The Ministry of Finance has clarified the nuances of difficulties with payment documents this year. Whether all fields on the form are filled out correctly determines whether the banking institution will accept it. Having carefully studied the example of filling out a payment order in 2021, you can fill out payment orders quickly and without errors.

Fields 15 and 17

As of January 1, 2021, two fields have been changed: 15 and 17.

- Field 17

: account numbers of territorial bodies of the Federal Treasury (TOFK) have been changed; - Field 15

: you must indicate the account number of the recipient's bank (the number of the bank account included in the single treasury account (STA)). In 2021 and earlier, this field was not filled in when paying taxes and contributions.

Until May 1, 2021, there was a transitional period when both old and new accounts could be entered in these fields.

From May 1, only new accounts are valid.

A table with new details is in the letter of the Federal Tax Service dated October 8, 2020 No. KCh-4-8/ [email protected] Use this table.

In addition, you can download the table in Excel format and check the account you need on the website of the magazine “Regulatory Acts for Accountants”. Download here.

In the table:

- for each region, the BIC and the name of the recipient bank are indicated (fields 14 and 13),

- for each recipient bank - the corresponding new and outdated (closed) TOFK account (field 17),

- bank account number of the recipient of funds (field 15).

Let's take the table and select from it (as an example) the necessary data to fill out the payment receipt for tax payment to the Federal Treasury for the Astrakhan Region.

Field 13 – Recipient's bank: ASTRAKHAN BRANCH OF THE BANK OF RUSSIA//UFK for the Astrakhan region, Astrakhan Field 14 – BIC: 011203901 Field 15 – Account No. (number of the bank account included in the single treasury account): 40102810445370000017 Field 17 – new account number recipient (treasury account number): 03100643000000012500, number of the previous (closed) TOFK account: 40101810400000010009. Select the correct data that you need to fill out payment orders.

Consequences of errors in a payment order

As stated in Article 45 of the Tax Code of the Russian Federation, if the details of the recipient’s bank and the SFC number are incorrectly indicated in the payment order, taxes and contributions will not go to the budget. In this case, the taxpayer’s obligation to pay the tax is not considered fulfilled, and the tax authority will charge penalties for late payment in the manner and under the conditions provided for by the Tax Code of the Russian Federation.

The taxpayer will have to check the details in the payment slip and look for outstanding funds. All this takes time and negatively affects the interaction of the Federal Tax Service with taxpayers.

What changes came into force earlier: from January 1, 2021

From January 1, 2021, a change is provided for individual payers who are not individual entrepreneurs. Order of the Ministry of Finance dated September 14, 2021 No. 199n updated the rules approved by Order of the Ministry of Finance dated November 12, 2013 No. 107n.

Previously, in order for inspectors to be able to determine who the payment came from, an individual had to indicate his TIN. Instead of the TIN, you could fill out field 108 “Number of the document that is the basis for the payment”, or enter the UIN in field 22 “Code” (in the absence of a UIN, it was possible to indicate the address of residence or stay).

Now, if you do not have a TIN and UIN, you can indicate the series and number of your passport or SNILS.

KBK

Depending on the activity carried out by an entrepreneur or company, the KBK designation has a different form.

- Tax on the sale of goods and services on the territory of the Russian Federation – 182 1 0300 110

- Import of goods from Kazakhstan, Belarus, Kyrgyzstan – 182 1 0400 110

- Import of goods from other countries – 153 1 0400 110

Changes that will come into effect in July and October 2021

From July 17, 2021 a

The rules for filling out payment orders when making deductions from employees’ wages will change.

In the payment receipt, in the “Payer’s INN” field, you will need to indicate not the company’s INN, but the employee’s INN.

The change was made by order of the Ministry of Finance dated September 14, 2021 No. 199n, and comes into force on July 17, 2021.

We indicate debt repayment for previous periods in fields: 106, 108, 109.

