Purpose of the document

Before drawing up a property accounting form, an act of acceptance is drawn up, from which all the basic information about the received fixed asset is entered.

Download samples of the acceptance certificate:

- OS-1;

- OS-1a;

- OS-1b.

In addition, an inventory card is filled out based on other accompanying documentation (technical passports for equipment). The issuance of a card according to the unified OS-6 form is carried out in companies where it is necessary to exercise control over the maintenance of fixed assets, their storage and movement.

As a rule, such enterprises have a significant amount of property. Inventory cards for recording fixed assets in the OS-6 form are issued for objects owned by the company, as well as those used under a lease agreement.

The main areas of use of the form are:

- simplifying the process of analyzing the state of an object,

- preparation of statistical reports.

The asset accounting card includes all information about any actions with property (purchase, repair, reconstruction, write-off, relocation). It is compiled by any enterprise for fixed assets (regardless of the company’s field of activity).

Tax inspectors check inventory cards very carefully. The presence of errors in filling them out entails quite serious sanctions.

Which form should I use?

The card has the approved unified form OS-6 (Decree of the State Statistics Committee No. 7 of January 21, 2003).

The form is filled out for each fixed asset (in one copy). When maintaining a document electronically, a copy must be present on paper.

The inventory card requires the signature of the materially responsible employee. The OS-6 form is not certified by a seal.

