How does an HOA, in a simplified manner, keep records of income and expenses (Zhuravleva V

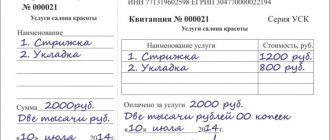

HOA "Ozero" entered into agency agreements for payments for housing and communal services with all residents of the apartment building. The partnership's commission is 0.1% of the amount of transferred payments. In October 2014, apartment owners consumed utilities in the amount of RUB 250,000. The HOA signed the certificates of completed work (services rendered) on October 31. On November 10, payment was received from the owners of the premises in the amount of 210,210 rubles. On November 20, the homeowners' association transferred the amount of 210,000 rubles to the resource supply company.

If the HOA uses the “simplified” approach with the object “income minus expenses,” this position of officials does not create any special problems. Because, having reflected the money received in income under the simplified tax system, the HOA will at the same time be able to take into account the amounts transferred to utility service providers in expenses.

Utility payments in case of taxation are taken into account as part of material expenses - Lawyer

Accounting articles and background information

Utility payments under the simplified tax system

Typically, the landlord himself pays the cost of utilities consumed by the tenant (hot and cold water supply, heating, energy supply, sewerage, etc.) to public utilities.

And the tenant compensates him for all these expenses separately or as part of the rent. The tenant can also enter into contracts with supplying organizations directly.

The article will tell you about each of these options .

Compensation for utility expenses

The provision for reimbursement of utility bills may be provided for in the lease agreement itself or in an additional agreement to it.

Moreover, regardless of what document the compensation for the “utility” is fixed, the relations of the parties in this case are not relations under the contract for the supply of utilities.

Since, in accordance with Article 539 of the Civil Code, the lessor is not a supplier of utility services (clause 22 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated January 11, 2002 No. 66).

Let us consider in detail the accounting for compensation of utility costs for the landlord and tenant using the simplified tax system.

Accounting for a homeowners association, simplified posting using an example in 2021

Amounts of payments for housing and communal services (electricity, water supply, etc.) received into the account of the HOA are revenue from the sale of work (services) and, accordingly, must be taken into account as part of income when calculating income tax in accordance with Article 249 of the Tax Code of the Russian Federation ( letters of the Ministry of Finance of the Russian Federation dated November 18, 2015 No. 03-11-06/2/669/7, dated June 29, 2011 No. 03-01-11/3-189). Taxation in HOAs regarding income-generating activities does not differ from the rules for commercial organizations.

To do this, make the following entries in accounting: Debit 62 (76) Credit 90, subaccount “Revenue” - utility fees have been charged; Debit 50 (51) Credit 62 (76) - payment for utilities received. At the same time, organize analytical accounting for accounts 62 and 76 so that settlements with each tenant are visible.

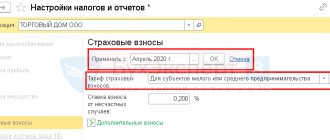

When an HOA using the simplified tax system has the right to apply reduced insurance premium rates

We recently went to a seminar for HOAs and residential complexes, where the auditor told us that HOAs and residential complexes cannot pay contributions to the relevant funds at a preferential rate, but must pay as for the OSN. But all last year we paid at a preferential rate, OKVED 70.32.1, using the simplified tax system. Many accountants who attended this seminar are now at a loss. We don't know what to do. Please, if possible, give us some kind of answer on the pages of the magazine so that we can get our bearings and avoid fines.

In accordance with paragraphs. “I.2” clause 8, part 1, art. 58 of the Federal Law of the Russian Federation dated July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund” during the transition period, reduced insurance premium rates are applied

for payers of insurance premiums making payments and other remuneration to individuals applying

a simplified taxation system, the main type of economic activity

(classified in accordance with the All-Russian Classification of Types of Economic Activities)

of which is

, in particular,

real estate management

.

Relevant type of economic activity

, provided for in clause 8, part 1, art.

58 of Law No. 212-FZ is recognized as the main type of economic activity, provided that the share of income

from the sale of products and (or) services provided for this type of activity

is at least 70%

of total income.

The amount of income is determined in accordance with Art. 346.15 Tax Code of the Russian Federation

.

Confirmation of the main type of economic activity

organization or individual entrepreneur is carried out in the manner established by the Ministry of Health and Social Development of the Russian Federation.