From October 1, 2021

The procedure for providing information when repaying debt for past periods will change. The changes are also provided for by Order of the Ministry of Finance dated September 14, 2021 No. 199n.

Until October 1, 2021, in field 106 “Basis of payment” of the payment order, you can specify one of the following values:

- “TR” - repayment of debt at the request of the tax authority to pay taxes (fees, insurance contributions);

- “PR” - repayment of debt suspended for collection;

- “AP” - repayment of debt according to the inspection report;

- “AR” - repayment of debt under a writ of execution;

- “ZD” is the voluntary repayment of debt for expired tax, settlement (reporting) periods in the absence of a requirement from the tax authority to pay taxes (fees, insurance contributions).

After October 1, 2021, the designations “TR”, “PR”, “AP” and “AR” no longer need to be indicated in field 106. There will be one and the same value for all cases, which must be entered in field 106 - “ZD”.

The codes “TR”, “PR”, “AP” and “AR” will need to be transferred to field 108 “Document number”.

For example, if money is transferred on the basis of a request from a tax authority to pay a tax (fee, insurance premiums), in field 108 write first TP and then, without a space, the request number for 13 acquaintances. If this is a writ of execution (executive proceedings), then in field 108 the AR and the document number, etc. are written in the same order.

In field 109 “Date of payment basis document” you will need to indicate the dates of the documents on the basis of which the money is transferred (demand, decision, etc.).

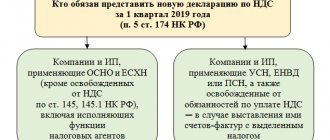

Who should fill out payments?

According to established rules, such documents are filled out by private entrepreneurs and companies performing transactions that are subject to taxes. Another category of taxpayers are individuals or legal entities engaged in the supply of goods across the customs border.

Persons and organizations that:

- They are engaged in performing various types of work, selling goods and providing services that are subject to VAT. For example, they sell building materials, renovate premises, and provide consultations.

- Transfers goods without the need to rally them, performs assigned tasks and provides services. In this case, the tax base is the actual market price for the type of services provided and work performed.

- They distribute goods throughout the country that are intended to fulfill their own needs. Such an action is subject to taxes if the company did not take into account the cost of carrying out these operations when calculating income taxes.

- They are engaged in construction work or installation of structures.

All persons carrying out such transactions must pay tax to the state treasury if the amount of money received for the previous trimester is more than 2 million rubles (the amount does not include the amount of tax). For entrepreneurs who sell goods subject to excise duty, this rule does not apply - they must pay tax regardless of their revenue. The procedure for filling out payment orders in 2021

Who can avoid paying tax?

You can obtain tax exemption by filling out a special form that is submitted to the regulatory authority. Documents confirming the financial transactions carried out by the company or entrepreneur must be attached to the form: companies need to attach extracts from the balance sheet, persons engaged in entrepreneurial activities - books of inputs and expenses, sales, and other internal business transactions.

What new statuses have appeared in the “101” field?

From October 2, 2021, new rules for filling out payment orders came into force, new codes appeared that need to be entered in the “101” field - payer status.

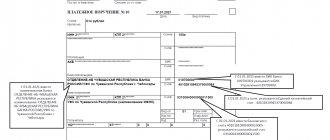

Look at the sample payment order to understand where this field is located. Below is the payment order with a description of the fields.

New statuses

From October 2, 2017, two new payer statuses are added:

- “27” - credit organizations (branches of credit organizations) that have drawn up an order for the transfer of funds transferred from the budget system of the Russian Federation, not credited to the recipient and subject to return to the budget system of the Russian Federation;

- “28” - participant in foreign economic activity - recipient of international mail.

