The Russian government regularly reforms tax legislation, stimulating business development in Russia. This is done in order to simplify the procedure for doing business as much as possible not only for legal entities, but also for individual entrepreneurs. The coming 2017 is no exception, as it is preparing many surprises for individual entrepreneurs. From January, amendments to the Federal Law regarding changes in the amount of insurance contributions to the Pension Fund, as well as an increase in the minimum wage, will come into force. Regarding the issue of reporting of individual entrepreneurs, significant changes are also coming here.

Who is required to submit a declaration

All legal entities and entrepreneurs working on a simplified basis are required to submit a final declaration under the simplified tax system for 2021, regardless of the object they choose: 1. Tax only on income.

2. Tax on income minus expenses.

Moreover, even those payers who did not conduct any activity in 2021 must submit a zero declaration under the simplified tax system for 2021. Simply put, when the business was “frozen”, it stood idle. In particular, there were no transactions on the accounts.

The deadline for submitting the simplified tax system declaration for 2021 is regulated by clause. 1 and 2 paragraphs 1 art. 346.23 Tax Code of the Russian Federation. And let’s say right away that there are no changes to these standards in 2021 or 2021. That is, the old rules apply.

Setting up the simplified tax system in 1C

Reporting under the simplified tax system is submitted both by organizations that have been using the simplified tax system from the very beginning, and by those who previously switched to the simplified tax system from the main tax system. Therefore, in the program “1C: Accounting 8”, ed. 3, it is now possible to specify the taxation system and rate both when creating an organization, and to change it in the “Main” section by going to the “Taxes and Reports”

, which will affect the organization’s accounting policy settings.

In the "Taxes and Reports"

You can also select or enter the simplified tax rate from the keyboard.

In accordance with Art. 346.20 of the Tax Code of the Russian Federation under the simplified tax system there are the following rates:

- 6% – if the object of taxation is the income of the organization;

- from 5% to 15% – if the object of taxation is income reduced by the amount of expenses.

Under the simplified system, the taxpayer has the right to choose the rate and, accordingly, the object of taxation, but only if he is not a party to a simple partnership agreement or a trust management agreement, as described in Art. 346.14 Tax Code of the Russian Federation.

When a taxpayer decides to switch from the main tax system to a simplified one, in the “Taxes and Reports”

In the

“Taxation regime”

, you must check the box

“Before the transition to the simplified tax system, the general tax regime was applied”

and enter the date of transition.

If accounting before the transition to the simplified tax system was kept in the same program (i.e. in “1C: Accounting 8”), then you can use the “Assistant for the transition to the simplified tax system”

, which will reflect in the program certain accounting operations related to the transition to the simplified tax system, and will also perform a number of technological actions, for example:

- will write off the remaining tax accounting data for corporate income tax;

- will write off balances from accumulation registers that are not used for accounting under the simplified tax system;

- will bring into compliance the batch accounting of inventory balances in the “Expenses under the simplified tax system”

and in the inventory accounting accounts.

When do organizations hand over

As a general rule, the deadline for filing a simplified taxation system declaration for 2021 by organizations (legal entities) is no later than March 31 (subclause 1, clause 1, article 346.23 of the Tax Code of the Russian Federation). However, March 31, 2021 falls on a Saturday - a day off. Therefore, according to the rules of the Tax Code of the Russian Federation, if the deadline falls on an official weekend or non-working day, then it is automatically subject to postponement. This is stated in paragraph 7 of Art. 6.1 Tax Code of the Russian Federation.

Thus, in 2021, the deadline for filing a tax return under the simplified tax system for 2021 by legal entities is April 2, 2021 inclusive. It will be Monday:

As you can see, simplified organizations have one extra day in 2021 to prepare and submit their simplified tax return for 2021 on time.

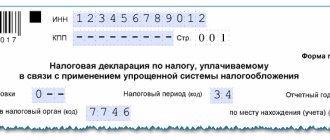

The declaration form under the simplified tax system, its electronic format and rules for filling out are fixed by order of the Federal Tax Service of Russia dated February 26, 2021 No. ММВ-7-3/99 (see “Declaration under the simplified tax system”).

Also see “Deadline for submitting a declaration under the simplified tax system for 2021: legal entities.”

BASIC

Organizations on the OSN submit tax returns and other reports to the Federal Tax Service and extra-budgetary funds.

Tax returns:

- VAT

- Profit

- Property

- Transport

- Earth

Reporting to extra-budgetary funds:

- 4-FSS

- Confirmation of main activity

- RSV-1

- SZV-M

Other reporting to the Federal Tax Service:

- For insurance premiums

- Average headcount

- 2-NDFL

- 6-NDFL

- Financial statements

VAT declaration

Companies report on VAT quarterly (Article 174 of the Tax Code of the Russian Federation).

