Kbk usn in 2021 for LLC and individual entrepreneur (15 and 6 percent)

Download the table with codes according to the simplified tax system

The article contains all the BCCs according to the simplified tax system for 2021 for LLCs, JSCs and individual entrepreneurs.

Please note that the BCC for simplifiers has changed. For a table of new codes from the Ministry of Finance, see the article in the Simplified magazine:

New KBK for simplifiers

In the article you will find:

- BCC for simplified tax system “Income” 6% in 2021 for individual entrepreneurs and legal entities (JSC and LLC)

- BCC for the simplified tax system “Income minus expenses” 15% for individual entrepreneurs and legal entities (JSC and LLC)

- Minimum tax codes

- Codes for penalties and fines

There is no difference between the BCC for LLCs and individual entrepreneurs using the simplified taxation system. The key point is only the object of taxation.

Kbk usn “income” 6% in 2021

If the taxpayer chooses the object of taxation “income”, then the single tax is calculated at a rate of 1-6 percent. In order not to make a mistake in the KBK, pay attention to digits 7-11 (should be “01011”). If you transferred the tax, but in the payment order you mistakenly indicated the KBK penalty payment, you can clarify the payment, for more details, see the article “The Ministry of Finance allowed the KBK to be specified.”

KBK simplified tax system 6 percent for individual entrepreneurs

Name of KBK revenues KBK number

| Tax simplified tax system for 2021 in 2021 | 182 1 0500 110 |

| Advance payments under the simplified tax system for the 1st, 2nd and 3rd quarters of 2021 | 182 1 0500 110 |

| Tax according to the simplified tax system for 2021 in 2021 | 182 1 0500 110 |

KBK simplified tax system 6% for legal entities LLC and JSC

Name of KBK revenues KBK number

| Tax simplified tax system for 2021 in 2021 | 182 1 0500 110 |

| Advance payments under the simplified tax system for the 1st, 2nd and 3rd quarters of 2021 | 182 1 0500 110 |

| Tax according to the simplified tax system for 2021 in 2021 | 182 1 0500 110 |

Kbk for the simplified tax system “income minus expenses” in 2021

If the taxpayer chooses the object of taxation “income minus expenses”, then the single tax is calculated at a rate of 5-15 percent.

For the object of taxation “income minus expenses”, category 7-11 in the KBK is “01021”.

KBK simplified tax system 15% for individual entrepreneurs

Name of KBK income minus expenses KBK number

| Tax simplified tax system for 2021 in 2021 | 182 1 0500 110 |

| Advance payments under the simplified tax system for the 1st, 2nd and 3rd quarters of 2021 | 182 1 0500 110 |

| Tax according to the simplified tax system for 2021 in 2021 | 182 1 0500 110 |

KBK simplified tax system 15% for legal entities LLC and JSC

Name of KBK income minus expenses Number

| Tax simplified tax system for 2021 in 2021 | 182 1 0500 110 |

| Advance payments under the simplified tax system for the 1st, 2nd and 3rd quarters of 2021 | 182 1 0500 110 |

| Tax according to the simplified tax system for 2021 in 2021 | 182 1 0500 110 |

Kbk minimum tax

Only taxpayers with the object of taxation “income minus expenses” have the right to pay the minimum tax.

The main condition for this is that the tax payable under the simplified tax system was below the minimum (1% of income). Name Number

| Minimum tax for 2021 in 2021 | 182 1 0500 110 |

| Advance payments for the 1st, 2nd and 3rd quarters of 2021 | The minimum tax on advances is not paid! |

| Tax according to the simplified tax system for 2021 in 2021 | 182 1 0500 110 |

Kbk for penalties according to usn

If the tax is not paid on time, penalties are assessed, which the taxpayer can pay independently, without waiting for the request of the tax inspectorate.

Name Number

| penalties according to the simplified tax system “income” | 182 1 0500 110 |

| penalties under the simplified tax system “income minus expenses” | 182 1 0500 110 |

Kbk for simplified fines

Failure to pay taxes on time will result in fines issued by the tax office.

Name Number

| fines under the simplified tax system “income” | 182 1 0500 110 |

| fines under the simplified tax system “income minus expenses” | 182 1 0500 110 |

In the “Simplified 24/7” program, tax payments are generated automatically with the correct BCC. There is no longer any need to verify and track changes in the BCC, since they are always relevant and updated by experts. You can calculate the tax and generate a payment invoice for free, having received full access to the program for 30 days.

Try for free

Source: //www.26-2.ru/art/351742-kbk-usn-2021

KBK 2021 for individual entrepreneurs

The BCC consists of a long chain of numbers, each of which contains a code that classifies the corresponding group of receipts.

This tool is necessary for the smooth functioning of the budget system, since the flow of revenues and the number of expenses is enormous. The structure of the encodings allows you to specify and detail each receipt. The procedure for using budget classification codes is regulated by the Ministry of Finance. 2018 was marked by changes to the directory of budget classification codes, uniform in all regions of the Russian Federation:

- introduction of new tax codes on bond income;

- The list of excise codes has been added.

