As you know, in our country there are several basic and special tax regimes. Entrepreneurs have the right to choose the taxation scheme that is most interesting and beneficial to them from the point of view of accounting support, tax accounting, type of activity and amount of tax payments. Therefore, before finally deciding on taxation, businessmen try to study in detail all the criteria, subtleties and nuances of each tax system. Most often, once they have chosen one of them, they continue to work on it throughout the existence of the enterprise. However, this does not always happen: sometimes, due to some external circumstances, there is a need to change the taxation system. This material will discuss how to switch to UTII.

Conditions for switching from simplified tax system to UTII

To switch from simplification to imputation, the following conditions must be met simultaneously:

- the number of employees (average) for the previous calendar year does not exceed 100 people;

- the company does not fall under the category of major taxpayers, is not a member of a joint activity agreement, as well as an agreement on trust management of property;

- in the organization’s charter capital, the share of other companies should not exceed 25 percent (an exception for organizations in which the average number of disabled employees exceeds 50 percent, and they own at least 25 percent of the wage fund);

- an organization or individual entrepreneur is engaged in a type of activity for which the use of UTII is permitted;

- your region provides for the payment of UTII (this is a municipal tax, so each region makes its own decision on its use).

UTII from the moment of registration

You can apply UTII from the very first day of the organization’s operation. The most important thing is that the activity that the enterprise plans to carry out is allowed to use “imputation”. A list of activities subject to the Single Tax is determined at the level of local and municipal authorities. This is usually due to the individual characteristics of certain regions of the Russian Federation. Regardless of how the future businessman will register with the tax service: as an individual entrepreneur or as the founder of an LLC, you can submit an application as a UTII payer simultaneously with the rest of the basic documents.

Attention: When choosing UTII, you need to remember the fact that you will have to pay this type of tax regardless of how much revenue the company has. And even in the absence of any activity, and, accordingly, no profit, tax will still have to be paid.

Are you switching from UTII? Connect Kontur.Accounting

45% discount in November: RUR 7,590 instead of 13,800 rub. per year of work

Easy bookkeeping

The system itself will calculate taxes and remind you of the deadlines for payments and submission of reports.

Automatic calculation of salaries, vacation pay and sick leave

Technical support 24/7, tips inside the service, reference and legal database

Sending reports via the Internet

Reports and KUDiR are generated automatically based on accounting data

Electronic document management and quick verification of counterparties

Documents, transactions, analytical reports, VAT reconciliation

There is a list of circumstances when the use of UTII is unacceptable. According to current legislation, the transition to imputation is not possible for companies that:

- organize catering in hospitals, schools and other institutions where this service is mandatory;

- not only sell products, but also engage in their production;

- It is also impossible to switch to UTII for companies and individual entrepreneurs that lease premises or land plots at gas stations, as well as lease land for the placement of retail facilities on it.

The transition to imputation occurs either voluntarily in the general order, or due to failure to fulfill the conditions for the simplified tax system. Let's consider these options in more detail.

When UTII does not apply

Please note that the transition to imputation is not possible if an organization or individual entrepreneur violates the following conditions:

- Number of employees - more than 100 people;

- 25% or more of the organization’s authorized capital belongs to other legal entities;

- The entrepreneur's transition to the simplified system was carried out on the basis of a patent;

- The enterprise is registered as a simple partnership;

- Agricultural tax applies.

Let us note that if all the above conditions are met, the transition to UTII will not present any difficulties for all categories of taxpayers who are on the simplified tax system.

Transition from simplified tax system to UTII, general procedure

The transition in the general order is made when the organization used the simplified tax system for the entire previous year, and the activities it carried out fully complied with the requirements of the simplified tax system. In such a situation, during the transition you must:

- submit a notice of deregistration from the simplified tax system on form No. 26.2-3 to the Federal Tax Service at the location of the individual entrepreneur or LLC before January 15 of the current year;

- provide an application for registration of UTII on the form UTII-1/UTII-2, established by order of the Federal Tax Service of the Russian Federation No. ММВ-7-6/941, and submit it no later than 5 days from the transition to UTII to the Federal Tax Service at the location of the company;

- it is also necessary to submit a certificate of tax registration, a certificate of state registration and, in the case of an individual entrepreneur, a passport.

