Before starting a business related to delivery trade, you, as an entrepreneur, need to study the features of running this business and the taxation scheme.

ATTENTION! Starting with reporting for the fourth quarter of 2021, a new tax return form for the single tax on imputed income will be used, approved by Order of the Federal Tax Service of Russia dated June 26, 2018 N ММВ-7-3/ [email protected] You can generate a UTII declaration without errors through this service , which has a free trial period.

What kind of trade is delivery?

In the Tax Code of the Russian Federation (part two) dated 05.08.2000 No. 117-FZ (as amended on 28.12.2016) Ch. 26.5. Art. 346.43. A fairly clear definition is given:

11) distribution trade - retail trade carried out outside a stationary retail network using specialized or specially equipped vehicles for trade, as well as mobile equipment used only with the vehicle. This type of trade includes trade using a car, a car shop, a car shop, a toner, a trailer, a mobile vending machine;

Thus, it becomes clear to us that delivery trade is mobile trade, not tied to a specific location. In other words, if you want, you can make a decision at any time and change your location, but at the same time you have the right to trade from a vehicle for a long time, remaining in the same place. But, suppose you are the owner of a mobile shop, devoid of signs of mobility (no wheels, towbar, etc.) - it rather resembles a kiosk, then trade from such a counter cannot be considered delivery trade.

In general, the Tax Code quite clearly defines the types of vehicles:

- automobile,

- auto shop,

- auto shop,

- tonar,

- caravan,

- mobile vending machine.

The legislator has a number of requirements for vehicles planned to be used for distribution trade:

- Your vehicle must meet the requirements of environmental class no lower than 4 (Euro 4);

- the vehicle must undergo technical inspection;

- the vehicle must be kept in proper sanitary and technical condition;

- according to modern requirements, you will have to equip the vehicle with a mobile geolocation system with the ability to track the vehicle via the Internet;

- the vehicle must be specially equipped for trading. What does this mean? Perhaps we are talking about a vehicle that was originally created for distribution trade, and, perhaps, converted for these purposes through a major overhaul. But in any case, the signs of trade should be obvious. You need to take care of the presence of a display case or counter, refrigeration, cash register and other technological equipment provided for by the requirements of regulations for the sale of products. Do not forget about the equipment of the seller’s workplace - it is necessary to install an umbrella or canopy, a chair, a table to be able to work with the client.

During operation, connection to utility networks may be required. You have the absolute opportunity to connect to energy and water supply networks on a temporary basis - this does not deprive your activity of the status of distribution trade.

After equipping the vehicle, it is very important to decide on the range of products sold. Here the All-Russian Product Classifier comes to our aid, according to which, and in accordance with the specialization of the vehicle, you can determine the list of goods:

| No. | Specialization |

| 1 | Fast food |

| 2 | Milk products |

| 3 | Meat products |

| 4 | Vegetables fruits |

| 5 | Fish, seafood |

| 6 | Bread, bakery products, confectionery |

| 7 | Products |

| 8 | Non-food products |

| 9 | Printed products |

| 10 | Flowers |

It is necessary to pay attention to the fact that you can work with the “Products” and “Non-Food Products” specializations only in cities with a population of less than 300 thousand people and in rural areas.

Business plan

Trading from a truck shop represents a specific path for a businessman, different from other types of entrepreneurship. It is necessary to think through a step-by-step plan for opening a point.

Necessary:

- Decide what products you will sell. The most common are:

- Bakery products.

- Dairy and cheese products.

- Fruits, vegetables, herbs.

- Semi-finished meat products.

- Household chemicals.

- Poultry meat.

- Fast food.

- Grocery.

- Egg.

- Cold drinks.

- Children's and adult clothing.

Remember! The sale of alcoholic beverages, beer and tobacco products without a proper license is strictly prohibited!

- Go to the local administration, the department of trade and entrepreneurship. Consult with officials and find out the most profitable direction.

- Register as an individual entrepreneur with the tax office or MFC. You need to pay a state fee, write an application, select an activity code, and indicate OKVED. Numbers 12, 33, 62, 63 allow retail trade in non-specialized stores.

- After five calendar days, indicate in which area of taxation you will work. Usually they choose UTII. Make the calculation carefully; it may be more convenient to purchase a patent. If you plan to operate in warm weather, buy and pay tax for six months. In this mode, reporting is not required.

