Filling out 6-NDFL when changing tax residence

Tax residents are individuals who are actually in the Russian Federation for at least 183 calendar days over the next 12 consecutive months. This is established by the Tax Code (clause 2 of Article 207 of the Tax Code of the Russian Federation). This period is not interrupted, for example, during his travel outside the territory of the Russian Federation for short-term (less than six months) treatment or training and in some other cases.

Filling out 6-NDFL for non-residents

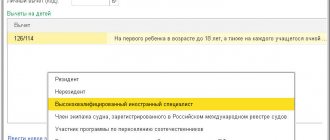

If during the year the employee was a resident, and on December 31 he became a non-resident for personal income tax, the calculation in form 6-NDFL for 2021 is filled out as follows:

- in line 010 - 30 percent;

- line 020 reflects the amount of income actually accrued for the year;

- in line 040 - the amount of tax calculated at a tax rate of 30 percent;

- in line 070 - the amount of tax actually withheld for the year at a tax rate of 13 percent;

- in line 080 - the amount of tax not withheld by the tax agent (the difference between the amount of calculated and actually withheld tax);

- in lines 100-140 - actual data on transactions performed over the last three months.

In this case, the tax agent, based on the provisions of paragraph 5 of Article 226 of the Tax Code, is obliged no later than March 1 of the following year to provide the taxpayer and the tax authority with information about the impossibility of withholding tax, the amount of income from which tax was not withheld, and the amount of unwithheld tax. The amount of tax not withheld by the tax agent is paid by an individual on the basis of the submitted tax return form 3-NDFL.

Submission of updated calculations for previous periods is not required.

EXAMPLE 1

The employee was registered as a member of the company on June 16. His status for personal income tax purposes is tax resident. The employee's salary is 30,000 rubles. From this income, the accountant withheld personal income tax monthly at a rate of 13%. In December, due to foreign business trips, the employee ceased to be a tax resident for personal income tax.

The amount of income for the period of work amounted to 195,000 rubles.

Personal income tax withheld at a rate of 13% for the period June-November - 21,450 rubles.

Personal income tax recalculated at a rate of 30% as of December 31 - 58,500 rubles.

Amount of tax not withheld by the tax agent:

58,500 – 21,450 = 37,050 rub.

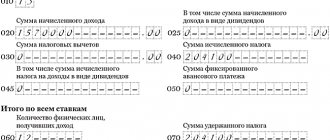

A sample of filling out Form 6-NDFL for the year is given below.

Filling out form 6-NDFL for non-residents

Filling out 6-NDFL for residents

Now let’s consider the opposite situation, if during the year the employee was a non-resident, and on December 31 he became a resident.

According to the clarifications of the Ministry of Finance of Russia (letter of the Ministry of Finance of Russia dated August 12, 2011 No. 03-04-08/4-146), starting from the month in which the number of days of the employee’s stay in the Russian Federation in the current tax period exceeded 183 days, the tax amounts withheld by the tax agent from his income before he receives tax resident status at a rate of 30 percent are subject to offset by the tax agent when determining the tax base on an accrual basis for all amounts of the employee’s income, including income on which tax was withheld at a rate of 30 percent.

Thus, in the case of payment of taxable income to an employee on December 31, the tax agent offsets the amounts of personal income tax withheld from the beginning of the year at a tax rate of 30 percent against the tax calculated on such income.

In this case, the payer returns the amount of tax excessively withheld by the tax agent on the basis of the provisions of paragraph 1.1 of Article 231 of the Tax Code on the basis of the submitted tax return form 3-NDFL.

Submission by the tax agent of updated calculations of Form 6-NDFL for previous periods is not required.

The calculation according to Form 6-NDFL for 2021 is filled out as follows:

- in line 010 - 13 percent;

- line 020 reflects the amount of income actually accrued for the year;

- in line 040 - the amount of tax calculated at a tax rate of 13 percent;

- in line 070 - the amount of tax actually withheld for the year at a tax rate of 30 percent;

- in lines 100-140 - actual data on transactions performed over the last three months.

