 0.68.

This is exactly the K2 value that will be in effect for the Ivanova IP store in 2021. The calculated coefficient value should be applied throughout 2021. There cannot be any changes within the year, since the calculated value of this coefficient is approved immediately for the year. What indicator will be in effect in 2019? If changes occur, the authorities must have time to approve them before the end of 2021. If updates to the version of Decision No. 37 are not released on time, the value of the coefficient will remain at the same level.

K1 UTII 2021 by type of activity

Companies often make changes to their OKVED regulations. This situation is completely legal and arises for various reasons - from a change in activities to the complete cessation of one and the creation of another. For example, in 1 sq. 2021 The individual entrepreneur was engaged in retail sales of equipment, but in March he stopped trading and started providing hairdressing services. When working on UTII for the 1st quarter of 2021, will K1 remain the same or change?

The answer is given in 346.27, which says that K2, but not K1, depends on the characteristics of the company’s activities. This means that no matter how often OKVED changes, the deflator indicator is always the same. If the value of the coefficient has already been officially approved by the Ministry of Justice, its value for the year (calendar) will be the same for all imputed taxpayers without any exceptions. Let’s say that K1 for 2021 for UTII in Kursk and K1 in Krasnodar for UTII are identical. Differences are possible only when we are talking not about imputation, but about other taxes. For example, about UTII and PSN or about UTII and simplified tax system, etc.

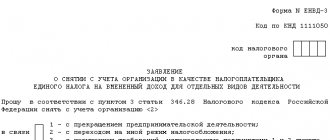

Fines for UTII declaration

As we said above, the deadline for submitting the UTII declaration is the 20th day of the first month of the next tax period (clause 3 of Article 346.32 of the Tax Code of the Russian Federation). Because October 20, 2018 is a day off, then the UTII declaration for the 3rd quarter of 2021 must be submitted no later than October 22, 2018.

UTII for the 3rd quarter of 2021 must be transferred to the budget no later than October 25, 2018. Here is a sample of filling out a payment slip for paying UTII for the 3rd quarter. 2021.

Penalties for violation of deadlines for filing a declaration are provided for in paragraph 1 of Art. 119 of the Tax Code of the Russian Federation and depend on whether the tax was actually paid. If payment has not been made, the fine will be 5% of the tax amount according to the declaration for each full and partial month of delay, but not more than 30% of the amount. If the taxpayer has settled with the budget, then the fine is applied in the minimum amount - 1000 rubles.

Tax authorities can also block the accounts of a taxpayer who has not submitted a return on time if the delay is more than 10 days (Clause 3 of Article 76 of the Tax Code of the Russian Federation).

In addition, responsible officials may be additionally punished with a fine of 300 to 500 rubles. according to Art. 15.5 Code of Administrative Offences.

Change in K1 for UTII for 2021

Invariably, any businessman strives to get as much profit as possible from his activities. The less taxes paid, the more money the business owner will have. K1 growth in 2021 is 3.89%. Simply put, the transfer to the treasury will have to be almost 4% more than in 2021. Considering that this is the first increase in the deflator since 2015, such a jump came as a surprise to many.

However, on the other hand, K1 has not increased much, and such a load, according to experts, is quite within the capabilities of most entrepreneurs. To be sure of the regulatory changes for K1 for 2021 for UTII tax.ru (the official portal of the Federal Tax Service) publishes all current innovations in the relevant sections. K2 values by region, tax rates, calculation and payment rules, as well as a lot of other useful reference information are also posted there. Using the data is very simple - the taxpayer just needs to select his subject of the Russian Federation and get all the necessary information.

Conclusion - in this article we described in detail what the K1 deflator coefficient is and how it affects the calculation of tax amounts payable. It was separately clarified what size of the deflator was approved for 2021 and intermediate quarters. When clarifying information on the current value of the coefficient, first of all it is necessary to understand for what purposes the individual entrepreneur needs this indicator.

If entrepreneurship is carried out on imputation, the value of K1 is taken at the same level - 1.868. If the company uses the simplified tax system, on the other - 1.481. If the individual entrepreneur uses PSN, the value is 1.481. The same value is valid for the property tax of citizens. In the case of personal income tax calculation, the value taken is 1.686. And when calculating the trading fee - 1.285. Be careful in the process of calculating fiscal payments so as not to have problems with the tax authorities.

How to find out K2 for UTII 2021

At first glance, it seems that it is difficult to independently determine the value of K2. But that's not true. You can correctly calculate the coefficient yourself. However, if you have difficulties, it is recommended that you contact your tax authorities directly for assistance. The inspector will help you calculate the effective value of K2. Keep in mind that many ATPs post current versions of legislative documents on their websites. But updates don't always arrive on time. Be careful when studying the regulatory framework: look for current versions of documents.

Conclusion - in this article we examined in detail what adjustment factors are under tax law and what they are. The procedure for approving the K2 indicator, its minimum and maximum possible values are given separately. Due to the fact that K2 is approved by the authorities of the constituent entities of Russia, so that the taxpayer can obtain accurate information about the size of the coefficient, it is recommended to obtain a certificate from your tax office.

In addition, everyone can get acquainted with the latest data on the official portal of the Federal Tax Service. All regulatory changes are taken into account here, and information is posted by region of the Russian Federation. Do not forget that the approval of the coefficient must take place before the beginning of the next year (calendar), otherwise the sizes of the previous period are used.