The Tax Code of the Russian Federation gives peasant farms (peasant farms) a special legal status. Thanks to him, they can receive various benefits. One of them is tax holidays. This is the period during which a company is exempt from paying tax on its income. We will tell you in the article under what conditions tax holidays are provided for peasant farms in 2021.

Tax holidays are a benefit that applies only to certain types of activities: scientific, social and industrial. Agricultural activities are classified as production and therefore also included in this list.

But please note: the rules by which peasant farms receive tax holidays in 2021 are largely determined by local legislation.

Therefore, if you want to figure out whether your peasant farm has the right to apply holidays, you first need to familiarize yourself with the legal acts of your region.

There is one more limitation that you need to pay attention to. Federal Law N 477-FZ of December 29, 2014, which amended the Tax Code of the Russian Federation, provides for the application of a zero tax rate only for those organizations that were founded after 2015. That is, after this document comes into force. Therefore, even if a peasant farm suspended its activities for some time and was deregistered with taxes, and then reopened in 2021, it does not have the right to take advantage of tax holidays.

Taxation of peasant farming: special regimes and reporting

12.07.2021

In this article we will talk about taxation and reporting in peasant farms (peasant farms).

What is a peasant farm?

A peasant farm is a commercial organization that produces, sells and processes agricultural products or provides services in this area (the latter came into force in 2021). The activities of peasant farms are regulated by Federal Law No. 74 “On Peasant Farming”.

A farm can be registered as a legal entity, but most often the head is registered as an individual entrepreneur.

By default, in the system for calculating taxes, pensions and insurance contributions, peasant farms operate at the individual entrepreneur level - that is, they submit the same reports and have the same benefits.

Types of taxation of peasant farms

Among farms, the Unified Agricultural Tax is most often used - an agricultural tax, which was actually introduced specifically for peasant farms. But, nevertheless, other tax systems are available to both organizations and individual entrepreneurs in the field of agriculture.

In each taxation system, LLCs (unlike individual entrepreneurs) additionally submit transport and land tax declarations (until February 1), accounting reports and information on financial results (until March 31).

Unified agricultural tax

The peculiarity of the unified agricultural tax lies in the relaxed requirements for record keeping and benefits provided specifically for peasant farms.

However, farms do not use it by default immediately after registration, but must submit an application to the Federal Tax Service about their intention to use the unified agricultural tax.

This can be done within a month after registering with the tax office in order to immediately begin your work on the Unified Agricultural Tax, or before December 31 - in order to begin applying the regime from January 1 of the next year.

The tax rate under the Unified Agricultural Tax is 6% of net profit (income minus expenses). Based on the decision of local authorities, the percentage is sometimes reduced to 4%.

The following have the right to use the Unified Agricultural Tax:

- Manufacturers of agricultural products, organizations processing and selling them. At the same time, income from the sale of own farm products must be more than 70% of the total.

- Agricultural consumer cooperatives, in which more than 70% of their income comes from the sale of products produced by members of the cooperative.

- Individual entrepreneurs and fishing enterprises with an average annual number of employees of less than 300, with income from the sale of catch in relation to total revenue of more than 70%.

- Organizations providing agricultural services.

To switch to the Unified Agricultural Tax, an enterprise must produce or sell agricultural products. For example, it is unacceptable to only process it.

All entrepreneurs who have chosen the Unified Agricultural Tax must maintain an accounting book (KUDiR). From 2021, it no longer needs to be certified by the Federal Tax Service, which also applies to peasant farms on the Unified Agricultural Tax.

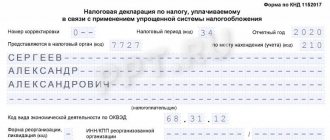

Tax reporting is submitted in the form of a Unified Agricultural Tax declaration annually, until March 31 of the following year. Advance payment under the Unified Agricultural Tax is made until July 25, and full tax payment is due until March 31 of the next calendar year.

