What are dividends

It’s hard to argue with the fact that each of us wants, in addition to the main one, to receive passive income and not spend a huge amount of effort and energy. If you don’t have enough time or experience on your own, then you can safely rely on trust management and engage an independent financial consultant who, among different directions for distributing your funds, will also rely on dividends. If you want to receive a dividend, you should define for yourself how this term is interpreted. I’ll say right away that we often use 2 meanings: official and common:

- A dividend is a certain part of the enterprise’s profit that the shareholder expects at the end of the financial period.

- A dividend is an infrequent payment made by blocks of shares of different denominations.

The era of dividends began to be actively introduced in the 90s, when many state-owned plants, factories and complexes underwent the privatization procedure, which means that a block of shares could be bought by anyone. Today the practice is popular in many countries, with exceptions being the size of the dividend.

Types of dividends

There are several classifications, but when talking about the payment of dividends depending on time, there are intermediate (preliminary) and final. They often talk about the varieties of such profit, taking into account the form in which it is produced:

- Shareholder - dividends in the form of new shares of the company or its subsidiary;

- Cash is the most popular option;

- Property or products of an enterprise.

The dividend may be regular or unstable; in this case, it can be accrued for the first time or reinvested. This is a fairly condensed classification, because, in fact, first of all, it is important what shares you have in your hands.

By share type

It is commonly said that there are 2 main types of shares that allow you to make regular dividends:

- Regular;

- Privileged.

What is the difference between them, besides the starting price and name? - you ask, and your curiosity will be absolutely understood, since the main rights to receive dividends, and sometimes the amount, depend on the type of shares. Sometimes a company only has common shares available for purchase. Rights of shareholders with ordinary shares regarding payment of dividends:

- Can participate in meetings;

- Receive a regular dividend depending on the size of your stock portfolio.

Rights of shareholders with preferred shares regarding payment of dividends:

- Do not participate in shareholders' meetings;

- Receive a dividend at a specified time in a fixed rate;

- In the event of liquidation, the liquidation value of the shares is received.

I can’t say that the owners of preferred shares have any more beneficial rights; the only thing that attracts a fixed dividend, regardless of how the year ended for the company, and in the event of its official liquidation, the cost will be compensated. In fact, we can say that such investments belong to the class of long-term investments, and protect the client quite profitably.

Frequency of payments

This nuance is clarified directly at shareholder meetings, and in addition is partially coordinated by Russian legislation. If you expect to receive a dividend, then the time to expect it is during the following periods:

- Based on the results of the calendar year;

- Twice a year;

- At the end of each quarter;

- Once every 9 months.

Assessing the practical realities, I note that payments, both at enterprises with average profitability and those that offer blue chips, are most often made once a year.

In addition, it is important to clarify that the “distribution of elephants” as such may not happen at all, since shareholders decide not to receive financial profit, but to invest it in the company’s turnover in order to increase potential profit over time.

This practice has both a positive connotation (potential increase in profit and safety of money) and a negative one - inflation, the shareholder needs funds right now, so payment is necessary. When placing a bet on such financial investments, I would advise not only to study the order and frequency of payments, but also how often these conditions may change, directly concluding an agreement to purchase shares.

Payment form

It’s interesting, but many people think that dividends are all about money. In fact, this is how it should be, but at the same time there are many loopholes in the legislation that partially make it possible not to make payments directly in money, in particular, the fact that this form of payment is provided exclusively for joint-stock companies, and, for example, an LLC can afford to issue profits for example, candy.

Sometimes a dividend is an additional share or shares in a company. Business angels will help you get valuable advice and recommendations on paying dividends, who will be able to advise you before the start and teach you how to calculate all the risks and potential profits. Highlighting the main types of how you will receive your profit, I will focus on:

- Fiat money (previously they were received at the company’s cash desk against a signature in a special ledger);

- Distribution of branded products;

- Capitalization or savings - that is, every investor should simply be warmed by the thought that this year the joint-stock company has earned him a profit, but he will not receive a profit yet.

Payment amount

The amount changes annually, since dividends directly depend on the indicator of financial success for a certain period. As a rule, the meeting of shareholders decides on the percentage amount - how much of the total profit will be spent on payments. Therefore, it is worth understanding that when buying shares, for example, 2 years ago, there might have been some conditions, but now they are completely different. Only those who bought preferred shares have stable amounts.

