Advance report

For funds issued to an accountable person, he must report within the prescribed period. This period is determined by the manager and upon completion the employee must report by submitting an advance report. Let's assume that the accountant has been given an advance payment for the purchase of office supplies for 5 days. At the end of this period, the accountant will need to provide an advance report within three days. If an advance report is provided for travel expenses, then the deadline for this is set within 3 days from the date of return from the trip.

Important! Accountable funds can be issued in cash or by bank transfer. In the first case, an expense cash order (RKO) is issued, and the cash itself is withdrawn from the company's current account or issued from the proceeds received at the cash desk in cash.

If money is transferred to an employee by bank transfer, then it is transferred to his bank card. In this case, the payment order must indicate that the money is issued on account .

For money received by the employee on the card, he can report later than the specified period. The rules of “cash” restrictions do not apply to non-cash payments, so the manager can set the deadlines for the report independently. The main thing is that this is recorded in a local document of the company, such as the Regulations on the issuance of accountable funds.

Settlements with accountable persons (account 71)

Accounting accounts: purpose, structure, sub-accounts and postings on them. The articles are structured based on the Chart of Accounts for commercial organizations for 2021.

Thus, the letter of the State Tax Service of the Russian Federation dated November 24, 1998 No. ШС-6-07/851 again proposed to charge insurance premiums on cash advances issued to employees for travel, entertainment and other similar expenses, the intended use of which is not confirmed within the established time frame by supporting documents.

In the process of financial and economic activities, organizations often need to purchase material assets, as well as various works and services, not only by bank transfer, but also for cash. For business trips, this period is calculated from the day when the employee returned from a business trip (clause 26 of the regulations on the specifics of sending employees on business trips, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749).

How is an advance report prepared?

To draw up an advance report, the established form can be used (AO-1, approved by Resolution of the State Statistics Committee of Russia No. 55), or an independently developed form. The front side of the report indicates the employee’s full name, his position and the purpose of the advance payment issued to him. On the reverse side there is a list of documents with which the employee can confirm his expenses. All attached documents are numbered in the order in which they were recorded in the JSC.

Having received an advance report from an employee, the accountant checks:

- targeted spending of funds;

- availability of supporting documents;

- correctness of the document;

- amounts of expenses, as well as accounting accounts.

After verification, the report is submitted to the director for approval and then accepted for accounting. The unused advance payment is handed over to the cashier, and a cash receipt order (PKO) is filled out. If there is an overexpenditure according to the advance report, then the required amount is issued to the accountable person using an expense cash order (RKO).

Personal income tax and insurance premiums

Regardless of the taxation system applied, money paid to an accountable person, provided there are supporting documents, is not taxed:

- Personal income tax (Article 209 of the Tax Code of the Russian Federation);

- contributions for compulsory pension (social, medical) insurance (Part 1, Article 7 of Law No. 212-FZ of July 24, 2009);

- contributions for insurance against accidents and occupational diseases (clause 1 of article 20.1 of the Law of July 24, 1998 No. 125-FZ).

The fact is that the amounts reimbursed to the accountable person are not remuneration for a completed task, but compensation for expenses incurred by him. These amounts were paid to the employee not as wages. In addition, they do not bring economic benefits (income) to the employee (Article 41 of the Tax Code of the Russian Federation).

Overspending on advance report

By checking the expense report, the accountant may discover that the employee spent more money than the cashier gave him. Such overspending requires reimbursement, but only if it is justified.

In order for an overspend to be considered justified, the following conditions must be met:

- The employee spent the money to complete the task assigned to him by the organization. As a rule, the purpose of issuing funds to the account is indicated in the director’s order).

- The employee presented documents that confirm the overexpenditure of funds. This could be, for example, cash receipts.

If both of these conditions are met, the employee is returned the money. Otherwise, there is no need to return the money.

Important! Money spent by the employee in addition to the advance received is given to him from the cash register. In this case, an expense cash order is issued in the KO-2 (RKO) form.

When an overrun is issued, the following posting is generated:

D71 K50 – expenses to the employee exceeding the money issued for the report were reimbursed.

Thus, if an employee has spent more money than was given to him, he draws up an advance report for the entire amount spent. Overspending is simply paid to him from the cash register. When filling out the expense report, he will need to fill out additional columns of the document. In the “Overexpenditure” line, you should indicate the amount that the employee needs to add to the full cost of the purchase. The line “Overexpenditure issued” indicates the amount that was reimbursed to the employee, as well as the details of the cash settlement or payment order (if the money was transferred to the employee’s card). But if the report was compiled before expenses were compensated, then this line is not filled in.

An example of compensation for overexpenditure according to an advance report

Accountant of LLC "Company" Ivanov I.I. Stationery supplies for the accounting department were purchased. For this purpose, he was given 2,000 rubles on March 15. However, when buying stationery, Ivanov spent more money, namely 2800 rubles. The accountant provided an advance report and supporting documents for all funds spent. As supporting documents, they were presented with: cash receipts and sales receipts, with VAT included. No invoice was provided. Ivanov’s advance report was checked and approved by the director, after which an overexpenditure of 800 rubles was issued.