The Ministry of Health and Social Development of the Russian Federation in a letter dated November 30, 2011 No. 5071-19 indicated that the main type of economic activity is confirmed

by the payer of insurance premiums

by submitting to the territorial body of the Pension Fund of the Russian Federation a calculation

of accrued and paid insurance premiums for compulsory pension insurance

in the form of RSV-1 Pension Fund

of the Russian Federation (approved by order of the Ministry of Health and Social Development of the Russian Federation of November 12, 2009 No. 894n),

in which payers of insurance premiums must reflect the share of income from the sale of

products and (or) services provided in the main type of activity in the total amount of income.

At the same time, information about the types of economic activities

organization,

contained in an extract from the Unified State Register of Legal Entities, is not linked to the procedure for recognizing

the type of economic activity of the payer as the main type of activity for the purpose of applying the legislation of the Russian Federation on insurance premiums.

Calculation of condition compliance

the right for insurance premium payers to use a reduced tariff for paying insurance premiums established by Part 3.2 of Art.

58 of Law No. 212-FZ, is given in table 4.4 of section 4 of the RSV-1 PFR form

.

If, at the end of the reporting (calculation) period, the main type of economic activity

organizations or individual entrepreneurs specified in clause 8, part 1, art.

58 of Law No. 212-FZ, does not correspond to the declared

main type of economic activity, such an organization or such an individual entrepreneur

is deprived of the right to apply reduced rates of insurance premiums

from the beginning of the reporting (calculation) period in which such a discrepancy was made, and the amount of insurance premiums is subject to restoration and payment to the budgets of state extra-budgetary funds in the prescribed manner.

In accordance with OKVED for group 70.32

management of the operation of the housing stock (

70.32.1

), management of the operation of the non-residential stock (

70.32.2

) is reflected.

Thus, the basis for the application of reduced insurance premium rates is the simultaneous fulfillment of two conditions

:

1.

The HOA independently manages

the operation of the housing stock.

2.

Income from this activity

must be

at least 70%

of the total income of the HOA.

Art. 135 Housing Code of the Russian Federation

It has been established that

a homeowners' association

is a non-profit organization, an association of owners of premises in an apartment building for joint management of a complex of real estate in an apartment building, ensuring the operation of this complex, ownership, use and, within the limits established by law, disposal of common property in an apartment building.

At the same time, HOA funds

consist, in particular, of obligatory payments, entrance and other contributions of members of the partnership (

Article 151 of the Housing Code of the Russian Federation

).

In accordance with paragraph 1 of Art. 346.15 Tax Code of the Russian Federation

When an organization applies

a simplified taxation system,

income from the sale of goods (work, services), property rights and non-operating income, determined in accordance with

Art.

249 and 250 of the Tax Code of the Russian Federation .

Income provided for in Art. 251 Tax Code of the Russian Federation

are not

included in income .

Based on pp.

1 item 2 art. 251 of the Tax Code of the Russian Federation, targeted revenues for the maintenance of non-profit organizations

and the conduct of their statutory activities include

contributions made in accordance with the legislation of the Russian Federation on non-profit organizations by founders (participants, members)

, donations recognized as such in accordance with the civil legislation of the Russian Federation, as well as

deductions for the formation

of established by

Art.

324 of the Tax Code of the Russian Federation according to the procedure

for reserves for repairs, major repairs of common property

, which are carried out by a homeowners’ association, housing cooperative, horticultural, gardening, garage-construction, housing-construction cooperative or other specialized consumer cooperative by their members.

Thus, the homeowners association

, which applies a simplified taxation system,

when determining the tax base, does not take into account entrance fees, membership fees, shares, donations

, as well as

deductions for the formation of a reserve

for repairs and major overhauls of common property, which are made to the homeowners’ association by its members.

According to officials, accounting for other payments

, received by the HOA from its members, as part of the income

will depend on the contractual relations of the HOA and its members

.

So, if :

– in accordance with the charter

, approved by the general meeting of members of the partnership,

the HOA is charged

with ensuring the proper sanitary, fire safety and technical condition of the residential building and surrounding area;

technical inventory of a residential building; provision of public services

; for the maintenance and repair of residential and non-residential premises; major renovation of a residential building;

– The HOA, on its own behalf, enters into contracts with manufacturers (suppliers)

of these works (services) and at the same time

acts on its own behalf

, and not on behalf of the HOA members (that is, based on contractual obligations,

it is not an intermediary

purchasing the specified services on behalf of the HOA members), and the HOA members are charged with paying for this activity of the HOA ,

then in accordance with Art.

