Changes affecting organizations that have the right to conduct “simplified” accounting affected:

- PBU 5/01 “Accounting for inventories”;

- PBU 6/01 “Accounting for fixed assets”;

- PBU 14/2007 “Accounting for intangible assets”;

- PBU 17/02 “Accounting for expenses for research, development and technological work.”

Let's remember who today uses simplified accounting methods and prepares simplified accounting (financial) statements.

Who conducts “simplified” accounting

The list of persons who can apply simplified methods of accounting and prepare simplified accounting (financial) statements is given in Article 6 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” (hereinafter referred to as Law No. 402-FZ). These include economic entities whose reporting is not subject to mandatory audit:

- small businesses;

- non-profit organizations;

- organizations that have received the status of participants in a project to carry out research, development and commercialization of their results in accordance with the Federal Law of September 28, 2010 No. 244-FZ “On Innovation.

Does not have the right to conduct “simplified” accounting (Part 5, Article 6 of Law No. 402-FZ):

- housing and housing construction cooperatives;

- credit consumer cooperatives (including agricultural credit consumer cooperatives);

- microfinance organizations;

- bar associations;

- law offices;

- lawyer consulting;

- bar associations;

- notary chambers;

- non-profit organizations included in the register of non-profit organizations performing the functions of a foreign agent (Clause 10, Article 13.1 of the Federal Law of January 12, 1996 No. 7-FZ “On Non-Profit Organizations”).

Reflection of inventories in financial statements according to PBU 05/01

PBU 05/01 also regulates the procedure for reflecting information about inventories in accounting reports. Inventories should be reflected in it in accordance with a classification that takes into account the method of their use in economic activities.

As of the end of the reporting year, inventories are shown on the balance sheet at cost, which is established based on the methods used to evaluate the corresponding reserves.

Materials and equipment that are obsolete or have lost their marketable appearance or have become cheaper are reflected in the balance sheet at the end of the year minus the reserves provided for the reduction in the value of inventories. The corresponding reserve is formed at the expense of financial results by the amount of the difference between the market value and the actual cost of inventories if the second indicator is higher than the first. This norm may not be followed by companies that conduct simplified accounting (clause 26 of PBU 5/01).

Inventory that is in transit or transferred to the consumer as collateral, the rights to which have been transferred to the legal entity, are reflected in accounting based on the assessment provided for in the contract, with further clarification of their actual cost.

The following must be included in inventory accounting:

- methods for assessing MPZ in relation to their groups or varieties;

- information about the consequences of changes to these assessment methods;

- the cost of inventories pledged as collateral;

- the amount and movement of reserves for reducing the cost of materiel.

For information on how management accounting for inventories is organized, read the article “Management accounting of inventories (nuances).”

Who is a small business?

The categories of small and medium-sized businesses are established by Federal Law No. 209-FZ of July 24, 2007 “On the development of small and medium-sized businesses in the Russian Federation” (hereinafter referred to as Law No. 209-FZ). These include business societies, business partnerships, production cooperatives, agricultural consumer cooperatives, peasant (farm) households and individual entrepreneurs, if they meet the criteria specified in Part 1.1 of Law No. 209-FZ. For example, business companies (joint stock and limited liability) are recognized as small and medium-sized businesses if:

1. The requirements specified in paragraph 1 of part 1.1 of Article of Law No. 209-FZ have been met. One of them is based on the share of participation in the authorized capital of a joint-stock company or LLC of the state, public, religious and charitable organizations and other foundations, foreign legal entities or legal entities that are not small and medium-sized businesses.

2. The average number of employees of the company for the previous calendar year does not exceed one hundred people. At the same time, among small enterprises, microenterprises with a maximum number of employees of fifteen people are distinguished. The average headcount should be determined in accordance with the Instructions for filling out the federal statistical observation form No. PM “Information on the main performance indicators of a small enterprise”, approved by Rosstat order No. 33 dated January 29, 2016.

3. The “tax” income of the company from business activities for the previous calendar year in the amount of all types of activities carried out and all tax regimes does not exceed 800 million rubles for a small enterprise, and 120 million rubles for a micro-enterprise (clause 1 of the resolution of the Government of the Russian Federation dated 07/13/2015 No. 702).

