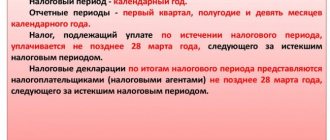

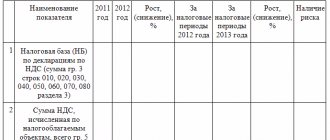

Everyone knows that taxes and contributions to extra-budgetary funds must be paid on time, and if the payment deadlines are missed, then you will have to pay a penalty in the amount of 1/300 of the rate of the Central Bank of the Russian Federation on the amount of tax or contribution debt. Penalties are charged for each calendar day of delay, starting from the day following the established payment deadline until the day of payment of the arrears, inclusively 1.

Note. From January 1, 2021, the refinancing rate is equal to the key rate, which is 11% 2.

It would seem that everything is simple, but questions about the calculation of penalties still arise. We will answer some in our article.

How to fill out a payment order for taxes and contributions in 2021

The main change concerns individual entrepreneurs, notaries, lawyers and heads of peasant farms. From October 1, 2021, payer status codes “09”, “10”, “11” and “12” will no longer be valid. Instead, the taxpayers listed above will indicate code “13,” which corresponds to individual taxpayers.

Also, some of the codes will be deleted or edited. New codes will be added:

- “29” - for politicians who transfer money to the budget from special election accounts and special referendum fund accounts (except for payments administered by the tax office);

- “30” - for foreign persons who are not registered with the Russian tax authorities, when paying payments administered by customs authorities.

From October 1, the list of payment basis codes will decrease. Codes will disappear:

- “TR” - repayment of debt at the request of the tax authorities;

- “AP” - repayment of debt according to the inspection report;

- “PR” - debt repayment based on a decision to suspend collection;

- "AR" - repayment of debt under a writ of execution.

Instead, you will need to indicate the code “ZD” - repayment of debt for expired periods, including voluntary. Previously, this code was used exclusively for voluntary debt closure.

Also, from October 1, the code “BF” will be removed - the current payment of an individual paid from his own account.

This field indicates the document number that is the basis for the payment. Its completion depends on how field 106 is filled in.

The new code for the basis of payment in the four invalid cases is “ZD”. But despite this, the deleted codes will appear as part of the document number - the first two characters. Fill out the field in the following order:

- “TR0000000000000”—number of the tax office’s request for payment of taxes, fees, and contributions;

- “AP0000000000000” - number of the decision to prosecute for committing a tax offense or to refuse to prosecute;

- “PR0000000000000” - number of the decision to suspend collection;

- “AR0000000000000” – number of the executive document.

For example, “TR0000000000237” - tax payment requirement No. 237.

The procedure for filling out field 109 changes to pay off debts for expired periods. When specifying the “ZD” code, you need to enter in the field the date of one of the documents that is the basis for the payment:

- tax requirements;

- decisions to prosecute for committing a tax offense or to refuse to prosecute;

- decisions to suspend collection;

- writ of execution and initiated enforcement proceedings.

Payment order for penalties in 2021

1.If you have received a decision in your taxpayer’s personal account to pay a penalty from the tax inspectorate, you must pay it off within the prescribed period

2. In the event of an error in the KBK regarding the penalty, the payment will go to the wrong place and the tax office may issue a decision to block the account, and the bank will be required to write off a penalty from you, and until the money reaches the Federal Tax Service, the account will work or be partially or completely frozen

3.And you will have to go to the inspectorate and find out where your penalty went, write an application to clarify the payment

4. After which, whose penalty will arrive faster, then the decision to block accounts will be canceled

As a rule, failure to pay penalties does not entail complete blocking of the current account. The client has worked and can continue to work. The bank blocks only the amount that it needs to use to pay off the penalty. A complete blocking occurs when the client owes a large amount of money.

1.Question No. 1:

Is it possible to pay a fine at a bank cash desk?

Answer:

Tax legislation does not provide any restrictions on paying taxes and penalties through bank cash desks. However, it will be better if you pay it from your company current account. By filling out a payment order indicating all the necessary details and columns. Namely, the BCC for the penalty of the tax for which it is accrued, OKTMO of the region where the organization is registered, as well as the period and basis, whether you pay on demand or independently.