VAT return deadlines in 2021

- for the fourth quarter of 2021 - until January 25

- for the first quarter of 2021 - until April 25

- for the second quarter of 2021 - until July 25

- for the third quarter of 2021 - until October 25

Most Russian businesses report VAT electronically. Only certain categories of VAT payers can submit a printed declaration (clause 5 of Article 174 of the Tax Code of the Russian Federation).

Income tax return

Unlike VAT, income tax is considered an accrual total; accordingly, the declaration is submitted for the first quarter, six months, 9 months and a year (Article 285 of the Tax Code of the Russian Federation). During reporting periods, advance payments are made, and at the end of the year, the Federal Tax Service budget replenishes the tax minus the transferred advances (Article 287 of the Tax Code of the Russian Federation). If the company makes a loss, you will not have to pay tax.

Deadlines for income tax returns in 2021

- for 2021 - until March 28

- for the first quarter of 2021 - until April 28

- for the first half of 2021 - until July 28

- for 9 months of 2021 - until October 30 (the deadline is shifted due to holidays)

If the average quarterly income is more than 15 million rubles, the taxpayer reports and pays advances every month (clause 3 of Article 286, Article 287 of the Tax Code of the Russian Federation).

Declaration on property tax of organizations

Companies that own property are recognized as payers of property tax.

Each subject of the Russian Federation determines its own procedure and terms for transferring taxes and advance payments (Article 383 of the Tax Code of the Russian Federation). Everyone, without exception, should report for the year.

Tax calculations are submitted for January - March, January - June and January - September, and a declaration is submitted at the end of the year.

Attention!

Subjects of the Russian Federation can cancel interim settlements (Article 379 of the Tax Code of the Russian Federation).

Deadlines for corporate property tax declarations

The property declaration for 2021 must be submitted by March 30, 2017 (Article 386 of the Tax Code of the Russian Federation).

Transport tax declaration

The transport tax affects companies that have vehicles registered with the State Traffic Safety Inspectorate (Article 357 of the Tax Code of the Russian Federation). Accordingly, these same organizations submit a declaration once a year.

Deadlines for transport tax declarations in 2021

In 2021, you need to report before 02/01/2017 (Article 363.1 of the Tax Code of the Russian Federation).

Land tax declaration

If the company owns land, it is necessary to report on land tax (Article 388 of the Tax Code of the Russian Federation).

Deadlines for land tax returns in 2021

The declaration for 2021 must be submitted before 02/01/2017 (Article 398 of the Tax Code of the Russian Federation).

Information on the average number of employees

At the end of the year, companies report the average number of employees to the Federal Tax Service. The form is light and consists of one sheet.

Deadline for submitting information on the average number of employees in 2021

The deadline for submitting information is January 20, 2017 (Clause 3, Article 80 of the Tax Code of the Russian Federation).

Form 4-FSS

Starting from 2021, the administrator of insurance premiums is changing, so Form 4-FSS may be canceled.

Deadline for submitting 4-FSS in 2021

But for 2021 you will need to report using the current Form 4-FSS by 01/20/2017 (on paper) and by 01/25/2017 (electronically).

Confirmation of main activity

Every year, companies determine the type of activity that has the greatest share. The data is submitted to the Social Insurance Fund (Order of the Ministry of Health and Social Development of the Russian Federation dated January 31, 2006 No. 55).

Deadlines for confirmation of the main activity in 2017

Until April 15, 2017, all companies submit a set of three components:

- Application indicating one leading type of activity

- Certificate confirming the main type of economic activity (with detailed calculations)

- A copy of the explanatory note to the balance sheet for 2021 (the note is not submitted by small businesses).

Form RSV-1 PFR

In 2021, instead of RSV-1, there will be a single calculation for insurance premiums.

At the moment, the new calculation has not yet been approved, and the RSV-1 form has not been canceled.

For 2021 you need to pass RSV-1

- until 02/15/2017 (on paper with a number of people not reaching 25 people)

- until 02/20/2017 (electronically)

Calculation of insurance premiums

For the first quarter of 2021, companies will submit calculations of contributions to the tax office. According to the project, the calculation consists of 24 sheets. It combines two calculations - 4-FSS and RSV-1.

Deadlines for submitting calculations for insurance premiums in 2021

- for the first quarter of 2021 - until May 2 (due to the May holidays the deadline is shifted);

- for the first half of 2021 - until July 31 (the deadline is postponed due to a holiday);

- for 9 months of 2021 - until October 30.

SZV-M

The form is also valid for 2021, but policyholders have been given more time to prepare it. Starting from the new year, the form must be submitted by the 15th day of the month following the reporting month (Article 2 of Federal Law No. 250-FZ dated July 3, 2016). This rule comes into force with reporting for December, that is, the December SZV-M must be submitted by 01/15/2017.

