What taxes and to what budgets do we pay?

As is known in Russia, the three-level budget system is the federal, regional and municipal budgets. The tax system includes the same levels, which are supplemented by corresponding taxes and fees.

- value added tax - a tax that is included by the manufacturer in the price of the product, so the buyer pays the tax; — excise taxes — a tax on socially dangerous goods: alcohol, tobacco, cigarettes, etc.; - personal income tax, as the name implies, this tax is payable if an individual receives any profit - wages, dividends, etc.; — unified social tax, includes payments to the federal budget, FFOMS (Federal Fund for Compulsory Medical Education), TFOMS, FSS (Social Insurance Fund); — corporate income tax; — mineral extraction tax; — water tax; — fees for the use of objects of the animal world and for the use of objects of aquatic biological resources; - National tax.

Research results

Let us consider the dynamics and structure of transport tax revenues to the federal budget and the consolidated budget of the Kursk region for 2016-2018. in table 1.

Table 1 - Dynamics and structure of transport tax revenues to the consolidated budget of the Kursk region for 2016-2018.

| Tax revenues | 2016 | 2017 | 2018 | Growth rate 2017/2016 (%) | Growth rate 2018/2017 (%) | |||

| Amount, million rubles | Ud. weight (%) | Amount, million rubles | Ud. weight (%) | Amount, million rubles | Ud. weight (%) | |||

| Total | 6907,84 | 100 | 7553,74 | 100 | 8 181, 47 | 100 | 109,4 | 108,3 |

| Transport tax | 139,97 | 2 | 139,07 | 1,8 | 154, 90 | 1,9 | 99,4 | 111,4 |

| Out of him | ||||||||

| Transport tax for organizations | 30, 18 | 21,56 | 29,89 | 21,49 | 27, 28 | 17,61 | 99 | 91,3 |

| Transport tax for individuals | 109, 78 | 78,43 | 109,18 | 78,5 | 127,61 | 82,38 | 99,5 | 116,9 |

Source: Data from report form No. 1-NM “Report on the accrual and receipt of taxes, fees and other obligatory payments to the budget system of the Russian Federation.”

According to the data presented in the table, transport tax takes up a small share of the revenue administered by the tax authorities of the budget of the Kursk region over three tax periods, since its share corresponds to 2% of all revenues of the region.

For comparison, let’s look at the dynamics of changes in transport tax revenues to the budget of the Kursk region from organizations and individuals for 2016-2018. in Figure 1.

Figure 1 – Dynamics of transport tax revenues to the budget of the Kursk region for 2016-2017. from organizations and individuals (million rubles)

Source: Data from the report form No. 1-NM “Report on the accrual and receipt of taxes, fees and other obligatory payments to the budget system of the Russian Federation”

Revenues from transport tax for the period 2016-2018. increased by 14.93 million rubles. The growth rate in 2021 compared to 2021 decreased by 0.6%, this change is associated with an increase in transport tax debt. The fact is that in 2021, employees of the postal department did not deliver about 40 thousand notices and receipts for property taxes, including transport taxes, to citizens due to their absence at the indicated addresses [5].

It follows that the interaction of the postal service of the Kursk region and the department of the Federal Tax Service of Russia in this region influences the result of the tax policy pursued in the region.

The growth rate was 11.4% in 2021 compared to 2021. The increase in growth rates was influenced by an increase in tax rates that came into force in 2021.

As part of the transport tax, the largest share for the period 2016-2017. consists of receipts from individuals - the average is 78.5, the growth rate in 2021 compared to the base period is 99.5%. And in 2021, receipts from individuals increased and became equal to 82.38%.

As for legal entities, it can be noted that the share of organizations in the total transport tax takes up less than half of the revenue. This is due to the introduction in November 2015 of a new transport tax benefit for legal entities that registered vehicles with a permissible maximum weight of over 12 tons and the number of transport units at the disposal of organizations.

From the table you can see that the amount of revenue from individuals prevails over the amount of tax from legal entities. This ratio indicates the significant role of individuals in the formation of the budget of the Kursk region.

In general, for the periods 2016-2018. there is an increase in revenues from this tax to the budget of the Kursk region, which can improve the living standards of the population and affect the rate of economic growth of the region.

Let's consider the impact of changes in transport tax legislation on the number of taxpayers and registered vehicles (Table 2).