Fill out the personal income tax payment taking into account the following rules.

- Fill in the payer status depending on who the payer is: the individual entrepreneur must enter code 09 in field 101 (when paying personal income tax for himself), and the tax agent (individual entrepreneur or organization) must enter code 02.

- Fill out field 104 taking into account changes in the KBK classifier for 2021. To pay personal income tax on wages and remunerations under GPC agreements, enter code 182 1 0100 110. And calculate tax on income over 5 million rubles at a rate of 15% and pay according to the new BCC - 182 1 0100 110.

- In field 105, enter the OKTMO code in accordance with the current all-Russian classifier.

- In field 106, reflect the code “TP” if you pay personal income tax in the current billing period. For example, if you transfer tax from your January salary in February. Different codes apply for penalties and fines.

- In field 107, indicate the tax period according to standard rules. For example, if you pay income tax for January 2021, reflect: MS: 01.2021.

- The order of transfer for regular payments is code “15”. For on-demand tax, use code "3". Field 22 “UIN” is filled in if you pay tax or penalty on demand. When filling out a payment slip for current payments, enter “0” in field 22.

When they talk about a payment order by decision of the tax authority, they mean the following situation:

- The payer (company/individual entrepreneur) is required by law to independently calculate the tax to be transferred to the treasury and draw up the appropriate payment document.

- The deadline established by law for voluntary repayment of the current tax debt has passed.

- The tax inspectorate received a request to make a tax payment within the deadline specified in it.

It should be noted that to fill out a payment order, by decision of the tax authority, use the same form as for voluntary repayment of current mandatory payments. It is enshrined in the regulation of the Central Bank of Russia dated June 19, 2012 No. 383-P. This form has index 0401060.

When you need to issue a payment order for a fine according to the decision of the Federal Tax Service in 2018, you should remember that in the KBK the numbers from 14 to 17 will be 3000. In addition:

- field 105 – OKTMO of the municipality, where funds from paying fines are accumulated;

- field 106 – “TR”;

- field 107 (“Tax period”) – “0”;

- field 108 – requirement number (the “No” sign does not need to be inserted);

- field 109 – date of the document from field 108 in the format “DD.MM.YYYY”;

- after 110 – do not fill in;

- field 22 (“Code”) – UIN (if it is not in the request, then “0”);

- field 101 – “01” for legal entities and “09” for “individual entrepreneurs”;

- “Payment order” – 5.

Basically, these are all the features of paying a fine to the Federal Tax Service by payment order in 2021.

If you find an error, please select a piece of text and press Ctrl+Enter.

First of all, let us remind you that through penalties the timely payment of mandatory payments is ensured. At the same time, a penalty is not a sanction, but an interim measure.

Read more about tax penalties in this article.

A payment order for penalties has both similarities with a payment order for the main payment (it states the same status of the payer, indicates the same details of the recipient, the same income administrator), and differences. Let's look at the latter in more detail.

The 2nd difference in the payment for penalties is the basis of the payment (field 106). For current payments we put TP here. Regarding penalties, the following options are possible:

- We calculated the penalties ourselves and pay them voluntarily. In this case, the basis for the payment will most likely have a code ZD, that is, voluntary repayment of debt for expired tax, settlement (reporting) periods in the absence of a requirement from the Federal Tax Service, because we, as a rule, transfer penalties not for the current period, but for past ones.

- Payment of penalties at the request of the Federal Tax Service. In this case, the payment basis will have the form TP.

- Transfer of penalties based on the inspection report. This is the basis of payment to AP.

All three of the above cases are discussed in detail in the Ready-made solution from ConsultantPlus. Samples of filling out payment forms are provided for each of them.

Read more about payment details in this article.

Depending on what served as the basis for the payment, filling out this field will vary:

- In case of voluntary payment of penalties (the basis of the PP), there will be 0 here, because penalties do not have a frequency of payment, which is inherent in current payments. If you are listing penalties for one specific period (month, quarter), it is worth indicating it, for example, MS.08.2019 - penalties for August 2021.

- When paying at the request of tax authorities (basis of TR) - the period specified in the request.

- When repaying penalties according to the verification report (the basis of the AP), they also put 0.