The deadline for submitting reports to the tax office is January 30 of the year following the reporting year, using the form “Calculation of insurance premiums.” The second section is completed.

Other possibilities of the Unified Agricultural Tax:

- Write-off of fixed assets when they are put into circulation;

- Inclusion of advance payments in the income item;

- Exemption from property tax, VAT and personal income tax.

simplified tax system

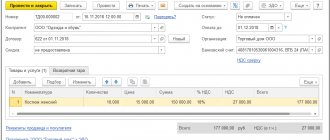

To apply the simplified tax system “Income” or “Income minus expenses”, you must submit an application to the tax office. It is better to do this immediately, when registering a company.

Peasant farms with minimal expenses prefer the “income” system (6%), and farms that have a significant share of expenses and are able to confirm them choose the “income minus expenses” system (profit tax is 15%).

Regional authorities can reduce the simplified tax rate by 1% on “income” and up to 5% on “income minus expenses.”

Accounting for peasant farms using the simplified tax system is also simplified. The farm must maintain KUDiR and provide it to the tax service upon request.

https://www.youtube.com/watch?v=35rk3XvEifU

The simplified declaration must be submitted to the Federal Tax Service once a year, before April 30. The tax is paid quarterly: three times in advance before the 25th, and the final tax for the year - until April 30.

Peasant farms in most situations are equated to individual entrepreneurs, therefore, regardless of the form of the legal entity, it can reduce the tax on the entire amount of insurance premiums for the head and other members, without a limit of 50% only if the labor of hired workers is not used.

BASIC

The general taxation regime is used in peasant farms extremely rarely and only when necessary. The complexity and volume of peasant farm reporting on OSNO is inferior to other options, but the main system allows farmers to cooperate with large network partners who deal only with VAT.

OSNO employs the majority of wholesale buyers who may be of interest to farmers. The fact is that the general regime allows wholesalers to significantly reduce the VAT burden. This regime will be applied to a newly formed farm automatically if its head does not have time to submit an application for the application of the simplified tax system or unified agricultural tax.

For some peasant farms, income tax can be reduced to zero. The full list of preferential areas is reflected in Article 284 of the Tax Code.

Automatically, all participants and the head of the farm are exempt from personal income tax payments for five years on income from the production, sale and processing of agricultural products.

It is legal to use this benefit only once - intentional re-registration of peasant farms is punishable by law. Income from activities not related to agriculture and farming is taxed without special benefits. Government subsidies and grants are not taxed.

The VAT return is submitted to the tax office once a quarter (in January, April, July and October before the 25th). Every year until April 30, forms 3-NDFL and 4-NDFL are provided. These requirements apply to both individual entrepreneurs and LLCs. Form 3-NDFL must be submitted even if there was no profit.

The company's reporting on OSNO also includes quarterly submission of income and property declarations.

Peasant farms on OSNO pay:

- Property tax;

- Land tax;

- Transport tax;

- Personal income tax (withheld from the wages of all hired employees);

- VAT;

- Mandatory insurance contributions.

Reporting to government funds

For members of peasant farms there are fixed insurance rates that do not depend on the minimum wage and are relevant for individual entrepreneurs.

The head of a farm that does not have hired employees is obliged to submit to the tax office every year on January 30 the calculation of insurance premiums for himself and for members of the peasant farm, filling out the 2nd section. The report can be provided in both paper and electronic format.

Insurance premiums must be paid before the end of the calendar year. This can be done in one payment or quarterly.

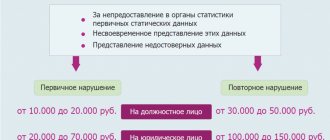

In addition, peasant farms are required to report to the state statistics service:

- Peasant farms with agricultural crops report annually before June 11 using form No. 1 - farmer.

- Peasant farms with livestock of farm animals report on form No. 3 - farmer until January 6.

Reporting for employees

If a peasant farm hires workers, then new obligations arise along with them.