The BCC for the simplified tax system in 2021 for individual entrepreneurs is divided into:

- BCC for payment of the simplified tax system for 2021 for individual entrepreneurs for the object “income”;

- BCC according to the simplified tax system for the object “income minus expenses” for 2021 for individual entrepreneurs.

Until the end of last year, there were 3 KBK for the simplified tax system for individual entrepreneurs. Below is information about the CBK on simplified taxation system income in 2021 for individual entrepreneurs (column No. 2), as well as the object “income minus expenses” (column No. 3):

| Object (1) | (2) | (3) |

| advance payments + single tax | 18210501011011000110 | 18210501021011000110 |

| penalty | 18210501011012100110 | 18210501021012100110 |

| fine | 18210501011013000110 | 18210501021013000110 |

Until the end of last year, payment of the lower threshold tax fee was carried out using a separate code; from 2021, it is mandatory to use the single tax code.

The date of payment is considered to be the day specified in the payment order (from the individual entrepreneur's current account to the Treasury account). Mandatory condition: the amount in the account must be sufficient to cover the payment.

We recommend you study! Follow the link:

KBK and other details for individual entrepreneurs on UTII for deduction of tax, penalties or fines

Kbk usn income minus expenses (usn 2021, kbk 2021)

The simplified tax system with the object “income minus expenses” involves paying a tax calculated at a rate of 15%. Check your KBK - due to an error in the payment, the tax will be underpaid and you will have to pay penalties.

Read in the article:

- Codes for “simplified”

- Object “income minus expenses”

- Object “income”

Under the simplified tax system “income minus expenses,” firms and entrepreneurs calculate tax on the difference between income and expenses at a rate of 15% or at a lower rate if regional authorities have reduced it:

- for individual entrepreneurs working in production, science, social sphere and providing services to the population - up to 0%;

- for other organizations and individual entrepreneurs – up to 5%.

You have to pay the tax three times during the year - in advance and also at the end of the year. The deadline for paying the simplified tax system is until the 25th day of the month after the calculation period. If the deadline falls on a working day, the deadline is postponed according to the rules of the Tax Code to the next next working day. Read more about the deadlines in Table 1.

Table 1. Payments under the simplified tax system

| Payment period | Payment terms for companies | Payment terms for individual entrepreneurs |

| Quarter | 25th of April | 25th of April |

| Half year | July 25 | July 25 |

| 9 months | the 25th of October | the 25th of October |

| Year | March 31 next year | April 30 next year |

The tax or advance on it is considered paid on the day when the company or entrepreneur submits a payment slip to their bank for the transfer of the simplified tax system, provided that there is enough money in the current account.

Try filling out the simplified taxation system online for free.

The declaration under the simplified tax system needs to be submitted only once a year:

- for companies - until March 31 of the following reporting year;

- Individual entrepreneur – until April 30 of the following reporting year.

Try to draw up and submit a declaration under the simplified tax system online.

KBK: USN

KBK is a budget classifier for expenses and income. For the budget, taxes transferred by firms and individual entrepreneurs are income.

The structure of the KBK includes three component codes:

- income administrator code;

- budget income type code;

- budget income subtype code.

Budget revenues in the form of taxes are managed by the Federal Tax Service of Russia, its code is 182. Therefore, in the KBK for the simplified tax system, the first three digits are 182.

- Download a reference book on the structure of the KBK USN.

When transferring tax according to the simplified tax system of the KBK, which consists of 20 characters, you must indicate it in field 104 on the payment slip so that the payment is received as intended. An error in the KBK payment leads to the fact that the transferred amount will be incorrectly allocated to budgets:

- or to the budget of the wrong municipal region of the Russian Federation;

- or to a budget of another level (for example, not to the regional, but to the local);

- or in the number of outstanding payments.

As a result, due to an error in the KBK simplified tax system, the tax will be underpaid and the company or entrepreneur will have to pay penalties. Therefore, we recommend that you check the KBK USN 2021 income minus expenses again.

Kbk 2021: income minus expenses

According to the simplified tax system, income minus expenses for 2021 BCC, see Table 2.

Table 2. STS 2021 income minus expenses, BCC 2021

| Payments according to the simplified tax system | KBK code |

| Advance payment for simplified tax systemAnnual simplified tax system | 182 1 0500 110 |

| Penalty | 182 1 0500 110 |

| Fines | 182 1 0500 110 |

The numbers in these codes indicate:

- 182 – Federal Tax Service of Russia;

- 105 – tax payment on income, in this case – simplified tax system;

- 01021 01 – grouping of budget income and type of budget (01 – federal);

- 1000, 2100, 3000 – analytical subtype of budget income – tax, penalty, fine;

- 110 – type of budget revenue, in this case tax revenue.