Inventory card for recording a fixed asset item

_______________________________ (name of organization) _______________________________ (structural unit) ——————- ———————————————— Inventory ¦Number¦ Date ¦ ¦ Standard service life code ¦ ¦ accounting card ¦ ¦ compilation¦ +————————————-+——-+ main object +——+————+ ¦Passport number (registration) ¦ ¦ funds ¦ ¦ ¦ ¦ +——— ———————-+——-+ ——+———— ¦ ¦factory ¦ ¦ ¦ +——————————-+——-+ ¦ ¦inventory ¦ ¦ +— —+——————————-+——-+ ¦Date of ¦acceptance for accounting¦ ¦ ¦ +——————————-+——-+ ¦ ¦write-off from the accounting accounting¦ ¦ ——+——————————-+——-+ Account, subaccount, analytical accounting code¦ ¦ +——-+ Object _____________________ ¦ ¦ (series, type of construction +——-+ ____________________________ ¦ ¦ or model, brand) ——— Location of fixed assets ___________________________________ Manufacturing organization ___________________________________________ (name) 1. Information about the condition of the fixed asset item on the date of transfer: ———————————————— ——————— ¦ Date ¦Document on entry into ¦Actual ¦Amount ¦Remaining ¦ ¦ ¦ operation ¦accrual ¦accurate¦ +———————-+————— -+operating ¦cost- ¦ ¦issue ¦last ¦name- ¦number¦date¦ation ¦depreciation-¦cost,¦ ¦(cost of ¦overhaul, ¦new¦ ¦ ¦ ¦ization, ¦rub. ¦ ¦construction)¦modernization,¦ ¦ ¦ ¦ ¦rub. ¦ ¦ ¦ ¦reconstruction¦ ¦ ¦ ¦ ¦ ¦ ¦ +———+————-+——-+——+—-+———+——-+——+ ¦ 1 ¦ 2 ¦ 3 ¦ 4 ¦ 5 ¦ 6 ¦ 7 ¦ 8 ¦ +———+————-+——-+——+—-+———+——-+——+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ———+————-+——-+——+—-+———+——-+——- 2. Information about the fixed asset item as of the date of acceptance for accounting: ——— ———————————————————— ¦ Initial cost at ¦ Useful life ¦ ¦ date of acceptance for accounting (standard period) ¦ ¦ accounting, rub. ¦ ¦ +———————————+———————————+ ¦ 1 ¦ 2 ¦ +———————————+————— ——————+ ¦ ¦ ¦ ———————————+———————————- 3. Revaluation: ———————- ———— ———- ———————- ¦Date¦Coefficient- ¦Recover-¦ ¦Date¦Coefficient- ¦Recover-¦ ¦Date¦Coefficient- ¦Recover-¦ ¦facial¦new- ¦ ¦ ¦factor¦ new- ¦ ¦ ¦ficient¦new- ¦ ¦ ¦re- ¦re- ¦ ¦ ¦re- ¦re- ¦ ¦ ¦re- ¦re- ¦ ¦accounts ¦cost- ¦ ¦ ¦accounts ¦cost- ¦ ¦accounts ¦cost - ¦ ¦ ¦(over- ¦ ¦, ¦ ¦ ¦(over- ¦, ¦ ¦ ¦(over- ¦, ¦ ¦ ¦ estimates)¦ rub. ¦ ¦ ¦ estimates)¦ rub. ¦ ¦ ¦ estimates)¦ rub. ¦ +—-+——-+——-+ +—-+——-+——-+ +—-+——-+——-+ ¦ 1 ¦ 2 ¦ 3 ¦ ¦ 1 ¦ 2 ¦ 3 ¦ ¦ 1 ¦ 2 ¦ 3 ¦ +—-+——-+——-+ +—-+——-+——-+ +—-+——-+——-+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ——+——-+——— ——+——-+——— ——+——-+——— 4. Information on acceptance, internal movements, disposal (write-off) of an object fixed assets: ——————————————————————— ¦ Document, ¦ Type ¦ Name ¦ Residual ¦ Last name, ¦ ¦ date, number ¦ transaction ¦ structural ¦ cost, ¦initials of the person, ¦ ¦ ¦ ¦divisions¦ rub. ¦responsible ¦ ¦ ¦ ¦ ¦ ¦ for storage ¦ +————-+———-+————-+————+—————+ ¦ 1 ¦ 2 ¦ 3 ¦ 4 ¦ 5 ¦ +————-+———-+————-+————+—————+ ¦ ¦ ¦ ¦ ¦ ¦ —————+———-+——— —-+————+—————- ———————— For reference: Participants in shared ownership: “Share in the common right” ¦ ______________________________ ¦ownership, % +—+ _______________________________ ¦ ¦ ¦ ——— ———-+—- 5. Changes in the initial cost of fixed assets: 6. Repair costs: ———————————- ———————————- ¦ Reconstruction, completion , ¦ ¦ Repair ¦ ¦ retrofitting, partial ¦ ¦ ¦ ¦ liquidation, modernization ¦ ¦ ¦ +——————————+ +———————————+ ¦view ¦ document ¦ amount ¦ ¦type ¦ document ¦ amount ¦ ¦opera- +——————+costs,¦ ¦opera- +——————+costs,¦ ¦rations¦name- ¦date¦number¦ rub. ¦ ¦walkie-talkie¦name- ¦date¦number¦ rub. ¦ ¦ ¦new¦ ¦ ¦ ¦ ¦ ¦new¦ ¦ ¦ ¦ +——+——-+—-+——+——-+ +——+——-+—-+——+——- + ¦ 1 ¦ 2 ¦ 3 ¦ 4 ¦ 5 ¦ ¦ 1 ¦ 2 ¦ 3 ¦ 4 ¦ 5 ¦ +——+——-+—-+——+——-+ +——+——-+— -+——+——-+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ——+——-+—-+——+——— ——+——-+—-+——+ ——— 7. Brief individual characteristics of the fixed assets object: ——————————————————————————— ¦Object ¦ Contents of precious ¦Naimenov-¦ Qualitative and ¦ Notes: basic and/or semi-precious, quantitative, materials (metals, design characteristics, accessories, stones, etc.) material (dimensions, other ¦ ¦ ¦collections,¦ ¦elements ¦information) ¦ ¦ ¦accessories- ¦ ¦and other ¦ ¦ ¦ ¦relations ¦ ¦signs,¦ ¦ ¦ +———+—————————+characteristics + ———————+ ¦ ¦most ¦most ¦edi-¦co- ¦mas- ¦os- ¦devices,¦ ¦ ¦me- ¦li- ¦novation¦men -¦nitsa¦li- ¦sa ¦object ¦new-¦belonging- ¦ ¦ ¦but- ¦ches-¦precious- ¦kla-¦iz- ¦che- ¦ ¦ ¦many¦ties, ¦ ¦ ¦va- ¦yours ¦valuable ¦tour-¦facilities¦ ¦ ¦attached ¦ ¦ ¦nie¦ ¦ and/or¦ny ¦re- ¦ ¦ ¦ ¦premises¦, etc.¦ ¦ ¦ ¦ ¦completely - ¦ ¦ ¦ ¦ ¦ ¦ +- t-- + ¦ ¦ ¦ ¦ drado- ¦ Mer ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦math- ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦rials ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +—-+—-+——-+—-+—-+ —-+—-+———-+—-+—+—+—+—-+——+ ¦ 1 ¦ 2 ¦ 3 ¦ 4 ¦ 5 ¦ 6 ¦ 7 ¦ 8 ¦ 9 ¦10 ¦ 11 ¦ 12 ¦ 13 ¦ 14 ¦ +—-+—-+——-+—-+—-+—-+—-+———-+—-+—+—+—+—-+——+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ——+—-+——-+—-+—-+—-+—-+———-+—-+—+—+—+— -+——- Person responsible for maintaining the inventory card ____________________ _________________________ (position, signature) (signature transcript)

A COMMENT

The form of this document is provided as an example.