Employees must provide the following to the tax office:

- Form 2-NDFL for each employee (until April 1);

- Form 6-NDFL (quarterly until the end of January, April, July and October and one annual along with 2-NDFL);

- Form on the average number of employees, KND 1110018 (until January 20).

Personal income tax withheld from employees' salaries must be transferred to the state no later than the day following the date of issue to the employee.

Calculation of insurance premiums is submitted to the Pension Fund quarterly, before mid-February, May, August and November. By the 15th day of each month, information about insured persons (SZV-M) is provided.

Form 4-FSS is submitted to the Social Insurance Fund; it must be submitted before the twentieth of January, April, July and October, if in paper form and before the 25th in electronic format. Once a year, before April 15, LLCs must confirm their main activity with the Social Insurance Fund.

Contributions to the Pension Fund and Social Insurance Fund for employees are made until the 15th of the next month.

Source: kakzarabativat.ru

Source: https://rynok-apk.ru/articles/actual/nalogooblozhenie-kfh/

Accounting specifics

If a farming company operates under the simplified tax system or unified agricultural tax, then there is no need to include summary information on the property in the reporting. With the general system, the accountant prepares a similar statement for submission to the Federal Tax Service.

To record property assets, special accounting forms are used. These documents record information on the company's tangible and intangible assets. Data on the number of working livestock, fattening animals, and products are entered into the accounting books.

Intangible assets (IMA) are also taken into account. The cost of intangible assets is calculated using the same methodology as fixed assets. Such assets include innovative developments for the field, breeding patents for plant varieties, copyrights, and permits for the exploitation of natural resources. Intangible assets are depreciation expenses, the period of their validity depends on the period of expectation of income.

The accountant also prepares personnel reports for hired specialists. Employees are hired according to the Labor Code of the Russian Federation. To calculate salaries and bonuses, primary documents are used - production sheets, waybills, work orders, registers.

Individual entrepreneurs and legal entities can hire workers. In this case, primary data on employees and their work activities is introduced into accounting:

- timesheets for recording work shifts and time;

- work orders for piecework work;

- waybills for transport;

- accounting statements and registers;

- documentation for calculation and issuance of salary.

Cash paid to employees is taxable. The farming company has the right to withhold contributions for payment to the treasury of the Russian Federation.

Taxation of peasant farms in 2021: special regimes, taxes and reporting

Hello! In this article we will talk about taxation and reporting in peasant farms (peasant farms).

Today you will learn:

- What taxation systems are available for peasant farms;

- What kind of reporting do peasant farms submit for their members and hired employees?

A peasant farm is a commercial organization that produces, sells and processes agricultural products or provides services in this area (the latter came into force in 2021).

The activities of peasant farms are regulated by Federal Law No. 74 “On Peasant Farming”.

A farm can be registered as a legal entity, but most often the head is registered as an individual entrepreneur.

By default, in the system for calculating taxes, pensions and insurance contributions, peasant farms operate at the individual entrepreneur level - that is, they submit the same reports and have the same benefits.

Insurance payments

Insurance contributions are paid from salaries to pension and extra-budgetary funds. The percentage of deductions is determined by the selected fee payment mode. Reporting is submitted to the Federal Tax Service. Deductions for cases of injuries and occupational diseases are sent to the Social Insurance Fund in the form of an abbreviated report.

Let's consider the types of reporting and place of submission:

- the final report is submitted to the Social Insurance Fund;

- data on deductions for injuries and occupational illnesses are provided to the Social Insurance Fund;

- the RSV-1 calculation is submitted to the Pension Fund;

- a report type SZV-M is submitted to the pension fund every month.

Today, all reports are accepted by the tax service quarterly.

What taxes does a peasant farm pay - the nuances of farming

Good afternoon friends. Today we’ll talk about peasant farms. My friends who are involved in agriculture and farming all work as individual entrepreneurs. The reasons are simple - they pay up to 6% of turnover, and about 3,000 per month to the pension fund. Since they don’t move millions every month, they have enough.

But these are all self-employed guys, small businesses. How things stand for more or less large farms - read further on the page. Perhaps a peasant farm will be a good option for you.