Inventory reporting in accordance with IFRS

IFRS requires firms to disclose when reporting inventories:

- the principles of the adopted accounting policy regarding the valuation of inventories, as well as the formula for estimating their cost;

- the total cost of all inventories for inventories, as well as specific types of inventories that are used in the organization;

- the carrying amount of inventories, which are accounted for at fair value, but less costs to sell;

- the size of inventories, which are recognized as expenses within the reporting period;

- amounts for any write-offs of the cost of inventories that are recognized as expenses within the reporting period;

- amounts for any reversals of write-offs that are recognized as a decrease in inventory, which is reflected as an expense within the reporting period;

- obligations or events as a result of which the write-off of the cost of inventories was restored;

- the book value of inventories that were pledged as a means of fulfilling the company’s obligations.

Fair value in the context of IFRS 2 is the price that a firm would receive to sell an inventory or pay to transfer a liability in an orderly transaction with a counterparty at the time the asset is measured.

Read about who in the Russian Federation has the obligation to prepare financial statements under IFRS here .

Who submits “simplified” reporting

As a general rule, small businesses have the right to prepare reports using both regular and simplified forms (Part 4, Article 6 of Law No. 402-FZ). The difference between simplified forms and regular ones is that they reflect all indicators by groups of articles.

The only business entities that cannot submit “simplified” reporting are:

- organizations whose accounting (financial) statements are subject to mandatory audit in accordance with the legislation of the Russian Federation;

- lawyer consulting;

- microfinance organizations. These include legal entities included in the state register of microfinance organizations and engaged in providing microloans, the amount of which cannot exceed 1 million rubles (clauses 1, 2, 3, part 1, article 2 of the Federal Law of July 2, 2010 No. 151- Federal Law “On microfinance activities and microfinance organizations”).

For organizations that have the right to use simplified methods of accounting, including simplified financial statements, simplified forms of the Balance Sheet and Statement of Financial Results have been approved (clause 6.1 of Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010).

Simplified accounting forms

The official website of the Ministry of Finance (minfin.ru) contains the document “Recommendations for small businesses on the use of simplified methods of accounting and preparation of accounting (financial) statements” (hereinafter referred to as the Recommendations). The recommendations were developed by the Institute of Professional Accountants and Auditors of Russia.

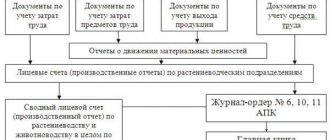

Three possible ways to organize simplified accounting are recommended:

- Full form. It resembles ordinary accounting, since here, too, all business transactions are accounted for using the double entry method in the appropriate registers;

- Short form. It provides that all facts of economic life must be recorded through double entry in one document - the Book (journal) of accounting for the facts of economic life. The form of this book can be developed independently on the basis of Form No. K-1 MP, approved in Appendix 11 to the Recommendations. The amounts for each transaction in the Book in the column “Amount” must be reflected in a double entry - simultaneously in the columns “Debit” and “Credit” of the corresponding accounts of the working Chart of Accounts;

- A simple system for introducing accounting. Only micro-enterprises can maintain accounting records using a simple system. In this case, there is no double entry (that is, the amounts for the debit and credit of accounts do not need to be reflected). All business transactions are recorded in a separate journal. It can be compiled on the basis of the Book (journal) of recording the facts of economic life (form No. K-2 MP), given in Appendix 12 to the Recommendations.

Inventory accounting according to IFRS: governing legislation

We are talking about the adoption of International Standard (IAS) 2 “Inventories”. It was put into effect by order of the Ministry of Finance of the Russian Federation dated December 28, 2015 No. 217n; its text in Russian is given in Appendix 2 to this order.

In this legal regulation, reserves are understood as assets that:

- held for sale in the ordinary course of business of the firm;

- are manufactured in production for the purpose of further sale;

- are in the form of raw materials or materials that are used by the company in production or in the provision of services.

