The Federal Tax Service of Russia develops many online services for taxpayers. Among them are those that allow you to remotely submit reports on taxes, contributions, and employees. We figured out how an individual entrepreneur can submit a declaration under the simplified tax system electronically. I must say, this is not the easiest procedure, and you cannot do without detailed instructions.

Let's start with the fact that it is impossible to submit reports either through the taxpayer's Personal Account on the Federal Tax Service website or through State Services. The only exception is that the possibility of submitting a 3-NDFL report is currently implemented through State Services. And to submit a return for another tax, you will have to go a long way. Let's write it down step by step.

1.3. Installing the KSKKEP key in the “Personal” certificate store

- We connect the KSKPEP media (flash card Rutoken or JaCarta) to the computer.

- From the Start , select Programs -> CRYPTO-PRO -> CryptoPro CSP

- Click " Service "

- Next “ View certificates in the container... ”

- Click " Browse... " next to the "Key Container Name" field:

- Select the key container corresponding to the connected electronic signature medium and click “ Ok ”

- Confirm by clicking “Next”

- Click “ Install ”

- «OK»

- Click “ Finish ” and close the program.

- The KSKPEP key is installed in the “Personal” certificate store

Where to get a subscriber code to work with the Federal Tax Service portal

Currently, the Federal Tax Service is actively inviting taxpayers to use the new service for submitting reports electronically through the official website of the Federal Tax Service on the Internet. A pilot project to organize a new service was approved by the Order of the Federal Tax Service dated July 15.

2011 The proposed option for sending reports has a number of difficulties: After checking the terms of use of the service, at the last step it is proposed to select a signature key certificate issued by a certification center accredited in the network of trusted certification centers of the Federal Tax Service of Russia, and enter the password for the key storage.

When you first log into the Portal, you must fill in the subscriber code and save your taxpayer profile.

Then go to the “File Upload” section and select a previously prepared transport container that meets the requirements of the Federal Tax Service.

How to register in your personal taxpayer account

At the moment, there are three main ways to register in your personal account on nalog.ru:

- Register using data from the State Services portal

- Get a login and password from any tax office

- Using a digital signature (Universal electronic card)

We will describe each access type in detail. This method is the simplest and least labor-intensive for the majority of the population.

What documents are needed to obtain a registration card:

- Passport. If you visited the tax office at your place of residence, then you don’t need anything else

- TIN – notification of registration as a taxpayer. It is only required if you applied to the tax office at a location other than your place of residence.

By presenting these documents, you receive a registration card, which contains information about when it was issued and by whom, taxpayer data and, most importantly, access details to your personal account.

How to get an electronic signature key for the tax office?

There are several ways to obtain an electronic signature key for the tax office. And the electronic signature key itself may be different. Which one is right for you, where to get it, when and how to use it - we will answer all these questions in this article.

Reporting in electronic form is required to be submitted by:

- employers with 25 or more employees - documents containing information on the income of individuals and personal income tax, and reports to the Pension Fund of the Russian Federation and the Social Insurance Fund.

- all VAT payers;

- organizations with more than 100 employees - to the Federal Tax Service;

An electronic report without an electronic signature cannot be submitted, since the systems for receiving reports and declarations will not be able to identify the submitter of these electronic documents. Law No. 63-FZ in Art. 5 identifies the following types of electronic signatures: Figure 1.

pH System Overview

An overview of the Kontur.Extern system interface is given in the video and instructions below.

The menu will contain the following services (the set of services may change depending on the chosen tariff): A legal reference service that provides access to the regulatory documents necessary for the work of an accountant, as well as allowing you to receive answers to questions related to accounting activities. "Focus. Verification of counterparties" The service allows you to check counterparties according to the Federal Tax Service of Russia and Rosstat: Unified State Register of Legal Entities, Unified State Register of Individual Entrepreneurs, Statregister, database of financial statements of organizations through the Kontur-Focus system.

“Diadoc. Electronic primary" Service Diadok, with which you can transmit electronic invoices, as well as acts, invoices and contracts via the Internet.

"Expert. Financial analysis and on-site inspections.”

1.4. Building the KSKPEP chain

In some cases, after installing KSKPEP in the certificate store, it is necessary to build a chain of trust to the installed personal certificate.

To find information about the next certificate in the chain, from the Start select Programs -> Crypto-Pro -> Certificates . Open the folder “ Certificates - current user ” -> Personal -> Registry -> Certificates :

Select the installed certificate by double-clicking on it with the left mouse button.

If under the inscription “Certificate information you see “ This certificate is intended for: ” (Fig. 1), then you can skip this section and proceed to the next section 1.5. If you see an exclamation mark and the words “ There is not enough information to verify this certificate ” (Fig. 2) or something similar, continue according to the instructions.

Fig.1

Fig.2

Go to the " Composition " tab:

In the upper window, select the line “ Access to information about certification authorities ” and in the lower window a link to the certificate will be displayed, which should end with “ . crt ". You can download the certificate from this link by pasting it into the address bar of your browser and confirming by pressing Enter .

After downloading the certificate, open it. Answer the warning with “ Open ”.

On the “ General ” tab (window with information about the certificate), click “ Install certificate ”. Click “ Next ”

Select “ Place all certificates in the following store ”, and then click “ Browse… ”:

Specify “ Trusted Root Certification Authorities ”, click “ OK ”:

Click “ Next ”:

To complete the Certificate Import Wizard, click “ Finish ”:

If a security warning appears, confirm installing the certificate by clicking Yes .