A fragment of a payment slip with field 104 looks like this:

Example 1. Symbol LLC, operating on the income-expenditure simplified tax system, made a tax advance for the first quarter in the amount of 60,000 rubles 5 days later than the due date. The key rate of the Central Bank of the Russian Federation is 7.25%. The late fees amounted to 72.50 rubles (60,000 rubles x 5 days x 7.25% / 300). In the payments, the Symbol accountant will indicate:

– KBK 182 1 0500 110 – for payment of 60,000 rubles;

– KBK 182 1 0500 110 – for payment of 72.50 rubles.

For the minimum tax according to the simplified tax system of the KBK, see table 3.

Table 3. Tax simplified tax system KBK

| Payment according to the simplified tax system | KBK code |

| Minimum simplified tax system | 182 1 0500 110 |

| Penalty | 182 1 0500 110 |

| Fines | 182 1 0500 110 |

Kbk 2021: income

For comparison, we present in Table 4 tax codes for income under the simplified tax system.

Table 4. KBK USN income

| Payment according to the simplified tax system | KBK code |

| Advance payment for simplified tax systemAnnual simplified tax system | 182 1 0500 110 |

| Penalty | 182 1 0500 110 |

| Fines | 182 1 0500 110 |

A fragment of a payment slip with field 104 looks like this:

- payments under the simplified tax system “income”.

Example 2. Symbol LLC, operating on the income-generating simplified tax system, made a tax advance for the first quarter in the amount of 60,000 rubles 10 days later than the due date. The key rate of the Central Bank of the Russian Federation is 7.25%. Late fees amounted to 145 rubles (60,000 rubles x 10 days x 7.25% / 300). In the payments, the Symbol accountant will indicate:

– KBK 182 1 0500 110 – for payment of 60,000 rubles;

– KBK 182 1 0500 110 – for payment 145 rubles.

Source: //www.BuhSoft.ru/article/1194-kbk-usn-dohody-minus-rashody

Tax payment deadlines

Article 346.21 of Chapter 26.2 of the Tax Code of the Russian Federation establishes the following deadlines for companies and individual entrepreneurs using the simplified taxation system:

- For advance payments - no later than the 25th day of the month after the end of each quarter, which are defined as reporting periods. This deadline is the same for all taxpayers.

- For year-end payments - no later than the following dates after the end of the reporting year:

- for legal entities - March 31;

- for individual entrepreneurs - April 30.

According to the general rule established by paragraph 7 of Art. 6.1 of the Tax Code of the Russian Federation, the tax payment deadline is moved to the first working day following the weekend.

The minimum tax, for which the law does not establish a separate payment date, should, according to tax authorities, be paid within the same period as other payments under the simplified tax system.

Table: dates for payment of simplified tax in 2021

| Taxpayers | Payment deadlines |

| Based on the results of 2021 | |

|

|

| Advance payments for organizations and individual entrepreneurs in 2021 | |

| For 1 quarter | 25th of April |

| For the 2nd quarter | July 25 |

| For the 3rd quarter | the 25th of October |

Kbk for usn minimum tax in 2021

Which BCCs should be applied under the simplified tax system in 2021? What are the BCCs with the object “income” and “income minus expenses” (6% and 15%)? Have the simplified BCC changed in 2021 for legal entities and individual entrepreneurs? Let's talk about this and provide a table with the BCC according to the simplified tax system for 2021 (for different taxation objects).

When to pay payments under the simplified tax system in 2021

Payers of the simplified tax system in 2021 must quarterly calculate and pay advance payments for the “simplified” tax no later than the 25th day of the month following the quarter, as well as the tax for the year no later than March 31 (for organizations) and April 30 (for individual entrepreneurs). When paying the simplified tax system, you must indicate in the payment slip the budget classification code (BCC) to which the tax is transferred according to the simplified tax system.

Budget classification codes according to the simplified tax system in 2021 must be indicated in field 104 of the payment order (according to the order of the Ministry of Finance of Russia dated July 1, 2013 No. 65n, as amended by order No. 90n dated June 20, 2021). For legal entities (organizations) and individual entrepreneurs (IP) on the simplified tax system, the indicators depend on:

- from the object of taxation;

- from the purpose of payment.

- Tax and advance payments - 182 1 0500 110

- Penalty — 182 1 0500 110

- Fines - 182 1 0500 110

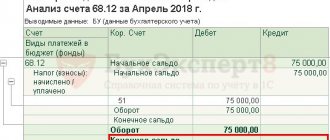

- taxable income - RUB 11,120,000;

- expenses taken into account for the purpose of calculating the tax base for the single tax under the simplified tax system - 10,700,000 rubles.

Kbk according to the usn “income” in 2021 (6%)

The BCC for the simplified tax system for 2021 with the object “income” is single – 182 1 05 01011 01 1000 110. Advance payments and a single tax at the end of the year are transferred using this code (182 1 0500 110).

The BCC for penalties of the simplified tax system 2021 and the code for paying the fine differs in the 14th and 15th digits (21 and 30 instead of 10). Let us summarize the BCC according to the simplified tax system “income” for 2021 in the table. It is relevant for organizations and individual entrepreneurs:

Pay taxes in a few clicks!

