Recently, many questions have been received about the taxes that citizens pay for their property, apartment, house, land and car. This tax raises quite a few questions about its fairness. After all, when purchasing property, we spend our earned money, from which tax has already been withheld. Every person needs somewhere to live, and it turns out that even for the only housing you need to pay a tax every year.

And recently news began to appear in various media that the issue of abolishing this type of tax is currently being discussed, and the information is different.

Some sources write that individuals may be exempt from property tax on one property (for example, a single home), others write that they will not have to pay property tax at all, etc.

But let’s take a closer look at whether such information has any connection with reality.

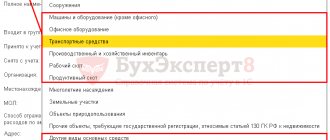

When movable property is included in the tax base

Property on the balance sheet of an enterprise is subject to tax. This is stated in the first paragraph of Article 374 of the Tax Code of the Russian Federation. Real estate is easy. It is always included in the payment, but you do not need to pay for part of the movable property. These objects are included in the list reflected in paragraph 4 of article 374.

This includes property:

- under the control of the state, which is used to strengthen defense capabilities and reduce the crime level;

- recognized as a cultural heritage or historical monument of the country;

- nuclear equipment used in scientific activities;

- waterborne special equipment: nuclear icebreakers, ships with nuclear installations and ships registered with the Russian Maritime Register (RMRS);

- classified by the government as the 1st or 2nd depreciation group of fixed assets of the enterprise;

- related to the space industry.

If there is no ownership right to movable property used in production, tax accounting is carried out in a special way. The details are described in Article 378 of the Tax Code. The above applies to a concession agreement, according to which the true owner transfers the thing for a time to the party that created it - the concessionaire.

The legislation of the Russian Federation provides for benefits when levying tax on movable property. They completely exempt citizens from paying. Article 381 of the Tax Code in paragraph 25 states that property registered before January 1, 2013 is not included in the tax base.

For which objects will you need to pay tax in 2021?

Based on paragraph 1 of Article 130 of the Civil Code of the Russian Federation, real estate includes land plots, subsoil plots and everything that is firmly connected to the land, that is, objects whose movement without disproportionate damage to their purpose is impossible, including:

- buildings, structures, unfinished construction projects;

- residential and non-residential premises;

- parts of buildings or structures intended to accommodate vehicles (car spaces), if the boundaries of such premises, parts of buildings or structures are described in the prescribed manner.

Real estate also includes objects subject to state registration: aircraft and sea vessels, inland navigation vessels. The Civil Code of the Russian Federation allows other property to be classified as real estate if it is defined by law (for example, space objects).

To confirm the existence of grounds for classifying a property as real estate, the Federal Tax Service of Russia recommends that the tax authorities establish the following circumstances (letter dated 02.08.2018 No. BS-4-21/):

- availability of a record about the object in the Unified State Register of Real Estate;

- in the absence of information in the Unified State Register of Real Estate - the presence of grounds confirming the strong connection of the object with the ground and the impossibility of moving the object without disproportionate damage to its purpose.

For example, for capital construction projects, these may be documents of technical accounting or technical inventory of the object as real estate; permits for construction and (or) commissioning; design or other documentation for the creation of an object and (or) its characteristics.

When to submit a movable property tax return

Legal entities are required to do this 4 times a year. It is necessary to report for each quarter separately and for the entire year. If the movable property of an enterprise is legally accepted for tax registration, the procedure for submitting a document to the Federal Tax Service does not differ from the generally accepted one.

To calculate the tax base, it is necessary to determine the average cost of the objects included in it. In paragraph 4 of Article 376 of the Tax Code it is stated that in the case of considering the fixed assets of an organization for a specific time period, the assessment is made exclusively for this period. If we are talking about a quarter, take the average price of the property for 3 months.

Calculations are made by adding the residual monthly value of the objects and dividing the result by the number of months that make up the tax period.

Any owned movable item requires a separate calculation of the amount paid to the state. It is found by multiplying the average cost of a fixed asset by the current tax rate.

You also need to submit a tax return in the following cases:

- zero value of the taxable object;

- when placed on the organization’s balance sheet after January 2013, that is, subject to compliance with the requirements specified in paragraph 25 of Article 381.

If the value of a taxable object is restored through depreciation payments, it must be included in the declaration submitted to the Federal Tax Service. This is a requirement of the Tax Service, set out in Letter 03-03-05/128 in 2010. If we briefly talk about the content, then an item of movable property recognized as a taxable object is reflected in the declaration until it is sold, registered as a contribution to the authorized capital, or exchanged. As long as he is registered, the obligation to report to the Federal Tax Service does not disappear.

The requirement to pay property tax arises upon documentary evidence of ownership. In this case, the taxpayer is also provided with benefits. A complete list of organizations applying for exemption from property payments is given in Article 381 of the Tax Code.

