The procedure for conducting cash transactions in an organization

Cash documents

Cash transactions are formalized by incoming cash orders, or PKO, and outgoing cash orders, or RKO (instructions of the Bank of Russia dated March 11, 2014 No. 3210-U).

For each PKO and RKO, entries must be made in the cash book. This order continued after the transition to online cash registers. Unified forms of cash documents are given in Resolution of the State Statistics Committee of the Russian Federation dated August 18, 1998 No. 88, which continues to be in force:

- cash receipt order (abbr. PKO, OKUD code 0310001);

- expense cash order (abbr. RKO, OKUD code 0310002);

- cash book (OKUD code 0310004).

If you issue a salary from the cash register, the payroll (OKUD code 0301011) or payroll (OKUD code 0301009) is used, approved. Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1.

Maintaining a cash book

Any organization, regardless of the taxation system, is required to maintain a cash book (form No. KO-4) if it receives or spends cash (clauses 1, 4, 4.6 of the Procedure for conducting cash transactions). Even the daily delivery of proceeds to the bank, including through collectors, does not exempt you from maintaining a cash book.

If a separate division of an organization receives or expends cash, it is also required to maintain a cash book. It does not matter whether the separate division has a current account (letter of the Bank of Russia dated May 4, 2012 No. 29-1-1-6/3255).

Within the time period established by the head of the organization, the separate division (SU) transfers to the head division:

- tear-off copies of sheets of the cash book - when the OP cash book is filled out by hand;

- second copies of cash book sheets printed on paper - if the OP’s cash book is filled out on a computer.

In the parent organization, the indicators of the OP's cash book are not entered into the organization's cash book. Sheets of the OP cash book are bookleted separately at least once a year.

The OP's money is reflected in the organization's cash book only if it deposits cash at the organization's cash desk using a cash receipt order.

Cash balance limit

The balance of cash in the cash register at the end of the day should not exceed the limit established by the organization (clause 2 of the Procedure for conducting cash transactions). If there is more money in the cash register, fines are provided: for an organization - 40-50 thousand rubles, for an official - 4-5 thousand rubles.

This rule does not apply to individual entrepreneurs and LLCs - small businesses: they can keep any amount of cash in the cash register. Formulas for calculating the balance limit are given in the Appendix to Bank of Russia Directives No. 3210-U.

Also, the limit can be violated on weekends and non-working holidays, if the organization accepted cash, as well as on days when it received money from the bank to pay salaries.

Issuance and delivery of small change coins

There should be no balance in the cash register either at the beginning of the working day or at the end. This is established by regulations that regulate the use of online cash registers. Therefore, before the start of the work shift, the cashier gives the cashier-operator some change money. To do this, the cashier writes out a settlement account for the amount of exchange, in which he indicates the full name of the cashier-operator in the “Issue” line, and writes “For exchange” in the “Base” line.

If a trade organization has a senior and ordinary cashiers, then the senior cashier gives the change coin to the cashier-operators. The amount of the change coin indicated in the cash register is recorded by the senior cashier in the cash book (form KO-4) and in the book of accounting for funds received and issued by the cashier (form KO-5). This procedure is established in clause 4.5 of the Procedure for conducting cash transactions and is valid when using an online cash register.

Thus, if there is no senior cashier, a cash receipt order is still sufficient to issue change coins. And if there is a senior cashier, in addition to registering cash registers, you need to keep a book in the KO-5 form.

The return of an unused change coin must also be issued in a separate PCO, indicating the return of change as the basis.

Trade and reflection of retail revenue in NTT

The process of reflecting trade in 1C Accounting 8.3 for a manual point of sale can be reflected in the following sequence:

- movement (admission) to NTT;

- inventory;

- fixation of retail revenue with a cash receipt order;

- Creation of a retail sales report based on inventory.

Since the topic of the article is retail revenue, I will only consider 1C cash documents - “Cash receipt order” and “Retail sales report”.

The topic of retail trade is covered in more detail in our article - Retail sales in 1C 8.3 Accounting

Trading in NTT does not imply daily reflection of revenue and reflection of sales of goods. The organization independently determines the period when to register receipt of revenue and take inventory.

Important! When registering an operation to receive revenue from a manual point of sale, you must first create and post a cash receipt order, and then draw up a sales report.

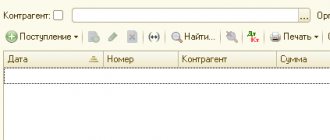

Now I’ll explain why. Let's create a PCO with the type of operation “Retail Revenue”. As a warehouse, we will indicate a retail outlet with the type “NTT”:

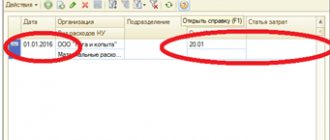

Let's run the document and see what movements (in particular postings) it will generate:

As you can see, account 90.01.1 does not have a third subaccount. And there is nowhere for it to come from, since the PKO does not contain information about the goods sold.

Now let’s create a report on retail sales in NTT (the program itself will determine the type of operation based on the type of warehouse). We will assume that we have already carried out an inventory and created a document with a report based on it:

We post the document and look at the postings:

When posting, the posting created by the cash receipt order is reversed, and postings are created with the third subaccount filled in. This analytics is needed to correctly perform routine operations at the end of the month.

This is why it is important that a PCO is carried out first.