A company is considered successful if once a year, based on the results of its accounting report, it pays shareholders 5-7% of its net profit. Among Russian companies we can name PJSC Gazprom and Sberbank.

Expectability

The meeting of the joint stock company must decide when to expect the next profit and, according to the law, this must be done no later than 6 months before the planned payments. When choosing shares of a particular company to purchase, take into account the fact that you have the right to receive information about the issuance of dividends in advance in order to understand how often they occur and make an informed and informed decision.

I recommend not to buy into dubious offers of issuing profits every month or quarter; As a rule, this indicates the immaturity of the company and fairly high risks.

How much profit can you expect?

In order to calculate the income from each share, it is important to know what percentage of profit the company pays and for what period. Since payments directly affect capitalization (significantly reducing it), on average, the amount of income is determined as a percentage of each security. In order to understand what total dividend income you can expect, you should use the calculation formula. But it’s worth understanding exactly how profits are calculated:

- a fixed percentage for each security specified in the company documents;

- floating interest depending on financial performance for a certain period.

I'll tell you how to calculate dividend income quickly and accurately. To do this, the amount of dividend per 1 security (the amount is decided at a meeting of shareholders) must be divided by the market value of the share and multiplied by 100%. Of course, investments on the Internet pay off faster and offer a shorter period of work, but at the same time with an increased share of risk.

Dividend payout ratio

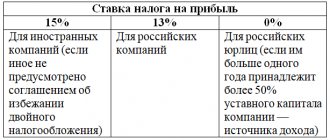

Basic rule: Dividend yield is calculated as a ratio of the company's annual earnings per share. It is difficult to predict developments in the current year, so data from last year is taken as a basis. I propose to get acquainted with the TOP 10 Russian companies with the highest dividend yield over the past 12 months.

| # | Company name | Amount of dividend income (in%) | Features of making a profit on a type of share |

| 1 | Mechel | 15,75 | Privileged |

| 2 | Severstal | 15,7 | Regular |

| 3 | IDGC of Center and Volga Region | 14,2 | Regular |

| 4 | IDGC Volga | 13,86 | Regular |

| 5 | Enel Russia | 13,63 | Regular |

| 6 | Lenenergo | 13,46 | Privileged |

| 7 | Aeroflot | 12,58 | Regular |

| 8 | Rostelecom | 12,43 | Privileged |

| 9 | Mostotrest | 11,94 | Regular |

| 10 | LSR Group | 11,93 | Regular |

Net interest margin

In terms of what dividend income is for shareholders, a parallel can be drawn with net interest margin. The coefficient is typical for the activities of a bank, but this principle also applies to OJSC or CJSC. In fact, it is the ratio of net interest income to average assets. The formula also takes into account the difference between interest income and interest expense. The coefficient indicates the effectiveness of management of any commercial organization.

mutual fund

If the value of the shares is large enough, cooperation with a mutual fund is used. In this case, the dividend yield ratio remains the same minus commissions. The principle is that small shareholders invest in the company. A very popular investment instrument in the USA, and in Russia this concept has its own analogue - a mutual fund. When choosing among those proposed, it is worth determining what the result of the work shows: the number of investors, total dividend income, learn more about reputation. Among the world's giants are the Vanguard High Dividend Index and Vanguard Index Fund investment funds.

Let me draw your attention: dividends can be paid not only in money, but in the company’s products or in its shares.

Exchange notes

This is the financial part that partially affects dividend income, because ETNs are an unsecured asset, and the company's proposed dividend rate depends on such debt obligation, its size, as well as whether a dividend will be paid. In fact, this is a loan that can be given to a reorganized organization, but with proper management, the note will bring profit. And the peculiarity is their low price (no more than $1), the ability to purchase large quantities, and also the fact that they partially coordinate market volatility.

Source of dividends

The financial activity of the enterprise is the main source of dividend payments, and in addition, the second important resource for “filling” the treasury remains the purchase of shares by new shareholders. Taking this into account, sometimes a company deliberately increases its issue in order to attract more shareholders and pay off debts on old obligations. A similar principle is used by companies whose shareholders are both private individuals and partly the state.

