How to track payment of sick leave on the FSS portal

Please note that the billing period consists entirely of excluded periods. Since it is not possible to calculate the average daily earnings, and within the framework of the Federal Law of December 29, 2021 No. 255-FZ (as amended on July 23, 2021) “On compulsory social insurance in case of temporary disability and in connection with maternity” (as amended and amendments coming into force from 09/01/2021), insured persons cannot be deprived of the right to maternity benefits; in this case, it is possible to calculate the benefit from earnings equal to the minimum wage established by Federal Law at the time of the insured event.

At the same time, according to Part 1 of Article 14 of Federal Law No. 255-FZ dated December 29, 2021, calendar years (calendar year) of the calculation period, at the request of the insured person, can be replaced by previous years (year), if this leads to an increase in the amount of benefits.

Social insurance portal for calculating sick leave

- Specify the amount of earnings for the two calendar years preceding the date of the insured event.

- Divide the result by 730 (the number of days in the reporting period). This rule applies even to situations where they are leap years, such as 2021. In theory, the total number of days should increase by 1, which means that the amount of earnings must be divided by 731 days. But Law No. 255-FZ clearly states that it must be divided by 730, so this figure cannot be changed.

- The resulting figure is the average daily earnings. It will then need to be multiplied by the number of sick days, including weekends. The resulting product will become the required amount of temporary disability benefits.

We recommend reading: Should paragraph 2 of Article 7 of the Law on LLCs be complied with when transforming from a joint stock company

For those who want to check the accuracy of the calculations, the FSS website has a special calculator program that will calculate everything itself. To do this, you only need to enter the initial data: wage system, employee work schedule, type of tariff rate, amount of time worked, dates of treatment, type of illness, and some other data. Using formulas already familiar to us, the system will calculate the specific amount of the benefit independently. To pay it to an employee, all you have to do is withhold tax.

Insurance payments according to SNILS and “return of pension savings”

No other “payments under SNILS” are provided for by law , that is, in fact, scammers are offering you to receive your future pension now (although for some reason they themselves write on their website that their offer is in no way connected with the Pension Fund, so supposedly there is no need to go and Asking the Pension Fund about these payments is a must!). This cannot happen by definition, because the budget does not provide money for this - now there is not enough money even for those who are already retired (for example, pensions have not been indexed for working pensioners for 2 years)! And in general, where does such generosity come from the state to distribute “money from heaven” to everyone, and for some reason, through some “private insurance funds”?

Payment of sick leave through the Social Insurance Fund in 2021

- The acquisition of one or another type of disease, as a result of which a citizen is temporarily unable to continue to perform his work duties. It is also important to pay attention to the fact that in this case the law does not distinguish between the fact of the place of acquisition of the disease. So it can be acquired during the performance of official duties or at home. In one case or another, a citizen can receive sick leave.

- Injury to an employee. The time and place of such injury also does not affect the approval or refusal of sick leave. The main condition remains the inability to continue working.

- The same document can also be issued to persons who, due to circumstances, are forced to care for a minor child under the age of 15 years. In some cases, this age may be extended to 18.

- If the employee undergoes a period of post-operative rehabilitation.

- If a relative has an illness of this type, as a result of which the employee must provide direct care for him. However, this provision does not apply to chronically ill relatives.

- If an employee is pregnant. Childbirth period. Abortion. This state of affairs can also be used to obtain sick leave.

Labor relations between employee and employer are regulated by the Labor Code of the Russian Federation. According to this legal act, an employee of a particular enterprise can count on support in case of illness. In order to use this service, the interested person must provide an appropriate sick leave certificate. According to which funds will subsequently be accrued.

Checking sick leave in the Social Insurance Fund by number online (2021

- Log in to the ITU Account.

- Select the required sick leave from the list, which will open immediately after logging in.

- The required sheet can be found using various filters - as is the case when the employer uses the web interface.

As for viewing the data on the sick leave, they are given in full and correspond to the data that is reflected in the regular sick leave. To find the required certificate, a person, like an employer or a doctor at a medical institution, can use special filters for various details of a certificate of incapacity for work.

How to register with the FSS

To use the personal account of the Federal Social Insurance Service, you must have a unified account on State Services.

It must be identified, that is, at least one official document must be confirmed. This will immediately open up a ton of new functionality using the site in question.