Inventories in IFRS also mean:

- goods purchased by the company for the purpose of further resale;

- finished products;

- remains of work in progress, which are subject to further use by the company during production.

By analogy with the procedures discussed above, regulated by Russian PBU 05/01, we will consider which standards of IFRS 2 can be applied to assess the value of inventories and generate reports on inventories.

PBU 14/2007 - NMA

As a general rule, the cost of intangible assets belonging to a commercial organization with a certain useful life is repaid through depreciation (clause 23 of PBU 14/2007 “Accounting for intangible assets”, approved by order of the Ministry of Finance of Russia dated December 27, 2007 No. 153n, hereinafter referred to as PBU 14/2007) . Depreciation begins on the first day of the month following the month the intangible asset was accepted for accounting, and is accrued until the cost is fully repaid or the asset is written off from accounting (clause 31 of PBU 14/2007).

Example 9

. Reflection of expenses for the purchase of intangible assets in “regular” accounting

A trade organization using the simplified tax system paid 84,960 rubles for the development of an Internet site. (including VAT 12,960 rubles) and received exclusive rights to it. The useful life of the site is 80 months. Depreciation on intangible assets is calculated using the straight-line method.

An accountant conducting “regular” accounting will make the following entries:

DEBIT 08-5 CREDIT 60

— 72,000 rub. (84,960 – 12,960) – the costs of creating a website are included in the initial cost of the website;

DEBIT 19 CREDIT 60

— 12,960 rub. – reflects the “input” VAT presented by the site developer;

DEBIT 08-5 CREDIT 60

— 12,960 rub. – “input” VAT is included in the initial cost of the site;

DEBIT 04 CREDIT 08-5

— 84,960 rub. – the site is accepted for registration as part of intangible assets;

DEBIT 60 CREDIT 51

— 84,960 rub. – paid for website development.

From next month, monthly:

DEBIT 44 CREDIT 05

— 1062 rub. (RUB 84,960 / 80) – depreciation on the site has been accrued.

However, now an organization that maintains simplified accounting will be able to recognize expenses for the acquisition (creation) of objects that meet the criteria of intangible assets as part of expenses for ordinary activities in the full amount as they are carried out (clause 3.1 of PBU 14/2007).

PBU 5/01 ACCOUNTING OF INVENTORIES

5. Inventories are accepted for accounting at actual cost.

6. The actual cost of inventories purchased for a fee is the amount of the organization’s actual costs for the acquisition, with the exception of value added tax and other refundable taxes (except for cases provided for by the legislation of the Russian Federation).

The actual costs of purchasing inventories include:

amounts paid in accordance with the agreement to the supplier (seller);

amounts paid to organizations for information and consulting services related to the acquisition of inventories;customs duties;

non-refundable taxes paid in connection with the acquisition of a unit of inventory;

remunerations paid to the intermediary organization through which inventories were acquired;

costs for the procurement and delivery of inventories to the place of their use, including insurance costs. These costs include, in particular, costs for the procurement and delivery of inventories; costs of maintaining the procurement and warehouse division of the organization, costs of transport services for the delivery of inventories to the place of their use, if they are not included in the price of inventories established by the contract; accrued interest on loans provided by suppliers (commercial loan); interest on borrowed funds accrued before the inventory was accepted for accounting, if it was raised for the acquisition of these inventories;

costs of bringing inventories to a state in which they are suitable for use for the intended purposes. These costs include the organization’s costs of processing, sorting, packaging and improving the technical characteristics of received stocks, not related to the production of products, performance of work and provision of services;

other costs directly related to the acquisition of inventories.

General and other similar expenses are not included in the actual costs of purchasing inventories, except when they are directly related to the acquisition of inventories.

7. The actual cost of inventories during their production by the organization itself is determined based on the actual costs associated with the production of these inventories. Accounting and formation of costs for the production of inventories is carried out by the organization in the manner established for determining the cost of relevant types of products.

8. The actual cost of inventories contributed as a contribution to the authorized (share) capital of the organization is determined based on their monetary value agreed upon by the founders (participants) of the organization, unless otherwise provided by the legislation of the Russian Federation.