If you pay the fine yourself, enter 0 in fields 108 “Document number” and 109 “Document date”.

In all other cases, in field 108, provide the document number - the basis for the payment (for example, a claim), and do not put the “No” sign.

In field 109, indicate:

- date of requirement of the Federal Tax Service - for the basis of payment TR;

- the date of the decision to bring (refusal to bring) to tax liability - for the basis of an administrative agreement.

A sample payment order for the payment of penalties in 2019-2020 can be viewed and downloaded on our website:

Penalties for non-payment of tax on the sale of an apartment

Apartment owners who decide to sell their property should remember that in some cases they need to pay personal income tax for the transaction. It is paid if the apartment has been owned for an insufficient number of years (established by law).

For residents who have purchased housing for less than three years, they will have to pay 13 percent of the transaction amount. If the tax on the sale of an apartment is not paid, as well as if a declaration has not been submitted to the inspectorate, penalties (daily) and fines will be assessed. Moreover, penalties are calculated both for late payment and for late submission of documents. The calculation is made using the standard formula.

Filling out a payment order in 2021: sample

- Rules for filling out payment orders

- Changes in KBK

- Filling in the details of the Federal Treasury bank according to the BIC classifier

- Payments to the budget to treasury accounts from 01/01/2021

- Change in payer status and payment grounds when transferring to the budget from 10/01/2021

- Other payments to government contractors

From January 1, 2021, a change is provided for individual payers who are not individual entrepreneurs. Order of the Ministry of Finance dated September 14, 2021 No. 199n updated the rules approved by Order of the Ministry of Finance dated November 12, 2013 No. 107n.

Previously, in order for inspectors to be able to determine who the payment came from, an individual had to indicate his TIN. Instead of the TIN, you could fill out field 108 “Number of the document that is the basis for the payment”, or enter the UIN in field 22 “Code” (in the absence of a UIN, it was possible to indicate the address of residence or stay).

Now, if you do not have a TIN and UIN, you can indicate the series and number of your passport or SNILS.

From January 1, 2021, new BCCs were introduced for personal income tax calculated on a progressive scale.

By Order No. 236n dated October 12, 2021, the Ministry of Finance added new codes to the KBK list for transferring personal income tax on income exceeding 5 million rubles. in year:

- for tax: 182 1 0100 110

- for stumps: 182 1 0100 110

- for fines: 182 1 0100 110.

From July 17, 2021, the rule for filling out a payment order will come into effect, when the employer deducts money from the employee’s salary to pay off the debt to the budget and transfers the withheld amount to the budget.

In the payment receipt, in the “Payer’s INN” field, you must indicate not the company’s INN, but the employee’s INN. This change is also provided for by Order of the Ministry of Finance dated September 14, 2021 No. 199n.

Repayment of debt for previous periods - fields 106, 108, 109

From October 1, 2021, changes will be introduced to the procedure for providing information when repaying debts for expired periods (also Order of the Ministry of Finance dated September 14, 2021 No. 199n).

Until October 1, 2021, in field 106 “Basis of payment” of the payment order, you can specify one of the following values:

- “TR” - repayment of debt at the request of the tax authority to pay taxes (fees, insurance contributions);

- “PR” - repayment of debt suspended for collection;

- “AP” - repayment of debt according to the inspection report;

- “AR” - repayment of debt under a writ of execution;

- “ZD” is the voluntary repayment of debt for expired tax, settlement (reporting) periods in the absence of a requirement from the tax authority to pay taxes (fees, insurance contributions).

According to the changes, the values “TR”, “PR”, “AP” and “AR” no longer need to be specified in field 106. There remains a single value for all the listed cases, which must be entered in field 106 - “ZD”.

And the codes “TR”, “PR”, “AP” and “AR” go to field 108 “Document number”.

For example, if money is transferred on the basis of a request from a tax authority to pay a tax (fee, insurance premiums), in field 108 write first TP and then, without a space, the request number for 13 acquaintances. If this is a writ of execution (executive proceedings), then in field 108 write AR and the document number, etc., in the same order.

In field 109 “Date of payment basis document” you will need to indicate the dates of the documents on the basis of which the money is transferred (demand, decision, etc.).