Benefits do not apply to enterprises that received movable property due to reorganization, as well as in a transaction between interdependent companies.

Who is recognized as a taxpayer? The comprehensive answer is found in Article 373 of the Tax Code of Russia. Article 374 states how the object of taxation is determined. Its 4th paragraph provides a list of movable property that is not included in the tax base. For everything else you will have to pay a property fee.

Although property placed on the balance sheet after January 2013 is not required to pay tax, it must be included in the declaration prepared for the Federal Tax Service. Article 381 of the Tax Code does not directly indicate that these items of property are not taxable items.

In December 2014, the Tax Service of the Russian Federation published letter No. BS-4-11 / [email protected] According to it, the beneficiaries mentioned in paragraph 25 of Article 381 are obliged to enter the value 2010257 in line 160 with the title “Tax Benefit Code”. the law will not be amended accordingly.

According to current legislation, local government authorities are free to set the tax rate and the time limit for payment of property fees.

In the capital and St. Petersburg, legal entities pay 2.2% for movable fixed assets.

Debt to the state is repaid every 3, 6, 9 months and at the end of the year. The advance payment is made within the month following the reporting quarter. Full annual calculations are made no later than March 30 of the following tax period of the year.

Where does property tax go?

Property tax paid by individuals is a local tax, and the rate is set by the municipality. Accordingly, the funds collected go to the local budget. These funds are spent on the maintenance of social facilities, schools, kindergartens, and children's playgrounds are built in courtyards. Thus, property tax, according to officials, performs a social function. We are unlikely to know what the funds from such taxes are actually spent on, but according to the law it should be this way.

Taxation of movable property from January 1, 2021

From January 1, 2021, Federal Laws dated 08/03/2018 N 334-FZ, dated 08/03/2018 N 302-FZ and dated 08/03/2018 N 297-FZ introduced a number of changes to the procedure for taxing the property of organizations. We will tell you about the innovations in Chapter 30 of the Tax Code of the Russian Federation.

Taxation of movable property of organizations

Currently, the object of property tax for Russian organizations, as a general rule, is movable and immovable property recorded on the balance sheet as fixed assets in the manner established for accounting (clause 1 of Article 374 of the Tax Code of the Russian Federation). Taxation of movable property is regulated by clause 25 of Art. 381, clause 3.3 art. 380, art. 381.1 of the Tax Code of the Russian Federation and regional laws on property tax of organizations.

As a result of the application of the above norms in different regions of Russia, the taxation of movable property is not carried out uniformly: in some constituent entities of the Russian Federation, the tax on movable property was completely abandoned, in some regions a reduced rate was established for movable property (less than 1.1%). As a result, in the country as a whole, some organizations pay tax on movable property, others are exempt from it, and still others apply a preferential rate.

From 2021, the tax on movable property (vehicles, machines, equipment, etc.), called the production modernization tax, has been abolished.

The concept of “movable property”

The Tax Code of the Russian Federation does not contain a definition of the concepts “movable property” and “real estate”.

According to paragraph 1 of Art. 11 of the Tax Code of the Russian Federation, institutions, concepts and terms of civil, family and other branches of legislation of the Russian Federation used in this Code are applied in the meaning in which they are used in these branches of legislation, unless otherwise provided by the Tax Code of the Russian Federation. Therefore, when classifying an object as movable or immovable property for the purpose of applying the provisions of Chapter 30 of the Tax Code of the Russian Federation, it is necessary to take into account the norms of civil legislation.

According to paragraph 2 of Art. 130 of the Civil Code of the Russian Federation, things not related to real estate are recognized as movable property.

In turn, based on paragraph 1 of Art. 130 of the Civil Code of the Russian Federation, immovable things (real estate, real estate) include land plots, subsoil plots and everything that is firmly connected to the land, that is, objects whose movement without disproportionate damage to their purpose is impossible, including buildings, structures, unfinished construction objects . Real estate also includes residential and non-residential premises and parts of buildings or structures intended to accommodate vehicles (car spaces), if the boundaries of such premises, parts of buildings or structures are described in the prescribed manner. Federal law may also classify other property as real estate.

According to paragraph 1 of Art. 131 of the Civil Code of the Russian Federation, ownership and other real rights to immovable things, restrictions on these rights, their emergence, transfer and termination are subject to state registration in the unified state register by the bodies carrying out state registration of rights to real estate and transactions with it.

In accordance with Federal Law dated July 13, 2015 N 218-FZ “On State Registration of Real Estate,” real rights to real estate are subject to state registration in the Unified State Register of Real Estate (hereinafter referred to as the EGRN).

Thus, the legal grounds for determining the type of property (movable or immovable) must be established in accordance with the above-mentioned rules of civil law on the conditions for recognizing a thing as movable or immovable property.