Table 2 - Structure of payers and data on objects of taxation for the period 2016-2017 (units)

| Indicators | 2015 | 2016 | 2017 | Growth rate 2016/2015 (%) | Growth rate 2017/2016 (%) |

| Number of taxpayers, incl. | 292515 | 290756 | 292638 | -0,60 | 0,65 |

| legal entities | 3450 | 3446 | 3426 | -0,12 | -0,58 |

| individuals | 289065 | 287310 | 289212 | -0,61 | 0,66 |

| Number of vehicles registered | 441319 | 432241 | 433125 | -2,06 | 0,20 |

| from legal entities | 32896 | 32325 | 32384 | -1,74 | 0,18 |

| for individuals | 408423 | 399916 | 400741 | -2,08 | 0,21 |

Source: Data from report No. 5-TN “Report on the tax base and structure of charges for transport tax.”

Having analyzed the table data, it can be argued that for the period 2015-2016. the number of taxpayers decreased, and for the period 2016-2017. has increased. In 2021, the number of tax payers decreased by 0.6% compared to 2015; in 2021 compared to 2016 – increased by 0.65%.

Over the tax periods under review, the number of transport tax payers increased by 0.04%: the number of legal entities decreased by 0.7%, and the number of individuals increased by 0.05%.

Thus, the number of individual taxpayers in 2021 compared to 2015 decreased by 0.61%, and in 2021 compared to 2021 increased by 0.66%. The number of taxpayer-organizations in 2021 compared to 2015 decreased by 0.12%; if we compare 2021 with 2021, we can see the same trend towards a reduction in the number of taxpayers by 0.58%.

Thus, during the periods under study, the number of taxpayers did not change significantly. Thus, in 2015 we have the following ratio in the overall structure of taxpayers: legal entities - 1.18%, individuals - 98.82%, in 2021 1.19% and 98.81%, respectively (the corresponding calculations are based on data table 2).

Analyzing the dynamics of vehicles in the Kursk region for 2015-2017, one can note a slight decrease in the number of transport units.

For comparison, let’s present the dynamics of vehicles in the Kursk region for 2015-2017. (units), by owner (Figure 2).

Figure 2 - Dynamics of vehicles in the Kursk region for 2015-2017. (units)

Source: Data from report No. 5-TN “Report on the tax base and structure of charges for transport tax.”

The figure clearly reflects the significant excess of the share of vehicles owned by individuals over the share of vehicles owned by organizations.

If we consider the shares of vehicles by owner groups in the volume of total revenues for 2021, we can see that for individuals it is 92.52%, and for legal entities - 7.47% (Figure 3).

Figure 3 – Structure of vehicles by owner in the Kursk region for 2021, %

Source: Data from report No. 5-TN “Report on the tax base and structure of charges for transport tax”

Note that the structure of vehicles in the Kursk region for 2015 by owner is as follows: 7.45% - the share of legal entities, 92.55% - the share of individuals. And for 2021, 7.48 and 92.52, respectively (data from Table 2 were used for calculation).

The number of transport units owned by individuals is many times greater than the number of vehicles owned by legal entities. At the same time, the share of transport by individuals in 2021 compared to 2015 decreased by 2.08%, and in 2021 compared to 2021 increased by 0.21%. Meanwhile, the share of legal entities in 2021 compared to 2015 decreased by 1.74%, and in 2021 compared to 2016 increased by 0.18%.

According to Art. 357 of the Tax Code of the Russian Federation, tax payers are persons (individuals and legal entities) to whom vehicles are registered [1].

If the obligation to pay tax is not fulfilled, a debt arises, which does not provide the necessary amount of cash receipts for the purpose of improving the condition of the road transport network.

In view of this, it seems appropriate to analyze the dynamics of transport tax debt to the consolidated budget of the Kursk region for 2016-2018. (Table 3).