Maria Lutsenko

There are as many types of taxes as there are so many penalties and fines for them. Each type requires its own payment form with special details. The details will even depend on whether you voluntarily intend to pay fines and penalties or not.

Elba prepares payments for penalties and fines automatically if a request for their payment has been received in the Letters section. You will see the “Pay or download payments” button in the open request.

Art. 75 Tax Code of the Russian Federation (2017): questions and answers

Art. 75 of the Tax Code of the Russian Federation is devoted to penalties, which are payments of a compensatory nature, paid to the budget in the event that the taxpayer failed to timely fulfill obligations to pay taxes, fees, and, from 2021, insurance contributions. What is the procedure for calculating, issuing and determining the amount of these payments?

What are the grounds for calculating penalties?

How is the penalty amount calculated?

What is the deadline for paying the tax authority’s demand for penalties?

Rules for filling out payment orders from 2021 in 1C

Such a payment order has both similarities with a regular one (it states the same status of the payer, indicates the same details of the recipient, the same income administrator), and differences. We will dwell on the latter in more detail, and then we will provide a sample payment slip for penalties for personal income tax 2021.

Props 21 indicates the order. It is determined in accordance with Article 855. Civil Code of the Russian Federation. When transferring tax, the values “3” and “5” can be indicated.

They determine in what order the bank will carry out operations if there are not enough funds in the organization’s account. When transferring personal income tax on a monthly basis, the value “5” is indicated in field 21.

If you transfer tax at the request of the Federal Tax Service, then indicate the value “3”.

Also read: Contract with an employee without a work book

Based on clause 3.11-1 of Art. 2 of the Federal Law of 03.11.

2006 No. 174-FZ “On Autonomous Institutions”, autonomous institutions, when concluding contracts (agreements) for the supply of goods, performance of work, provision of services involving advance payments, comply with the requirements defined by regulatory legal acts of the Russian Federation, regulatory legal acts of constituent entities of the Russian Federation, municipal legal acts regulating budget legal relations for recipients of funds from the corresponding budget of the budget system of the Russian Federation.

Payment order field no . Name Filling procedure

| 3, 4 | Number and date | Write down the payment number in accordance with the numbering maintained by the company. It cannot be more than six characters. Write down the date in the format DD.MM.YYYY. |

| 5 | Payment type | The procedure for filling out this field is determined by the bank. The filling procedure is different for paper and electronic orders. |

| 107 | Payer status | You must enter a two-digit code in the field. When transferring VAT from your own activities, enter 101. |

| 6 | Suma in cuirsive | Write down the amount you transfer to the budget, write it down in letters (in words) |

| 7 | Amount of payment | Write down the tax amount in numbers. VAT is transferred in whole rubles, the tax is rounded according to the rules of mathematics |

| 8 | Payer | Write down the name of the company, its tax identification number and checkpoint |

| 60 | TIN | |

| 102 | checkpoint | |

| 9 | Account No. | Write down the payer's bank details |

| 10 | Payer's bank | |

| 11 | BIC | |

| 12 | Account No. | |

| 16 | Recipient | Record payee information |

| 61 | TIN | |

| 103 | checkpoint | |

| 13 | payee's bank | Recipient's bank details |

| 17 | Account No. | |

| 14 | BIC | |

| 18 | Type of operation | Write down the payment document code. Payment orders are assigned a code |

| 19 | Payment due date | When transferring taxes, these fields do not need to be filled in. |

| 20 | Purpose of payment | |

| 21 | Payment order | If the company transfers tax at the request of the inspectorate, then “3” must be entered in the field. If the company pays tax on its own initiative, then it must be set to “5” |

| 22 | Code | You do not need to fill out this field |

| 23 | Reserve field | You do not need to fill out this field |

| 104 | KBK | Write down the KBK tax 2021 |

| OKTMO | Write down the code in accordance with the 2021 classifier | |

| 106 | Basis of payment | Write down the two-digit code. For example, TP - current payment, TP - payment at the request of the inspection |

| 107 | Taxable period | Write down the period code, which consists of 10 characters. For example, for the tax for the 1st quarter - KV.01.2021 |

| 108 | Document number – basis for payment | Write down the details of the document on the basis of which you are transferring the payment (for example, tax requirements). When paying current taxes, enter 0 in this field |

| 109 | Document date – basis for payment | Enter the date of the document according to which you are transferring money. For example, tax requirements. When transferring current taxes (payment basis “TP”), in field 109, indicate the date of signing the tax return |

| 110 | Payment type | No need to fill out |

| 24 | Purpose of payment | Write down additional information. For example, the name of the tax and the period for which you are transferring it. |