Pay taxes, fees and submit reports without leaving your home! The service will remind you of all reports.

Every simplifier pays taxes to the budget using budget classification codes. BCCs can change at any time, so there is a question: which BCCs are currently relevant. In the article we will tell you what KBK is, how to use them and which KBK for the simplified tax system to use in 2021.

What is KBK and where should it be indicated?

The budget classification code (BCC) shows where the state receives its revenues and where its expenses are directed. The KBK system was created to regulate financial flows; with their help, a budget program is drawn up at the level of the state and constituent entities.

Organizations and entrepreneurs using the simplified tax system should also know and use KBK in payments. Whether the tax authorities will take this payment into account or not depends on the correctness of filling out the order.

If the tax office does not see the tax on time, it can collect it unilaterally and charge penalties. In 2021, as in the past, field 104 is provided in the payment form for KBK.

The rules for applying the BCC are regulated by Order of the Ministry of Finance No. 65n dated July 1, 2013.

The simplified single tax is paid for the quarter in the form of advance payments until the 25th of the next month. Tax for the year is paid by organizations until March 31 and until April 30 for individual entrepreneurs. To transfer tax, fill out the payment form correctly and indicate the correct BCC depending on the object of taxation and the purpose of the payment.

Kbk usn "income" 2021

For the simplified tax system “income” a rate of 6% is applied (or less - we wrote about rates in the regions here). It only taxes the income of the organization. Despite new changes in legislation on behalf of the Ministry of Finance, the BCC for the simplified tax system of 6% remained the same. The codes for taxes, penalties and fines are different.

For tax not paid on time, the Federal Tax Service charges penalties for each day of delay. There is a special KBK for their payment, as well as for fines. The differences between these codes are only in characters 14 to 17. Tax - 1000, penalties - 2100, fine - 3000.

Kbk usn “income minus expenses” 2021

The simplified version with the object “income minus expenses” has other BCCs, which depend on the purpose of the payment. There have been no changes to the KBK simplified tax system of 15% in 2021, so please indicate the following codes in the payment order:

Tax and advance payments - 182 1 0500 110 Penalties - 182 1 0500 110

Fines - 182 1 0500 110

As you can see, the codes for different taxation objects are practically the same. 19 out of 20 digits match, the difference is only in the 10th digit. When transferring tax on the “income minus expenses” object, always make sure that the 10th digit is the number “2”.

Kbk usn 2021 for minimum tax

For simplifiers with the object “income minus expenses”, it is mandatory to pay a minimum tax. When the tax amount for the year does not exceed 1% of your income, you will have to pay a minimum tax of 1% of income.

When filling out a payment order, please note that from 2021, the same BCC is applied to transfer the minimum tax as for advance payments on the simplified tax system of 15%.

Therefore, when transferring the minimum tax, in field 104 indicate KBK 182 1 0500 110. The codes have been combined to facilitate the work of the Federal Tax Service.

They can now automatically count advance payments made for the year toward the minimum tax.

Kbk usn for individual entrepreneurs

Individual entrepreneurs using the simplified tax system are wondering which KBK they should use to pay a single tax. According to Art. 346.21 of the Tax Code of the Russian Federation, individual entrepreneurs pay tax in the general manner.

For individual entrepreneurs, the simplified tax system does not provide for separate BCCs; they are the same for individuals and legal entities.

The only difference is the timing of tax payment; individual entrepreneurs can pay the final tax payment for the year before April 30, and not until March 31, like an organization.

What are the consequences of an incorrect KBK in a payment order?

The absence or incorrect indication of the code may result in the payment being among the unknown. The responsibility for indicating the correct BCC lies with the taxpayer, since the codes are enshrined in law.

If you indicated the wrong code, but the payment was received by the budget, send an application to the Federal Tax Service to clarify the payment. The tax authority will recalculate penalties for the period from the date of payment until the payment is clarified. In Article 45 p.

4 of the Tax Code of the Russian Federation specifies two types of errors in which the payment will not be counted: an incorrect treasury account number or an error in the name of the recipient bank. In this case, a different procedure for correctly determining the payment applies.

How to check the KBK for correctness

You can see the current BCCs on the Federal Tax Service website (//www.nalog.ru/rn22/taxation/kbk/) in the “Taxation in the Russian Federation”/ “Budget Revenue Classification Codes” section. Select individual entrepreneur, legal entity or individual and the required tax.

In addition, the Federal Tax Service website has a service for filling out a payment document - //service.nalog.ru/payment/payment.html. Specify the taxpayer and the payment document, then enter the BCC in the special field. This way you can find out for which payments this code is used.

Elizaveta Kobrina

The cloud service Kontur.Accounting helps generate payment orders for paying taxes - all that remains is to transfer them to the Internet bank and pay. Keep records, submit reports and pay salaries with us. Calculate taxes and generate payments for free; new users are given access to the service for 30 days.

Articles on the topic

In 2021, in payment orders for the transfer of the simplified tax system 15 (income minus expenses), it is necessary to indicate the correct BCC income minus expenses 15 2021, otherwise difficulties will arise with clarifying the payment.