EXAMPLE 2

The employee was registered as a member of the company on June 16. His status for personal income tax purposes is not a tax resident. The employee's salary is 30,000 rubles. From this income, the accountant withheld personal income tax monthly at a rate of 30%. In December, the employee received tax resident status for personal income tax.

The amount of income for the period of work amounted to 195,000 rubles.

Personal income tax withheld at a rate of 30% for the period June-November - 49,500 rubles.

Personal income tax recalculated at a rate of 13% as of December 31—RUB 25,350.

Amount of tax over-withheld by the tax agent:

49,500 – 25,350 = 24,150 rubles.

A sample of filling out Form 6-NDFL for the year for this situation is given below.

Filling out form 6-NDFL for residents

If a resident has become a non-resident, there is no need to recalculate personal income tax

At the end of last year, the Russian Ministry of Finance issued a letter No. 03-04-06/6–332 dated November 22, 2012, in which the financial department expressed its opinion that at the end of the year the organization should clarify the final tax status of employees and, if necessary, recalculate Personal income tax. That is, if it turns out that an employee who was a tax resident of Russia at the beginning of the year ceased to be one as of some date (stayed in the Russian Federation for less than 183 days a year), then the organization must recalculate the amount of personal income tax for the entire year at the rate 30 percent instead of 13.

But the implementation of such recommendations is fraught with significant financial losses for such workers. Therefore, it makes sense to argue with them.

The fact is that the Tax Code of the Russian Federation does not contain provisions on the recalculation of taxes when the status of a taxpayer changes. The tax status is determined for each tax payment date based on the actual time an individual is in the territory of the Russian Federation. Previously, officials of the Russian Ministry of Finance also agreed with this (letter dated May 31, 2012 No. 03-04-05/6–670).

The approach of the Ministry of Finance of Russia, expressed in its letter dated November 22, 2012 No. 03-04-06/6–332, does not comply with the norms of tax legislation. Moreover, paragraph 2 of Article 210 of the Tax Code of the Russian Federation directly states that the tax base for personal income tax is determined separately for each type of income, for which different tax rates are established.

To calculate personal income tax on the income of residents, paragraph 3 of Article 226 of the Tax Code of the Russian Federation provides the following algorithm: income is taken into account on an accrual basis from the beginning of the year, the amount received is taxed at a rate of 13 percent. And then the tax previously calculated in previous months is deducted from it. As for the income of non-residents, personal income tax on them is calculated separately for each amount.

In their letter, officials of the Russian Ministry of Finance refer to the fact that the tax period for personal income tax is the calendar year (Article 216 of the Tax Code of the Russian Federation). However, this does not mean that the tax base for the tax is always considered only as a cumulative total.

This was also confirmed by the Presidium of the Supreme Arbitration Court of the Russian Federation in its resolution dated 07/05/11 No. 1051/11, indicating that the deadlines for withholding and transferring personal income tax to the budget are provided for in Article 226 of the Tax Code of the Russian Federation and are not related to the end of the tax period.

Thus, for those employees whose status has changed from resident to non-resident, there is no need to recalculate the tax base at the end of the year. The 30 percent tax rate must be applied from the date on which the resident lost his or her status.

Career

At the end of the personal income tax period, it is necessary to determine the tax status of the employee so that there are no problems with tax amounts that may be excessively withheld, or vice versa. We are considering options for changing tax status and filling out form 6-NDFL.

| The article is published within the framework of cooperation between HRMaximum and the journal “Actual Accounting”. |

Tax residents are individuals who are actually in the Russian Federation for at least 183 calendar days over the next 12 consecutive months. This is established by the Tax Code (clause 2 of Article 207 of the Tax Code of the Russian Federation). This period is not interrupted, for example, during his travel outside the territory of the Russian Federation for short-term (less than six months) treatment or training and in some other cases.