249 of the Tax Code of the Russian Federation, the amounts of payments by HOA members for housing and communal services

received to the organization’s account are revenue from the sale of work (services) and, accordingly,

should be taken into account

by the HOA

as part of its income

when determining the tax base for the tax paid in connection with the application of the simplified tax system .

Moreover, if the HOA applies the simplified tax system with the object of taxation in the form of income reduced by the amount of expenses

, then for tax purposes he has the right

to take into account expenses

that meet the requirements provided for in

paragraph 1 of Art.

252 Tax Code of the Russian Federation .

If the amount of tax calculated in the general manner is less than the amount of the calculated minimum tax, such taxpayers are required to pay the minimum tax

in the amount of 1 percent of the tax base, which is income determined in accordance with

Art.

346.15 Tax Code of the Russian Federation .

If in accordance with the charter

The HOA is entrusted with the responsibilities for providing the above-mentioned housing and communal services and the HOA,

on its own behalf on behalf of the HOA members or on behalf and at the expense of the HOA members,

enters into contracts with manufacturers (suppliers) of these works (services) (that is,

based on contractual obligations,

is an intermediary

, purchasing services on behalf of HOA members), then on the basis of

paragraphs. 9 clause 1 art. 251 of the Tax Code of the Russian Federation, the income

of the specified organization

will be commission, agency or other similar remuneration

(letters

of the Ministry of Finance of the Russian Federation

dated January 27, 2012 No. 03-11-06/2/9, dated October 5, 2011 No. 03-11-06/2 /136,

Federal Tax Service of the Russian Federation

dated April 22, 2011, No. KE-4-3/ [email protected] ).

If

Your

HOA took into account the amounts of homeowners' payments for housing and communal services as part of its income

and these amounts constitute

at least 70%

of total income,

then you have every right to apply reduced insurance premium rates

.

The HOA may not have included

in its income for calculating the single tax

paid in connection with the application of the simplified tax system, funds received from members of the homeowners’ association for the maintenance and operation of a residential building, taking into account proceeds for home repairs, for the following reasons.

The homeowners association has the right to conclude

in accordance with the law,

an agreement for the management of an apartment building

, as well as

agreements on the maintenance and repair of common property in an apartment building, agreements on the provision of utilities

and other agreements in the interests of members of the partnership (

Article 137 of the Housing Code of the Russian Federation

).

Payment for residential premises and utilities for the owner of the premises

in an apartment building

includes

:

1)

payment for maintenance and repair of residential premises

, which includes payment for services and work on managing an apartment building, maintenance, current and major repairs of common property in an apartment building;

2) utility bills

(

Art. 154 Housing Code of the Russian Federation

).

In turn, utility fees include

payment for cold and hot water supply, sewerage, electricity supply, gas supply (including the supply of domestic gas in cylinders), heating (heat supply, including the supply of solid fuel in the presence of stove heating).

According to paragraph 5 of Art. 155 Housing Code of the Russian Federation

members of the homeowners association make

mandatory payments and (or) contributions related to the payment of expenses for the maintenance, current and major repairs of common property

in an apartment building,

as well as payment for utilities

, in the manner established by the governing bodies of the homeowners association.

Thus, HOA members do not pay for housing and utilities, but mandatory payments and contributions

.

The purpose of creating an HOA

is the management of a complex of real estate in an apartment building, ensuring the operation of this complex, as well as ensuring ownership, use and, within the limits established by law, disposal of common property in an apartment building.

Therefore, funds received at the disposal of fellow members of the partnership that are strictly targeted are excluded from the tax base under the simplified tax system

.

But in this case, the HOA has no revenue from sales

services for managing the operation of an apartment building.

After all, all receipts from HOA members with this approach are recognized as targeted receipts that are not included in income

.

That is, income from the main activity is 0%

in total income.

And you need at least 70%

.

Therefore, in this case, the HOA does not have the right to apply reduced insurance premium rates

.

Taxation of HOAs under the simplified tax system in 2019

The HOA keeps records of targeted funds in account 86 “Targeted Financing”. For account 86, it is necessary to open sub-accounts based on the sources of funds received. Let's consider the accounting of HOA fees, except for payments for housing and communal services, the accounting of which will be discussed below.

- mandatory payments, entrance and other fees of HOA members;

- payments from homeowners who are not members of the HOA;

- income from the entrepreneurial activities of the HOA, aimed at fulfilling the goals, objectives and responsibilities of the HOA (Article 152 of the Housing Code of the Russian Federation);

- subsidies for the operation of common property, carrying out current and major repairs, providing certain types of utilities and other subsidies;

- other supply.