If you terminate your activity under the simplified tax system and abandon this system, you must submit a final declaration and pay a single tax to the budget by the 25th of the next month. Payment of taxes on activities that do not fall under UTII will be made in accordance with the general taxation system.

The transition from the simplified tax system to imputation is possible only at the beginning of the year. That is why, when submitting all of the above notifications, you must strictly adhere to the deadlines and submit applications no later than 5 working days from the beginning of the next year.

What is the essence of UTII and the procedure for its application

The letter combination UTII is correctly deciphered as Unified Tax on Imputed Income. This special tax regime is extremely popular and common among small and medium-sized businesses. Its demand is quite justified, since it implies a fixed tax levy from entrepreneurs engaged in certain types of work and provision of services.

It is important to distinguish one more feature of UTII: the tax is paid not on specific turnover or profit, but on estimated, that is, potentially possible income.

For many entrepreneurs, especially those with fairly large revenues, the undoubted advantage of UTII is the fact that, regardless of the amount of income, the tax amount remains unchanged.

History: until 2013, in accordance with the Tax Code of the Russian Federation, UTII was mandatory for some enterprises and organizations. Now you can switch to it only with a voluntary expression of will, either from the beginning of the new calendar year, or, if any compelling circumstances arise, in the middle of the year. In this case, you will need to start paying tax based on the results of the quarter in which the activity that falls under the “imputation” appeared.

Transition to UTII if simplified conditions are not met

In the process of using the simplified tax system, an organization may commit some violations of the conditions (for example, receive income above the permissible level) and cease to comply with the conditions of Art. 346.12 Tax Code of the Russian Federation. Then you need to stop charging tax according to the simplified tax system from the beginning of the quarter and must inform the tax authorities no later than 15 days following the quarter of loss of the right to use the simplified tax system.

If the violation was committed in the second quarter of 2021, then provide notification by July 15, 2021. Then, already from the second quarter, the right to use the simplified tax system is lost, taxes are paid according to the general regime. The transition to UTII is possible at the beginning of next year and only if all conditions for using this system are met and the following documents are provided:

- application for registration under UTII on the form UTII-1/UTII-2, established by order of the Federal Tax Service of the Russian Federation No. ММВ-7-6/941;

- tax registration certificate;

- certificate of state registration;

- passport (for individual entrepreneurs).

Where to apply for transfer

The application, as noted above, must be submitted to the tax service. When determining the specific location of the Federal Tax Service, it is necessary to take into account the location of objects that are subject to taxation.

So, by default, you must submit an application at the location of the individual entrepreneur or LLC. If the activity is carried out on the territory of several regions or regions, then the application must be submitted to each branch of the Federal Tax Service where the facility is geographically located and the activity is carried out.

Combination of simplified tax system and UTII

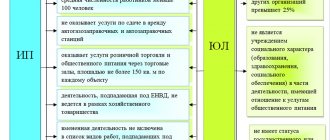

The Tax Code of the Russian Federation does not prohibit the one-time use of simplification and imputation if the taxpayer calculates the simplified tax system for some types of activities, and UTII for others. At the same time, the LLC must carry out those types of activities that satisfy the conditions of the simplified tax system and UTII and are listed in Art. 346.26 Tax Code of the Russian Federation. When combining the simplified tax system and UTII for an LLC, the following conditions must be met:

- no more than 100 employees in total;

- the residual value of the fixed assets should not exceed 150 million rubles;

- income from activities under the simplified tax system for the year does not exceed 150 million rubles;

- the company keeps separate records of property, liabilities and transactions for which it plans to apply the simplified tax system and UTII;

- Management companies with a founder's share of legal entities of no more than 25 percent.

To combine the simplified tax system and UTII for individual entrepreneurs, the following requirements must be met:

- trade area no more than 150 sq. m.;

- the entrepreneur does not combine types of activities (for example, agricultural activities plus public catering);

- no more than 100 employees;

- the entrepreneur keeps separate records of employees who are engaged in activities on the simplified tax system or UTII.

The rules and regulations by which such separate accounting will be carried out are developed by each company independently and are reflected in the accounting policies of the organization. There is a need for separate accounting of income from activities based on simplification and imputation, separate accounting of costs, as well as separate accounting for wages to employees and insurance premiums.