Table 3 - Dynamics of transport tax debt to the consolidated budget of the Kursk region for 2016-2018.

| Debt | 2016 | 2017 | 2018 | Growth rate 2017/2016 (%) | Growth rate 2018/2017 (%) | |||

| Amount, thousand rubles | Ud. weight (%) | Amount, thousand rubles | Ud. weight (%) | Amount, thousand rubles | Ud. weight (%) | |||

| Total | 6871,11 | 100,00% | 4163,7 | 100,00% | 2719,8 | 100,00% | 60,60% | 65,32% |

| Transport tax | 629,25 | 9,16% | 823,4 | 19,78% | 361,1 | 13,28% | 130,85% | 43,85% |

| Out of him: | ||||||||

| Transport tax for organizations | 16 | 2,54% | 24 | 2,91% | 27,2 | 7,53% | 150,00% | 113,33% |

| Transport tax for individuals | 613,3 | 97,47% | 799,4 | 97,09% | 334 | 92,50% | 130,34% | 41,78% |

Source: Data from report No. 4-NM “Report on debts on taxes and fees, penalties and tax sanctions to the budget system of the Russian Federation”

Based on the data presented in Table 3, it can be noted that the share of the total debt of the Kursk region budget for 2021 is 13%.

Over the 3 analyzed tax periods, taxpayers' debt to the budget decreased by 4151.31 thousand rubles, which is 39.58%. In the total transport tax debt, the largest share is occupied by the debt of individuals - on average 96%, and the growth rate in 2021 compared to 2021 was 42%.

As a result of the study, we can conclude that there has been a real reduction in transport tax debt and the effective regulation of its level in the Kursk region, which is undoubtedly a positive trend in the development of the regional economy.

To what budget do taxpayer insurance contributions go?

List of federal, regional and local taxes in 2021 (table) Type of tax Tax Taxpayers Object Rates Federal taxes VAT The section “VAT” Art. 143 Art. 146 Art. 164 Excise taxes Find answers to questions about what goods are excisable, what are the tax rates, and how to fill out a declaration in the “Excise taxes” section of Art. 179 Art. 182 Art. 193 Personal income tax How to calculate and withhold personal income tax, what deductions and benefits apply, how to prepare reports, see the “Personal income tax” section Art. 207 Art. 209 Art. 224 Income Tax In the “Income Tax” section you can find all the news on the calculation, payment and submission of a declaration for this tax Art. 246 Art. 247 Art.

Federal taxes are payable throughout the Russian Federation. And these include: - value added tax - a tax that is included by the manufacturer in the cost of the product, so the tax is paid by the buyer; - excise taxes - tax on socially dangerous goods: alcohol, tobacco, cigarettes, etc.; - tax on income of individuals, as the name implies, this tax is payable if an individual receives any profit - wages, dividends, etc.; - unified social tax, includes payments to the federal budget, FFOMS (Federal Mandatory Medical Fund) education), TFOMS, FSS (Social Insurance Fund); - corporate income tax; - mineral extraction tax; - water tax; - fees for the use of wildlife and for the use of aquatic biological resources; - state duty.

We recommend reading: Department of the Ministry of Internal Affairs for Migration Requirements

Calculus mechanism

How local budget taxes are calculated were described above. The general characteristics of local taxes allow you to independently calculate the amount to pay on your existing property or commercial activity. The following examples of calculating local taxes can be given:

- The company owns an administrative and shopping center with an area of 110 square meters. m. and a cadastral value of 3 million 600 thousand rubles. The rate for this amount is 0.1%. It turns out that the company pays 3,600 rubles annually.

- An individual has an agricultural land plot. The cadastral value of the property is 570 thousand rubles. The rate in this case is 0.3%, as a result of which the owner pays 1,710 rubles annually.

- An individual owns a residential building in which he lives. The cadastral value of the object is 2 million 100 thousand rubles. The current interest rate in this case is 0.1%, so the owner pays 2,100 rubles annually.

- The organization is engaged in trade, renting a premises measuring 23 square meters. m. The rate is 457 rubles per 1 sq. m. m. This means that entrepreneurs pay a fee of 10,511 rubles every quarter.

In a similar way, you can calculate all the remaining types of fees that a Russian citizen must pay if he is a taxpayer.

What contributions should I pay to the Federal Tax Service in 2021?

Separate divisions, which have the right to calculate and pay wages to employees, are required to pay insurance premiums, as well as submit settlements at the location of the separate division. At the same time, the parent organization submits calculations for insurance premiums (clause 11 of Article 431 of the Tax Code of the Russian Federation).

If an organization has separate divisions located outside the territory of the Russian Federation, payment of payments and submission of settlements occur at the location of the parent organization (clause 14 of Article 431 of the Tax Code of the Russian Federation).