9. The actual cost of inventories received by an organization under a gift agreement or free of charge, as well as those remaining from the disposal of fixed assets and other property, is determined based on their current market value as of the date of acceptance for accounting.

For the purposes of this Regulation, current market value means the amount of money that can be received as a result of the sale of these assets.

10. The actual cost of inventories received under contracts providing for the fulfillment of obligations (payment) in non-monetary means is recognized as the cost of assets transferred or to be transferred by the organization. The value of assets transferred or to be transferred by an organization is established based on the price at which, in comparable circumstances, the organization usually determines the value of similar assets.

If it is impossible to determine the value of assets transferred or to be transferred by an organization, the value of inventories received by the organization under agreements providing for the fulfillment of obligations (payment) in non-monetary means is determined based on the price at which similar inventories are purchased in comparable circumstances.

11. The actual cost of inventories, determined in accordance with paragraphs , and of these Regulations, also includes the actual costs of the organization for the delivery of inventories and bringing them into a condition suitable for use, listed in paragraph of these Regulations.

12. The actual cost of inventories, in which they are accepted for accounting, is not subject to change, except in cases established by the legislation of the Russian Federation.

13. An organization engaged in trading activities may include the costs of procuring and delivering goods to central warehouses (bases), incurred until they are transferred for sale, as part of sales costs.

Goods purchased by an organization for sale are valued at their cost of acquisition. An organization engaged in retail trade is allowed to evaluate purchased goods at their selling price with separate consideration of markups (discounts).

13.1. An organization that has the right to use simplified accounting methods, including simplified accounting (financial) reporting, can evaluate purchased inventories at the supplier’s price. In this case, other costs directly related to the acquisition of inventories are included in expenses for ordinary activities in full in the period in which they were incurred.

13.2. A micro-enterprise that has the right to use simplified accounting methods, including simplified accounting (financial) statements, may recognize the cost of raw materials, supplies, goods, other costs for production and preparation for sale of products and goods as expenses for ordinary activities in the full amount at as they are acquired (implemented).

Another organization that has the right to use simplified accounting methods, including simplified accounting (financial) statements, may recognize these costs as expenses for ordinary activities in full, provided that the nature of the activity of such an organization does not imply the presence of significant material and production balances stocks. At the same time, significant balances of inventories are considered to be those balances, information about the presence of which in the financial statements of an organization can influence the decisions of users of the financial statements of this organization.

13.3. An organization that has the right to apply simplified accounting methods, including simplified accounting (financial) statements, may recognize expenses for the acquisition of inventories intended for management needs as expenses for ordinary activities in the full amount as they are acquired (implemented) ).

14. Inventories that do not belong to the organization, but are in its use or disposal in accordance with the terms of the contract, are taken into account in the assessment provided for in the contract.

PBU 17/02 - R&D

As a general rule, R&D expenses that yield a positive result are written off as expenses for ordinary activities from the 1st day of the month following the month in which the actual application of the results obtained from R&D in the production of products (performance of work, provision of services) began ), or for the management needs of the organization (clause 10 of PBU 17/02 “Accounting for expenses for research, development and technological work”, approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 115n, hereinafter referred to as PBU 17/02). You can write off R&D expenses either linearly or in proportion to the volume of products, work, and services (clause 11 of PBU 17/02). Let's give an example.

Example 10

. Reflection of R&D expenses under “regular” accounting

The organization paid a third-party contractor for work to improve its products at a cost of 81,000 rubles. (without VAT). The work gave a positive result, which is used in production activities. In the month of completion of the work, the organization made settlements with the contractor and began using the results of R&D that are not subject to legal protection. The period for writing off R&D expenses on a straight-line basis is four and a half years (54 months).

An accountant conducting “regular” accounting will make the following entries:

DEBIT 08-8 CREDIT 60

— 81,000 rub. – the debt for payment for work performed is reflected;

DEBIT 04 CREDIT 08-8

— 81,000 rub. – R&D that produced a positive result was taken into account;

DEBIT 60 CREDIT 51

— 81,000 rub. – paid for the work performed.