And I repeat - if you have agricultural self-employment, then so far they haven’t come up with anything better than an individual entrepreneur with the simplified tax system.

Taxation of peasant (farm) farming

One of the least regulated organizational and legal forms of business activity in Russian legislation is the peasant (farm) economy.

Peasant (farm) farms (peasant farms) carry out commercial activities in the production of agricultural products.

What is meant by agricultural products, see here.

This specificity determines the peculiarities of taxation of peasant farms in comparison with other organizational and legal forms of conducting commercial activities.

Peculiarities of taxation of peasant (farm) economy:

Peasant farms have the right to apply 3 taxation systems:

1. General taxation system;

2. Simplified taxation system (6% of income or 15% “income-expenses”);

3. Unified agricultural tax.

Features of the application of the general taxation system for peasant farms are as follows:

1. The composition of taxes paid by peasant farms fully corresponds to the composition of taxes of an individual entrepreneur and has nothing to do with the taxation of legal entities; They pay personal income tax (13%), VAT (10/18%), land tax, transport tax, insurance contributions to the Pension Fund, FFOMS, TFOMS, Social Insurance Fund

2. The first 5 years from the date of registration of peasant farms are exempt from paying income tax from individuals (13%).

Tax reporting is submitted within the usual time frame, as for individual entrepreneurs on the OSN.

Many peasant farms remain on the general taxation system in order to retain customers for their products, since the vast majority of wholesale buyers work on the special tax system and in order to reduce their tax burden they simply need to purchase products from organizations (individual entrepreneurs, peasant farms) that work with VAT, since only in this case they will be able to reimburse the VAT paid for the products from the budget and thereby receive additional benefits from the transaction.

The specifics of payment of insurance premiums consist in the differentiation of rates for members of peasant farms and for employees. For members of peasant farms there are fixed rates, calculated on the basis of the minimum wage, relevant for individual entrepreneurs.

There are no specific specifics for the application of the simplified taxation system by peasant farms in comparison with other organizational and legal forms. Everything is traditional here.

To apply the simplified tax system of 6% or 15% (in some regions of the Russian Federation the rate is reduced), you should submit an application to the tax authorities upon registration.

The use of unified agricultural tax is of particular interest. Practice shows that the use of unified agricultural tax is the most profitable option for taxing the activities of peasant farms. In order to apply it, you must also submit a corresponding application for the decision to apply the Unified Agricultural Tax.

From the site: https://puti-uspeha.ru/nalogi/543-nalogi-kfh.html

The procedure and features of tax calculation for farmers - peasant farm regime, how much taxes to pay?

How much taxes should peasant farms pay? One of the forms of management recognized at the legislative level is a peasant (farm) enterprise, which has the status of a legal entity. In accordance with this, it can carry out commercial activities with the aim of obtaining material benefits in the form of profit.

And, like any other legal entity, peasant farms are obliged to pay appropriate taxes. We will tell you in more detail how to calculate and pay taxes to farmers in this article.

Peasant (farm) farming: what is it?

Peasant (farm) farming is a type of entrepreneurial activity aimed at producing and selling agricultural products for the purpose of making a profit.

In order for a peasant farm to have a legally significant status, it must be registered with state regulatory authorities, and the head of the peasant farm responsible for its activities must also be elected.

At the same time, a peasant farm may include citizens of the Russian Federation who own certain property and carry out production or business operations for commercial purposes, and the head is its leader.

A peasant farm is registered in his name, the name of which will sound like IP GKFH Full Name, which indicates that it has characteristics closer to individual entrepreneurship than to other organizational and legal forms.

The relationship between peasant farms and the state is based on the norms of the Civil Code of the Russian Federation, which states that this farm is recognized as a legal entity, and therefore is endowed with the rights, duties and responsibilities that characterize this economic entity.

- agricultural production;

- processing of agricultural products;

- transportation of agricultural products;

- storage of agricultural products;

- sales of agricultural products.

