28.05.2021What documents can be requested from the bank for verification?

Banks have the right to request documents from the company to verify the sources of profit. The legislation gives credit organizations the corresponding right.

28.05.2021Registering a business through a notary

A bill has been approved, according to which it is possible to open a new company or register as an individual entrepreneur through a notary.

28.05.2021Debt forgiveness by making a contribution to LLC property: what about income taxes?

The organization received a loan from a foreign founder, whose share is 49% in its authorized capital. In order to increase the company's net assets, the founder plans to forgive the debt by contributing the amount of principal and interest to additional capital. Should a Russian company pay income tax on the amount of the forgiven debt and interest under the loan agreement? The explanations of the Ministry of Finance in letter dated April 19, 2021 No. 03-03-06/1/29226 will help you understand the issue.

28.05.2021Transport tax is not paid for a “killed” car

Every year, transport tax is paid by all individuals and legal entities to whom the car is registered. The amount of tax depends on the power of the car. If the car is damaged and cannot be repaired, there is no need to pay tax. But before that, it needs to be deregistered.

28.05.2021The right to VAT deduction cannot be increased by the days the declaration is submitted

The organization was held accountable for committing a tax offense and was assessed a fine. The basis was the refusal to apply a tax deduction for VAT after the expiration of a 3-year period. But the company did not agree with this and went to court. She believed that she still had time to claim the deduction.

28.05.2021Small Business Legal Mistakes

Legal problems are among the TOP 16 reasons why startups fail, according to the analytical company CB Insights. At the same time, in Russia, many beginning entrepreneurs often make similar, from a legal point of view, mistakes. We tell you how to minimize such risks.

28.05.2021Details of creation and adjustment of doubtful provision

Doubtful debt is any debt to an organization arising in connection with the sale of goods, performance of work, or provision of services. But only if it is not repaid within the terms established by the agreement and is not secured by a pledge, surety, or bank guarantee (clause 1 of Article 266 of the Tax Code of the Russian Federation).

28.05.2021Reducing the number or staff of employees: who cannot be fired?

When reducing numbers or staff, the employer does not have the right to dismiss certain categories of employees. What specialists do they belong to?

28.05.2021Russia has been swept by a wave of “commercial” moonshine

Business Ombudsman Boris Titov proposed banning the open sale of moonshine stills in Russia. In his opinion, this can help in the fight against the underground alcohol market. Handcrafted alcoholic drinks are often made not for personal use, but for sale, Titov’s apparatus is convinced.

27.05.2021Deduction of personal income tax when selling a share in the management company of a company

If it is impossible to exempt income from the sale of an individual’s share in the charter capital of the company on the basis of clause 17.2 of Article 217 of the Tax Code of the Russian Federation, the accrued personal income tax can be reduced in the prescribed manner.

27.05.2021On vacation in 2021: calculation and payment of vacation pay. Cheat sheet for an accountant

There are no fundamental changes in the calculation of vacation pay in 2021. You just need to carefully calculate your vacation pay and not forget that there were non-working days in the billing period. Otherwise, the rules for calculating vacation pay are simple and clear.

27.05.2021Imposing disciplinary sanctions: maintaining order

The list of disciplinary sanctions applicable to an employee is limited. If you don’t want to get punished yourself, try not to go beyond it.

27.05.2021Depositing cash into the company's account through ATMs under control

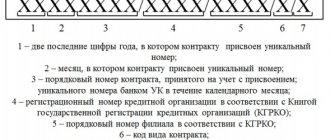

Depositing cash into a company's account through an ATM is not that uncommon today.

27.05.2021How to change information about several directors in the Unified State Register of Legal Entities if they were registered before November 25, 2020

In September 2021, the JSC decided to introduce provisions into the charter stating that the management of the JSC is carried out by several directors acting jointly. The new version of the charter was registered on October 15, 2021. At the same time, the forms of registration documents in force at that time did not allow information to be entered into the Unified State Register of Legal Entities indicating that the directors were acting jointly. How to submit documents for registration of changes about several directors of a joint-stock company, given that information about them can be submitted from November 25, 2021?

27.05.2021There is not much time to adjust SZV-M

If you find an error in the SZV-M, you can avoid a fine only by submitting an adjustment yourself. This must be done before the error is detected by the Pension Fund.