KBK USN 15 income minus expenses 2021 is needed to pay tax by companies and individual entrepreneurs that use a simplified taxation system with the object “income minus expenses.” We will tell you in more detail which codes you need to pay taxes, penalties and fines for this year.

Kbk usn 2021 income minus expenses 15

Last year, a separate KBK of the simplified tax system, income minus expenses, was abolished for the minimum tax paid by simplified companies with the object “income minus expenses” if, at the end of the tax period, the tax calculated in the general manner was less than 1% of the company’s income.

Now for the simplified tax system income minus expenses 15 there is a single BCC - 182 1 0500 110. A separate code for the minimum tax is no longer used (code 182 1 0500 110). The Ministry of Finance approved the changes by order No. 90n dated June 20, 2021.

Kbk usn 2021 income minus expenses 15

Minimum tax under the simplified tax system, income minus expenses in 2021: calculation, KBK, payments

The obligation to pay the minimum tax under the simplified tax system in 2021 may only appear for “simplified” taxation workers with the object of taxation being income minus expenses. To understand whether you need to pay it, calculate this payment at the end of the year.

The amount of the minimum tax is calculated as 1% of the income received, taken into account under the simplified tax system. And you need to pay the minimum tax only if its amount is greater than the single tax calculated in the general manner (clause 6 of Article 346.18 of the Tax Code of the Russian Federation).

That is, you need to compare two amounts.

Taxpayers who incurred losses at the end of the year (which means the single tax is zero) will also be forced to pay a minimum tax. Of course, it is equal to zero if there is no income for the reporting year.

At the end of the first quarter, half a year and 9 months, you cannot pay the minimum tax. During the year, advance payments for a single tax are considered provided that there is no loss. If you have a loss during the year, advances are zero.

You can calculate the minimum tax in our program “Simplified 24/7”. Consultation on all accounting issues is available to users 24 hours a day, 7 days a week. The first year of work in the Simplified 24/7 program is completely free for you. Get started now.

Calculation example

Success LLC applies the simplified tax system with the object of taxation being income minus expenses, the tax rate is 15%. The 2021 figures are as follows:

At the end of 2021, the accountant calculated the single and minimum taxes.

The minimum tax is 111,200 rubles. (RUB 11,120,000 × 1%).

Single - 63,000 rub. [(RUB 11,120,000 – RUB 10,700,000) × 15%].

Since the minimum tax turned out to be more than one (111,200 rubles > 63,000 rubles), at the end of 2021, Success LLC transferred the minimum tax to the budget.

Payment deadlines

In accordance with paragraph 7 of Article 346.21 of the Tax Code of the Russian Federation, the single tax after the reporting year must be transferred to the budget no later than the deadline established for filing tax returns. This is March 31, 2021 - for organizations and April 30 - for entrepreneurs (clause 1 of Article 346.23 of the Tax Code of the Russian Federation).

Source: //korholding.ru/kbk-dlja-usn-minimalnyj-nalog-v-2021-godu/

What is KBK and where should it be indicated?

The budget classification code (BCC) shows where the state receives its revenues and where its expenses are directed.

The KBK system was created to regulate financial flows; with their help, a budget program is drawn up at the level of the state and constituent entities. Organizations and entrepreneurs using the simplified tax system should also know and use KBK in payments. Whether the tax authorities will take this payment into account or not depends on the correctness of filling out the order. If the tax office does not see the tax on time, it can collect it unilaterally and charge penalties. In 2021, as in the past, field 104 is provided for the KBK payment order. The rules for using the KBK are regulated by Order of the Ministry of Finance No. 65n dated July 1, 2013.

The simplified single tax is paid for the quarter in the form of advance payments until the 25th of the next month. Tax for the year is paid by organizations until March 31 and until April 30 for individual entrepreneurs. To transfer tax, fill out the payment form correctly and indicate the correct BCC depending on the object of taxation and the purpose of the payment.

Kbk for usn minimum tax 2021 - Moneyprofy.ru

The BCC for the simplified tax system “income” in 2021 is established by the Instructions approved by Order of the Ministry of Finance dated July 1, 2013 No. 65n. For the simplified tax system with the taxable object “income”, the BCC for 2021 is set at 18210501011011000110.

Please note that when transferring tax, it is required to indicate the BCC in the payment slip, depending on whether the amount of tax itself, penalties and (or) fines are subject to transfer.

KBK simplified tax system “income” in 2021 is as follows:

Kbk usn with “minimum tax” in 2021

The minimum tax in 2021 must be transferred according to the BCC of ordinary advance payments. This provision follows from the order of the Ministry of Finance of Russia dated June 20, 2021 No. 90n.

Let's assume that the organization has finalized the simplified tax system by the end of the year. At the same time, she reached the minimum tax and must pay it no later than March 31, 2021. You need to transfer money to KBK - 182 1 0500 110. This KBK is valid for both regular tax with the object “income minus expenses” and for the minimum “simplified tax”.