Since a peasant (farm) enterprise is a legal entity carrying out commercial activities with the aim of making a profit, it is obliged to pay taxes to the state budget, like any other economic entity of the Russian Federation.

Taxation of peasant farms: main points

Since the object of activity of a peasant (farm) enterprise is agriculture and its products, the tax to farmers has some specificity compared to industrial or commercial enterprises. In this case, farmers can apply one of three forms of taxation, namely:

- general;

- simplified;

- single agricultural tax

If the first two systems are the most familiar to legal entities and entrepreneurs, then the latter is not encountered so often, and therefore it is worth talking about it in more detail, as well as recalling others.

| System | Peculiarities | Taxes |

| General |

Source: https://blogfinansista.com/nalogooblozhenie-kfh/

Accounting Basics

Accounting in an agricultural organization is built around material assets and turnover. Accountants record in reports how much materials were received and how much was used. Most of it is occupied by estimating the cost of goods, calculating production and sales costs. The reporting also records the loss of agricultural products, livestock or raw materials due to natural causes.

All information is reflected in quantitative units of measurement. Accounting in livestock farming, crop production and processing has its own nuances.

Individual peasant farm tax benefits

FREE CONSULTATIONS ARE AVAILABLE TO ALL CITIZENS AT THE SPECIFIED PHONE NUMBERS OR VIA CHAT MODE

FREE CONSULTATIONS ARE AVAILABLE TO ALL CITIZENS AT THE SPECIFIED PHONE NUMBERS OR VIA CHAT MODE

Contributions and What taxes should a peasant (farm) enterprise (peasant farm) pay?

- Land tax, if in the area in which the peasant farm operates there are no benefits for this tax;

If a peasant farm uses a simplified tax system, then there are no special features of its taxation in this regime. Based on this, calculate taxes in the general manner.

If a member of a peasant farm belongs to several categories at one time, he pays contributions for each reason (clause 3 of Article 5 of Law No. 212-FZ dated July 24, 2009, order of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 2, 2013 No. 58/13 in case No. A60-7424/2012).

The individual head of the peasant farm, which specific reports to submit and pays taxes

- Peasant farms created in the form of a legal entity (Clause 1, Article 86.1 of the Civil Code of the Russian Federation);

- A personal entrepreneur who is the head of a peasant farm created without the formation of a legal entity on the basis of an agreement (Clause 5 of Article 23 of the Civil Code of the Russian Federation).

- At the end of the reporting period - half a year, no later than 25 calendar days, it is necessary to transfer the tax deposit in connection with the Unified Agricultural Tax.

This conclusion is drawn from paragraph 3 of Article 2, subparagraph “b” of paragraph 1 of Article 5, paragraph 2 of Article 14 of the Law of July 24, 2009.

No. 212-FZ. With payments to hired employees, the head of the peasant farm will also need to pay insurance premiums against occupational diseases and accidents (paragraph 7, article 3 of the Law of July 24, 1998 No. 125-FZ).

Contributions for the necessary pension and medical insurance for the participants of the peasant farm are paid by its head in a fixed amount (clause

What specific tax benefits (preferences) do peasant farms have?

If he does not submit an application to the inspectorate to switch to a special tax regime, then he is a personal income tax payer.

https://www.youtube.com/watch?v=bYI_5dZH-_E

Lost land tax benefits (preferences) for farmers will be able to be compensated.

A peasant (farm) enterprise, as a subject of entrepreneurial activity, is a tax payer.

Dear readers!

We describe typical ways to resolve legal issues, but each case is unique and requires individual legal assistance.

To quickly resolve your problem, we recommend contacting qualified lawyers on our website .

Tax holidays for peasant farms

According to the law, organizations that appeared after the entry into force of this law, in other words, not earlier than 2015, will be able to take advantage of these holidays. It will not be possible to fool the tax authorities, even if you deregister the farm and then register it again.