27.05.2021How to fill out and submit documents for benefits if an employee was sick for only 3 days: explanations from the Social Insurance Fund

Since 2021, a mechanism for “direct” payment of benefits from the Social Insurance Fund of the Russian Federation has been in effect. In order to assign benefits, the organization must submit a number of documents to the Fund. But in the event of an employee’s illness, the employer must still pay for the first 3 days from its own funds. What should an employer do if an employee has been sick for only 3 days, representatives of the MRO FSS told in letters dated 05/14/2021 No. 15-15/7710-9682l, dated 05/17/2021 No. 15-15/7710-10787l.

27.05.2021The employee was charged with corrective labor

Correctional labor is a type of criminal punishment, which means that the convicted person is forced to work with income deducted from his earnings in favor of the state. Anyone who receives a sentence of correctional labor will serve it at his place of work.

27.05.2021The tax authorities “froze” accounts: is it possible to recover damages?

The tax authorities suspended operations on the organization’s accounts, and it suffered losses. In what cases can damage caused be recovered?

27.05.2021The Russian Armed Forces refused to consider squash caviar a “defense product”

The “tricky” task... Can you find the difference between a machine gun, tarpaulin boots and... squash caviar? That's it! No amount of erudition and intellect will be enough... But don’t be complex - the judges of two judicial instances also failed. But the Supreme Court could do it, that’s why it’s the Supreme Court. And thereby saved the company from a large fine, a rather large fine (determination dated May 26, 2021 No. 310-ES20-22195).

26.05.2021Personal income tax on compensation for moral damage paid under a settlement agreement

The organization paid the individual compensation for moral damage on the basis of a settlement agreement concluded with him.

Does she need to withhold personal income tax when paying such compensation? 1 Next page >>

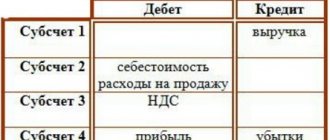

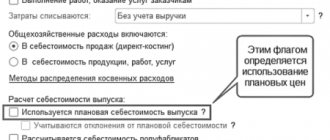

Profit distribution method

The profit distribution method can be used in the following cases:

1) if it is impossible to use other methods and if there is a significant relationship between the activities carried out by the parties to the analyzed transaction (group of homogeneous analyzed transactions);

2) if the parties to the analyzed transaction have rights to objects of intangible assets that have a significant impact on the level of profitability (in the absence of homogeneous transactions, the subject of which are objects of intangible assets, concluded with persons who are not interdependent).

Essence of the method

The profit distribution method consists of comparing the actual distribution between the parties to the analyzed transaction of the total profit received by all parties to this transaction with the distribution of profit between the parties to comparable transactions.

In essence, this is a redistribution of profit in the analyzed transaction according to market rules.

When applying the profit distribution method, the following is distributed :

— the total profit of all parties to the transaction;

— (or) residual profit of all parties to the transaction.

Note. If several similar transactions were made between interdependent persons during the tax period, then redistribution is made in relation to the entire set of such transactions, the so-called. group of similar transactions. In other words, such a group of transactions is considered as an analyzed transaction.

Application of the method for distributing the total profit on the analyzed and homogeneous transactions

The profit distribution method is also applied to the total profit on the analyzed transaction and related similar transactions in the case when:

— the parties to the analyzed transaction are simultaneously of their interdependent persons ;

— (and) price assessment for the specified homogeneous transactions for tax purposes is carried out in conjunction with the analyzed transaction.

Note. In this case, total profit should be understood as the total profit received by the parties to the analyzed transaction and similar transactions.

For example, organization 'A' (general taxation regime) leases premises to organization 'B' (general taxation regime). Organizations 'A' and 'B' are interdependent. Organization 'B' subleases the same premises to organization 'B' (STS “income”). In this case, organizations 'B' and 'C' are interdependent entities, but organizations 'A' and 'B' are not. However, in order to control pricing according to “market rules”, the aggregate (total) profit received by the parties to the lease and sublease agreement must be redistributed.

The concept of total profit

The total profit of all parties to the analyzed transaction is the sum of the operating profit of all parties to the analyzed transaction for the analyzed period.

There is no concept of operating profit in Russian accounting standards. There is no definition of this term in Russian tax legislation.

In international practice, operating profit refers to profit from operating (ordinary) activities. The indicator is calculated as the difference between gross profit and operating expenses (commercial and administrative).

Thus, the indicator “operating profit” is an analogue of the indicator “profit from sales”, which is used in domestic accounting.

The concept of residual income

Residual profit (loss) is determined in the following order:

1) for each person who is a party to the analyzed transaction (group of homogeneous analyzed transactions), based on the market price interval for this party, the estimated profit (loss) , which is calculated taking into account:

— the functions performed by this person;

— the assets he uses;

— accepted economic and commercial risks.