In other words, in 2021, organizations using the simplified tax system used two different BCCs. One was used for regular tax under the simplified tax system, the other for the minimum tax. Starting in 2021, the situation has changed - the KBK has become unified.

From January 1, 2021, the BCC for insurance premiums approved for 2021 will apply. A table containing budget classification codes for insurance premiums is presented in this article.

When transferring personal income tax in 2021, tax agents must indicate the following BCC.

KBK 18210202140061100160 - Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of insurance pensions for periods expired before January 1, 2021

18210202101082011160 kbk transcript 2021 Question: 18210202101082011160 kbk transcript 2021 what tax? Answer: This is the budget code..

18210202110062110160 KBK transcript 2021 Question: 18210202110062110160 KBK transcript 2021 what tax? Answer: This is the budget code..

tgdon.ru

How to calculate the minimum tax under the simplified tax system 2021 - 2021

Organizations and individual entrepreneurs - individual entrepreneurs who apply the simplified tax system with the taxable object INCOME minus EXPENSES (USN D-R) must calculate the amount of the minimum tax based on the results of the tax period (year). There is no need to calculate the minimum tax based on the results of reporting periods.

According to Article 346.19 of the Tax Code of the Russian Federation, the tax period under the simplified tax system is a calendar year. Reporting periods under the simplified tax system are the first quarter, six months and nine months of the calendar year.

Also, if the object of taxation under the simplified tax system is INCOME, then in this case the minimum tax is not calculated and not paid, because in this case there is always income, of course, if economic activity was carried out. And these incomes are taxed at their own rate.

Formula for calculating the minimum tax 2021

So, according to clause 6 of Article 346.18 of the Tax Code of the Russian Federation, when applying the simplified tax system as an object of taxation, income minus expenses, pays the minimum tax.

The amount of the minimum tax is calculated for the tax period in the amount of 1 percent of the tax base, which is income determined in accordance with Article 346.15 of the Tax Code.

The minimum tax is paid if for the tax period the amount of tax calculated in the general manner is less than the amount of the calculated minimum tax, i.e. a loss was incurred. Therefore, it is beneficial for income to be slightly higher than expenses, so that there is no loss under the simplified tax system D-R.

The minimum amount of tax under the simplified tax system for an object of income minus expenses is calculated using the following formula:

Minimum tax = Taxable income received during the tax period × 1%.

The minimum tax under the simplified tax system 2021 should be paid to the budget if, at the end of the tax period, it turned out to be more than the “simplified” tax, calculated at the regular rate (15% or less).

For example, a company applies the simplified tax system with the object of taxation being income minus expenses:

Let's calculate what tax the company must pay at the end of 2021.

Since the recorded expenses are greater than income, this means that at the end of the year there will be a loss in the amount of 160,300 rubles. (RUB 28,502,000 – RUB 28,662,300). Therefore, the tax base and single tax at the regular rate are equal to zero. It is in this case that the minimum tax must be calculated. It will be:

RUB 285,020 (RUB 28,502,000 × 1%)

The minimum tax is greater than the single tax, so at the end of 2021 you will have to pay a minimum tax to the budget.

If the simplified tax system is combined with another tax regime, for example with a patent taxation system, the amount of the minimum tax is calculated only on income received from “simplified” activities (letter of the Federal Tax Service of Russia dated 03/06/2013 No. ED-4-3/).

It must be remembered that the minimum tax is paid only at the end of the year, and only if the “simplified tax” loses the right to the simplified tax system during the year, then the minimum tax (if it was payable) must be transferred based on the results of the quarter in which the right to simplified tax was lost . There is no need to wait until the end of the year.

Deadlines for payment, BCC minimum tax

The Tax Code of the Russian Federation does not establish special deadlines for paying the minimum tax. This means that it must be transferred in the general manner no later than the deadline established for filing a tax return:

- legal entities pay the minimum tax no later than March 31.

- entrepreneurs - no later than April 30 of the year

Source: //moneyprofy.ru/kbk-dlja-usn-minimalnyj-nalog-2021/

Kbk for income tax according to usn 6

KBK simplified tax system income for 2021 and 2021 - have they changed or remained the same? This question is often of interest to those who work in simplified language. We will consider in our material which BCCs under the simplified tax system are provided for in 2021-2021.

Have the BCCs changed for the simplified tax system in 2021–2021?

When working on a simplified basis, it is important to know the current BCC for the simplified tax, which must be paid quarterly.

To learn about what requirements must be met in order to switch to the simplified tax system, read the article “ Procedure for applying the simplified taxation system .”

Both old and new payers of the simplified tax system need to monitor the relevance of the KBK, because when paying taxes, the KBK is the most important requisite for correctly reflecting the received payment on the payer’s personal account.

The BCC of the simplified tax system for 2021–2021 remained unchanged - this applies to both the object of taxation “income minus expenses” and the object “income”. But there are changes in terms of the minimum tax under the KBK. From 2021, a separate BCC for it has been abolished, and this tax must be paid on the same BCC as the main tax of the simplified tax system “income minus expenses”.