Russia refused to pay a contribution to the budget of the Council of Europe

“The minister informed the Secretary General of the Council of Europe about the decision to suspend the payment of the contribution... and drew Jagland’s attention to the statement of the Russian Foreign Ministry on this topic dated June 30,” the Russian Foreign Ministry said in a statement.

“PACE has launched a frantic campaign to persecute parliamentarians who are committed to the speedy normalization of interaction with Russia within the Council of Europe and the preservation of the infrastructure of pan-European cooperation in accordance with its Assembly Charter,” the text explained.

Name and codes of payments to the local budget

Receipts of funds (part of funds) received from the rental of capital structures (buildings, structures), isolated premises, parking spaces, parts thereof, military property transferred to the economic management or operational management of legal entities

Interest on the use of budget loans, budget credits, as well as on payments made from the budget in accordance with guarantees of the Government of the Republic of Belarus and local executive and administrative bodies on loans issued by banks of the Republic of Belarus

What tax is paid to which budget in the country?

Regional, or, as they are also called, republican taxes, are also subject to mandatory payment, but on the territory of the constituent entities of the federation where they operate, all legal relations in this case are regulated by national and local legislation. In particular, they are established by the laws of the Russian Federation, and the specific rates of such taxes are regulated by republican authorities. Regional taxes include the following types of payments:

- property tax of organizations and enterprises, the amount after payment of which is proportionally credited to the budget of the subject of the federation and budgets of lower levels, down to the city;

- transport tax;

- gambling tax;

- forest tax.

- personal income tax, the name of which speaks for itself;

- value added tax, which is paid by the end buyer when purchasing products in retail chains;

- a unified social tax, which is a means of replenishing basic federal funds, including social insurance, health insurance, and the like;

- excise taxes or additional taxes on certain types of goods, in particular tobacco products and alcohol. It, like value added tax, is covered by the end buyer;

- mineral extraction tax, paid by entities involved in the exploitation of natural resources;

- income tax, enterprises and organizations, the essence of which is clear from the name;

- water tax, which implies payments for the exploitation of water resources;

- various types of duties.

We recommend reading: Bonus coefficient when a working pensioner retires

Introduction

The road transport system is an important component of the Russian economy; with its help, communication is ensured between various constituent entities of the Russian Federation.

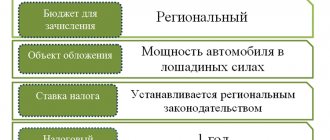

In this regard, it is necessary to highlight the special role of vehicles that contribute to ensuring economic ties and, thereby, having a direct impact on the development of the state. And one of the sources of revenue generation for the budgets of the Russian Federation is the transport tax, which is regulated by Ch. 28 of the Tax Code of the Russian Federation and the laws of the constituent entities of the Russian Federation.

Financial resources are needed to address the damage cars cause to roads and the environment. In view of this, a transport tax was introduced.

Due to the fact that taxes paid by the owners of registered vehicles are credited to the budgets of the constituent entities of the Russian Federation, it is advisable to evaluate the role of transport tax in the formation of regional budgets.

According to M.V. Mochalov [4], regional taxes are the basis for the formation of the tax base of the region, and thanks to tax revenues, the constituent entities of the Russian Federation have the opportunity to independently form their budget, develop and implement socio-economic development programs.

In addition, regional taxes have an impact on the financial condition of citizens, reflect the result of the implemented tax policy and occupy not the last place in the formation of the revenue side of the budget of a constituent entity of the Russian Federation.

It is necessary to note the following relationship: the volume of regional budget revenues directly depends on the current tax legislation and the efficiency of tax administration, and the development of regions directly affects the rise of the Russian economy.

It is necessary to note the following relationship: the correctness of the drafting of the current tax legislation and the efficiency of tax administration directly affect the volume of revenues of regional budgets. The implementation of these measures will improve tax collection and will lead to the receipt of the required level of financial resources to ensure the complete implementation of the tasks and functions of the regions, which will ultimately have a beneficial effect on the development of both the regions themselves and the Russian economy as a whole.

If we talk about the role of transport tax, then, according to F. S. Aguzarova [2], in the formation of revenues of the consolidated budgets of the subjects, it is insignificant. For this reason, there is an urgent need to increase the importance of this property tax.