Subtleties of using UTII

As follows from the Tax Code of the Russian Federation, not all commercial enterprises and organizations have the right to apply UTII. Here are just a few restrictions:

- In terms of household services: small companies often operate under UTII, providing various household services to the population. There is one significant nuance here: services should be provided only to individuals. If a company enters into an agreement to provide similar services to legal entities, it no longer has the right to pay UTII; BUT! This does not apply to veterinary clinics, car repair services, car washes, parking lots and some other types of services that can also be called household;

- In the advertising business, not all types of services are subject to the application of a single tax on imputed income. In particular, if a company is engaged in the distribution or placement of advertising, then, please, UTII is completely acceptable. If we are talking about the production of advertising goods, the development of services, or the rental of advertising structures, then you will have to choose some other methods of taxation;

- When leasing space, UTII can be used only on the condition that a particular retail outlet does not have a sales area;

- For taxi services and motor transport enterprises there is also a limitation: on the number of transport units - no more than 20 of them must be registered per organization.

In fact, there are quite a lot of nuances in using UTII. They exist both in terms of determining the types of activities under UTII and in terms of various restrictions, and in the methods of transition from other tax regimes. Therefore, before you finally make a decision on changing taxation, it is advisable not to be lazy and consult local tax authorities or experienced business representatives about the options and intricacies of applying a single tax on imputed income.

General provisions

The procedure for switching from the simplified tax system to UTII is regulated by the Tax Code of the Russian Federation. However, to begin with, it should be said that “imputation” is very popular among small businesses due to the fact that instead of several mandatory payments, the company pays a single fee calculated from the estimated amount of income.

In addition, this prevalence of “imputation” can also be explained by the fact that the taxpayer only needs to submit declarations to the fiscal service 4 times during the year in order to confirm the indicators used to calculate the payment amount. In addition, the already small amount can be reduced by the amount of insurance contributions to the Social Insurance Fund.

If we talk about who has the right to work under “imputation”, then it should be noted that in order to implement the planned actions, enterprises and organizations must meet the following criteria:

- the enterprise or organization must have a total income of no more than 45.0 million rubles;

- such a business entity must have no more than 100 employees;

- the balance of fixed assets of such an enterprise should not exceed the amount of 100.0 million rubles;

- the type of activity of a legal entity or individual entrepreneur is not subject to the mandatory application of other fiscal regulations.

Only in this case can organizations choose a simplified taxation system.

However, if the type of activity corresponds to the one for which the proposed regulation is applicable, then such an enterprise or organization has the right to change the simplified tax system to the preferred taxation regulation. The types of activities applicable for imputation include:

- provision of household services;

- provision of veterinary services;

- transportation of passengers and cargo;

- retail trade;

- catering.

In order to become a participant in the specified tax regulations, the management of the organization is required to timely submit an application to the tax authorities.

Self-employment: how to switch from UTII to NAP

The professional income tax is already applied throughout Russia. More than 1.3 million taxpayers have already chosen this mode.

The amount of tax for a self-employed person depends on who he received the income from:

- if from an individual, the tax rate will be 4%,

- if from a company or individual entrepreneur - 6%.

The payment amount is calculated from income, but income cannot be reduced for expenses. You need to calculate and pay your tax in the “My Tax” application.

You can register as a self-employed person (NPP payer) at any time.

Individual entrepreneurs will not be able to become payers of professional income tax if they:

- sell excisable and mandatory labeling goods,

- resell goods or rights to own, use and dispose of real estate,

- extract and sell minerals,

- conduct business on the basis of agency agreements, commission agreements or agency agreements.

Example

There are no restrictions in the self-employment law for car service owners. But we must remember that self-employed people cannot hire employees under employment contracts.

Evgeniy, if he chooses self-employment mode, will have to pay 4% for settlements with individuals and 6% for legal entities and individual entrepreneurs. In his case, there will be no reporting; all transactions will take place in the Federal Tax Service application “My Tax”.

At the same time, in self-employment mode, Evgeniy cannot sell spare parts for cars.

We have discussed all the pros and cons of self-employment in our article.

