Good afternoon, dear fellow ecologists! Now the moment has come when for the first time it is necessary to calculate the environmental fee and make payment.

Previously, a note was published about what an environmental fee is and what regulations govern it. Refresh your memory here.

Let us remind you that the environmental fee (ES) is a certain fee for disposal, levied on enterprises producing or importing products that are included in a special approved list of goods. This list was approved by the Government of the Russian Federation and has 36 groups of goods out of 433 items. These products must be recycled. Control over the correct calculation and timely payment of the environmental fee is assigned to the Federal Service for Supervision of Natural Resources (Rosprirodnadzor).

The formula for calculating the environmental fee includes three indicators: the environmental fee rate [C]; weight of goods or packaging [M]; recycling standard [N]. To calculate the amount of the fee, you need to multiply these indicators using the formula:

ES = S * M * N

Environmental tax rates were established on April 22, 2016. The rate ranges from 2,025 to 33,476 rubles. The first payment is due in 2021 by April 15. According to the order of the Government of the Russian Federation dated December 4, 2015 No. 2491-r for 2021, not all companies will pay the environmental fee, since for 70% of the goods from the List the recycling standard is zero. But reporting is still necessary!

For 2021, companies producing car tires, petroleum products, glass and rubber products, plastic and cardboard packaging, metal containers, batteries and batteries will pay an environmental fee.

Who is required to pay the environmental fee for 2021

The environmental fee for 2021 must be paid by organizations and individual entrepreneurs that in the reporting year produced or imported goods that are subject to mandatory disposal after loss of consumer properties.

The list of such goods (including packaging) was approved by Decree of the Government of the Russian Federation dated September 24, 2015 No. 1886-r. There is no need to pay a fee for products not mentioned in this list. Automatically generate a payment invoice for payment of the environmental fee based on the data from the declaration and submit all collection reports Submit an application

Please note: from the beginning of 2021, a different list of goods (including packaging) subject to disposal after they have lost their consumer properties has been in effect. This list was approved by Decree of the Government of the Russian Federation dated December 28, 2017 No. 2970-r. But payers will apply the new list only in 2021 when calculating the environmental fee for 2018. As for 2017, the previous list was in effect during this period, so it should be used now.

Results

The deadline for paying the environmental fee in 2021 is identical to the deadline for submitting reports on the environmental fee for 2016 and falls on April 17, 2021.

The date has been moved to 04/17/2017 due to the fact that 04/15 falls on a day off. Payment of the fee is carried out at the territorial office of Rosprirodnadzor by manufacturers and importers of those goods that have lost their consumer properties. Details for paying the fee can be found on the official website of the department by selecting the desired region. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Environmental fee regarding packaging

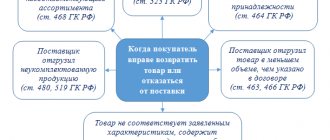

Practice has shown that it is very difficult for manufacturers and importers to figure out whether in a given situation it is necessary to pay a fee in relation to packaging (hereinafter we are talking about packaging included in the list of goods subject to mandatory disposal after loss of consumer properties). For example, when a company purchases packaging and partially uses it for its own needs, and partially to sell its products. Or when the importer receives parts in boxes, assembles the finished products, packs them in the same boxes and sells them to customers. Questions also arise from organizations and individual entrepreneurs that sell empty containers as an independent product.

Officials have not yet given comprehensive explanations on these issues. The only case commented on by Rosprirodnadzor concerns packaging that was used for its own needs. The letter dated 02.20.17 No. OD-06-02-32/3380 clearly states that such packaging is not subject to environmental tax.

When resolving other issues, in our opinion, one should be guided by paragraph 10 of Article 24.2 of the Federal Law of June 24, 1998 No. 89-FZ “On Production and Consumption Waste” (hereinafter referred to as the Law on Industrial Waste). It states that the responsibility to comply with packaging recycling regulations rests with those who manufacture and import goods in that packaging. This means that organizations and individual entrepreneurs who use containers for packaging and selling their products must pay an environmental fee.

From the above norm, the following conclusions can be drawn.

Firstly, the sale of empty containers as an independent product does not entail the obligation to pay an environmental fee.

Secondly, the sale of finished products in the same packaging in which the parts were previously received also does not entail the obligation to pay a fee. The fact is that, according to the law, the eco-tax for this container had to be paid by the one who packaged and sold the parts. True, this is only true if the packaged parts were purchased from a Russian supplier. If the seller is a foreign person, then, logically, the Russian buyer will have to pay the fee.