Note. The market price range is determined by one of 4 methods:

— method of comparable market prices;

— (or) the subsequent sale price method;

— (or) a costly method;

— (or) the method of comparable profitability;

2) residual profit (loss) on the analyzed transaction is determined as the difference between the total profit (loss) received (received) on the analyzed transaction and the amount of estimated profit (loss) from sales for all parties to the analyzed transaction.

Adjustment of indicators

If organizations total profit is subject to distribution maintain accounting records based on different accounting requirements, then for the purposes of applying the profit distribution method, such accounting (financial) statements must be brought to uniform accounting requirements.

Principles of profit distribution

The choice of profit distribution principles depends on the circumstances of the analyzed transaction (group of homogeneous analyzed transactions).

The chosen principle should lead to a distribution of profit for the analyzed transaction, which would correspond to the distribution of profit between persons carrying out similar activities in comparable commercial and (or) financial conditions.

In this case, the distribution of profit between the parties to the analyzed transaction (group of homogeneous analyzed transactions) is made on the basis of an assessment of the contribution of the parties to the analyzed transaction (group of homogeneous analyzed transactions) to the total profit for the analyzed transaction (group of homogeneous analyzed transactions) in accordance with the following criteria or their combinations:

1) in proportion to the contribution to the total profit of the analyzed transaction of the functions performed by the parties to the analyzed transaction, the assets they use and the economic (commercial) risks they accept;

2) in proportion to the distribution between the parties to the analyzed transaction of the profitability received on the invested capital used in the analyzed transaction;

3) in proportion to the distribution of profits between the parties to a comparable transaction.

The procedure for applying the profit distribution method

When distributing the residual profit (loss) of all parties to such a transaction between the parties to the analyzed transaction, the final amount of profit (loss) of each person who is a party to the analyzed transaction (group of homogeneous analyzed transactions) is determined by summing the corresponding estimated profit (loss) and residual profit (loss) .

To distribute between the parties to the analyzed transaction the total or residual profit (loss) of all parties to such a transaction, the following indicators are taken into account:

1) the amount of costs incurred by a person who is a party to the analyzed transaction for the creation of intangible assets, the use of which affects the amount of actual profit (loss) received on the analyzed transaction;

2) characteristics of the personnel employed by the person who is a party to the analyzed transaction, including their number and qualifications (time spent by personnel, amount of labor costs), which influence the amount of actual profit (loss) from sales under the analyzed transaction;

3) the market value of assets in the use (disposition) of a person who is a party to the analyzed transaction, the use of which affects the amount of actual profit (loss) from sales under the analyzed transaction;

4) other indicators reflecting the relationship between the functions performed, the assets used and the economic (commercial) risks taken and the amount of actual profit (loss) received from sales for the analyzed transaction.

The distribution of profit between the parties to the analyzed transaction (a group of homogeneous analyzed transactions) according to the principle “in proportion to the distribution of profit between the parties to a comparable transaction” is carried out if information is available on the distribution of the amount of profit (loss) from sales on similar transactions made between persons who are not interdependent. This principle may be applied provided that:

1) the accounting data of the parties to the analyzed transaction are comparable with the accounting data of the parties to comparable transactions or are brought to a comparable form by making the necessary adjustments;

2) the total return on assets of the parties to the analyzed transaction does not differ significantly from the total return on assets of the parties to comparable transactions or must be brought to a comparable form by making the necessary adjustments.

The procedure for recognizing (determining) the amount of “market” profit for a party to the analyzed transaction is presented in the table. Based on the data obtained, the taxpayer’s profit is adjusted for corporate income tax purposes.

Table. Determination of “market” profit for tax purposes

| Amount of profit (loss) accepted for tax purposes | Conditions for recognizing the amount of profit (loss) for tax purposes |

| Actual profit received by the party to the analyzed transaction | The profit received by a party to the transaction being analyzed is equal to or greater than the profit calculated for that party in accordance with the profit distribution method. |

| Actual loss incurred by the party to the analyzed transaction | The loss incurred by a party to the transaction being analyzed is equal to or less than the loss calculated for that party in accordance with the profit distribution method. |

| Profit calculated using the profit distribution method | The profit received by the party to the analyzed transaction is less than the profit calculated for this party in accordance with the profit distribution method. |

| Loss calculated in accordance with the profit sharing method | The loss incurred by a party to the transaction being analyzed exceeds the loss calculated for that party in accordance with the profit distribution method. |