“Simplified” as an alternative to the outgoing UTII: features 2021

Organizations and individual entrepreneurs using UTII this year can choose from January 1, 2021 the simplified tax system as an alternative to the outgoing “imputation”. How to change the tax regime correctly and what are the features of the transition? Part of the letter of the Federal Tax Service of Russia dated November 20, 2020 No. SD-4-3/ [email protected]

Notification of the Federal Tax Service

Payers of UTII who wish to switch to the simplified tax system from January 1, 2021 must notify tax authorities of their decision. The deadline for submitting the notification is no later than December 31 of the current year (clause 1 of Article 346.12 of the Tax Code of the Russian Federation).

The notification can be drawn up according to the recommended form No. 26.2-1 (approved by order of the Federal Tax Service of Russia dated November 2, 2012 No. MMV-7-3 / [email protected] ).

The notification should indicate the selected taxable object:

- income or

- income reduced by expenses.

In addition, the notification must contain the following information:

- on the residual value of fixed assets;

- about the amount of income.

This information is indicated as of October 1, 2021 (paragraph 2, clause 1, article 346.13 of the Tax Code of the Russian Federation).

The line “Income received for nine months of the year the notification was submitted” reflects income only from those types of activities that are taxed in accordance with the general taxation regime (GTR) (clause 4 of Article 346.12 of the Tax Code of the Russian Federation). In other words, this line is filled out only by those taxpayers who combine UTII and OSN in 2021.

One more nuance: income received under UTII is not taken into account when determining the income limit (no more than 112,500,000 rubles) for switching to the simplified tax system.

The notification can be submitted to the Federal Tax Service at the location of the organization or place of residence of the individual entrepreneur in the following ways:

- personally or through a representative;

- send by registered mail or

- transmit in electronic form via telecommunication channels using a qualified digital signature, including through the “Personal Account of an Individual Entrepreneur Taxpayer” service posted on the website of the Federal Tax Service of Russia in the “My Taxation System” section.

After submitting a notification about the transition to the simplified tax system, the “imputed” person has the right to change the initially selected object of taxation or refuse to apply this special taxation regime. To do this, he must send:

- new notification about the transition to the simplified tax system and (or)

- corresponding appeal on the non-application of the “simplified system” in 2021.

A new notification must be submitted no later than December 31 of the current year. Tax authorities will have to cancel the previously submitted notification (letter of the Federal Tax Service of Russia dated October 20, 2020 No. SD-4-3 / [email protected] ).

The taxpayer could combine the simplified tax system and UTII until the end of the current year. In relation to this category of persons, the management of the tax service believes that they do not need to submit a second notification about the transition to the simplified tax system. Taxpayers who previously notified the Federal Tax Service of the transition to the simplified tax system are recognized as payers applying the simplified tax system after January 1, 2021, including for income that was subject to UTII taxation before that date.

Accounting for income and expenses during transition

By starting to apply the simplified tax system in 2021, the former “imputed” person can receive income from goods (work, services) purchased (performed, provided) during the period of application of UTII. What to do with such income?

When answering this question, it should be taken into account that the “simplified” ones when determining the tax base:

- take into account income from sales and non-operating income, which are determined in accordance with the Tax Code of the Russian Federation (Articles 249 and 250), and

- do not take into account the income specified in Article 251 of the Tax Code of the Russian Federation.

For the purposes of applying Chapter 26.2 of the Tax Code of the Russian Federation, the date of receipt of income is the day of receipt of funds into bank accounts and (or) cash desks, receipt of other property (work, services) and (or) property rights, as well as repayment of debt (payment) to the taxpayer by other method (cash method) (clause 1 of Article 346.17 of the Tax Code of the Russian Federation).

Thus, when transitioning from UTII to the simplified tax system, the tax base for the single tax within the simplified tax system includes income from the sale of goods (work, services) that will be received by the taxpayer during the period of application of the simplified tax system for goods (work, services) sold (that is, actually transferred on a reimbursable basis) during the period of application of the simplified tax system. These incomes are taken into account on the date of their receipt.

If goods (work, services) are sold during the period of application of UTII, then income from their sale received by the taxpayer during the period of use of the simplified tax system is not taken into account when determining the tax base under the simplified tax system.