What is the BCC according to the simplified tax system “income minus expenses” in 2021–2021

Let us remind you that the use of this or that object on the simplified tax system is voluntary, and the taxpayer himself decides which method of calculating tax is optimal for him. The rate for the object “income reduced by expenses” can vary from 5 to 15% (clause 2 of article 346.20 of the Tax Code of the Russian Federation).

When paying tax on the simplified tax system for the object “income minus expenses”, the following BCCs should be indicated:

What does the BCC look like for the simplified tax system “6 percent” in 2021-2021?

If the taxpayer has chosen the object “income”, then the BCC for the simplified tax system is 6% (recall that the constituent entities of the Russian Federation, according to clause 1 of Article 346.20 of the Tax Code of the Russian Federation, from 2021 have the right to reduce this rate to 1%) in 2021 will be as follows:

Which BCC to pay the minimum tax in 2021–2021 on the simplified tax system

It follows from the norms of the Tax Code of the Russian Federation that the minimum tax is a tax on the object “income minus expenses”, obligatory for payment by the taxpayer if the simplified tax calculated by him for the tax period is less than 1% of the amount of income received for this period.

To pay the minimum tax from 2021, the same BCCs are used as for the main tax on the object “income minus expenses”, i.e.:

To learn about the form and time frame for submitting a declaration under the simplified tax system, read the material “Sample of filling out a declaration under the simplified tax system in 2021-2021.”

BCCs according to the simplified tax system change quite rarely, but their values still need to be checked periodically. It is important to remember that for each of the taxable objects of the simplified tax system there are individual BCCs.

Be the first to know about important tax changes

Have questions? Get quick answers on our forum!

nalog-nalog.ru

Kbk according to the usn in 2021

Which BCCs should be applied under the simplified tax system in 2021? What are the BCCs with the object “income” and “income minus expenses”? How will the simplified BCC change in 2021? We'll talk about this in our article.

Deadline for transferring the single tax to KBK in 2021

Payers of the simplified tax system must quarterly calculate and pay advance payments for the “simplified” tax no later than the 25th day of the month following the quarter, as well as the tax for the year no later than March 31 (for organizations) and April 30 (for individual entrepreneurs). When paying the simplified tax system, you must indicate in the payment slip the budget classification code (BCC) to which the tax is transferred according to the simplified tax system.

Kbk usn “income” in 2021

The BCC for the simplified tax system for 2021 is provided for by the Instructions approved by Order of the Ministry of Finance dated July 1, 2013 No. 65n. For the simplified tax system with the object “income”, the unified BCC for 2021 is 182 1 0500 110.

Please keep in mind that in 2021, when transferring a “simplified” tax, the payment order must indicate the BCC, depending on whether the amount of tax itself, a penalty or a fine is being transferred.

KBK simplified tax system “6 percent” in 2021 are as follows:

Kbk usn “income minus expenses” in 2021

If “income minus expenses” is chosen as the object of taxation, then the KBK simplified tax system in 2021 for organizations and individual entrepreneurs is as follows:

Kbk usn with “minimum tax” in 2021

From 2021, the minimum tax under the simplified tax system will no longer have a separate BCC. That is, the minimum tax in 2021 will need to be transferred according to the code for ordinary advance payments (Order of the Ministry of Finance of Russia dated June 20, 2021 No. 90n). Let us explain how such a change in the BCC to the simplified tax system will affect real life.

Let’s assume that an organization with the object “income minus expenses” lost the right to the simplified tax system in September 2021. Based on the results of 9 months of 2021, it reached the minimum tax according to the simplified tax system. It must be transferred no later than October 25th. You need to deposit money to KBK 182 1 05 01050 01 1000 110. It is this KBK that is valid for the minimum tax under the simplified tax system in 2021.

Now let’s imagine that the organization has finalized the simplified version by the end of the year. She has reached the minimum tax and must pay it no later than March 31, 2021. You need to transfer the money to another KBK - 182 1 0500 110. The new KBK from 2021 is valid both for the regular tax on the object “income minus expenses” and for the minimum “simplified tax”.

In other words, in 2021, organizations with the object “income minus expenses” used two different BCCs. One for regular tax under the simplified tax system, the other for the minimum tax. Starting from 2021, the situation is changing - the BCC for such payments will be uniform. Below is a table of the BCC according to the simplified tax system for 2021.

buhguru.com

Articles on the topic

KBK simplified tax system 6 percent 2021 is used on a simplified taxation system with the object “income”. See the current codes for taxes, penalties and fines in the table, as well as a sample payment order.

Kbk usn 6 percent in 2021

The simplified tax system rate is 6 percent - the rate at which the entire income of an organization applying a special regime is taxed (Article 346.20 of the Tax Code of the Russian Federation).

The use of the simplified tax system of 6 percent among small business owners is considered the simplest accounting system. And this tax is transferred to individual KBKs.

Despite the latest changes in budget classification codes starting this year, KBK STS revenues 2021

not changed. At the same time, the code for taxes, penalties and fines is different (see table).