The cost of such a transfer depends on the tariff for services at the bank. Some banks charge a percentage for transfers (usually for withdrawals to a personal account). The cost of processing a payment order by an operator at a bank is from 20 to 100 rubles.

At Sberbank, processing a payment order costs 250 rubles, withdrawal of funds to another bank 1%(.), withdrawal 2%, maintenance 1000 rubles/month. Alfa Bank is doing no better.

My bank (Tinkoff) charges 30 rubles for payment processing, and transferring funds to your card is interest-free, service is 400 rubles/month! Be careful when choosing a bank. See also: Which bank to open a current account in.

\n\n

A clear rule will come into effect in the event that the accounting department deducts money from an employee’s salary to pay off debts to the budget. Next, the withheld amount is transferred to the treasury by a separate payment order. In such a payment in the field “TIN of the payer”, from July 17, 2021, it is strictly prohibited to indicate the identification number of the employing company. Instead, you need to put the TIN of the employee himself (amendments made by Order No. 199n).

\n\n

Summarizing

Citizens of Russia are faced with such a concept as penalties not only in relation to utility bills, but also in case of non-payment of taxes. Such a sanction measure is provided for by law and is mandatory for payment in case of overdue tax payments. If the taxpayer came to his senses on time and repaid the debt to the tax service, the amount of the penalty will be insignificant. It is much more dangerous to “forget” about taxes for legal entities that pay large sums to the treasury. After all, the larger the debt and the number of overdue days, the higher the penalty will be. Be careful!

Sources:

https://avtonalogi.ru/articles/kak-nachislyayutsya-peni-za-nesvoevremennuyu-uplatu-nalogov https://aif.ru/dontknows/eternal/grozit_li_chto-libo_za_neuplatu_peney https://www.9111.ru/%D1 %82%D1%80%D0%B0%D0%BD%D1%81%D0%BF%D0%BE%D1%80%D1%82%D0%BD%D1%8B%D0%B9_%D0%BD %D0%B0%D0%BB%D0%BE%D0%B3/%D0%BF%D0%B5%D0%BD%D0%B8_%D0%B7%D0%B0_%D1%82%D1%80% D0%B0%D0%BD%D1%81%D0%BF%D0%BE%D1%80%D1%82%D0%BD%D1%8B%D0%B9_%D0%BD%D0%B0%D0% BB%D0%BE%D0%B3/ https://pravoved.ru/question/540894/ https://www.klerk.ru/buh/articles/45071/ https://nalog-expert.com/oplata- nalogov/peni-za-neuplatu-nalogov.html

How to fill out tax payments taking into account the changes for 2021?

\n\n

There are innovations for individuals who pay taxes, fees, insurance and other payments administered by the tax authorities. The changes concern field 101 (the status of the payment originator is entered in it).

\n\n

Until October 2021, when filling out field 101, these individuals must select one of the following values:

\n\n

- \n\t

- “09” - individual entrepreneur who pays taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “10” - a notary engaged in private practice, paying taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “11” - a lawyer who has established a law office that pays taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “12” is the head of a peasant (farm) enterprise who pays taxes, fees, insurance premiums and other payments administered by the tax authorities.

- “13” is an “ordinary” individual.

\n\t

\n\t

\n\t

\n\t

\n

\n\n

Starting in October 2021, the values "09", "10", "11" and "12" will be removed. Instead, the value remains, the same for all individuals (“ordinary”, individual entrepreneurs, lawyers, etc.) - “13”. Changes were made by order No. 199n.

When filling out the recipient's details, you need to take into account changes in two fields. Innovations are associated with the transition to a new treasury service and treasury payment system.