- Obtain permission from the administration to sell from a vending machine.

- A certificate confirming the safety of trade is issued by the machine manufacturer. You must carry it with the rest of the relevant papers at all times.

- If you decide to sell food, you must purchase a health certificate (from the SES) and undergo the necessary medical examination.

- When you have collected all the required documents, notify the Rospotrebnadzor office about your activities. For the first three years you will not be checked, work calmly! There is no need to buy a cash register; it is not required.

- Find a storage area that meets fire safety requirements.

- What other documents are needed to trade from a car shop in your area, ask your local administration.

After 10 working calendar days, a notification will be sent to your name about permission or refusal to open a point on the street.

What kind of trade cannot be considered delivery trade?

Now let’s look at the mistakes that will help you avoid problems with the law when determining the type of trade as delivery:

- trade cannot be considered delivery if you deliver the goods in accordance with a previously completed application or purchase and sale agreement;

- if your vehicle is not properly equipped, then trade from this vehicle also cannot be considered a delivery trade;

- if you trade from a tray, table, box, drawer, etc., i.e. Your trade equipment does not have the characteristics of a vehicle, then such trade cannot be considered delivery trade either.

Questions and answers

Question 1. Is trading through an online store considered delivery if the goods are delivered by courier?

Answer: No, trade through an online store cannot be classified as delivery trade.

Question 2. Can trade in a store-car and store-ship be classified as distribution trade?

Answer: Section 346.43. The Tax Code of the Russian Federation does not provide for store-cars and store-ships as a vehicle from which delivery trade can be carried out.

Question 3. Is it possible to include computer programs in the range of goods during distribution trade?

Answer: In accordance with clause 4 of the Rules approved by Decree of the Government of the Russian Federation of January 19, 1998 No. 55, when conducting retail trade outside of stationary retail facilities, the sale of programs for electronic computers and databases is not allowed. Consequently, delivery trade in computer programs is prohibited, and transferring this activity to UTII is impossible.

Question 4. Can I receive a cash receipt electronically if an online cash register is introduced?

Answer: Yes, the online checkout allows you to send the seller a check to the buyer’s phone or email address.

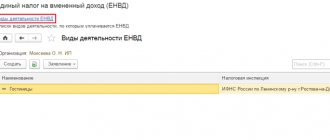

Is it possible to apply UTII for distribution trade?

According to the Tax Code of the Russian Federation, entrepreneurs engaged in delivery trade have the right to apply a single tax on imputed income (UTII). To do this, you must submit an application to the tax office at the location of the organization or at the place of residence of the individual entrepreneur within five days from the date of commencement of business. Within five days from the date of receipt of the application, the tax office issues a notice of registration as a single tax payer on imputed income.

What goods can be sold from the auto shop?

In essence, you can trade any product. At the same time, the question of whether there will be demand in the village for intimate lingerie or gourmet sausages does not require an answer. The focus is on the age of the residents, and it varies between 40 and above, but closer to the elderly. From this it becomes clear that it is more advisable to choose everyday goods as the main direction of trade.

A typical list of food products sold by a food truck:

- bread and baked goods;

- fermented milk products;

- meat;

- sausages;

- pasta;

- cereals;

- canned foods;

- oil;

- fruits;

- juices, carbonated waters and other soft drinks;

- salt;

- sugar.

Household goods:

- detergents;

- matches, lighters;

- batteries;

- light bulbs.

Important: the sale of cigarettes and alcoholic beverages in the drive-thru is prohibited.

Seasonality also affects the assortment of the auto store. If in the spring galoshes and rubber boots may be in demand, then closer to summer - inexpensive slates, in the fall - lids and cans for preservation.

Tip: Taking orders from the public is a great way to increase profits without the risk that products will remain unsold. For example, someone may need a radio component, and someone may need a birthday cake. Orders can be accepted in person or by phone.

The advantage of a drive-thru store is that goods unsold in one locality can be successfully sold in another, which is not typical for a stationary store.

Calculation of UTII for distribution trade

When calculating UTII, a physical indicator is used - the number of employees, including the entrepreneur, which is 4,500 rubles for each employee. In addition to the physical indicator, the following coefficients are used:

- K1 – deflator coefficient

- K2 – correction factor

K1 for the next calendar year is established by the Ministry of Economic Development of the Russian Federation.