How to register on the State Service website

- Follow the link: https://esia.gosuslugi.ru/idp/rlogin?cc=bp .

- Use the “Register for full access to services” link.

- Next, you need to choose the appropriate registration method: through your bank online or by visiting the nearest State Services branch. In both cases, further instructions are different. A qualified employee of the company will help you.

How to check the status of sick leave on the FSS website

- check sick leave status;

- gain access to data regarding EL disability;

- search for electronic sheets according to certain criteria that can be specified by the user in any quantity and sequence;

- view all benefits already accrued to the applicant;

- familiarize yourself with the documents available in the database.

- organization of a unified register of sick leave provided by employees of enterprises and organizations;

- changing entered data, transferring documents to other statuses;

- verification of documents and the ability to quickly respond to suspicions regarding the authenticity of documents.

We recommend reading: Which pension is higher for disability or old age?

How to check payment of sick leave on the FSS website

Payment from the Social Insurance Fund is made even in the first days of an employee going on sick leave. Therefore, all funds are accrued from there. What documents are needed For documentation, you will need to collect a small package of papers. The list approved by the FSS consists of three points: Application from the employee It is drawn up taking into account the wishes of the FSS Calculation of contributions The amount of funds deposited into the FSS account and the ratio with accrued payments is established Confirming certificates This is a sick leave certificate, a certificate of pregnancy and childbirth of the employee The application is based on the requirements of the Fund . A sample application to the Social Insurance Fund for sick leave can be downloaded here.

Let's take a closer look at how to review a document of incapacity for authenticity. Examination of a sick leave certificate for authenticity based on external features. Each genuine sick leave certificate contains a number of signs and distinctive features by which it can be checked for the legality of its issuance.

FSS confirmation of type of activity 2020

The Social Insurance Fund approves your contribution rate “for injuries”, based on data about your main type of activity. The main type of economic activity is considered to be the one that, based on the results of the previous year, has the largest share in the total volume of products produced and services provided (clause 9 of the Rules, approved by Government Resolution No. 713 of December 1, 2005).

To confirm the main type of activity, the following set of documents is submitted to the territorial body of the Social Insurance Fund where the policyholder is registered, on paper or electronically (clause 3 of the Procedure, approved by Order of the Ministry of Health and Social Development dated January 31, 2006 No. 55):

- Application for confirmation of the main type of economic activity;

- Certificate confirming the main type of economic activity;

- A copy of the explanatory note to the balance sheet for the previous year (except for insurers - small businesses).

To confirm the type of activity in the Social Insurance Fund in 2021, the application form is the same as in 2021.

Confirmation deadlines

To confirm the main type of activity for 2021, documents must be submitted to the Social Insurance Fund no later than April 15, 2020 (clause 3 of the Procedure, approved by Order of the Ministry of Health and Social Development dated January 31, 2006 No. 55).

How to track payment of sick leave on the FSS portal

The basis for this is precisely the same false document that was received and examined by the accountant. If the company nevertheless makes payments under a false document, the social insurance fund, of course, will not cover its expenses (it has this right according to subparagraph 3, paragraph 1, article 11

Federal Law dated July 16, 2021 No. 165-FZ). If the falsity was discovered after the verification of the authenticity of the sick leave was completed and payments were assigned, the employing company has every right to withhold from the employee the entire amount of payments in the form of twenty percent penalties from each benefit payment or from each salary payment.

Sick leave accrual

In this situation, the employee has every right to receive compensation from the company. As evidence of the illness that has occurred, a document with information about temporary disability is presented.

Benefits that were previously paid by the employer can be reimbursed in the future from the Social Insurance Fund. After submitting the certificate of incapacity for work to the accounting department, benefits are accrued within 10 days, calculations along with the necessary documents are presented to the Social Insurance Fund, which necessarily checks the documents and the procedure for filling out sick leave.

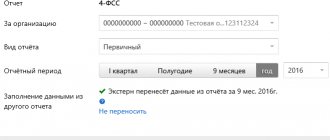

How to apply for and receive an electronic sick leave certificate through your FSS personal account

When drawing up a document, a person must give the doctor written consent to process personal data and issue a sick leave certificate online. The document does not have to be certified by the chief physician and the receptionist.