Statuses in field 101 that have changed

Changes have also been made to two other payer statuses, which are indicated in field “101” - status “03” and “06”. Look in the table to see how the content of these statuses has changed.

| After 10/02/2017 | |

| The federal postal service organization that drew up the order for the transfer of funds for each payment by an individual | The federal postal service organization that drew up the order for the transfer of funds for each payment by an individual, with the exception of payment of customs duties |

| Participant in foreign economic activity - legal entity | A participant in foreign economic activity is a legal entity, with the exception of the recipient of international mail |

New details in payments

When filling out payment documents, two new statuses:

- “27” - credit organizations (branches of credit organizations) that have drawn up an order for the transfer of funds transferred from the budget system of the Russian Federation, not credited to the recipient and subject to return to the budget system of the Russian Federation;

- “28” - participant in foreign economic activity - recipient of international mail.

The changes apply only to credit institutions, Russian Post and recipients of international mail.

In addition, for customs payments two new values will be added to the “106” detail

:

- “PD” - passenger customs declaration;

- “KV” is a receipt from the recipient of an international postal item.

How to save and print an application for a new type of international passport of a citizen of the Russian Federation

All application forms and applications are presented on official resources in PDF format.

You can download and save the application through any modern browser. After clicking on the download link, the document is automatically downloaded and saved on the PC in a location pre-specified by the user. You can find out the folder in which the document was saved in your browser settings. You can open a document in a folder through the Downloads menu by right-clicking on the icon of the downloaded document and selecting “Show in folder”.

To fill out the document, install the free Adobe Acrobat Reader DC program on your PC from the developer’s official website. To fill out the form directly in a PDF file, you will need a program version of at least 6.0.

When working with the website of the Main Directorate for Migration of the Ministry of Internal Affairs of the Russian Federation, after clicking on the link, the form automatically opens in a new browser window and is available for filling out. It can then be saved on your computer in PDF format by clicking on the downward arrow in the top menu of the browser window. Nearby there is a “printer” button, which allows you to print a blank or completed document, provided that a printer is connected to your PC.

To fill it out by hand, you should print out the form in two copies on both sides of one sheet of paper using black ink.

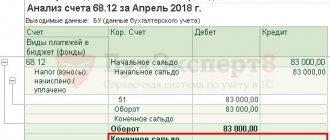

New rules for calculating penalties

From October 1, 2021, the procedure for calculating penalties for non-payment of tax in relation to organizations will change. Amendments were made to paragraph 4 of Article 75 of the Tax Code by Federal Law No. 401-FZ of November 30, 2016.

If payment is late by up to 30 calendar days, the penalty will be calculated as usual - based on one three hundredth of the Bank of Russia refinancing rate. According to the new rule, starting from the 31st day, the penalty will be one hundred and fiftieth of the discount rate.

The refinancing rate is now 8.5% per annum.

The changes apply only to legal entities. For individuals, including individual entrepreneurs, everything remains the same.

General provisions about the document

The payment order form, like all other forms of documents used to make payments, was prepared and approved by the Central Bank of the Russian Federation in Regulation No. 383-P dated June 19, 2012. It also presents the methodology by which the document is filled out, and Appendix No. 3 contains its approved form indicating numbered fields for ease of completion. We will not list all the payment details, since for our publication only field 110 is of particular interest. In payment order 2018

year, or rather in the Central Bank’s requirements for filling it out, there have been no changes yet, since the latest adjustments were approved quite recently - in August 2021. Let’s look into the vicissitudes of completing this detail.

General rules for filling out the application form for a biometric passport

When filling out the form electronically or by hand on a printed form, identical information is entered. It is very important that all information provided is correct and up to date. The list of papers that contain the information necessary to draw up the application depends on the age of the person for whom the international passport is being issued.

To correctly fill out the application form for a new international passport, you will need to have the following documents on hand:

- internal passport of a citizen of the Russian Federation (for persons over 14 years of age and legal representatives of minor citizens under the age of 18);

- an old-style international passport, if its validity has not expired;

- a certificate or certificate of change of name, if any;

- military ID for men - citizens of the Russian Federation - aged 18-27 years;

- permission from the command for military personnel and employees of federal executive authorities (not required for persons undergoing compulsory military service upon conscription);

- employment history.