Advances received from buyers of goods or consumers of services are taken into account under the simplified tax system as income in the reporting (tax) period of their receipt. Accordingly, if an advance for the sale of goods (rendering services) was received during the period of application of UTII, and the services themselves were provided when using the simplified tax system, such an advance should not be taken into account as part of the income of the “simplified person”.

Expenses for the purchase of goods for resale, incurred during the period of application of UTII, are allowed to be taken into account after the transition to the simplified tax system in accordance with subparagraph 2 of paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation as the goods are sold (clause 2.2 of Article 346.25 of the Tax Code of the Russian Federation).

Expenses directly related to the sale of these goods (including storage, maintenance and transportation), when applying the simplified tax system, are taken into account in the reporting (tax) period in which their actual payment was made after the transition to the simplified tax system.

In letter No. SD-4-3/ [email protected] , tax officials emphasized that expenses for the purchase of goods can only be taken into account if there are supporting primary documents (clause 2 of article 346.16, clause 1 of article 252 of the Tax Code of the Russian Federation).

On the date of transition to the simplified tax system, the “imputed” has the right to take into account the residual value of fixed assets and intangible assets. The residual value is determined as the difference between the price of acquisition (creation) of these assets and the amount of depreciation accrued in the manner established by the accounting legislation for the period of application of UTII (paragraph 4, clause 2.1, article 346.25 of the Tax Code of the Russian Federation).

The residual value is included in the expenses taken into account when determining the tax base under the simplified tax system, in equal shares for the reporting periods in the manner established by the Tax Code of the Russian Federation (subclause 3, clause 3, article 346.16) in relation to fixed assets and intangible assets with a useful life:

- up to three years inclusive - during the first calendar year of application of the simplified tax system;

- from three to 15 years inclusive: during the first calendar year of application of the simplified system - 50% of the cost, the second calendar year - 30% of the cost, the third calendar year - 20% of the cost;

- over 15 years - during the first 10 years of application of the simplified tax system.

Example

An organization operating in retail trade and using UTII in 2021 will switch to the simplified tax system from January 1 of the next year. In business activities, the organization used the following fixed assets acquired and paid for during the period of application of UTII:

- commercial equipment with a useful life of 30 months, the residual value of the object is RUB 56,840;

- a car with a useful life of 50 months, the residual value of the object is 458,400 rubles;

- building with a useful life of 250 months, the residual value of the object is RUB 1,258,320.

After switching to the simplified tax system, the organization has the right to take into account the costs of acquiring the specified fixed assets in the following order:

- residual value of retail equipment in the amount of 56,840 rubles. – during 2021 for 14,210 rubles. (RUB 56,840: 4 sq. x 1 sq.) for each quarter of the tax period;

- residual value of the car is 458,400 thousand rubles:

- for 2021 – 229,200 rubles. (RUB 458,400 x 50%), including for the first quarter – RUB 57,300. (RUB 229,200: 4 sq. x 1 sq.), for the six months – 114,600 rubles. (229,200 rubles: 4 sq. x 2 sq.), for nine months - 171,900 rubles. (RUB 229,200: 4 sq. x 3 sq.);

- for 2022 – 137,520 rubles. (RUB 458,400 x 30%), including for the first quarter – RUB 34,380. (RUB 137,520: 4 sq. x 1 sq.), for the first half of the year – RUB 68,760. (137,520 rubles: 4 sq. x 2 sq.), for nine months - 103,140 rubles. (RUB 137,520: 4 sq. x 3 sq.);

- for 2023 – 91,680 rubles. (RUB 458,400 x 20%), including for the first quarter – RUB 22,920. (91,680 rubles: 4 sq. x 1 sq.), for the six months – 45,840 rubles. (91,680 rubles: 4 sq. x 2 sq.), for nine months - 68,760 rubles. (RUB 91,680: 4 sq. x 3 sq.); What to do with the cost of raw materials and supplies that were purchased and paid for during the period of application of UTII, but will be used (written off for production) during the period of application of the simplified tax system with the object of taxation in the form of income reduced by the amount of expenses? The legislator allowed taxpayers to take into account the cost of such raw materials and supplies as expenses as they are used (written off for production) (Clause 1, Article 4 of Federal Law No. 373-FZ of November 23, 2020).