But if the farm has chosen a single agricultural tax (in most cases this is the case), it is also possible to take the right to a tax holiday. Moreover, the head of a peasant farm may be exempt from paying taxes for five years. This is stated in Art. 217 of the Tax Code of Russia.

The countdown begins from the year in which the farm was registered with the tax authority.

Only those incomes that were taken from the sale of agricultural products and from processing are exempt from taxes.

If in less than 5 years the farm switches again to a non-specialized taxation regime, then the opportunity to take advantage of tax benefits again will still remain.

FREE CONSULTATIONS ARE AVAILABLE TO ALL CITIZENS AT THE SPECIFIED PHONE NUMBERS OR VIA CHAT MODE

What specific taxes does the peasant farm pay in 2021?

In the second case, the rate by which the amount of income taken minus the costs incurred is multiplied to form 15%.

Peasant farms pay the Unified Agricultural Tax tax only twice a year - this reduces the amount of forced costs for deposits by 2.

In the first case, the rate by which the amount of income taken is multiplied is 6%.

Individual peasant farm benefits (preferences) on taxes

6. Completed application for registration of a peasant farm with a notarized signature of the Head of the peasant farm on it

- large area of agricultural land

owned by the peasant farm under another right - rent, use of shares, etc.) - is not limited.

We can provide you with the service of filling out application forms and drawing up any other legal documentation. The price of the work is here

Contact us!

Farmers are exempt from personal income tax for five years

Personal income tax is not subject to personal income tax on amounts received from the budgetary aggregate of the Russian Federation and in the form of grants and subsidies for the development and creation of peasant farms, grants for the development of a domestic livestock farm, and one-time assistance for the everyday life of a beginning farmer.

The income of the head of a peasant farm is exempt from personal income tax for five years from the date of registration. This benefit (preference) will remain in the event that during this time he switches to the taxation regime in the form of paying the Unified Agricultural Tax, and after that returns to the non-specialized regime.

Clause 2 of Article 3 of Law No. 161-FZ of October 2, 2012 extended the impact of these norms to the period from January 1, 2012. Based on this, it is possible to take advantage of these standards already at the moment, when submitting a declaration in form 3-NDFL for 2012

Taxation of peasant farming: special regimes and reporting

Form 3-NDFL must also be submitted if there was no profit.

Regional authorities will be able to reduce the simplified tax rate by 1% on “income” and up to 5% on “income minus costs.”

The deadline for submitting reports to the tax administration is January 30 of the year following the reporting year, using the form Calculation of insurance premiums. The second section is completed.

Rules for providing tax holidays for personal entrepreneurs

If an individual entrepreneur works under UTII or OSNO, it will not be possible to take benefits (preferences).

Tax holidays for entrepreneurs operate differently in different regions . One of the very first regions to adopt the law was the Penza region.

Tax holidays are only available to those entrepreneurs who are registering for the first time .

Registration of an agricultural business: individual entrepreneur or peasant farm

- It is possible to accept strangers into society, but only so that their total number does not exceed 5.

- The maximum number of different families in society is 3.

The head of a peasant farm is called a personal entrepreneur, and the farming society is disclosed at the place of his registration.

Since the peasant farm is not a legal entity, the head of the community, in accordance with the law of December 29, 1995 No. 222-FZ, can keep records using a simplified total.

Accounting statements, in accordance with the law, must be kept according to the book of expenses and income accounting. But different peasant farms will vary greatly in their scale.

For large farms, the most common combination of double entry and accounts will be. It allows you to reflect in detail all processes and business transactions.

FREE CONSULTATIONS ARE AVAILABLE TO ALL CITIZENS AT THE SPECIFIED PHONE NUMBERS OR VIA CHAT MODE

- Benefits (preferences) individual disabled person 2 groups FREE CONSULTATIONS ARE AVAILABLE FOR ALL CITIZENS AT THE SPECIFIED PHONE NUMBERS OR VIA CHAT benefits (preferences) individual disabled person 2 groups benefits (preferences) for disabled people...