Income from dividends

Speaking about the payment of dividends, you should not consider this method as the only key one that allows you to receive income; there are 3 more directions:

- Regular payments from the company in which you are a shareholder;

- The difference is in the course. You buy shares, invest some in the company itself, and bring some to the market and sell at a better price;

- You buy shares and immediately sell them, assessing the cost and average profitability of each share listed on the stock exchange, and the one who bought from you will receive a dividend.

Average DD in Russia and America

As data for 2021 show, the spread of dividend yields of Russian issuers is quite large.

For example, Telegraph shareholders received a return of 43% per annum - this is an abnormal one-time payment. And investors in the telecommunications giant MTS will receive 3.37% profit for the first half of 2021.

In Russia, the average dividend yield is 7–9% per annum. This is a very approximate indicator, depending on the interest rates of the central bank, the state of the economy of the state, the industry and the company itself.

The average dividend yield on American securities is much more modest and amounts to about 3–5%. But there are also shares with larger payouts. For example, the telecommunications company CenturyLink made its shareholders 13.7% richer at the end of 2021.

It is worth remembering that high dividend yields do not provide any guarantee of constant payments in the future. Abnormally high values tend to converge to their average values, so an investor must consider a large historical period when deciding to buy specific stocks.

How are dividends calculated?

I have already said that the fundamental difference in accrual lies in the segment that for owners of ordinary shares the size of dividends is determined by equity participation, for those who have preferred shares it is stable and fixed. In fact, it is profitable to choose portfolio investments, but it is better to bet on several projects at once. I note that all accruals are carried out exclusively based on the results of a certain period and are based on standard mathematical formulas: everything that is earned, minus tax, minus fixed dividend payments to VIP clients and then proportional accruals to ordinary shareholders.

An important point: decisions on the payment of dividends are not made in court, that is, even if a company or joint stock company has not paid them, it is impossible to receive monetary compensation through the court. But at the same time, in the event of a previously adopted decision by the board of shareholders to pay dividends, and if it was not implemented, it is necessary to file a claim to collect such debt, but only on the condition that 3 years have not passed since the payments were not made .

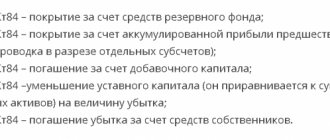

Order of bonus distribution

If you own premium shares, then you can expect that insurance payments will be reimbursed to you if the company goes bankrupt and officially ceases to exist. On the one hand, they protect your investments, on the other, let’s be realistic: the bankruptcy procedure in our country is so long that it is difficult and sometimes not even realistic to receive payments in your hands.

Plus, if the company achieves profit on the “green line” for the year, payments will be made in any case. The first to receive dividends are the owners of the privileged stake.

Amount of bonuses

For those who have already discovered what investments are and decided to purchase shares of companies, it will be important to note that the payment and size of the dividend is not fixed, and it can change from one period to another, taking into account the performance of the company. The amount of bonuses is stable only for owners of preferred shares, and those who hold ordinary shares may not fully know how much they will receive in the end. Speaking about the most typical factors that influence dividend payments, the following are highlighted:

- The amount of the company's net profit for the reporting period;

- Issue of shares of ordinary and preferred segments;

- Number of shareholders;

- Was a new batch of shares issued and brought to the market;

- Prospects for further development.

Tax collection

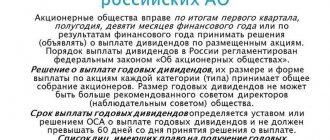

The dividend, although not that large for the average shareholder, since it is pure profit, is taxable. In particular, this process is coordinated by the Tax Code of the Russian Federation, namely its second part. Leafing through the boring book, I’ll point out that tax is calculated differently, depending on whether the company in which you have shares is located in Russia or abroad.

- If the company that pays the dividend is registered and operates outside the Russian Federation, the shareholder pays 13% income tax independently.

- If, then you receive a dividend as already net profit, the company pays 13% of your profit on its own.

I note that a couple of years ago the tax was lower and amounted to only 9%, and the payment of dividends was talked about as being quite profitable. For legal entities that receive dividends, the tax rate is similar and amounts to 13%.

The payment must be reported, especially since some shares are sold so publicly and openly through banks or company branches that it is impossible to hide it.