To confirm the reliability of this position, we will conduct a study of the role of transport tax using the example of a specific subject of the Russian Federation.

Compulsory medical insurance premiums: KBK in 2021

Now we present a table that summarizes the current BCC for 2021 when paying medical contributions, which organizations and individual entrepreneurs transfer for their employees, and entrepreneurs also transfer for themselves in a fixed amount.

When indicating the BCC for insurance premiums for compulsory medical insurance in 2021, there is always a possibility that some accountants will transfer the payment for medical premiums for employees to an outdated budget classification code or make an inaccuracy when indicating the BCC that is current for 2021. And if the error only crept into the KBK, then nothing terrible happened. Payment of compulsory medical insurance contributions can be clarified.

Where to pay insurance premiums in 2021-2021

Where are insurance premiums paid in 2021-2021? Contributions regulated by the Tax Code of the Russian Federation should be paid to the budget at the location of the taxpayer, and if he has separate structural units that calculate and pay wages, then at the location of such structural units. Payment documents, as before, are issued separately for the payment intended for each of the funds, but in accordance with the requirements valid for tax payments.

Once included in the Tax Code of the Russian Federation, insurance premiums began to obey all its rules, i.e. they turned out to be equivalent to budget payments paid in a special order, which concerns not only the rules for processing payment documents, but also the details for transfer.

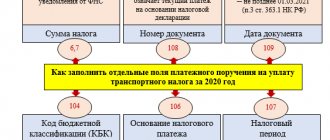

Preparation of payment documents

Please fill out payment orders for the transfer of transport tax in accordance with the Regulation of the Bank of Russia dated June 19, 2012 No. 383-P and appendices 1 and 2 to the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n. Features of filling out payment orders when transferring funds to the budget are presented in the table.

An example of calculating transport tax for payment to the budget

On the balance sheet of Alpha LLC (Moscow) there is a passenger car with an engine power of 85 hp. With. The transport tax rate for this category of vehicles is 12 rubles. for 1 l. With. (Article 2 of the Law of Moscow dated July 9, 2008 No. 33). The deadline for payment of transport tax for 2014 is no later than February 5, 2015. Payment of advance payments for transport tax in Moscow is not provided.

The Alpha accountant calculated the transport tax as follows: 85 l. With. × 12 rub./l. With. = 1020 rub.

On February 4, 2015, the accountant transferred the amount of the calculated tax (RUB 1,020) using the tax office details.

Individual entrepreneur taxes 2021

But if an individual entrepreneur on the general system decided to conduct business from abroad, and was not recognized as a tax resident, then, even as a Russian citizen, he falls into a big financial trap - all income he receives is taxed at a rate of 30%, with professional deductions cannot be used.

The tax base for the “Income” option is the monetary value of income. For the “Income minus expenses” option, the tax base will be the monetary value of income reduced by the amount of expenses. To calculate the amount of tax payable, you need to multiply the tax base by the tax rate, which is 6% for “Income” and 15% for “Revenue minus expenses.”

What taxes, to what budget?

Regional authorities, with the consent of the federal authorities, can make or introduce changes to them. Local governments of cities and districts may introduce local taxes that do not contradict federal tax legislation and after their coordination with the federal authorities.

We recommend reading: Portal to live together of the state program accessible environment

All citizens of the Russian Federation who have reached the age of majority are required to pay taxes, so many will be interested in knowing what taxes must be paid to which budget. Types of taxes, as well as special tax regimes, are established by the Tax Code of the Russian Federation. Taxes are federal, regional and local; they are divided into direct and indirect.

Payment upon liquidation

If an organization is liquidated, the obligation to pay transport tax is fulfilled by the liquidation commission (Clause 1, Article 49 of the Tax Code of the Russian Federation). It draws up an interim liquidation balance sheet, which reflects all the obligations of the organization. Tax debts are repaid only after the following have been repaid:

- debt to people to whom the liquidated organization is liable for causing harm to life or health (for example, the organization must compensate for harm caused to the buyer’s health due to defects in the product);

- debts for payment of royalties, severance pay and salaries to employees;

- debt to pledgees (at the expense of funds from the sale of the pledged item).

This follows from paragraph 3 of Article 49 of the Tax Code of the Russian Federation and Article 64 of the Civil Code of the Russian Federation.