In particular, to confirm the existence of grounds for classifying a property as real estate, it is advisable for tax authorities to establish the following circumstances:

— availability of a record about the object in the Unified State Register of Real Estate;

- in the absence of information in the Unified State Register of Real Estate - the presence of grounds confirming the strong connection of the object with the land and the impossibility of moving the object without disproportionate damage to its purpose (for example, for capital construction projects: the availability of technical registration documents or technical inventory of the object as real estate; construction permits and ( or) commissioning; design or other documentation for the creation of an object and (or) its characteristics).

Additionally, during a tax audit of property tax reporting of organizations, tax authorities (if there are grounds provided for by the Tax Code of the Russian Federation) may conduct inspections, appoint examinations, involve specialists, and request documents (information). Such clarifications are given in the Letter of the Federal Tax Service of Russia dated 08/02/2018 N BS-4-21/ [email protected]

So, movable property is property whose criteria and characteristics do not allow it to be classified as real estate.

Taxation of movable property until January 1, 2019

Changes in Chapter 30 of the Tax Code of the Russian Federation regarding the taxation of movable property have occurred several times in recent years.

From 01/01/2013 to 31/12/2014, movable property registered as fixed assets on January 1, 2013 was not recognized as an object of taxation for corporate property tax (subclause 8, clause 4, article 374 of the Tax Code of the Russian Federation, clause 3, art. 1, Article 3 of the Federal Law of November 29, 2012 N 202-FZ).

From 01/01/2015 to 31/12/2017, movable property was recognized as preferential and not excluded from taxation. Throughout Russia, there was a federal benefit in the form of tax exemption for movable property belonging to depreciation groups from 3 to 10, registered as fixed assets starting from 01/01/2013 (except for movable property, registered as a result of the reorganization or liquidation of legal entities, as well as received from interdependent entities recognized as such in accordance with clause 2 of Article 105.1 of the Tax Code of the Russian Federation). This exception from 01/01/2017 did not apply to railway rolling stock produced starting from 01/01/2013 (clause 25 of article 381 of the Tax Code of the Russian Federation, clause 57 of article 1, clause 5 of article 9 of the Federal Law of November 24, 2014 N 366 -FZ, subparagraph “b”, paragraph 4, article 2, paragraph 1, article 4 of the Federal Law of December 28, 2016 N 475-FZ).

From 01.01.2018 to 31.12.2018 in accordance with clause 1 of Art. 381.1 of the Tax Code of the Russian Federation, tax relief on movable property established by clause 25 of Art. 381 of the Tax Code of the Russian Federation, is valid in the territory of a specific region only if the corresponding law is adopted by a subject of the Russian Federation (clause 58, article 2, clause 5, article 13 of the Federal Law of November 30, 2016 N 401-FZ).

Clause 3.3 of Art. 380 of the Tax Code of the Russian Federation provides that tax rates determined by the laws of the constituent entities of the Russian Federation in relation to the property specified in paragraph 25 of Art. 381 of the Tax Code of the Russian Federation, not exempt from taxation in accordance with Art. 381.1 of the Tax Code of the Russian Federation cannot exceed 1.1% in 2021 (clause 69, article 2, clause 4, article 9 of the Federal Law of November 27, 2017 N 335-FZ). Therefore, if a constituent entity of the Russian Federation has not adopted a law establishing a tax benefit for movable property in 2018, then organizations must pay tax on the value of movable property specified in paragraph 25 of Art. 381 of the Tax Code of the Russian Federation, this year at a rate not higher than 1.1% (clause 3.3 of Article 380 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated April 27, 2018 N 03-05-06-04/28685). In particular, in the Penza region this rate is 0.55% (Law of the Penza Region dated December 20, 2017 N 3127-ZPO “On amendments to Article 2.4 of the Law of the Penza Region “On the establishment and enforcement of corporate property tax in the Penza Region” "), in Crimea and Sevastopol - 1% (clause 5 of Article 380 of the Tax Code of the Russian Federation, clause 1 of Article 4 of the Law of the Republic of Crimea dated November 19, 2014 N 7-ZRK/2014 “On the property tax of organizations”, clause 1 Article 2 of the Law of the city of Sevastopol dated November 26, 2014 N 80-ZS “On the property tax of organizations”). If a subject of the Russian Federation for 2018 has not adopted a law on the application of a federal tax benefit for movable property and has not reduced tax rates, then such property is taxed at a marginal rate of 1.1% (Letter of the Ministry of Finance of Russia dated December 19, 2017 N 03-05- 05-01/84676).

You can obtain detailed information about rates and benefits for property taxes of organizations in various constituent entities of the Russian Federation on the website of the Federal Tax Service of Russia using the service “Reference information on rates and benefits for property taxes” (https://www.nalog.ru/rn77/service/ tax/).