From next month, monthly:

DEBIT 20 CREDIT 04

— 1500 rub. (RUB 81,000 / 54) – another part of R&D expenses was written off.

However, now an organization that has the right to conduct simplified accounting will be able to write off R&D expenses as expenses for ordinary activities in the full amount as they are carried out (clause 14 of PBU 17/02).

I. General provisions

1. These Regulations establish the rules for the formation in accounting of information about the organization’s inventories. An organization is further understood as a legal entity under the laws of the Russian Federation (with the exception of credit organizations and budgetary institutions).

2. For the purposes of these Regulations, the following assets are accepted for accounting as inventory:

- used as raw materials, materials, etc. in the production of products intended for sale (performance of work, provision of services);

- intended for sale;

- used for the management needs of the organization.

Finished products are part of the inventory intended for sale (the final result of the production cycle, assets completed by processing (assembly), the technical and quality characteristics of which comply with the terms of the contract or the requirements of other documents, in cases established by law). Goods are part of inventory purchased or received from other legal entities or individuals and intended for sale.

3. The accounting unit for material and industrial inventories is selected by the organization independently in such a way as to ensure the formation of complete and reliable information about these inventories, as well as proper control over their availability and movement. Depending on the nature of inventories, the order of their acquisition and use, a unit of inventories may be an item number, a batch, a homogeneous group, etc.

4. This Regulation does not apply to:

- assets used in the production of products, performance of work or provision of services or for the management needs of the organization for a period exceeding 12 months or the normal operating cycle, if it exceeds 12 months;

- assets characterized as work in progress.

From when to apply innovations?

If an organization decides to take advantage of new opportunities, it will have to change its accounting policy for accounting purposes (clause 10 of PBU 1/2008 “Accounting Policy of an Organization,” approved by Order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n). Such organizations can reflect changes in accounting policies in their financial statements prospectively, that is, without adjusting the reporting indicators of previous periods (clause 15.1 of PBU 1/2008).

The reporting period is the period for which the organization must prepare financial statements (clause 4 of PBU 4/99 “Accounting statements of an organization”, approved by order of the Ministry of Finance of Russia dated July 6, 1999 No. 43n, hereinafter referred to as PBU 4/99). Reporting should be prepared for the month, quarter and year on an accrual basis from the beginning of the reporting year, unless otherwise established by the legislation of the Russian Federation. The reporting period for annual financial statements (reporting year) is the calendar year - from January 1 to December 31 inclusive, with the exception of cases of creation, reorganization and liquidation of a legal entity. At the same time, the financial statements for the month and quarter are interim (Part 1, Article 15 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting”, paragraph 29 of the Regulations on Accounting and Financial Reporting in the Russian Federation, approved by order Ministry of Finance of Russia dated July 29, 1998 No. 34n, clause 48 PBU 4/99).

According to the Ministry of Finance of Russia, when deciding to start using the above-mentioned simplified methods of accounting, one should proceed from the fact that in order to ensure comparability of financial statements for a number of years, changes in accounting policies are made from the beginning of the reporting year, unless otherwise determined by the reason for such a change (h 7 Article 8 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”). In this regard, the organization has the right to decide to apply each of the above simplified accounting methods in relation to financial statements both for 2021 and for any subsequent year.

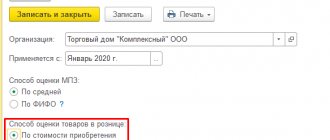

Valuation of reserves upon disposal according to PBU 05/01

Another inventory accounting procedure regulated by PBU 05/01 is their assessment upon disposal. It can be carried out based on:

- from the cost of a unit of material stock;

- average cost of inventories;

- the cost of the very first purchased inventories - using the FIFO method.

If inventories are used by a company in a special manner or are not interchangeable in normal use, they can be valued based on the cost of each unit of inventory.

If the accounting policy defines a specific method of accounting for inventories for the reporting year, only this method should be used during the corresponding period. The method of accounting for inventories is selected based on its applicability to the activities carried out by the legal entity.

The assessment of inventories that do not relate to goods, which are recorded at sales value, as of the end of the reporting period is carried out in the same way as is used when disposing of the corresponding inventories.