The use of this form is not necessary, since it is not included in the list of primary accounting documents approved by Resolution of the Council of Ministers of the Republic of Belarus dated March 24, 2011 N 360. The list of mandatory information that primary accounting documents must contain is provided for in subsection. 1.4 Decree of the President of the Republic of Belarus dated March 15, 2011 N 114 “On some issues of using primary accounting documents.”

Filling in upon receipt of OS

Initially, the accounting card is filled out when fixed assets are received by the enterprise.

The header of the OS-6 form contains information about:

- name of the enterprise (owner of the object);

- the structural unit to which the fixed asset is assigned;

- inventory card number;

- date of compilation and name of the recorded property.

In the column on the right side of the document, the codes are filled in: OKPO (in accordance with the constituent papers of the organization) and OKOF (according to the classifier of fixed assets).

Below in the columns are written the numbers: depreciation group of the object, passport, inventory and factory, as well as the date of registration of the fixed asset in the accounting documentation and the accounting account number.

Next, the location of the fixed asset (workshop, maintenance department, accounting department) is recorded, indicating the coding, if any.

In the next line from the technical passport of the object, information about the manufacturer's organization is entered.

Then, in the OS06 form, tables are presented for filling out information on the registered fixed asset object:

- section No. 1 - is not filled out for new property, data is entered only for fixed assets that were previously in operation;

- section No. 2 - the cost of the fixed asset is recorded on the date of acceptance for accounting, consisting of the sum of all costs, the period of its use (useful);

- Section No. 4 - information about the movements of property is entered.

The fourth section is filled out strictly in accordance with the accompanying documentation indicating the type of operation for the fixed asset.

The third section of the inventory card is filled out if the cost of the object is recalculated to match market prices. The initial cost can be either increased or decreased. The changed cost of the fixed asset is replacement value, it is recorded in column 3.

In addition, accrued depreciation is also revalued; for this purpose, a conversion rate is used. It is determined by dividing the replacement cost by the original cost, and then multiplying the result by depreciation. The coefficient is written in column 2. The first column is the date of depreciation, as a rule, this is the end of the calendar year.

For property worth less than 40 thousand rubles, depreciation is calculated as 100% of the total cost on the date of its acceptance for accounting. Objects with a cost of more than 40 thousand rubles are subject to depreciation in accordance with established standards.

If the owners of the property are several people, then they are indicated under table No. 4 indicating the percentages due to each of the owners.

On the reverse side of the unified form of inventory card OS-6, upon receipt of an item of fixed assets, section 7 is filled out if the property is characterized by special data, including the presence of precious metals and stones in its composition. Structural components, other distinctive features of the OS object, qualitative and quantitative indicators are also subject to registration here. To enter special notes into the inventory card regarding the characteristics of the property, the last column of the table is provided.

The OS-6 form is endorsed by an employee of the organization responsible for its correct preparation. Typically, these actions at an enterprise are carried out by an accounting employee.

Also on the reverse side there are sections:

- No. 5 - filled in when the initial cost of a fixed asset changes, the costs of major repairs, modernization, and liquidation are reflected, which leads to an increase in the initial cost;

- No. 6 - is intended to display information about the costs of current repairs, which do not lead to an increase in cost, but are subject to write-off to the cost of the product.

Important nuances

Features of filling out the inventory accounting form:

- When filling out information about a fixed asset at the time of its acceptance, it is necessary to enter only the cost of acceptance of this property.

- Data on the receipt, movement, and write-off of objects are recorded in chronological order. The first entry will be about the receipt of fixed assets. The documents that provide the basis for the actions taken must be indicated - acts of acceptance, transfer, and write-off.

- Information about adjustments to the starting value of property is recorded on the basis of the figures indicated in the OS-3 act.

- Repair costs are recorded only for those that do not affect the value of the property.

- Individual indicators include any information characterizing the registered object.

If the enterprise has a relatively small number of fixed assets, it is allowed to create a consolidated inventory card (inventory book). Then it is allowed not to draw up a separate document for each object.