Note! Regional benefit in relation to movable property specified in paragraph 25 of Art. 381 of the Tax Code of the Russian Federation, may be provided for in relation to movable property objects belonging to the 3rd - 10th depreciation groups, since fixed assets included in the first or second depreciation group in accordance with the Classification of fixed assets included in depreciation groups approved by the Resolution Government of the Russian Federation dated 01/01/2002 N 1, are not recognized as objects of taxation in the period from 01/01/2015 to 12/31/2018 (subclause 8, clause 4, article 374 of the Tax Code of the Russian Federation, clause 55, article 1, clause 5, article 9 of the Federal Law of November 24, 2014 N 366-FZ, subparagraph “c” of clause 19 of Article 2, clause 2 of Article 4 of the Federal Law of August 3, 2018 N 302-FZ).

In addition, in 2021, in relation to movable property specified in paragraph 25 of Art. 381 of the Tax Code of the Russian Federation, from the date of issue of which no more than 3 years have passed, as well as property classified by the law of a constituent entity of the Russian Federation as innovative high-performance equipment, the law of a constituent entity of the Russian Federation may establish additional tax benefits up to the complete exemption of such property from taxation (clause 2 of Art. 381.1 of the Tax Code of the Russian Federation, subparagraph “b”, paragraph 70, article 2, paragraph 4, article 9 of the Federal Law of November 27, 2017 N 335-FZ).

Reporting on movable property until 01/01/2019

Until 01/01/2019 in the tax return for the property tax of organizations and in the tax calculation for the advance payment for the property tax of organizations, the forms of which are approved by Order of the Federal Tax Service of Russia dated 03/31/2017 N ММВ-7-21/ [email protected] (clause 1 Article 80, paragraph 1 of Article 373, subparagraph 8 of paragraph 4 of Article 374, paragraph 25 of Article 381, Article 386 of the Tax Code of the Russian Federation):

— there is no need to reflect fixed assets (including movable property) included in the first or second depreciation group in accordance with the Classification of fixed assets, since they are not recognized as objects of taxation (subclause 8, clause 4, article 374 of the Tax Code of the Russian Federation) ;

- it is necessary to show the movable property specified in paragraph 25 of Art. 381 of the Tax Code of the Russian Federation, as preferential, despite its exemption from tax.

In this case, in section 2 of the declaration (calculation), where the data for calculating the average annual value of property for the tax (reporting) period is indicated, in lines 020 - 140 in column 4 (in lines 020 - 110 in column 4 of the calculation) the residual value of the preferential movable property is entered property. In addition, such preferential movable property must be included in line 270 of section 2 of the declaration (in line 210 of section 2 of the calculation), which reflects the residual value of all fixed assets recorded on the balance sheet as of December 31 of the tax period (as of the first day of the month following reporting period), with the exception of the residual value of property that is not taxed under sub. 1 - 7 p. 4 tbsp. 374 Tax Code of the Russian Federation. On line 040 of section 3 of the declaration and calculation, as well as on line 160 of section 2 of the declaration (line 130 of section 2 of the calculation), where the calculation of the amount of tax (advance payment) is given, you must indicate in the first part of this indicator benefit code 2010257 for movable property accepted for accounting from January 1, 2013, according to clause 25 of Art. 381 of the Tax Code of the Russian Federation, and in the second part dashes are added (subclauses 3, 5, 16 clause 5.3, subclause 7 clause 7.2 of the Procedure for filling out a tax return, subclauses 3, 5, 13 clause 5.3, subclause 7 clause 7.2 The procedure for filling out the calculations approved by Order of the Federal Tax Service of Russia dated March 31, 2017 N ММВ-7-21/ [email protected] ).

Taxation of movable property from January 1, 2019

From 01/01/2019, all movable property (regardless of the depreciation group, the date of its registration, the method or source of receipt) is excluded from taxation for the corporate property tax (clause 1 and subclause 8 of clause 4 of article 374 of the Tax Code of the Russian Federation) , clause 19 article 2, clause 2 article 4 of the Federal Law of 03.08.2018 N 302-FZ, hereinafter referred to as Law N 302-FZ, Letter of the Federal Tax Service of Russia dated 06.08.2018 N BS-4-21/ [email protected ] ). Clause 3.3 art. 380, paragraph 25 of Art. 381, paragraph 2 of Art. 381.1 of the Tax Code of the Russian Federation were declared invalid, the phrase “movable property” was removed from Chapter 30 of the Tax Code of the Russian Federation, and the mention of clause 25 of Art. 381 of the Tax Code of the Russian Federation is excluded from the provisions of paragraph 1 of Art. 381.1 of the Tax Code of the Russian Federation (clauses 21, 22, 23 of Article 2, clause 2 of Article 4 of Law No. 302-FZ).

Thus, Law No. 302-FZ removed from Chapter 30 of the Tax Code of the Russian Federation all references to tax benefits (additional regional benefits) for movable property, and tax rates for movable property previously specified in paragraph 25 of Art. 381 of the Tax Code of the Russian Federation, but not exempt from taxation. As a result, from this date, the benefits for movable property established in the constituent entities of the Russian Federation cease to apply. From 2021, organizations in all regions of the country will pay property tax only on the value of real estate.