We recommend reading: Separation of shares in an apartment

The procedure for maintaining accounting records under the simplified tax system (2019)

The forms of simplified accounting registers must be provided as appendices to the order. For the full simplified accounting option, they will generally be similar to the balance sheets used in OSNO, but can combine information on related accounting accounts and require the formation of a consolidated checkerboard sheet in addition to them. The forms of simplified accounting registers recommended by the Ministry of Finance of Russia can be seen in the appendices to the protocol of the IPB of the Russian Federation dated April 25, 2013 No. 4/13 and the order of the Ministry of Finance of Russia dated December 21, 1998 No. 64n.

Accounting under the simplified tax system should be organized in such a way that, if it is necessary to return to OSNO or switch from the simplified tax system “income” to the simplified tax system “income minus expenses,” it is possible to restore analytics using accounting data in accordance with the requirements of the relevant tax system with a minimum amount of labor costs.

What reports does the homeowners' association submit for registration in 2019?

IMPORTANT: From January 1, 2021, changes have been made to the procedure for filling out the Income and Expense Accounting Book. According to Order No. 227n dated December 7, 2016, section 5 was added, in which it is necessary to reflect the amounts of trade fees for legal entities operating in the territory of Moscow and the Moscow region.

You must report for 2021 by April 2, 2019, because March 31 falls on a day off. Simplified residents must pay the annual single tax within the same deadline established for filing the declaration, i.e., before March 31, and taking into account the postponement of the deadline due to a day off, until April 2, 2019.

List of expenses under the simplified tax system “income minus expenses”: table for 2021 with explanation

Having chosen the object of taxation “income reduced by the amount of expenses”, the payer of the simplified tax system in 2021 must keep records of income received and expenses incurred in the book of income and expenses. And based on this book, determine the final amount of tax to be paid.

- expenses for the acquisition (construction, production), as well as completion (retrofitting, reconstruction, modernization and technical re-equipment) of fixed assets;

- costs of acquiring or independently creating intangible assets;

- material costs, including costs for the purchase of raw materials and materials;

- labor costs;

- the cost of purchased goods purchased for resale;

- amounts of input VAT paid to suppliers;

- other taxes, fees and insurance premiums paid in accordance with the law. An exception is the single tax, as well as VAT allocated in invoices and paid to the budget in accordance with paragraph 5 of Article 173 of the Tax Code of the Russian Federation. These taxes cannot be included in expenses (subclause 22, clause 1, article 346.16 of the Tax Code of the Russian Federation).

- costs for maintenance of CCP and removal of solid waste;

- expenses for compulsory insurance of employees, property and liability, etc.

Tax reporting under the simplified tax system

Every year, TSN submits a single tax declaration (clause 1, Article 346.12 of the Tax Code of the Russian Federation) if it is a payer of the simplified tax system.

The use of this system significantly reduces the amount of tax payments for TSN.

But the use of the system is possible only if certain criteria are met: revenue less than 120 million rubles, employees - up to 100 people, fixed assets costing no more than 100 million rubles.

There are two possible options for taxation objects: simplified tax system 6% and simplified tax system 15%. Here the choice remains with TSN. Filling out the tax return depends on the choice of object.

Other taxes and contributions (personal income tax, Pension Fund, Social Insurance Fund) are calculated as usual. One caveat: insurance rates can be reduced to 20% (instead of 30%).

Expenses of the HOA under the simplified tax system

Simplified tax system or OSNO – which taxation regime should a management company choose? The general taxation system can be used by any organization and, from the point of view of simplicity, is the most acceptable. However, the tax burden that falls on the company in this case is quite high - the organization needs to pay income tax at a rate of 20% and value added tax.

We recommend reading: Sell an apartment received by inheritance

Then the costs of the enterprise will also include the costs of renting municipal property. According to the law, the provision of services is already a business activity (Clause 1, Article 2 of the Civil Code of the Russian Federation), which is aimed at making a profit from the use of property and is carried out at your own peril and risk. This is a commercial activity that is already subject to taxation in accordance with the general procedure.

Tax reporting under OSNO

When applying the OSNO regime, TSN must calculate the following types of taxes:

- at a profit;

- VAT;

- on property;

- Personal income tax for employees.

The amount of income tax also remains 20% of the tax amount. Amounts of expenses must be documented in order for them to be considered for deductions.