Download a free form and sample with an example

Let's look at an example of filling out an inventory card when a truck arrives.

This object is a fixed asset, it arrives at the enterprise in a new condition, and therefore the first section in the inventory card is not filled out.

The second section of the OS-6 form indicates the initial cost, in this example it is 1 million rubles. and useful life: this car is assigned to depreciation group 4 and has an SPI of 5 years = 60 months.

At the time the vehicle is accepted for registration, it is also necessary to fill in information about the document on the basis of which the vehicle was received; the data is entered in section 4 of the OS-6 form, as well as additional information about the receipt.

The completed sample card is signed by the responsible employee - usually an accountant. As necessary, information on the fact of revaluations, repairs, and movements of the vehicle between departments will be entered into this form. The final entry is made at the time of disposal or write-off of the vehicle.

You can download the OS-6 form in Word for free using the link.

The form of the inventory card for accounting of fixed assets in excel format can be downloaded here.

A sample of filling out the accounting form upon receipt of the car -.

What a completed accounting card looks like for this example:

Inventory numbers and inventory card numbers in 1C Accounting for government agencies 1.0.

The inventory number is assigned by the documents “Acceptance for accounting of fixed assets” or “Free receipt of fixed assets”. When creating an inventory number, the number is assigned automatically in order within the institution. It is also possible to create a specific template according to which the newly created inventory number will be automatically filled in.

To create a template, go to the Institutions

–

institutions

, go to the organization’s card and follow the link “Template for generating inventory numbers of fixed assets and intangible assets.”

To get a consultation

Then we get into the template directory, click on the plus sign to create a new template.

When creating a new template, the institution is filled in automatically. Enter the name of the template. We temporarily set the length of the inventory number to be longer (in our example I will set it to 30). Now we add the necessary details that will be in the inventory number to the tabular part with a plus sign.

To get a consultation

Since Instruction No. 148n does not contain provisions on the formation of the structure of the inventory number, the institution must develop it independently.

This number may contain the information that an institution needs for operational accounting of non-financial assets. For example, I will add three details: Date.Year, Funding source code and serial number (this detail must be required and be the last one in the template). After selecting the details, all other fields are filled in automatically. We look at the final length of the number and write it down in the line “Length of inventory number.” As a result, we ended up with this template:

We write down the template.

Let's move on to the document “Acceptance for accounting of fixed assets”. In the tabular part, on the “fixed assets” tab, go to select the inventory number. There we create a new inventory number and after that our template appears with the filled in indicators.

Date.Year is the year the inventory number was created.

The funding source code is the KFO used for accounting.

The serial number is a number that will increase by 1 when creating new inventory numbers. Because its value = 5, then there will also be 5 numbers in the number (in the picture it is 00002 because 00001 was created for another example).

The final inventory number is shown at the bottom of the window and is highlighted in blue. You can also add the necessary details in the templates yourself.

To get a consultation

Inventory card numbers.

Previously, it was not necessary to fill in the inventory card number to print the “Inventory Card”; now this detail has become mandatory. Otherwise, this card will not be included in the inventory f. 0504033.

There are also automatic filling templates for inventory card numbers. To create them, let's go to the Institution - Institution

and let's go to our organization.

In the organization, follow the link Accounting policy of the institution.

In the accounting policy, on the Assets, Intangible Assets, Legal Entities tab, check the “Automatic numbering” box. The item “through” means that the numbers will be automatically filled in in order. We need a “by template” item. We fall through three template selection points.

To get a consultation

In the directory of inventory card templates with a plus sign, we add a new template. In the new template, enter a name. And we transfer the details we need to the right side of the document. There is no “serial number” attribute, it is added automatically, you just need to indicate its length at the bottom of the document.

Write down and close the template. We select it in the accounting policy. And we will save the changes in accounting policy.

Let's go to the document Acceptance for accounting of fixed assets

. On the fixed assets tab, double-click on the “Inventory card number” field, after which an arrow appears in this field to automatically assign a number. Click on this arrow and the number is automatically generated according to our template.

To get a consultation

2019 is the year in which the card number is assigned.

2 is KFO.

00001 – serial number.

If you have not specified numbers before, there is special processing for mass assignment of card numbers.

This processing is located on the tab OS, intangible assets, legal acts – Working with information registers from the OS – Managing inventory card numbers.