Example. On the balance sheet, which is a payer of property tax for organizations, only movable property is included in the composition of fixed assets. Since the movable property of an organization from 01/01/2019 will not be recognized as an object of taxation for corporate property tax in accordance with the provisions of Federal Law dated 08/03/2018 N 302-FZ, it will not be recognized as a payer of corporate property tax in 2021.

Starting from the tax period of 2021, there will be no obligation to submit tax returns and tax calculations for the property tax of organizations, since the specified tax reporting is submitted only by payers of this tax (clause 1 of Article 80, clause 1 of Article 386 of the Tax Code of the Russian Federation).

As noted in the Letter of the Ministry of Finance of Russia dated August 24, 2018 N 03-01-11/60353, in order to create incentives for the accelerated implementation and development of technologies in domestic industry, renewal of the active part of fixed assets of organizations, Federal Law N 302-FZ was adopted on August 3, 2021 “ On amendments to parts one and two of the Tax Code of the Russian Federation", providing, in particular, for the exclusion from January 1, 2021 of movable property from the objects of taxation on the property tax of organizations, including machinery, equipment, machine tools, vehicles, production equipment , storage and sale of products and other movable property. In addition, the abolition of the tax on all movable property is a measure to reduce the tax burden on organizations.

The procedure for forming the tax base for property tax

and tax reporting

Currently, the tax base for the property tax of organizations is formed separately in relation to (clause 1 of Article 376 of the Tax Code of the Russian Federation as amended, valid until 01/01/2019):

— property subject to taxation at the location of the organization (place of registration with the tax authorities of the permanent representative office of the foreign organization);

— property of each separate division of the organization, which has a separate balance sheet;

- each piece of real estate located outside the location of the organization, a separate division of the organization that has a separate balance sheet, or a permanent representative office of a foreign organization;

- property included in the Unified Gas Supply System in accordance with Federal Law dated March 31, 1999 N 69-FZ “On Gas Supply in the Russian Federation”;

- property, the tax base for which is determined as its cadastral value;

- property taxed at different tax rates.

In this regard, now tax returns for the property tax of organizations (tax calculations for advance payments) must be submitted to the tax authorities at the end of each tax (reporting) period (clause 1 of Article 386 of the Tax Code of the Russian Federation, as amended, valid until 01/01/2019 ):

— by location of the organization;

— at the location of each separate division of the organization that has a separate balance sheet;

- according to the location of each piece of real estate (for which a separate procedure for calculating and paying tax has been established);

- at the location of the property included in the Unified Gas Supply System.

From 01/01/2019, the tax base for the property tax of organizations will be determined separately in relation to (clause 1 of article 376 of the Tax Code of the Russian Federation, clause 20 of article 2, clause 2 of article 4 of the Federal Law of 03.08.2018 N 302-FZ, Letter of the Federal Tax Service of Russia dated 08/06/2018 N BS-4-21/ [email protected] ):

— each object of real estate of the organization;

— property included in the Unified Gas Supply System in accordance with Federal Law dated March 31, 1999 N 69-FZ “On Gas Supply in the Russian Federation.”

In this regard, taxpayers will be required, at the end of each reporting and tax period, to submit tax calculations for advance payments and a tax return to the tax authorities at the location of real estate and (or) at the location of property included in the Unified Gas Supply System (para. 1 clause 1 article 386 of the Tax Code of the Russian Federation, clause 24 article 2, clause 2 article 4 of the Federal Law of 03.08.2018 N 302-FZ).

Table 1

Taxation of movable property

| Period | Movable property objects | Tax rules | Base |

| from 01/01/2019 | any movable property (regardless of the depreciation group, the date of its registration, the method or source of receipt) | excluded from taxation objects; references to tax benefits (additional regional benefits) for movable property, tax rates for movable property previously specified in paragraph 25 of Art. 381 of the Tax Code of the Russian Federation, but not exempt from taxation | pp. 19, 21, 22, 23 art. 2, paragraph 2 art. 4 of the Law of 03.08.2018 N 302-FZ |

| from 01/01/2018 to 31/12/2018 | movable property from the 3rd to the 10th depreciation groups, registered as fixed assets starting from 01/01/2013 (except for those registered as a result of the reorganization/liquidation of legal entities and received from interdependent persons. This is an exception from 01/01/2017 does not apply to railway rolling stock manufactured starting from 01/01/2013) | preferential property (regional benefit in the form of tax exemption) | clause 25 art. 381, clause 3.3 art. 380, art. 381.1 Tax Code of the Russian Federation, clause 58 art. 2, paragraph 5 art. 13 of the Law of November 30, 2016 N 401-FZ, paragraph 69 of Art. 2, paragraph 4 art. 9 of the Law of November 27, 2017 N 335-FZ, laws of constituent entities of the Russian Federation on property tax of organizations |

| from 01/01/2018 to 31/12/2018 | movable property specified in paragraph 25 of Art. 381 of the Tax Code of the Russian Federation, from the date of issue of which no more than 3 years have passed, as well as property classified by the law of a constituent entity of the Russian Federation as innovative high-performance equipment | additional regional tax benefits up to complete tax exemption | clause 25 art. 381 Tax Code of the Russian Federation, paragraph 2 of Art. 381.1 Tax Code of the Russian Federation, subp. "b" clause 70 art. 2, paragraph 4 art. 9 of the Law of November 27, 2017 N 335-FZ, laws of constituent entities of the Russian Federation on property tax of organizations |

| from 01/01/2015 to 31/12/2017 | movable property from the 3rd to the 10th depreciation groups, registered as fixed assets starting from 01/01/2013 (except for those registered as a result of the reorganization/liquidation of legal entities and received from interdependent persons. This is an exception from 01/01/2017 does not apply to railway rolling stock manufactured starting from 01/01/2013) | preferential property (federal benefit in the form of tax exemption) | clause 25 art. 381 Tax Code of the Russian Federation, clause 57 art. 1, clause 5, art. 9 of the Law of November 24, 2014 N 366-FZ, subp. "b" clause 4 of Art. 2, paragraph 1, art. 4 of the Law of December 28, 2016 N 475-FZ |

| from 01/01/2015 to 31/12/2018 | objects of fixed assets (including movable property) of the 1st and 2nd depreciation groups according to the Classification of fixed assets (Resolution of the Government of the Russian Federation dated 01.01.2002 N 1) | are not recognized as an object of taxation | subp. 8 clause 4 art. 374 Tax Code of the Russian Federation, clause 55 art. 1, clause 5, art. 9 of the Law of November 24, 2014 N 366-FZ, subp. "c" clause 19 of Art. 2, paragraph 2 art. 4 of the Law of 03.08.2018 N 302-FZ |

| from 01.01.2013 to 31.12.2014 | movable property registered as fixed assets from 01/01/2013 | was not recognized as an object of taxation | subp. 8 clause 4 art. 374 Tax Code of the Russian Federation, paragraph 3 of Art. 1, Art. 3 of the Law of November 29, 2012 N 202-FZ |

| until 01/01/2013 | all movable property | object of taxation | pp. 1, 4 tbsp. 374 of the Tax Code of the Russian Federation (as amended in force at that time) |

Presentation of information on establishment, change

and termination of regional taxes

Property tax is a regional tax and is credited in full to the budget of the constituent entity of the Russian Federation (clause 1 of article 14 of the Tax Code of the Russian Federation, clause 1 of article 56 of the Budget Code of the Russian Federation).

From 01/01/2019, information on the establishment, change and termination of regional and local taxes specified in clause 1 of Art. 16 of the Tax Code of the Russian Federation, must be submitted by state authorities of the constituent entities of the Russian Federation and local self-government bodies to the territorial body of the Federal Tax Service of Russia for the corresponding constituent entity of the Russian Federation (to the Federal Tax Service) in electronic form. The form, format and procedure for sending the specified information in electronic form must be approved by the Federal Tax Service of Russia (clauses 1, 2 of article 16 of the Tax Code of the Russian Federation, clause 1 of article 1, clause 3 of article 4 of the Federal Law of 03.08.2018 N 302- Federal Law, Letter of the Federal Tax Service of Russia dated 08/06/2018 N BS-4-21/ [email protected] ).

Before the date specified in Art. 16 of the Tax Code of the Russian Federation did not stipulate the form for presenting such information.

Application of cadastral value as a tax base

The innovation introduced into Chapter 30 of the Tax Code of the Russian Federation by Federal Law No. 334-FZ of August 3, 2018 (hereinafter referred to as Law No. 334-FZ) concerns the calculation of property tax for organizations - in relation to objects on which the tax is calculated at the cadastral value (clause 15 Article 378.2, paragraph 5.1 of Article 382 of the Tax Code of the Russian Federation, paragraphs 2, 3 of Article 2, paragraph 3 of Article 3 of Law No. 334-FZ).

Currently, changes in the cadastral value of taxable objects during the tax period are not taken into account when determining the tax base in the current and previous tax periods, with the exception of two grounds for revising the cadastral value of an object established by clause 15 of Art. 378.2 of the Tax Code of the Russian Federation as amended, valid until 01/01/2019:

1) due to the correction of errors made in determining its cadastral value. Such a change is taken into account when determining the tax base starting from the tax period in which the erroneously determined cadastral value was applied (paragraph 2 of clause 15 of Article 378.2 of the Tax Code of the Russian Federation as amended before 01/01/2019);

2) by decision of the commission for resolving disputes on the results of determining the cadastral value or by a court decision. Then information about the cadastral value established by the decision of the said commission or a court decision is taken into account when determining the tax base starting from the tax period in which the corresponding application for revision of the cadastral value was submitted, but not earlier than the date of entry into the Unified State Register of Real Estate of the cadastral value that was the subject challenges (paragraph 3, clause 15, article 378.2 of the Tax Code of the Russian Federation as amended before 01/01/2019).

Law N 334-FZ streamlines the procedure for recalculating the property tax of organizations when changing the cadastral value of an object, increases the number of grounds for changing the cadastral value of an object and introduces uniform rules for the use of cadastral value as a tax base for taxation of real estate of organizations starting from the tax period of 2021 (p 2 Article 375, paragraph 15 Article 378.2 of the Tax Code of the Russian Federation, paragraphs 1, 2 Article 2, paragraph 3 Article 3 of Law No. 334-FZ):

1) the cadastral value indicated in the Unified State Register of Real Estate as of January 1 of the year of the tax period is applied, taking into account the following features:

1.1) it is established that a change in the cadastral value of a taxable object due to a change in the qualitative and (or) quantitative characteristics of this object is taken into account when determining the tax base from the date of entry into the Unified State Register of Information that is the basis for determining the cadastral value;

1.2) in the event of a change in the cadastral value of a taxable object due to the correction of a technical error in the USRN information, as well as in the case of a decrease in the cadastral value due to the correction of errors made in determining the cadastral value, revision of the cadastral value by decision of a commission or court in the event of unreliability of the information used when determining the cadastral value, information about the changed cadastral value entered into the Unified State Register of Real Estate is taken into account when determining the tax base starting from the date of application for tax purposes of information about the changed cadastral value;

1.3) in the event of a change in the cadastral value of a taxable object based on the establishment of its market value by decision of a commission or court, information about the cadastral value established by a decision of the commission or court, entered into the Unified State Register of Real Estate, is taken into account when determining the tax base starting from the date of commencement of application of the cadastral value for tax purposes which is the subject of dispute.

The provisions of the new edition of paragraph 15 of Art. 378.2, establishing the procedure for applying the cadastral value changed during the tax period, are subject to application to information on changes in cadastral value entered into the Unified State Register of Real Estate on grounds that arose from January 1, 2021 (clause 2 of article 2, clause 3 of article 3 of Law N 334-FZ, Letter of the Federal Tax Service of Russia dated 08/06/2018 N BS-4-21/ [email protected] ).

In addition, starting from the tax period of 2021, in the event of a change during the tax (reporting) period in the qualitative and (or) quantitative characteristics of real estate objects specified in Art. 378.2 of the Tax Code of the Russian Federation, the calculation of the amount of tax (the amount of advance tax payments) in relation to these real estate objects is carried out taking into account the coefficient determined in the manner established by clause 5 of Art. 382 of the Tax Code of the Russian Federation (new clause 5.1 of Article 382 of the Tax Code of the Russian Federation, clause 3 of Article 2, clause 3 of Article 3 of Law No. 334-FZ).

This means that if the qualitative or quantitative characteristics of the taxable object change (for example, area or purpose), the property tax of organizations must be calculated at the new cadastral value from the date of entering new information about the object into the Unified State Register. According to the old estimate, it will be necessary to determine the amount for full months from the beginning of the year before the change; according to the new estimate, after the change and until the end of the year.

The property tax of organizations in such a situation should be calculated as follows: (cadastral value before the change, multiplied by the tax rate and the number of full months for the period from the beginning of the year before changes were made to the Unified State Register of Real Estate, divided by 12 months) plus (cadastral value after the change, multiplied by the tax rate and by the number of full months for the period from the date of amendments to the Unified State Register until the end of the year, divided by 12 months). In this case, the number of full months for the period from the beginning of the year until changes are made to the Unified State Register and the number of full months for the period from the date of changes to the Unified State Register until the end of the year is determined according to the rules of clause 5 of Art. 382 of the Tax Code of the Russian Federation (clause 5.1 of article 382 of the Tax Code of the Russian Federation, clause 3 of article 2, clause 3 of article 3 of Law No. 334-FZ).

As can be seen from Table 2, for the purposes of taxation of real estate, only information on changes in cadastral value entered into the Unified State Register of Real Estate will be used on grounds that arose from January 1, 2021. If the cadastral value changes as a result of an appeal or correction of an error, it will be possible to recalculate the property tax of organizations for previous tax periods when the erroneous (disputed) cadastral value was used for its calculation (and not from the year the application for challenge was filed, as now). Currently, Chapter 30 of the Tax Code of the Russian Federation does not provide for the possibility of extending the disputed results of the cadastral value (the market value of a real estate property) to past tax periods, which leads to the need to pay corporate property tax for these periods at an unreasonable (erroneous, not corresponding to the market value) cadastral value and complicates the process of challenging the cadastral value by taxpayers.