Filling out 6-NDFL for non-residents

If during the year the employee was a resident, and on December 31 he became a non-resident for personal income tax, the calculation in form 6-NDFL for 2021 is filled out as follows:

- in line 010 - 30 percent;

— line 020 reflects the amount of income actually accrued for the year;

- in line 040 - the amount of tax calculated at a tax rate of 30 percent;

- in line 070 - the amount of tax actually withheld for the year at a tax rate of 13 percent;

- in line 080 - the amount of tax not withheld by the tax agent (the difference between the amount of calculated and actually withheld tax);

- in lines 100-140 - actual data on operations performed over the last three months.

In this case, the tax agent, based on the provisions of paragraph 5 of Article 226 of the Tax Code, is obliged no later than March 1 of the following year to provide the taxpayer and the tax authority with information about the impossibility of withholding tax, the amount of income from which tax was not withheld, and the amount of unwithheld tax. The amount of tax not withheld by the tax agent is paid by an individual on the basis of the submitted tax return form 3-NDFL.

Submission of updated calculations for previous periods is not required.

EXAMPLE 1

The employee was registered as a member of the company on June 16. His status for personal income tax purposes is tax resident. The employee's salary is 30,000 rubles. From this income, the accountant withheld personal income tax monthly at a rate of 13%. In December, due to foreign business trips, the employee ceased to be a tax resident for personal income tax.

The amount of income for the period of work amounted to 195,000 rubles.

Personal income tax withheld at a rate of 13% for the period June-November - 21,450 rubles.

Personal income tax recalculated at a rate of 30% as of December 31 - 58,500 rubles.

Amount of tax not withheld by the tax agent:

58,500 – 21,450 = 37,050 rub.

A sample of filling out Form 6-NDFL for the year is given below.

Filling out form 6-NDFL for non-residents (see example)

Filling out 6-NDFL for residents

Now let’s consider the opposite situation, if during the year the employee was a non-resident, and on December 31 he became a resident.

According to the clarifications of the Ministry of Finance of Russia (letter of the Ministry of Finance of Russia dated August 12, 2011 No. 03-04-08/4-146), starting from the month in which the number of days of the employee’s stay in the Russian Federation in the current tax period exceeded 183 days, the tax amounts withheld by the tax agent from his income before he receives tax resident status at a rate of 30 percent are subject to offset by the tax agent when determining the tax base on an accrual basis for all amounts of the employee’s income, including income on which tax was withheld at a rate of 30 percent.

Thus, in the case of payment of taxable income to an employee on December 31, the tax agent offsets the amounts of personal income tax withheld from the beginning of the year at a tax rate of 30 percent against the tax calculated on such income.

In this case, the payer returns the amount of tax excessively withheld by the tax agent on the basis of the provisions of paragraph 1.1 of Article 231 of the Tax Code on the basis of the submitted tax return form 3-NDFL.

Submission by the tax agent of updated calculations of Form 6-NDFL for previous periods is not required.

The calculation according to Form 6-NDFL for 2021 is filled out as follows:

- in line 010 - 13 percent;

— line 020 reflects the amount of income actually accrued for the year;

- in line 040 - the amount of tax calculated at the tax rate of 13 percent;

- in line 070 - the amount of tax actually withheld for the year at a tax rate of 30 percent;

- in lines 100-140 - actual data on operations performed over the last three months.

EXAMPLE 2

The employee was registered as a member of the company on June 16. His status for personal income tax purposes is not a tax resident. The employee's salary is 30,000 rubles. From this income, the accountant withheld personal income tax monthly at a rate of 30%. In December, the employee received tax resident status for personal income tax.

The amount of income for the period of work amounted to 195,000 rubles.

Personal income tax withheld at a rate of 30% for the period June-November - 49,500 rubles.

Personal income tax recalculated at a rate of 13% as of December 31—RUB 25,350.

Amount of tax over-withheld by the tax agent:

49,500 – 25,350 = 24,150 rubles.