Cash transactions for individual entrepreneurs

Entrepreneurs are also required to observe cash discipline. But a simplified procedure is provided for them. Here's what not to do if you're an entrepreneur:

- do not draw up cash documents (PKO, RKO) (clause 4.1, clause 4 of the Bank of the Russian Federation Directive N 3210-U);

- do not keep a cash book (clause 4.6, clause 4 of Directive No. 3210-U);

- do not set a cash balance limit (clause 2 of Directive No. 3210-U).

Individual entrepreneurs can spend the cash proceeds received at the cash desk for personal needs (clause 1 of Bank of the Russian Federation Directive No. 5348-U).

Revenue in 1C 8.3 - how to view

Use standard reports to analyze revenue. It is more convenient to use the Turnover balance sheet report, but others are also possible.

For more information about setting up reports, see the article Setting up reports in 1C 8.3.

Let's take a closer look at how to analyze revenue for each type of accounting.

BOO

To analyze revenue, generate a report only for account 90.01.

NU (income tax)

To analyze revenue, generate a report on account 90.01, and also do not forget to add income from sales on account 91.01.

To do this, select them by Type of directory Other income and expenses .

Don’t forget about selecting by the Accepted for tax accounting and restrictions on the main tax system.

NU (USN)

Income under the simplified tax system is determined in the same way as for income tax, but is recognized on a cash basis:

- money was actually received (to a bank account or to the cash desk), other property, work, services, property rights;

- the debt is repaid in some other way.

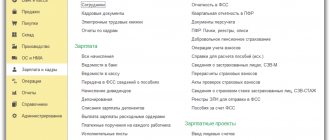

Data under the simplified tax system, unlike income tax, is not reflected in the accounts of accounting departments, therefore, when analyzing revenue under the simplified tax system, it is inconvenient to use the Turnover Balance Sheet . We recommend generating the report Analysis of Accounting according to the simplified tax system (section Reports – Analysis of Accounting).

Taking the amount from blocks without verification is risky. The Receipts from Customers block will reflect all receipts of money (cash and non-cash) processed through the Payment from Customers . And there may also be a list of fines and penalties for violation of contract terms.

Be sure to analyze the manually reflected income : all adjustments will be reflected there.

Fiscal documents instead of standardized forms for CCP

Unified forms for cash register equipment

Previously, when making payments through the cash register, organizations used unified forms of primary accounting documentation KM-1–KM-9 (approved by Resolution of the State Statistics Committee of the Russian Federation dated December 25, 1998 No. 132):

But Resolution No. 132 was not adopted in accordance with Law 54-FZ, therefore, according to officials, it is not necessary to apply it (letters of the Ministry of Finance of the Russian Federation dated May 12, 2017 No. 03-01-15/28914, dated April 4, 2017 No. 03-01-15 /19821, dated January 25, 2017 No. 03-01-15/3482, dated September 16, 2016 No. 03-01-15/54413, No. 03-11-11/61091 dated August 13, 2019)

So organizations that use online cash registers in accordance with 54-FZ are not required to prepare certificates and reports from the cashier-operator (form KM-6) and keep a journal of the cashier-operator (form KM-4) for each cash register (letter from the Ministry of Finance of the Russian Federation dated 12.05 .2017 No. 03-01-15/28914).

Let us remind you that incoming cash orders (PKO) and outgoing cash orders (RKO) must be issued on the basis of fiscal documents (clause 4.1 of Instructions No. 3210-U).

Fiscal documents

Fiscal documents are checks and reports that cash register equipment creates according to established formats (Article 1.1 54-FZ).

Fiscal documents include (clause 4 of article 4.1 of law No. 54-FZ):

- registration report;

- report on changes in registration parameters;

- shift opening report;

- cash receipt (strict reporting form);

- correction cash receipt (strict correction reporting form);

- shift closing report;

- report on closing the fiscal drive;

- report on the current state of settlements;

- operator confirmation (this is the only document that is generated not on a cash register, but by technical means of the OFD).

The formats of fiscal documents are approved by Order of the Federal Tax Service of the Russian Federation dated March 21, 2017 No. ММВ-7-20/ [email protected]

Separately, it is worth mentioning the duration of the shift. By law, work with fiscal equipment is divided into cash register shifts. Before the start of calculations using cash register systems, a report on the opening of a shift is generated, and upon completion of calculations, a report on the closure of a shift is generated.

In this case, a cash register receipt cannot be generated later than 24 hours from the moment the report on the opening of a shift is generated (clause 2, article 4.3 of Law No. 54-FZ). This means that a shift when working at an online cash register cannot last more than 24 hours. This is explained by the capabilities of the fiscal drive: if the shift is more than 24 hours, the fiscal sign of the document is not formed on the check (paragraph 9, clause 1, article 4.1 of Law No. 54-FZ).

You can open a cash register shift on one day and close it the next day, but provided that the total duration of the shift does not exceed 24 hours. There are no other restrictions in 54-FZ, including no requirements that the shift must be closed at a certain time (letter of the Ministry of Finance of the Russian Federation dated May 5, 2017 No. 03-01-15/28066).

Profit in 1C 8.3 - how to see

Profit will be reflected only after completing the routine operation Closing accounts 90, 91 of the Closing of the month procedure.

Account balance 99:

- debit - loss;

- credit - profit.

For analysis, also use the Turnover balance sheet .

To analyze profit from core activities or non-operating profit, use the Account Analysis or Account Turnover .

For the simplified tax system, we also recommend generating the report Analysis of Accounting according to the simplified tax system (section Reports - Accounting Analysis).