K2 is determined by municipalities for an indefinite period.

If local authorities do not apply a reduced tax rate, then the amount of UTII must be calculated at a rate of 15% .

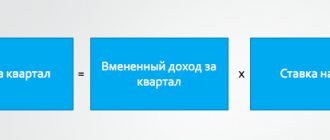

So, to calculate UTII, first of all, we determine the tax base for the reporting quarter:

| Tax base for UTII for the quarter | = | Basic profitability per month (4500.00) | * | (Average number of employees for 1 month of the quarter | + | Average number of employees for the 2nd month of the quarter | + | Average number of employees for the 3rd month of the quarter) | * | K1 | * | K2 |

Having determined the tax base for UTII for the quarter, you can calculate the amount of UTII using the formula:

UTII = Tax base for UTII for the quarter * 15%

Example:

IP Ivanov I.I. trades seedlings from its own vehicle in Yekaterinburg. In the region, the UTII rate is 15%.

Let's determine the tax base for the quarter:

4500 rub/person*(1+1+1)*1.798*0.64 = 15534.72

Let's calculate the amount of UTII:

15534,72 * 15% = 2330,21

UTII for the 1st quarter is equal to 2330.21 rubles.

If during the specified period there were payments of hospital benefits and insurance premiums, then the amount of UTII can be reduced.

Who pays the trading fee

— The total area is calculated on the basis of inventory and title documents. They must contain information about the purpose, design features and layout of the premises, as well as information confirming the right to use the point. Calculate the fee rate using an online calculator >>

Who should pay the trade tax

Catering services, including the sale of purchased products, if it is an integral part of these services, are not recognized as trading activities (Letter of the Ministry of Finance No. 03-11-11/40960 dated June 5, 2021). Therefore, catering organizations do not have to pay a sales tax.

- The location changes, but the business remains. This principle is important as a guarantee that entrepreneurs will be provided with compensatory places in the event that the location of a non-stationary facility is required for state or municipal needs.

- The contract is extended without bidding. The bill proposes to set the minimum validity period of a contract for the placement of a non-stationary retail facility at 5 years.

- Framework rules on appearance are established by regulation.

Common mistakes in maintaining UTII

Let's look at the most common mistakes in maintaining UTII.

| Common mistakes | Explanation |

| The start date of business activity is incorrectly determined | An application to the tax office must be submitted within 5 days from the date of commencement of activities falling under UTII. There is no need to submit an application in advance - you will be forced to pay tax for the period in which there was actually no activity. The date of commencement of business can be considered the date of the first economic fact. |

| The individual entrepreneur does not count himself as an employee | When calculating the tax base for UTII, the physical indicator is the number of employees. But often, when making calculations, an individual entrepreneur does not take himself into account as an employee, because in fact, he is not an employee, which is a mistake. The consequence of this error is an incorrect calculation of the tax base, and, consequently, the tax will be underestimated, which will certainly lead to the accrual of fines and penalties. |

| Incorrect calculation to reduce the amount of UTII | Individual entrepreneurs working independently have the right to reduce UTII by fixed contributions paid for themselves. But if an individual entrepreneur hires workers, then this right is lost, but the tax amount can be reduced due to insurance payments for employees. Please note that the tax amount cannot be reduced by more than half. |

| Lack of activity when applying UTII | UTII is a tax that does not depend on the income received, so even if there is no actual activity of the company or entrepreneur, the tax will still have to be paid. This explains the lack of point in switching to UTII in advance. If an activity falling under UTII is suspended for any reason, it is better to deregister with the tax office. In this case, the tax will be charged on the number of days of the quarter when the activity was carried out. |

Initial capital

From the experience of practicing entrepreneurs, it becomes clear that you need little money to open your own small business. 100 thousand rubles will be enough for you to purchase products. When trading begins, try to invest the profit received in expanding the assortment.

You should not buy an expensive imported car; it is not intended for frequent off-road travel (if you trade in remote villages). Spare parts and machine repairs are also expensive.

Some people prefer domestic vehicles “GAZ-5301”, “Gazelle”, other mini-sized trucks, or just a passenger car with a trailer. If you do not have the required amount for a car shop from the manufacturer, buy a used one. Then be prepared for additional car repair costs.