Reporting income of individuals

Once a quarter, form 6-NDFL is submitted to the Federal Tax Service (Clause 2 of Article 230 of the Tax Code of the Russian Federation)

Deadlines for submitting form 6-NDFL in 2021

- for 2021 - until April 3 (due to weekends, the deadline is delayed);

- for the first quarter of 2021 - until May 2 (due to weekends and May holidays, the deadline is postponed);

- for the first half of 2021 - until July 31;

- for 9 months of 2021 - until October 31.

Financial statements

Companies disclose information about their financial condition, debt, reserves, and capital in their annual financial statements. The Federal Tax Service and Rosstat are waiting for a copy of such reporting from payers.

Deadlines for submitting financial statements in 2021

For 2021, reports must be submitted by March 31, 2017 (clause 5, clause 1, article 23 of the Tax Code of the Russian Federation, clause 2, article 18 of the Federal Law of December 6, 2011 No. 402-FZ).

When is the IP submitted?

As for individual entrepreneurs, the deadline for submitting a declaration under the simplified tax system for 2021 has been shifted exactly 1 month later (subclause 2, clause 1, article 346.23 of the Tax Code of the Russian Federation) - until April 30, 2021 inclusive. Although it will be Monday, it will be an official non-working day due to the following first May holidays.

Also see 2021 Production Calendar.

As a result, the deadline for filing an individual entrepreneur’s declaration of the simplified tax system for 2021 is also subject to the rule of the Tax Code of the Russian Federation on postponing the deadline. It falls on May 03 – Thursday. This will be the first working day after the extended May weekend:

Thus, entrepreneurs on a simplified basis in 2021 have two additional days to prepare and submit their declaration for 2021. Let us remember that merchants do this at their place of residence.

The deadlines for submitting declarations under the simplified tax system for legal entities and individual entrepreneurs differ. The law gives simplified entrepreneurs exactly 1 month more to fill out and submit this annual report. And interim declarations - based on quarterly results - are not submitted by individual entrepreneurs under the simplified tax system.

What is the penalty for missing a deadline?

If the above deadlines for submitting the simplified tax system declaration for 2021 are not met, then you will face a fine under clause 1 of Art. 119 of the Tax Code of the Russian Federation. This is at least 1000 rubles, even if you pay the tax in full to the budget. And in general, the inspection will collect from 5 to 30% of the amount of tax not transferred to the treasury according to the simplified tax system according to the declaration for each full or partial month starting from:

- from April 3, 2021 – in relation to legal entities;

- from May 4, 2021 – for entrepreneurs.

Another extremely undesirable measure that the leadership of the Federal Tax Service may take is freezing bank accounts, including the movement of electronic payments (clause 3 of Article 76 of the Tax Code of the Russian Federation). There is a reason when the delay in filing a declaration is at least 10 working days. That is, the inspectors never saw her:

- by April 17, 2021 – from the organization;

- by May 21, 2021 – from the individual entrepreneur.

The Federal Tax Service must cancel the suspension of transactions on accounts no later than one business day following the day when the simplifier finally submitted the declaration (paragraph 2, paragraph 3, paragraph 11, article 76 of the Tax Code of the Russian Federation).

According to clarifications of the Ministry of Finance dated October 7, 2011 No. 03-02-08/108, an administrative fine for individual entrepreneurs under Art. 15.5 of the Code of Administrative Offenses of the Russian Federation, the simplified tax system is not imposed for late submission of a declaration. It threatens only officials of the organization - the manager, accountant, etc.

Also see “Changes to the simplified tax system in 2021”.

How to get a tax deduction in 2021: what's new

The procedure for preparing the 3-NDFL report is established by the relevant instructions:

- The report can be generated on a computer or filled out manually on a printed form. Blue or black ink should be used.

- If the declaration is drawn up using a computer, then the Courier New font should be used, and the size should be 16-18 points.

- When filling out 3-NDFL, you need to remember that it should have one page per sheet. Duplex printing cannot be used. Each sheet of the declaration is numbered, and the title page must have the number “001”. In addition to the number, the TIN must be present on each sheet of the report.

- The data in the declaration must be transferred from the relevant supporting documents, which can be 2-NDFL certificates, settlement and payment documents.

- Data in reporting must be entered in such a way that only one character is present in the field.

- When a voluminous report is compiled and there is not enough space for information on one page, then another sheet of the same type is filled out.

- It is not permitted to correct errors in this reporting. If it was admitted, then the report should be completed again.

- Cost indicators should be expressed in rubles and kopecks. In this case, the tax amount is fixed without kopecks.

- Numeric and text fields must be filled out starting from the left cell.