- Field 17: the account number of the territorial body of the Federal Treasury (TOFK) is changed;

- Field 15: starting from January 2021, it is necessary to indicate the account number of the recipient's bank (the number of the bank account included in the single treasury account (STA)). In 2021 and earlier, this field was not filled in when paying taxes and contributions.

A clear rule will come into effect in the event that the accounting department deducts money from an employee’s salary to pay off debts to the budget. Next, the withheld amount is transferred to the treasury by a separate payment order. In such a payment in the field “TIN of the payer”, from July 17, 2021, it is strictly prohibited to indicate the identification number of the employing company. Instead, you need to put the TIN of the employee himself (amendments made by Order No. 199n).

Until October 2021, in payments issued when repaying debts for expired periods, in field 106 you can, if necessary, specify one of the following values:

- “TR” - repayment of debt at the request of the tax authority to pay taxes (fees, insurance contributions);

To pay through the banking system of the Russian Federation, you must comply with the requirements of the relevant departments. The approved form of the payment order form is enshrined in Appendix 2 of the Regulations of the Central Bank of the Russian Federation No. 383-P dated June 19, 2012. And in Appendix 3 of Regulation 383-P the meanings of payment order codes are indicated. The filling procedure is set out in Order of the Ministry of Finance No. 107n dated November 12, 2013. Since 2021, there have been fundamental changes in the administration of contributions related to insurance by tax authorities:

- pension;

- medical;

- social in case of temporary disability and maternity.

Insureds form transfers for the corresponding insurance payments in the same way as taxes on wages and payments to individuals under contracts for work performed or services rendered.

Since 2021, Chapter 34 of the Tax Code of the Russian Federation “Insurance contributions” has come into force. As a result, there have been changes in reporting and other related regulations that govern this area. For example, Order of the Ministry of Finance No. 132n dated 06/08/2018 was introduced regarding the application of the BCC.

Experts say that in 2021 the deficit of the Russian Pension Fund should be reduced by about 20%, but will this be enough? It’s no secret that increasing life expectancy is a significant problem for the pension fund, although for everyone else it is a huge leap forward development. This is explained by the fact that at the time the retirement age was established, the life expectancy of the population was much shorter, and therefore there were more people who had the opportunity to work.

Information about the file To transfer fines, a unified payment order form approved by Bank of Russia Regulation No. 383-P dated June 19, 2020 is used. When transferring penalties, most fields of the payment order are filled out in the same way as when transferring the contribution itself. But you cannot transfer the fee and penalties in one payment.

Where can I get a payment order for free? How to fill out a payment order? What types of payment orders are there? I will post here samples of filling out payment slips in Excel for 2020-2020, made using the free Business Pack program. This is a fast and simple program. In addition to payment slips, it also contains a bunch of useful documents. I recommend to all! Especially useful for small organizations and individual entrepreneurs who want to save money. Some additional functions in it are paid, but for payment orders it is free.

Each type of payment administered by the Federal Tax Service has its own distinctive features. These include:

- KBK (sector 104 of the payment order) - it is individual for each type;

- payer status (sector 101) - depends on the organizational form of the payer and the type of transfer.

Let's take a closer look at an example of a payment order for insurance premiums 2021.

Step 1. At the top of the document, the status of the payer of the payment document is indicated. Filling out 101 fields is defined by adj. 5 Order 107n. Status in the payment slip for insurance premiums 2021:

- organizations indicate code 01;

- individual entrepreneurs - 09.

Payment order for fines on demand

It is important to say that a fine can be imposed not only on the organization as a tax payer, but also on its officials, for example, a director or accountant, who are responsible for the timely submission of reports to the funds. The amount of penalties in this case can range from 300 to 500 rubles. Employees may have a paid day off to take care of their health. A bill has been submitted to the State Duma for consideration, proposing to oblige employers to provide their employees with an additional day off to undergo a medical examination. Payment order to the pension fund in 2021 (form and sample to fill out)

To transfer mandatory insurance contributions, as well as to pay taxes, a special bank document is filled out - a payment slip. Since 2020, all social fees for legal entities and individual entrepreneurs go through the tax office. Therefore, the sample payment order for insurance premiums in 2021 has been changed. Let's take a closer look at the innovations that have come into force.