- Benefits (preferences) for house tax FREE CONSULTATIONS ARE AVAILABLE FOR ALL CITIZENS AT THE SPECIFIED PHONE NUMBERS OR VIA CHAT benefits (preferences) for house tax What specific benefits (preferences)…

- A benefit on tax contributions is FREE CONSULTATIONS AVAILABLE FOR ALL CITIZENS AT THE SPECIFIED PHONE NUMBERS OR VIA CHAT A benefit on tax contributions is What specific benefits (preferences)…

Dear readers!

We describe typical ways to resolve legal issues, but each case is unique and requires individual legal assistance.

To quickly resolve your problem, we recommend contacting qualified lawyers on our website .

Source: https://nashy-lgoty.ru/ip-kfh-lgoty-po-nalogam/

Errors in calculations

Mistake No. 1. Not taking into account prepayment.

The fact that prepayment amounts are not included in income is an error. To calculate the amount of income under the Unified Agricultural Tax, the amount of advances must be included in income on the date of receipt of funds (subclause 1, clause 5, article 346.5 of the Tax Code of the Russian Federation).

Mistake No. 2. Unlawful reduction of the base.

The Unified Agricultural Tax base cannot be reduced by the amount of loss that the company received when applying other regimes. It is possible to apply a loss received only under the Unified Agricultural Tax (Clause 5 of Article 346.6 of the Tax Code of the Russian Federation)

What taxes and contributions should a peasant (farm) enterprise (peasant farm) pay - Tax Review.Info

The procedure for paying taxes depends on the form in which the peasant (farm) enterprise (peasant farm) operates. Members of a peasant farm may register an organization, or they may not do so - simply enter into an agreement on the creation of a peasant farm. In the latter case, it is enough for the head of the peasant farm to register as an entrepreneur.

All this follows from paragraph 1 of Article 86.1 and paragraph 5 of Article 23 of the Civil Code of the Russian Federation.

Taxation of peasant farms registered as an organization

If a peasant farm is registered as an organization, it can apply:

- general taxation system;

This follows from the norms of chapters 25, 26.1 and 26.2 of the Tax Code of the Russian Federation.

BASIC

Under the general taxation system, peasant farms pay:

- property tax (if there are taxable objects);

- land tax (if there are taxable objects and if in the area in which the peasant farm operates there are no benefits for this tax);

- transport tax (if there are taxable objects);

- Personal income tax (as a tax agent).

As for income tax, peasant farms are not exempt from it (Article 246 of the Tax Code of the Russian Federation). However, if certain conditions are met, they will not have to pay this tax. In particular, for agricultural producers who have not switched to the Unified Agricultural Tax, a reduced rate has been established - 0 percent.

This rate can be applied to activities related to the sale of produced agricultural products, as well as the sale of produced and processed own agricultural products. Such rules are established in paragraph 1.

3 Article 284 of the Tax Code of the Russian Federation.

The procedure for paying personal income tax also has some features.

Thus, there is no need to pay personal income tax on income received by members of a peasant farm (including its head) from the production (processing) and sale of agricultural products for five years, counting from the year of registration of the peasant farm.

Such a benefit can be applied to the income of a member of a peasant farm only if he is using it for the first time and has not used it before.

The benefit is provided by default, that is, there is no need to write any statements (notifications) to the tax office.

After five years, from this income, as well as initially from other income of members of the peasant farm and hired employees, its head pays personal income tax as a tax agent in the general manner.

This conclusion follows from Articles 207 and 226, paragraph 14 of Article 217 of the Tax Code of the Russian Federation.

The remaining taxes (VAT, property tax, land and transport taxes) are paid by the peasant farm in the general manner.

This follows from Articles 143, 226, 373, 357, paragraph 2 of Article 387, paragraph 1 of Article 388 of the Tax Code of the Russian Federation.

simplified tax system

If a peasant farm applies a simplified tax regime, then there are no specific features of its taxation under this regime. Therefore, calculate taxes in the general manner.