The following operations will be carried out in accounting:

| Business transaction | Wiring |

| Ivanov was given 2,000 rubles from the cash register on account | D71 K50 |

| Stationery purchased by Ivanov received | D10 K71 |

| VAT on purchased stationery has been taken into account | D19 K71 |

| VAT is written off from own funds | D91.2 K19 |

| Ivanov was compensated for expenses in excess of the amount given to him in advance against the report in the amount of 800 rubles | D71 K50 |

Supporting documents

Supporting documents prove the fact of expenses, these are cash receipts, invoices, a numbered form for strict reporting, an invoice, a purchase and sale agreement.

Documents must necessarily contain all the details: name, date of preparation, name of the organization, content of the operation, name and units of measurement, cost, signature, stamp and others. In case of a business trip, for the advance report, keep documents confirming travel expenses (ticket) and accommodation.

Reimbursement of overspending on an advance report to an employee’s card

You can issue funds on account either from the cash register in cash or by bank transfer, that is, the money is transferred to the employee’s bank card. If an overspend occurs, the accountant may wonder whether it can also be transferred to a bank card.

The legislation does not provide a direct answer to this question. But the Treasury and the Ministry of Finance of the Russian Federation allow the transfer of money to an employee’s card. If you look at the advance report form itself, it provides for the only way to reimburse overruns - in cash. Therefore, the company will have to make its own decision on how to reimburse the money. To avoid unnecessary disputes with regulatory authorities, it would be better if overexpenditures on accountable funds are issued only from the cash desk in cash .

First we spend - then we receive

The tax office at one time actively equated the reimbursement of money spent in the interests of the company to a sale. In the understanding of the state, the employee sold goods to the employer, and personal income tax had to be withheld from him, and VAT had to be charged to the company (for OSNO) and included in the tax base (for OSNO and simplified tax system). Nowadays such situations are much less common.

Ideally, for such purchases, you should be asked to provide a memo indicating the reasons that prompted the employee to spend his own funds. Of course, few people do this; it is enough to get the report approved by the boss and we can say that the management recognized the costs as justified.

Deadline for reimbursement of overexpenditures according to the advance report

Until recently, reimbursement of expenses to an employee based on an advance report was carried out only after drawing up an order. Today, it is not necessary to draw up an order; it is enough to simply indicate this condition in the organization’s accounting policies. This may be stated in internal documents in the form of rules and deadlines for reimbursement of overexpenditures by the joint-stock company.

Important! Overexpenditure is paid to the employee on the basis of the advance report submitted by him, approved by the manager. Therefore, he does not need to write any statements for this. The legislation does not contain this requirement.

To justify the fact that there really was an overrun and the money was paid, the following conditions must be met: the expenses are justified and documented. In addition, the employee must draw up an expense report approved by the organization’s manager. The report is checked and certified by the manager. Only in this case can the overexpenditure be reimbursed to the employee. After the expense report has been checked and approved, a mark is placed in the appropriate box of the document. When issuing an overrun, the accountant enters the date and number of the consumable.

Important! The report must contain the signature and transcript of the signature of the company cashier and chief accountant.

After this, the accountable amounts are written off. The write-off is carried out on the basis of an advance report approved by the director. If the report does not pass the test (for example, the overspending is found to be unfounded), then it cannot be accepted for accounting.

Answers to common questions

Question: Is it possible to make an entry about compensation for overexpenditure of accountable money in the advance report after it has been approved.

Answer: Yes, the law does not limit the period of time during which the employee must be compensated for overexpenditure. Therefore, a record of debt repayment can be made after the advance report has been approved.

Question: Who should fill out an advance report - an employee or an accountant?

Answer: The advance report is filled out by the employee to whom the funds were given in advance. The accountant only checks that the document is filled out correctly, as well as the presence of all the supporting documents listed in the report. But if necessary, you can fill out an advance report for the employee.

Postings for receiving advance payment

In some cases, buyers transfer money to the seller before purchasing a product, service or work. In this case, the accountant is obliged to allocate VAT from the funds received.

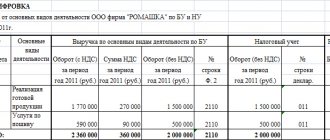

Table 1. Records for recording the received advance payment in the accounting system.

| Wiring Description | Dt | CT | Base | Sum |

| To credit money transferred as an advance | 50 (51, 52) | 62.2 | payment slip | RUB 24,550 |

| For VAT calculation | 76 | 68 | invoice, bank statement | RUB 4,092 |

| To calculate sales revenue | 62.1 | 90.1 | invoice | RUB 24,550 |

| To record VAT on sales | 90 (VAT) | 68 | invoice | RUB 4,092 |

| To deduct VAT on an advance payment (following the sale) | 68 | 76 (advances) | Book of purchases | RUB 4,092 |

Detailed video about advance reports: