Consider, using an example, how to fill out and reflect 6-NDFL under GPC agreements and work contracts. Let's study the features of calculating payments under GPC agreements in 1C ZUP 3.0 and 1C ZUP 2.5 to correctly fill out 6-NDFL.

In 6-NDFL, the date of receipt of income under civil contracts is the date of payment under the contract. It does not matter for what period the contract is concluded and what is paid - an advance payment under this contract or the final payment. What is important here is that once income is paid, it means that the individual has received income. Accordingly, personal income tax must be calculated, withheld and transferred to the budget.

GPC agreement

If companies or individual entrepreneurs engage individuals to perform any work, they enter into civil law agreements (GPC) with them. Under this agreement, the date of receipt of income is in fact considered the date of payment of funds to the individual. In this case, it will not matter what was paid - an advance or the final amount. Each payment in 6-NDFL will be reflected in a separate block and under a separate date.

Important! If we compare a GPC agreement with a regular agreement, then according to the latter, the date of receipt of income will be considered the last day of the month for which wages are paid. In addition, in this case, personal income tax will not be withheld from the advance.

Contract agreement: main points

The definition is contained in the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation), in article 702. A contract is an agreement between the customer and the other party, the contractor. It is drawn up in writing and is aimed at fulfilling any order of the customer with the obligation to accept the result of its full or phased implementation for a certain fee within a specified time frame, most often with the help of the contractor’s funds and materials.

Conditions of conclusion

The agreement must be drawn up in accordance with all the rules. When concluding an agreement, the document specifies the general and essential conditions:

- name of the form and date of its preparation;

- details and signatures of the parties to the agreement;

- the subject of the contract, that is, the result of fulfilling the customer’s assignment;

- time interval - the period during which the task is planned to be completed (the exact start and end dates of work/individual stages are specified).

Also, the contract must contain additional conditions that do not require mandatory prior agreement between the parties. They enter into legal force from the moment the agreement is concluded on the basis of the norms of current legislation and include the following points:

- Methods and methods of implementation (unless otherwise specified, they are determined by the contractor, in accordance with Article 703, paragraph 3 of the Civil Code of the Russian Federation).

- From what materials, by whom (contractor - Article 704, 1st paragraph of the Civil Code of the Russian Federation).

- Cost and method of calculating expenses (an approximate cost estimate is attached or a fixed cost of work is indicated; possible cases for revising the prices specified in the contract are articles of the Civil Code of the Russian Federation: 424, 451, 709, 710, 713 and 723).

- The possibility of using subcontracting, that is, the contractor engaging the services of a third party when performing the customer’s assignment (the contractor has the right to do this in accordance with Article 706 of the Civil Code of the Russian Federation).

- Distribution of the resulting savings between the customer and the contractor, if this happens (Article 710 of the Civil Code of the Russian Federation assigns the right to it to the contractor if the customer cannot prove that the result of the service provided or the work performed does not comply with the quality of the result).

- The contractor’s right to receive full payment according to a previously reached agreement for the result of the completed task (Article 711 of the Civil Code of the Russian Federation obliges the customer to make the final payment).

- The procedure for delivery by the contractor and acceptance by the customer of the final result of the work to complete the task (the main provisions are stated in Article 720 of the Civil Code of the Russian Federation).

- The customer’s assistance and assistance to his contractor when he performs the work (by default, the procedure for assistance and its volume are indicated in Article 718 of the Civil Code of the Russian Federation).

- Quality control of execution, in accordance with the specific terms of the contract or general requirements for similar orders (Articles 721 and 722 of the Civil Code of the Russian Federation).

- Further instructions (to the customer from the contractor) on the operation or application of the result of the work performed (Article 726 of the Civil Code of the Russian Federation).

The agreement may also reflect so-called “incidental conditions”, by agreement of both parties to the contractual relationship. Their presence or absence does not affect the validity of the concluded transaction, but only supplements or changes the basic requirements of the regulations.

Procedure for withholding personal income tax

Important! If an organization or individual entrepreneur hires individuals under a GPC agreement and pays them income, then they are required to reflect this in 6-NDFL, since in this case they are tax agents. This means that the organization is responsible for withholding personal income tax from payments and paying them to the treasury.

First of all, it is necessary to find out in what time frame the amount of tax on personal income should be calculated, withheld and paid to the budget.

The date on which an employee receives income under a GPC agreement is the tax withholding date. On this day, the individual is paid for work from the cash register, or money is transferred to his card. This date will need to be reflected in 6-NFDL on line 100.

Since the date on which income under the GPC is received is also the date of personal income tax withholding, which means that this date must be indicated in form 6-NDFL on line 110. This date must also be consistent with the one indicated as the settlement date in the agreement contract

As in all other cases when transferring personal income tax to the budget, this must be done no later than the next business day after the payment of funds to the individual. This date is indicated in form 6-NDFL on line 120.

6-NDFL under a contract with an individual

An organization that pays income to an individual—not an individual entrepreneur—is a tax agent for personal income tax. She must not only calculate the tax, withhold it from the paid income and transfer it to the budget, but also report on this operation in form 6-NDFL (clauses 1, 2 of Article 226, clause 2 of Article 230 of the Tax Code of the Russian Federation).

In this regard, the Federal Tax Service of Russia reported how to fill out a calculation using Form 6-NDFL when paying remuneration to an individual under a civil contract (with the exception of a purchase and sale agreement and cases of advance payment).

Indicators of form 6-NDFL

Regarding the income of an individual under a civil contract, Form 6-NDFL for 2021 will reflect at least the following information.

In section 1:

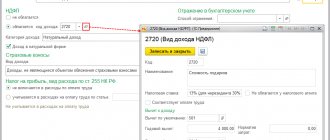

- on line 010 - tax rate (13 percent or 30 percent);

- on line 020 - the amount of accrued income on an accrual basis from the beginning of the calendar year;

- on line 040 - the amount of calculated personal income tax on an accrual basis from the beginning of the calendar year;

- on line 070 - the total amount of personal income tax withheld on an accrual basis from the beginning of the calendar year.

In section 2:

- on line 100 - the date of actual receipt of income by an individual;

- on line 110 - the date of deduction of personal income tax from the amount of income received;

- on line 120 - the date no later than which personal income tax must be transferred;

- on line 130 - the amount of income received (without subtracting personal income tax) on the date indicated in line 100;

- on line 140 - the amount of personal income tax withheld on the date indicated in line 110.

Key dates

If an advance payment is not provided under a civil law agreement, then the date of actual receipt of income is the date of payment of remuneration (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated May 26, 2014 No. 03-04-06/24982). The calculated personal income tax on such income should be withheld upon its actual payment (clause 4 of article 226 of the Tax Code of the Russian Federation). And the tax must be transferred to the budget no later than the day following the day of payment of remuneration to an individual (clause 6 of Article 226 of the Tax Code of the Russian Federation).

Filling out form 6-NDFL

The Federal Tax Service of Russia believes that any income is reflected in form 6-NDFL in the period in which it is considered received (and not accrued). And an operation that was started in one period and completed in another is reflected in the period in which it was completed (letter of the Federal Tax Service of Russia dated December 5, 2016 No. BS-4-11/ [email protected] , dated October 17, 2016 No. BS- 3-11/ [email protected] ). These rules determine the filling out of form 6-NDFL for income in the form of remuneration under a civil law agreement.

In particular, if the acceptance certificate of work (services) under a civil contract was signed in December 2021, and the remuneration to an individual for the provision of services under this contract was paid in January 2021, then this operation is reflected in sections 1 and 2 of the form 6-NDFL for the first quarter of 2017.

Please note: an individual cannot receive a property deduction from an organization with which a civil contract has been concluded, since it is not an employer (Article 220 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated October 14, 2011 No. 03-04-06/7-271, dated June 30, 2011 No. 03-04-06/3-157). At the same time, personal income tax on remuneration can be reduced by standard and professional tax deductions (Articles 218, 221 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated November 19, 2015 No. 03-04-05/66968, dated April 7, 2011 No. 03-04- 06/10-81).

Example

. Reflection of remuneration to an individual in form 6-NDFL.

Let’s say that a tax resident of the Russian Federation performed work under a contract on December 29, 2016, worth 50,000 rubles, and the organization paid for the work on January 10, 2017. The individual did not claim standard or professional deductions.

This operation is not reflected in Form 6-NDFL for 2021. And in the 6-NDFL form for the first quarter of 2021, the operation will generate the following indicators:

- on line 020 – 50,000;

- on line 040 – 6500;

- on line 070 – 6500;

- on line 100 – 01/10/2017;

- on line 110 – 01/10/2017;

- on line 120 – 01/11/2017;

- on line 130 – 50,000;

- on line 140 – 6500.

How to reflect GPC in 6-NDFL

In 2021, Form 6-NDFL for GPC is filled out on the basis of Federal Tax Service order No. ММВ-7-11/450 dated 10/14/2015. The order specifies the following filling requirements:

- For each OKTMO the form is filled out separately. The organization also needs to indicate the code of the municipality in which the company's division is located.

- Payment for GPC in form 6-NDFL is not indicated in certain sections. This amount must be indicated in reporting on a general basis. The first section should contain data on income and tax that was calculated and paid on an accrual basis for 1 quarter, half a year, 9 months and a year. For each tax rate, the first section is completed. Reporting data for the reporting period are indicated in the second section.

- If in one tax period personal income tax was paid at different rates, then information for each rate is entered into 6-personal income tax separately. To ensure that the tax office does not impose penalties, you must carefully check the correctness of the information entered.

Based on the specified requirements, the GPC in 6-NDFL is reflected and submitted for each reporting period no later than the last day of the month following the reporting period.

Filling rules

The document form (KND form 1151099) is filled out for all payments made to individuals during the calendar year. It consists of the following parts:

- Title page with general information: name of the report, codes of the submission period and tax authority, details of the tax agent or authorized person, marks confirming the accuracy of the transmitted information, stamp if available, signature with transcript, date of preparation, records of reception by the controlling organization.

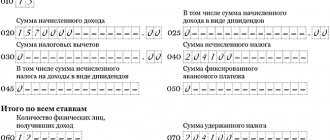

- Section number 1 includes lines: 010, 020, 030, 040, 050, 060, 070, 080 and 090 (reflection of total data from the beginning of the year).

- Section number 2 consists of an unlimited total number of lines: 100, 110, 120, 130 and 140 (detailed breakdown of accrued, withheld and received amounts of income and calculated tax for the quarter), depending on the number of payments during the last three months of the reporting quarter period.

The procedure and rules for filling out 6-personal income tax are specified in detail in MMV-7-11 / [email protected] - Order of the Federal Tax Service dated October 14, 2015, with subsequent additions and changes. In 6 personal income tax, a contract must be reflected if a legal entity has used the services of a citizen (not an individual entrepreneur).

An example of reflecting GPC in 6-NDFL

Continent LLC entered into an agreement with individuals for the provision of services from April 1 to May 31. The cost of services provided under the contract is 10,000 rubles, the amount of personal income tax on this amount is 1,300 rubles. The payment was made on June 10.

On line 070 of form 6-NDFL, the amount of withheld personal income tax is recorded, that is, 1,300 rubles. On the same day, personal income tax was withheld, which means that on lines 100 and 110 the same amount is indicated under the date June 10. The total amount of income paid is 10,000 rubles. This value is entered on line 130 of form 6-NDFL.

The savings are obvious

There are two parties involved in the contractual relationship – the contractor and the customer. The contractor undertakes to perform certain work according to the customer’s instructions and deliver it to the customer for the appropriate fee. That is, a contract is an agreement to perform work. Payments under civil contracts, the subject of which is the performance of work or the provision of services, are recognized as subject to taxation as “pension” and “medical” contributions.

But contributions to compulsory social insurance in case of temporary disability and in connection with maternity do not need to be accrued and paid from payments to the contractor.

This is stated in subparagraph 2 of paragraph 3 of Article 422 of the Tax Code of the Russian Federation.

Example 1

The company pays insurance premiums at the general rate - 30%. Petrov's salary is 33,700 rubles. Ivanov works under a contract, the remuneration for which is 33,700 rubles. The company pays pension contributions at a rate of 22%, medical - 5.1%, insurance for temporary disability and in connection with maternity - 2.9%. Amount of insurance contributions for payments to Petrov per month is 10,110 rubles. (RUB 33,700 x 30%). Insurance premiums in case of temporary disability and in connection with maternity are not accrued for Ivanov’s remuneration under the contract. Therefore, the amount of contributions is 9132.7 rubles. (RUB 33,700 x 27.1%).

Reflection in 6-NDFL of interim payments and final settlement under the GPC agreement

Section 1: 1 section is completed in the usual manner. All payments made under the GPC agreement will be included in total income and reflected on line 020. From this amount, personal income tax will be indicated below on lines 040 and 070.

Section 2: the advance payment, as well as the final payment that was paid over the last three months, will be indicated in a separate block on lines 100-140. This is due to the fact that they were paid at different times.

Date of actual receipt of income in the form of remuneration under the GPC agreement

The Federal Tax Service of Russia has repeatedly noted in its letters (dated July 21, 2017 No. BS-4-11/, dated October 17, 2016 No. BS-3-11/) that for the purposes of calculating personal income tax, the date of actual receipt of income in the form of remuneration for the performance of work (provision of services) under the GPC agreement is the date of payment under the agreement, i.e. the day when the money is transferred to the contractor’s bank account or issued to him from the enterprise’s cash desk (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation). In this case, it does not matter for what period the GPC agreement is concluded, when the certificate of completion of work (services rendered) is signed, an advance is paid or the final payment under the agreement is made. The fact of payment itself is important. And if this fact has happened, then the “physicist” has received income.

Features of reflecting income in 6-NDFL

Organizations and individual entrepreneurs enter into contractual relations with individuals, individual entrepreneurs or non-residents. When companies generate a report, certain filling features will be highlighted for each case. For example:

- Entrepreneurs independently calculate the amount of tax and reflect it in their reporting. If the GPC is issued with an individual entrepreneur, then 6-NDFL will not be filled out, and the organization should not calculate personal income tax. The customer does not reflect in the certificate the payments under the GPC agreement with the individual entrepreneur. This is due to the fact that the individual entrepreneur independently pays personal income tax payments to the budget, and, accordingly, reports on them independently.

- If the contract is concluded with an individual who is not a resident, the personal income tax rate will be 30%.

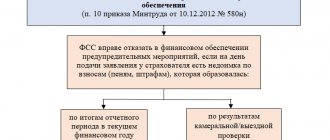

Composition of calculations for insurance premiums

Reporting on insurance premiums is submitted to the tax office in the form of a single calculation. Its form was approved by order of the Federal Tax Service of the Russian Federation dated October 10, 2021 No. MMV-7-11/ [email protected]

The composition of the actually completed calculation and the number of completed sheets depends on the applied tariffs, the number and categories of employees and the availability of social insurance expenses.

If a company pays employee benefits, it must complete the following sections:

- title page;

- Section 1 “Summary of the obligations of the payer of insurance premiums”;

- subsections 1.1 and 1.2 of Appendix No. 1 “Calculation of the amounts of insurance contributions for compulsory pension and health insurance” to section 1;

- Appendix No. 2 “Calculation of the amounts of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity” to section 1;

- Section 3 “Personalized information about insured persons.”