Situation: can a simplified peasant farm with the object “income” reduce the single tax by the entire amount of mandatory insurance contributions for the head and for all members of the peasant farm without a limit of 50 percent?

Answer: yes, it can, but only if the peasant farm does not use hired labor. Moreover, this applies to both peasant farms registered as an organization and those without registration of a legal entity.

Regardless of the form in which the peasant farm is registered - as an organization or without forming one, insurance premiums for compulsory pension (social, medical) insurance are always paid by the head of the peasant farm. And the law equates him to an individual entrepreneur.

The head of a peasant farm pays mandatory insurance premiums for himself and members of the farm in a fixed amount.

This procedure is established in paragraph 3 of Article 2 and paragraph 2 of Article 14 of the Law of July 24, 2009 No. 212-FZ.

Based on these provisions, the Ministry of Finance of Russia, in letter dated December 22, 2014 No. 03-11-06/2/66200, also for simplification purposes equated peasant farms to entrepreneurs. That is, a peasant farm without hired personnel can reduce the single tax by the entire amount of insurance premiums paid for the head of the peasant farm and its members (paragraph 3, subclause 3, clause 3.1 of Article 346.21 of the Tax Code of the Russian Federation). The 50 percent limit does not apply to them.

Unified agricultural tax

When using the Unified Agricultural Tax, pay taxes in the same manner as other organizations.

Taxation of peasant farms without registering an organization

If a peasant farm is not registered as an organization, this means that its head operates as an entrepreneur. In this case, he can use:

- general taxation system;

This follows from the provisions of Chapters 25, 26.1 and 26.2 of the Tax Code of the Russian Federation.

Calculation example when using unified agricultural tax

Yablonka LLC has been operating as an agricultural producer since 2015. Previously, the BASIC mode was used. The company decided to switch to Unified Agricultural Tax. At the same time, the state has equipment at a cost of 240 rubles. and a useful life of 5 years.

For 2021, payment for products was made in the amount of 1540 rubles.

Company expenses:

- salary -420 tr;

- mattresses and fuels and lubricants – 180 rubles;

- insurance premiums for crop insurance against drought (voluntary) – 40 tr;

- rent – 240 rubles;

- penalty for failure to meet delivery deadlines – 25 tr;

- office expenses – 25 tr;

- quality certificate – 50 tr.

Due to the fact that expenses for the first half of the year were higher than income, the advance payment was not paid.

Based on the results of all 2021 goals, the calculation looks like this: (click to expand)

- income amounted to 1540 tr;

- expenses were: 420 + 180 + 40 +240 + 30 +25 + 50 +240 = 1225 tr;

- tax: (1540 – 1225 * * 6/100 = 18.9 tr.

FAQ

- What status will a farmer have after state registration?

A company operating in the agricultural sector can be registered as an individual entrepreneur or a legal entity. The status is assigned immediately after state registration of the business.

- Is it possible for a farming organization to use a simplified accounting system?

Yes, a company can use a minimum amount of registers when maintaining tax and accounting records.

- Do I need to take into account funds from cash transactions?

The farm undertakes to comply with legal regulations. If there are cash transactions, then these transactions need to be documented.

- If at the end of the reporting period there is a loss, is a fine imposed under the Unified Agricultural Tax?

The profitability or unprofitability of an enterprise does not affect the taxpayer’s obligations to make advance and principal payments to the Federal Tax Service. If the money is not received, a fine (penalty) will be imposed.

Inventory

Accounting in agricultural companies is complicated by the constant circulation of assets, recalculation of production costs, and natural loss of property. To obtain up-to-date information about the condition of assets, an inventory is carried out. The list of property being inspected and the frequency of inspections are determined by the farmer, taking into account the nature of the activity.

Usually the status is checked:

- property assets as part of fixed/current assets;

- livestock in the main herd and young animals;

- grain crops, seeds for sowing;

- reporting on transactions with counterparties;

- other assets of the company.

The inventory is carried out by a special commission, which is approved by the management of the organization. The data obtained during the verification process is noted in the inventory list.