The income tax return is filled out in a form approved by law and is no different from other companies. The declaration must be filled out even if both income and expenses were equal to “0”.

A sample income tax return for TSN is presented in the appendix to the article.

VAT can be calculated at a rate of 18%. It is accrued only for those types of work that were performed on their own. If, after all, the work was carried out by a third party, then the VAT rate is preferential. If the revenue of such an organization for a quarter does not exceed 2 million rubles, then it is possible to obtain an exemption from VAT under Article 145 of the Tax Code of the Russian Federation. Then reporting and accounting will become easier. The VAT declaration was approved by clause 1 of the Procedure, which was approved by order of the Federal Tax Service of Russia dated November 29, 2014 No. ММВ-7-3/558.

All other taxes: personal income tax and insurance contributions can be calculated and paid on the same basis as for ordinary organizations.

How is registration carried out in HOAs?

Revenue received from the provision of services and performance of work is income from ordinary activities. To reflect it, the credit of account 91 “Sales” with subaccount 90-1 “Revenue” is intended, corresponding to accounts 62 “Settlements with buyers and customers” or a subaccount to account 76 “Settlements with various debtors and creditors”.

- Art. 135, 136, 148 of the Housing Code of the Russian Federation;

- Federal Law No. 402-FZ dated 06.12. 2011 “On Accounting”;

- Accounting Regulation No. 106n “Accounting Policy of the Organization” PBU 1/2008, approved by Order of the Ministry of Finance of the Russian Federation 06.10. 2008 - in those parts that do not contradict the above Federal Law;

- Order of the Ministry of Finance of the Russian Federation No. 66n “On the forms of financial statements of organizations” dated 02.07. 2010;

- internal accounting policy of the organization.

Report on insurance premiums for TSN

TSN also has the right to hire employees to conduct its activities. And the amounts of their remuneration are included in the annual budget.

If there are employees, TSN is the insured for them in the social insurance funds: pension, medical, Social Insurance Fund (Article 6 of Law No. 167-FZ of December 15, 2011).

If TSN is on a simplified basis, then it is possible to use reduced insurance premium rates in a situation where real estate management is the main activity for TSN.

As an insurer for employees, TSN is required to submit a declaration of insurance premiums.

Most common mistakes

Error No. 1. TSN on simplified tax system 6%.

Initial data:

- form – TSN;

- taxation system – simplified tax system 6%;

- 6% is paid from the services of providers and advertisers.

When applying the simplified tax system of 6%, target funds are not taken into account when compiling the tax base. They do not take into account the 6% income. Therefore, it is considered a mistake to pay 6% tax on them.

Error No. 2. Most payers do not take into account the right to apply reduced tariffs, or they do, but incorrectly. They can apply them only in a situation where the main type of economic activity is real estate management (code 68.32 OKVED). The following conditions must also be met:

- income from the sale of services for this type of business accounts for more than 70% of the total income structure;

- the total amount of income cannot be more than 79 million rubles.

FAQ

Question No. 1. What are the deadlines for submitting VAT reports for TSN?

Deadlines for submitting VAT reports quarterly:

- 1st quarter – April 25;

- 2nd quarter – July 25;

- 3rd quarter – October 25;

- 4th quart – January 25th.

Question No. 2. Where to submit reports on contributions under TSN?

Starting from 2021, reports are submitted to the tax office, and injury declarations are submitted to the Social Insurance Fund. At the Pension Fund of Russia they take SZV-M monthly and SZV-M experience.

How can a homeowners association calculate their unit tax in 2019?

The reduced rate cannot be lower than 1% (with the exception of the 0% rate for individual entrepreneurs carrying out entrepreneurial activities in the production, social and (or) scientific spheres and registered for the first time after the law on “tax holidays” came into force in a constituent entity of the Federation).

It is possible to reduce the difference between the income and expenditure side regardless of the size of the net income side, which is a significant advantage for large housing structures. The disadvantages of the simplified system in relation to housing associations include: The need for additional accounting operations for correct accounting of accounts.

Accounting and tax accounting in HOAs (TSN): postings, documents, benefits

When choosing the most profitable option, certain nuances should be taken into account. By choosing to tax income at a rate of 6%, the taxpayer receives the advantage of ease of calculation. But at the same time, it is important to correctly take into account all income, as well as expenses that can reduce the amount of tax (sick leave, insurance payments).