In processing, we indicate the date (on which the change or assignment of numbers will occur) and the organization. On the right side of processing, put the necessary checkboxes.

With numbers – if you want to replace existing numbers with new ones.

Without numbers - if you want to assign numbers to OSs that do not have card numbers.

After selecting all the required items, click the “Fill”

. After this, the tabular part of the processing will be filled in.

To get a consultation

Next, you need to select a rule for filling numbers. In our example, we will select by template and indicate the created template. And press the number button. In the tabular section we will see the current number and the new number that the OS will have after saving. If everything suits you, then click the “ Create document”

».

After completing the “Changing OS Data” document, you will be assigned inventory card numbers to the listed fixed assets.

Do you have any questions?

Call or write. Do you want to place an order? Leave a request

We are in social networks! Subscribe!

Storage

Cards registering fixed assets refer to primary documentation forms. They are subject to standard storage rules for such papers - 5 years. After its expiration, the documents are disposed of properly.

Sometimes, depending on the category of fixed asset, the duration of storage of inventory cards may be longer.

Once every few years it is necessary to carry out an inventory of inventory cards. The purpose of this event is to register accounting forms. By implementing this procedure, the safety and availability of documentation is confirmed. Registration is carried out in accordance with the data of budget accounts.

How to fill out OS-6a correctly

The first step is to enter information into the header of the document. Indicate:

- name of the company or enterprise, department or workshop;

- OKUD and OKPO codes;

- depreciation group number;

- analytical accounting code, account, subaccount;

- number and day of opening of this paper.

Fill in the fields with the name of the recipient's structural unit, full name of the financially responsible employee, and his personnel number.

Next is the table and continues on the reverse side. If there are many operating systems, then you can add the required number of rows to the table.

So, the following information is entered into the table (the numbering in the list corresponds to the numbering of the columns in the table):

- Serial number of the record. Only one row is allocated for each object.

- Name of the property.

- Inventory number.

- Code OKOF.

- Date of issue, production or construction.

- Details of the document according to which the operating system was received by the company. Most often this is the act of receiving and transmitting a group of objects.

- Date of acceptance for accounting.

- The initial cost on the day of acceptance for accounting.

- Useful life of the object.

- Amount of depreciation.

- Residual value. It is equal to the difference between the indicators of column 8 and column 10.

- Revaluation date.

- Coefficient for calculating revaluation.

- Replacement cost.

- Details of the document by which the object was disposed of. This could be a purchase and sale agreement, a deed of write-off.

- Reason for disposal of the object.

Attention! Points 1 to 11 are filled out on the basis of the act of acceptance and transfer of groups of objects in the OS-1b form. All data must match exactly.

Important! Columns 12 to 14 are filled out on the basis of the act of revaluation of fixed assets.

Attention! If the object was disposed of through sale, then columns 15 and 16 are filled out based on the act in form OS-1b. If you left because it fell into disrepair, then they take into account the act of writing off groups of objects in the OS-4b form. When moving, groups of objects rely on the OS-2 form.

At the end of the form, the employee responsible for maintaining this paper puts his signature.

conclusions

An inventory card is the main tool for accounting for fixed assets entering, moving and leaving an organization.

The form is drawn up according to the unified OS-6 form and reflects all the necessary information about the object. If the organization has a small volume of fixed assets, then it is permissible to use a consolidated inventory book.

The responsible accountant is responsible for filling out and maintaining the accounting card. After five years, the document can be destroyed.

Inventory card (OS-6) in 1C 8.3

The organization must approve the form of the inventory card for further accounting of fixed assets. In 1C 8.3, a card of the OS-6 form is used. It reflects all operations carried out with the OS object from the moment it was accepted into the OS (clause 12, clause 13 of the Guidelines for accounting of OS, approved by Order of the Ministry of Finance of the Russian Federation dated October 13, 2003 N 91n).

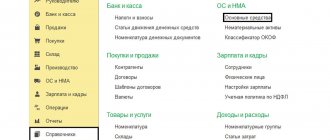

Where can I find the OS inventory card (OS-6) in 1C 8.3? The fixed asset card in 1C 8.3 is located in the section Directories - OS and intangible assets - Fixed assets.

An inventory card is created when a fixed asset is received by the organization. In general, the card is filled out automatically when documents are processed, but some data must be entered manually.

The data in the fields filled in automatically is relevant as of the current date. If you are analyzing (printing) past data, then in the Date of information , indicate the desired date.

If you don’t see such a field in the card, then add it using the More - Change form button.