Thirdly, companies and entrepreneurs who buy empty containers, package their products and sell them must pay an environmental fee.

Calculation of environmental fee

The amount of the environmental fee for 2021 is calculated as the product of three quantities: the weight of the product and (or) packaging, the corresponding recycling standard and the fee rate.

Recycling standards for 2015-2017 were approved by Decree of the Government of the Russian Federation dated December 4, 2015 No. 2491-r. Please note: from the beginning of 2018, other standards have been in force (approved by Decree of the Government of the Russian Federation dated December 28, 2017 No. 2971-r). But they are designed for the period from 2021 to 2021, so you need to apply them for the first time in 2021 when calculating the 2021 levy.

The environmental fee rates were approved by Decree of the Government of the Russian Federation dated 04/09/16 No. 284.

Example

The publishing house produces glossy magazines; recycling is not carried out on its own. In 2021, 10 tons of magazines were released. The recycling rate is 10%, the rate is 2,378 rubles. per ton.

The amount of environmental collection for 2021 is 2,378 rubles (10 tons × 10% × 2,378 rubles/ton).

Calculation and Payment of the Environmental Fee in 2017!

Let us remind you that the environmental fee (ES) is a certain fee for disposal, levied on enterprises producing or importing products that are included in a special approved list of goods. This list was approved by the Government of the Russian Federation and has 36 groups of goods out of 433 items. These products must be recycled. Control over the correct calculation and timely payment of the environmental fee is assigned to the Federal Service for Supervision of Natural Resources (Rosprirodnadzor).

Calculation of environmental fees in 2021

The formula for calculating the environmental fee includes three indicators: the environmental fee rate [C]; weight of goods or packaging [M]; recycling standard [N]. To calculate the amount of the fee, you need to multiply these indicators using the formula:

ES = S * M * N

Environmental tax rates were established on April 22, 2016. The rate ranges from 2,025 to 33,476 rubles. The first payment is due in 2021 by April 15. According to the order of the Government of the Russian Federation dated December 4, 2015 No. 2491-r for 2021, not all companies will pay the environmental fee, since for 70% of the goods from the List the recycling standard is zero. But reporting is still necessary!

For 2021, companies producing car tires, petroleum products, glass and rubber products, plastic and cardboard packaging, metal containers, batteries and batteries will pay an environmental fee.

Download the form for calculating the amount of the environmental fee

Documents regulating the payment of environmental fees

Recycling standard - Decree of the Government of the Russian Federation dated December 4, 2015 No. 2491-r “On approval of standards for recycling waste from the use of goods .

Environmental fee rate - Decree of the Government of the Russian Federation dated 04/09/2016 No. 284 “On establishing environmental fee rates for each group of goods subject to disposal after they have lost their consumer properties, paid by manufacturers, importers of goods who do not ensure independent disposal of waste from the use of goods " .

Letter of the Ministry of Natural Resources of Russia dated February 20, 2021 No. OD-06-02-32/3380 “On payment of environmental fees”.

Until 2021, it is planned to gradually increase recycling standards.

Recycling standards are set as a percentage of manufactured products per year. The rates and standards are affected by the following conditions:

- Economic situation on the territory of the Russian Federation;

- The degree of danger and harmfulness of waste to the environment and health;

- Difficulty of recycling (technological process costs, process complexity).

Cases when companies do not pay the environmental fee:

- If a company recycles goods, but does not comply with the full recycling standards, then it pays an environmental fee for non-recyclable goods;

- The environmental fee is not paid for exported goods that are disposed of outside the Russian Federation;

- If the company disposes of the standard amount of waste from its products and their packaging after use.

Disposal methods:

- Independently by the organization producing (importing) these goods. At the same time, she must have a special permit and all conditions for the destruction or processing of waste must be created (reception points, processing points, special equipment, workers, etc.)

- With the help of a third party, under a contract;

- By forming an association with other manufacturers (importers) to organize recycling.

The Law on Environmental Fees introduced a gradual increase in rates. This gives businesses the opportunity to prepare in advance to pay a fee or take disposal measures. Calculate the benefits of these measures. Make a list of products to be disposed of and enter the data into records.