How to find out the taxpayer identifier code of the subscriber

Taxes » Questions » How to find out the taxpayer ID and subscriber code

Dear users of the Taxpayer program, you can use tax and accounting reports in electronic form to submit tax and accounting reports to the tax inspectorates through the official website of the Federal Tax Service on the Internet.

The service works for free, we only pay for the electronic signature to the certification center and once for the encryption program (crypto). These costs are significantly lower than payments to intermediaries for delivery.

It’s up to you to decide to pay the delivery company and receive a full service, or pay significantly less and sign yourself, install a crypto program, and check the reports being sent.

General taxation system (annual subscription fee) - 4956 rubles. Simplified taxation system (annual subscription fee) - 2832 rubles.

To connect to the service, you need to fill out a connection application. General taxation system (annual subscription fee) - 3540 rubles.

Simplified taxation system (annual subscription fee) - 2124 rubles. Send an application for additional connection.

Tax office

— The taxpayer must contact any CA that is part of the RTC network of the Federal Tax Service of Russia. The list of certification centers accredited in the network of the RTC of the Federal Tax Service of Russia, and from which you can obtain an electronic signature key for the ability to work with the Internet service, is presented on the Internet sites of the Federal Tax Service of Russia (https://www.nalog.ru) and the Federal State Unitary Enterprise GNIVTs FTS of Russia ( https://www.gnivc.ru).

How to get a tax ID

The key must be registered by the certification center that previously issued the electronic signature key in the information resource service, which allows for automatic registration and updating of registration data of participants (IRUTS) for the submission of tax and accounting reports through the website of the Federal Tax Service of Russia.

A taxpayer identifier, also known as a payer identifier (IP), includes an identifier for information about an individual or an identifier for information about a legal entity.

The following are used as identifiers of information about an individual: - insurance number of the individual personal account of the insured person in the PFR personalized accounting system (SNILS); — taxpayer identification number (TIN); — series and number of the identity document; — series and number of the driver’s license; — series and number of the vehicle registration certificate with the Ministry of Internal Affairs; — registration code of the Federal Migration Service; — other identifiers of information about an individual, used in accordance with the legislation of the Russian Federation. One of the following identifiers is used as an identifier for information about a legal entity: - taxpayer identification number (TIN) together with the reason code for registration with the tax authority (KPP) of the legal entity;

— code of a foreign organization (FIO) together with the code of the reason for registration with the tax authority (KPP) of a legal entity.

Submission of tax and accounting reports through the website of the Federal Tax Service of Russia

It should be noted that the digital key and the Crypto Pro cryptographic information protection tool are provided for a fee by certification centers. They set the prices. Therefore, to obtain information about the cost of the digital signature key, you must contact the certification center from which the digital signature key will be purchased.

The key must be registered by the certification center that previously issued the electronic signature key in the information resource service, which allows for automatic registration and updating of registration data of participants (IRUTS) for the submission of tax and accounting reports through the website of the Federal Tax Service of Russia.

Authentication method for subscribers of the operator's cellular network

The authentication system receives the request and then searches for the external application profile using the identification key contained in the request. Next, the authentication system checks in the external system profile for the presence of the necessary rights to access the requested operation.

If this external application does not have rights, the authentication system generates a response message indicating the impossibility of authentication. If the verification is successful, the authentication system searches for the user's profile and checks the ability to authenticate using the subscriber ID.

If authentication by subscriber ID is prohibited (additional authentication methods are specified), then the subscriber number is automatically determined to belong to the operator, additional authentication scripts and security policies specified by the operator are executed, and the user interface is formed in accordance with the operator’s corporate style.

GGSN is a gateway (ordinary router) between a cellular network (its part for GPRS data transmission) and external information highways of packet data transmission PDNs (Packet Data Networks): Internet, corporate Intranet networks, other GPRS systems. GGSN contains all the necessary information about the networks that GPRS subscribers can access, as well as connection parameters.

What is a login identifier in Sberbank Online

An ID along with a personal password is required for authentication when logging into Sberbank Online through your personal account. It is impossible to get into your personal account without entering your ID. This measure is part of an entire security system, reliably protecting the client from hacking and fraud.

Subscriber code unique subscriber identifier how to get

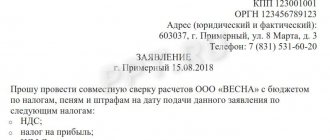

In accordance with Article 80 of the Tax Code of the Russian Federation, a tax return can be submitted by the taxpayer to the tax authority in person or through a representative acting on the basis of a power of attorney, sent in the form of a postal item with a list of the contents.

Information technologies are increasingly penetrating all spheres of society. It has long become familiar to us: paying for services via the Internet, sending documents electronically and much more. Modern technologies have not bypassed such an area as taxes.

Today, taxpayers are given a real opportunity to send any information, including tax and accounting reports, to the tax authorities in a timely manner.

The work of tax authorities is aimed both at improving the administration of taxes and fees, and at optimizing work with taxpayers and providing them with quality service.

The volume of information is growing rapidly, so the capabilities of the tax service for centralized storage, processing of information and timely access to it require constant improvement.

I submit a tax return for income tax to the Federal Tax Service

I downloaded the Taxpayer Legal Entity program from the website nalog.ru, when I create a transport container it asks for a subscriber code (must be provided by the CA). Help!

Indicate the code of the tax office to which you are submitting the declaration.

Interdistrict tax office No. 24 for Moscow

The certificate you are working with dated 09/26/2013?