If an organization is late in submitting reports on insurance premiums, the tax authorities will issue a fine in the amount of 5 to 30% of the amount not paid within the period established by the legislation on taxes and fees, but not less than 1000 rubles.

Since the report contains information about three types of insurance, the tax office in Letter of the Federal Tax Service of Russia dated 05.05.2017 No. PA-4-11/864 stated that the amount of the fine should be divided proportionally to the tariffs.

When paying a fine of 1000 rubles, you must transfer:

- RUR 733.33 — for pension payments (1000 / 30 × 22);

- 170 rub. — for medical payments (1000 / 30 × 5.1);

- 96.67 rub. — for social payments (1000 / 30 × 2.9).

There is another type of payment associated with violation of legal requirements - penalties. The procedure for filling out a payment for penalties does not differ significantly from a regular payment to the budget, but, as mentioned above, there are features for each type of transfer:

- Own BCC (field 104) - each contribution to the budget has an individual BCC for penalties.

- The basis (field 106) depends on the fact of determining a violation of legal requirements. Code “ZD” - calculated and paid independently. At the request of the tax office - code “TR”. And in the case of an inspection report - code “AP”. The list of field codes is given in Order 107n.

- Field 107 “Tax period” will depend on the basis of the payment. Codes “ZD” or “AP” in field 106 will correspond to code “0” in field 107. If penalties are transferred for a specific period, then the field indicates the period for which the transfer is made. If a penalty is paid on demand, field 107 shall indicate the period specified in the request.

We have prepared video instructions for you on how to fill out a payment form to pay penalties.

First of all, let us remind you that through penalties the timely payment of mandatory payments is ensured. At the same time, a penalty is not a sanction, but an interim measure.

Read more about tax penalties in this article.

A payment order for penalties has both similarities with a payment order for the main payment (it states the same status of the payer, indicates the same details of the recipient, the same income administrator), and differences. Let's look at the latter in more detail.

So, the first difference is KBK (field 104). For tax penalties, there is always a budget classification code, in the 14th–17th digits of which the income subtype code is indicated - 2100. This code is associated with a significant change in filling out payment orders: since 2015, we no longer fill out field 110 “Payment Type” .

Previously, when paying penalties, the penalty code PE was entered in it. Now we leave this field empty, and the fact that this is a penalty can be understood precisely from the KBK.

ATTENTION! Starting from 2021, the procedure for determining the BCC is regulated by a new regulatory legal act - Order of the Ministry of Finance dated 06/08/2018 No. 132n. Order No. 65n dated July 1, 2013 has lost force. But this will not affect the general procedure for assigning penalties to BCC.

The 2nd difference in the payment for penalties is the basis of the payment (field 106). For current payments we put TP here. Regarding penalties, the following options are possible:

- We calculated the penalties ourselves and pay them voluntarily. In this case, the basis for the payment will most likely have a code ZD, that is, voluntary repayment of debt for expired tax, settlement (reporting) periods in the absence of a requirement from the Federal Tax Service, because we, as a rule, transfer penalties not for the current period, but for past ones.

- Payment of penalties at the request of the Federal Tax Service. In this case, the payment basis will have the form TP.

- Transfer of penalties based on the inspection report. This is the basis of payment to AP.

Penalties for non-payment of income tax

Income tax is direct; all companies and entrepreneurs are required to pay it. Otherwise, a penalty will be charged, and then more serious measures will follow, including the seizure of accounts. In this case, the payment occurs precisely from the net profit received, that is, the taxable amount is calculated not only taking into account income, but also expenses. If a company operates under a special regime - simplified tax system, UTII, unified agricultural tax, then no income tax is charged.

In case of non-compliance with the law and late or non-payment of income tax, a penalty is imposed. As a result, the debt to the state is growing every day. Penalties are charged not only for late payment of taxes, but also for advance payments. It can be calculated using the formula:

Arrears x 1/300 x Central Bank Refinancing Rate x Number of days late = Penalty

Please note: if the organization does not deposit the money within 30 days, then penalties for non-payment of income tax will increase due to a change in the coefficient - 1/150 will be applied. The situation with penalties for collection on the income of individuals is developing similarly.