To fill out an application for an international passport, a child under 14 years of age will additionally need his birth certificate, as well as an old international passport, if he had one. In addition, to fill out an application for a new generation passport for children and adolescents under the age of 14, the following documents will be required:

- passport of a Russian citizen of the parent/other legal representative;

- a document certifying that the minor applicant has Russian citizenship (insert in the birth certificate, if one was issued);

- act of the guardianship and trusteeship authority on the appointment of a guardian/trustee (if any).

The completed application form is printed out in duplicate and submitted in person to the MFC or the Main Directorate for Migration of the Ministry of Internal Affairs of the Russian Federation.

General recommendations and nuances that you should pay attention to when filling out the application form:

- the place of birth is indicated exactly as in the internal passport;

- date of birth is indicated in numbers;

- when filling out by hand, the data must be entered in printed capital letters, the ink color is black or blue;

- the address of registration (registration) on the territory of the Russian Federation is indicated as the place of residence;

- after printing, the electronic application form is certified by the applicant’s signature by hand;

- do not paste the photo yourself - this is the task of the specialists who accept your package of documents;

- Full name is entered on one line;

- email and telephone number are indicated at the request of the applicant;

- the need to have the application form certified at the place of work has been cancelled.

Instructions for filling out the questionnaire for persons over 18 years of age

When the application form is already in your hands, we proceed to entering the data:

- FULL NAME. Indicated in full, as in the passport. If there is no surname or patronymic, what is available is indicated. However, the simultaneous absence of a first and last name is not allowed.

- Floor. Select the desired one from two options and put a cross in the form.

- Applicant's date of birth. Specified in full in the format DD.MM.YYYY.

- Place of Birth. All data from the birth certificate is entered.

- Information about changing your name. Entered only if the applicant changed his last name, indicating the date and place of the data change.

- Residence address. It is written in full, as in the national internal passport. In this case, the subject in the application for a foreign passport is the region in which a specific settlement is located.

- Instead of the registration address, the address of actual residence may be indicated.

- A telephone number is provided at the request of the applicant.

- Email. Indicated at the request of the applicant as an additional contact.

- Details of the Russian passport, as they are indicated in the document.

- Paragraphs 11 and 12 indicate whether the applicant has access to information of special importance and contracts, under the terms of which it is impossible to travel outside the Russian Federation. If everything is normal, just put a cross next to “no”.

- Details of your existing foreign passport. To be entered if the document has not expired.

- Information about the applicant's activities over the past 10 years. This includes study, work, military service. If there is a shortage of columns, the information is indicated in Appendix No. 2 (2a) (Information on changes in personal data. Information on work activity over the last 10 years).

As for pensioners, for them the instructions for filling out are no different from the main ones. The only caveat is filling out block 14 about the applicant’s activities over the past 10 years. If this period includes at least a year of work, then this must be indicated. The years of retirement are indicated in the column “Position and place of work” as follows: “Did not work. Pensioner". In the column “Location of the organization, educational institution” the home address is indicated. All addresses are indicated without an index.

In the Responsibility block, checkboxes are placed to confirm your consent and awareness. All signatures are placed as in a passport.

A sample application form for a biometric passport is presented below.

Features of filling out the application form for a foreign passport for persons under 18 years of age

The interests of minor citizens of the Russian Federation under the age of 18 are represented by their parents/legal representatives.

Features of filling out a questionnaire for a child:

Which country would you rather live in? ⚡ Take the test in 2 minutes

- Roman numerals from the birth certificate number are indicated in Latin capital letters;

- series, birth certificate number and registration number are not required to fill out the column when submitting an application in electronic form (if they are not present in a document issued in another state);

- A student or student enrolled in a foreign university indicates in the application for a foreign passport temporary departure or residence as the purpose of obtaining the document.

The sample will help you fill out the application form correctly.

If you are unable to complete the form yourself, you can contact a company that provides such services for help. The cost of such consultations ranges from 300-500 rubles.