What to do with the cost of raw materials and materials

that were purchased and paid for during the period of application of UTII, but will be used (written off for production) during the period of application of the simplified tax system with the object of taxation in the form of income reduced by the amount of expenses?

The legislator allowed taxpayers to take into account the cost of such raw materials and supplies as expenses as they are used (written off for production)

(Clause 1, Article 4 of Federal Law No. 373-FZ of November 23, 2020).

Example

An organization that provides repair, maintenance and washing services for motor vehicles in 2021 and uses UTII will switch to the simplified tax system from January 1, 2021. As of January 1, 2021, she has paid for spare parts for cars in her accounting records in the amount of RUB 132,780. Of these, spare parts worth 58,320 rubles were used for vehicle repairs in the first quarter of 2021, in the second quarter – in the amount of 40,830 rubles, in the third – in the amount of 33,630 rubles.

“Simplified”, when determining the taxable base for the simplified tax system (clause 1, article 4 of law No. 373-FZ), takes into account in expenses the cost of spare parts purchased and paid for under UTII, used on the simplified tax system:

- in the first quarter of 2021 – in the amount of 58,320 rubles;

- for the six months - an additional amount of 40,830 rubles, a total of 99,150 rubles. (58,320 + 40,830);

- for nine months - another amount of 33,630 rubles.

As of September 30, 2021, the cost of spare parts purchased and paid for under UTII will be taken into account by the simplifier in expenses when determining the tax base in full - 132,780 rubles. (58,320 + 40,830 + 33,630).

Restoration of VAT upon transition from a combined regime

It is possible that in 2021 the taxpayer combined the general tax regime and UTII. In connection with the abolition of UTII from 2021, it was decided to completely switch to the simplified tax system with the object of taxation “income reduced by the amount of expenses.”

“Simplers,” as is known, are not recognized as VAT payers (clause 2 of Article 346.11 of the Tax Code of the Russian Federation).

When switching to the simplified tax system, VAT amounts accepted for deduction on goods (work, services), including fixed assets and intangible assets, and property rights in the manner prescribed by Chapter 21 of the Tax Code of the Russian Federation, are subject to restoration. It is necessary to restore VAT in the tax period preceding the transition to the simplified tax system

(paragraph 5, subparagraph 2, paragraph 3, article 170 of the Tax Code of the Russian Federation).

Based on this, when switching to the simplified tax system from January 1, 2021, the amount of VAT accepted for deduction on goods (work, services) registered at the time of the transition must be restored by the taxpayer in the fourth quarter of 2021.

In order to restore VAT amounts in the sales book, it is necessary to register invoices on the basis of which tax amounts are accepted for deduction, if in the tax period preceding the taxpayer’s transition to the simplified tax system, their storage period has not expired. If invoice data is missing due to the expiration of the established storage period in the sales book, you can register an accountant’s certificate, which reflects the amount of VAT to be restored.

Reporting Features

Taxpayers submit a tax return for UTII at the place of business. The tax return according to the simplified tax system based on the results of the tax period is sent by the “simplified person” to the tax authority at the location of the organization (place of residence of the individual entrepreneur) (clause 1 of Article 346.23 of the Tax Code of the Russian Federation).

If a simplified entity has separate divisions, a tax return under the simplified tax system is not submitted at their location.

The Tax Code of the Russian Federation also does not provide for the submission of a tax return under the simplified tax system for each place of business of an individual entrepreneur.

The calculated amount of tax according to the simplified tax system (advance tax payments) is paid at the place of registration of the organization's head unit (place of residence of the individual entrepreneur).

When can I go?

If you familiarize yourself with the requirements of the Tax Code of the Russian Federation, then according to paragraph 346.28, in the case when the taxpayer pays fees using imputed income, then in this case the transition is possible only from the beginning of the next year.

However, it should be taken into account that in order to change the taxation procedure, timely submission of an application is necessary. The deadline for submitting such an application to the fiscal service at the place of registration of the enterprise is set as no later than January 15.

There are times when entrepreneurs want to apply UTII to a new line of work. In this case, the application can be submitted at any time. Then the two tax systems will be combined.

If an individual entrepreneur previously worked for OSNO, then he can also declare preferences regarding the specified fiscal regime at any time.