- If the report contains appendices, the number of their pages should be indicated on the title page.

If an entrepreneur did not have taxable income during the reporting period, he still needs to submit 3-NDFL with zero figures to the tax report. Its filling has some peculiarities.

The document must include three pages - title page, section 1 and section 2.

The title page is formatted in a standard manner, as for a simple declaration.

On the sheet with section 2 you must indicate:

- TIN of the entrepreneur;

- Last name and initials;

- Tax rate.

All other columns on this sheet must be crossed out.

On the sheet with section 1, fill in:

- Again, TIN and full name;

- Code “3” is written in line 010 – no tax payment;

- KBK code corresponding to the payment of personal income tax by the entrepreneur;

- OKTMO code.

All remaining columns are also crossed out. After the sheets are completed, they are numbered in order, and each sheet is signed by the individual entrepreneur.

The Tax Code establishes liability if the 3-NDFL tax return was not submitted on time or was not submitted at all.

Violation of the deadline for sending a document entails a fine of five percent of the amount of tax for each month (both full and partial) that has passed since the deadline for filing. Moreover, its minimum amount is 1000 rubles, and the maximum cannot exceed 30% of the tax amount under this declaration.

If an entrepreneur does not submit a zero declaration, he will need to pay a minimum fine of 1,000 rubles.

It is expected that the new declaration on the simplified tax system will come into force on January 1, 2021.

Don't forget to update your accounting software.

- When filling out the form by hand, all text and numerical fields (full name, tax identification number, amounts, etc.) should be written from left to right, starting from the leftmost cell, in capital printed characters according to the model that can be found on the Federal Tax Service website . The letters should be even and as similar to the sample as possible. If after filling out the line there are empty cells left, dashes should be placed in them to the very end of the field. If any field is left blank, all its cells must also have dashes.

- Filling out the 3-NDFL declaration on a computer requires aligning all numerical values to the right. It is recommended to use only the Courier New font with a size set between 16 and 18.

- enter the TIN, surname and initials;

- Leave the page number for now;

- 010 - column for indicating the cadastral number of the property. Contained in property documents, you can find out for free in the Rosreestr database;

- 020 - enter the cadastral value of the property as of January 1 of the year in which the property was purchased. If the property has not been assessed as of the specified date, a dash is added;

- 030 - income received from the sale based on the contract;

- 040 - if data on the cadastral value is available, it is multiplied by a factor of 0.7. If field 020 is empty, then 040 is left empty;

- 050 - line to indicate the taxable amount. Select the larger value from fields 030 and 040.

On October 16, 2021, the Ministry of Justice of Russia registered the order of the Tax Service dated October 3, 2021 No. ММВ-7-11/569, by which it approved a completely new tax return form 3-NDFL from 2021, as well as the procedure for filling it out and the electronic format for submission. In this article we talk about what has changed in the report form and whether it has become easier to fill out a declaration of income (deductions).

- 13 pages instead of 20

- the composition of sheets for calculating various incomes and deductions for personal income tax has been changed;

- the letter designation of sheets has been replaced with appendices with corresponding numbering (in total, the new declaration includes 2 sections and 8 appendices );

- the calculation of standard, social and investment tax deductions is combined into one Appendix 5;

- professional deductions along with income from business, advocacy and private practice are now calculated in Appendix 3;

- the section concerning the determination of the tax base for transactions with securities and derivative funds, as well as for transactions within an investment partnership, has been shortened;

- amendments to the Tax Code of the Russian Federation regarding the exemption from personal income tax of income received during the liquidation of a foreign company were taken into account (Law No. 34-FZ dated February 19, 2021).

The total number of pages, as well as the number of sheets of supporting documents, must be indicated on the Title Page in the line “The Declaration is drawn up on “__” pages with attachments of supporting documents or copies on “__” sheets.

An important field that you need to pay attention to when preparing the title page is the taxpayer category code in the 3-NDFL declaration. All values used are given in Appendix No. 1 to the procedure for filling out the report. Here are some of them:

Of the remaining sheets, the taxpayer must fill out those that contain information. It is only mandatory for everyone to fill out Section 1 “Information on the amounts of tax subject to payment (addition) to the budget/refund from the budget.” It must contain the relevant data on the amount of personal income tax or deduction.

It is recommended to fill out the declaration specifically from the calculation and appendices 1 and 6, and then fill out the title page and sections, and indicate page numbers. This is especially important if you write down all the data manually, because you cannot correct anything in the finished declaration.

The new 3-NDFL declaration form for 2021 has not yet been approved and published in official sources. We expect its appearance at the beginning of 2021. As soon as the document is published, we will post its form and sample form on this page. The instructions for filling out the declaration will also be updated in accordance with the changes that the form will undergo.