KBK simplified tax system income for 2021

KBK simplified tax system income for 2021 consists of 20 digits, where

- 182 - payment administrator code - Federal Tax Service;

- 105 - simplified tax system;

- 0101101 - budget type (federal), subgroups, code, income subitem;

- 1000 - tax;

- 110 - tax revenues.

- The tax base is calculated.

- The amount of the advance payment is determined.

- The amount of tax payable is calculated.

In the payment order of the simplified tax system, income must be indicated exactly KBK18210501011011000110, both when paying tax in the current year and for previous periods.

Download KBK USN 2021 income

Thus, companies on the simplified tax system with an income object have one BCC for tax, one for fines and one for penalties. Read more about this.

Kbk usn income penalties 2021

If the tax is not paid on time, tax authorities will charge penalties. They must be paid using a special separate code - KBK penalties according to the simplified tax system income 2021: 18210501011012100110.

The differences between the penalty code and the simplified tax system tax code are only in 14-17 digits. For penalties it is 2100. For tax - 1000. For fines - 3000.

Kbk usn 6 percent 2021 for individual entrepreneurs: sample payment order

In field 104 of the payment order according to the simplified tax system (“Recipient”), you must put the budget classification code, which consists of 20 characters. BCC 6 percent according to the simplified tax system for individual entrepreneurs 2021 - 182 1 0500 110.

If you indicate an incorrect BCC of the simplified tax system for individual entrepreneur income 2021, then the Tax Code of the Russian Federation does not prohibit clarification of the erroneous BCC. However, it can be clarified within the limits of one tax, for example, if instead of a new code the company has installed an old one. But this will have to be proven in court (resolution of the Federal Antimonopoly Service of the Central District dated January 31, 2013 No. A64-5684/2012).

In order not to argue with the inspectorate, it is easier to pay the tax again to the correct BCC. And ask for an erroneous payment to be offset against future payments.

Watch the video about the KBK simplified tax system 6 percent. Tatyana Novikova, Ph.D. in Economics, auditor, tax consultant, associate professor at Moscow State University of Management, Moscow Government, talks about what has changed in the codes.

www.gazeta-unp.ru

Kbk on usn “income”

An individual entrepreneur, having registered his activities, if he has chosen the simplest tax system of the simplified tax system, then gets rid of a number of paper documentation.

It exempts you from many reporting documents, but you still need to fill out and submit a tax return. To do this, there are certain deadlines for submitting the document and paying the tax.

When filling out the payment form, the merchant must indicate KBK 18210501011011000110.

At first glance, all these numbers are scary and not at all understandable to entrepreneurs, because they are businessmen, not accountants. But in the process of doing business, you have to deal not only with sales, but also with accounting documents and payment orders.

If an entrepreneur works independently, without employees, then knowledge of bank details and correct entry of the BCC is an important condition. Any slip, mistake, and the tax authorities will immediately impose a fine and penalties along with it.

But before submitting payment documents, you need to know what tax you should pay. To do this you need to make some calculations.

How is tax calculated according to the simplified tax system?

A businessman working under the simplified tax system has to calculate the tax that is payable to the Federal Tax Service on a quarterly basis. How to calculate tax and find out the amount to be paid? To do this you need to perform several actions:

To make the calculation, you need to know the value of the tax base; determining it is not difficult. For example, during the quarter, individual entrepreneur Sologub earned 100,000 rubles, which means the tax according to the simplified tax system of 6% will be as follows:

100,000 * 6% = 6,000 rubles.

The simplified tax system of 6% for the year is calculated as follows: (advance payment for 1 quarter) + (advance payment for 2 quarters) + (advance payment for 3 quarters) + (advance payment for 4 quarters).

Once you know your tax, you can start filling out your tax return and then pay the tax. Very often, merchants are faced with the fact that all the details have already been entered into payment documents.

On the one hand, this simplifies the procedure for filling out the payment form, and there will be no errors when indicating the BCC, but on the other hand, the merchant wants to know what tax he pays in 2021, according to BCC 18210501011011000110.

This is a normal desire, to find out what tax it is, you can understand the structure of the BCC, and the numbers will reveal a lot. For example, the numbers 182 indicate the authority where the money is sent.

We must also remember that legislation in the country very often undergoes various changes. This is due both to the economic situation and to tightening control over taxpayers. Therefore, when it comes time to pay taxes, it is imperative to check the relevance of a particular classification code.

Do not forget that the amount of the simplified tax system can be reduced. Read about this in this article.

Current BCCs for simplifiers in 2021

Entrepreneurs are asking what codes will be valid in 2021 for paying taxes? Changes are expected for one type of tax. Merchants who paid the minimum tax used a separate BCC; it will be changed in 2021.

If a businessman is interested in KBK 18210501011011000110 for 2021 , then we can safely say that this will be a tax payment for the simplified tax system of 6%. In the table you can see which CBCs are used by entrepreneurs for special purposes. modes in 2021.

saldoa.com