Environmental fee rates and recycling standards

| Product group name | Rate (RUB per 1 ton | Recycling rate in % for 2021 | Recycling rate in % for 2021 |

| Finished textile products (except clothing), as well as carpet products | 16 304 | 0 | 0 |

| Special clothing, underwear and other clothing | 11 791 | 0 | 0 |

| Wooden products (containers, construction, carpentry, etc.) | 3 066 | 0 | 5 |

| Paper and cardboard (corrugated cardboard containers) | 2 378 | 10 | 20 |

| Paper bags, household sanitary supplies (plates, glasses, trays, paper napkins, toilet paper) paper stationery (notebooks, notepads, albums). | 2 378 | 5 | 10 |

| Petroleum products | 3 431 | 10 | 15 |

| Tires | 7 109 | 15 | 20 |

| Rubber products | 8 965 | 15 | 20 |

| Plastic containers (bags, bags, bottles, boxes with a capacity of up to 2 liters.) | 3 844 | 5 | 10 |

| Plastic packaging (bags, bags, bottles, boxes with a capacity of more than 2 liters.) | 3 844 | 10 | 15 |

| Construction plastic (coverings for floors, walls, ceilings (linoleum, self-adhesive and non-self-adhesive wallpaper, oilcloth, plastic film), parts for bathtubs, toilets, tanks, tanks) | 4 701 | 0 | 5 |

| Door and window frames, blinds, shutters, thresholds, frames | 4 701 | 0 | 0 |

| Other plastic products (gloves, dishes, stationery, etc.) | 4 156 | 0 | 5 |

| Sheet glass (safety, toughened) | 2 858 | 10 | 15 |

| Mirrors, glass products (building blocks, panels, mosaics, stained glass) | 2 858 | 0 | 5 |

| Hollow glass (bottles, jars, dishes, corks, lids) | 2 564 | 10 | 15 |

| Metal containers (tin cans) | 2 423 | 20 | 30 |

| Metal containers (barrels, cans, boxes with a volume of more than 300 liters) | 2 423 | 5 | 10 |

| Computers, office equipment, household appliances, communications equipment, optical and photographic equipment (computers, sound-conducting equipment, printers, units, copiers, etc.; video cameras, movie cameras, cameras, telephones, televisions, tape recorders, radios, etc. .) | 26 469 | 0 | 5 |

| Batteries | 2 025 | 10 | 15 |

| Rechargeable batteries | 33 476 | 10 | 15 |

| Electric lighting fixtures, household electrical appliances (refrigerators, vacuum cleaners, irons, kitchen appliances), household non-electrical appliances (stoves, heaters). | 9 956 | 0 | 5 |

| Semi-mechanized hand tools, industrial refrigeration and ventilation equipment | 26 469 | 0 | 5 |

| Other machines and equipment | 3 037 | 0 | 5 |

| Newspaper products (magazines, advertising booklets, newspapers, etc.) | 2 378 | 0 | 5 |

Reporting to Rosprirodnadzor on environmental fees

Rosprirodnadzor, in a letter dated January 17, 2018 No. ВС-06-02-32/721, reminded that no later than April 1, 2021, environmental fee payers must fill out and submit two reports:

- declaration on the number of finished goods put into circulation on the territory of the Russian Federation during the previous calendar year, including packaging, subject to disposal (the form and regulations on the declaration were approved by Decree of the Government of the Russian Federation dated December 24, 2015 No. 1417);

- report on compliance with the standard for recycling waste from the use of goods subject to disposal after they have lost their consumer properties (the form and rules for submission are approved by Decree of the Government of the Russian Federation dated December 8, 2015 No. 1342).

Also, letter No. ВС-06-02-32/721 states that no later than April 15, 2021, payers of the environmental fee must submit one more document: calculation of the amount of the environmental fee (the form was approved by order of Rosprirodnadzor dated 08.22.16 No. 488).

We would like to add that all of these types of reports are compiled in electronic form, signed with an electronic signature and sent to Rosprirodnadzor via the Internet. The official website of this department contains free reporting services. The submission date is the day the report is sent via the Internet. Additionally, there is no need to submit paper reports. In this case, there are two ways to submit electronic reports to the RPN.

First: buy an electronic signature certificate from one of the accredited certification centers, generate and sign reports, and then independently upload them to the receiving gateway of Rosprirodnadzor.