Include advertising in your expenses so that the population knows about you. It is best to decorate your mobile point with logos of the products you sell.

For all these needs you will have to pay from 500 to 700 thousand rubles.

Funding your business will be helped by:

- Partnership private investments.

- State support program for small businesses (contact the Employment Exchange).

- Bank lending.

- Vehicle leasing.

Don’t think that once you start working, you will immediately get a huge profit. You need to be aware of the costs:

- Administrative expenses.

- Various tax deductions.

- Salary for salesperson and driver.

- Car costs (fuel, repairs, spare parts for the car).

- Rent for storage space.

- Costs of purchasing products.

Small start-up investments, high profitability and return on your costs will make your business productive.

Using online cash registers

Online cash registers will soon occupy a significant place in the trade sector. The new cash register equipment will differ in that it will send online tax information about completed sales in real time. The online cash register does not require ECLZ or fiscal memory, but a fiscal storage device is required. A fiscal drive is a removable unit used to store, protect and transmit information to the Federal Tax Service. As the drive fills up, it must be replaced, as well as the online cash register. Each copy is registered electronically with the tax authority.

Ways to attract clients

An auto store does not need advertising, because this is a sought-after niche in trade. But even here it would be useful to use additional ways to attract customers:

- When visiting a locality for the first time, you should contact the administration and agree on trading activities and select a point of sale. Firstly, this will eliminate unnecessary problems with the authorities, initially determining the entire legality of the enterprise. Secondly, administration officials are interested in providing the village with food, so the news will spread to all residents instantly.

- Visiting a populated area at certain hours will allow buyers to plan their time, rather than constantly monitoring every approaching vehicle. If an entrepreneur keeps a schedule for visiting the village, he will gain favor and trust.

- Carrying out periodic discounts and promotions - in this case you need to act not regularly, but spontaneously. Even those people who do not need anything will approach the car in the hope of purchasing a cheaper product. There is a promotion - the buyer is happy. There is no promotion - in 80% of cases a person will still buy something.

When will the special regime be cancelled?

From July 1, 2021, all entrepreneurs engaged in delivery trade and falling under UTII will be required to start using online cash registers.

| Term | Explanation |

| Until July 01, 2021 | Voluntary use of the online cash register |

| From July 01, 2021 | Mandatory use of online cash register |

In order to start using the online cash register you need to:

- purchase cash register equipment;

- connect the cash register to the Internet;

- select a fiscal data operator and conclude an agreement (indicate the operator’s IP at the checkout);

- register an online cash register with the tax office and receive an online registration card;

- start using it!

For non-compliance with the law and the lack of an online cash register, significant fines are provided (for legal entities at least 30,000 rubles, for individuals at least 10,000 rubles).

Obtaining licenses

There is a list of goods that are subject to mandatory licensing. If you want to sell alcoholic beverages, medications (narcotic, psychotropic), hunting accessories and ammunition, veterinary and children's products, you must register with the tax office as a legal entity. Individual entrepreneurs are prohibited from issuing a license by Russian law.

Be prepared that permits are expensive. For example, when you receive the right to sell alcoholic beverages at retail, you will pay a state fee in the amount of 65 thousand rubles. in a year. Over five years - 325 thousand rubles.

The law on non-stationary trade may be adopted in 2021

According to the bill, delivery trade can be carried out by legal entities or individual entrepreneurs on the basis of a certificate of delivery trade. It is issued if a legal entity or individual entrepreneur has the right of ownership, lease or other legal basis of vehicles intended for delivery trade.

The essence of the terminology: non-stationary and mobile retail facility, delivery trade

Defined as a retail facility that is a temporary structure, structure, structure or device that is not firmly connected to the land plot, regardless of the presence or absence of a connection to utility networks.

Obtaining permission to sell any product is not difficult, but it is very important to choose the appropriate tax payment system. To understand the issue of choice, it is necessary to consider in detail all the nuances of the main tax systems in order to ultimately make the right decision. Registration of an individual entrepreneur is carried out within five days, but you must choose the system by which you will work in advance. You can register your individual enterprise yourself or with the help of special organizations, but you must choose taxation yourself.