table 2

| Reasons for changing the cadastral value for tax recalculation | Date of application of the new cadastral value when determining the tax base | Chapter 30 norm Tax Code of the Russian Federation | |

| from 01/01/2019 | until 01/01/2019 | ||

| Change in cadastral value due to correction of errors made when determining the cadastral value of a taxable object | X | starting from the tax period in which the erroneously determined cadastral value was applied | para. 2 clause 15 art. 378.2 Tax Code of the Russian Federation |

| Change in cadastral value due to correction of a technical error in the USRN information on the value of the cadastral value | information about the changed cadastral value entered into the Unified State Register of Real Estate is taken into account starting from the date of commencement of application for tax purposes of information about the changed (incorrect) cadastral value | X | para. 3 clause 15 art. 378.2 Tax Code of the Russian Federation, clause 2 of Art. 2, paragraph 3 art. 3 of the Law of 03.08.2018 N 334-FZ |

| Change of cadastral value by decision of the commission for the consideration of disputes on the results of determining the cadastral value or by court decision | X | starting from the tax period in which the application for revision of the cadastral value was submitted, but not earlier than the date of entry into the Unified State Register of the cadastral value, which was the subject of a challenge | para. 3 clause 15 art. 378.2 Tax Code of the Russian Federation |

| Reduction of cadastral value due to the correction of errors made in determining the cadastral value, revision of the cadastral value by decision of the commission for resolving disputes about the results of determining the cadastral value or by a court decision in case of unreliability of the information used in determining the cadastral value | information about the changed cadastral value entered into the Unified State Register of Real Estate is taken into account starting from the date of commencement of application for tax purposes of information about the changed (incorrect) cadastral value | X | para. 3 clause 15 art. 378.2 Tax Code of the Russian Federation, clause 2 of Art. 2, paragraph 3 art. 3 of the Law of 03.08.2018 N 334-FZ |

| Change in cadastral value due to changes in qualitative and (or) quantitative characteristics of the taxable object | from the date of entry into the Unified State Register of Information that serves as the basis for determining the cadastral value | X | para. 2 clause 15 art. 378.2 Tax Code of the Russian Federation, clause 2 of Art. 2, paragraph 3 art. 3 of the Law of 03.08.2018 N 334-FZ |

| Changing the cadastral value based on establishing the market value of the taxable object by decision of the commission for the consideration of disputes about the results of determining the cadastral value or by a court decision | information about the cadastral value established by a decision of the commission or a court decision, entered into the Unified State Register of Real Estate, is taken into account starting from the date of commencement of application for tax purposes of the cadastral value that is the subject of a challenge | X | para. 4 clause 15 art. 378.2 Tax Code of the Russian Federation, clause 2 of Art. 2, paragraph 3 art. 3 of the Law of 03.08.2018 N 334-FZ |

Example. If the cadastral value of a property changes in 2021 based on the results of consideration of the taxpayer’s application for revision of the cadastral value submitted in 2018, such a change can only be taken into account in relation to the corporate property tax calculated for 2021.

When challenging the cadastral value and submitting an application to revise the cadastral value in 2021, a recalculation of the corporate property tax can be made for the previous tax period (within three years). For such years, a refund of overpaid tax is possible. This can be done if a new cadastral value (revaluation) of the property has not been established as of 01/01/2019.

Reporting on property tax of organizations from 01/01/2019

approved by Order of the Federal Tax Service of Russia dated March 31, 2017 N ММВ-7-21/ [email protected] ensure the correctness of tax calculation and advance tax payments in accordance with the currently applicable tax and levy legislation.

Currently, a draft order of the Federal Tax Service of Russia has been prepared “On amendments to the Appendices to the Order of the Federal Tax Service dated March 31, 2017 N ММВ-7-21/ [email protected] “On approval of forms and formats for submitting a tax return for the property tax of organizations and the tax calculation of advance payment for property tax of organizations in electronic form and procedures for filling them out.”

The document is posted on the federal portal of draft regulatory legal acts (https://regulation.gov.ru/projects#npa=82178), project ID 02/08/07-18/00082178. The need for its preparation is related to the need to ensure the possibility of correctly calculating the amounts of property tax of organizations and the amounts of advance payments for tax when filling out tax reporting forms for tax and ensuring the correct submission of these forms when legislative changes to Chapter 30 “Tax” come into force from the tax period of 2021 on the property of organizations" of the Tax Code of the Russian Federation in terms of excluding movable property from objects of taxation for the property tax of organizations, changing the procedure for determining the tax base (in the event of a change in the cadastral value of a real estate property during the tax period due to changes in the qualitative and (or) quantitative characteristics of the real estate property) , changes in the procedure for submitting tax reporting forms.

The order will be applied starting from the submission of tax calculations for the advance payment of corporate property tax for the first quarter of 2021.

Department for work with taxpayers of the Interdistrict Inspectorate of the Federal Tax Service of Russia No. 4 for the Republic of Tatarstan