- log into your FSS personal account and find the document by number;

- obtain data from the virtual form about the period of validity of the electronic sick leave for further payment calculations;

- enter your information into the electronic sick leave in the FSS.ru account about the organization, the length of service of the insured person and the average salary;

- check the filled information. If there is an error in the electronic sick leave, then correct it at this stage;

- send the completed form from your account to the FSS department by pressing the appropriate button.

How can an employer fill out an electronic sick leave?

In the section “TO BE COMPLETED BY THE INSURER”, the columns do not differ from the columns of a similar section of the paper version of the certificate of incapacity for work, approved by Order of the Ministry of Health and Social Development of Russia dated April 26, 2011 N 347n (clause 73 of the Procedure for issuing and processing certificates of incapacity for work).

For example, these are the lines (fields): “Average earnings for calculating benefits”, “Insurance period”, “Total accrued”, “Start date WW_WW_WWWW”.

All dates are selected from pop-up calendars.

Amounts are entered in rubles and kopecks separated by a “.” (dot).

Checking sick leave by number online on the FSS website

Any employee who is absent from work due to illness is required to provide the employer with a certificate of incapacity for work. Within 10 calendar days, the accounting department calculates the benefits due to the employee and pays them on the next payday.

Since paper sick leave is now used on a par with electronic sick leave, risks remain for the employer when paying benefits for paper sick leave. If the employer pays the benefit and the sick leave turns out to be fake, the Social Insurance Fund will not reimburse the company for the expenses incurred. Which will entail additional charges, penalties and fines.

FSS find out from SNILS whether accruals have been made for sick leave

The essence of this method is as follows: the transfer of contributions will not be made until the entire total amount of sick leave has been spent. This rule is applicable only for one year, for example, the payment was made in the current year. The amount of this benefit can be used to reduce the contributions that need to be made. This applies to any month of the year during which the corresponding payment was made for the employee’s sick leave.

On the FSS website, each employer has the opportunity to check reports before submitting them to the funds under a special FSS verification program. Using this program, the completion of all calculation tables, base amounts, accruals and payment of contributions is checked. Calculations are made on an accrual basis for reimbursable expenses.

Sick leave at the expense of the Social Insurance Fund

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

The accrual of temporary disability benefits concerns not only the employee who took sick leave and was absent from work, but also his employer and the Social Insurance Fund, which is directly involved in the payment.

We recommend reading: Tax deductions for additional education in 2021

Signature and storage of electronic sick leave

To transfer information to the FSS of the Russian Federation, it must be confirmed with enhanced qualified electronic signatures of the chief accountant (another person authorized to conduct accounting) and the manager. If the manager has assumed the duties of the chief accountant, only the manager’s signature is sufficient (clause 74 of the Procedure for issuing and processing certificates of incapacity for work).

The authority to assign, calculate and pay insurance coverage to employees can be transferred to an authorized person on the basis of the employer’s administrative document and a power of attorney (clause 74 of the Procedure for issuing and processing certificates of incapacity for work).

The FSS of the Russian Federation noted that electronic sick leave has legal force. They are generated and stored in the Social Insurance Unified Insurance System. Therefore, the employer does not need to print out such sick leave and store copies of them (Information from the Federal Social Insurance Fund of the Russian Federation “Certificates of incapacity for work. Electronic certificates of incapacity for work (ELN) (question-answer)”).

The employer must keep the calculation of benefits for electronic sick leave on paper or in the form of an electronic document. Information in the calculation of benefits is confirmed by a handwritten signature or an enhanced qualified electronic signature of the chief accountant. They can be signed by the head of the organization, if he has assumed the duties of the chief accountant, or another authorized person (clause 75 of the Procedure for issuing and processing certificates of incapacity for work).

How to check a certificate of incapacity for work by number on the FSS website

The accrual of benefits for a certificate of incapacity for work is made after 10 days after its presentation. During this time, you must verify the authenticity of the document. If this happens later, you can recover the amount paid through the court.

A temporary disability certificate is a document filled out on an officially accepted form and necessary for a working citizen to confirm illness or other grounds for legal absence from work for a certain period.