Second: connect to a reporting system in which you can fill out a report using all current parameters. Fill out and check, and then send it to the RPN website.

Submitting reports through the system has two big advantages.

- You do not have to “knock” on the receiving gateway of the on-load tap-changer yourself. As the practice of submitting reports to the RPN shows, the gateway can work with serious interruptions. Therefore, there is a high probability that you will have to spend more than one hour to successfully download reports. But when submitting through the system, you send the report once to the server of the electronic document management (EDF) operator, and then the robot itself uploads it to the RPN gateway.

- When submitting a report through the system, the EDF operator records the time of loading the report. And this gives you a document that confirms that you submitted the report at a certain time. This will be very useful if a dispute arises about the time of submission of the report. Judicial practice shows that if there is confirmation from the EDF operator, the courts usually make decisions in favor of the declarant.

Fill out and submit environmental reporting through an EDI operator Submit an application

However, if the payer does not have the technical ability to use the Internet, he has the right to submit reports on paper. Then, manufacturers must submit a declaration on the number of goods released into circulation and a report on compliance with recycling standards to the territorial department of Rosprirodnadzor, and importers to the central office of this department. As for the “paper” calculation of the amount of the environmental fee, all payers without exception must submit it to their territorial administration.

Reporting on paper is drawn up in one copy and either sent by mail (with a list of attachments and notification of delivery) or delivered in person. A copy on electronic media must be attached to the “paper” declaration on the quantity of goods released into circulation. The date of submission is considered to be the date of mailing or the date when Rosprirodnadzor made a note about receipt of the report on paper.

What is indicated in the Control Certificate?

a) facts of errors made when performing calculations and contradictions (inconsistencies) between the information contained in the calculation of the amount of the environmental fee and the information available to the administrator of the environmental fee and (or) received by him in the prescribed manner when declaring goods and packaging of goods, when reporting on standards and when monitoring compliance with established recycling standards, as well as federal state environmental supervision;

b) facts of non-payment, incomplete payment or untimely payment of the environmental fee;

c) the fact of overestimation of the amount of calculated and (or) paid environmental fees;

d) the requirement to submit to the administrator of the environmental fee, within 10 working days from the date of receipt of such a requirement, reasonable explanations regarding the calculation of the amount of the environmental fee, and (or) making corrections to it to eliminate the facts specified in subparagraph “a” of this paragraph, by making changes in the calculation of the amount of the environmental fee, which are re-sent to the administrator of the environmental fee, and (or) repayment of debt on the environmental fee if the facts specified in subparagraph “b” of this paragraph are revealed.

The Act itself is sent via telecommunication networks or on paper with a notification (depending on the form in which the payer reports) within 3 business days after signing.

Disagreement with the Control Act

In case of disagreement with the requirement specified in the control report, the payer, within 10 working days from the date of receipt of such requirement, sends to the administrator of the environmental fee copies of documents confirming the validity of the calculation of the amount of the environmental fee, payment of the environmental fee, as well as explanations of the reasons for the discrepancy in the information provided by the payer .

Deadlines for payment of environmental fees

According to paragraph 2 of Article 24.5 of the Industrial Waste Law, the environmental fee must be transferred no later than April 15 of the year following the reporting period. Accordingly, the fee for 2017 must be transferred no later than April 15, 2021. This date is named in the letter of Rosprirodnadzor dated January 17, 2018 No. ВС-06-02-32/721.

A sample payment order with all the necessary details, including the budget classification code, is provided on the Rosprirodnadzor website. A copy of the payment order should be attached to the calculation of the amount of the environmental fee.

Fines for non-payment and failure to submit reports

An organization or entrepreneur that has not paid or has not fully paid the environmental fee will receive a demand from Rosprirodnadzor to repay the debt. If, within 30 calendar days from the date of receipt of the demand, it is not fulfilled voluntarily, the amount of the fee will be collected in court (clause 25 of the rules for collecting environmental fees, approved by Decree of the Government of the Russian Federation dated October 8, 2015 No. 1073). There is currently no penalty for non-payment of the environmental fee.

But if the payer of the fee does not report on time, or provides false information, he may be brought to administrative liability on the basis of Article 8.5 of the Code of Administrative Offenses of the Russian Federation. This provision implies a fine for concealing or distorting environmental information: for officials and entrepreneurs - from 3 to 6 thousand rubles, for legal entities - from 20 to 80 thousand rubles.