How to pay insurance premiums to a budget organization

So, based on Art. 431 of the Tax Code of the Russian Federation, we can affirmatively state that disputes about how insurance premiums are paid (with or without kopecks in 2021) are absolutely groundless. Paragraph 5 of this article gives a comprehensive answer: we pay in rubles if the amount is “round”, and in rubles and kopecks if the amount is a fraction.

The calculation procedure has not been changed (Article 52 of the Tax Code of the Russian Federation): as in the previous calendar period, the tax base is multiplied by the established tariff. The procedure for determining the taxable base is now established by Art. 420-421 Tax Code of the Russian Federation. Insurance payments, which should not be included in the base for calculating SV, are enshrined in Art. 422 of the Tax Code of the Russian Federation. In comparison with the norms of Law No. 212-FZ, the list of insurance payments has been modified in terms of daily allowances, payments to guardians and employer payments for voluntary social security.

Payment upon reorganization

When reorganizing, transport tax must be paid by:

- organization that arose during the merger (clause 4 of article 50 of the Tax Code of the Russian Federation);

- organization that arose during the transformation (clause 9 of article 50 of the Tax Code of the Russian Federation);

- an organization that has annexed another organization (clause 5 of article 50 of the Tax Code of the Russian Federation);

- organizations that were formed during division (clause 6 of article 50 of the Tax Code of the Russian Federation).

In the latter case, the amount of transport tax must be transferred by the organization that is responsible for paying this tax by the separation balance sheet. If the separation balance sheet does not allow it to be determined, then, by a court decision, the organizations that arose during the reorganization in the form of separation pay the tax jointly. This procedure follows from paragraph 7 of Article 50 of the Tax Code of the Russian Federation.

The tax period for transport tax for a reorganized organization is the period from the beginning of the year until the day the reorganization is completed (clause 3 of Article 55 of the Tax Code of the Russian Federation). Therefore, the amount calculated according to the final declaration is recognized not as an advance payment, but as a tax. Since during reorganization the deadlines for paying taxes do not change (clause 3 of Article 50 of the Tax Code of the Russian Federation), the assignee must transfer the transport tax within the period established by the regional law (clause 1 of Article 363 of the Tax Code of the Russian Federation).

How Ukraine disgraced itself with its contribution to the Council of Europe

Network publication "Pravda.Ru" el No. FS77-72263 dated February 01, 2021, issued by the Federal Service for Supervision of Communications, Information Technology and Mass Communications. Founder: TechnoMedia LLC. Editor-in-Chief: Novikova Inna Semenovna. Email address Telephone

Let us recall that in the spring of this year, PACE admitted that due to Moscow’s refusal to pay contributions, as well as due to the fact that Turkey returned to the status of a regular payer, a deficit of €18 million had formed in the Council of Europe budget.

When and to what budget should transport tax be paid?

- decision of the inspectorate to seize the organization’s property;

- a court decision to take interim measures in the form of suspension of transactions on the organization’s accounts, seizure of funds or property of the organization.

The organization must pay transport tax at the location of the car (clause 1 of Article 363 of the Tax Code of the Russian Federation). The location of the car is recognized as the location of the organization or its separate division to which the car is registered (subclause 2, clause 5, article 83 of the Tax Code of the Russian Federation).

Tax and reporting periods

The tax period for transport tax is a calendar year (Clause 1, Article 360 of the Tax Code of the Russian Federation). The reporting periods are the I, II and III quarters (clause 2 of Article 360 of the Tax Code of the Russian Federation). At the same time, regional legislators are given the right not to establish reporting periods for transport tax in the corresponding constituent entity of the Russian Federation (clause 3 of Article 360 of the Tax Code of the Russian Federation).

If reporting periods are not established, for example, in Moscow (Moscow Law of July 9, 2008 No. 33), then transport tax must be paid once a year. If reporting periods are established, for example, in the Moscow region (Article 2 of the Moscow Region Law of November 16, 2002 No. 129/2002-OZ), then for the first, second and third quarters, organizations are required to transfer advance payments for transport tax. In this case, the amount of tax that will need to be paid at the end of the year is determined as the difference between the amount of transport tax calculated for the year and the amount of accrued advance payments (clause 2 of Article 362 of the Tax Code of the Russian Federation).