View payments by SNILS

Reimbursement of expenses to the Insured for paying four additional days off to one of the parents (guardian, trustee) to care for disabled children using interbudgetary transfers from the federal fund

In order to find out the status of calculations for benefits (except for benefits for child care up to 1.5 years), you need to enter the registration number (10 digits) or SNILS number (11 digits) without hyphens or spaces. You only need to enter numbers in the form fields; after entering, click the “Search” button. This input format is required!

How to check a sick leave certificate for authenticity in 2021 on the FSS website online

In this case, the employee will be held responsible for providing a counterfeit. What are the employer's actions? He has the right to withhold 20% of his salary until the amount of overpaid funds is covered. Often employees try to avoid penalties and quit. In this case, the employer can sue him.

- If the check confirms the falsity of the form, then the FSS does not accept it and the employer does not pay benefits;

- If the error is discovered after the money has been accrued, the insurance fund will not cover the company’s expenses.

How to check the authenticity of a sick leave certificate

However, there is a small problem: according to current legislation, all information about patients, diagnoses, treatment methods, and so on is a hospital secret and is not subject to disclosure. Despite the fact that most clinic employees are willing to make contact, they have every right not to provide the accountant with the information he asked for.

- insured citizens of the Russian Federation;

- foreigners and/or stateless persons who permanently or temporarily reside in the territory of the Russian Federation;

- women who were fired due to the liquidation of the organization and became pregnant during the calendar year before they were officially recognized as unemployed;

- persons who do not have a job (provided that they are officially registered and officially registered with the employment service).

FSS electronic sick leave in your personal account

The insured person is given the opportunity to choose the form of sick leave. You should find out in advance about the possibility of an accountant creating an electronic document. Often unpleasant situations arise when an employee’s virtual certificate of incapacity for work is not accepted.

A company employee can view his electronic sick leave certificate from the Social Insurance Fund in his personal account . A simple procedure eliminates the need to go to the accounting department to obtain the necessary information related to disability.

FSS how to see payment status using SNILS

Having gained access to the FSS personal account, the policyholder must notify subordinates about the availability of the service. In order to use it, you need to enter personal data into the electronic sick leave sheet at your medical institution, if such a possibility exists.

If necessary, you can generate a sick leave file in XML format in order to subsequently process it in a cryptographic program if it is used by the employer for electronic document management with government agencies.

How to check sick leave on the FSS website online

If during verification of the sick leave it turns out that it is not real, then the employer does not have the right to assign payments based on such documentation. There is no reason for this: a document issued in accordance with the established procedure confirming incapacity for work. The Social Security Fund will not pay the costs of this benefit incurred by the employer.

If the forgery is discovered after the benefit has been paid to the employee, then the employer has the right to withhold the entire amount of the benefit from the employee in an amount not exceeding 20% of the amount due to the insured person upon subsequent payments of the benefit or his salary. If the payment of benefits or wages was stopped (for example, if the employee was fired), then the remaining debt will be demanded in court.

Create an account

To work with the personal account of the social insurance fund, you must have a confirmed account on the State Services service portal. To register you will need:

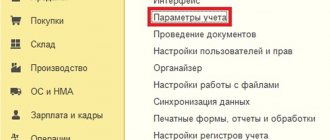

Go to the portal: https://fss.ru/, scroll the page down a little until a menu appears on the right. Here you need to click “Personal account of the policyholder”.

The user will be redirected to the page of the unified identification and authentication system, where under the login form there is a button “Register for full access to services.”

The system will prompt you to choose one of the methods:

Online banking

Having chosen this registration method, the user will be asked to select one of the banks that support online registration.

Next, the visitor will be redirected to the banking institution’s website, where for verification, he needs to log in to his account. Due to the fact that the bank has verified scanned copies of documents, the data will automatically be included in the registration form. Thus, the time required to create an account is significantly reduced and does not require visiting a multifunctional center to confirm status.

Service centers

After pressing the button, the system will display an interactive map, showing the nearest government agencies that provide account registration services. To create an account in this way, the applicant must provide proof of identification.

Online

Online registration in the State Services system allows you to create an entry-level account that has limited functionality. To confirm your profile, you will need to visit one of the MFC offices and provide identification.

To register you will need to provide:

- Last name;

- Name;

- E-mail address;

- Cell phone number.

The last step is to confirm your email and mobile number by clicking on the link that will be sent in the letter.