Money received as membership or other fees does not form the partnership’s income and is used to pay for utilities and maintain housing in proper condition. When carrying out activities and concluding contracts, the HOA must act only in the interests of home owners.

Other types of TSN reporting depending on the availability of taxable objects

In addition to the main taxes listed above, TSN is also required to pay other taxes . This fact depends on whether they have a corresponding taxable object.

- Property tax. Applies if the property is used for commercial or other economic purposes. The tax rate is determined by the cadastral or book value of the property.

Important! The property tax declaration is submitted to the Federal Tax Service by March 30. The form was approved by Order of the Federal Tax Service dated March 31, 2017 No. ММВ-7-21/ [email protected]

- Land tax. It is calculated and paid only when TSN has its own land plot. The tax base in this case is the cadastral value of the plot. And the rate is set at the municipal level.

Important! The land tax declaration is submitted to the Federal Tax Service by 02/01/2021. The form was approved by Order of the Federal Tax Service dated May 10, 2017 No. ММВ-7-21/347 @.

- Transport tax. It is calculated and paid if TSN has any equipment (trucks, special equipment, passenger vehicles). The tax is calculated at rates adopted by regional authorities based on data on the power of equipment.

Important! The tax return is submitted to the Federal Tax Service after the end of the calendar year, before February 1, in the form of Federal Tax Service Order No. ММВ-7-21 dated December 5, 2016/ [email protected]

- Personal income tax. The rate is set depending on the employee’s status. If the status is resident, then the rate is 13%. If the employee is a non-resident, then the rate is up to 30%. The 6-NDFL declaration is submitted quarterly no later than the 31st day of the reporting month.

Important! The declaration form was approved by order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/ [email protected]

Accounting, tax accounting and reporting in HOAs

If utility payments have been accrued to the owners of real estate, they must be reflected in the appropriate accounting accounts. The difference that arises between the actual and nominal cost of utility bills is subject to taxation at rates approved by current legislation. If payment for utility services is received into the current account from property owners who have not entered into a partnership and have not entered into an agreement with it for the provision of agency services, then the HOA accounting department must accrue taxes on them in full.

- contributions for major repairs;

- receipts in the form of entrance and membership fees;

- penalties for late paid utilities (the full amount of rent is not included);

- subsidies;

- the difference between received utility payments and their actual cost;

- income received while conducting commercial activities, etc.

Comparison of tax options for TSN

The table below presents comparative characteristics of various taxation options that can be applied to TSN

| Criterion | OSN | simplified tax system 15% |

| Expenses | Unlimited | List closed |

| Carry forward of losses | Available | Not possible |

| Minimum tax amount | 0 | 1% |

| Bid | 20% | 15% |

| Reduced fee rates | No | Eat |

| Tax burden is higher | VAT on property | No VAT, no property tax |

| Scope of reporting | Higher | Below |

Example No. 1.

TSN "Rial" has an agency agreement with apartment owners to accept utility payments. The reward is 0.5%. TSN does not pay VAT. Is on a simplified basis and has the right to benefits on social insurance contributions.

Income for the year: (click to expand)

| Income item | Amount, t.r. |

| property maintenance | 1296 |

| cost of utilities | 4752 |

| agent's commission | 24 |

| paid work | 72 |

| total cost | 6144 |

The costs were:

| Expenditure | Amount, t.r. |

| payments to suppliers for utilities | 4752 |

| Purchase of materials | 328 |

| Salary with personal income tax | 730 |

| Connection | 2 |

| TOTAL | 5812 |

Please note that utility bills are not included in revenue, as well as expenses.

The table shows payments to the budget

| Index | USN, t.r. | BASIC, t.r. |

| Income that is subject to taxation | 1392 | 1392 |

| Salary insurance contributions | 147 | 220 |

| Expenses that are taken into account | 1207 | 1280 |

| Basis for calculating taxes | 184 | 111 |

| Tax for the year | 28 | 22 |

| Total paid | 175 | 243 |

The presented calculations indicate that the use of the simplified tax system for TSN “Romashka” is much more profitable in terms of the amount of payments to the budget. The savings are justified by a reduction in tariffs for social insurance contributions.

Example No. 2. Let's take the same conditions as in the first example, but with the caveat that TSN does not have hired employees. Then the expenses for the year will be 950 tr. These amounts cannot be deducted when calculating the single tax (according to the Tax Code of the Russian Federation), which means the tax amount for the year will be equal to 159 tr. And the income tax at the same costs will be only 22 tr, which is more profitable for the company.