Although it is difficult to contain your indignation when the company paid you 5% of profits, of which 13% went to tax. When filling out your annual tax return, be sure to include these payment items in it to avoid any unpleasant issues with the law.

Taxation

involved in investing are required to pay taxes This is stated in Article 284 of the Tax Code of the Russian Federation.

If an individual is a resident of the state, the tax he is obliged to pay is 13%; if not, it is 2% more. Residents are those citizens who have stayed in the country for more than 180 days over the past year.

As for legal entities: Russian companies pay a tax of 13% , and foreign companies - 15% .

Helpful information! If an individual has debts in the tax sector , but does not know their size, you can find out by last name.t

Dividend calendar 2021 for Russian companies

I think I won’t surprise you if I say that many people want to get closer to paying dividends, and they are betting specifically on the domestic segment of companies. Convenient: profits are accrued regularly, and at the same time we are confident in supporting domestic business. Let me point out that today the most profitable areas are considered not only the oil and gas refining sector, but also telecommunications companies and the energy complex, as well as financial institutions.

Each company has its own, strictly designated issue of shares, and therefore sometimes it is profitable to invest at the very start of work, sometimes after waiting a little until the company gets on its feet and “unwinds”. For the convenience of determining dates for investors when investors in different companies are expected to make a profit. There are many monitoring systems - a combined online resource where you can see a list of companies and how much the shares are currently valued. The timing of dividend payments is clarified:

- Company sector;

- Time period - year, quarter, half year;

- Ticker;

- You can choose the option for upcoming or approved dividends. This is convenient when an investor wants to ensure a payment that takes into account time and level of stability.

For those who are used to buying shares and immediately trading them on the stock exchange, benefiting from the difference in exchange rate, MICEX quotes will become relevant, and in addition, I recommend paying attention to 2 important indices:

- Dividend stability index - takes into account how regularly the company pays profits and whether there are indicators of profit growth;

- Dividends per share - that is, what dividend is accrued per 1 share in the portfolio of a particular company.

Here it is worth thinking about paying dividends in advance, and assessing the profitability of the purchase, both ordinary and preferred. Plus, using online dividend calculator resources, evaluate:

- Closing share price;

- Dividend yield;

- Last day to purchase shares;

- Dividend register closing date.

At least 25 days must pass from the date of purchase of the share to the accrual of the dividend. In fact, the state uses a similar principle when it offers us to buy bonds from it, and then we come up with the most successful time option for sale. A dividend is not just a fantastic opportunity to receive payments for nothing, but, first of all, it is an investment in shares that generate income: either there is a capitalization of interest, or a regular payment of profitability. Financial experts do not call this type of investment unduly risky, but it also cannot be called particularly profitable. That is why it is rational to bet on several parallel investments: both in amount, and in terms of timing, and in types of company activities, in order to minimize risks and, as it were, regularly make a profit. You need to understand that with the same shares, you can work differently in order to increase your income. Traditionally, I wish you that you know first-hand about the payment of dividends, and that you regularly and consistently receive good profits from various domestic and foreign companies.

Author Ganesa K.

A professional investor with 5 years of experience working with various financial instruments, runs his own blog and advises investors. Own effective methods and information support for investments.

Rating of stocks with constant growth in dividend yield

I offer the most promising securities of Russian and foreign companies that consistently pay dividends.

Russian shares

The Russian stock market is relatively young compared to its overseas counterpart, so it is too early to judge the mathematical reliability of dividend yield.

However, check out the list of securities whose 5-year dividend yield was above the market average:

- "Surgutneftegaz" (AP) - 14.84%;

- Bashneft (AP) – 10.86%;

- Norilsk Nickel - 10.8%;

- MTS – 9.45%;

- Severstal - 9.32%.

Investments in blue chips - Gazprom and Lukoil - over 5 years on average would bring 6% annual dividend yield.

American securities

Here is a list of some American issuers with dividends that exceed the market average:

- CenturyLink – 13.2%;

- L Brands Inc – 8.3%;

- Kimco Realty, Corp. and Iron Mountain, Inc. – 7.2% each;

- Ford Motor Co and Invesco – 7.1%;

- Coty, Inc. – 7%.